Forex Mein Stop Loss Hunting Method:@:@:@

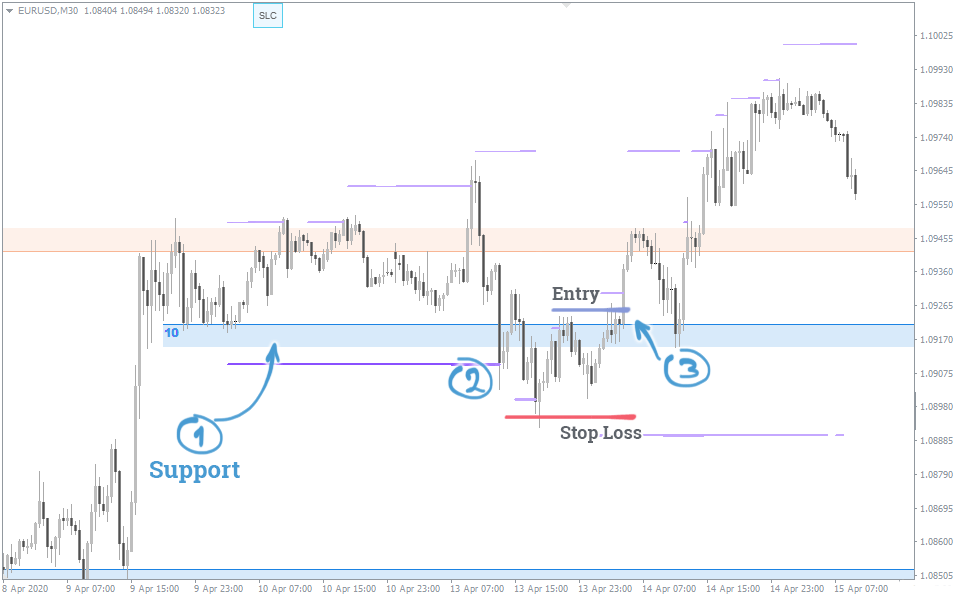

Forex mein "Stop Loss Hunting" aik aisi hikmat-e-amli hai jo kuch barey maliyati idaray aur market makers istemal karte hain taake chote traders ke stop loss orders ko trigger kar sakein. Is amal mein, ye idaray market ki prices ko us level tak le jate hain jahan bohot se traders ne apne stop loss orders lagaye hote hain.

Jab stop loss orders trigger ho jate hain, to in orders ki wajah se ziada buying ya selling hoti hai, jo market ko ek specific direction mein aur zyada push kar sakti hai. Yeh idaray phir is movement ka faida uthate hain.

Forex Mein Stop Loss Hunting Se Bachne Ke Tariky:@:@:@

Forex trading mein stop loss hunting se bachne ke aur bhi tareeqe hain jo aapko market manipulation se bachane mein madadgar ho sakte hain:

1. Market Sentiment Analysis

Forex mein "Stop Loss Hunting" aik aisi hikmat-e-amli hai jo kuch barey maliyati idaray aur market makers istemal karte hain taake chote traders ke stop loss orders ko trigger kar sakein. Is amal mein, ye idaray market ki prices ko us level tak le jate hain jahan bohot se traders ne apne stop loss orders lagaye hote hain.

Jab stop loss orders trigger ho jate hain, to in orders ki wajah se ziada buying ya selling hoti hai, jo market ko ek specific direction mein aur zyada push kar sakti hai. Yeh idaray phir is movement ka faida uthate hain.

Forex Mein Stop Loss Hunting Se Bachne Ke Tariky:@:@:@

Forex trading mein stop loss hunting se bachne ke aur bhi tareeqe hain jo aapko market manipulation se bachane mein madadgar ho sakte hain:

1. Market Sentiment Analysis

- Market sentiment analysis ka istemal karke dekhain ke market ka rujhan kya hai. Agar majority traders kisi ek taraf wager kar rahe hain, to stop loss hunting ke chances barh jate hain.

- Economic news aur events par nazar rakhein jo market ko hila sakti hain. Important announcements ke time par price spikes se bachne ke liye trades ko manage karein.

- Proper risk management strategies istemal karein jaise ke 1-2% risk per trade, taake agar stop loss hit bhi ho jaye to aapko zyda nuksan na ho.

- Sirf stop loss order par depend na karein. Stop loss ke sath sath limit orders, trailing stops aur market orders ka bhi istemal karein.

- Overleveraging se bachain. Zyada leverage use karne se market mein choti si movement bhi apke liye bohot bara nuksan sabit ho sakta hai.

- Advanced charting tools ka istemal karein jaise ke Fibonacci retracements, moving averages, aur Bollinger bands taake better entry aur exit points identify kar sakein.

- Multiple time frames analyze karein. Agar aap sirf ek short-term time frame dekh rahe hain, to broader trend miss kar sakte hain.

- Liquidity pools ko samjhein. Jahaan liquidity ziada hoti hai, wahan price manipulation ke chances bhi ziada hote hain.

- Market maker behavior ko samjhein. Market makers ke trade aur unke price movements ko analyze karne se aap better trades place kar sakte hain.

- Forex trading communities aur forums mein shaamil ho kar doosre traders ke insights aur experiences ka faida uthain. Yeh aapko real-time market scenarios samajhne mein madad kar sakta hai.

تبصرہ

Расширенный режим Обычный режим