Baby candlestick pattern

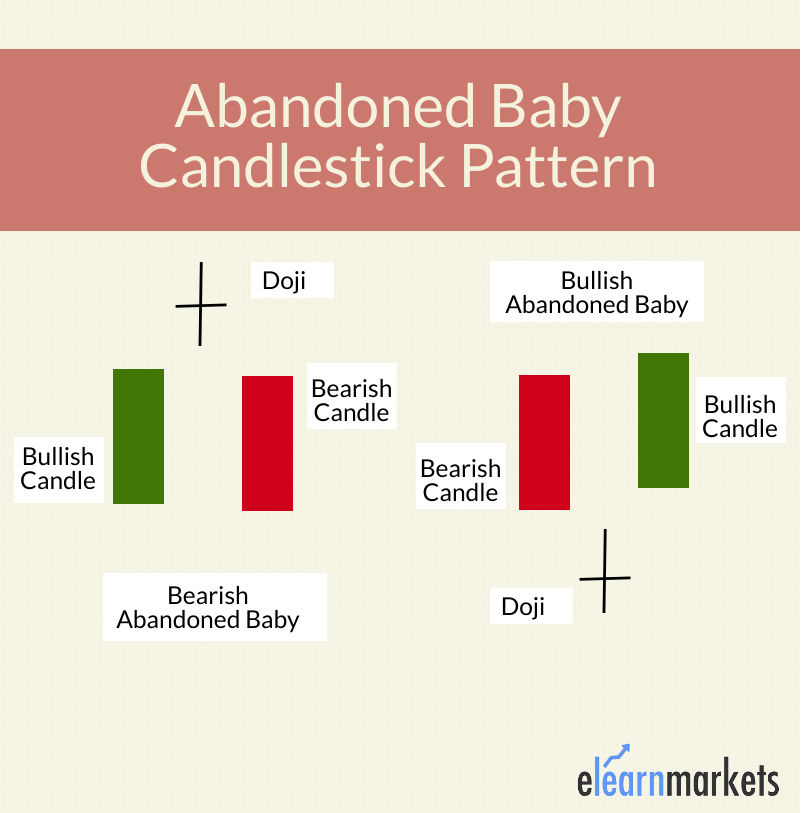

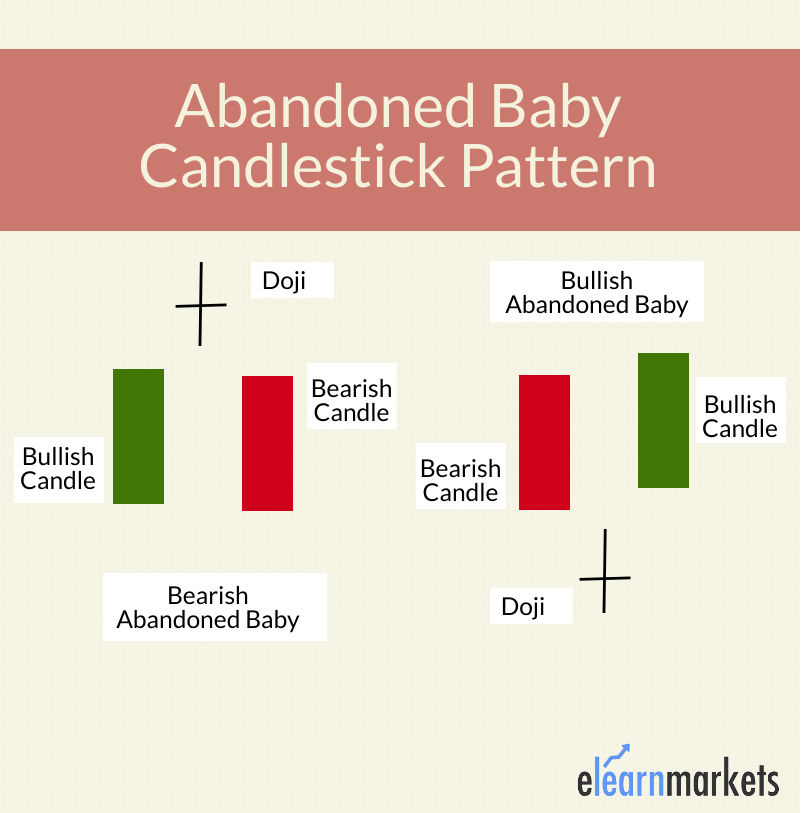

Baby Candlestick Patterns: Ek Samjhdaar Tijarat Ki informationBaby candlestick patterns, yaani "choti candlestick patterns," technical analysis mein istemal hone wale traditional Japanese candlestick patterns ki aik qisam hain. Ye patterns maaliyat, jaise ke stocks, forex, aur cryptocurrencies, mein qeemat ke harkat ko samajhne aur peishgoi karne ke liye istemal hoti hain. In patterns ki buniyad maaliyat ke jazbat ko samajhne mein aur market ke future ki peishgoi karne mein hai. Is hawale se, hum do aam baby candlestick patterns ke bare mein tafseel se baat karenge aur trading ke context mein inki ahmiyat ko samjhenge. 1. DojiDoji, jo ke "Dow-jee" ke tarjume hota hai, sab se pehchanay jane wale aur ahem candlestick patterns mein se aik hai. Ye market mein tashwish ko dikhata hai aur ek mogheeq qeemat ki taraf ishara karta hai. Doji pattern tab banta hai jab opening aur closing ke prices aik dosre ke qareeb hotay hain, jiski wajah se candlestick mein aik chhota sa jism aur lambi upper aur lower wicks hoti hain.Doji Ko Samajhna: Jab Doji bullish candles ke ek series ke baad banti hai, to yeh ishara karta hai ke khareedne walay apni taqat khota ja rahe hain aur bearish reversal hone ke imkanat hain. Umge, agar Doji ek downtrend ke baad aati hai, to yeh dikhata hai ke bechne walay apni taqat khota ja rahe hain aur bullish reversal hone ke imkanat hain. Jo zyada lambi upper aur lower wicks ho, woh utni zyada potential reversal ko darust karti hain.Example:Aik lambi uptrend ke baad, market mein aik Doji candle bani. Yeh dikhata hai ke khareedne walon ki taqat kam ho rahi hai aur bearish u-turn hone ke imkanat hain.2. HammerHammer, yaani "Ha-mur," ek aur ahem baby candlestick pattern hai. Isse bullish reversal ko darust karna jata hai aur iska khasosiyat yeh hota hai ke ismein aik chhota sa jism hota hai, lambi lower wick hoti hai aur upper wick khatam hoti hai.

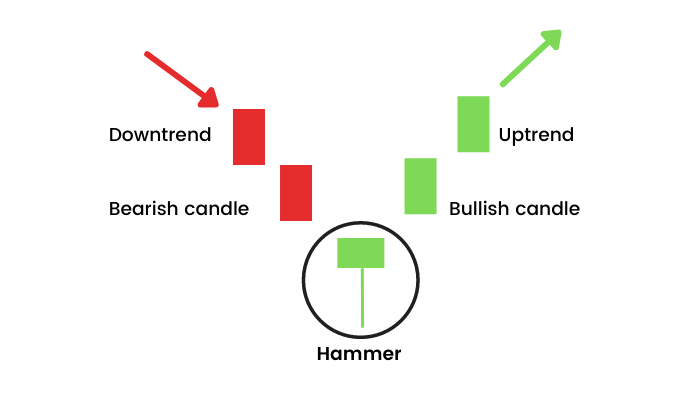

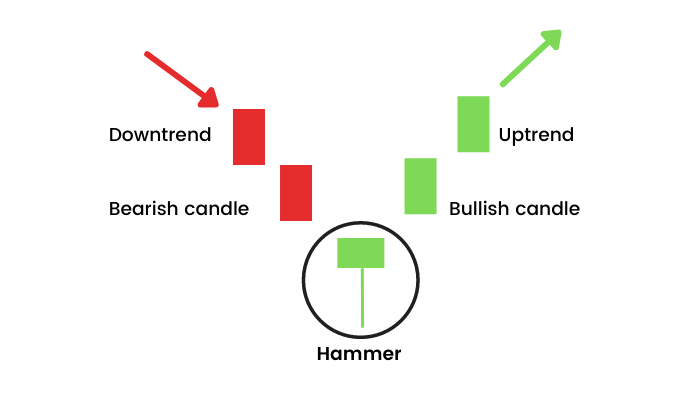

1. DojiDoji, jo ke "Dow-jee" ke tarjume hota hai, sab se pehchanay jane wale aur ahem candlestick patterns mein se aik hai. Ye market mein tashwish ko dikhata hai aur ek mogheeq qeemat ki taraf ishara karta hai. Doji pattern tab banta hai jab opening aur closing ke prices aik dosre ke qareeb hotay hain, jiski wajah se candlestick mein aik chhota sa jism aur lambi upper aur lower wicks hoti hain.Doji Ko Samajhna: Jab Doji bullish candles ke ek series ke baad banti hai, to yeh ishara karta hai ke khareedne walay apni taqat khota ja rahe hain aur bearish reversal hone ke imkanat hain. Umge, agar Doji ek downtrend ke baad aati hai, to yeh dikhata hai ke bechne walay apni taqat khota ja rahe hain aur bullish reversal hone ke imkanat hain. Jo zyada lambi upper aur lower wicks ho, woh utni zyada potential reversal ko darust karti hain.Example:Aik lambi uptrend ke baad, market mein aik Doji candle bani. Yeh dikhata hai ke khareedne walon ki taqat kam ho rahi hai aur bearish u-turn hone ke imkanat hain.2. HammerHammer, yaani "Ha-mur," ek aur ahem baby candlestick pattern hai. Isse bullish reversal ko darust karna jata hai aur iska khasosiyat yeh hota hai ke ismein aik chhota sa jism hota hai, lambi lower wick hoti hai aur upper wick khatam hoti hai.  Hammer Ko Samajhna:Ek Hammer ek downtrend ke baad aati hai, jisey dikhaya jata hai ke khareedne walay market mein dakhil ho rahe hain aur qeemat ki rukh badal sakti hai. Lambi lower wick yeh dikhata hai ke bechne walay trading session mein qeemat ko neeche le gaye lekin khareedne walon ne ise wapas ooper le gaya aur session ke close ke qareeb kiya. Aik sahi Hammer ke liye, jism candlestick ke upper hissay ke qareeb hona chahiye, session ke close ke qareeb.example:Ek Hammer pattern ek downtrend ke baad aya. Yeh ishara karta hai ke khareedne walay ab market mein dakhil ho rahe hain aur bullish reversal ka imkan hai.

Hammer Ko Samajhna:Ek Hammer ek downtrend ke baad aati hai, jisey dikhaya jata hai ke khareedne walay market mein dakhil ho rahe hain aur qeemat ki rukh badal sakti hai. Lambi lower wick yeh dikhata hai ke bechne walay trading session mein qeemat ko neeche le gaye lekin khareedne walon ne ise wapas ooper le gaya aur session ke close ke qareeb kiya. Aik sahi Hammer ke liye, jism candlestick ke upper hissay ke qareeb hona chahiye, session ke close ke qareeb.example:Ek Hammer pattern ek downtrend ke baad aya. Yeh ishara karta hai ke khareedne walay ab market mein dakhil ho rahe hain aur bullish reversal ka imkan hai.

Baby Candlestick Patterns: Ek Samjhdaar Tijarat Ki informationBaby candlestick patterns, yaani "choti candlestick patterns," technical analysis mein istemal hone wale traditional Japanese candlestick patterns ki aik qisam hain. Ye patterns maaliyat, jaise ke stocks, forex, aur cryptocurrencies, mein qeemat ke harkat ko samajhne aur peishgoi karne ke liye istemal hoti hain. In patterns ki buniyad maaliyat ke jazbat ko samajhne mein aur market ke future ki peishgoi karne mein hai. Is hawale se, hum do aam baby candlestick patterns ke bare mein tafseel se baat karenge aur trading ke context mein inki ahmiyat ko samjhenge.

1. DojiDoji, jo ke "Dow-jee" ke tarjume hota hai, sab se pehchanay jane wale aur ahem candlestick patterns mein se aik hai. Ye market mein tashwish ko dikhata hai aur ek mogheeq qeemat ki taraf ishara karta hai. Doji pattern tab banta hai jab opening aur closing ke prices aik dosre ke qareeb hotay hain, jiski wajah se candlestick mein aik chhota sa jism aur lambi upper aur lower wicks hoti hain.Doji Ko Samajhna: Jab Doji bullish candles ke ek series ke baad banti hai, to yeh ishara karta hai ke khareedne walay apni taqat khota ja rahe hain aur bearish reversal hone ke imkanat hain. Umge, agar Doji ek downtrend ke baad aati hai, to yeh dikhata hai ke bechne walay apni taqat khota ja rahe hain aur bullish reversal hone ke imkanat hain. Jo zyada lambi upper aur lower wicks ho, woh utni zyada potential reversal ko darust karti hain.Example:Aik lambi uptrend ke baad, market mein aik Doji candle bani. Yeh dikhata hai ke khareedne walon ki taqat kam ho rahi hai aur bearish u-turn hone ke imkanat hain.2. HammerHammer, yaani "Ha-mur," ek aur ahem baby candlestick pattern hai. Isse bullish reversal ko darust karna jata hai aur iska khasosiyat yeh hota hai ke ismein aik chhota sa jism hota hai, lambi lower wick hoti hai aur upper wick khatam hoti hai.

1. DojiDoji, jo ke "Dow-jee" ke tarjume hota hai, sab se pehchanay jane wale aur ahem candlestick patterns mein se aik hai. Ye market mein tashwish ko dikhata hai aur ek mogheeq qeemat ki taraf ishara karta hai. Doji pattern tab banta hai jab opening aur closing ke prices aik dosre ke qareeb hotay hain, jiski wajah se candlestick mein aik chhota sa jism aur lambi upper aur lower wicks hoti hain.Doji Ko Samajhna: Jab Doji bullish candles ke ek series ke baad banti hai, to yeh ishara karta hai ke khareedne walay apni taqat khota ja rahe hain aur bearish reversal hone ke imkanat hain. Umge, agar Doji ek downtrend ke baad aati hai, to yeh dikhata hai ke bechne walay apni taqat khota ja rahe hain aur bullish reversal hone ke imkanat hain. Jo zyada lambi upper aur lower wicks ho, woh utni zyada potential reversal ko darust karti hain.Example:Aik lambi uptrend ke baad, market mein aik Doji candle bani. Yeh dikhata hai ke khareedne walon ki taqat kam ho rahi hai aur bearish u-turn hone ke imkanat hain.2. HammerHammer, yaani "Ha-mur," ek aur ahem baby candlestick pattern hai. Isse bullish reversal ko darust karna jata hai aur iska khasosiyat yeh hota hai ke ismein aik chhota sa jism hota hai, lambi lower wick hoti hai aur upper wick khatam hoti hai.  Hammer Ko Samajhna:Ek Hammer ek downtrend ke baad aati hai, jisey dikhaya jata hai ke khareedne walay market mein dakhil ho rahe hain aur qeemat ki rukh badal sakti hai. Lambi lower wick yeh dikhata hai ke bechne walay trading session mein qeemat ko neeche le gaye lekin khareedne walon ne ise wapas ooper le gaya aur session ke close ke qareeb kiya. Aik sahi Hammer ke liye, jism candlestick ke upper hissay ke qareeb hona chahiye, session ke close ke qareeb.example:Ek Hammer pattern ek downtrend ke baad aya. Yeh ishara karta hai ke khareedne walay ab market mein dakhil ho rahe hain aur bullish reversal ka imkan hai.

Hammer Ko Samajhna:Ek Hammer ek downtrend ke baad aati hai, jisey dikhaya jata hai ke khareedne walay market mein dakhil ho rahe hain aur qeemat ki rukh badal sakti hai. Lambi lower wick yeh dikhata hai ke bechne walay trading session mein qeemat ko neeche le gaye lekin khareedne walon ne ise wapas ooper le gaya aur session ke close ke qareeb kiya. Aik sahi Hammer ke liye, jism candlestick ke upper hissay ke qareeb hona chahiye, session ke close ke qareeb.example:Ek Hammer pattern ek downtrend ke baad aya. Yeh ishara karta hai ke khareedne walay ab market mein dakhil ho rahe hain aur bullish reversal ka imkan hai.

تبصرہ

Расширенный режим Обычный режим