Usage of nose pin bar in forex trading.

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

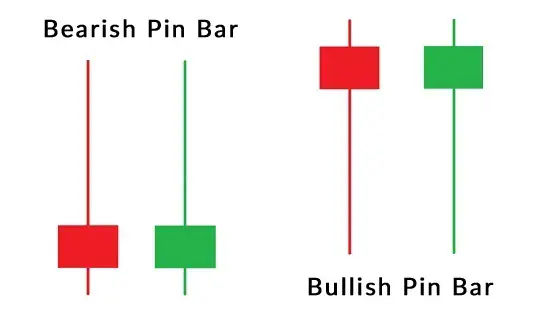

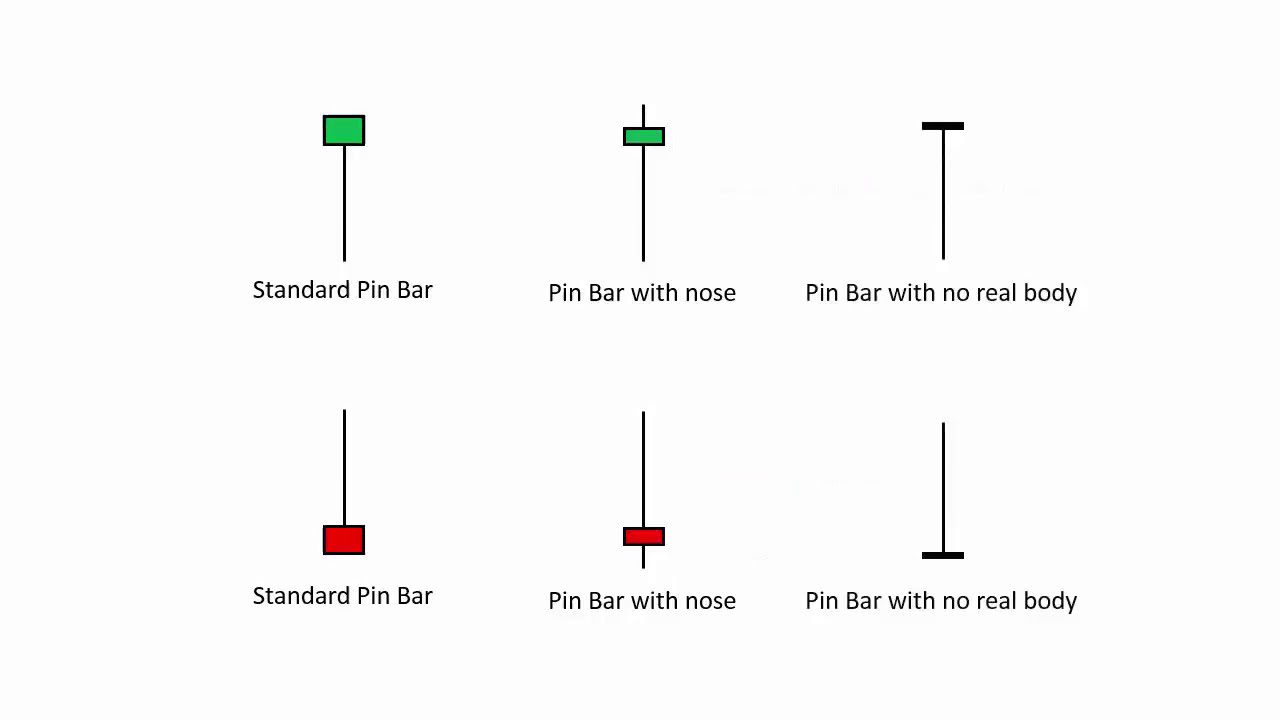

WHAT IS NOSE PIN BAR.Hello friends,Forex trading mein jb bi update technical analysis ko complete Karte Hain Tu aesi situation main aapko nose pin bar se related apni complete learning Hasil karna chahie.kyu ky yeh aap ky technical analysis ko bahut perfect kar sakti hai aur aap ki decision making mein bahut helpful ho sakti hai.yah candlestick bahut hi valuable aur important information provide karti hai, aur aap ky technical analysis ky perfect sage mein bahut important role play kar sakti hai isliye is candlestick ki proper identification aur iski proper recognition ke liye bahut zaroori hy.market ke support or resistance level per Jab pin bar candle nose ki shape Mein Banti Hai Tu phir market ke retracement ka waqt a jata hai aur yahan se market reverse Ho Jaati Hai.Agar nose pin bar Candle support area per form hti hai tu trend change hota hai aur isi Tarah sy resistance area per bhi form hoti hy hai tu trend changing ka signal provide kerta Hai.CHARACTERISTICS OF NOSE PIN BAR.Forex market mein pin bar ki body short hoti ha or legg long hoti ha jis sy hum easily sy pin bar ko identify kar sakty hain.Pin bar jab bi resistance level per form hoti ha tu yeh bearish hoti ha aor jab bi pin bar support level pe form hoti hy tu yeh bullish pin bar hoti hy.pin bar different shape ki hoti han en main kuch pin bar ki nose hoti ha kuch ki ni hoti ha kisi ki body bilkal ni hoti ha is tahra pin bar pe trading kar k hum log better planning aor strategy k sath positive earning kar sakty hain.Nose pin bar candle me price candle ki aik side pe bohut hi ziada move kar chuki hoti hai lekin waha se candle stick ki rejection ho jati hai. Nose pin bar mein market pe kisi khas waqat market price ka pressure waqti tawar par aik side per move ker jata hai lekin woh kuch time ky baad reject ho kar wapis candle stick ki open position k nazdeek aa jata hai. Nose pin bar mein agar nose bullish side per ho tu ess ka matlab hai k market ne bearish side ko reject kia hai, aur woh movement bullish side ki karna chah rahe hein. Jab k agar yeh nose pin bar bearish side per create ho tou market bullish side ki rejection ko indicate karti hai. Is waja se market mein nose pin bar bar candle stick pe focus rakhna bhout zaroori ho jata hy.TECHNICAL ASPECTS.Dear fellows market ki movement ki prediction hee trading ki kamyabi ki base hoti hy,ess leye prediction mein expertese gain kerna actual knowledge aur learning hy.tammam traders ko ess aspects per concentrate kerny ki bhout zaoorat hoti hy. Forex trading ma expert trader candlestick ki types ko observe ker ky samaj jaty hain k market ka volume kiya hai, aor market mein es time par buying pressure zayada hai ya selling pressure zayada hai. Jo trader market mein candlestick ko achy sy learn karna trader k lae tb he possible hoti hai jab trader k pass acha experience hota hai.pin bar Ek bahut hi best trading strategy hoti hai market Mein pin bar trading strategies ko technical analysis ke jariye se apply kiya Ja sakta h market Mein traders ko kam karte waqt nosepin bar ko bhi acche se confirm kar lena chahieye.Forex trading ke Business mein Hamesha Usi trader Ko kamyabi milati Hai Jo market Mein available Tamam candlestick pattern ko acchi Tarah Se study kar leta hai aur inke related complete knowledge Hasil kar leta hai.forex trading main jtni mehnat karny gy utna humara knowledge aor experience ziada ho ga jis sy hum log behtar planning or strategy sy trading kar k ache earning kar sakty hain. jis ky baad trading mein apny knowledge ko apply ker ky market mein sucessfull trader ban sakty hein.es kleye zaroori hy ky hum market mein ziada time spent kerein aur pattern ky sath sath different indicators ka use kerna bee lern kerein. i hope yeh post ap ko pin baar pattern ko understand kerny mein helpful ho ge. ap kee feed back ka intezaar rahy ga.thanks -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Pin bar candlestick pattern ko Forex mein aik powerful trading signal kaha jata hai. Ye pattern candlestick chart par dikhai deta hai, jo traders ki taraf se use kya jata hai price action analysis ke liye. Pin bar pattern ko is liye powerful kaha jata hai kyun ke is ke through traders ko price ki direction ka pata chal jata hai. Explenation Is pattern ka matlab hota hai ke price ne ek particular level tak jana tha, lekin wahan se palat gaya hai. Pin bar ki shape ki wajah se ise aam tor par 'hammer' ya 'shooting star' bhi kaha jata hai. Agar pin bar candlestick pattern ek uptrend ke doran show ho raha hai, to is ka matlab hota hai ke buyers ki strength kam ho rahi hai aur market mein selling pressure increase ho rahi hai. Agar ye pattern downtrend ke doran show ho raha hai, to is ka matlab hota hai ke sellers ki strength kam ho rahi hai aur market mein buying pressure increase ho rahi hai. Is pattern ke liye traders ko ek particular set of rules follow karna hota hai, jaise ke is ka tail minimum 2/3 of the total candle ki length tak hona chahiye, is ka body small hona chahiye aur is ke tail ki taraf price movement ke against jana chahiye. Ye rules traders ki taraf se follow kye jate hai ke is ke through unhein confirm ho sake ke pin bar pattern hai ya nahi. Types of Pin bar candlestick pattern in forex. Forex mein pin bar candlestick pattern ke kuch different types hote hain, jinhe traders price action analysis ke liye use karte hain. Ye types aam tor par usi basis par differentiate kiye jate hain ke pin bar ke tail aur body kis taraf direction mein ja raha hai. In types ke baare mein detail se baat karte hain:- Bullish Pin Bar: Ye type jab show hota hai jab market downtrend se uptrend mein shift hone lage. Is ke through traders ko ye signal milta hai ke buyers ki strength increase ho rahi hai aur market mein price movement up ki taraf jaa sakta hai. Is ke tail neechay ki taraf jata hai aur body upar ki taraf jati hai.

- Bearish Pin Bar: Ye type jab show hota hai jab market uptrend se downtrend mein shift hone lage. Is ke through traders ko ye signal milta hai ke sellers ki strength increase ho rahi hai aur market mein price movement down ki taraf jaa sakta hai. Is ke tail upar ki taraf jata hai aur body neechay ki taraf jati hai.

- Long-Tailed Pin Bar: Is type ke pin bar mein tail ki length normal se zyada hoti hai. Ye type market mein potential trend reversal ka signal deta hai. Agar ye type bullish trend ke baad show ho raha hai, to is ka matlab hota hai ke buyers ki strength kam ho rahi hai aur market mein selling pressure increase ho rahi hai. Agar ye type bearish trend ke baad show ho raha hai, to is ka matlab hota hai ke sellers ki strength kam ho rahi hai aur market mein buying pressure increase ho rahi hai.

- Doji Pin Bar: Ye type jab show hota hai jab pin bar ki body almost non-existent hoti hai aur tail bahut zyada elongated hoti hai. Ye type market mein indecision ka signal deta hai aur potential trend reversal ko indicate karta hai.

- Trading signal: Pin bar pattern ek powerful trading signal hai, jis ki wajah se traders ko market trend aur price movement ka pata chal jata hai. Is ke through traders potential trend reversal aur market entry/exit points ka pata laga sakte hain.

- Price action analysis: Pin bar pattern price action analysis ke liye bahut useful hai. Traders is ko use kar ke market ki direction aur price movement ka pata laga sakte hain. Ye pattern price action trading strategies ke liye bahut important hai.

- Risk management: Pin bar pattern traders ko risk management ke liye help karta hai. Traders is ke through stop loss levels aur profit targets ka pata laga sakte hain. Is ke use se traders apni trading risk ko minimize kar sakte hain.

- Easy to identify: Pin bar pattern easy to identify hai, jis ki wajah se traders ko is ka use karne mein asaani hoti hai. Traders is ke through apni trading decisions quickly aur accurately make kar sakte hain.

- High success rate: Pin bar pattern ka success rate traders ke liye high hota hai. Agar traders is ko sahi tareeqe se use karein aur is ke rules ko follow karein to unhein high probability trades ke liye opportunities mil sakte hain.

Like tu banta hay ik🙏 -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Nose pin bar ek technical analysis tool hai jo forex traders dwara price action trading ke liye use kiya jaata hai. Nose pin bar ki shape ki wajah se ise hanging man bhi kaha jaata hai. Nose pin bar pattern ko identify karne ke baad traders trend reversal ki possibility ko analyze kar sakte hain. Nose pin bar pattern ka matlab hota hai ki price ek particular level tak pahuncha aur phir wahan se palat gaya hai. Nose pin bar pattern mein tail lower shadow ki length se zyada upper shadow ki length hoti hai aur iska body small hota hai. Nose pin bar pattern ko bullish ya bearish trend ke bich mein dekha jata hai. Nose pin bar pattern bullish trend ke doran show hone par iska matlab hota hai ki buyers ki strength kam ho rahi hai aur market mein selling pressure increase ho rahi hai. Jabki nose pin bar pattern bearish trend ke doran show hone par iska matlab hota hai ki sellers ki strength kam ho rahi hai aur market mein buying pressure increase ho rahi hai. Nose pin bar pattern ke through traders ko entry aur exit points ka pata chalta hai. Agar nose pin bar pattern bullish trend ke doran show ho raha hai to traders ko selling positions le lena chahiye. Jabki agar nose pin bar pattern bearish trend ke doran show ho raha hai to traders ko buying positions lena chahiye. Nose pin bar pattern ke through traders ko ye bhi pata chalta hai ki kis level tak price move ho sakta hai. Nose pin bar pattern ko identify karne ke liye traders ko kuch rules follow karne hote hain. Nose pin bar pattern ke liye tail ki length minimum 2/3 of the total candle ki length honi chahiye. Iska body small hona chahiye aur tail ki taraf price movement ke against jana chahiye. Nose pin bar pattern ki confirmations ke liye traders ko dusre indicators bhi use karne hote hain. For example, traders support aur resistance levels ko identify karne ke liye pivot points aur moving averages ka use kar sakte hain. Nose pin bar pattern ke through traders ko market mein trend reversal ka pata chalta hai. Nose pin bar pattern ke sath-sath traders ko stop loss aur take profit levels ka bhi pata chalta hai. Traders ko apni trades ko place karte waqt stop loss levels ka use karna chahiye. Stop loss level ki help se traders ko ye pata chalta hai ki kitni loss unhein tolerate karna hoga. Take profit levels ka use karke traders apni profits ko maximize kar sakte hain. Nose pin bar pattern ka use karne se pahle traders ko market ki conditions aur trend ko analyze karna chahiye. Market ki volatility, trend, aur trading activity ko analyze karne ke baad traders ko apni trades ko place karna chahiye. Nose pin bar pattern ke through traders ko entry aur exit points ka pata chalta hai. Nose pin bar pattern ke sath-sath traders ko risk management aur money management ki bhi zaroorat hoti hai.

Nose pin bar pattern ko identify karne ke liye traders ko kuch rules follow karne hote hain. Nose pin bar pattern ke liye tail ki length minimum 2/3 of the total candle ki length honi chahiye. Iska body small hona chahiye aur tail ki taraf price movement ke against jana chahiye. Nose pin bar pattern ki confirmations ke liye traders ko dusre indicators bhi use karne hote hain. For example, traders support aur resistance levels ko identify karne ke liye pivot points aur moving averages ka use kar sakte hain. Nose pin bar pattern ke through traders ko market mein trend reversal ka pata chalta hai. Nose pin bar pattern ke sath-sath traders ko stop loss aur take profit levels ka bhi pata chalta hai. Traders ko apni trades ko place karte waqt stop loss levels ka use karna chahiye. Stop loss level ki help se traders ko ye pata chalta hai ki kitni loss unhein tolerate karna hoga. Take profit levels ka use karke traders apni profits ko maximize kar sakte hain. Nose pin bar pattern ka use karne se pahle traders ko market ki conditions aur trend ko analyze karna chahiye. Market ki volatility, trend, aur trading activity ko analyze karne ke baad traders ko apni trades ko place karna chahiye. Nose pin bar pattern ke through traders ko entry aur exit points ka pata chalta hai. Nose pin bar pattern ke sath-sath traders ko risk management aur money management ki bhi zaroorat hoti hai.  Nose pin bar pattern ko recognize karne ke liye traders ko candlestick charts ke sath-sath price action aur trend analysis ko bhi samajhna zaroori hota hai. Nose pin bar pattern ka matlab hota hai ki price ek particular level tak pahuncha aur phir wahan se palat gaya hai. Nose pin bar pattern mein tail lower shadow ki length se zyada upper shadow ki length hoti hai aur iska body small hota hai. Nose pin bar pattern ka use bullish aur bearish trend ke doran kiya jata hai. Agar nose pin bar pattern bullish trend ke doran show ho raha hai to traders ko selling positions le lena chahiye. Jabki agar nose pin bar pattern bearish trend ke doran show ho raha hai to traders ko buying positions lena chahiye. Nose pin bar pattern ki confirmations ke liye traders ko dusre indicators bhi use karne hote hain. For example, traders Fibonacci retracements aur trend lines ka use kar sakte hain. Nose pin bar pattern ke sath-sath traders ko stop loss aur take profit levels ka bhi pata chalta hai. Traders ko apni trades ko place karte waqt stop loss levels ka use karna chahiye. Stop loss level ki help se traders ko ye pata chalta hai ki kitni loss unhein tolerate karna hoga. Take profit levels ka use karke traders apni profits ko maximize kar sakte hain.

Nose pin bar pattern ko recognize karne ke liye traders ko candlestick charts ke sath-sath price action aur trend analysis ko bhi samajhna zaroori hota hai. Nose pin bar pattern ka matlab hota hai ki price ek particular level tak pahuncha aur phir wahan se palat gaya hai. Nose pin bar pattern mein tail lower shadow ki length se zyada upper shadow ki length hoti hai aur iska body small hota hai. Nose pin bar pattern ka use bullish aur bearish trend ke doran kiya jata hai. Agar nose pin bar pattern bullish trend ke doran show ho raha hai to traders ko selling positions le lena chahiye. Jabki agar nose pin bar pattern bearish trend ke doran show ho raha hai to traders ko buying positions lena chahiye. Nose pin bar pattern ki confirmations ke liye traders ko dusre indicators bhi use karne hote hain. For example, traders Fibonacci retracements aur trend lines ka use kar sakte hain. Nose pin bar pattern ke sath-sath traders ko stop loss aur take profit levels ka bhi pata chalta hai. Traders ko apni trades ko place karte waqt stop loss levels ka use karna chahiye. Stop loss level ki help se traders ko ye pata chalta hai ki kitni loss unhein tolerate karna hoga. Take profit levels ka use karke traders apni profits ko maximize kar sakte hain.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:38 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим