What is Breakout

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

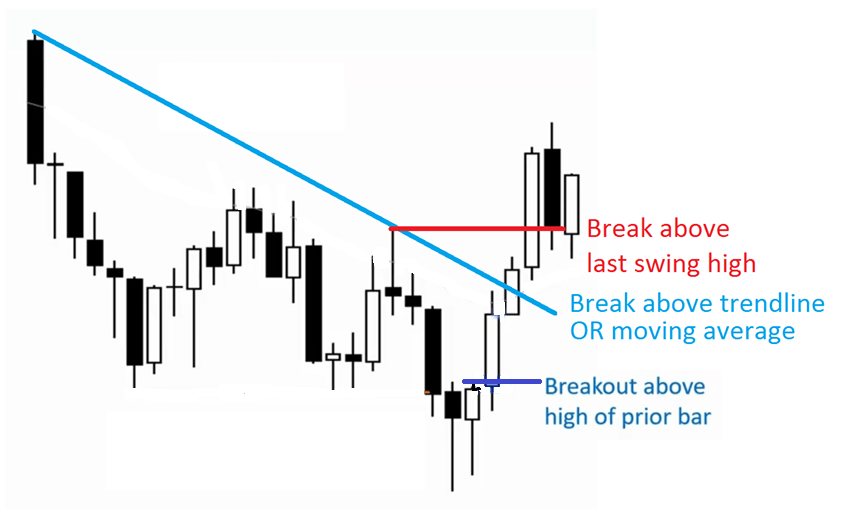

Assalam.o alaikum dosto What is Breakout break out se morad jab kisi asasay ki qeemat muzahmati ilaqay se oopar jati hai, ya support area se neechay jati hai. break qeemat ke break out simt mein rujhan shuru karne ke imkaan ki nishandahi karte hain. misaal ke tor par, chart ke patteren se oopar ki taraf break out is baat ki nishandahi kar sakta hai ke qeemat ziyada trained hona shuru kar day gi. break out jo ziyada volume par hotay hain ( aam hajam ke nisbat ) ziyada yaqeen zahir karte hain jis ka matlab hai ke qeemat ka is simt mein rujhan honay ka ziyada imkaan hai. ahem take ways break out tab hota hai jab qeemat muzahmati satah se oopar jati hai ya support level se neechay jati hai. break out ho satke hain kyunkay tamam traders yaksaa himayat aur muzahmati sthon ko nahi pehchanen ge ya istemaal nahi karen ge. break out mumkina tijarti mawaqay faraham karte hain. oopar ki taraf break out taajiron ko lambi position haasil karne ya mukhtasir position haasil karne ka ishara deta hai. manfi pehlu ka break out taajiron ko mumkina tor par mukhtasir honay ya lambi pozishnin farokht karne ka ishara deta hai. nisbatan ziyada hajam ke sath break out yaqeen aur dilchaspi zahir karte hain, aur is liye qeemat ke break out simt mein barhatay rehne ka ziyada imkaan hota hai. kam rishta daar volume par break out ziyada nakami ka shikaar hotay hain, is liye qeemat ka break out simt mein rujhan honay ka imkaan kam hota hai . What does a breakout tell you break out aam tor par ya deegar chart patteren ke sath munsalik hotay hain, Bashmole masalas, jhanday, pachar, aur sir aur kandhay. yeh namoonay is waqt bantay hain jab qeemat aik makhsoos andaaz mein harkat karti hai jis ke nateejay mein achi terhan se tay shuda support aur / ya muzahmati satah hoti hai. phir tajir break out ke liye un sthon ko dekhte hain. agar qeemat muzahmat se oopar toot jati hai to woh lambi position shuru kar satke hain ya mukhtasir position se bahar nikal satke hain, ya agar qeemat support se neechay toot jati hai to woh mukhtasir position shuru kar satke hain ya lambi position se bahar nikal satke hain. ziyada volume break out ke baad bhi, qeemat aksar ( lekin hamesha nahi ) break out ki simt mein dobarah jane se pehlay break out point par wapas aajay gi. is ki wajah yeh hai ke qaleel mudti tajir aksar ibtidayi break out kharedtay hain, lekin phir munafe ke liye kaafi taizi se farokht karne ki koshish karte hain. yeh farokht earzi tor par qeemat ko break out point par wapas le jati hai. agar break out jaaiz hai ( nakami nahi ), to qeemat ko break out simt mein wapas jana chahiye. agar aisa nahi hota hai to yeh aik nakaam break out hai. Example of breakout woh tajir jo tijarat shuru karne ke liye break out ka istemaal karte hain aam tor par break out nakaam honay ki soorat mein stap las ke orders ka istemaal karte hain. ulta break out par taweel safar karne ki soorat mein, stap nuqsaan aam tor par muzahmati satah se bilkul neechay rakha jata hai. davn side break out par mukhtasir jane ki soorat mein, aik stap nuqsaan aam tor par support level se bilkul oopar rakha jata hai jis ki khilaaf warzi ki gayi hai. break out ki misaal tasweer tasweer Sabrina jayang © investopedia 2020 chart hajam mein aik bara izafah dekhata hai, jo aamdani ke ajra se munsalik hota hai, kyunkay qeemat masalas chart patteren ke muzahmati ilaqay se guzarti hai. break out itna mazboot tha ke is ki wajah se qeematon mein farq para. qeemat musalsal barhti rahi aur asal break out point par wapas nahi gayi. yeh aik bohat mazboot break out ki alamat hai. tajir mumkina tor par lambi pozishnon mein daakhil honay aur / ya mukhtasir pozishnon se bahar niklny ke liye break out ka istemaal kar satke thay. agar lamba daakhil ho raha hai to, aik stap nuqsaan masalas ki muzahmati satah ke bilkul neechay rakha jaye ga ( ya masalas support se bhi neechay ). chunkay qeemat mein bara farq tha, is liye yeh stap nuqsaan ka maqam misali nahi ho sakta. break out ke baad qeemat musalsal bherne ke baad khatray ko kam karne ya munafe mein band karne ke liye stap nuqsaan ko agay badhaya ja sakta hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Market me break out ke bary me bat cheet AOA support level se neechay jati hai. break out ho satke hain kyunkay tamam traders yaksaa support aur rizstns level ko nahi pehchanen ge ya istemaal nahi karen ge .break out mumkina tijarti mawaqay faraham karte hain. oopar ki taraf break out taajiron ko lambi position haasil karne ya supd tijarat mein daakhil hona hai jaisay hi qeemat apni had se bahar honay ka intizam karti hai. tajir mazboot raftaar ki talaash mein hain aur asal break out position mein daakhil honay ka ishara hai aur is ke baad honay wali market ki harkat se munafe hai .port level se oopar hoti hai, mumkina tor par kuch waqt ke liye. muzahmat ya support level rait mein aik lakeer ban jata hai jisay bohat se tajir entry points set karne ya nuqsaan ki satah ko roknay ke liye istemaal karte hain. jab qeemat support ya rizstns level se toot jati hai to traders break out jump un ka intzaar karte hain, aur woh log jo nahi chahtay thay ke qeemat break out ho taakay barray nuqsanaat smukhtasir position haasil karne ka ishara deta hai. manfi pehlu ka break out taajiron ko mumkina tor par mukhtasir honay ya lambi pozishnin farokht karne ka ishara deta hai . nisbatan ziyada hajam ke sath break out yaqeen aur dilchaspi zahir karte hainBasic knowledge is ko samjhny ke lye Is se hmme baseerat ko kaafi wazeh andaaz mein paish karta hai. break out ke baad, purani muzahmati sthon ko naye support ke tor par kaam karna chahiye aur puranay support level ko hai kyunkay yeh is baat ka taayun karne ka aik marozi tareeqa hai ke tijarat kab nakaam hui hai aur is baat ka breakout level ke upar ya niche stop orders lagate hain, jisse ki jab price breakout level cross karta hai to unki positions automatically enter ho jaati hain. Traders breakout ke baad trend ki direction ke according apni positions enter karte hain, jisse ki unki positions profitable ho sakein.Breakout trading strategy ka ek drawback ye hai ki ye false breakouts ke risk ko bhi include karta hai. False breakout ke case mein, price breakout level ko cross karta hai, lekin phir se us level ke andar aa jaata hai. False breakouts ke risk ko minimize karne ke liye, traders typically trading signals aur price action analysis ka use karte hain.Overall, Breakout ek price movement ki term hai, jismein price ki movement kisi specific level se break karke, new high ya new low banata hai. Breakout trading strategy mein traders kisi specific level ke breakout ko anticipate karke trade karte hain, jisse ki unki positions profitable ho sakein. Is se Loss ko bachna kaisy he? yeh bearish breakout hai aur agar price resistance level ko break karke upar move karne lagta hai, to yeh bullish breakout hai.Breakout ki pehchan karne ke liye traders trend lines bhi use karte hain. Trend lines ki help se traders support aur resistance levels ko draw karte hain aur breakout level ko anticipate karte hain. Breakout ki pehchan karne ke liye traders ko market volatility ko bhi monitor karna hota hai, kyonki jyada volatile mar taayun karne ka aik aasaan tareeqa hai ke aap ke stop loss order ko kahan set karna hai. position lainay ke baad, khonay wali tijarat ko band karne ke liye purani support ya muzahmati satah ko rait mein aik lakeer ke tor par istemaal karen .ket mein false breakouts ke chances bhi jyada hote hain.Breakout ki pehchan karne ke liye traders ko market ki news aur economic indicators ko bhi monitor karna hota hai, kyonki ye factors bhi breakout ko influence kar sakte hain. Traders breakout ki pehchan karne ke liye technical indicators bhi use karte hain, jaise ki Bollinger Bands, Moving Averages, Breakout ki pehchan karne ke liye traders price action analysishota he

-

#4 Collapse

Break out Stretegy Purpose ;- Break out strategy ek is Tarah ki strategy hai ke iski help lekar maximum members apni trading ko successful kar rahe hote hain isliye depend karta hai ki members Apne trading mein kis Tarah se successful ho rahe hain to members ko break out strategy ke bare mein apni learning ko acchi Tarah se increase kar lena hoga . Working of Strategy ;- Dear traders agar hum is strategy ki working ke bare mein baat Karen to ham sabko yah idea ho jaega ki is strategy ki help lekar koi bhi member Apne trading ko successful kar sakta hai lekin sabko apni learning ko acchi Tarah se increase karna hoga aur agar is strategy ke related acchi learning Nahin hogi to Kam Karne aur trading karne mein problem hogi. Main points ;- Technical indicators ki help lekar Kisi bhi strategy per work out Kiya jata hai aur is Tarah se vah strategy successful sabit Hoti hai is Tarah se members ko technically har Tarah se market ko analyse kar lene ke liye indicators ke bare mein knowledge Hona mast hai aur agar technically members ko knowledge Nahin hoga to is Tarah se vah Kisi bhi strategy per acchi Tarah se Amal nahin kar payenge. Trading se related sab strategies bahut important hoti hain isliye members ko learning per acchi Tarah se focus kar lene ke bad hi har Tarah se apni strategy ko possible working Karke successful kar lena hota hai aur tabhi members apni trading mein acchi Tarah se successful ho jaate Hain aur apne trading ko continue kar lene ke bad achcha profit bhi earn kar paate Hain. -

#5 Collapse

Assalamo Alaekum friends. Kasy hain ap sabMain umed karta hon ap sab bilkul thek thak hon gay. Aj ka jo topic zer e behs hay uska nam break out hay . Yeh hamen kia btayega r kia information deta hay yeh dekhty hain. Yeh hamen kia kuch btaya hay yeh ab ham agy mazeed dekhty hain. Break out Break out aek stock ki qeemat hy jo aek mukarrah himayat ya muzahmati satah sy bhr brhti hoi hujam k sath hoti hy aek break out trader stock ki qeemat muzahmat sy opr tutny k bd lambi position me dakhil hota hy ya support sy neechy stock tutny k bad mukhtasir position me dakhil hota hy. Benefits of Break Out Break out is leay hota hy q k qeemat muzahmti satah sy neechy ya support level sy upr jati hy mumkina tor pr kuch wqt k leay muzahmat ya support level rait me aek lakeer bn jata hy jisy bht sy tajir entry points set krny ya nuqsan ki satah ko rokny k leay istmal krty hy jb qeemat support ya resistance level sy toot jati hy to trader break out jump in ka intzar krty hy or wo log jo nhi chahty thy k qeemat break out ho ta k bary nuqsanat sy bach sky srgrmi ki ye halchalakst hujam me izafy ka sabab bny gi js sy zahir hota hy k bht sary tajir break out level me dilchaspi rkhty thy.Osat sy zyada volume break out ki tasdeeq me madad krta hy agr break out pr thora sa hujam hy to ho skta hy k ye satah bht sary tajiro k leay ehm na ho ya kafi tajiro ko abhi tk satah k qareeb tijarat krny k leay mujrim mehsos na ho .Ye km volume break outs k nakam hony ka zyada imkan hy ulta break out ki surat me agr ye nakam ho jata hy to qeemat muzahmat sy neechy gir jaey gi .Down side break out ki surat me jisy aksr break down kha jata hy agr ye nakam ho jata hy to qeemat is k neechy tuti hoi support level sy opr aa jaey gi. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is BreakoutAssalam.o alaikum dosto What is Breakout break out se morad poke kisi asasay ki qeemat muzahmati ilaqay se oopar jati hai, ya support region se neechay jati hai. break qeemat ke break out simt mein rujhan shuru karne ke imkaan ki nishandahi karte hain. misaal ke pinnacle standard, graph ke patteren se oopar ki taraf break out is baat ki nishandahi kar sakta hai ke qeemat ziyada prepared hona shuru kar day gi. break out jo ziyada volume standard hotay hain ( aam hajam ke nisbat ) ziyada yaqeen zahir karte hain jis ka matlab hai ke qeemat ka is simt mein rujhan honay ka ziyada imkaan hai. ahem take ways break out tab hota hai poke qeemat muzahmati satah se oopar jati hai ya support level se neechay jati hai. break out ho satke hain kyunkay tamam dealers yaksaa himayat aur muzahmati sthon ko nahi pehchanen ge ya istemaal nahi karen ge. break out mumkina tijarti mawaqay faraham karte hain. oopar ki taraf break out taajiron ko lambi position haasil karne ya mukhtasir position haasil karne ka ishara deta hai. manfi pehlu ka break out taajiron ko mumkina pinnacle standard mukhtasir honay ya lambi pozishnin farokht karne ka ishara deta hai. nisbatan ziyada hajam ke sath break out yaqeen aur dilchaspi zahir karte hain, aur is liye qeemat ke break out simt mein barhatay rehne ka ziyada imkaan hota hai. kam rishta daar volume standard break out ziyada nakami ka shikaar hotay hain, is liye qeemat ka break out simt mein rujhan honay ka imkaan kam hota hai .What does a breakout tell you​

break out aam pinnacle standard ya deegar graph patteren ke sath munsalik hotay hain, Bashmole masalas, jhanday, pachar, aur sir aur kandhay. yeh namoonay is waqt bantay hain poke qeemat aik makhsoos andaaz mein harkat karti hai jis ke nateejay mein achi terhan se tay shuda support aur/ya muzahmati satah hoti hai. phir tajir break out ke liye un sthon ko dekhte hain. agar qeemat muzahmat se oopar honk jati hai to woh lambi position shuru kar satke hain ya mukhtasir position se bahar nikal satke hain, ya agar qeemat support se neechay honk jati hai to woh mukhtasir position shuru kar satke hain ya lambi position se bahar nikal satke hain. ziyada volume break out ke baad bhi, qeemat aksar ( lekin hamesha nahi ) break out ki simt mein dobarah jane se pehlay break out point standard wapas aajay gi. is ki wajah yeh hai ke qaleel mudti tajir aksar ibtidayi break out kharedtay hain, lekin phir munafe ke liye kaafi taizi se farokht karne ki koshish karte hain. yeh farokht earzi peak standard qeemat ko break out point standard wapas le jati hai. agar break out jaaiz hai ( nakami nahi ), to qeemat ko break out simt mein wapas jana chahiye. agar aisa nahi hota hai to yeh aik nakaam break out hai. Illustration of breakout woh tajir jo tijarat shuru karne ke liye break out ka istemaal karte hain aam peak standard break out nakaam honay ki soorat mein stap las ke orders ka istemaal karte hain. ulta break out standard taweel safar karne ki soorat mein, stap nuqsaan aam pinnacle standard muzahmati satah se bilkul neechay rakha jata hai. davn side break out standard mukhtasir jane ki soorat mein, aik stap nuqsaan aam pinnacle standard help level se bilkul oopar rakha jata hai jis ki khilaaf warzi ki gayi hai. break out ki misaal tasweer Sabrina jayang © investopedia 2020 graph hajam mein aik bara izafah dekhata hai, jo aamdani ke ajra se munsalik hota hai, kyunkay qeemat masalas diagram patteren ke muzahmati ilaqay se guzarti hai. break out itna mazboot tha ke is ki wajah se qeematon mein farq para. qeemat musalsal barhti rahi aur asal break out point standard wapas nahi gayi. yeh aik bohat mazboot break out ki alamat hai. tajir mumkina peak standard lambi pozishnon mein daakhil honay aur/ya mukhtasir pozishnon se bahar niklny ke liye break out ka istemaal kar satke thay. agar lamba daakhil ho raha hai to, aik stap nuqsaan masalas ki muzahmati satah ke bilkul neechay rakha jaye ga ( ya masalas support se bhi neechay ). chunkay qeemat mein bara farq tha, is liye yeh stap nuqsaan ka maqam misali nahi ho sakta. break out ke baad qeemat musalsal bherne ke baad khatray ko kam karne ya munafe mein band karne ke liye stap nuqsaan ko agay badhaya ja sakta hai. Re: What is Breakout Market me break out ke bary me bat cheet AOAsupport level se neechay jati hai. break out ho satke hain kyunkay tamam brokers yaksaa support aur rizstns level ko nahi pehchanen ge ya istemaal nahi karen ge .break out mumkina tijarti mawaqay faraham karte hain. oopar ki taraf break out taajiron ko lambi position haasil karne ya supd tijarat mein daakhil hona hai jaisay hello there qeemat apni had se bahar honay ka intizam karti hai. tajir mazboot raftaar ki talaash mein hain aur asal break out position mein daakhil honay ka ishara hai aur is ke baad honay wali market ki harkat se munafe hai .port level se oopar hoti hai, mumkina peak standard kuch waqt ke liye. muzahmat ya support level rait mein aik lakeer boycott jata hai jisay bohat se tajir passage focuses set karne ya nuqsaan ki satah ko roknay ke liye istemaal karte hain. hit qeemat support ya rizstns level se honk jati hai to brokers break out hop un ka intzaar karte hain, aur woh log jo nahi chahtay thay ke qeemat break out ho taakay barray nuqsanaat smukhtasir position haasil karne ka ishara deta hai. manfi pehlu ka break out taajiron ko mumkina pinnacle standard mukhtasir honay ya lambi pozishnin farokht karne ka ishara deta hai .nisbatan ziyada hajam ke sath break out yaqeen aur dilchaspi zahir karte hain Fundamental information is ko samjhny ke lyeIs se gee baseerat ko kaafi wazeh andaaz mein paish karta hai. break out ke baad, purani muzahmati sthon ko naye support ke pinnacle standard kaam karna chahiye aur puranay support level ko hai kyunkay yeh is baat ka taayun karne ka aik marozi tareeqa hai ke tijarat kab nakaam hui hai aur is baat ka breakout level ke upar ya specialty stop orders lagate hain, jisse ki punch cost breakout level cross karta hai to unki positions consequently enter ho jaati hain. Merchants breakout ke baad pattern ki bearing ke agreeing apni positions enter karte hain, jisse ki unki positions beneficial ho sakein.Breakout exchanging technique ka ek disadvantage ye hai ki ye bogus breakouts ke risk ko bhi incorporate karta hai. Bogus breakout ke case mein, cost breakout level ko cross karta hai, lekin phir se us level ke andar aa jaata hai. Bogus breakouts ke risk ko limit karne ke liye, merchants normally exchanging signals aur cost activity examination ka use karte hain.Overall, Breakout ek cost development ki term hai, jismein cost ki development kisi explicit level se break karke, new high ya new low banata hai. Breakout exchanging methodology mein brokers kisi explicit level ke breakout ko expect karke exchange karte hain, jisse ki unki positions beneficial ho sakein. Is se Misfortune ko bachna kaisy he? yeh negative breakout hai aur agar cost obstruction level ko break karke upar move karne lagta hai, to yeh bullish breakout hai.Breakout ki pehchan karne ke liye merchants pattern lines bhi use karte hain. Pattern lines ki assist se dealers with supporting aur obstruction levels ko draw karte hain aur breakout level ko expect karte hain. Breakout ki pehchan karne ke liye brokers ko market unpredictability ko bhi screen karna hota hai, kyonki jyada unstable blemish taayun karne ka aik aasaan tareeqa hai ke aap ke stop misfortune request ko kahan set karna hai. position lainay ke baad, khonay wali tijarat ko band karne ke liye purani support ya muzahmati satah ko rait mein aik lakeer ke pinnacle standard istemaal karen .ket mein bogus breakouts ke chances bhi jyada hote hain.Breakout ki pehchan karne ke liye dealers ko market ki news aur financial pointers ko bhi screen karna hota hai, kyonki ye factors bhi breakout ko impact kar sakte hain. Merchants breakout ki pehchan karne ke liye specialized pointers bhi use karte hain, jaise ki Bollinger Groups, Moving Midpoints, Breakout ki pehchan karne ke liye brokers cost activity analysishota he

-

#7 Collapse

What is Breakout break out se morad punch kisi asasay ki qeemat muzahmati ilaqay se oopar jati hai, ya support region se neechay jati hai. break qeemat ke break out simt mein rujhan shuru karne ke imkaan ki nishandahi karte hain. misaal ke peak standard, diagram ke patteren se oopar ki taraf break out is baat ki nishandahi kar sakta hai ke qeemat ziyada prepared hona shuru kar day gi. break out jo ziyada volume standard hotay hain ( aam hajam ke nisbat ) ziyada yaqeen zahir karte hain jis ka matlab hai ke qeemat ka is simt mein rujhan honay ka ziyada imkaan hai. ahem take ways break out tab hota hai hit qeemat muzahmati satah se oopar jati hai ya support level se neechay jati hai. break out ho satke hain kyunkay tamam merchants yaksaa himayat aur muzahmati sthon ko nahi pehchanen ge ya istemaal nahi karen ge. break out mumkina tijarti mawaqay faraham karte hain. oopar ki taraf break out taajiron ko lambi position haasil karne ya mukhtasir position haasil karne ka ishara deta hai. manfi pehlu ka break out taajiron ko mumkina pinnacle standard mukhtasir honay ya lambi pozishnin farokht karne ka ishara deta hai. nisbatan ziyada hajam ke sath break out yaqeen aur dilchaspi zahir karte hain, aur is liye qeemat ke break out simt mein barhatay rehne ka ziyada imkaan hota hai. kam rishta daar volume standard break out ziyada nakami ka shikaar hotay hain, is liye qeemat ka break out simt mein rujhan honay ka imkaan kam hota hai . What does a breakout tell youbreak out aam pinnacle standard ya deegar diagram patteren ke sath munsalik hotay hain, Bashmole masalas, jhanday, pachar, aur sir aur kandhay. yeh namoonay is waqt bantay hain poke qeemat aik makhsoos andaaz mein harkat karti hai jis ke nateejay mein achi terhan se tay shuda support aur/ya muzahmati satah hoti hai. phir tajir break out ke liye un sthon ko dekhte hain. agar qeemat muzahmat se oopar honk jati hai to woh lambi position shuru kar satke hain ya mukhtasir position se bahar nikal satke hain, ya agar qeemat support se neechay honk jati hai to woh mukhtasir position shuru kar satke hain ya lambi position se bahar nikal satke hain. ziyada volume break out ke baad bhi, qeemat aksar ( lekin hamesha nahi ) break out ki simt mein dobarah jane se pehlay break out point standard wapas aajay gi. is ki wajah yeh hai ke qaleel mudti tajir aksar ibtidayi break out kharedtay hain, lekin phir munafe ke liye kaafi taizi se farokht karne ki koshish karte hain. yeh farokht earzi pinnacle standard qeemat ko break out point standard wapas le jati hai. agar break out jaaiz hai ( nakami nahi ), to qeemat ko break out simt mein wapas jana chahiye. agar aisa nahi hota hai to yeh aik nakaam break out hai. Illustration of breakout woh tajir jo tijarat shuru karne ke liye break out ka istemaal karte hain aam pinnacle standard break out nakaam honay ki soorat mein stap las ke orders ka istemaal karte hain. ulta break out standard taweel safar karne ki soorat mein, stap nuqsaan aam pinnacle standard muzahmati satah se bilkul neechay rakha jata hai. davn side break out standard mukhtasir jane ki soorat mein, aik stap nuqsaan aam pinnacle standard help level se bilkul oopar rakha jata hai jis ki khilaaf warzi ki gayi hai. break out ki misaal tasweer Sabrina jayang © investopedia 2020 diagram hajam mein aik bara izafah dekhata hai, jo aamdani ke ajra se munsalik hota hai, kyunkay qeemat masalas graph patteren ke muzahmati ilaqay se guzarti hai. break out itna mazboot tha ke is ki wajah se qeematon mein farq para. qeemat musalsal barhti rahi aur asal break out point standard wapas nahi gayi. yeh aik bohat mazboot break out ki alamat hai. tajir mumkina peak standard lambi pozishnon mein daakhil honay aur/ya mukhtasir pozishnon se bahar niklny ke liye break out ka istemaal kar satke thay. agar lamba daakhil ho raha hai to, aik stap nuqsaan masalas ki muzahmati satah ke bilkul neechay rakha jaye ga ( ya masalas support se bhi neechay ). chunkay qeemat mein bara farq tha, is liye yeh stap nuqsaan ka maqam misali nahi ho sakta. break out ke baad qeemat musalsal bherne ke baad khatray ko kam karne ya munafe mein band karne ke liye stap nuqsaan ko agay badhaya ja sakta hai.

-

#8 Collapse

Describe Breakout Break-Out ki confirmation karne ke liye, tajir aam tor par qeemat ki karwai ki talaash karte hain jo is iqdaam ki himayat karti hai, jaisay tijarti hajam mein izafah ya aik mazboot candle stuck patteren. woh takneeki isharay bhi istemaal kar satke hain, jaisay momentum andikitrz ya moving average, harkat ki taaqat ki tasdeeq ke liye . Yeh note karna zaroori hai ke ghalat break out ho satke hain, jahan qeemat mukhtasir tor par aik satah se toot jati hai lekin phir taizi se range ke andar wapas aa jati hai. lehaza, taajiron ko ahthyat baratnay ki zaroorat hai aur tijarat mein daakhil honay se pehlay haqeeqi break out ki tasdeeq ka intzaar karna chahiye .Majmoi tor par, break out ki tasdeeq forex trading ki hikmat e amli ka aik ahem jazo hai, kyunkay yeh taajiron ko ghalat break out ke khatray ko kam karte hue aala imkani tijarti mawaqay ki nishandahi karne mein madad karta hai . Details Forex market mein Breakout ek price movement ki term hai, jismein price ki ek particular level se cross karte huye ek naya level banate hain. Breakout ka matlab hai ki price ki movement kisi specific level se break karke, new high ya new low banata hai. Ye movement typically price resistance ya support level ko cross karne ke baad hota hai.Breakout ki ek example samjhte hain: Agar kisi currency pair ka price $1.20 se $1.25 tak badh raha hai aur $1.25 ke level ko cross karke $1.30 tak pahunch jaata hai, to yeh breakout ka ek example hai. Yahan, price $1.25 level ko cross karke ek new high bana raha hai.Breakout trading strategy mein traders typically kisi specific level ke breakout ko anticipate karke trade karte hain. Is strategy mein, traders typically breakout level ke upar ya niche stop orders lagate hain, jisse ki jab price breakout level cross karta hai to unki positions automatically enter ho jaati hain. Traders breakout ke baad trend ki direction ke according apni positions enter karte hain, jisse ki unki positions profitable ho sakein.Breakout trading strategy ka ek drawback ye hai ki ye false breakouts ke risk ko bhi include karta hai. False breakout ke case mein, price breakout level ko cross karta hai, lekin phir se us level ke andar aa jaata hai. False breakouts ke risk ko minimize karne ke liye, traders typically trading signals aur price action analysis ka use karte hain.Overall, Breakout ek price movement ki term hai, jismein price ki movement kisi specific level se break karke, new high ya new low banata hai. Breakout trading strategy mein traders kisi specific level ke breakout ko anticipate karke trade karte hain, jisse ki unki positions profitable ho sakein.

Trading Breakout trading strategy ke liye traders ko kuch tools aur indicators ki zaroorat hoti hai jaise ke support aur resistance levels, trend lines, Fibonacci retracements aur price action signals. Ye sabhi tools aur indicators traders ko ye batate hain ke market ka trend kis direction mein ja raha hai aur kya potential breakout points hain. Breakout trading strategy ke liye traders ko kuch important points yaad rakhne chahiye. Sabse pehle toh ye ke breakout trading strategy mein traders ko trend direction ka pata lagana bohot important hai. Agar traders trend direction ka pata nahin lagate toh woh apni positions enter ya exit karne mein galat ho sakte hain. Dusri baat ye hai ke breakout trading strategy ko traders ko apne risk management aur money management rules ke sath use karna chahiye. Breakout trading strategy ka use karte waqt traders ko apni positions ke liye stop loss aur take profit levels set karna chahiye. Iske sath hi traders ko apni positions ko enter karte waqt apne account balance aur risk tolerance ke hisab se lot size set karna chahiye.

Thank YOU!

Thank YOU!

- Mentions 0

-

سا0 like

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

forex mein break out se morad takneeki tajzia ka namona hai jo is waqt hota hai jab kisi asasa ki qeemat muawnat ya muzahmat ki aik ahem satah se oopar ya neechay toot jati hai. yahan woh anwanat hain jo forex mein break out ko bayan karne ke liye istemaal kiye ja satke hain : tareef : break out is waqt hota hai jab kisi asasa ki qeemat support ya muzahmat ki kaleedi satah se oopar ya neechay toot jati hai, jo rujhan ki simt mein mumkina tabdeeli ki nishandahi karti hai . support aur muzahmat : support aik aisi satah hai jis par kharidaron ka market mein daakhil honay aur qeemat ko mazeed girnay se roknay ka imkaan hota hai, jabkay muzahmat aik aisi satah hai jis par baichnay walay ka market mein daakhil honay aur qeemat ko mazeed bherne se roknay ka imkaan hota hai . break out ki aqsam : break out do simtao mein ho satke hain - oopar ki taraf aur neechay ki taraf. oopar ki taraf break out is waqt hota hai jab qeemat muzahmat se oopar toot jati hai, jab ke neechay ki taraf break out hota hai jab qeemat support se neechay toot jati hai . tijarti hikmat e amli : tajir aksar tijarat mein daakhil honay ya bahar niklny ke liye break out ka istemaal karte hain. misaal ke tor par, aik tajir asasa khareed sakta hai jab woh muzahmat se oopar toot jata hai ya asasa farokht kar sakta hai jab woh support se neechay toot jata hai. mumkina nuqsanaat ko mehdood karne ke liye stap las order support ke neechay ya muzahmat se oopar diye ja satke hain . tasdeeq : tajir aksar aik ahem time frame par qeemat ke break out level ke oopar ya neechay band honay ka intzaar kar ke break out ki tasdeeq talaash karte hain, jaisay ke rozana ya hafta waar chart . ghalat break out : ghalat break out is waqt hota hai jab qeemat mukhtasir tor par support ya muzahmat ki kaleedi satah se oopar ya neechay toot jati hai, sirf taizi se simt ko rivers karne ke liye. taajiron ko ghalat break out se aagah hona chahiye aur mumkina break out ki tasdeeq ke liye izafi takneeki isharay aur tajzia istemaal karna chahiye . rissk managment : taajiron ko hamesha munasib rissk managment taknik ka istemaal karna chahiye, jaisay ke stap las ke orders tarteeb dena, aur mumkina nuqsanaat se bachney ke liye trading break out karte waqt –apne trading plan par amal karna chahiye ."Dream bigger. Do bigger"

(mahroosh) :1f607:

-

#10 Collapse

What is breakout Dear friends jesy k Forex trading main breakout k bary main pucha gya swal hai to yeh aam trading strategy hai jise traders use karte hain Breakout ka matlab hota hai ki price ko ek certain level sy cross kar k move karta hai jisy traders aik signal ki tarah interpret karty hain ki price aik naye trend mein move kar rahi hai. Breakout strategies k liye traders usually aik support ya resistance level k paas ka wait karty hain jahan price waqt k liye trade kar rahi hai or phir aik sudden price movement hoti hai Agar price aik support level ko break kar k down jati hai toh is situation ko l breakout kehty hain agar price aik resistance level ko break kar k up jati hai toh traders esy bullish breakout kehty hai Is strategy mein traders usually aik stop loss order lgaty hain jis mein hum apni trading position ko close kar dety hain agar price opposite direction mein move krny lagti hai Breakout strategy mein traders ki income potential kaafi high hoti hai lekin is mein risk bhi kaafi high hota hai Isliye humen apny risk management k bary mein bhi sochny ki zaroorat hoti hai Break out kab hota hai? Pyary members, Forex market mein breakout ka time frame market ki conditions event or dosry factors k upar depend karta hai. Breakout kisi bhi time frame mein ho sakta hai lekin normally jab price kisi important support or resistance level ko cross kar k ya phir koi significant trend line ko break karta hai tab breakout hota hai. Iske alawa kuch traders news announcements or economic events k time mein bhi breakout ka wait karty hai jesy k interest rate decisions GDP releases employment data and other important economic indicators Jab koi important news announcement aati hai toh price movement bohat volatile hoti hai or breakout hony ka chance bhi barh jaty hain. Lekin aik important baat hai k breakout ki timing predict karna bohat difficult hota hai or is mein risk bhi bahut zyada hota hai Is liye traders normally breakout ka wait karny ki bajaye price action k upar focus karty hain or support or resistance levels ko follow karty hain aksar hum technical analysis ko follow kr rahy hoty hain to news ki waja sy trade humari entry k muhalif chaali jati hai or humary support ya phir resistance ko jab break kr jati hai to hamen apni entry sy eixt ho jana chahiye ya phir stop loss ka use lazmi krna chahiye Understanding the breakouts & key points Forex trading main breakout ka matlab hota hai jab currency pair ki price ki movement kisi specific level sy cross kar jati hai yani k aik range sy bahir nikal jati hai Breakouts traders ki nazar main kafi profitable hoti hain q k yeh aik strong trend ki shuruwat ko represent karti hain Breakout trading k mukhtalif tariqay hotay hain jin main sy kuch key points apko nichy bta rahi hun Price levelBreakout trading main sab sy pehlay ye dekha jata hai k currency pair ki price ki movement kisi specific level sy cross karti hai Breakout level ki selection ki techniques mukhtalif hoti hain jis main aam taur par resistance or support levels ka use kiya jata hai. breakout volumesBreakout level ko cross karny wali price movement k sath, aam tor par trading volume ka izafa bhi hota hai Breakout ko confirm karnay kay liye traders volume ki izafay par b nazar rakhtay hain. Trend analysis:Breakout trading main trend analysis ki techniques ki istemal hoti hain Trend k upar jatay huay breakout ko mukammal tarikay say trade kiya jata hai, kyun k trend ko confirm karnay k baad hi trading ki jata hai Breakout trading main risk management ka khaas khayal rakha jata hai Traders normally stop loss orders ka istemal kartay hain taa k in case of a failed breakout trade k loss ko minimize kia ja sakay. -

#11 Collapse

Market me break out ke bary me bat cheet Neechay jati hai support level se. Breakout ho satke hain kyunkay traders yaksaa support aur rizstns level ko nahi pehchanen ge ya istemaal nahi karen ge.mumkina tijarti mawaqay faraham karte hain, let out. Jaisay hi qeemat apni had se bahar honay ka intizam karti hai oopar ki taraf break out taajiron ko lambi position haasil karne ya supd tijarat mein daakhil hona hai. Is ke baad honay wali market ki harkat se munafe hai, asal break out position mein daakhil honay ka ishara hai, and tajir mazboot raftaar ki talaash mein hain.Mumkina tor par kuch waqt ke liye, port level se oopar hoti hai. Muzzammat and support level rait mein aik lakeer ban jata hai jisay bohat se tajir entry points set karne ya nuqsaan ki satah ke liye istemaal karte hain. When a trader breaks out at a support or resistance level, or when a price level is reached, or when a price level is reached, or when a price level is reached, or when a price level is reached, or when a price level is reached, or when a price level is reached, or when a price level is reached. Lambi pozishnin farokht karne ka ishara deta hai manfi pehlu ka break out taajiron ko mumkina tor par mukhtasir honay. Details Breakout is a phrase used to describe price movement in the forex market. It occurs when a price crosses a certain level and another level follows. New highs or new lows are the result of a price movement breaking through a specified level, which is known as a breakout. Price resistance and support levels are often crossed in a movement's favor.Breakout's first example is given below: If a currency pair's price moves from $1.20 to $1.25 or from $1.25 to $1.30 and crosses both, a breakout occurs, as in the example below. Yahan, the price has crossed the $1.25 level and is now at a new high.When using a breakout trading technique, traders frequently predict a breakout at a particular level before trading. According to this method, traders often place breakout level ke upar or niche stop orders; however, when a price crosses a breakout level, new positions are immediately entered. Traders enter positions in accordance with apni breakout ke bad trend ki direction ke, jisse ki unki positions profitable ho sakein.False breakouts are a downside of the breakout trading method that must be taken into account. In the event of a false breakout, the price will reach the breakout level, but no actual breakthrough will have occurred. False breakouts' risk is minimized by traders who frequently use price movement research and trading signals.Overall, the phrase "Breakout" refers to a price movement that breaks at a particular level, resulting in a new high or new low. When using a breakout trading technique, traders anticipate a certain level's breakout and trade at that point if the position is lucrative.

Details Breakout is a phrase used to describe price movement in the forex market. It occurs when a price crosses a certain level and another level follows. New highs or new lows are the result of a price movement breaking through a specified level, which is known as a breakout. Price resistance and support levels are often crossed in a movement's favor.Breakout's first example is given below: If a currency pair's price moves from $1.20 to $1.25 or from $1.25 to $1.30 and crosses both, a breakout occurs, as in the example below. Yahan, the price has crossed the $1.25 level and is now at a new high.When using a breakout trading technique, traders frequently predict a breakout at a particular level before trading. According to this method, traders often place breakout level ke upar or niche stop orders; however, when a price crosses a breakout level, new positions are immediately entered. Traders enter positions in accordance with apni breakout ke bad trend ki direction ke, jisse ki unki positions profitable ho sakein.False breakouts are a downside of the breakout trading method that must be taken into account. In the event of a false breakout, the price will reach the breakout level, but no actual breakthrough will have occurred. False breakouts' risk is minimized by traders who frequently use price movement research and trading signals.Overall, the phrase "Breakout" refers to a price movement that breaks at a particular level, resulting in a new high or new low. When using a breakout trading technique, traders anticipate a certain level's breakout and trade at that point if the position is lucrative.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Market me break out ke bary me bat cheet AOA support level se neechay jati hai. break out ho satke hain kyunkay tamam brokers yaksaa support aur rizstns level ko nahi pehchanen ge ya istemaal nahi karen ge .break out mumkina tijarti mawaqay faraham karte hain. oopar ki taraf break out taajiron ko lambi position haasil karne ya supd tijarat mein daakhil hona hai jaisay hello there qeemat apni had se bahar honay ka intizam karti hai. tajir mazboot raftaar ki talaash mein hain aur asal break out position mein daakhil honay ka ishara hai aur is ke baad honay wali market ki harkat se munafe hai .port level se oopar hoti hai, mumkina peak standard kuch waqt ke liye. muzahmat ya support level rait mein aik lakeer boycott jata hai jisay bohat se tajir passage focuses set karne ya nuqsaan ki satah ko roknay ke liye istemaal karte hain. hit qeemat support ya rizstns level se honk jati hai to brokers break out hop un ka intzaar karte hain, aur woh log jo nahi chahtay thay ke qeemat break out ho taakay barray nuqsanaat smukhtasir position haasil karne ka ishara deta hai. manfi pehlu ka break out taajiron ko mumkina pinnacle standard mukhtasir honay ya lambi pozishnin farokht karne ka ishara deta hai .nisbatan ziyada hajam ke sath break out yaqeen aur dilchaspi zahir karte hainFundamental information is ko samjhny ke lyeIs se gee baseerat ko kaafi wazeh andaaz mein paish karta hai. break out ke baad, purani muzahmati sthon ko naye support ke pinnacle standard kaam karna chahiye aur puranay support level ko hai kyunkay yeh is baat ka taayun karne ka aik marozi tareeqa hai ke tijarat kab nakaam hui hai aur is baat ka breakout level ke upar ya specialty stop orders lagate hain, jisse ki punch cost breakout level cross karta hai to unki positions consequently enter ho jaati hain. Merchants breakout ke baad pattern ki bearing ke agreeing apni positions enter karte hain, jisse ki unki positions beneficial ho sakein.Breakout exchanging technique ka ek disadvantage ye hai ki ye bogus breakouts ke risk ko bhi incorporate karta hai. Bogus breakout ke case mein, cost breakout level ko cross karta hai, lekin phir se us level ke andar aa jaata hai. Bogus breakouts ke risk ko limit karne ke liye, merchants normally exchanging signals aur cost activity examination ka use karte hain.Overall, Breakout ek cost development ki term hai, jismein cost ki development kisi explicit level se break karke, new high ya new low banata hai. Breakout exchanging methodology mein brokers kisi explicit level ke breakout ko expect karke exchange karte hain, jisse ki unki positions beneficial ho sakein. Is se Misfortune ko bachna kaisy he? yeh negative breakout hai aur agar cost obstruction level ko break karke upar move karne lagta hai, to yeh bullish breakout hai.Breakout ki pehchan karne ke liye merchants pattern lines bhi use karte hain. Pattern lines ki assist se dealers with supporting aur obstruction levels ko draw karte hain aur breakout level ko expect karte hain. Breakout ki pehchan karne ke liye brokers ko market unpredictability ko bhi screen karna hota hai, kyonki jyada unstable blemish taayun karne ka aik aasaan tareeqa hai ke aap ke stop misfortune request ko kahan set karna hai.

position lainay ke baad, khonay wali tijarat ko band karne ke liye purani support ya muzahmati satah ko rait mein aik lakeer ke pinnacle standard istemaal karen .ket mein bogus breakouts ke chances bhi jyada hote hain.Breakout ki pehchan karne ke liye dealers ko market ki news aur financial pointers ko bhi screen karna hota hai, kyonki ye factors bhi breakout ko impact kar sakte hain. Merchants breakout ki pehchan karne ke liye specialized pointers bhi use karte hain, jaise ki Bollinger Groups, Moving Midpoints, Breakout ki pehchan karne ke liye brokers cost activity analysis hota hy.

-

#13 Collapse

What is Breakout Break free and moan Support area se neechay jati hai, kisi asasay ki qeemat muzahmati ilaqay se oopar jati hai. Break out simt mein rujhan shuru karne ke imkaan ki nishandahi karte hain, break qeemat ke. Chart ke patteren se oopar ki taraf break out is baat ki nishandahi kar sakta hai ke qeemat ziyada trained hona shuru kar day gi, misaal ke tor par. (Aam Hajam Ke Nisbat) Ziyada yaqeen zahir karte hain jis ka matlab hai ke qeemat ka is simt mein rujhan honay ka Ziyada imkaan hai, break out jo ziyada volume par hotay hain. Ahem, take exits, break out, and support levels, respectively, when qeemat muzhmati satah se oopar jati hai. Breakout ho satke hain kyunkay tamam traders yaksaa himayat aur muhsamati sthon ko nahi pehchanen ge ya istemaal nahi karen ge. mumkina tijarti mawaqay faraham karte hain, let out. Ishara deta hai oopar ki taraf break out taajiron ko lambi position ya mukhtasir position haasil karne. Lambi pozishnin farokht karne ka ishara deta hai manfi pehlu ka break out taajiron ko mumkina tor par mukhtasir. In addition, isliye qeemat ke break out simt mein barhatay rehne ka ziyada imkaan hota hai, nisbatan ziyada hajam ke sath break out yaqeen aur dilchaspi zahir karte hain. Isliye qeemat ka break out simt mein rujhan honay ka imkaan kam hota hai, kam rishta daar volume par break out ziyada nakami ka shikaar hotay hain. Details Price movement in the forex market is referred to as a breakout. When a price reaches one level and then moves to another, it happens. A price movement breaking through a particular level is referred to as a breakout, and it results in new highs or lows. Price support and resistance levels are frequently crossed in favor of movements.The first instance of Breakout is provided below: A breakout happens, as in the example below, when the price of a currency pair advances from $1.20 to $1.25 or from $1.25 to $1.30 and crosses both. Yahan, the price has reached a new high after crossing the $1.25 mark.Trading breakout strategies typically include forecasting a breakout at a specific level before entering a trade. This approach has traders placing ke upar or niche stop orders at breakout levels, but when a price reaches a breakout level, new positions are quickly opened. Apni breakout ke bad trend ki direction ke, jisse ki unki positions profitable ho sakein, is how traders initiate positions.False breakouts are a drawback of the breakout trading strategy that needs to be considered. A false breakout occurs when the price reaches the breakout level without an actual breakthrough having taken place. Traders that routinely use price movement research and trading signals reduce the chance of false breakouts.In general, the term "Breakout" describes a price movement that abruptly stops at a specific level and makes a new high or low. When adopting a breakout trading strategy, traders wait for the breakout of a particular level and, if the position is profitable, trade at that point.Market me break out ke bary me bat cheet Support level se neechay jati. Trading yaksaa support and resistance levels are not breaking out, and the system is not breaking out.Released, mumkina tijarti mawaqay faraham karte hain. Intizam karti hai Jaisay hi qeemat apni had se bahar honay ka oopar ki taraf break out taajiron ko lambi position haasil karne ya supd tijarat mein daakhil hona hai. Asal break out position mein daakhil honay ka ishara hai, is ke baad honay wali market ki harkat se munafe hai, and tajir mazboot raftaar ki talaash mein hain.Port level se oopar hoti hai, mumkina tor par kuch waqt ke liye. Bohat se tajir entry points set karne ya nuqsaan ki satah ke liye istemaal karte hain, muzzammat and support level rait mein aik lakeer ban jata hai. whenever a trader breaks out at a support or resistance level, whenever a price level is reached, whenever a price level is reached, whenever a price level is reached, whenever a price level is reached, whenever a price level is reached. Manfi pehlu's break out taajiron ko mumkina tor par mukhtasir honay lambi pozishnin farokht karne ka ishara deta hai.

- Mentions 0

-

سا0 like

-

#14 Collapse

Assalam o alaikum doston! Umeed hai app sab khairyat se hain. Ajj ka topic neechay mention kia gya hai. What is Breakout Trading mein break out se morad security ki qeemat ki harkat hai jo support ya muzahmat ki pehlay se tay shuda satah se agay barh jati hai. Jab security ki qeemat support ki aik ahem satah se toot jati hai, to usay bearish break out samjha jata hai, aur jab yeh muzahmat ki aik ahem satah se guzarta hai, to usay taizi ka break out samjha jata hai. Goal: hatmi maqsad break out ki simt mein security ko khareed ya farokht karkay munafe kamaana hai. Aims and objective: Break out trading hikmat e amli ka aim mumkina break out level ki nishandahi karna aur break out hotay hi market mein daakhil hona hai. Maqsad yeh hai ke rujhan ko agay barhana aur qeematon ki ziyada se ziyada harkat ko haasil karna hai is se pehlay ke yeh rivers ya mazboot hona shuru ho. Mumkina break out levels ki nishandahi karne aur aala tijarti hajam aur raftaar ke sath break out ki tasdeeq karne ke liye takneeki tajzia ke tools jaisay ke chart patteren, trained lines, aur isharay istemaal karkay yeh haasil kya ja sakta hai . Break out trading ki hikmat e amli ka hatmi maqsad qeemat ki aik ahem harkat ko pakar kar munafe kamaana hai. Taham, khatray ka intizam karna aur mumkina nuqsanaat ko mehdood karne ke liye munasib position sayzng aur stop las orders ka istemaal karna zaroori hai agar break out tawaqqa ke mutabiq nahi hota hai. Mazeed bar-aan, munafe ko band karne ke liye bahar niklny ki aik achi terhan se tay shuda hikmat e amli ka hona zaroori hai aur agar rujhan badal jata hai to munafe wapas dainay se guraiz karen . Break out ko aksar security ki talabb aur rasad ke tawazun mein numaya tabdeeli ke isharay ke tor par dekha jata hai, aur qeematon mein khatir khuwa harkat ka baais ban sakti hai. tajir aksar takneeki tajzia ka istemaal mumkina break out ki nishandahi karne aur is baat ka taayun karne ke liye karte hain ke aaya break out ki simt ki bunyaad par security khareedna ya bechna hai. Agar break out tawaqqa ke mutabiq nahi hota hai to kuch tajir mumkina nuqsanaat ko mehdood karne ke liye stop las orders ka bhi istemaal karte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

break out ki misaal tasweer tasweer Sabrina jayang © investopedia 2020 chart hajam mein aik bara izafah dekhata hai, jo aamdani ke ajra se munsalik hota hai, kyunkay qeemat masalas chart patteren ke muzahmati ilaqay se guzarti hai. Forex trading main breakout ka matlab hota hai jab currency pair ki price ki movement kisi specific level sy cross kar jati hai yani k aik range sy bahir nikal jati hai Breakouts traders ki nazar main kafi profitable hoti hain q k yeh aik strong trend ki shuruwat ko represent karti hain Breakout trading k mukhtalif tariqay hotay hain jin main sy kuch key points apko nichy bta rahi hun Breakout trading main sab sy pehlay ye dekha jata hai k currency pair ki price ki movement kisi specific level sy cross karti hai Breakout level ki selection ki techniques mukhtalif hoti hain jis main aam taur par resistance or support levels ka use kiya jata hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:21 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим