Algorithmic Trading Procedure.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction. Algorithmic Trading ka matlab hota hai kisi bhi trade ya investment ka istemaal computer programs aur mathematical algorithms se karna. Ismein, computer programs kisi stock, commodity, ya currency ki price trends ko analyze karte hain aur phir trades execute karne ke liye signals generate karte hain. Explanation. Is tarah ki trading mein, traders khud trades nahi karte, balki unke behalf par computer programs trading karte hain. Ye programs traders ke dwara pre-set kiye gaye rules aur parameters ke anusaar kaam karte hain. Traders trading Strategy. Algorithmic Trading ke zariye, traders bade amounts mein trades execute kar sakte hain aur khud ki emotions ya biases se bache reh sakte hain. Isse, trading mein aap ko btata chaloon kay consistency aur efficiency aati hai aur algorithmic trading mein, traders ko apne strategies aur trading parameters ko regularly update karna hota hai, taki wo market trends ke anusaar adjust kar sakein. Ismein, historical data ka istemaal kiya jata hai, jisse traders future price trends ko predict kar sakte hain aur apne trades ko optimize kar sakte hain algorithmic trading aaj kal financial markets mein kaafi popular ho chuka hai aur bahut se large financial institutions aur hedge funds bhi iska istemaal karte hain. Benifits of Algorithmic Trading. Algorithmic Trading aik computerized trading hai jo financial markets me istemal hota hai. Ismein computer programs ko istemal kiya jata hai jo market data ka analysis karte hain aur trading decisions lene mein madad karte hain. Yeh trading method bahut se faide pesh karta hai, kuch unke hain: Taiz Tareen Trading: Algorithmic Trading ki sab se bari faida yeh hai keh yeh bohat taiz tareen hota hai. Computer programs ki madad se, trade orders bohat jaldi aur bila tasur lagaye execute kiye ja sakte hain, jo manual trading se bohat zyada taiz hai. Khud Se Control: Algorithmic Trading mein traders apne trading strategies ko automate kar sakte hain aur unhein khud se control kar sakte hain. Is se human error kam ho jata hai aur trading decisions bohat sateh aur logical tareeqe se liye ja sakte hain. Bila Tasur Execution: Algorithmic Trading ke zariye trades bila tasur lagaye jate hain, jis se market manipulation ki koshishon se bacha ja sakta hai. Ismein traders ko khud se trading decisions lene ki zaroorat nahi hoti hai, jis se emotions aur biases ki wajah se trading mein ghalat faislay liye jane ki sambhavna kam ho jati hai. Kharchon Mein Kami:Algorithmic Trading ka istemal karne se traders ki trading costs mein kami aati hai, kyun keh ismein human intervention ki zaroorat kam ho jati hai. Is se brokerage charges aur other trading expenses mein kami aati hai. Data Analysis: Algorithmic Trading ke computer programs market data ka analysis karte hain aur us se patterns aur trends nikal kar trading decisions lete hain. Is se traders ko market ki tareekh aur trends samajhne mein madad milti hai aur trading strategies ko improve karne ka mauqa milta hai. In sab faidon ke sath-sath, Algorithmic Trading apne risks bhi le kar ata hai, jaise ke technical errors aur connectivity issues, lekin is ke benefits ki wajah se yeh aaj kal financial markets mein bohat istemal hota hai. -

#3 Collapse

Assalamu Alaikum Dosto!

Algorithmic Trading

Algorithmic trading yeh automated trading hai jahan investors aur traders trades ko enter aur exit karte hain jab criteria computerized instructions ke mutabiq milte hain. Systems ko instructions ke sath code kiya gaya hai trades ko bina insani intervention ke khud-ba-khud execute karne ke liye. Ye investors ke liye bohot zyada waqt bachata hai jo ke mazeed trades le sakte hain apni tezi se execution ki wajah se.

Algorithmic trading mein koi insani jazbat nahi hote. Sirf cheez jo overall trading process ko guide karti hai wo code ki gayi instructions hoti hai, jo buyers aur sellers ke requirements ko match karte hain. Agar aisa hota hai, to system deal ko mutabiq kholti aur band karti hai.

Algorithmic trading ek aise automated trading technique hai jo mathematical methods aur algorithms aur doosre programming tools ka istemal karke trades ko tezi se execute karne aur traders ka waqt bachane ke liye develop ki gayi hai. Ye technology ko deploy karna mushkil ho sakta hai, lekin jab ye kamiyab taur par lagaya jata hai, to non-human intervened trading hoti hai.

Algorithmic trading munafa dene wala hai kyunke ye traders ko ek sath kai trades karne ki ijaazat deta hai aur mauqe par faida uthane ki ijazat deta hai. Ye technique arbitrage, scalping, wagera mein kamyabi se istemal hoti hai.

Key Points:- Algorithmic trading automated trading hai jo computerized platforms, advanced mathematics, aur computer programming tools ka istemal karti hai trading transactions ko chalane ke liye. Computer program market ki halaat ko dinamik taur par tay karta hai aur market ki sentiments ke mutabiq ek hedging strategy ko amal mein laata hai.

- Regularity authorities hamesha circuit breakers lagate hain, algo-trades ki functionality ko had mein rakhne ke liye.

- Algorithm ka tayyar karna bohot complex aur challenging ho sakta hai, lekin jab woh acchi tarah se lagaya jata hai to execution ko tezi milti hai.

Algorithmic Trading Setup

Algorithmic trading ko tayyar karne ke liye mukhtalif components ka istemal hota hai, jo shamil hote hain:- Algorithm ko code ki gayi instructions ke taur par kaam karne ke liye programming knowledge ka pura ilm hona zaroori hai.

- Computer aur network connectivity systems ko jor ke rakhte hain aur ek dusre ke sath ham ahang taur par kaam karte hain.

- Iske ilawa, ek automated trading platform ek zariya faraham karta hai jisse financial markets mein kharid aur farokht orders ke liye algorithm ko amal mein liya ja sakta hai.

- Technical analysis measures jaise moving averages, aur random oscillators, market securities ke price movements ka mutala karte hain aur analyze karte hain.

- Last mein, backtesting ko istemal kiya jata hai. Ye algorithm ko test karne ka process hai aur ye tasdeeq karta hai ke kya ek strategy umeed ke mutabiq nataij faraham karegi.

Algorithmic Trading Kaise Kaam Karta Hai?

Algorithmic trading, jise algo trading kehte hain, ek advanced technique hai jo advance coding aur formula par kaam karti hai aur ek riyazi model par mabni hai. Aksar muqarrar taur par, yeh tarika bilkul automated hota hai.

Insani dimaag codes tayyar karte hain taake systems ko maqwiyati mawaqe par faisley karne ke liye instructions de sakein. Riyazi models aur algorithms aise banaye gaye hain ke computerized devices market ki halaat ko behtareen taur par tay karte hain. Masalan, automated analysis ke mutabiq, traders trades ko open-close ya enter-exit karte hain.

Investors algo trading ko scalping mein wasee taur par istemal karte hain kyunke isme assets ki tezi se kharid-o-farokht hoti hai takay choti se choti increments par jald munafa ho sake. Is natije mein, traders din bhar mein kai trades mein shamil ho sakte hain aur trades ko tezi se execute karke faida utha sakte hain. Stock markets ke ilawa, algo trading currency trading aur crypto trading mein bhi dominant hai.

Algorithmic Trading Strategies

Algorithm trading mukhtalif strategies ko shamil karta hai jin par developers coded instructions tayyar karte hain aur algorithm ko qaabil-e-bharosa kaam karne ke liye banate hain. Kuch algorithmic trading strategies niche di gayi hain:- Trend Detection:

Pehli strategy jo algo trading ko chalati hai woh trend identification hai. Codes market trends ko analyze karne mein madad karti hain jo ke price, support, resistance, volume, aur dosre factors ko madde nazar rakhte hain jo invest karne ke faisley par asar daal sakte hain. Kyunki algorithms technology aur formulas par kaam karte hain, to automated systems ko sahi trends pehchanne ka zyada imkaan hota hai. - Mean Reversion:

Yeh woh tareeqa hai jo ek stock ki average highs aur lows ko monitor karta hai, jo investors ko yeh decide karne mein madad karta hai ke kya ek company ki stock par paisa lagana chahiye ya nahi. Average fluctuations ke hisaab se, software tay karta hai ke ek particular trade mein stocks ko kis price par lena hai. Jab prices barhne ki umeed hoti hai, to deal ki ja sakti hai. Doosri taraf, agar market prices average level ke bahar fluctuate karte hain, to aise stocks ko kam bharosa kiya jata hai. - Arbitrage:

Automated trading facility investors ko arbitrage opportunities deti hai. Arbitrage ek dual-listed security ko kharidna shamil karta hai. Ek investor ek market mein stock ko kam keemat par kharid sakta hai aur usi ko doosre market mein zyada keemat par bech sakta hai jaldi kharid-farokht ke saath. - Index Fund Rebalancing:

Index fund portfolios mein frequent changes hote hain, underlying assets ke price fluctuations ke baais par. Ye rebalancing traders ko better returns ke liye deal karna ke liye algo trading ke zariye kaam karta hai. Chhoti mein, changing portfolios investors ko sahi waqt par aur behtareen prices par stocks dilwati hain kam transaction costs ke saath.

Components

Algorithmic trading kaam karne ke liye, ek insani dimaag aur theek hardware aur software infrastructure hona zaroori hai. Algorithms ko code ki gayi instructions ke taur par kaam karne ke liye, programming knowledge ka pura ilm hona chahiye. Insani dimaag programming skills ke sath woh behtareen zariya hai jo algo trading ke liye aise coded instructions tayyar kar sakte hain jo if-else aur doosre clauses ke sath hote hain.

Agla, computer aur network connectivity zaroori hai taake systems jor ke rakhe ja sakein aur ek dusre ke sath ham ahang taur par kaam karein. Iske ilawa, ek automated trading platform ek zariya faraham karta hai jisse algorithm ko execute kiya ja sakta hai. Ant mein, yeh computer programs ke zimme hota hai jo programmers aur algo traders dwaara banaye gaye hote hain kharid aur farokht orders ke saath kaam karne ke liye.

Iske ilawa, technical analysis measures ek algorithmic trading ke components hote hain. Analysis market mein listed securities ke price movements ko mutala karta hai aur analyze karta hai. Methods jaise moving averages, random oscillators, wagera, kisi khaas security ke liye price trends ko pehchanne mein madad karte hain.

Ant mein, backtesting list par hoti hai. Ye ek algorithm ko test karne ka process hai aur ye tasdeeq karta hai ke kya ek strategy umeed ke mutabiq nataij faraham karegi. Isme programmer ki approach ko historical market data par test kiya jata hai. Iske ilawa, ye technique traders ko identify karne mein madad karti hai ke kya masail paida ho sakte hain agar traders is strategy ko live market trades ke saath istemal karte hain.

Examples

Neeche di gayi algorithmic trading misalen samajhne ke liye:- Example:

Samjho ek trader ek trading criterion ko follow karta hai jo hamesha 100 shares kharidta hai jab stock price double exponential moving average ke upar aur upar chale jata hai. Ek sell order tab place hota hai jab stock price double exponential moving average ke neeche jata hai. Trader ek computer programmer ko hire kar sakta hai jo double exponential moving average ke concept ko samajh sakta hai.

Programmer ek computer code tayyar karta hai jo upar di gayi do instructions ke mutabiq trading activities perform karta hai. Computer program itna dynamic hota hai ke wo financial markets ki live prices ko monitor kar sakta hai aur phir inke mutabiq activities ko trigger kar sakta hai. Ye trader ka waqt bachata hai kyunke unhein trading platforms par prices ko monitor karne aur trading orders ko place karne ki zaroorat nahi hoti. - Example:

2010 ka flash crash algorithm trading ka aik misal hai. Is crisis mein securities ke liye turant sell orders place kiye gaye the. Trade orders ke deposits ke liye bhi turant withdrawal aur high-frequency trades hui.

Regulatory authorities baad mein circuit breakers lagate hain taake financial markets mein flash crash se bacha ja sake. Unho ne bhi algo-trades ko exchanges ke saath seedha access karne se roka.

Algorithmic Trading Benifits & Drawbacks

Kyunke koi insani intervention nahi hota, isliye ghalatiyon ki sambhavnaayein kaafi kam hoti hain, agar coded instructions sahi hain. Codes ke adhaar par, system financial market ki trade signals ko pehchanti hai aur phir ye tay karti hai ke kya is par amal kiya jaye.

Algorithmic trading software systems ko buyers aur sellers dono ki zarooriyat ko feed karne mein madad karti hai. Jab algo ek mukhlis match pehchanti hai, to trade turant open aur close hota hai. Amal ka process insaaf aur tez hota hai. Natije mein, traders ko deal ko turant mukammal karna hota hai jaise hi unhein ek match ki notification milti hai. Agar mauka chhut jata hai, to unhein doosra match milne tak intezaar karna padta hai.

Regulatory authorities hamesha circuit breakers lagate hain, algo-trades ki functionality ko had mein rakhne ke liye. Iske ilawa, algo-traders ke dwara faraham ki gayi liquidity lagbhag turant ya kuch seconds mein khatam ho sakti hai.

Bina insani intervention ke algo-trades ki execution speed live trades aur settlements ko bura asar daal sakti hai, jo trading platforms aur financial markets ki functionality ko aur bhi had tak mehdood karta hai. Iske alawa, agar algo-trades ko monitor na kiya jaye, to ye financial markets mein be-maqsad raitubat paida kar sakte hain.

-

#4 Collapse

Algorithmic Trading ek tarah ka trading hai jismein computer algorithms ya bots istemal kiye jate hain jo trading decisions ko automate karte hain. Yeh tafseeli points Roman Urdu mein Algorithmic Trading ko samjhanay mein madadgar hain:

Algorithm Development:

Algorithmic Trading ke liye pehle ek trading strategy ya algorithm develop kiya jata hai. Ye algorithm market analysis, technical indicators, aur risk management principles par based hota hai.

Backtesting:

Algorithm ko develop karne ke baad, backtesting kiya jata hai jismein past market data par algorithm ko test kiya jata hai. Backtesting se ye pata chalta hai ke algorithm kis tarah ka performance deta hai aur kis tarah ke market conditions mein effective hota hai.

Execution Platforms:

Algorithmic Trading ke liye traders ko execution platforms ki zarurat hoti hai jo unhein market access provide karte hain. Ye platforms real-time data aur trade execution ke liye APIs (Application Programming Interfaces) offer karte hain.

High-Frequency Trading (HFT):

High-frequency trading ek tez tarikh ka algorithmic trading hai jismein traders fractions of a second ke liye positions lete hain aur phir unhe jaldi se close karte hain. HFT ki strategies ki khaasiyat yeh hoti hai ke woh bohot zyada tezi se trade karte hain aur bohot choti movements par profit earn karte hain.

Market Making:

Market making ek aur common form hai algorithmic trading ka jismein traders apni khud ki liquidity provide karte hain. Market makers bid aur ask prices ko maintain karte hain taki buyers aur sellers ka efficient order execution ho sake.

Risk Management:

Algorithmic Trading mein risk management bohot ahem hota hai. Algorithms ko develop karte waqt, traders ko apni risk tolerance aur position sizing ka khayal rakhna hota hai. Algorithmic Trading ke zariye traders ko market mein efficiency aur speed provide hoti hai, lekin ismein market volatility aur risks bhi hote hain. Isliye sahi strategy aur robust risk management bohot zaroori hota hai. -

#5 Collapse

Introduction

Forex trading mein algorithmic trading ek computer program ya algorithm ke istemal se trading execute karne ka tareeqa hai. Ismein computer program trading decisions ko automate kar deta hai, jis se human intervention ki zaroorat kam ho jati hai.

Steps in Algorithmic trading procedure

Algorithmic trading ke procedure mein kuch steps shamil hote hain:

1: Data Collection

Forex trading mein data collection ki ahmiyat bohat hai, kyunke isse market trends aur movements ke mutabiq trading decisions liye ja sakte hain. Data collection mein kuch important elements shamil hote hain:

A: Price Data

Price data sab se ahmiyat hota hai, jisme currency pairs ke current aur historical prices shamil hote hain. Ismein bid price, ask price, high, low, aur closing prices shamil hote hain.

B: Volume Information

Volume information bhi collect ki jati hai, jo batati hai ke kitni trading activity market mein ho rahi hai. Yeh ek important indicator hai market liquidity aur momentum ka pata karne ke liye.

C:

Economic Indicators: Forex trading mein economic indicators bhi important hote hain, jaise ke GDP, employment data, interest rates, aur trade balances. In indicators ki data collection se traders market ke overall health aur future direction ka andaza laga sakte hain.

D: News Events

Current events aur news updates bhi important hote hain forex trading ke liye. Ismein geopolitical events, central bank announcements, aur economic reports shamil hote hain, jo market sentiment aur volatility ko impact kar sakte hain.

Yeh data collection ke elements traders ko market conditions aur trends ke bare mein maloomat dete hain. Is data ko analyze kar ke traders trading strategies tayyar karte hain aur trading decisions lete hain.

2: Stretegy Development

Forex trading mein strategy development ka matlab hai ke traders tayyar karte hain ek set of rules aur guidelines jinhe follow kar ke woh trading decisions lete hain. Strategy development ke doran traders kuch important steps follow karte hain:

A: Analysis

Sab se pehle traders market conditions aur price movements ko analyze karte hain. Ismein technical analysis (price charts, indicators) aur fundamental analysis (economic indicators, news events) ka istemal hota hai.

B: Risk Tolerance

Traders apni risk tolerance aur trading goals ko define karte hain. Isse unhe pata chalta hai ke woh kitna risk le sakte hain aur kitna profit expect kar sakte hain.

C: Entry aur Exit Points

Strategy development mein traders entry aur exit points define karte hain. Entry point woh level hota hai jahan par trader position enter karta hai, jab ke exit point woh level hota hai jahan par trader position ko close karta hai.

D: Position Sizing

Traders apne positions ke size ko define karte hain, jisse unka risk aur potential profit tayyar kiya ja sakta hai.

E: Risk Management Rules

Strategy development ke doran traders apne risk management rules tayyar karte hain, jaise ke stop-loss aur take-profit levels. Yeh rules unhe protect karte hain loss se aur unki profits ko secure karte hain.

F: Backtesting

Develop ki gayi strategy ko historical data par test kiya jata hai takay pata chale ke previous market conditions mein strategy kaisa perform kiya.

Is tareeqe se traders apni trading strategy tayyar karte hain, jo unhe market mein direction aur trading decisions lene mein madadgar hoti hai. Lekin strategy ki development ke sath-sath uski constant monitoring aur adjustment bhi zaruri hoti hai.

-

#6 Collapse

Algorithmic Trading Procedure.

Algorithmic trading kya hai ?

Algorithmic trading qeemat, waqt aur hajam jaisay veriables ke hisaab se khudkaar aur pehlay se programme shuda trading Hadayat ko istemaal karte hue orders par amal daraamad karne ka amal hai. aik Algorithmic kisi maslay ko hal karne ke liye Hadayat ka aik majmoa hai. computer Algorithmic waqt ke sath sath poooray order ke chhootey hissay market mein bhaijtay hain .

Algorithmic trading paicheeda farmolon ka istemaal karti hai, jo rayazi ke models aur insani nigrani ke sath mil kar, exchange par maliyati sikyortiz ki khareed o farokht ke faislay karne ke liye karti hai. Algorithmic traders aksar aala tadaad trading technology ka istemaal karte hain, jo aik firm ko fi second dsyon hazaar tijarat karne ke qabil banati hai. Algorithmic trading ko mukhtalif qisam ke halaat mein istemaal kya ja sakta hai Bashmole order par amal daraamad, salisi, aur trained trading ki hikmat e amli .

ahem nukaat

Algorithmic trading amal aur qawaid par mabni Algorithmic ka istemaal hai taakay tijarat ko injaam dainay ke liye hikmat amlyon ko istemaal kya ja sakay .

1980 ki dahai ke awail se is ki maqboliat mein numaya izafah sun-hwa hai aur idaara jati sarmaya karon aur barri tijarti frmin usay mukhtalif maqasid ke liye istemaal karti hain .

agarchay yeh fawaid faraham karta hai, jaisay ke taizi se amal daraamad ka waqt aur laagat mein kami,

Algorithmic trading ko samjhna:

1970 ki dahai mein Amrici maliyati mandiyon mein kmpyotrayzd tijarti nizaam muta-arif honay ke baad tijarat mein Algorithmic ka istemaal barh gaya. 1976 mein, New York stock exchange ne exchange flour par traders se mahireen tak orders ki rotting ke liye designated order trun arround ( dot ) system muta-arif karaya .

1.agli dahaiyo mein, aykschinjz ne electronic trading ko qubool karne ki un ki salahiyaton mein izafah kya, aur 2009 tak, America mein tamam tijartoon ka 60 feesad se ziyada computers ke zariye injaam diya gaya .

musannif Michael leves ne aala tadaad,Algorithmic trading ko awam ki tawajah mabzol karaya jab is ne sab se ziyada farokht honay wali kitaab flash boys shaya ki, jis mein wall street ke taajiron aur karobari afraad ki zindagion ko dastaweez kya gaya tha jinhon ne un companiyon ki taamer mein madad ki jo electronic trading ke dhanchay ki wazahat karne mein ayen. America is ki kitaab ne istadlaal kya ke yeh companian pehlay se ziyada taiz computer bananay ke liye hathyaaron ki daud mein masroof theen, jo taiz raftari ke sath hareefon par faida haasil karne ke liye tabadlay ke sath ziyada taizi se baat cheet kar sakti hain, order ki aqsam ka istemaal karte hue jis se inhen ost sarmaya karon ko nuqsaan pouncha .

haliya barson mein, Algorithmic trading ka rivaaj wasee ho gaya hai. hadge funds jaisay quantopian, misaal ke tor par, shoqia programmes ke crowd source Algorithmic jo sab se ziyada munafe bakhash code likhnay par commission jeetnay ka muqaabla karte hain. is amal ko taiz raftaar internet ke phelao aur nisbatan sastay damon par hamesha taiz tareen computers ki taraqqi ke zariye mumkin banaya gaya hai.koantiox jaisay plate form aisay din ke taajiron ki khidmat ke liye ubhray hain jo Algorithmic trading mein apna haath aazmana chahtay hain .

wall street par aik aur ubharti hui technology machine learning hai. masnoi zahanat mein honay wali nai pishrft ne computer programmes ko aisay programme tayyar karne ke qabil bana diya hai jo dip learning Nami takrari amal ke zariye khud ko behtar bana satke hain. tajir Algorithmic tayyar kar rahay hain jo khud ko ziyada munafe bakhash bananay ke liye gehri seekhnay par inhisaar karte hain .

Algorithmic trading ke faiday aur nuqsanaat:

Algorithmic trading bunyadi tor par idaara jati sarmaya karon aur barray brokrij haosz trading se munsalik akhrajaat ko kam karne ke liye istemaal karte hain. tehqeeq ke mutabiq, Algorithmic trading khaas tor par barray order ke size ke liye faida mand hai jo majmoi tijarti hajam ke 10 % tak par mushtamil ho sakti hai .

3

aam tor par market bananay walay likoyditi peda karne ke liye Algorithmic tijarat ka istemaal karte hain .

Algorithmic trading orders ke taiz aur aasaan amal daraamad ki bhi ijazat deti hai, jo usay tabadlay ke liye purkashish banati hai. badlay mein, is ka matlab yeh hai ke tajir aur sarmaya car qeemat mein choti tabdeelion par fori munafe buk kar satke hain. skelping trading ki hikmat e amli aam tor par Algorithmic ko istemaal karti hai kyunkay is mein choti qeematon ke izafay par sikyortiz ki taizi se khareed o farokht shaamil hoti hai .

order par amal daraamad ki raftaar, aam halaat mein aik faida, is waqt aik masla ban sakta hai jab insani mudakhlat ke baghair aik sath kayi ehkamaat par amal daraamad kya jata hai. 2010 ke flash haadsay ka ilzaam Algorithmic trading par lagaya gaya hai .

Algorithmic tijarat ka aik aur nuqsaan yeh hai ke likoyditi, jo taizi se khareed o farokht ke orders ke zariye peda hoti hai, aik lamhay mein gayab ho sakti hai, jis se taajiron ke liye qeematon mein tabdeeli se faida uthany ka mauqa khatam ho jata hai. yeh likoyditi ke fori nuqsaan ka baais bhi ban sakta hai. tehqeeq ne inkishaaf kya hai ke 2015 mein soys frank ke euro peg ko band karne ke baad currency marketon mein likoyditi ke nuqsaan ka aik bara Ansar Algorithmic trading tha . -

#7 Collapse

Algorithmic trading, jisey algo trading bhi kehte hain, ek modern trading approach hai jo trading mein automation aur technology ko utilize karta hai. Isme pre-defined rules aur strategies ke zariye trades ko execute kiya jaata hai, jisme human intervention ki zarurat nahi hoti. Algorithmic trading ke through, aap large volumes mein trades ko bohot jaldi execute kar sakte hain, jo human speed aur accuracy se bohot aage hai. Algo trading institutions, hedge funds, aur financial institutions mein bohot popular hai, lekin ab individual traders bhi ise adopt kar rahe hain. Algorithmic trading ka procedure thoda technical hota hai, lekin iske benefits bohot zabardast hote hain, jaise ke speed, accuracy, aur human errors ki kami.

Algorithmic trading mein computer algorithms ko istimaal karke trading strategies ko automatically execute kiya jaata hai. Algorithmic trading ek set of rules ko follow karta hai jo pehle se define kiye gaye hote hain. Ye algorithms market conditions, technical indicators, aur price actions par depend karte hain, aur inhe istimaal karke buy ya sell orders generate kiye jaate hain.

Algo trading ka major advantage ye hai ke ye high-frequency trades ko asaani se handle kar sakta hai. Iske zariye market ki minute price changes ka faida uthaya ja sakta hai, jo manual trading mein mushkil hota hai. Is process mein, aapko sirf ek trading strategy set karni hoti hai, aur phir algorithm usko follow karta hai.

Algorithmic Trading ka Procedure

Algorithmic trading ka procedure kuch specific steps par mabni hota hai, jo niche detail mein explain kiye gaye hain:

1. Trading Strategy Ka Development

Algorithmic trading ka pehla aur sabse important step trading strategy ko develop karna hota hai. Iska matlab ye hai ke aapko decide karna hoga ke kis strategy ko use karke market mein trades execute karni hain. Strategy develop karte waqt aapko yeh cheezain consider karni padengi:- Price Actions: Kya aap kisi specific price level par buy ya sell karna chahte hain?

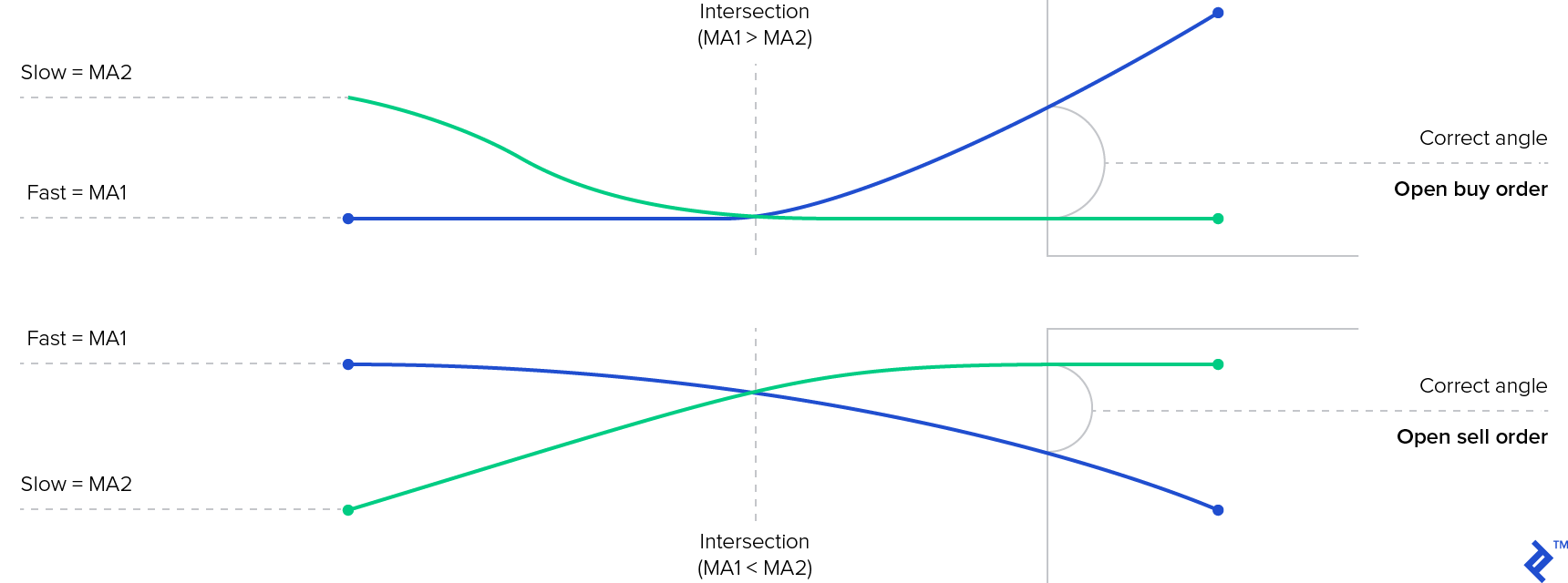

- Indicators: Kya aap technical indicators, jaise moving averages, RSI, MACD, waghera use kar rahe hain?

- Time Frame: Kya aap short-term (intraday) trading kar rahe hain ya long-term (swing trading)?

- Risk Management: Kitna risk aap har trade mein lena chahte hain? Stop-loss aur take-profit levels kya honge?

Example: Agar 50-period moving average 200-period moving average ko cross kar jaye upar ki taraf, to algorithm ek buy order execute karega.

2. Backtesting Aur Optimization

Strategy develop karne ke baad, agli step hoti hai us strategy ka backtesting. Backtesting ka matlab hai ke aap apni trading strategy ko historical data par test karte hain taake yeh dekha ja sake ke agar aapne ye strategy past mein use ki hoti, to results kaise hote. Backtesting ke liye, aapko accurate historical data ki zarurat hoti hai.

Backtesting ke zariye aapko apni strategy ki performance ka idea hota hai, aur agar kahin improvements ki zarurat ho to aap apni strategy ko optimize kar sakte hain. Optimization ke process mein aap parameters ko adjust karte hain taake aapki strategy zyada efficient aur profitable ban sake.

3. Execution System Ka Development

Jab aapki strategy backtesting aur optimization ke baad ready hoti hai, to agli step hoti hai execution system ka development. Execution system wo platform hota hai jahan aapka algorithm trading decisions leta hai aur orders ko market mein place karta hai. Aap apni strategy ko automate kar sakte hain ek programming language (jaise Python, C++, etc.) ya kisi algorithmic trading platform (jaise MetaTrader, NinjaTrader, etc.) ka use karke.

Execution system ka kaam yeh hota hai ke wo aapki strategy ke rules ko follow kare aur live market mein trading orders ko timely aur accurately execute kare. Ye system market ke price data ko continuously monitor karta hai, aur jab bhi koi trading signal match hota hai, to turant order execute hota hai.

4. Order Types aur Execution

Algo trading mein different types ke orders place kiye jaate hain, aur ye aapki strategy par depend karta hai ke aap kis tarah ka order use karna chahte hain. Kuch common order types yeh hain:- Market Order: Ye order turant market ke current price par execute hota hai.

- Limit Order: Is order mein aap ek specific price set karte hain jahan trade execute hoga.

- Stop-Loss Order: Ye order apne position ko loss se bachane ke liye set kiya jaata hai.

- Take-Profit Order: Ye order ek specific profit level tak pohnchne par trade ko close karta hai.

5. Monitoring Aur Risk Management

Algo trading ke baad bhi, aapko apne execution system ko monitor karte rehna padta hai taake aapko pata chale ke sab kuch theek chal raha hai. Kabhi kabhi technical issues, data feed problems, ya unexpected market conditions ki wajah se strategy theek se kaam nahi kar paati, to aise mein monitoring zaroori hoti hai.

Risk management algorithmic trading ka ek important hissa hai. Kyunki aap high-frequency trades kar rahe hote hain, to risk zyada hota hai. Is liye aapko risk management tools, jaise stop-loss, position sizing, aur capital allocation ko sahi se implement karna hota hai.

Algorithmic Trading Ki Strategies

Algorithmic trading mein bohot si different strategies use ki jaati hain. Niche kuch popular strategies ka zikr kiya gaya hai:

1. Trend-Following Strategies

Ye strategies market ke trend ko follow karti hain. Agar market bullish hai, to algorithm buy signals generate karta hai, aur agar market bearish hai, to sell signals. Trend-following strategies mein commonly moving averages, trendlines, aur momentum indicators ka use hota hai.

Example: Agar 50-period moving average 200-period moving average ko upar ki taraf cross kare, to ye bullish signal hota hai, aur algorithm buy order execute karega.

2. Mean Reversion Strategies

Mean reversion strategy ka basic concept ye hai ke price apne average ya mean par wapas aata hai. Is strategy ke zariye, algorithm tab buy karta hai jab price apne historical average se neeche hota hai, aur sell karta hai jab price average se upar hota hai.

Example: Agar stock price apne 20-day moving average se neeche jaata hai, to algorithm buy order place karega, expecting ke price wapas average par aayega.

3. Arbitrage Strategies

Arbitrage strategy tab use ki jaati hai jab ek asset ki price different markets ya exchanges mein different hoti hai. Algorithmic trading ke through aap ek market se sasta asset khareedte hain aur doosri market mein mehnga bechte hain, aur beech ka profit banate hain.

Example: Agar Bitcoin ki price ek exchange par $50,000 hai aur doosri par $50,200, to algorithm pehle exchange se buy karega aur doosri exchange par sell karega.

4. High-Frequency Trading (HFT)

High-frequency trading ek strategy hai jisme bohot jaldi aur large volumes mein trades ko execute kiya jaata hai. HFT traders seconds ya milliseconds mein trades ko complete karte hain. Is strategy ka fayda ye hai ke aap bohot choti price movements ka faida utha sakte hain, lekin isme high risk bhi hota hai.

5. Market Making

Market making ek aur popular strategy hai jahan algorithm continuously buy aur sell orders ko place karta hai taake market liquidity banaye rakhe. Market makers buy aur sell prices ke beech ka difference (spread) ka faida uthate hain.

Algorithmic Trading ke Advantages

Algorithmic trading ke bohot se advantages hain jo isse traditional manual trading se behtar banate hain:- Speed: Algorithmic trading trades ko milliseconds mein execute karta hai, jo human traders ke liye possible nahi hai. Isse aap short-term market opportunities ka faida utha sakte hain.

- Accuracy: Kyunki algorithm predefined rules follow karta hai, isme human errors ki gunjaish nahi hoti. Aap apni strategy ko ek baar set kar lete hain, aur phir algorithm usko accurately follow karta hai.

- Discipline: Algorithmic trading emotional trading ko eliminate karta hai. Human traders kabhi kabhi fear ya greed ki wajah se galat decisions le lete hain, lekin algorithm strictly rules ko follow karta hai.

- Backtesting: Aap apni strategy ko historical data par test kar sakte hain taake aapko pata chale ke wo strategy kaise perform karegi.

- Diversification: Algo trading ke through aap ek waqt mein multiple assets ya markets mein trade kar sakte hain. Isse aap apne portfolio ko diversify kar sakte hain aur risk ko kam kar sakte hain.

Algorithmic trading ke kuch disadvantages bhi hain jo aapko dhyaan mein rakhne chahiye:- Technical Issues: Algorithmic trading fully technology par depend karta hai, to kabhi kabhi technical glitches, system crashes, ya data feed issues aa sakte hain jo trades ko affect kar sakte hain.

- Market Volatility: Algo trading strategies volatile markets mein achi tarah perform nahi kar paati, kyunki market unpredictable ho sakta hai.

- Overfitting: Kabhi kabhi traders apni strategy ko backtesting mein itna optimize kar dete hain ke wo real market conditions mein kaam nahi karti. Is process ko overfitting kehte hain.

- Costs: Algo trading ko set up karne ke liye high-speed computers, advanced software, aur accurate data feeds ki zarurat hoti hai, jo costly ho sakti hain.

Algorithmic trading ne modern trading ko puri tarah se badal diya hai, aur ye traders ko tez aur efficient trading decisions lene mein madad deta hai. Algorithmic trading ka procedure technical aur complex hai, lekin agar aap isko samajh kar use karte hain, to aap market ke short-term price movements ka faida asaani se utha sakte hain. Isme strategy development, backtesting, execution, aur monitoring jese important steps hote hain jo aapki overall success ke liye zaroori hain.

Algorithmic trading ke fayde bohot zyada hain, jaise ke speed, accuracy, aur emotional decision-making ki kami. Lekin iske kuch disadvantages bhi hain, jaise technical issues, overfitting, aur cost. Aapko in sab cheezon ka dhyaan rakhte hue apni algo trading strategy ko carefully implement karna chahiye. Agar aap ek trader hain aur trading ko zyada efficient banana chahte hain, to algorithmic trading aap ke liye ek zabardast option ho sakta hai. Lekin iske liye aapko apni strategy ko acche se test karna hoga aur technology ko sahi se use karna hoga taake aap apni trading mein consistently profit bana saken.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#8 Collapse

Algorithmic Trading Procedure

Algorithmic trading ek automated trading strategy hai jisme computers aur algorithms ko use karke market mein trades kiye jaate hain. Iska maqsad trading ko faster aur zyada accurate banana hota hai, taake human emotions aur errors ko minimize kiya ja sake. Algorithmic trading kaafi popular ho chuki hai, khaaskar financial markets jaise forex, stocks, aur commodities mein. Ab hum iske procedure ko detail mein samjhte hain.

### 1. **Strategy Development**

Algorithmic trading ka pehla aur sabse ahem step strategy development hai. Is mein trader ya developer ko ek profitable trading strategy design karni hoti hai jo historical data ke basis pe test ho sake. Strategy typically technical indicators, price patterns, aur statistical models par mabni hoti hai. For example, aap Moving Averages, RSI, Pivot Points, ya order flow analysis ka use kar sakte hain. Strategy mein yeh define hota hai ke kis point par buy ya sell signals generate honge.

### 2. **Backtesting**

Jab strategy develop ho jati hai, agla step hai uska backtesting. Backtesting mein historical market data ko use karke strategy ko test kiya jata hai. Is se pata chalta hai ke agar strategy past mein use hoti to kaisi performance hoti. Is step mein trading system ke results ko evaluate karna hota hai, jaise profit/loss ratios, risk, aur win/loss percentages. Backtesting accurate ho, is ke liye authentic aur clean data ka hona zaroori hai. Agar strategy backtest mein achha perform kare to usay aage deploy kiya ja sakta hai.

### 3. **Risk Management**

Algorithmic trading mein risk management kaafi zaroori hota hai, warna short-term gains kaafi zyada losses mein convert ho sakte hain. Risk management strategies mein stop loss levels set karna, position sizing rules, aur maximum drawdown define karna shamil hota hai. Yeh ensure karta hai ke algorithm kabhi bhi zyada loss na kare jo account ko wipe out kar sake. Yeh rules algorithms mein hard-coded hote hain taa ke automatically trade manage ho sake.

### 4. **Execution**

Algorithmic trading mein execution process automated hota hai. Jab bhi algorithm kisi specific condition ko meet karta hai, to wo trade automatically broker ke through execute karta hai. Brokers ka role yeh hota hai ke wo algorithm ko fast aur accurate trade execution ke liye access de, aur latency ko minimize kare. Execution ki accuracy kaafi zaroori hoti hai, khaaskar jab high-frequency trading (HFT) ki baat hoti hai jahan seconds ka farq bhi impact daal sakta hai.

### 5. **Real-time Monitoring**

Algorithmic systems ko real-time monitor karna bhi zaroori hota hai taake kisi bhi unexpected behavior ko notice kiya ja sake. Jab system live market mein trade karta hai, to trader ko system ke performance ko check karna hota hai aur dekha jata hai ke algorithm sahi tarah se kaam kar raha hai ya nahi. Kabhi kabhi market conditions bohot tezi se badalti hain, jisme kuch strategy modifications ki zaroorat hoti hai.

### 6. **Optimization aur Fine-tuning**

Market dynamic hoti hain, is liye ek hi strategy hamesha profitable nahi hoti. Algorithm ko time ke saath optimize aur fine-tune karna padta hai. Yeh optimization ki process kaafi detail-oriented hoti hai jisme historical data ke basis par parameters ko adjust kiya jata hai. Agar zaroori ho, to puri strategy ko dubara redesign bhi kiya ja sakta hai. Optimization mein yeh dekha jata hai ke kis parameter ko kaise change karne se risk-adjusted returns improve hote hain.

### 7. **Regulation aur Compliance**

Algorithmic trading mein compliance ka dhyan rakhna bohot zaroori hai. Har market apne regulations aur rules ke mutabiq kaam karti hai, aur trader ko yeh ensure karna hota hai ke uski algorithmic strategy in rules ko violate na kare. Khaaskar jab high-volume aur high-frequency trading ki baat hoti hai, to regulation ka role aur bhi barh jata hai.

### Conclusion

Algorithmic trading ek highly technical aur data-driven process hai jo market mein speed aur efficiency lata hai. Ismein accurate strategy development, risk management, aur real-time monitoring ka role bohot ahem hota hai. Jab properly implement kiya jata hai, to algorithmic trading zyada profitable aur kam risky hoti hai, magar isko sahi tarah se samajhna aur deploy karna successful trading ke liye zaroori hai.

-

#9 Collapse

Algorithmic Trading Procedure

Assalam o Alaikum Dear Friends and Fellows, Algorithmic trading ka procedure kuch is tarah hota hey:

Strategy Development: heinkarty

Pehly step main trader ya quant aik algorithmic strategy banata hey. Ye strategy kisi technical analysis, fundamental analysis, ya phir kisi mathematical model par mabni hoti hey. Strategy yeh tay karti hey ke kis waqt stocks ya kisi aur asset ko khareedna ya bechna hey.

Backtesting:

Friends, Jab strategy tayar ho jati hey, to usay pichlay data par test kiya jata hey (backtesting). Is se ye pata chalata hey ke strategy pehle ke data par kaise perform karti thi. Agar acha result aye to agli manzil ki taraf badha jata hey.

Risk Management:

Dear Fellows, Algorithm main risk management rules ko shamil kiya jata hey. Ye rules yeh decide karty main ke aik trade main kitna paisa lagana hey, aur kab position ko close karna hey take nuqsan se bacha ja sake.

Execution System:

Dosto, Execution system wo platform ya broker hota hey jo algorithmic trading ko asani se markets main implement karta hey. Jab algorithm kisi specific signal par pohanchta hey, to wo execution system ko notify karta hey ke trade kiya jaye.

Optimization:

Dear Forex members, Time ke sath, strategy ko optimize kiya jata hey take ye badalte market conditions ke mutabiq ho sake. Is main parameters ko adjust karna aur naye rules ko shamil karna shamil hota hey.

Real-time Monitoring:

Dear Friends, Jab algorithm ko live market main lagaya jata hey, to trader ya system usay monitor karta hey takty koi ghalati ya unexpected cheez na ho. Agar zarurat ho to trader algorithm ko modify kar sakta hey.

Ye aik am tareeqa hey jo algorithmic trading ke liye use hota hey. Har trader apni strategy aur tools ko apny hisab se customize karta hey.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

Algorithmic Trading Procedure

Algorithmic trading ka tareeqa aik automated trading system ka istemal karta hai jo ke predefined instructions ke zariye asaar-e-haal market mein trades execute karta hai. Is process ka maksad trading ko zyada efficient, fast, aur disciplined banana hota hai.

Algorithmic Trading Kya Hai?

Algorithmic trading mein trading ke decisions human emotions ke bajaye aik computer ke programmed instructions ke zariye liye jaate hain. Yeh instructions kisi bhi strategy ya rule ke mutabiq set kiye ja sakte hain. Yeh strategy mein technical indicators ka istemal, price movements ka analysis, aur historical data ka review shamil hota hai. Is trading ka faida yeh hota hai ke yeh high-speed aur accurate hoti hai, jo ke badi markets mein profitable sabit hoti hai.

Step-by-Step Trading Procedure

1. Strategy Development:

Sabse pehla qadam yeh hai ke aik profitable trading strategy develop ki jaye. Yeh strategy market ke data, indicators, ya patterns ke analysis ke zariye banayi jaati hai. Is mein entry aur exit points, stop-loss levels, aur risk management ka bhi tayeun kiya jata hai.

2. Backtesting:

Jab strategy develop ho jati hai, to pehla step hota hai us strategy ka backtest karna. Is mein historical data ka istemal hota hai takay yeh dekhne mein madad mile ke agar yeh strategy pehle market mein lagayi jati to kya yeh profitable hoti ya nahi.

3. Risk Management:

Algorithmic trading mein risk management bohat ahm hota hai. Is mein trader apni risk tolerance ke mutabiq stop-loss aur position sizing ka tayeun karta hai. Yeh ensure karta hai ke zyada nuksan se bacha ja sake.

4. Execution:

Jab strategy backtesting aur risk management ke tamam phases se guzar jati hai, to algorithmic system ko real market mein execute kiya jata hai. Is process mein algorithm apni programmed strategy ke mutabiq trades khud hi execute karta hai. Yeh real-time trading hoti hai jo ke human intervention ke baghair hoti hai.

5. Monitoring aur Optimization:

Algorithmic trading ko lagataar monitor aur optimize karna zaroori hota hai. Is mein yeh dekha jata hai ke strategy kaam kar rahi hai ya nahi aur agar koi bugs ya unexpected results samnay aayen to unhe fix kiya jaye.

Conclusion

Algorithmic trading trading ke liye aik modern aur sophisticated approach hai jo ke trades ko tezi aur efficiency ke sath execute karta hai. Is mein constant monitoring aur strategy optimization zaroori hoti hai taake consistently profitable results hasil ho sakain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:23 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим