Range bound trading strategy

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

DEFINITION Range Bound trading strategy ek trading method Hai Jiski madad se trader mostly forex market ke andar different techniques ko apply karte hue apni trade open Karte hain range Bound trading strategy ke dauran mostly trader support level per apni trade ko buy karte hain aur resistance level per apni trade ko sell Karte hain Aisa trading method Jis per trader support aur resistance level ki buniyad per trading karte hain range bound trading strategy kahlati hai. ROLE OF TRENDLINE IN RANGE BOUND TRADING STRATEGY Range bound trading strategy ke dauran trend line most important hoti hai aur mostly trader market ke andar trend line ko follow karte hue market ka trend Maloom karne ki koshish Karte hain.

ROLE OF TRENDLINE IN RANGE BOUND TRADING STRATEGY Range bound trading strategy ke dauran trend line most important hoti hai aur mostly trader market ke andar trend line ko follow karte hue market ka trend Maloom karne ki koshish Karte hain.  STOP LOSS and TOOK PROFIT Range Bound trading strategy ke dauran trader mostly support aur resistance level ko horizontal trend line ke sath connect kar dete hain aur Is Tarah vah market ka trend Maloom kar sakte hain ISI Tarah trader market ke high point aur Market ke low point ko horizontal trend line ke sath connect Karke market ka support aur resistance level Maloom kar sakte hain. jitni bar market ka high point aur low point ko ham horizontal trend line ke sath connect karte hain utani zyada es trend ki strength hoti hai. for example Agar market price four to five martba low ya high point ki taraf move karti hai aur dusri price do martba move karti hai To pahla pattern zyada strong hoga. Is Tarah trader market ke andar support level per repeated pattern mein buy trade open kar sakte hain aur resistance pattern mein sell trade open kar sakte hain .mostly trader market ke andar upper aur lower trend line Ke above Apna stop loss aur took profit Lagate Hain. bound range trading strategy ke dauran exact trend Maloom karne ke liye trader relative strength index indicator ko bhi use karte hain.

STOP LOSS and TOOK PROFIT Range Bound trading strategy ke dauran trader mostly support aur resistance level ko horizontal trend line ke sath connect kar dete hain aur Is Tarah vah market ka trend Maloom kar sakte hain ISI Tarah trader market ke high point aur Market ke low point ko horizontal trend line ke sath connect Karke market ka support aur resistance level Maloom kar sakte hain. jitni bar market ka high point aur low point ko ham horizontal trend line ke sath connect karte hain utani zyada es trend ki strength hoti hai. for example Agar market price four to five martba low ya high point ki taraf move karti hai aur dusri price do martba move karti hai To pahla pattern zyada strong hoga. Is Tarah trader market ke andar support level per repeated pattern mein buy trade open kar sakte hain aur resistance pattern mein sell trade open kar sakte hain .mostly trader market ke andar upper aur lower trend line Ke above Apna stop loss aur took profit Lagate Hain. bound range trading strategy ke dauran exact trend Maloom karne ke liye trader relative strength index indicator ko bhi use karte hain.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Range bound trading aik popular trading strategy hai jo market ki price movements ka faida uthati hai jab market aik specific range ke andar trade kar rahi hoti hai. Is strategy ko channel trading bhi kaha jata hai. Ye strategy traders ko market ki stability aur predictability ka faida uthane ka mauka deti hai. Range bound trading un traders ke liye ideal hai jo consistent returns aur low risk ke saath trading karna pasand karte hain. Range bound trading ka basic concept yeh hai ke market ki price aik upper aur lower limit ke darmiyan move karti rehti hai. Yeh limits support aur resistance levels kehlati hain. Jab price support level ke qareeb hoti hai to traders expect karte hain ke price wapas upar move karegi, aur jab price resistance level ke qareeb hoti hai to traders expect karte hain ke price niche move karegi.

Key Concepts- Support Level: Support level woh price point hai jahan demand (buying interest) strong hoti hai ke price ko aur niche jaane se roke. Is level pe, traders sochte hain ke price ka niche jana mushkil hai aur yahan se bounce back kar sakti hai.

- Resistance Level: Resistance level woh price point hai jahan supply (selling interest) strong hoti hai ke price ko aur upar jaane se roke. Is level pe, traders expect karte hain ke price ka aur upar jana mushkil hai aur yahan se reverse kar sakti hai.

Identification of Range Bound Market

Range bound market ko identify karna aik essential step hai. Iske liye kuch common techniques use hoti hain:- Technical Analysis: Technical indicators jaise ke Moving Averages, Bollinger Bands, aur Relative Strength Index (RSI) ko use karke range bound markets ko identify kiya ja sakta hai. For example, Bollinger Bands market ke volatility ko measure karte hain aur range ko define karte hain.

- Chart Patterns: Bar aur candlestick charts pe horizontal trendlines draw karke support aur resistance levels identify kiye ja sakte hain. Agar price repeatedly in levels ke darmiyan move kare, to yeh range bound market ka indicator hota hai.

Range bound trading mein different strategies use hoti hain. Kuch popular strategies yeh hain:- Buy at Support and Sell at Resistance: Yeh sabse basic aur common strategy hai. Jab price support level pe ho to buy karna aur jab price resistance level pe ho to sell karna. Is strategy ka success depend karta hai accurate support aur resistance levels ko identify karne pe.

- Oscillator Based Trading: Oscillators jaise ke RSI, Stochastic Oscillator, aur MACD (Moving Average Convergence Divergence) use karke overbought aur oversold conditions ko identify kiya jata hai. Jab market oversold ho to buy karna aur jab overbought ho to sell karna.

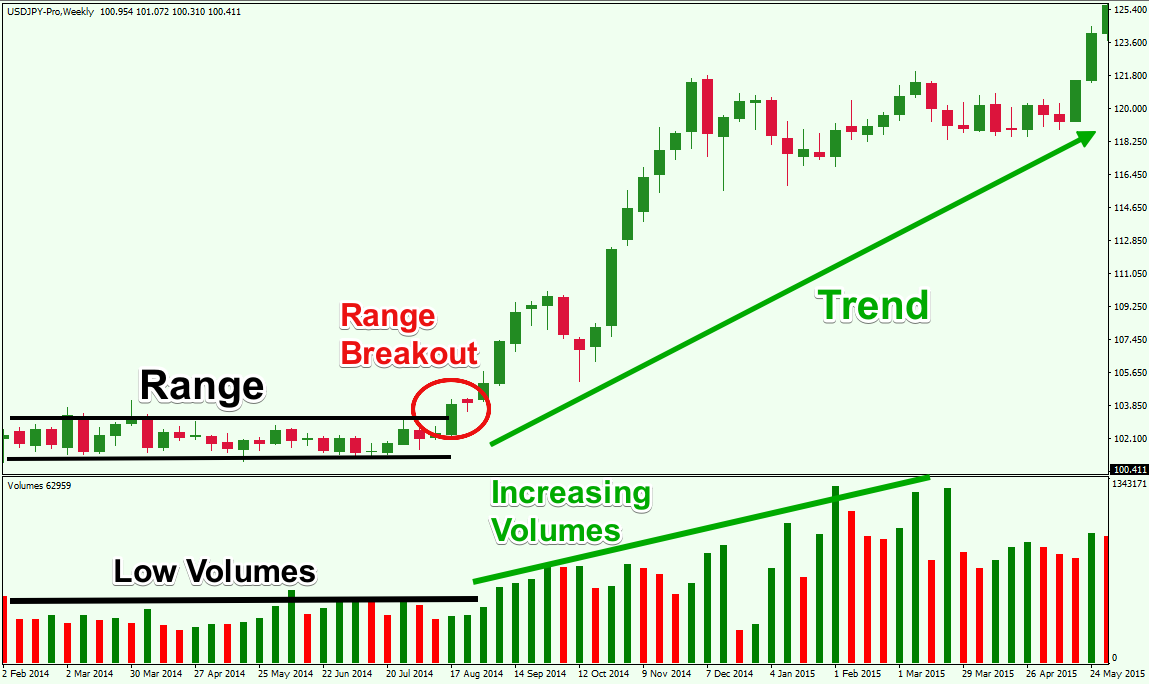

- Breakout Strategy: Yeh strategy tab use hoti hai jab traders expect karte hain ke market range se breakout karegi. Is strategy mein traders range ke break hone ka wait karte hain aur us direction mein trade enter karte hain. For example, agar price resistance level ko break kare to buy karna aur agar support level ko break kare to sell karna.

Range bound trading mein risk management bohat important hai kyun ke market kabhi bhi range se breakout kar sakti hai. Risk management ke kuch essential aspects yeh hain:- Stop-Loss Orders: Stop-loss orders use karke losses ko control kiya jata hai. For example, agar aap support level pe buy karte hain to stop-loss order ko support level se thoda niche place karna chahiye.

- Position Sizing: Position sizing ka matlab hai ke kitni quantity mein trade enter kiya jaye. Yeh aapke risk tolerance aur account size pe depend karta hai. Small positions use karke aap apne risk ko control kar sakte hain.

- Diversification: Diversification ka matlab hai ke aap apne capital ko different assets mein invest karen. Yeh strategy aapko ek asset ke loss se bachati hai aur overall portfolio risk ko reduce karti hai.

Range bound trading ke kuch key advantages yeh hain:- Consistency: Range bound trading consistent returns provide karti hai kyun ke market ka movement predictable hota hai.

- Low Risk: Is strategy mein risk comparatively low hota hai kyun ke price ek defined range ke andar move karti hai.

- Easy to Implement: Range bound trading simple aur easy to understand strategy hai jo beginners ke liye bhi suitable hoti hai.

Disadvantages of Range Bound Trading

Range bound trading ke kuch disadvantages bhi hain:- Limited Profit Potential: Is strategy mein profit potential limited hota hai kyun ke price ek range ke andar hi move karti hai.

- False Breakouts: Kabhi kabhi market false breakouts create karti hai jo traders ko confuse kar sakti hai aur losses ka sabab ban sakti hai.

- Requires Patience: Is strategy ko successfully implement karne ke liye patience ki zaroorat hoti hai kyun ke kabhi kabhi market ko range bound conditions mein ane mein waqt lagta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

Range bound trading strategy ka matlab hota hai jab market ki price kisi specific range ke andar move kar rahi hoti hai aur investors iss range ke beech mein hi trading karte hain. Iss strategy ka istemal kar ke traders price ke fluctuations se faida uthate hain jab market stable hoti hai.

Range bound trading strategy ka mukhya uddeshya hota hai ki jab market mein kisi particular range ke beech mein price move kar rahi hai, toh traders iss range ke andar hi buying aur selling kar ke profit earn kar sakte hain. Yeh strategy market ke volatility ko exploit kar ke profits kamane mein madad karti hai.

Is strategy ka istemal karne ke liye traders ko ek range ka pata hona chahiye jiske andar market move kar rahi hai. Yeh range price action, technical analysis aur market trends ke madhyam se identify kiya ja sakta hai. Traders ko range ke upper aur lower boundaries ko confirm karna chahiye taaki woh sahi samay par entry aur exit points decide kar sakein.

Kuch important points range bound trading strategy ke bare mein hain:

1. Range identification: Sabse pehle traders ko market mein kis range ke andar price move kar rahi hai, yeh identify karna important hota hai. Range ko confirm karne ke liye traders price action patterns aur technical indicators ka istemal karte hain.

2. Entry points: Range bound trading mein entry points ko sahi se decide karna crucial hota hai. Traders ko range ke upper boundary par buying aur lower boundary par selling karna chahiye. Isse woh market ke movement ke hisab se position le sakte hain.

3. Stop loss: Har trading strategy mein stop loss ka hona important hota hai. Range bound trading mein bhi stop loss level ko define karna zaroori hai taaki traders apne losses ko control kar sakein.

4. Profit targets: Traders ko apne profit targets ko bhi define karna chahiye. Range bound trading mein traders ko range ke boundaries ke beech mein hi profit targets set karna chahiye taaki woh risk reward ratio maintain kar sakein.

5. Risk management: Har trading strategy mein risk management ka hona zaroori hota hai. Traders ko apne risk tolerance level ke hisab se position size decide karna chahiye taaki unka capital loss na ho.

Range bound trading strategy ke faide aur nuksan:

Range bound trading strategy ka istemal karne ke kuch faide aur nuksan hain jo traders ko dhyan mein rakhna chahiye.

Faide:

1. Iss strategy se traders market ke volatility se bach kar steady profits earn kar sakte hain.

2. Range bound trading mein risk kam hota hai kyunki market mein stable movement hoti hai.

3. Traders ko entry aur exit points clear hote hain jisse woh trading decisions sahi tareeke se le sakte hain.

Nuksan:

1. Agar market range break karke trend mein move karta hai toh traders apne positions ko adjust karna mushkil ho sakta hai.

2. Range bound trading strategy mein liquidity ki kami bhi ho sakti hai jisse trading execution mein dikkat ho sakti hai.

3. Jab market range ke beech mein tight ho toh trading opportunities kam ho sakti hai.

Conclusion:

Range bound trading strategy ek effective tareeka hai trading karne ka jab market stable ho aur price range mein move kar rahi ho. Traders ko range ki boundaries ko samajh kar sahi samay par entry aur exit points decide karna chahiye. Is strategy ka istemal kar ke traders apne risk ko manage kar sakte hain aur consistent profits earn kar sakte hain. Lekin traders ko market conditions ko samajh kar sahi trading decisions lena zaroori hai. -

#5 Collapse

Forex Market ka Range Bound Trading Strategy

Forex trading dunya bhar mein bohot mashhoor hai aur log isay apni qismat badalne ke liye istemal karte hain. Lekin trading karna itna aasaan nahi hai, isme bohot zyada risks aur complexities hain. Forex market mein different trading strategies hain jo log apnaate hain, lekin aaj hum Range Bound Trading Strategy ke bare mein baat karenge. Ye strategy un market conditions ke liye behtareen hoti hai jab price ek specific range ke andar hi move kar rahi hoti hai.

Range Bound Trading Strategy ki Samajh

Range Bound Trading Strategy ka basic concept yeh hai ke price ek specific high aur low ke darmiyan bound hoti hai aur trader is range ko pehchaan kar trading decisions leta hai. Is strategy mein trader support aur resistance levels ko identify karta hai. Support level wo price point hota hai jahan se price niche nahi jaati aur resistance level wo point hota hai jahan se price upar nahi jaati. Trader in levels ko identify karke buy karne ka decision support level par aur sell karne ka decision resistance level par leta hai.

Market Conditions aur Range Bound Strategy

Range bound strategy tab zyada effective hoti hai jab market mein koi clear trend nahi hota. Jab market sideways move kar rahi hoti hai, us waqt price ek range mein move karti rehti hai. Ye strategy un traders ke liye bohot effective hoti hai jo short-term profits kamana chahte hain kyunki ye strategy short-term movements ko capture karti hai. Lekin agar market mein koi strong trend ho toh ye strategy kaam nahi karti aur trader ko loss bhi ho sakta hai.

Support aur Resistance Levels ka Identify Karna

Support aur resistance levels identify karna is strategy ka sabse important hissa hai. Ye levels identify karne ke liye traders technical analysis tools ka istemal karte hain. Price charts ko dekh kar aur historical data ko analyze kar ke ye levels identify kiye ja sakte hain. Moving averages, Bollinger Bands, aur Relative Strength Index (RSI) jaise indicators bhi madadgar hotay hain. Support level wo hota hai jahan se price pehle baar baar upar gayi hoti hai aur resistance level wo hota hai jahan se price pehle baar baar niche aayi hoti hai.

Entry aur Exit Points ka Faisla

Range bound trading mein entry aur exit points ka sahi faisla karna bohot zaroori hai. Jab price support level ke qareeb ho toh ye buying opportunity hoti hai aur jab price resistance level ke qareeb ho toh ye selling opportunity hoti hai. Lekin trader ko ye bhi dekhna hota hai ke price support ya resistance ko break kar sakti hai. Is liye stop-loss orders ka istemal bohot zaroori hota hai. Stop-loss orders trader ko kisi bhi unexpected price movement ke against protect karte hain.

Risk Management

Range bound trading strategy mein risk management ka bhi bohot ahm kirdar hota hai. Forex trading mein risk ko minimize karna sabse pehle priority honi chahiye. Risk management ke liye trader ko apni position size ko control karna hota hai. Iske ilawa stop-loss orders ka istemal karna bhi risk management ka hissa hai. Stop-loss order ek pre-determined price hota hai jahan par trader apni position close kar leta hai taake zyada loss na ho. Is strategy mein over-leveraging se bhi bachna chahiye kyunki over-leveraging se losses bohot zyada ho sakte hain.

Range Bound Strategy ke Fayde

Range bound trading strategy ke kai fayde hain. Pehla yeh ke isme market ka trend pehchaan ne ki zaroorat nahi hoti. Jab market sideways move kar rahi ho toh ye strategy bohot effective hoti hai. Doosra yeh ke ye strategy short-term profits generate karne mein madadgar hoti hai. Teesra yeh ke isme risk management karna relatively aasaan hota hai. Lekin is strategy mein patience aur discipline bohot zaroori hai kyunki market kabhi bhi unpredictable ho sakti hai.

Range Bound Strategy ke Nuqsanat

Range bound trading strategy ke kuch nuqsanat bhi hain. Sabse pehla nuqsan yeh hai ke agar market mein koi strong trend develop ho toh ye strategy fail ho sakti hai aur trader ko loss ho sakta hai. Doosra nuqsan yeh hai ke is strategy mein trading opportunities limited hoti hain kyunki price sirf ek specific range mein move kar rahi hoti hai. Teesra nuqsan yeh hai ke agar trader support aur resistance levels ko sahi se identify na kar paye toh bhi loss ho sakta hai.

Note

Forex market mein trading karna ek challenging task hai lekin agar aapke paas sahi strategy ho toh aap successful ho sakte hain. Range bound trading strategy ek aisi strategy hai jo market ke sideways movements ko capitalize karti hai. Is strategy mein support aur resistance levels ko identify karna aur sahi entry aur exit points ka faisla karna bohot zaroori hota hai. Risk management bhi is strategy ka ahm hissa hai. Lekin is strategy ko successful banane ke liye patience aur discipline bohot zaroori hai. Forex trading mein hamesha yeh yaad rakhen ke risk ko manage karna sabse pehle priority honi chahiye. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Range bound trading strategy Kia hai

?

Range-bound trading strategy ek market trading strategy hai jisme traders attempt karte hain to profit from price movements within a defined price range. Is strategy mein traders typically buy near the lower boundary of the range aur sell near the upper boundary. Yeh strategy market conditions par depend karti hai jo generally sidhi aur stable hon, jaise ki sideways market movements. Trader ko price range identify karna hota hai aur phir us range ke andar price fluctuations ka advantage lena hota hai buy aur sell positions ke through.

Range-bound trading strategy ka mukhya uddeshya market ke defined range mein price movements ka advantage lena hota hai. Yeh strategy generally un situations mein kaam aati hai jab market sideways trend mein hota hai aur price ek specific range ke andar oscillate karta hai, instead of trending up or down.

Yeh kuch key points include karte hain:- Range Identification: Trader ko sabse pehle market ka range identify karna hota hai, jisme price move kar raha hai. Yeh range usually support aur resistance levels se define hota hai.

- Buy Near Support, Sell Near Resistance: Range-bound strategy mein traders support (neche ki boundary) near buy positions aur resistance (upper boundary) near sell positions establish karte hain. Jab price support level tak girta hai, traders buy positions enter karte hain, aur jab price resistance level tak pahunchta hai, toh sell positions establish karte hain.

- Stop Loss aur Profit Targets: Har trade mein traders ko stop loss aur profit targets set karna hota hai. Stop loss un levels par lagaya jata hai jo range ke bahar ho, taki agar price unexpected direction mein move kare, toh loss minimize ho sake. Profit targets range ke opposite boundary tak set kiye jate hain.

- Range Breakout: Range-bound strategy mein ek important consideration hai range breakout. Agar price range ke bahar nikal jata hai, toh yeh indicate karta hai ki market direction mein change ho sakta hai. Traders ko is breakout ko monitor karna chahiye aur uske according apne positions adjust karna hota hai.

- Technical Indicators: Traders technical indicators ka use karte hain jaise ki Bollinger Bands, moving averages, RSI (Relative Strength Index) etc., jo help karte hain range ke levels identify karne mein aur entry/exit points decide karne mein.

Overall, range-bound trading strategy require discipline aur patience. Yeh strategy market volatility se kam benefit provide karti hai, lekin sahi conditions mein consistently profitable ho sakti hai jab market sidha aur stable hai.

Range bound trading strategy Ki mazeed wazahat

Range-bound trading strategy ka mukhya uddeshya hota hai market ke defined range mein price movements se fayda uthana. Is strategy mein traders price range ke andar fluctuations ke basis par trades enter karte hain, jab market trend na ho aur price ek specific range ke andar oscillate karta hai.

Yahan kuch aur mukhya points hain jo range-bound trading strategy ko samajhne mein madad karte hain:- Range Identification: Sabse pehla step range-bound strategy mein range ko identify karna hota hai. Range usually support aur resistance levels se define hota hai. Support level range ka lower boundary hota hai jahan se price rebound expect kiya jata hai, aur resistance level range ka upper boundary hota hai jahan se price selling pressure expect kiya jata hai.

- Entry Points: Range-bound strategy mein traders support level par buy positions aur resistance level par sell positions enter karte hain. Jab price support level tak girta hai, traders buy positions enter karte hain ummid karte hue ki price phir se upper boundary tak jaegi. Jab price resistance level tak pahunchta hai, toh traders sell positions enter karte hain ummid karte hue ki price phir se lower boundary tak aayegi.

- Stop Loss aur Profit Targets: Har trade mein traders ko stop loss aur profit targets set karna hota hai. Stop loss usual practice mai laga jata hai. Trader kabhi haikaa haking aur

Range bound trading strategy Ki Aqsam

Range-bound trading strategy ke kuch pramukh aqsam hote hain jo traders apne trading plan mein incorporate kar sakte hain, depending on market conditions and their trading style:- Support and Resistance Trading: Yeh sabse basic form hai range-bound trading ki. Isme traders support aur resistance levels ke paas buy aur sell orders place karte hain. Support level par buy karte samay ummid hoti hai ki price phir se upar jaayegi, aur resistance level par sell karte samay ummid hoti hai ki price phir se neeche jaayegi.

- Bollinger Bands Strategy: Bollinger Bands ek popular technical indicator hai jo volatility ko measure karta hai. Range-bound traders Bollinger Bands ka use karte hain to identify price range aur uske andar price fluctuations ko exploit karte hain. Jab price upper Bollinger Band se near ho ya lower Bollinger Band se near ho, traders buy ya sell positions enter karte hain expecting ki price phir range ke andar move karega.

- Moving Average Strategy: Moving averages bhi range-bound trading mein effective ho sakte hain. Traders moving averages ka use karte hain to identify trend direction aur phir range ke boundaries ke near buy aur sell positions enter karte hain jab price moving average ke against move karta hai.

- Range Breakout Strategy: Range-bound strategy ke opposite, range breakout strategy mein traders price range ke bahar move hone ki expectation mein trades enter karte hain. Jab price range ke upper ya lower boundary se bahar nikalta hai, yeh indicate karta hai ki market mein trend start ho sakta hai aur traders us trend ke sath positions lete hain.

- Mean Reversion Strategy: Mean reversion strategy mein traders expect karte hain ki agar price range ke ek extreme boundary tak gaya hai (jaise ki upper boundary), toh woh phir se mean (yaani range ka center) ki taraf revert hoga. Is strategy mein traders opposite direction mein positions lete hain expecting ki price range ke center ya opposite boundary tak wapas aayega.

Har ek strategy apne advantages aur limitations rakhti hai aur traders ko apne risk tolerance aur market conditions ke according select karni chahiye. Range-bound trading strategies mein discipline aur strict risk management ka hona bahut zaroori hai kyunki range-bound markets mein price fluctuations limited hote hain aur false breakouts common ho sakte hain.

Shukria -

#7 Collapse

Range bound trading strategy Kia hai

?

Range-bound trading strategy ek market trading strategy hai jisme traders attempt karte hain to profit from price movements within a defined price range. Is strategy mein traders typically buy near the lower boundary of the range aur sell near the upper boundary. Yeh strategy market conditions par depend karti hai jo generally sidhi aur stable hon, jaise ki sideways market movements. Trader ko price range identify karna hota hai aur phir us range ke andar price fluctuations ka advantage lena hota hai buy aur sell positions ke through.

Range-bound trading strategy ka mukhya uddeshya market ke defined range mein price movements ka advantage lena hota hai. Yeh strategy generally un situations mein kaam aati hai jab market sideways trend mein hota hai aur price ek specific range ke andar oscillate karta hai, instead of trending up or down.

Yeh kuch key points include karte hain:- Range Identification: Trader ko sabse pehle market ka range identify karna hota hai, jisme price move kar raha hai. Yeh range usually support aur resistance levels se define hota hai.

- Buy Near Support, Sell Near Resistance: Range-bound strategy mein traders support (neche ki boundary) near buy positions aur resistance (upper boundary) near sell positions establish karte hain. Jab price support level tak girta hai, traders buy positions enter karte hain, aur jab price resistance level tak pahunchta hai, toh sell positions establish karte hain.

- Stop Loss aur Profit Targets: Har trade mein traders ko stop loss aur profit targets set karna hota hai. Stop loss un levels par lagaya jata hai jo range ke bahar ho, taki agar price unexpected direction mein move kare, toh loss minimize ho sake. Profit targets range ke opposite boundary tak set kiye jate hain.

- Range Breakout: Range-bound strategy mein ek important consideration hai range breakout. Agar price range ke bahar nikal jata hai, toh yeh indicate karta hai ki market direction mein change ho sakta hai. Traders ko is breakout ko monitor karna chahiye aur uske according apne positions adjust karna hota hai.

- Technical Indicators: Traders technical indicators ka use karte hain jaise ki Bollinger Bands, moving averages, RSI (Relative Strength Index) etc., jo help karte hain range ke levels identify karne mein aur entry/exit points decide karne mein.

Overall, range-bound trading strategy require discipline aur patience. Yeh strategy market volatility se kam benefit provide karti hai, lekin sahi conditions mein consistently profitable ho sakti hai jab market sidha aur stable hai.

Range bound trading strategy Ki mazeed wazahat

Range-bound trading strategy ka mukhya uddeshya hota hai market ke defined range mein price movements se fayda uthana. Is strategy mein traders price range ke andar fluctuations ke basis par trades enter karte hain, jab market trend na ho aur price ek specific range ke andar oscillate karta hai.

Yahan kuch aur mukhya points hain jo range-bound trading strategy ko samajhne mein madad karte hain:- Range Identification: Sabse pehla step range-bound strategy mein range ko identify karna hota hai. Range usually support aur resistance levels se define hota hai. Support level range ka lower boundary hota hai jahan se price rebound expect kiya jata hai, aur resistance level range ka upper boundary hota hai jahan se price selling pressure expect kiya jata hai.

- Entry Points: Range-bound strategy mein traders support level par buy positions aur resistance level par sell positions enter karte hain. Jab price support level tak girta hai, traders buy positions enter karte hain ummid karte hue ki price phir se upper boundary tak jaegi. Jab price resistance level tak pahunchta hai, toh traders sell positions enter karte hain ummid karte hue ki price phir se lower boundary tak aayegi.

- Stop Loss aur Profit Targets: Har trade mein traders ko stop loss aur profit targets set karna hota hai. Stop loss usual practice mai laga jata hai. Trader kabhi haikaa haking aur

Range bound trading strategy Ki Aqsam

Range-bound trading strategy ke kuch pramukh aqsam hote hain jo traders apne trading plan mein incorporate kar sakte hain, depending on market conditions and their trading style:- Support and Resistance Trading: Yeh sabse basic form hai range-bound trading ki. Isme traders support aur resistance levels ke paas buy aur sell orders place karte hain. Support level par buy karte samay ummid hoti hai ki price phir se upar jaayegi, aur resistance level par sell karte samay ummid hoti hai ki price phir se neeche jaayegi.

- Bollinger Bands Strategy: Bollinger Bands ek popular technical indicator hai jo volatility ko measure karta hai. Range-bound traders Bollinger Bands ka use karte hain to identify price range aur uske andar price fluctuations ko exploit karte hain. Jab price upper Bollinger Band se near ho ya lower Bollinger Band se near ho, traders buy ya sell positions enter karte hain expecting ki price phir range ke andar move karega.

- Moving Average Strategy: Moving averages bhi range-bound trading mein effective ho sakte hain. Traders moving averages ka use karte hain to identify trend direction aur phir range ke boundaries ke near buy aur sell positions enter karte hain jab price moving average ke against move karta hai.

- Range Breakout Strategy: Range-bound strategy ke opposite, range breakout strategy mein traders price range ke bahar move hone ki expectation mein trades enter karte hain. Jab price range ke upper ya lower boundary se bahar nikalta hai, yeh indicate karta hai ki market mein trend start ho sakta hai aur traders us trend ke sath positions lete hain.

- Mean Reversion Strategy: Mean reversion strategy mein traders expect karte hain ki agar price range ke ek extreme boundary tak gaya hai (jaise ki upper boundary), toh woh phir se mean (yaani range ka center) ki taraf revert hoga. Is strategy mein traders opposite direction mein positions lete hain expecting ki price range ke center ya opposite boundary tak wapas aayega.

Shukria -

#8 Collapse

Range Bound Trading Strategy forex trading mein bohot hi common aur effective approach hai. Is strategy ka maksad price ke ek specific range mein move karne ka faida uthana hota hai. Jab market trend nahi kar raha hota aur ek specific support aur resistance level ke beech range-bound hota hai, to range bound trading strategy bohot useful hoti hai.

Range Bound Trading Strategy Kya Hai?

Range bound trading strategy market ke un periods ko target karti hai jab price ek defined range ke beech move kar rahi hoti hai. Is range ka lower boundary support level hota hai aur upper boundary resistance level hota hai. Traders in levels ke darmiyan buy aur sell positions le kar profit generate karte hain.

Key Concepts

1. Support and Resistance

Support Level

Aisa price level jahan demand strong hoti hai aur price neeche nahi girti. Jab price support level par pohanchti hai, to yeh typically bounce back karti hai.

Resistance Level:

Aisa price level jahan supply strong hoti hai aur price upar nahi jati. Jab price resistance level par pohanchti hai, to yeh typically revert karti hai.

2. Identifying the Range

Range bound market ko identify karne ke liye aapko support aur resistance levels ko plot karna hota hai. Yeh levels chart par easily dekhe ja sakte hain jab price repeatedly ek specific range ke beech bounce back karti hai.

Example:

Agar EUR/USD pair 1.1000 se 1.1100 ke range mein move kar raha hai, to 1.1000 support level aur 1.1100 resistance level hoga.

Trading Strategy

1. Buy at Support

Jab price support level par pohanche aur wahan se bounce back kare, to yeh buy signal hota hai. Is point par aap buy position le sakte hain.

- Entry Point:

Support level par price ke bounce back hone par buy karein.

- Stop Loss:

Support level ke thoda neeche set karein.

- Take Profit:

Resistance level ke thoda neeche set karein.

2. Sell at Resistance

Jab price resistance level par pohanche aur wahan se revert kare, to yeh sell signal hota hai. Is point par aap sell position le sakte hain.

- Entry Point:

Resistance level par price ke revert hone par sell karein.

- Stop Loss:

Resistance level ke thoda upar set karein.

- Take Profit:

Support level ke thoda upar set karein.

3. Risk Management

Range bound trading strategy mein risk management bohot important hota hai. Aapko apne stop loss levels ko strictly follow karna chahiye taake unexpected breakouts ke case mein aapka loss limited ho.

Example

Suppose karo ke GBP/USD ka daily chart hai aur aap dekhte hain ke price 1.2500 se 1.2600 ke range mein move kar rahi hai.

1. Jab price 1.2500 ke support level par pohanchti hai aur bounce back karti hai, to aap buy position enter karte hain with stop loss at 1.2480 aur take profit at 1.2580.

2. Jab price 1.2600 ke resistance level par pohanchti hai aur revert karti hai, to aap sell position enter karte hain with stop loss at 1.2620 aur take profit at 1.2520.

Conclusion

Range bound trading strategy forex trading mein bohot hi effective approach hai jab market ek defined range ke beech move kar raha hota hai. Is strategy mein support aur resistance levels ko identify karna, timely entries aur exits lena, aur proper risk management bohot important hai. Hamesha yaad rakhein ke koi bhi trading strategy 100% accurate nahi hoti, isliye risk management aur additional confirmations zaroori hain. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Range-bound trading strategy

Range-bound trading strategy ek aisi trading strategy hai jismein traders is baat ka fayda uthate hain ki kisi security ki kimat ek nishchit range mein chal rahi hai. Yah strategy un markets mein kaam karti hai jo trending nahin hain, yani jinmein kimat ek taraf nahi badh rahi hai.

Range-bound trading strategy kaise kam karti hai?

Range-bound trading strategy mein, traders do tarah ke levels ki pahchan karte hain: support aur resistance.- Support yah woh level hai jahan par kimat girne ke baad utarne lagti hai.

- Resistance yah woh level hai jahan par kimat badhne ke baad girne lagti hai.

Jab traders support level ki pahchan kar lete hain, to woh is ummid mein security kharidte hain ki kimat badhegi. Jab traders resistance level ki pahchan kar lete hain, to woh is ummid mein security bechte hain ki kimat girne lagegi.

Range-bound trading strategy ke liye kuchh tips- Ek acchi trading platform ka istemal karen. Aapki trading platform mein aise tools hone chahiye jo aapko support aur resistance levels ki pahchan karne mein madad karein.

- Apne risk ko manage karen. Kisi bhi trade mein jitna paisa aap invest karte hain, uski seema tay karen aur us seema se zyada risk na len.

- Dhairya rakhen. Range-bound trading mein paisa kamane ke liye dhairya rakhna zaruri hai. Kyunki kimat ekdam se support aur resistance levels ko nahin todti hai.

- Apne emotions ko control mein rakhen. Trading karte samay apne emotions ko control mein rakhna bahut zaruri hai. Kisi bhi trade mein dar ya laalach ke karan koi bhi decision na len.

Range-bound trading strategy ke kuchh fayde- Yeh ek kam-risk wali strategy hai. Kyonki traders sirf tabhi trade karte hain jab kimat support ya resistance level ke karib hoti hai.

- Yeh ek consistent strategy hai. Range-bound markets bahut aam hain, isliye yeh strategy aapko consistent profits kamaane mein madad kar sakti hai.

- Yeh ek short-term strategy hai. Agar aapko paise ki jaldi zarurat hai, to range-bound trading strategy aapke liye ek achcha option ho sakti hai.

Range-bound trading strategy ke kuchh nuksan- Yeh ek slow strategy hai. Range-bound trading mein paisa kamane mein samay lagta hai.

- Yeh ek risky strategy ho sakti hai. Agar aap support aur resistance levels ko sahi se nahin pahchan paye, to aapko loss ho sakta hai.

- Yeh ek emotional strategy ho sakti hai. Range-bound trading mein paisa kamane ke liye dhairya rakhna zaruri hai, lekin kuchh traders dar ya laalach ke karan galat decision le sakte hain.

Range-bound trading strategy aapke liye sahi hai ya nahi, yah aapke trading goals aur risk tolerance per depend karta hai. Agar aap ek kam-risk wali strategy ki talash mein hain jo aapko consistent profits kamaane mein madad kar sakti hai, to range-bound trading strategy aapke liye ek achcha option ho sakti hai.

Kuchh aur resources:- Range-Bound Trading Strategy: A Complete Guide

- Range-Bound Trading Strategies

- How to Build a Winning Range-Bound Trading Strategy [Invalid URL remove kiya gaya]

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

**Range Bound Trading Strategy: Ek Effective Approach Forex Market Mein**

Range bound trading strategy forex market mein ek popular approach hai jo traders ke liye useful hota hai jab market specific price range ke andar consolidate hota hai aur clear trend na ho. Is strategy ka maqsad hota hai ke traders price range ke andar buying aur selling opportunities identify karke profit generate kar sakein.

Range bound trading strategy ko implement karne ke liye traders ko yeh steps follow karne chahiye:

1. **Identify Range**: Sab se pehle traders ko market mein current range identify karna hota hai jisme price move kar raha hai. Is range ko identify karne ke liye support aur resistance levels ko dekha jata hai jisse price boundaries clear ho.

2. **Buy near Support, Sell near Resistance**: Range bound strategy mein traders support level ke qareeb buy aur resistance level ke qareeb sell karne ki koshish karte hain. Support par price bounce hone ki ummeed se traders buy positions open karte hain aur resistance par price reversal ki expectation se sell positions open karte hain.

3. **Use Technical Indicators**: Traders technical indicators jaise ki RSI (Relative Strength Index), stochastic oscillators, aur moving averages ka istemal karte hain price direction aur momentum ko confirm karne ke liye. In indicators ki madad se traders range bound conditions ko identify aur confirm karte hain.

4. **Risk Management**: Is strategy mein risk management bahut zaroori hota hai. Traders stop-loss levels set karte hain jisse ki agar trade opposite direction mein move karta hai toh loss ko minimize kiya ja sake.

Range bound trading strategy ka benefit yeh hai ke yeh market ke volatile periods mein bhi kamai karne ka ek tareeqa provide karta hai jab market clear trend na ho. Is strategy ko effectively use karne ke liye traders ko market conditions ko samajhna, price action ko analyze karna, aur patience rakhna zaroori hota hai.

Overall, range bound trading strategy forex market mein ek flexible aur effective approach hai jo traders ko market ke price movements ko exploit karne mein madad deta hai. Iske istemal se traders apne trading skills ko improve kar sakte hain aur consistent profits generate kar sakte hain jab market non-directional ho.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:36 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим