What is Triple candlestick pattern?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Assalamualaikum aj is thread me apko me Pakistan forex trading ke ak bhot he important topic triple candlestick pattern ki importance ke bare me btao ga Or me umeed karta ho ke jo information me apse share karo ga wo apke knowledge or experience me zaror izafa kare ge. What is Triple candlestick pattern? Triple candle stuck patteren teen mom btyon ke majmoay hain, jo aik sath bantay hain. un ka istemaal takneeki tajzia mein is simt ka andaza laganay ke liye kya jata hai jis mein kisi asasay ki qeemat bherne ka imkaan hai. woh takneeki tajzia karon ke liye mumkina tabdeelion ya rujhan ke tasalsul ki nishandahi karne ke liye zaroori tools hain. lekin, triple candle stuck patteren kya hain, aur aap un ki shanakht kaisay kar satke hain ? Understanding Triple candle stuck set up teen mom btyon ka aik group hai jo tamam asason ke chart par aik makhsoos farmission banata hai, Bashmole currency, stock, etfs, index, commodity, aur cripto currency *. set up ke lehaaz se inhen mazboot khareed o farokht ke signal samjha jata hai. . yeh note karna zaroori hai ke farmishnz ko mazboot samjha jata hai agar woh aik taweel rujhan ke baad hotay hain. mazeed bar-aan, tajir un farmishnz ki tasdeeq karne aur mustaqbil ki qeemat ki naqal o harkat ki pishin goi karne ke liye deegar takneeki tajzia ke tools, jaisay ke support aur muzahmati satah aur isharay istemaal karte hain . Three white solider Three white solider aik taizi se reversal set up hain aur yeh neechay ke rujhan ke ekhtataam par bantay hain, jab lagataar teen taizi ki candle stick ziyada qareeb qeematon ke sath namodaar hoti hain, jo ke aik mazboot oopar ki taraf rujhan ki nishandahi karti hain. tenu candles ka jism lamba aur bohat chhota hona chahiye ( ya ghair mojood ) oopri saaye. is ke ilawa, tenu shammen pichli mom batii ke asli body ke andar khlni chahiye aur pichli oonchai se ziyada qareeb honi chahiye, jo is baat ki nishandahi karti hain ke bail qeemat ko barha rahay hain . Three Black Crow yeh set up teen safaid faam fojion ke bar aks hai. usay bearish samjha jata hai aur yeh sirf oopri rujhan ke ekhtataam par bantaa hai jab pichli candle ke asli body mein musalsal teen bearish candle steaks khulti hain aur kam qareeb qeematein banti hain, jo ke neechay ki taraf mazboot rujhan ki nishandahi karti hai. har aik ka jism lamba hona chahiye jis mein thora sa saya mojood nah ho, jis se zahir hota hai ke reechh qeemat ko neechay dhakel rahay hain .

- Mentions 0

-

سا0 like

-

#3 Collapse

Forex trading mein technical analysis ek critical component hai, aur candlestick patterns iska ek integral hissa hain. Candlestick patterns traders ko price action aur market sentiment ke baare mein valuable insights provide karte hain. Triple candlestick patterns, jo teen consecutive candlesticks se mil kar bante hain, forex trading mein significant importance rakhte hain. Yeh patterns bullish ya bearish reversal aur continuation signals provide karte hain. Triple candlestick patterns market mein potential reversals ya continuations ko indicate karte hain. Yeh patterns teen consecutive candlesticks se mil kar bante hain aur generally strong signals provide karte hain compared to single ya double candlestick patterns. Common triple candlestick patterns mein morning star, evening star, three white soldiers, aur three black crows shamil hain.

Types of Triple Candlestick Patterns- Morning Star:

- Bullish Reversal Pattern: Morning star ek bullish reversal pattern hai jo downtrend ke baad appear hota hai aur potential trend reversal ko indicate karta hai.

- Formation:

- Pehli candle ek long bearish candle hoti hai, jo existing downtrend ko represent karti hai.

- Doosri candle small body (bullish ya bearish) ke sath ek gap down opening ke sath open hoti hai, jo indecision ya consolidation ko show karti hai.

- Teesri candle ek long bullish candle hoti hai jo pehli bearish candle ke body ke midpoint ke upar close hoti hai, confirming the reversal.

- Example: Agar EUR/USD pair downtrend mein trade kar raha hai aur morning star pattern form hota hai, toh yeh potential bullish reversal ka indication ho sakta hai.

- Evening Star:

- Bearish Reversal Pattern: Evening star ek bearish reversal pattern hai jo uptrend ke baad appear hota hai aur potential trend reversal ko indicate karta hai.

- Formation:

- Pehli candle ek long bullish candle hoti hai, jo existing uptrend ko represent karti hai.

- Doosri candle small body (bullish ya bearish) ke sath ek gap up opening ke sath open hoti hai, jo indecision ya consolidation ko show karti hai.

- Teesri candle ek long bearish candle hoti hai jo pehli bullish candle ke body ke midpoint ke niche close hoti hai, confirming the reversal.

- Example: Agar USD/JPY pair uptrend mein trade kar raha hai aur evening star pattern form hota hai, toh yeh potential bearish reversal ka indication ho sakta hai.

- Three White Soldiers:

- Bullish Continuation Pattern: Three white soldiers ek bullish continuation pattern hai jo downtrend ya consolidation ke baad appear hota hai aur strong bullish momentum ko indicate karta hai.

- Formation:

- Yeh pattern teen consecutive long bullish candles se mil kar banta hai, jahan har candle previous candle ke high ke upar close hoti hai aur minimal wicks hoti hain.

- Example: Agar GBP/USD pair consolidation phase mein hai aur three white soldiers pattern form hota hai, toh yeh strong bullish continuation ka indication ho sakta hai.

- Three Black Crows:

- Bearish Continuation Pattern: Three black crows ek bearish continuation pattern hai jo uptrend ya consolidation ke baad appear hota hai aur strong bearish momentum ko indicate karta hai.

- Formation:

- Yeh pattern teen consecutive long bearish candles se mil kar banta hai, jahan har candle previous candle ke low ke niche close hoti hai aur minimal wicks hoti hain.

- Example: Agar AUD/USD pair consolidation phase mein hai aur three black crows pattern form hota hai, toh yeh strong bearish continuation ka indication ho sakta hai.

Triple candlestick patterns ka significance unki ability mein hai to provide strong reversal ya continuation signals, jo traders ko informed trading decisions lene mein madad karte hain:- Reliable Signals:

- Confirmation of Trends: Triple candlestick patterns reliable signals provide karte hain kyunke yeh three consecutive candles ki price action ko incorporate karte hain.

- Example: Morning star pattern ka formation aur confirmation ek strong bullish reversal signal provide karta hai jo traders ke liye valuable hota hai.

- Clear Entry and Exit Points:

- Defined Levels: Triple candlestick patterns clear entry aur exit points provide karte hain jo risk management ko enhance karte hain.

- Example: Evening star pattern ke baad bearish position enter karna aur pattern ke high pe stop loss set karna risk ko effectively manage karta hai.

- Enhanced Market Analysis:

- Comprehensive View: Triple candlestick patterns market sentiment aur underlying momentum ka comprehensive view provide karte hain, jo traders ke analysis ko improve karte hain.

- Example: Three white soldiers pattern ka formation bullish market sentiment aur strong buying pressure ko indicate karta hai.

Triple candlestick patterns ko effectively use karne ke liye kuch specific trading strategies adopt karni zaroori hain:- Confirmation and Validation:

- Wait for Confirmation: Triple candlestick patterns pe trade enter karne se pehle confirmation ka wait karna zaroori hai taake false signals se bacha ja sake.

- Example: Morning star pattern ke baad bullish position enter karne se pehle teesri bullish candle ka close hona confirm karna chahiye.

- Combine with Other Indicators:

- Use of Technical Indicators: Triple candlestick patterns ko other technical indicators jaise moving averages, RSI, aur MACD ke sath combine karke more reliable signals generate kiye ja sakte hain.

- Example: Agar three white soldiers pattern moving average crossover ke sath coincide karta hai, toh yeh stronger bullish signal provide karta hai.

- Risk Management:

- Set Stop Losses: Effective risk management ke liye stop loss levels set karna zaroori hai jo potential losses ko limit karte hain.

- Example: Evening star pattern ke baad bearish position enter karte waqt stop loss pattern ke high ke upar set karna chahiye.

- Trade Sizing:

- Proper Position Sizing: Proper position sizing ka use karke overall portfolio risk ko manage karna zaroori hai.

- Example: Agar three black crows pattern form hota hai, toh position size risk tolerance aur account balance ke hisaab se adjust karni chahiye.

Advantages:- Strong Signals:

- High Reliability: Triple candlestick patterns strong aur reliable signals provide karte hain jo traders ko confident trading decisions lene mein madad karte hain.

- Example: Morning star pattern ka formation ek high probability bullish reversal signal hai.

- Clear Market Sentiment:

- Enhanced Understanding: Triple candlestick patterns market sentiment aur price action ka clear understanding provide karte hain.

- Example: Three black crows pattern strong bearish sentiment aur selling pressure ko clearly indicate karta hai.

- Versatile Application:

- Multiple Time Frames: Triple candlestick patterns different time frames pe apply kiye ja sakte hain, jo inhe versatile banate hain.

- Example: Daily, hourly, aur even minute charts pe yeh patterns equally effective hote hain.

- False Signals:

- Market Noise: Market noise aur volatility ke wajah se sometimes triple candlestick patterns false signals bhi generate karte hain.

- Example: Economic news releases ya unexpected events ke dauran patterns ka effectiveness reduce ho sakta hai.

- Delayed Entry:

- Late Confirmation: Patterns ka confirmation late entry points cause kar sakta hai, jo potential profits ko reduce karte hain.

- Example: Teesri candle ke close hone ka wait karte waqt price already significant move kar chuki hoti hai.

- Complex Analysis:

- Multiple Factors: Triple candlestick patterns ko accurately identify aur analyze karna complex ho sakta hai, jo beginners ke liye challenging ho sakta hai.

- Example: Proper formation aur confirmation ke bina patterns ko accurately trade karna difficult ho sakta hai.

Essential Tips for Trading Triple Candlestick Patterns

Triple candlestick patterns ko effectively trade karne ke liye kuch essential tips follow karna zaroori hai:- Educate Yourself:

- Market Knowledge: Candlestick patterns aur market mechanics ke baare mein thorough education zaroori hai taake informed trading decisions liye ja sakein.

- Example: Trading books, online courses, aur experienced traders ke insights se knowledge enhance karni chahiye.

- Practice on Demo Account:

- Risk-Free Learning: Demo account pe practice karke patterns ko identify aur trade karne ki skills develop karni chahiye.

- Example: Different market conditions mein patterns ko trade karke experience gain karna zaroori hai.

- Stay Updated with Market News:

- Economic Events: Market news aur economic events se updated rehna zaroori hai kyunke yeh factors patterns ko influence karte hain.

- Example: Economic calendar ko regularly check karke important news releases ko monitor karna trading decisions ko improve karta hai.

- Use Multiple Indicators:

- Confirm Signals: Patterns ke signals ko confirm karne ke liye multiple technical indicators ka use karna effective hota hai.

- Example: Moving averages, RSI, aur MACD ke sath patterns ko combine karke stronger signals generate kiye ja sakte hain.

- Maintain Discipline:

- Emotional Control: Trading mein discipline aur emotional control maintain karna zaroori hai taake impulsive decisions aur overtrading avoid kiya ja sake.

- Example: Predefined trading plans aur risk management rules ko strictly follow karke emotional stress ko manage kiya ja sakta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Morning Star:

-

#4 Collapse

Forex Trade Mein Triple Candlestick Patterns Kya Hote Hain?

Forex trading mein candlestick patterns ek mukhtalif tareeqay hain jinhe traders istemal karte hain market trends aur price movements ko analyze karne ke liye. Ek aham aur complex candlestick pattern jo experienced traders ke liye mukhtasir waqt mein kafi information provide karta hai, woh hai "Triple Candlestick Pattern".

1. Triple Candlestick Pattern Ki Introduction

Triple candlestick patterns teen alag-alag candlesticks se mil kar banta hai, jo ek specific market situation ko indicate karte hain. Ye patterns typically three consecutive candles se form hote hain aur inki formation ka sequence pattern ke type par depend karta hai.

Triple candlestick patterns primarily mein include hote hain evening star, morning star, aur three black crows. Har pattern apne unique characteristics aur implications ke saath aata hai, jo traders ko market direction aur potential reversals ke baare mein insights provide karte hain.

2. Types of Triple Candlestick Patterns

Triple candlestick patterns ke kai prakar hote hain jo traders ko market sentiment aur price action ke bare mein important signals dete hain:- Evening Star Pattern: Evening star pattern ek bearish reversal pattern hai jo uptrend ke baad dikhta hai. Is pattern mein pehla candle bullish hota hai, doosra small body ya doji hota hai jo confusion aur indecision indicate karta hai, aur teesra candle bearish hota hai jo downtrend ki starting indicate karta hai.

- Morning Star Pattern: Morning star pattern ek bullish reversal pattern hai jo downtrend ke baad dikhta hai. Is pattern mein pehla candle bearish hota hai, doosra small body ya doji hota hai jo market indecision indicate karta hai, aur teesra candle bullish hota hai jo uptrend ki starting indicate karta hai.

- Three Black Crows: Three black crows pattern ek bearish reversal pattern hai jo uptrend ke baad dikhta hai. Is pattern mein teen consecutive long bearish candles hote hain jo downward trend ko confirm karte hain.

Har ek pattern ka apna specific formation hota hai jo candlestick shapes, sizes, aur relative positions par depend karta hai. In patterns ke saath sahi time par entry aur exit points identify karna traders ke liye crucial hota hai.

3. Evening Star Pattern

Evening star pattern ek powerful bearish reversal signal hai jo uptrend ke baad dikhta hai. Is pattern mein pehla candle bullish hota hai, doosra small body ya doji hota hai jo market indecision ko indicate karta hai, aur teesra candle bearish hota hai jo selling pressure aur potential downtrend ko confirm karta hai.

Evening star pattern ki effectiveness market conditions aur candlestick formations par depend karta hai. Yeh pattern jab properly identify kiya jata hai toh strong selling opportunities provide karta hai, lekin confirmatory indicators aur risk management ke saath use karna zaroori hai.

4. Morning Star Pattern

Morning star pattern ek bullish reversal signal hai jo downtrend ke baad dikhta hai. Is pattern mein pehla candle bearish hota hai, doosra small body ya doji hota hai jo market indecision ko indicate karta hai, aur teesra candle bullish hota hai jo buying pressure aur potential uptrend ko indicate karta hai.

Morning star pattern bullish market reversals ke liye powerful indicator hai, lekin iski confirmation aur validation ke liye additional technical analysis tools aur market indicators ka use kiya jata hai. Traders ko is pattern ko recognize karne aur uska correct interpretation karna important hai trading decisions ke liye.

5. Three Black Crows

Three black crows pattern ek strong bearish reversal signal hai jo uptrend ke baad dikhta hai. Is pattern mein teen consecutive long bearish candles hote hain jo downtrend ki initiation aur selling pressure ko confirm karte hain.

Three black crows pattern ko samajhna aur identify karna traders ke liye zaroori hai taaki woh market trends ko predict kar sakein aur sahi time par apne trades ko manage kar sakein. Is pattern ki success rate market conditions aur proper formation par depend karti hai.

6. How to Identify Triple Candlestick Patterns

Triple candlestick patterns ko identify karna traders ke liye crucial hota hai. In patterns ko recognize karne ke liye traders ko candlestick shapes, sizes, aur relative positions ko carefully analyze karna hota hai.- Candlestick Shapes: Har ek candle ka shape aur size pattern ke analysis mein important hota hai. Bullish aur bearish candles ki lengths aur bodies ke comparative analysis se traders ko pattern ki formation samajhne mein madad milti hai.

- Relative Positions: Candlesticks ke relative positions pattern ki formation ke liye critical hoti hai. Pehle aur teesre candle ke positioning aur unke interactions doosre candle ke saath determine karte hain ki pattern bullish ya bearish reversal indicate kar raha hai.

- Volume Analysis: Candlestick patterns ke saath volume analysis bhi important hai. High trading volumes patterns ki validity ko confirm karte hain aur trend reversals ko validate karte hain.

Triple candlestick patterns ki accurate identification ke liye historical data analysis aur real-time market monitoring zaroori hai. Traders ko patterns ke subtle nuances ko samajhne aur interpret karne mein proficiency develop karna hota hai.

7. Importance of Triple Candlestick Patterns in Forex Trade

Triple candlestick patterns forex trading mein ek significant role play karte hain kyunki yeh market sentiment aur price action ke important indicators provide karte hain. In patterns ke through traders market reversals aur trend changes ko identify kar sakte hain aur effective trading decisions le sakte hain.

Triple candlestick patterns ke study se traders ko market psychology aur price dynamics ke deeper insights milte hain. Yeh patterns short-term aur long-term trading strategies ke liye valuable tools hote hain jo traders ko market conditions ko better understand karne mein madad karte hain.

8. Candlestick Pattern Analysis in Trading

Candlestick pattern analysis ek critical component hai technical analysis ka jo traders ko market trends aur price movements ke bare mein detailed information provide karta hai. Candlestick patterns ko identify karna aur unka correct interpretation karna trading decisions ke liye crucial hota hai.- Trend Reversal Signals: Candlestick patterns primarily trend reversals ko identify karne mein help karte hain. Bullish aur bearish reversal patterns traders ko potential entry aur exit points provide karte hain.

- Continuation Patterns: Some candlestick patterns continuation trends ko indicate karte hain. In patterns ka use karke traders current trends mein trading opportunities explore karte hain.

- Risk Management: Candlestick patterns ka use risk management strategies mein bhi kiya ja sakta hai. Patterns ki confirmation aur additional technical indicators ke saath traders apne trades ko manage kar sakte hain aur risk ko minimize kar sakte hain.

Candlestick pattern analysis mein historical data, technical indicators, aur market sentiment ka analysis bhi important hai. Traders ko patterns ke saath confirmatory signals aur market context ko consider karna hota hai trading decisions ke liye.

9. Triple Candlestick Patterns ki Strategy

Triple candlestick patterns ko effectively trade karne ke liye traders ko apni trading strategy ko develop karna hota hai jo pattern identification, confirmation, aur risk management ko include karta hai. Yeh strategies market conditions aur trader preferences par depend karti hain.- Pattern Recognition: Traders ko patterns ko identify karne aur unki formation ko samajhne ke liye technical analysis tools ka use karna hota hai. Pattern recognition strategies traders ko patterns ke subtle details ko capture karne mein madad deti hain.

- Confirmation Signals: Patterns ki confirmation ke liye traders additional technical indicators aur price action analysis ka use karte hain. Confirmatory signals patterns ki validity ko enhance karte hain aur trading decisions ko strengthen karte hain.

- Risk Management: Triple candlestick patterns ki trading strategies mein risk management ka integration important hota hai. Proper stop-loss levels aur position sizing strategies traders ko losses se protect karte hain aur consistent profitability ko ensure karte hain.

Har ek trader apne unique trading style aur risk tolerance ke according triple candlestick patterns ka use karta hai. Strategies ko back-testing aur real-time market conditions par test karna important hai trading consistency aur success ke liye.

10. Triple Candlestick Patterns ka Use Risk Management Mein

Triple candlestick patterns ka use karke traders apne risk management strategies ko enhance kar sakte hain. Patterns ki identification, confirmation, aur proper risk assessment ke through traders apne trades ko better manage kar sakte hain.- Stop-loss Placement: Triple candlestick patterns ki trading mein stop-loss levels ko define karna critical hota hai. Stop-loss placement patterns ke invalidation point se close proximity mein rakha jata hai toh trading losses ko minimize karta hai.

- Position Sizing: Position sizing techniques triple candlestick patterns ke volatility aur market conditions ke according adjust kiya jata hai. Proper position sizing traders ko consistent risk exposure aur trading capital management provide karta hai.

- Risk Reward Ratio: Triple candlestick patterns ki trading mein risk reward ratio ko consider karna important hai. High probability setups aur favorable risk reward ratios traders ko profitable trading opportunities provide karte hain.

Risk management strategies ke saath triple candlestick patterns ka proper use traders ko disciplined trading approach provide karta hai. Isse traders apne trading risks ko control kar sakte hain aur long-term profitability maintain kar sakte hain.

11. Real-life Examples of Triple Candlestick Patterns

Real-life examples se traders ko samajhne mein madad milti hai ki triple candlestick patterns kaise kaam karte hain aur unka use kaise kiya ja sakta hai. Historical data aur recent market trends se examples ki analysis traders ke liye valuable insights provide karte hain.- Case Study Analysis: Successful trades aur market reversals ke examples traders ko patterns ke practical applications demonstrate karte hain. Case studies traders ko patterns ki effectiveness aur market conditions ke impact ko samajhne mein madad dete hain.

- Live Market Examples: Real-time market examples triple candlestick patterns ke identification aur trading strategies ko illustrate karte hain. Traders ko current market trends ke basis par patterns ka analysis karke trading decisions lene mein confidence milti hai.

Real-life examples se traders ko patterns ke various applications aur market conditions ke implications ko better understand karne mein help milti hai. Isse traders apne pattern recognition skills ko improve karte hain aur effective trading strategies develop karte hain.

12. Benefits of Using Triple Candlestick Patterns

Triple candlestick patterns ka use karne ke kai benefits hote hain jo traders ko market analysis aur trading decisions mein madad karte hain:- Clear Market Signals: Patterns clear market signals provide karte hain jo trend reversals aur potential price movements ko indicate karte hain.

- Enhanced Entry and Exit Points: Patterns traders ko entry aur exit points ko identify karne mein help karte hain, jo profitable trades ko execute karne mein madad dete hain.

- Market Sentiment Analysis: Patterns market sentiment aur investor psychology ke insights provide karte hain jo effective trading strategies develop karne mein madad dete hain.

- Risk Management: Patterns traders ko risk management strategies ko strengthen karne mein madad dete hain. Proper stop-loss levels aur risk reward ratios ki calculation patterns ke through traders ko accuracy provide karte hain.

Triple candlestick patterns ke benefits trading consistency aur profitability ko enhance karte hain. Isse traders apne trading skills ko refine kar sakte hain aur market conditions ke adaptive trading strategies develop kar sakte hain.

13. Challenges in Using Triple Candlestick Patterns

Triple candlestick patterns ka use karne mein kuch challenges bhi hote hain jo traders ko face karna padta hai:- Complex Interpretation: Patterns ke complex nature ki wajah se unko interpret karna challenging ho sakta hai, especially beginners ke liye.

- False Signals: Market volatility aur pattern formation mein anomalies ki wajah se false signals generate ho sakte hain, jo incorrect trading decisions lead kar sakte hain.

- Confirmation Requirements: Patterns ki confirmation aur validation ke liye additional technical indicators aur market analysis ki zaroorat hoti hai, jo extra time aur effort require karte hain.

Traders ko triple candlestick patterns ke saath sahi risk management aur confirmatory signals ka use karna important hai. Challenges ko recognize karke traders apne strategies ko refine kar sakte hain aur consistent trading performance achieve kar sakte hain.

14. Triple Candlestick Patterns vs. Single Candlestick Patterns

Triple candlestick patterns aur single candlestick patterns mein kuch key differences hote hain jo traders ko understand karne mein madad karte hain:- Complexity: Triple candlestick patterns single candlestick patterns se zyada complex hote hain aur detailed market insights provide karte hain.

- Information Density: Triple candlestick patterns multiple candles ke through detailed information provide karte hain, whereas single candlestick patterns single candle ke through limited information offer karte hain.

- Confirmation Requirements: Triple candlestick patterns ki validation aur confirmation single candlestick patterns se zyada technical indicators aur market analysis ki zaroorat hoti hai.

Har ek pattern ki apni unique characteristics aur implications hoti hain jo traders ko market conditions ko analyze karne mein madad deti hain. Patterns ke comparative analysis se traders ko trading decisions lene mein confidence milti hai aur effective strategies develop karne mein help milti hai.

15. Technical Indicators aur Triple Candlestick Patterns

Technical indicators aur triple candlestick patterns ka combination traders ko robust trading strategies provide karta hai:- Support and Resistance Levels: Technical indicators support aur resistance levels ke identification mein madad karte hain jo triple candlestick patterns ki validity ko confirm karte hain.

- Moving Averages: Moving averages triple candlestick patterns ke confirmatory signals provide karte hain jo market trends aur reversals ko validate karte hain.

- RSI (Relative Strength Index): RSI triple candlestick patterns ke momentum aur overbought/oversold conditions ko analyze karte hain jo trading decisions ke liye valuable insights provide karte hain.

Technical indicators ke saath triple candlestick patterns ka integration traders ko comprehensive market analysis provide karta hai. Isse traders apne trading strategies ko refine kar sakte hain aur accurate market predictions kar sakte hain.

16. Triple Candlestick Patterns aur Price Action

Triple candlestick patterns price action trading mein ek crucial role play karte hain, jo ki traders ko detailed market insights dete hain:- Candlestick Formations: Triple candlestick patterns ke candlestick formations price action analysis ke through traders ko market sentiment aur price dynamics ke insights provide karte hain.

- Market Reversals: Triple candlestick patterns bearish aur bullish market reversals ko indicate karte hain jo price action patterns ke saath correlate hota hai.

- Pattern Recognition: Price action analysis triple candlestick patterns ke accurate identification mein help karta hai jo trading decisions ke liye critical hota hai.

Price action trading strategies ke saath triple candlestick patterns ka use traders ko market trends ko interpret karne mein help karta hai. Isse traders accurate trading decisions lene mein proficient ho sakte hain aur consistent profitability achieve kar sakte hain.

17. Triple Candlestick Patterns ki Success Rate

Triple candlestick patterns ki success rate market conditions aur pattern type par depend karti hai:- Market Volatility: High volatility conditions mein triple candlestick patterns ki success rate low ho sakti hai due to erratic price movements.

- Pattern Formation: Proper pattern formation aur confirmation ke saath triple candlestick patterns ki success rate enhance hoti hai.

- Historical Data Analysis: Historical data analysis aur pattern recognition traders ko patterns ki success rate evaluate karne mein help karte hain.

Traders ko patterns ki accurate identification aur sahi time par entry aur exit points determine karne ke liye proficiency develop karna hota hai. Isse traders apne trading skills ko improve kar sakte hain aur consistent trading performance achieve kar sakte hain.

18. Triple Candlestick Patterns ki Educational Resources

Triple candlestick patterns ko samajhne ke liye traders ke liye kai educational resources available hain jo market analysis aur technical analysis ko enhance karte hain:- Online Courses: Online courses traders ko patterns ke detailed study aur practical applications provide karte hain.

- Webinars: Webinars triple candlestick patterns ke real-life examples aur case studies provide karte hain jo traders ke learning experience ko enrich karte hain.

- Books and Articles: Books aur articles traders ko patterns ke comprehensive study aur historical analysis provide karte hain.

Educational resources ki help se traders apne technical analysis skills ko refine kar sakte hain aur effective trading strategies develop kar sakte hain. Isse traders market conditions ko better understand kar sakte hain aur profitable trading decisions lene mein proficient ho sakte hain.

19. Conclusion

Triple candlestick patterns forex trading mein ek powerful tool hai jo traders ko market movements ke bare mein detailed information provide karta hai. In patterns ko samajhna aur sahi tareeke se interpret karna traders ke liye zaroori hai jo effective trading decisions lene mein madad karte hain.

Is article mein hamne dekha ki triple candlestick patterns kya hote hain aur unka forex trading mein kaise use kiya ja sakta hai. Triple candlestick patterns ke study aur practice se traders apne trading skills ko improve kar sakte hain aur consistent profits generate kar sakte hain. -

#5 Collapse

A Triple Candlestick Pattern ka matlab hai teen candles ka set jo price chart mein milkar ek potential market reversal ya continuation ka signal dete hain. Yeh patterns technical analysis ka hissa hain aur traders ko future price movements predict karne mein madad karte hain. Yahan kuch mashhoor Triple Candlestick Patterns hain:

1. Morning Star- Type: Bullish Reversal

- Structure:

- Pehli Candle: Lambi bearish candle.

- Doosri Candle: Choti-bodied candle (bullish ya bearish ho sakti hai) jo pehli candle se gap down hoti hai.

- Teesri Candle: Lambi bullish candle jo pehli candle ke body ke aadhe se zyada close hoti hai.

- Psychology: Yeh ishaara deti hai ke selling pressure kam ho raha hai aur buyers control mein aa rahe hain, jo ek potential uptrend ka signal hai.

- Type: Bearish Reversal

- Structure:

- Pehli Candle: Lambi bullish candle.

- Doosri Candle: Choti-bodied candle (bullish ya bearish ho sakti hai) jo pehli candle se gap up hoti hai.

- Teesri Candle: Lambi bearish candle jo pehli candle ke body ke aadhe se zyada close hoti hai.

- Psychology: Yeh ishaara deti hai ke buying pressure kam ho raha hai aur sellers control mein aa rahe hain, jo ek potential downtrend ka signal hai.

- Type: Bullish Continuation/Reversal

- Structure:

- Teen Lagataar Bullish Candles: Har candle pehli candle ke body ke andar ya uske kareeb open hoti hai aur progressively higher close hoti hai.

- Psychology: Yeh strong buying pressure aur ek potential continuation ya reversal of an uptrend dikhata hai.

- Type: Bearish Continuation/Reversal

- Structure:

- Teen Lagataar Bearish Candles: Har candle pehli candle ke body ke andar ya uske kareeb open hoti hai aur progressively lower close hoti hai.

- Psychology: Yeh strong selling pressure aur ek potential continuation ya reversal of a downtrend dikhata hai.

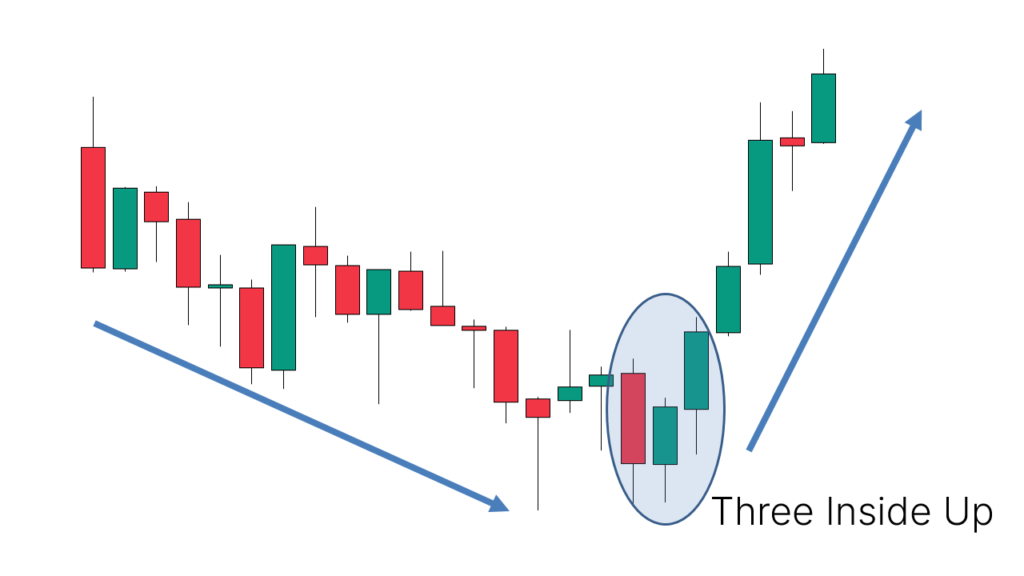

- Type: Bullish Reversal

- Structure:

- Pehli Candle: Lambi bearish candle.

- Doosri Candle: Choti bullish candle jo pehli candle ke body ke andar poori hoti hai.

- Teesri Candle: Lambi bullish candle jo pehli candle ke high se upar close hoti hai.

- Psychology: Yeh downtrend ke weakening aur ek potential reversal to an uptrend ka signal deti hai.

- Type: Bearish Reversal

- Structure:

- Pehli Candle: Lambi bullish candle.

- Doosri Candle: Choti bearish candle jo pehli candle ke body ke andar poori hoti hai.

- Teesri Candle: Lambi bearish candle jo pehli candle ke low se neeche close hoti hai.

- Psychology: Yeh uptrend ke weakening aur ek potential reversal to a downtrend ka signal deti hai.

- Confirmation: Sabhi triple candlestick patterns ke liye, mazeed indicators (e.g., volume, RSI, MACD) ya ek subsequent candle pattern ke direction mein aksar dekhi jaati hai.

- Entry: Aam tor par, traders pattern ke confirmation ke baad position enter karte hain.

- Stop-Loss: Bullish setups ke liye pattern ke low ke neeche ya bearish setups ke liye pattern ke high ke upar rakha jaata hai.

- Target: Nearest support/resistance levels ya ek risk-reward ratio ko istemal karke determine kiya jaata hai.

Yeh triple candlestick patterns technical analysis mein widely used hain, aur inhein use karke traders historical price movements aur trader psychology ke base par informed trading decisions le sakte hain.

-

#6 Collapse

Triple Candlestick Pattern Kya Hai?

Forex trading mein candlestick patterns ka use market ke movements ko samajhne aur potential reversals ko predict karne ke liye hota hai. Triple candlestick patterns teeno candlesticks par mushtamil hote hain jo market ke sentiment mein change ka indication dete hain. Yeh patterns traders ko effective trading decisions lene mein madad karte hain. Aaj hum kuch mashhoor triple candlestick patterns jaise Morning Star, Evening Star, aur Three White Soldiers/Three Black Crows discuss karenge.

Morning Star Pattern

Tashreeh

Morning Star ek bullish reversal pattern hai jo downtrend ke bottom par appear hota hai aur uptrend ke start hone ka signal deta hai.

Formation- Pehla Candle: Pehla candle lamba bearish candle hota hai jo strong selling pressure ko dikhata hai.

- Doosra Candle: Doosra candle choti body wala candle hota hai (bullish ya bearish) jo market mein indecision ko dikhata hai. Yeh candle pehle candle se neeche gap down karta hai.

- Teesra Candle: Teesra candle lamba bullish candle hota hai jo pehle candle ke body ke andar close karta hai, jo buyers ke control mein aane ka indication deta hai.

Morning Star pattern yeh suggest karta hai ke selling pressure kam ho raha hai aur buying pressure barh raha hai, jo potential reversal aur uptrend ke start hone ka signal hai.

Trading Strategy- Entry Point: Teesra candle ke close hone ke baad buy position lein jab yeh pehle candle ke midpoint ke upar close ho.

- Stop-Loss: Stop-loss ko doosre candle ke low ke neeche place karein.

- Take Profit: Take-profit ko next resistance level par ya pre-determined risk-reward ratio ke mutabiq set karein.

Tashreeh

Evening Star ek bearish reversal pattern hai jo uptrend ke top par appear hota hai aur downtrend ke start hone ka signal deta hai.

Formation- Pehla Candle: Pehla candle lamba bullish candle hota hai jo strong buying pressure ko dikhata hai.

- Doosra Candle: Doosra candle choti body wala candle hota hai (bullish ya bearish) jo market mein indecision ko dikhata hai. Yeh candle pehle candle se ooper gap up karta hai.

- Teesra Candle: Teesra candle lamba bearish candle hota hai jo pehle candle ke body ke andar close karta hai, jo sellers ke control mein aane ka indication deta hai.

Evening Star pattern yeh suggest karta hai ke buying pressure kam ho raha hai aur selling pressure barh raha hai, jo potential reversal aur downtrend ke start hone ka signal hai.

Trading Strategy- Entry Point: Teesra candle ke close hone ke baad sell position lein jab yeh pehle candle ke midpoint ke neeche close ho.

- Stop-Loss: Stop-loss ko doosre candle ke high ke upar place karein.

- Take Profit: Take-profit ko next support level par ya pre-determined risk-reward ratio ke mutabiq set karein.

Tashreeh

Three White Soldiers pattern ek bullish continuation pattern hai jo strong upward momentum aur uptrend ke continuation ko indicate karta hai.

Formation- Pehla Candle: Pehla candle lamba bullish candle hota hai jo apni high ke qareeb close hota hai.

- Doosra Candle: Doosra candle lamba bullish candle hota hai jo pehle candle ke body ke andar open hota hai aur uske high ke upar close karta hai.

- Teesra Candle: Teesra candle bhi lamba bullish candle hota hai jo doosre candle ke body ke andar open hota hai aur uske high ke upar close karta hai.

Three White Soldiers pattern strong aur sustained buying pressure ko indicate karta hai, jo uptrend ke continuation ka signal deta hai.

Trading Strategy- Entry Point: Teesra candle ke close hone ke baad buy position lein jab yeh doosre candle ke high ke upar close ho.

- Stop-Loss: Stop-loss ko pehle candle ke low ke neeche place karein.

- Take Profit: Take-profit ko next resistance level par ya pre-determined risk-reward ratio ke mutabiq set karein.

Tashreeh

Three Black Crows pattern ek bearish continuation pattern hai jo strong downward momentum aur downtrend ke continuation ko indicate karta hai.

Formation- Pehla Candle: Pehla candle lamba bearish candle hota hai jo apni low ke qareeb close hota hai.

- Doosra Candle: Doosra candle lamba bearish candle hota hai jo pehle candle ke body ke andar open hota hai aur uske low ke neeche close karta hai.

- Teesra Candle: Teesra candle bhi lamba bearish candle hota hai jo doosre candle ke body ke andar open hota hai aur uske low ke neeche close karta hai.

Three Black Crows pattern strong aur sustained selling pressure ko indicate karta hai, jo downtrend ke continuation ka signal deta hai.

Trading Strategy- Entry Point: Teesra candle ke close hone ke baad sell position lein jab yeh doosre candle ke low ke neeche close ho.

- Stop-Loss: Stop-loss ko pehle candle ke high ke upar place karein.

- Take Profit: Take-profit ko next support level par ya pre-determined risk-reward ratio ke mutabiq set karein.

Triple candlestick patterns forex trading mein bohot ahmiyat rakhte hain aur market ke sentiment ko samajhne mein madad karte hain. In patterns ko sahi tarah se identify aur use karna trading success ke liye zaroori hai. Proper risk management aur confirmation ke sath, aap in patterns ka faida utha sakte hain aur apni trading strategies ko improve kar sakte hain. Morning Star, Evening Star, Three White Soldiers, aur Three Black Crows jaise patterns reliable signals provide karte hain jo aapki trading performance ko enhance kar sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

**Triple Candlestick Pattern Kya Hai?**

Triple candlestick pattern forex aur stock market mein technical analysis ka ek important tool hai jo market trends aur reversals ko predict karne mein madad deta hai. Is pattern mein teen consecutive candles shamil hote hain jo ek specific market scenario ko indicate karte hain.

**Types of Triple Candlestick Patterns:**

1. **Morning Star:** Morning star pattern ek bullish reversal pattern hai jo downtrend ke baad dikhta hai. Isme pehla candle bearish hota hai, doosra small range mein form hota hai, aur teesra bullish candle formation complete karta hai.

2. **Evening Star:** Evening star pattern ek bearish reversal pattern hai jo uptrend ke baad dikhta hai. Isme pehla candle bullish hota hai, doosra small range mein form hota hai, aur teesra bearish candle formation complete karta hai.

3. **Three Black Crows:** Three black crows pattern ek bearish continuation pattern hai jo downtrend ke dauran dikhta hai. Isme teen consecutive long bearish candles form hote hain, jisse ke price downward trend mein continue hota hai.

4. **Three White Soldiers:** Three white soldiers pattern ek bullish continuation pattern hai jo uptrend ke dauran dikhta hai. Isme teen consecutive long bullish candles form hote hain, indicating ki uptrend jari hai aur price further increase hone ki possibility hai.

**Triple Candlestick Pattern ka Importance:**

- Triple candlestick patterns market sentiment aur price action ke strong indications provide karte hain. In patterns ko identify karne ke baad traders potential reversals ya continuations ke liye trades plan karte hain.

**Trading Strategy:**

- **Confirmation:** Triple candlestick pattern ko confirm karne ke liye next few candles ka price action monitor karna zaroori hai. Agar pattern ke according price move hota hai, tab entry position consider kiya ja sakta hai.

- **Stop Loss:** Recent low ya high ke neeche ya upar stop loss rakha ja sakta hai, depending on the direction of the trade.

- **Target:** Previous support ya resistance level tak ja sakta hai, jisse ki potential profit maximize kiya ja sake.

**Conclusion:**

Triple candlestick patterns forex trading mein ek powerful tool hote hain jo traders ko market movements ke patterns aur trends ko samajhne mein madad karte hain. In patterns ko sahi tarah se identify karke aur confirm karne ke baad hi trades execute kiye ja sakte hain. Har ek pattern ki apni characteristics hote hain jinhe samajhne ke baad hi trading decisions liye ja sakte hain. Technical analysis tools ka sahi istemal aur market conditions ko samajhne ke baad hi consistent profitability achieve kiya ja sakta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:33 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим