Long and Short terms trading

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

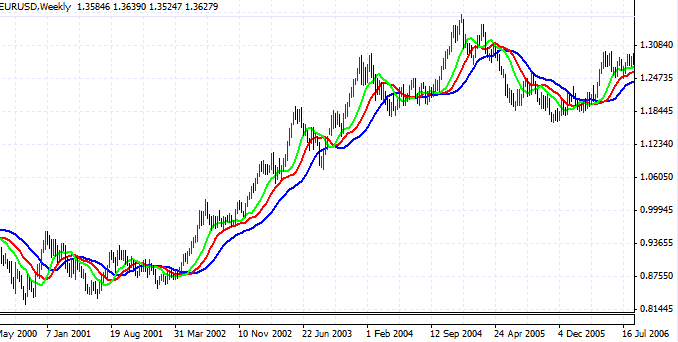

Aslam O Alaikum Dear Pakistan Forex From Members Hope I am sub loog kher khariyat si Hungry or fun krir rahi apni training life ko dosto aaj ka our topic is on trading type hai jo trader apne hikmat amali ke mutabik use karate hai topic main hum Yah jane ke syush kareng ke consa term trader ke liye pahatar hota hai aur in donon main kya farak hota hai to aye tafsilat se isis ko jane ke syush karte hai Long term trading Dosto Long Term Trading Men traders are good at analyzing market key, such as economic indicators, geopolitical events and market trends. Long term traders usually hold ko position ko karne ki aukat dete hai, unmen se kuch traders unhen kai hafte ya mahino tak karte hai, aur kuch traders unhen sal bhar tak karte hai. For example, traders tend to be more prone to light-heavy swings in the market, because they do not pay attention to the daily fluctuations of the market. Short terms trading Friends, the objective of short-term trading is to profit from small-to-heavy fluctuations within a short time frame. Short term traders use their best technical analysis, such as key chart patterns, indicators or market momentums. Short term traders tend to focus on the market or quick moves or choppy price action. In short term trading, traders usually hold their positions for a few hours, minutes or seconds. difference Dosto in dono strategy mein sabse bada farak yah hai ki long term trading mein aapko darji aur dhair ka karan hota hai, jabki short term trading mein aapko gada se fayda hota hota hai. Short term trading me, traders k pas kuch teji honi chahiye, jabki long term traders co market k tamiya movement or choppy price action k liye tayer rehna chahiye. Day trading involves risk, but in short term trading the risk is a bit higher, as traders often make quick decisions and often use leverage. -

#3 Collapse

Forex trading: Forex mein long-term aur short-term trading dono tareeke hotay hain. Long-term trading mein aap apne trades ko kuch maheenon ya saalon ke liye hold karte hain. Is mein aap fundamental analysis, technical analysis aur market sentiment ki madad se currency pairs ke direction ka analysis karte hain. Long-term trading mein aap ziyada time aur patience ke saath kaam karte hain aur ismein usually low leverage ka istemaal hota hai. Short-term trading mein aap apne trades ko kuch ghanton ya dinon ke liye hold karte hain. Is mein aap technical analysis ka ziyada istemaal karte hain aur currency pairs ke chhote movements par focus karte hain. Short-term trading mein aap apne trades ko active monitoring karte hain aur ismein high leverage ka istemaal hota hai. Dono tareekon mein apnay trades ko manage karna aur risk management karna bohat zaroori hai. Forex trading types: Forex trading mein long term aur short term trading do tarah ki hoti hai. Long term trading mein aap apne trades ko kuch hafte, mahine ya saal tak hold karte hain. Yeh tarika un traders ke liye zyada behtar hota hai jo market ki trends ko predict kar sakte hain aur aik longer time frame ke liye position le sakte hain. Is tarah ke traders ko market ke fluctuations se kam nuqsan hota hai aur woh apni trades ko control mein rakh sakte hain. Short term trading mein aap apne trades ko kuch minutes, ghante ya din ke liye hold karte hain. Yeh tarika un traders ke liye behtar hota hai jo market ke short term price movements ko predict kar sakte hain aur jaldi se profit hasil karna chahte hain. Is tarah ke traders ko market ke fluctuations se zyada nuqsan hota hai lekin unko apni trades ki nigrani rakhna asaan hota hai. Dono tarah ke trading apne apne faide aur nuqsanat ke saath aate hain, aur inmein se koi bhi tarika aapke trading style aur aapke goals ke hisaab se behtar ho sakta hai. Long term vs short term: Forex trading mein long-term aur short-term trading dono hi tarike istemal kiye jate hain. Long-term trading mein aap currency pairs ko kharid kar unhein kafi samay tak hold karte hain, jaise kuch mahine ya saal tak. Long-term trading mein kuch fundamentals, jaise economic indicators aur geopolitical events ke saath pair ki price movement ko analyze karke trading ki jati hai. Wahin short-term trading mein aap currency pairs ko chhote samay ke liye hold karte hain, jaise kuch minutes ya hours ke liye. Ismein technical analysis ke saath price action aur market trends ko dhyan mein rakhte hue trading ki jati hai. Dono tarah ke trading ke apne advantages aur disadvantages hote hain, aur aapko apni trading strategy ko apne risk tolerance aur trading goals ke hisab se tay karna chahiye. -

#4 Collapse

Assalamu Alaikum Dosto!Short-Term aur Long-Term Forex TradingForex trading short term aur long term dono trading k leye maozon plateform hai. Forex market main traders par depend karta hai, k wo short term trading karna pasand karte hen, ya long term ki trading, q k dono k apne apne fawayed aur nuqsananat hen. Forex trading maon apne profit ko ziada se ziada aur risk ko kam se kam karne ka behtareen tareeqa market ko samajhna aur aur apne trading plan k hisab trading ka amal karna hota hai. Short term ki trading ka inhisar currencies k prices ki bohut ziada volitilety aur kam waqat main munafa hasil karne par hoti hai, jab k long term ki trading main fundamental anasir ko made nazar rakh kar waqat k sath lambey arsey tak aram se munafay hasil karne ka amal hai. Bari companies ziada tar long term ki trading karne main dilchaspi rakhte hen, jab k kuch inferadi trader computerck zarye se technical analysis ki madad se trading kam waqat main munafa hasil karte hen.Short-term TradingForex trading k short term ki trading strategy main trades ko lambay arsey ki bajaye kam waqat k leye trades ko open rakhte hen. Short term ki trading main position ko minton, ghanton ya aik din k leye trades main rakhe jate hen, lekin aam tawar par saat (7) din se ziada nahi, jiss k nateejay main kam waqat main ziada munafa hasil ho jata hai. Ziada tar forex broker is trading strategy ko faida mand qarar dete hen. Lekin risk ki waja se ye trading hikmate amli ziada khatarnak hai, jo iss ka aik tareek pehlo hai. Har aik trader price volitilety ko bardasht nahi kar sakta hai. Risk management rules aur regulations ko follow karne se risk ko kafi had tak kam kia ja sakta hai. Jinn traders ko riak management k osolon ka elam nahi hai, khas kar k new traders unn k leye short term ki trading unn main bohut maqbol hai. Short term ki trading ki risk ko kam karne k leye bohut cheezon ki zarorat parti hai. Ye trading techniques traders k market k bare main knowledge, experience aur trading skills khas kar technical analysis se bohut ziada asar andaz hoti hai.Advantages of Short-term Trading- Fori Munafa

- Short term trading ka sab se bara faida ye hai k iss main munafa bohut jaldi hasil hota hai. Jab bhi market open hoti hai aap uss main se faida hasil kar sakte hen. Aik short timeframe main aap jaldi assets khareedne aur ferokht kar sakte hen. Jo aap ko apne peso par control de sakta hai.

- Munafa ki Dobara Sarmayakari

- Short term k trading main aap apne sarmaye ko ziada kar sakte hen, aur hasil honne wale muafa par dobara trading bhi kar sakte hen, jiss app apne sarmaye ko mazzeed barha sakte hen.

- Risk ko Kam Karna

- Short term ki trading main chonkeh trader din k ihtetam par apne trades ko close karte hen, iss waja se wo apne account k risk ko kam karte hen, jiss se raat k dowran market ki volitilety k nuqsan se mehfoz raha ja sakta hai.

- Behtar Munafa

- Short term k trading main trader market k mukhtasir mudat k up down se faida uthate hen, jiss se wo kam waqat main behtar faida hasil karte hen. Ye aik behtareen opportunity hoti hai, k market k prices k up down jane se traders ko profit melta hai.

Disadvantages of Short-term Trading- High Volitilety

- Short term ki trading main sab se bara masla, jiss se traders ko bohut ziada loss ho sakta hai, wo high Volitilety ka hai. Volitilety ki waja se ziada tar log iss trading se hichkechahat mehsos karte hen.

- Unpredictability

- Short term ki trading main sab se bara masla prices ki semat malom karna bhi hota hai, jo k aik qisam ka mushkil kam hai. Qeematon k sahi semat ka aghalat andaza lagane se bhi ziada loss ho sakta hai.

- Technical Analysis

- Forex trading ka sab se mushkil kam ahi, jiss k karne k leye ghanton ghanto computer k samen bethna parta hai. Technical Analysis se hi traders market main prices ki agli movement ko predict kar sakte hen, lekin nakami ki sorat main loss ka bhi khatra hota rehta hai.

Long-term TradingForex trading k hawale sab se kam trading techniques hai, jiss main trades hafton, maheeno aur yahan tak salon k leye market main open hote hen. Trades k overall trend ka pata lagane k leye long term k tools ka istemal ziada aham hota hai, jiss main volitilety kam honne ki waja se false signal nahi hote hen, jo short term k trading k leye istemal hote hen. Long term ki trading weekly aur monthly chart patterns k sath technical aur fundamental dono tarah ki analysis par inhisar karti hai. Iss trading strategy main traders long term k leye trades open keye hote hen. Short term ki trading ko bohut sare traders tarjeeh dete hwn, lekin long term ki trading aik to ziada kamyab rehti hai aur dosra ye ziada munafa bhi deti hai, jiss se traders sahi strategies ka istemal karte howe risk ko kam kar sakta hai.Advantages Of Long-Term Trading- Low Commission

- Long term ki trading main chonkeh trades ziada arsa k leye open rehte hen, iss waja se iss par brokers ki taraf se lagat kam ati hai, jiss se traders ko ziada commission pay nahi karna part hai.

- Short Time

- Long term ki trading main main prices k volitilety weekly ya daily base par honne ki waja se kam hoti hai, jiss se chart pattern bohut achahy aur wazih nazar ate hen. Market analysis aur chart pattern par ziada waqat nahi lagaya jata.

- Low Stress

- Short term ki trading main loss hone se stress bhi ziada hoti hai, jiss se baar baar market ka tazeya karna parta hai, jab k long term ki trading main baar baar market ko nahi dekhna parta hai, jiss se loss hone k bawajood bhi stress kam hoti hai.

- Quality Signal

- Long term ki trading ka signal short term ki nisbat ziada reliable hote hen, jiss se uss se munafa bhi achah melta hai. Trend hamesha long term k timeframes ka ziada reliable hota hai, jab k chart pattern aur candlestick pattern bhi long term k achah result deta hai.

- Low Risk

- Ye long term ki trading ka sab se bara fayda hai k uss main risk bohut kam hota hai. Iss main overnight par trades jane par bhi koi masla nahi hota hai k baar baar trades ko open karke ch3ck kia jaye.

Disadvantages Of Long-Term Trading- Achahy Moqa ka Zaya Hona

- Long term ki trading main achahy moqa jo zuada tar volitilety main hota hai, wo zaya ho sakta hai. Yanni long term k traders volitilety k kam ya zuada honne se faida hasil nahi kar sakte jiss tarah se short term k traders karte hen.

- Sabar Se kaam lena

- Long term ka trading months aur years mar muheet ho sakta hai iss waja se months aur years tak iss tak profit k leye intezar karna parta hai, jo k aam trader ya new traders to bulkul nahi kar sakte hen.

- Fundamental Knowledge

- Long term ki trading k leye fundamental knowledge ka hona bohut ziada zaroei hai, jiss se har waqat almi dunya k social, political aur economical soratehal se bakhabar honna zarori hai. Fundamental analysis iss kam main bohut ziada aham hai.

-

#5 Collapse

In friendly strategy mein sabse bada farak yah hai ki long term trade mein aapko darji aur dhair ka karan hota hai, jabki short term trade mein aapko gada se fayda hota hota hai. Short-term trading, traders, long-term traders market t tamiya movement or low price movement k liye tayer rehna chahiye. Day trading involves risk, but the risk is quite high in short-term trading because traders often make quick decisions and often use leverage. -

#6 Collapse

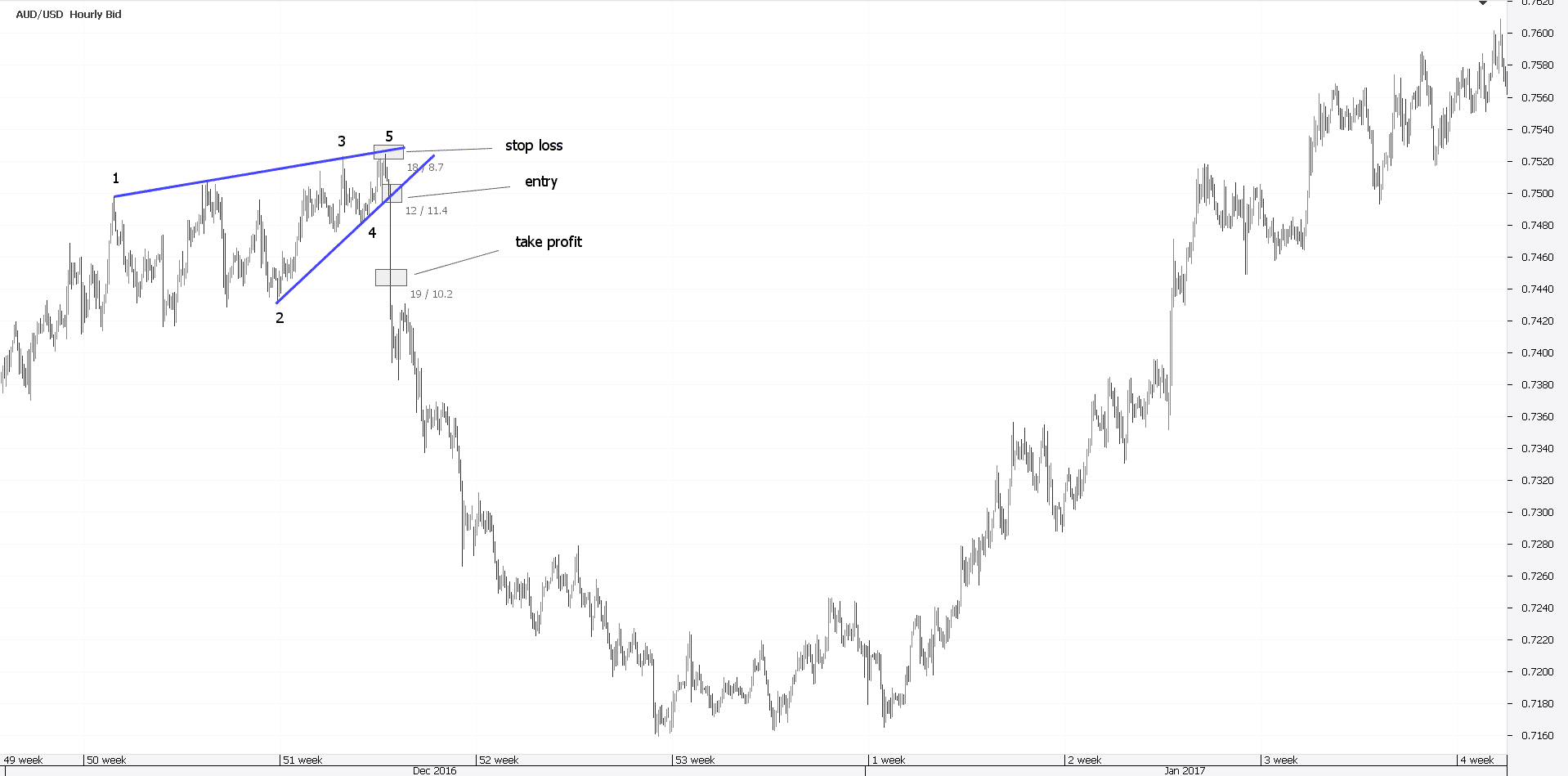

harmonic price chart pattern is technically a market pattern and we need to analyze it. When we do market or technical analysis, we can understand the market and then we can work on the market by analyzing harmonic patterns. Harmonic pattern analysis ko thik tarik se nahi karte hai to hame suja nahi mil patte hai isliye hame bazar mein analysis harmonic pattern ko karte bahat jaru hai jab market mein hum technical analyst -

#7 Collapse

forex trading memory khyal se h4 time frame sab se behtarin time frame hai ismein pattern bahut clear hota hai jo Euro USD aur pound USD per hota hai iske alava usdjp per bhi carrier hota hai lekin usmein jyadatar rader race kar lete hain lekin loss mein jaate Hain Jo aasani se Ham analysis kar sakte hain USD per hai isliye koshish karen aur jo bhi demo trading account per experience Karen iske alava petrol Baki ko bhi dekhna chahie bahut jyada jaruri hai agar practis nahin karenge to Ham loss ko jyadatar face karenge isliye practis Karen demo per FIR uske bad real account per credit karke profit kamaen . -

#8 Collapse

Long and Short terms trading

Assalaamu alikum Dear Pakistan Forex Members, I sincerely hope that I am subloog kher khariyat si. Our topic is on trading type hai, and trader apne hikmat amali ke mutabik use karate hai topic main hum Yah jane ke syush kareng ke consa term trader ke liye pahatar hota hai, and in donon main kya farak hota ha Long term tr ading Long-term trading at Dosto Indicators of the market, such as economic developments, geopolitical events, and market patterns, are well-analyzed by those who trade. Unmen se kuch traders unhen kai hafte ya mahino tak karte hai, aur kuch traders unhen sal bhar tak karte hai. Long-term traders typically hold ko position ko karne ki aukat dete hai. For instance, because they pay little attention to the daily variations of the market, traders are more likely to experience light-heavy swings in the market. Short terms trading Friends, the goal of short-term trading is to make money quickly from light to heavy volatility. The best technical analysis is used by short-term traders, including important chart patterns, indicators, and market momentums. Short-term investors frequently concentrate on the market, swift movements, or choppy price action. Traders typically hold their holdings in short-term trading for a few hours, minutes, or seconds. difference Dosto in dono strategy mein sabse bada farak yah hai ki short term trading mein aapko gada se fayda hota hota hai, long term trading mein aapko darji aur dhair ka karan hota hai. Long-term traders should avoid the market if there is turbulent price action or short-term traders should avoid it if there is short-term movement. Risk is a part of day trading, but it's a little larger in short-term trading because traders frequently act quickly and frequently employ leverage. Short-Term aur Long-Term Forex TradingShort-term and long-term forex trading both use the same trading platform. The primary traders on the forex market rely on each other, with short-term trading taking precedence over long-term trading and vice versa. Forex trading maon apne profit ko ziada se ziada aur risk ko kam se kam karne ka behtareeqa market ko samajhna aur aur apne trading plan k hisab trading ka amal karna hota hai.

ading Long-term trading at Dosto Indicators of the market, such as economic developments, geopolitical events, and market patterns, are well-analyzed by those who trade. Unmen se kuch traders unhen kai hafte ya mahino tak karte hai, aur kuch traders unhen sal bhar tak karte hai. Long-term traders typically hold ko position ko karne ki aukat dete hai. For instance, because they pay little attention to the daily variations of the market, traders are more likely to experience light-heavy swings in the market. Short terms trading Friends, the goal of short-term trading is to make money quickly from light to heavy volatility. The best technical analysis is used by short-term traders, including important chart patterns, indicators, and market momentums. Short-term investors frequently concentrate on the market, swift movements, or choppy price action. Traders typically hold their holdings in short-term trading for a few hours, minutes, or seconds. difference Dosto in dono strategy mein sabse bada farak yah hai ki short term trading mein aapko gada se fayda hota hota hai, long term trading mein aapko darji aur dhair ka karan hota hai. Long-term traders should avoid the market if there is turbulent price action or short-term traders should avoid it if there is short-term movement. Risk is a part of day trading, but it's a little larger in short-term trading because traders frequently act quickly and frequently employ leverage. Short-Term aur Long-Term Forex TradingShort-term and long-term forex trading both use the same trading platform. The primary traders on the forex market rely on each other, with short-term trading taking precedence over long-term trading and vice versa. Forex trading maon apne profit ko ziada se ziada aur risk ko kam se kam karne ka behtareeqa market ko samajhna aur aur apne trading plan k hisab trading ka amal karna hota hai.

-

#9 Collapse

taweel mudti aur qaleel mudti tijarat maliyati mandiyon ke liye do mukhtalif nuqta nazar hain. taweel mudti tajir aam tor par kayi mahino se kayi saloon tak –apne ohdon par Faiz rehtay hain, jabkay qaleel mudti tajir sirf chand minton se chand dinon tak apni position par Faiz reh satke hain. zail mein do tareeqon ke darmiyan kuch ahem ikhtilafat hain : long term trading : bunyadi baton par tawajah markooz karen : taweel mudti tajir company ya maeeshat ki majmoi sehat aur taraqqi ke imkanaat mein dilchaspi rakhtay hain. woh mukhtalif awamil ka tajzia karte hain, Bashmole maliyati bayanaat, sanat ke rujhanaat, aur macro economic isharay, kam qeemat walay stock ya asason ki nishandahi karne ke liye . ziyada munafe ka imkaan : taweel mudti tajir aam tor par aala miyaar ki sarmaya kaari ki talaash mein rehtay hain jo waqt ke sath sath khatir khuwa munafe faraham kar saken. woh market ke utaar charhao aur utaar charhao ke zariye –apne ohdon par qaim rehne ke liye tayyar hain, is yaqeen ke sath ke un ki sarmaya kaari waqt ke sath sath qader mein barhay gi . kam lain deen ke akhrajaat : taweel mudti tajir kam tijarat karte hain, is liye woh lain deen ke akhrajaat, jaisay commission, اspreads, aur slpage mein kam adaigi karte hain . short term trading : takneeki tajzia par tawajah markooz karen : qaleel mudti tajir qaleel mudti qeematon ki naqal o harkat aur rujhanaat ki shanakht ke liye takneeki tajzia par inhisaar karte hain. woh patteren aur signals talaash karne ke liye charts, isharay aur market data jaisay tools ka istemaal karte hain jo mumkina qeemat mein tabdeeli ki nishandahi karte hain . taiz raftaar tijarat : qaleel mudti tajir market ke halaat ke lehaaz se chand minton ya ghanton ke andar apni position mein daakhil aur bahar nikal satke hain. qaleel mudti market ke utaar charhao se faida uthany ke liye inhen fertyla aur taiz raftaar honay ki zaroorat hai . ziyada lain deen ki laagat : qaleel mudti tajir bohat saari tradings karte hain, is liye woh lain deen ke akhrajaat mein ziyada adaigi karte hain, jaisay commission, اspreads, aur slpage . aakhir mein, taweel mudti aur qaleel mudti tijarat do mukhtalif nuqta nazar hain jin ke –apne fawaid aur nuqsanaat hain. taajiron ko woh nuqta nazar muntakhib karna chahiye jo un ke sarmaya kaari ke ahdaaf, khatray ki bardasht, aur tijarti andaaz ke mutabiq ho ."Dream bigger. Do bigger"

(mahroosh) :1f607:

-

#10 Collapse

Forex Trading Short and Long Term Strategy Forex Trading jisme kisi currency ko kharidne aur bechne ke zariye paise kamaye jate hain, ek bhut hi risk bhara kaam hai. Isme aapko sahi samay par sahi faisla lena padta hai, kyonki aapki ek galat faisla aapko bhari nuksan pahucha sakta hai. Forex Trading mei, aap apne Trading ki length ko decide karne ke liye kuchh strategies ka upyog kar sakte hain. Short Term aur Long Term trading dono hi apne apne fayde aur nuksaan ke saath aate hain. Long Term Trading Long Term Trading, jaise naam se pata chalta hai, kuchh time period ke liye hota hai. Ye Trading mei apne liye ek saal ya usse bhi adhik ka samay hota hai. Ye Trading Strategy long term investment par adharit hoti hai. Isme aap ek currency ko kharid kar rakh sakte hain aur uski keemat ko badhne den sakte hain. Isme aapko jyada risk nahi lena padta hai, kyonki isme aap apne money ko kisi choti harkat par khone ka risk nahi lete hain. Long Term Trading ke liye aapko kuchh baaton ko dhyan mei rakhna padta hai: Fundamental Analysis Fundamental Analysis ek aisi technique hai jisme aap kisi currency ke upar ke kai factors ko dekhkar uski keemat ke baare mei jaan sakte hain. Ismei aapko kuchh factors ko dekhna hoga jaise ki Economic Calendar, News, aur Political situations. Diversification Isme aap apne money ko ek se adhik currencies mei invest kar sakte hain. Aap apna money ek hi currency mei invest nahi karenge, jisse aapko jyada fayda ho sake. Patience Long Term Trading mei patience ka bhut bada role hota hai. Aapko apne Trading ko ek saal ya usse bhi adhik time period tak hold karna padta hai. Ismei aapko market ki fluctuations ko bhi dekhna padta hai aur us par dhyan dena padta hai. Short Term Trading Short Term Trading jaise naam se pata chalta hai, kuchh time period ke liye hota hai. Ye Trading Strategy short term investment par adharit hoti hai. Ismei aap apne money ko kuchh time period ke liye hi invest karte hain aur ismei jyada risk hota hai. Short Term Trading ke liye aapko kuchh baaton ko dhyan mei rakhna padta hai: Technical Analysis Short Term Trading mei Technical Analysis ka upyog karna padta hai. Ismei aapko kisi currency ke past ki performance ko dekhkar uski keemat ke baare mei pata chalta hai. Ismei aapko Technical Indicators ka upyog karna hota hai. Stop Loss Order Ismei aapko Stop Loss Order ka review karna padta hai. Ye aapko ek limit set karne deta hai, jisse aap ko kam loss ka samna karna parta hai or ap ki trading save rheti hain or ap achy tariqy sy apni yrade ko mange kar skaty hain es liye stop loss ka istamaal lazmi karen . -

#11 Collapse

hello!! my dear friends.SHORT TERMS TRADING: Short-term trading, also known as day trading or swing trading, involves buying and selling financial assets within a short time frame, usually within a day or a few days. Short-term traders aim to make profits by capitalizing on the price fluctuations of the asset in the short term. Short-term trading can be very profitable if done correctly, but it also carries higher risks than long-term trading. They use technical analysis and other trading strategies to identify short-term market trends and execute trades quickly. The key to success in short-term trading is to have a sound trading plan, strict risk management, and discipline in executing trades. Short-term traders need to be able to make quick decisions based on market movements, and they must be able to cut their losses quickly if trades move against them.Short-term trading requires a higher level of knowledge, experience, and risk tolerance than long-term trading. It's important to understand the risks and rewards involved and to develop a solid trading plan before engaging in short-term trading. Some common short-term trading strategies include scalping, where traders aim to make small profits by buying and selling assets quickly, and swing trading, where traders aim to profit from short-term price swings by holding positions for a few days to a few weeks. SHORT TERMS TRADING STRATEGIES: Some common strategies of short-term trading are Scalping, Daytrading, Swingtrading.- Making small profits on a large number of trading by buying and selling securities quickly in involves in Scalping.

- Buying and selling securities within the same trading day involves in Day trading.

- Holding a position for a few days or weeks to capture short-term price movements involves in Swing trading.

- Value investing: This strategy involves identifying stocks or other assets that are undervalued by the market and holding them until they reach their true value. Value investors often look for companies with strong fundamentals, such as a low price-to-earnings ratio, high dividend yield, or a strong balance sheet.

- Growth investing: This strategy involves investing in companies that are expected to grow faster than the overall market. Growth investors often look for companies with strong revenue growth, expanding profit margins, and a track record of reinvesting earnings into their business to fuel further growth.

- Dividend investing: This strategy involves investing in companies that pay regular dividends to shareholders. Dividend investors often look for companies with a history of consistent dividend payments and a strong balance sheet.

- Buy and hold: This strategy involves buying a diversified portfolio of assets and holding them for the long-term, regardless of short-term market fluctuations. Buy-and-hold investors often focus on a mix of stocks, bonds, and other assets to achieve a balanced portfolio.

- Asset allocation: This strategy involves diversifying investments across multiple asset classes, such as stocks, bonds, and real estate, to reduce risk and maximize returns over the long-term. Long-term trading requires patience, discipline, and a long-term perspective. It's important to have a solid understanding of the underlying fundamentals of the assets being invested in, as well as a plan for managing risk and volatility over the long-term.

-

#12 Collapse

Long and Short terms exchanging Aslam O Alaikum Dear Pakistan Forex From Individuals Trust I'm sub loog kher khariyat si Eager or fun krir rahi apni preparing life ko dosto aaj ka our point is on exchanging type hai jo dealer apne hikmat amali ke mutabik use karate hai theme principal murmur Yah jane ke syush kareng ke consa term broker ke liye pahatar hota hai aur in donon primary kya farak hota hai to yes tafsilat se isis ko jane ke syush karte hai Long haul exchanging Dosto Long haul Exchanging Men dealers are great at investigating market key, for example, financial pointers, international occasions and market patterns. Long haul merchants as a rule stand firm on ko foothold ko karne ki aukat dete hai, unmen se kuch dealers unhen kai hafte ya mahino tak karte hai, aur kuch brokers unhen sal bhar tak karte hai. For instance, dealers will generally be more inclined to light-weighty swings on the lookout, since they don't focus on the everyday variances of the market. Short terms exchanging Companions, the target of transient exchanging is to benefit from little to-weighty variances inside a brief period of time. Transient brokers utilize their best specialized investigation, for example, key outline examples, pointers or market energies. Momentary merchants will more often than not center around the market or speedy moves or rough cost activity. In transient exchanging, merchants generally stand firm on their footholds for a couple of hours, minutes or seconds. Dosto in dono system mein sabse bada farak yah hai ki long haul exchanging mein aapko darji aur dhair ka karan hota hai, jabki momentary exchanging mein aapko gada se fayda hota hai. Transient exchanging me, brokers k pas kuch teji honi chahiye, jabki long haul dealers co market k tamiya development or rough cost activity k liye tayer rehna chahiye. Day exchanging implies risk, however in transient exchanging the gamble is a piece higher, as dealers frequently pursue speedy choices and frequently use influence.

Dosto in dono system mein sabse bada farak yah hai ki long haul exchanging mein aapko darji aur dhair ka karan hota hai, jabki momentary exchanging mein aapko gada se fayda hota hai. Transient exchanging me, brokers k pas kuch teji honi chahiye, jabki long haul dealers co market k tamiya development or rough cost activity k liye tayer rehna chahiye. Day exchanging implies risk, however in transient exchanging the gamble is a piece higher, as dealers frequently pursue speedy choices and frequently use influence.

- Mentions 0

-

سا0 like

-

#13 Collapse

Aslam O Alaikum Dear Pakistan Forex From Individuals Trust I'm sub loog kher khariyat si Ravenous or fun krir rahi apni preparing life ko dosto aaj ka our point is on exchanging type hai jo dealer apne hikmat amali ke mutabik use karate hai theme primary murmur Yah jane ke syush kareng ke consa term merchant ke liye pahatar hota hai aur in donon principal kya farak hota hai to affirmative tafsilat se isis ko jane ke syush karte hai. exchanging Forex exchanging: Forex mein long haul aur momentary exchanging dono tareeke hotay hain. Long haul exchanging mein aap apne exchanges ko kuch maheenon ya saalon ke liye hold karte hain. Is mein aap basic examination, specialized investigation aur market feeling ki madad se cash matches ke bearing ka examination karte hain. Long haul exchanging mein aap ziyada time aur tolerance ke saath kaam karte hain aur ismein generally low influence ka istemaal hota hai. Momentary Exchanging Forex exchanging k transient ki exchanging technique principal exchanges ko lambay arsey ki bajaye kam waqat k leye exchanges ko open rakhte hen. Momentary ki exchanging principal position ko minton, ghanton ya aik commotion k leye exchanges primary rakhe jate hen, lekin aam tawar standard saat (7) noise se ziada nahi, jiss k nateejay fundamental kam waqat principal ziada munafa hasil ho jata hai. Ziada tar forex merchant is exchanging methodology ko faida mand qarar dete hen. Lekin risk ki waja se ye exchanging hikmate amli ziada khatarnak hai, jo iss ka aik tareek pehlo hai. Har aik broker cost volitilety ko bardasht nahi kar sakta hai. Risk the executives rules aur guidelines ko adhere to karne se risk ko kafi had tak kam kia ja sakta hai. Jinn brokers ko riak the board k osolon ka elam nahi hai, khas kar k new merchants unn k leye transient ki exchanging unn primary bohut maqbol hai. Transient ki exchanging ki risk ko kam karne k leye bohut cheezon ki zarorat parti hai. Ye exchanging procedures dealers k market k uncovered primary information, experience aur exchanging abilities khas kar specialized examination se bohut ziada asar andaz hoti hai. Long haul Exchanging Forex exchanging k hawale sab se kam exchanging procedures hai, jiss principal exchanges hafton, maheeno aur yahan tak salon k leye market primary open hote hen. Exchanges k in general pattern ka pata lagane k leye long haul k apparatuses ka istemal ziada aham hota hai, jiss principal volitilety kam honne ki waja se misleading sign nahi hote hen, jo transient k exchanging k leye istemal hote hen. Long haul ki exchanging week after week aur month to month diagram designs k sath specialized aur key dono tarah ki investigation standard inhisar karti hai. Iss exchanging technique primary dealers long haul k leye exchanges open keye hote hen. Transient ki exchanging ko bohut sare merchants tarjeeh dete hwn, lekin long haul ki exchanging aik to ziada kamyab rehti hai aur dosra ye ziada munafa bhi deti hai, jiss se dealers sahi techniques ka istemal karte howe risk ko kam kar sakta hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

Ager him log long term trading krni ha to is ky leyae him logo ko currency ma trading krni chyae is ma him logo ko bhot fida ho ga or Ager him logo ko short term trading krni ha to is ky leyae him logo ko gold or bitcoin or oil ma trading krni chyae is ka him logo ko bhot fida ho ga fida fono term ma ha laken loss ky bi chances ha is leyae plan kr ky trading krni ho to Thek ha or acha bi ha him sub logo ky leyae

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:42 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим