What is empty position?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

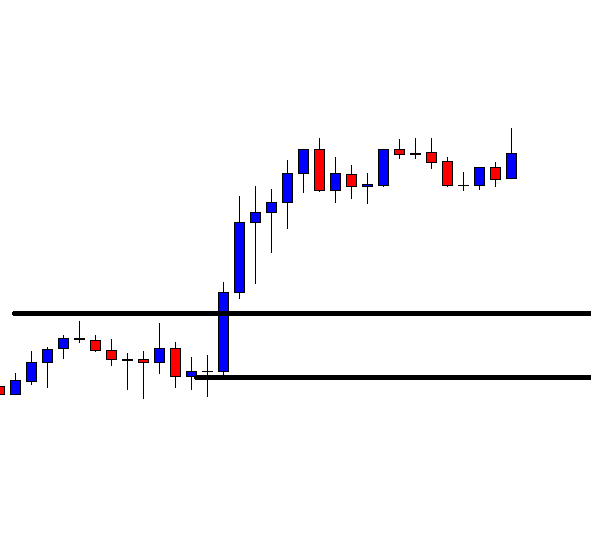

PokeBanner graph layout ek continuation design hai jo replacing ke time period ke beech mein boycott sakta hai. Yeh format sample ke continuation ke baad ek chota forestall ya union length dikhata hai aur phir pattern ke heading mein phir se float karta hai. Banner Diagram layout ek bullish ya poor sample ke baad momentary solidification length hota hai, jis mein cost variety ek banner jaisi form banata hai. Banner define layout ko replacing mein use karne se pehle investors ko pattern ko verify karna hota hai, jis se ke design ki recognizable evidence precise ho purpose. Flagpole complete ho jata hai, tab marketplace sidha ruk jaata hai aur value development ko merge karne lagta hai. Yeh mixture level banner ki form mein create hota hai, jo often 5% to fifteen% ke andar rehta hai. Is combination degree ke andar, cost improvement variety-bound hota hai, jismein cost ki usaand downs banner ke andar greetings rehta hai.Jab banner example complete ho jata hai, tab market ka pattern wohi hota hai jo flagpole ke doran tha. Isliye, agents banner example ko is tarah se decipher karte hain ki flagpole ki tarah greetings market ka sample banner example ke baad bhi jaari rahega. Iska matlab hai ki agar flagpole upturn mein tha, to signal example ke baad bhi upswing greetings rahega. Vaise hi there, agar flagpole downtrend mein tha CHart Flag Pattern trading akneeki empty characteristic aik aisi tijarat hai jo qaim ho chuki hai, lekin jo abhi tak mukhalif tijarat ke sath band nahi hui hai. Agar koi sarmaya automobile stock ke 300 hasas ka maalik hai, to woh is inventory mein is waqt tak khuli characteristic rakhta hai punch tak ke usay farokht nah kya jaye. Sarmaya automobile ke liye market ayksposr ki numaindagi karta hai, aur role band honay tak khatrah barqarar rehta hai .Fuss ke tajir chand sikndon mein apni pozishnin kholtey aur band karte hain aur upheaval ke ekhtataam sizable koi khuli function nah rakhna chahtay hain .Understandingmisaal ke zenith famous, aik sarmaya automobile jo kisi khaas inventory ke 500 hasas ka maalik hai kaha jata hai ke is inventory mein khuli position hai. Hit sarmaya vehicle un 500 hasas ko farokht karta hai, to arrange band ho jati hai. Kharedo aur pakro sarmaya karon ke paas aam pinnacle popular kisi bhi waqt aik ya ziyada khuli pozishnin hoti hain. Qaleel mudti tajir" spherical fabric" tijarat injaam day satke hain. Aik characteristic nisbatan mukhtasir muddat mein khulti aur band hoti hai. Commotion ke tajir aur racket bhar mein kam se kam lekin mutadid qeematon ki naqal o harkat ko pakarney ki koshish karte tone chand 2nd ke andar aik position ko khol aur band kar satke hain . Ke tanazur mein, aik jhanda qeemat ka aik namona hai jo, aik mukhtasir waqt ke frame mein, qeemat ke chart par aik taweel waqt ke body mein dekhe jane walay murawaja qeemat ke rujhan ka muqaabla karta hai. Is ka naam is liye rakha gaya hai ke yeh dekhnay walay ko jhanday par jhanday ki yaad dilaata hai. Flag patteren ka istemaal kisi pichlle rujhan ke mumkina tasalsul ki nishandahi karne ke liye kya jata hai jahan se qeemat isi rujhan ke khilaaf barhi hai. Agar rujhan dobarah shuru hota hai to, qeematon mein izafah taizi se ho sakta hai, jis se parcham ke patteren ko dekh kar tijarat ke waqt ko faida hota hai. Bhi isi hajam aur break out patteren ki pairwi karte hain. Ibtidayi izafay ke baad tijarti hajam mein kami ke patteren ki khususiyaat hain. Is ka matlab yeh hai ke murawaja rujhan ko agay badhaane walay taajiron ko istehkaam ki muddat ke douran apni khareed o farokht ko jari rakhnay ki kam ujlat hai, is terhan yeh imkaan peda hota hai ke naye tajir aur sarmaya car josh o kharosh ke sath is rujhan ko apnayen ge, jis se qeematein mamool se ziyada taiz raftari se barh jayen gi. . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex jo ke foreign exchange ka short form hai ek global tijarat hai jahan currencies ko khareedne aur bechne ka amal hota hai. Yeh duniya bhar mein kayi tarah ke trading centers aur financial institutions ke zariye chalta hai, jaise banks, hedge funds, corporations, aur individual traders. Forex market 24/5 khulta hai, matlab ke haftay ke 5 din tak continuously kaam karta hai. Yahan par traders currencies ke pairs mein trade karte hain, jaise ke USD/EUR (US Dollar aur Euro), GBP/JPY (British Pound aur Japanese Yen) wagira. Forex trading mein ek aam term hai jo empty position ya kehlata hai. Ye ek aesi position hoti hai jab trader ke paas kisi bhi currency pair mein koi khareedne ya bechne wala contract ya trade na ho. Iska matlab hai ke trader ne abhi tak kisi bhi currency pair ko kharida ya becha nahi hai aur uska account kisi bhi currency ke pair mein open positions nahi hain. Is tarah ki position ko empty position kaha jata hai. Empty position forex trading mein ek normal cheez hai aur traders ise istemal karte hain apni trading strategies ke hisab se. Ye kisi bhi trader ke trading account mein samay samay par ho sakti hai. Kuch traders apni positions ko close karne ke baad temporary taur par empty position rakhte hain ta ke wo future mein mazeed trading kar sakein, ya phir woh unko carry trading ke liye istemal karte hain. Empty position ko samajhne ke liye, aapko ye samajhna hoga ke forex trading mein positions ko khareedne aur bechne ke liye long aur short dono types ke orders hotay hain. Jab trader kisi currency pair ko khareedta hai, to usay long position kehte hain, aur jab wo kisi currency pair ko bechta hai, to usay short position kehte hain. Jab trader kisi currency pair ko khareedta hai, to uski trading platform par ek long position open hoti hai. Aur jab wo currency pair bechta hai, to uski trading platform par ek short position open hoti hai. Jab position ko close kar diya jata hai, to wo empty position ban jati hai. Forex market mein empty position ko carry trading ke liye bhi istemal kiya jata hai. Carry trading ek aisi trading strategy hai jahan par traders long term positions ko istemal karke interest rate differentials se faida uthate hain. Interest rate differentials, ya phir currency pairs ke beech ke interest rate ke farq, carry trading ke liye ek important factor hota hai. Jab trader carry trading strategy istemal karta hai, to wo ek currency pair ko long position par rakhta hai jis currency ki interest rate zyada hai aur ek currency pair ko short position par rakhta hai jis currency ki interest rate kam hai. Is tarah trader long position wali currency pair se interest receive karta hai, aur short position wali currency pair par interest pay karta hai. Is se trader ko net interest receive hota hai, jisse usko carry trading ke through profit milta hai. Ek trader, carry trading strategy ko istemal karne ke liye, ek currency pair ko long position par rakhega, jis currency ki interest rate zyada hai, aur ek currency pair ko short position par rakhega, jis currency ki interest rate kam hai. Trader apni positions ko hold karke interest rate differentials se faida uthayega. Is tarah, trader empty position ko rakhega takay wo future mein carry trading kar sake aur interest rate differentials se munafa kamayega. Empty position ko traders us waqt tak hold kar sakte hain jab tak wo apni trading strategy ke mutabik samjte hain. Jab trader ko lagta hai ke uski trading strategy ke mutabik currency pair ki price mein koi movement hone wali hai, ya phir wo kisi dusre trading opportunity ko avail karne wala hai, to usko apni empty position ko close karke naye positions ko open karne ka option hota hai.

Jab trader kisi currency pair ko khareedta hai, to uski trading platform par ek long position open hoti hai. Aur jab wo currency pair bechta hai, to uski trading platform par ek short position open hoti hai. Jab position ko close kar diya jata hai, to wo empty position ban jati hai. Forex market mein empty position ko carry trading ke liye bhi istemal kiya jata hai. Carry trading ek aisi trading strategy hai jahan par traders long term positions ko istemal karke interest rate differentials se faida uthate hain. Interest rate differentials, ya phir currency pairs ke beech ke interest rate ke farq, carry trading ke liye ek important factor hota hai. Jab trader carry trading strategy istemal karta hai, to wo ek currency pair ko long position par rakhta hai jis currency ki interest rate zyada hai aur ek currency pair ko short position par rakhta hai jis currency ki interest rate kam hai. Is tarah trader long position wali currency pair se interest receive karta hai, aur short position wali currency pair par interest pay karta hai. Is se trader ko net interest receive hota hai, jisse usko carry trading ke through profit milta hai. Ek trader, carry trading strategy ko istemal karne ke liye, ek currency pair ko long position par rakhega, jis currency ki interest rate zyada hai, aur ek currency pair ko short position par rakhega, jis currency ki interest rate kam hai. Trader apni positions ko hold karke interest rate differentials se faida uthayega. Is tarah, trader empty position ko rakhega takay wo future mein carry trading kar sake aur interest rate differentials se munafa kamayega. Empty position ko traders us waqt tak hold kar sakte hain jab tak wo apni trading strategy ke mutabik samjte hain. Jab trader ko lagta hai ke uski trading strategy ke mutabik currency pair ki price mein koi movement hone wali hai, ya phir wo kisi dusre trading opportunity ko avail karne wala hai, to usko apni empty position ko close karke naye positions ko open karne ka option hota hai. Empty position ko handle karne ka ek important tareeqa stop loss aur take profit orders ka istemal karna hai. Stop loss aur take profit orders traders ke liye ek risk management tool hota hai jisse wo apni trades ko control kar sakte hain. Jab trader kisi trade ko open karta hai, to wo usme stop loss aur take profit levels set karta hai. Stop loss level wo price hota hai jahan par trade automatically close hojati hai agar price us level tak pohnch jaye, jabke take profit level wo price hota hai jahan par trade automatically close hojati hai agar price us level tak pohnch jaye. Agar trader ko lagta hai ke uski empty position ko close karna chahiye, to wo apne stop loss ya take profit level par trade ko close kar dega. Is tareeqe se wo trade ko profit ya loss ke sath band kar sakta hai aur uski empty position ko samapt kar sakta hai. Empty position ko handle karte waqt, traders ko bhi dhyan rakhna hota hai ke wo apni trading plan aur risk management ke principles ko follow karein. Jab trader kisi empty position ko open rakhta hai, to usko market ke movement ko samajhna aur analyze karna zaroori hota hai. Isse wo sahi waqt par apni empty position ko close kar sakega aur trading strategy ko effectively implement kar sakega. Iske ilawa, traders ko apne trading accounts ko regularly monitor karna chahiye takay wo apni empty positions ko manage kar sakein aur sahi waqt par trading decisions le sakein. Empty position ko samjhe baghair, trader ki trading strategy aur overall trading plan adhoori reh jati hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:59 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим