Piercing Pattern Candlestick

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

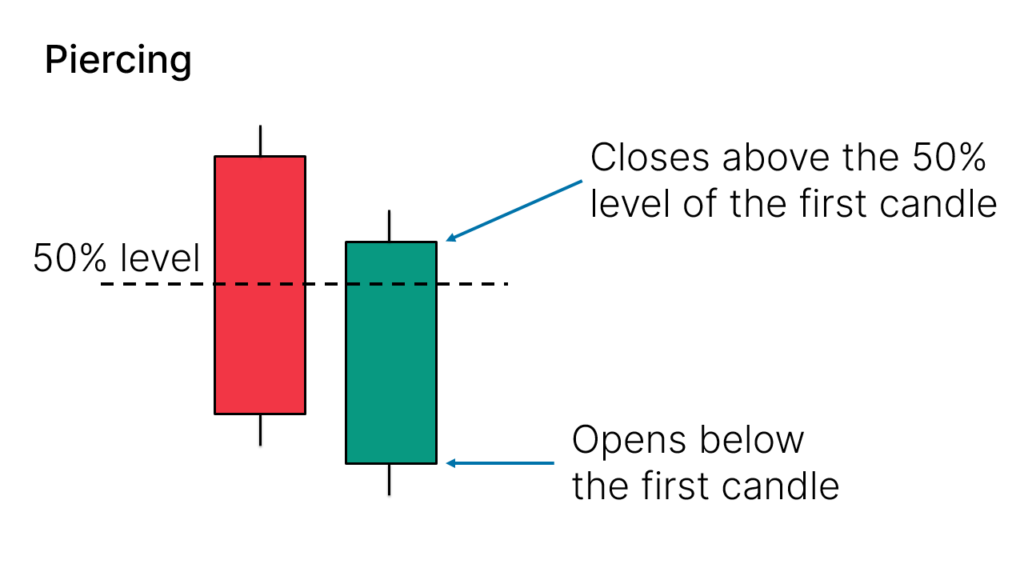

Piercing Pattern – How to trade with Piercing Candlestick? Piercing patteren aik candle stick patteren hai jo support levels ke qareeb bantaa hai, aur yeh hamein mumkina taizi ke ulat jane ke isharay deta hai . Yeh neechay ke rujhan ke ekhtataam ki taraf paaya jata hai aur siyah baadal ke ihata se kaafi milta jalta hai . Farq sirf itna hai ke gehray baadal ka ihata bearish reversal ka ishara deta hai, jabkay piercing patteren taizi ke ulat jane ka ishara karta hai . Is qisam ka namona two candle stick se bana hai, pehla bearish hai, aur dosra bullish candle stick hai. Lekin jab aap stock market mein tijarat karne ke liye takneeki tajzia istemaal karte hain to kya yeh candle stick istemaal karna itna aasaan hai. . What is a Piercing Pattern? Yeh taizi se ulatnay wala patteren hai jo neechay ke rujhan ke aakhir mein paaya ja sakta hai . Yeh candle stick patteren lambi position mein daakhil honay ya farokht ki position se bahar niklny ke liye bator isharay istemaal hota hai . Is qisam ka namona is waqt bantaa hai jab bull aur bear, dono qeematon par control haasil karne ke liye lar rahay hotay hain . Puercing ka namona two candle stick se banta hai . Pehli candle stick surkh rang ki honi chahiye jis ka asli jism bara hai aur doosri candle stick sabz rang ki honi chahiye aur yeh bhi pichli candle stick se neechay honi chahiye . Doosri candle stick ko pehli candle stick ke asli body ke middle ke oopar band hona chahiye . Dono candlestick maru buzzu honi chahiy or dono ka aks ni hona chahiy. .Formation of Piercing Candlestick Pattern Piercing stick nechy shakal me di gai hain Is market pehlay hi neechay ke rujhaan mein hai, ibtidayi qeemat ziyada hai aur farokht ki sargarmi jari hai .Trading session ke ekhtataam par, ikhtitami qeemat neechay tak pahonch jati hai aur is terhan aik bearish candle banti hai . Yeh bearish candle stick aam tor par Marubuzzu hai jis ke oopri ya nichale saaye nahi hotay hain . Agli candle stick ka iftitah pichli bearish candle stick ke ikhtitami nuqta se neechay hai . Bulls ki taraf se maang mein izafah hota hai aur qeemat bherne lagti hai . Din ke ekhtataam par, bull qeematon mein izafah karne mein kamyaab ho jatay hain, aur ikhtitami qeemat pichli bearish candle stick ke darmyan se ziyada hai . .How to use Piercing Pattern? Sarmaya karon ko chaidnay ke patteren ke sath tijarat karte waqt chand khususiyaat ko dekhna chahiye : 1. Sab se pehly rujhan ko neechay ka rujhan hona chahiye, kyunkay patteren taizi se reversal patteren hai . 2. Candle stick ki lambai is qowat ka taayun karne mein ahem kirdaar ada karti hai jis ke sath ulat jaye gi . 3. Mandi aur taizi ki candles ke darmiyan farq is baat ki nishandahi karta hai ke trend reversal kitna taaqatwar hoga . 4. Bullis candle stick ko pichli bearish candle stick ke middle point se ziyada band hona chahiye . 5. Brish ke sath sath bullish candle stick ki bhi barri body honi chahiye . -

#3 Collapse

Assalamu Alaikum Dosto!Piercing Line PatternPiercing line candlestick pattern aik strong bullish trend reversal pattern hai, jo k prices k downtrend ya low price area main banta hai. Ye pattern dekhne main same "Bullish Belt-Hold Candlestick Pattern" ya "Bearish Thrusting Line Pattern" jaisa dekhaye deta hai, lekin dosri bearish candle ki shape thori si difference honne ki waja se ye uss mukhtalif ban jata hai. Ye pattern do candles par mushtamil hota hai, jiss main pehli candle bearish aur dosri bullish candle hoti hai. Bullish candle ki haseyat ye hai k ye candle aik to bearish candle se below gap main banti hai aur dosra ye candle close pehli candle k midpoint se above hoti hai, jo k trend reversal ka sabab banti hai.Candles FormationPiercing line candlestick pattern trend reversal pattern honne ki waja se prices k bottom par ya bearish trend main banta hai, jiss se prices apne trend ko badalne main majboor ho jati hai. Pattern do candles par mushtamil hota hai, jiss ki tafseel darjazzel hai; 1. First Candle: Piercing line candlestick pattern ki pehli candle aik long real body wali bearish candle honi chahie, jo k bearish trend ya low prices ko zahir karti hai. Ye candle black ya red color main hoti hai. 2. Second Candle: Piercing line candlestick pattern ki dosri candle aik real body wali bullish candle hoti hai, jo k pehli candle k bottom par open ho kar ussi k midpoint se above close hoti hai. Ye candle lazmi 50% se above close honi chaheye. Ye candle color main white ya green hoti hai.ExplanationPiercing line candlestick pattern two days candle ka aik bullish trend reversal pattern hai, jo k bearish trend ya low prices area main banta hai. Piercing line candlestick pattern k opening side par aik small wick ya shadow honi chaheye hai, q k issi tarah se ye pattern belt-hold line pattern se mukhtalef ban jata hai. Ye pattern prices k bottom par do candles se mel kar banta hai, jiss main pehli candle aik bearish candle hoti hai, jiss k baad aik bullish candle below gap main ban kar bearish candle k real body main darmeyan se ooper aur open price se nechay close hoti hai. Bullish candle ka bearish candle k open price se below lazmi close hona zarori hai.TradingPiercing line candlestick pattern ki pehli candle normal bearish trend wali candle hoti hai, jo k prices k bearish trend ki alamat hoti hai, jab k dosri candle pehli candle k lower gap main open honne k bawajood close pehli candle k 50% se above area main hoti hai, jiss se dosri candle ki mazboti zaher hoti hai. Pattern par trading se pehle market ka downtrend ya prices ka lower honna zarori hai. Pattern par trading se pehle trend confirmation ka honna zarori hai. Trend confirmation price action se bhi ho sakti hai aur kisi reliable indicator se bhi ho sakti hai. Pattern k dosri candle k bad agar aik real body bullish candle banti hai, to yahan par market main entry ki ja sakti hai. Stop Loss pattern k sab se lowest point jo umoman dosree candle ka lower ya open banta hai, se aik ya do pips below par set karen. -

#4 Collapse

Forex trading ek tezi se badalne wale aur complex market hai jahan traders mukhtalif tools aur strategies istemal karte hain taake woh malumat hasil kar sakein aur sahi faislay kar sakein. Aik aisa tool hai candlestick patterns, jo ke traders ko price movements ka analysis karne aur market reversals ke liye peshgoiyon mein madad karte hain. Piercing Pattern aik ahem candlestick pattern hai jo technical analysis mein ahemiyat rakhta hai.

Piercing Pattern Ki Tafseelat:

Piercing Pattern ek bullish reversal candlestick pattern hai jo dikhata hai ke market mein bearish trend ke baad ab bullish trend shuru hone ke chances hain. Yeh pattern do candlesticks se banta hai: pehla candlestick bearish hota hai aur doosra candlestick bullish hota hai.- Pehla Candlestick: Piercing Pattern ka pehla candlestick bearish hota hai, jo batata hai ke market mein pehle se bearish trend hai. Is candlestick ki opening price se shuru hoti hai aur closing price opening price se neeche hoti hai.

- Dusra Candlestick: Piercing Pattern ka doosra candlestick bullish hota hai, jo pehle candlestick ki neeche opening hoti hai aur phir tezi se upar jaata hai. Is candlestick ka closing price pehle candlestick ke body ke andar ya uske kareeb hoti hai.

Piercing Pattern Ka Tijarat Mein Istemal:

Piercing Pattern ka istemal karne ke liye traders ko market trend ko pehchanne ki zarurat hai. Agar market mein bearish trend hai aur Piercing Pattern ban raha hai, toh yeh ek bullish reversal ka ishara ho sakta hai.- Trend Ki Tafteesh: Pehle toh traders ko market trend ko pehchan'na zaroori hai. Agar market mein bearish trend hai aur Piercing Pattern ban raha hai, toh yeh ek potential reversal ka indication ho sakta hai.

- Piercing Pattern Ki Pehchan: Traders ko Piercing Pattern ko sahi se pehchanne ki zarurat hai. Iske liye, pehla candlestick bearish hona chahiye aur doosra candlestick bullish hona chahiye, ideally pehle candlestick ke adhe se zyada size ka hona chahiye.

- Confirmation Ke Liye Thori Der Ka Intezar: Piercing Pattern ko confirm karne ke liye traders ko thori der ka intezar karna chahiye. Agar doosra candlestick mein sufficient buying pressure hai, toh yeh ek reversal ki taraf ishara kar sakta hai.

- Stop Loss Aur Target Levels Ka Setup Karein: Har trade mein stop loss aur target levels ka setup karna zaroori hai. Yeh trader ko protect karta hai agar trade opposite direction mein chala gaya.

- Risk Aur Reward Ka Taulaq Karein: Har trade ke liye risk aur reward ka taulaq karna zaroori hai. Yeh traders ko yeh samajhne mein madad karta hai ke kitna risk lena chahiye aur kitna profit expect kiya ja sakta hai.

Piercing Pattern Ke Nuqsanat:- Galat Signals: Jaise ke har technical indicator aur pattern mein hota hai, Piercing Pattern bhi galat signals generate kar sakta hai. Isliye, iska istemal karne se pehle doosre technical analysis tools ka bhi istemal kiya jana chahiye.

- Market Shurat: Market ki shuruaat par bhi asar hota hai. Agar market mein high volatility hai ya kisi major economic event ke announcement hone wale hain, toh Piercing Pattern ki reliability kam ho sakti hai.

- Confirmation Ke Liye Intezar: Traders ko confirmation ke liye intezar karna padta hai, jo kuch traders ke liye sabr ka imtehan ho sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

"Piercing Pattern Candlestick: Market Mein Tezi Ka Ishara"

Taaruf: Piercing Pattern Candlestick ek bullish reversal pattern hai jo market mein hone wale trend change ko darust karta hai. Yeh pattern do consecutive candlesticks par mabni hota hai aur traders ko indicate karta hai ke downtrend ke baad ab uptrend ka dor shuru ho sakta hai. Is article mein, ham Piercing Pattern Candlestick ke tafseelat par ghaur karenge.

Piercing Pattern Candlestick Kya Hai? Piercing Pattern Candlestick ek bullish reversal pattern hai jismein do candlesticks shamil hote hain. Pehli candlestick ek bearish (downward) candle hoti hai, aur dusri candlestick ek bullish (upward) candle hoti hai. Dusri candlestick pehli ki opening price se neeche open hoti hai lekin day ki mid-point par close ho jati hai.

Pehchan: Piercing Pattern Candlestick ki pehchan ke liye kuch mukhtalif chezein madadgar sabit ho sakti hain:- Bearish Candle:

- Pehli candlestick ek bearish candle hoti hai, yani ke iski closing price opening price se neeche hoti hai.

- Bullish Candle:

- Dusri candlestick ek bullish candle hoti hai, yani ke iski opening price pehli candle ki opening price se neeche hoti hai lekin day ki mid-point par close ho jati hai.

- Gap Down:

- Is pattern mein typically ek gap down hota hai jab dusri candle start hoti hai, lekin phir price day ki mid-point ke paas recover karta hai.

Piercing Pattern Candlestick Ka Istemal: Piercing Pattern Candlestick ka istemal market mein hone wale trend reversals ko identify karne mein hota hai. Agar market mein downtrend hai aur Piercing Pattern dikhai deta hai, toh yeh traders ko indicate karta hai ke ab market mein uptrend shuru ho sakta hai.

Traders ko chahiye ke is pattern ko confirm karne ke liye doosre technical indicators aur analysis tools ka bhi istemal karein, taake unki trading decisions mazboot ho aur nuksan se bacha ja sake.

Conclusion: Piercing Pattern Candlestick ek mofeed tool hai jo traders ko market mein hone wale bullish reversals ko identify karne mein madad karta hai. Iske istemal se pehle, traders ko market ke overall context ko samajhna chahiye aur doosre tajaweezati tools ka bhi istemal karke apne trading decisions ko confirm karna chahiye.

- CL

- Mentions 0

-

سا0 like

- Bearish Candle:

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:03 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим