Trading at Negtive Volume Index.

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

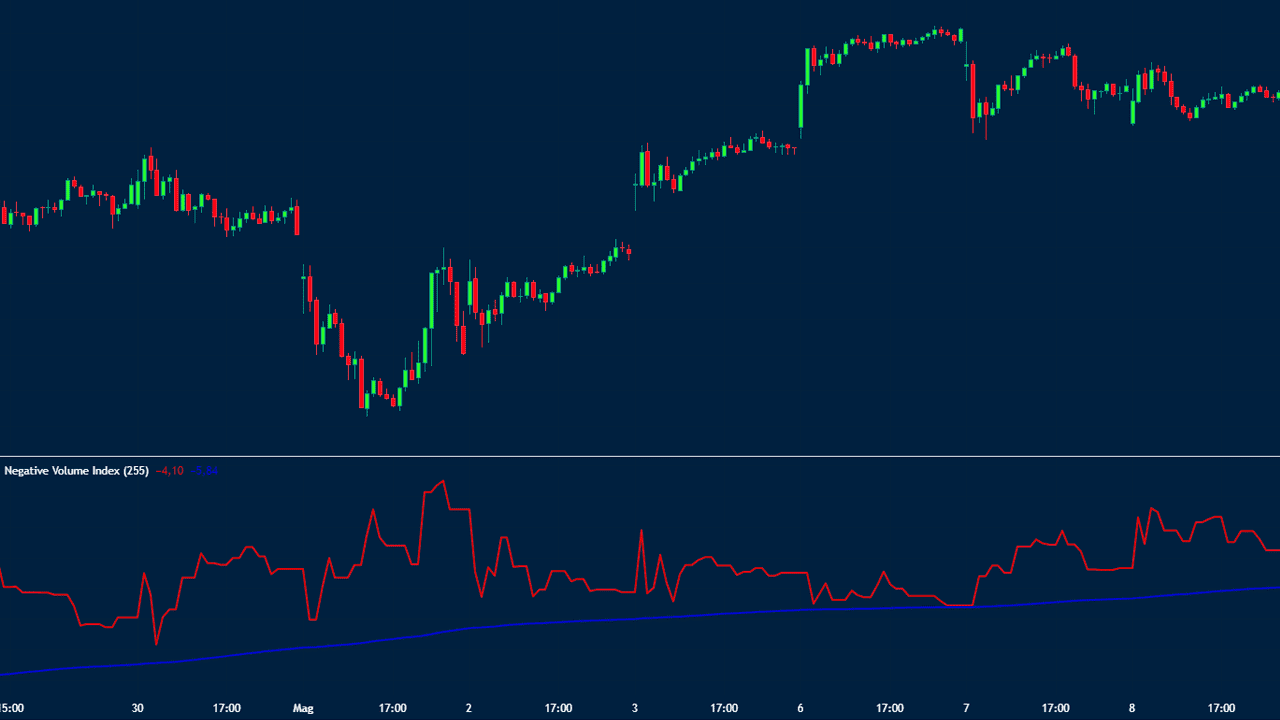

Introduction. Negative volume index ( NVI ) aik technical indicator hai jo trading volume mein tabdeelion ka istemaal karte hue security ki qeemat mein tabdeelion ka andaza lagaata hai. nvi is khayaal par mabni hai ke jab girty hui market mein tijarti hajam barhta hai, to yeh is baat ki nishandahi karta hai ke smart paisa market chore raha hai, aur is terhan, market mein musalsal kami ka imkaan hai. Invention of Negative Volume index. Negtive Volume Index (NVI) ko paal desrat ne 1930 ki dahai mein tayyar kya tha aur 1980 ki dahai mein norman fuss back ki kitaab" stock market logic" ki ashaat ke sath maqboliat haasil ki thi. nvi ka hisaab mojooda din ki ikhtitami qeemat ko pichlle din ki ikhtitami qeemat se taqseem karkay, aur phir is hissa ko din ke hajam se zarb day kar lagaya jata hai. nateejay mein anay wali qader ko pichlle din ke nvi mein shaamil kya jata hai. How to Calculate Negative Volume Indecator (NVI) Agar mojooda din ki ikhtitami qeemat pichlle din ki band qeemat se ziyada hai, to NVI ko adjust nahi kya jata hai. nvi ko aam tor par security ki qeemat ke sath aik chart par plot kya jata hai taakay rujhanaat aur mumkina tabdeelion ki nishandahi ki ja sakay. How to Use Negative Volume Index. Dear traders negative volume index bohat se takneeki isharay mein se sirf aik hai jo taajiron aur sarmaya karon ke zariye stock market ka tajzia karne ke liye istemaal kya jata hai, aur sarmaya kaari ke faislay karne ke liye is par mukammal inhisaar nahi kya jana chahiye aur kisi bhi sarmaya kaari ki hikmat e amli ki terhan, sarmaya kaari ke faislay karne se pehlay mukammal tehqeeq aur tajzia karna bohat zaroori hai aur khusoosi tor par inhisaar nahi kya jana chahiye. tamam takneeki tajzia ke tools ki terhan, yeh ghalat signals ke tabay hai aur bakhabar tijarti faislay karne ke liye usay tajzia ki deegar aqsam, jaisay bunyadi tajzia ke sath mil kar istemaal kya jana chahiye air NVI is bunyaad par mabni hai ke jab tijarti hajam kam hota hai, to smart paisa market mein fa-aal tor par hissa nahi le raha hota hai, aur market par khorda sarmaya karon ka ghalba hota hai jo jazbati faislay karne ka ziyada imkaan rakhtay hain. doosri taraf, jab tijarti hajam ziyada hota hai, to smart paisa market mein fa-aal tor par hissa le raha hota hai, aur market ke ziyada aqli faislon se chalne ka imkaan hota hai aur jab negtive volume index bardh raha hai, to yeh ishara karta hai ke smart paisa hasas khareed raha hai aur jama kar raha hai. jab nvi gir raha hai, to yeh ishara karta hai ke smart paisa hasas ki farokht aur taqseem kar raha hai. NVI mein trading zaroori nahi ke woh khud aik hikmat e amli ho is ke bajaye, yeh aik aisa tool hai jisay dosray isharay ya ishaaron ki tasdeeq ya tazaad ke liye istemaal kya ja sakta hai. jo tajir nvi istemaal karte hain woh aam tor par is ka istemaal deegar takneeki tajzia tools ke sath mil kar karen ge, jaisay moving average, trained lines, ya deegar isharay, tijarat ke liye mumkina dakhlay aur kharji raastoon ki shanakht ke liye. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

TRADING AT NEGATIVE VOLUME INDEX DEFINITION Negative volume Index ek overall indicator hai Jise paul dysart ne 1930s tiyar kiya tha, Jo volume Mein change ka istemal karte hue Yeh decide Karta Hai Ke smart Money kab active hai negative volume index Farz karta hai ke samart money price mein Move Paida Karega stock market logic ke norman fosback ne negative volume index ka compared to uski one year 225 bar moving average Se Kiya jab negative volume index moving average se upar Hota Hai to usne hisab Lagaya ki is baat ka 96 persent chance hai ke bull market Jari hai BACKGROUND AND THEORY NEGATIVE VOLUME INDEX Negative value index Ke Piche Idea yah Hai Ki zyada tijarati volume uninformative traders ka result hai low volatility ke dauran negative volume index zyada change Nahin Hota Hai Kyunki yah ek strong Trends ke bagair Ek sideway markets hai dusri Taraf March 2020 ki Market Mandi ke dauran negative volume index mein izaafa hua hai set up section negative volume index strategy ke Ek version ka analyzes karta hai sharpe ratio risk se adjusted basis par investment ki strategy Ki Karkardgi ki measures karta hai

BACKGROUND AND THEORY NEGATIVE VOLUME INDEX Negative value index Ke Piche Idea yah Hai Ki zyada tijarati volume uninformative traders ka result hai low volatility ke dauran negative volume index zyada change Nahin Hota Hai Kyunki yah ek strong Trends ke bagair Ek sideway markets hai dusri Taraf March 2020 ki Market Mandi ke dauran negative volume index mein izaafa hua hai set up section negative volume index strategy ke Ek version ka analyzes karta hai sharpe ratio risk se adjusted basis par investment ki strategy Ki Karkardgi ki measures karta hai  BULLISH NVI SIGNAL LINE CROSS ya scan Stocks ko zahar karta hai Jahan negative volume index mein apni signal line se upar cross Kiya Hai negative volume index indicator kafi powerful hai negative volume index Hamesha 1,000 ke value se start Hota Hai negative volume Index mein experience se learn aur EMA ko blue color Mein dikhaya gaya hai Jo ke taraki pazie issue ki number aur zaval pazir issue ki numbers Ke Darmiyan mutalik fark ka 25 day ka kal hai aur trading studies ki several types ke volume ko istemal karne mein pesh tha negative volume index main trading zaruri Nahin ke vah Khud Ek hikmat e Amli Ho Uske bajay yah Ek Aisa tool hai jisse dusre Isharay ya Isharon ki tasdeek ke liye istemal Kiya jata hai Jo support and resistance ko understand Hain

BULLISH NVI SIGNAL LINE CROSS ya scan Stocks ko zahar karta hai Jahan negative volume index mein apni signal line se upar cross Kiya Hai negative volume index indicator kafi powerful hai negative volume index Hamesha 1,000 ke value se start Hota Hai negative volume Index mein experience se learn aur EMA ko blue color Mein dikhaya gaya hai Jo ke taraki pazie issue ki number aur zaval pazir issue ki numbers Ke Darmiyan mutalik fark ka 25 day ka kal hai aur trading studies ki several types ke volume ko istemal karne mein pesh tha negative volume index main trading zaruri Nahin ke vah Khud Ek hikmat e Amli Ho Uske bajay yah Ek Aisa tool hai jisse dusre Isharay ya Isharon ki tasdeek ke liye istemal Kiya jata hai Jo support and resistance ko understand Hain

-

#4 Collapse

**Negative Volume Index (NVI) Par Trading Kya Hai?**

Negative Volume Index (NVI) ek technical analysis tool hai jo trading volumes ke changes ko analyze karta hai aur market trends aur signals ko identify karne mein madad karta hai. NVI ka main focus volume ke decrease par hota hai, jo market ke trend direction aur strength ko assess karne ke liye use hota hai. Is post mein, hum NVI ke concept ko samjhenge aur is par trading karne ke faayde aur techniques ko explore karenge.

**Negative Volume Index (NVI) Ka Concept**

Negative Volume Index ka concept simple hai: ye market ke price movements ko volume ke decrease ke context mein analyze karta hai. NVI primarily un days ke volumes ko track karta hai jab trading volume decrease hota hai, yaani ki market ki trading activity kam hoti hai. Ye indicator trader ko market ke true trend aur price direction ko samajhne mein help karta hai.

1. **Calculation**: NVI ko calculate karne ke liye, pehle initial NVI value ko set kiya jata hai, jo typically 1000 hoti hai. Uske baad, jab volume decrease hota hai aur price increase hoti hai, to NVI value ko previous value se add kiya jata hai. Jab volume decrease hota hai aur price decrease hoti hai, to NVI value ko previous value se subtract kiya jata hai.

2. **Trend Confirmation**: NVI indicator market ke long-term trends ko confirm karne mein madad karta hai. Agar NVI increasing trend dikha raha hai, to ye suggest karta hai ke market ka overall trend bullish hai. Agar NVI decreasing trend dikha raha hai, to ye bearish trend ko indicate karta hai.

**Trading With NVI**

1. **Entry Signals**: NVI ka use trading signals generate karne ke liye kiya jata hai. Jab NVI price ke uptrend ko confirm karta hai aur volume decrease hota hai, to ye bullish signal hota hai. Traders is signal ke base par buy orders place kar sakte hain.

2. **Exit Signals**: Jab NVI price ke downtrend ko confirm karta hai aur volume decrease hota hai, to ye bearish signal hota hai. Traders is signal ke base par sell orders place kar sakte hain aur apni positions ko exit kar sakte hain.

3. **Complementary Use**: NVI ko other indicators ke sath combine karke use kiya jata hai, jaise Moving Averages aur RSI. Is combination se traders ko more accurate trading signals aur market trends ki confirmation milti hai.

**Conclusion**

Negative Volume Index (NVI) ek valuable technical indicator hai jo trading volumes ke changes ko analyze karke market trends aur signals ko identify karta hai. Accurate NVI analysis aur proper risk management ke sath, traders market ke true trends ko capture kar sakte hain aur informed trading decisions le sakte hain. NVI ko effectively use karke, aap trading strategy ko enhance kar sakte hain aur market movements ka better insight hasil kar sakte hain.

-

#5 Collapse

Trading at negative volume" ka concept technical terms mein directly exist nahi karta. Lekin agar aapka matlab hai ke volume decrease ho raha hai ya trading activity kam ho rahi hai, toh iska matlab yeh ho sakta hai ke market mein liquidity ya interest kam ho raha hai.

Volume financial markets mein ek important indicator hota hai jo dikhata hai ke ek specific stock ya asset kitni baar trade hua hai. Agar volume gir raha hai, toh iska matlab yeh ho sakta hai ke ya toh price ke movements pe confidence kam hai ya market mein uncertainty hai.

Agar aap kisi aur specific situation ya concept ke baare mein pooch rahe hain, toh please clarify karen taake main aapko behtar samjha sakoon.

Volume trading ke analysis mein ek key factor hota hai. Jab aap "negative volume" ka zikr karte hain, toh aap shayad decreasing volume ya low volume ke baare mein baat kar rahe hain. Iska matlab yeh hota hai ke trading activity mein kami aa rahi hai.

Volume ka girna ya low volume indicate kar sakta hai ke:

Market Interest Mein Kami: Jab volume low hota hai, toh iska matlab hota hai ke fewer buyers aur sellers market mein hain. Yeh condition market ki strength ya trend ke continuation par sawaal uthata hai.

Trend Reversal: Low volume ke saath agar price movement ho rahi hai, toh yeh ek weak trend ya potential reversal ka signal de sakti hai. Strong trends typically higher volumes ke saath aate hain.

Market Consolidation: Jab volume low hota hai, market consolidation phase mein ho sakta hai jahan buyers aur sellers ek narrow range mein trade kar rahe hote hain, price ek tight range mein move karta hai.

False Breakouts: Agar ek breakout low volume par hota hai, toh yeh false breakout ho sakta hai, jisme trend sustain nahin karta. High volume ke saath breakouts zyada reliable hote hain.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Negative Volume Index (NVI) ek technical indicator hai jo trading ke liye price movements ko samajhne mein madad karta hai jab market volume ghat rahi hoti hai. Iska istemal zyada tar long-term investors aur traders karte hain jo trend-following strategies use karte hain. NVI ka concept pehli baar Paul Dysart ne 1930s mein develop kiya tha, aur baad mein Norman Fosback ne is theory ko popular banaya. NVI ka basic principle yeh hai ke jab market ka volume ghatta hai (negative volume days), to smart money—yaani experienced aur well-informed investors—market mein kaam karte hain. Dusri taraf, jab market ka volume badhta hai, to yeh aam logon (retail investors) ki activity ka reflection hota hai jo mostly herd mentality se influenced hoti hai. NVI ke zariye traders yeh andaza lagane ki koshish karte hain ke low-volume days par price movements ka kya impact ho sakta hai, aur kaun se trends continue ya reverse ho sakte hain.

Negative Volume Index ek aisa indicator hai jo sirf un dino ka analysis karta hai jab market ka volume pichle din ke muqablay mein kam hota hai. Jab volume ghatta hai, to NVI price changes ka account karta hai, lekin jab volume badhta hai to NVI koi changes nahi karta. Iska basic logic yeh hai ke jab market mein volume kam hoti hai, to professional aur well-informed traders zyada active hote hain, aur market ke price movements ko zyada effectively drive karte hain.

Agar NVI ka value increase hota hai, to iska matlab hai ke smart money market mein buying kar rahi hai, aur agar NVI decrease hota hai to iska matlab yeh hai ke smart money market se nikal rahi hai ya selling kar rahi hai.

Key Points- NVI sirf low-volume days ke price movements ko focus karta hai.

- NVI smart money ka reflection hota hai jab market volume ghat rahi hoti hai.

- High-volume days (jab volume badhti hai) ko NVI ignore karta hai.

- Starting Value of NVI: Pehle din ke liye NVI ka initial value 1000 set ki jati hai.

- Daily Calculation: Har din ke liye aap check karte hain ke aaj ka volume pichle din ke volume se kam hai ya nahi.

- Agar volume kam hai, to aap upar diya gaya formula use karte hain aur NVI ka value update karte hain.

- Agar volume zyada hai, to aap NVI ko unchanged rehte dete hain.

Samjhte hain ke aap ek stock ka analysis kar rahe hain jiska pichle kuch din ka data yeh hai:- Day 1: Closing Price: $50, Volume: 200,000

- Day 2: Closing Price: $52, Volume: 180,000 (Volume kam hua)

- Day 3: Closing Price: $51, Volume: 250,000 (Volume zyada hua)

- Day 4: Closing Price: $53, Volume: 170,000 (Volume kam hua)

- Day 5: Volume pichle din se zyada hai, to NVI unchanged rahega:

- Day 6: Volume pichle din se kam hai, to NVI update hoga:

NVI ki Interpretation

NVI ko interpret karna relatively simple hota hai agar aap price action aur volume ka analysis karna jaante hain. NVI ke indicator ko zyada tar trend confirmation aur reversals identify karne ke liye use kiya jata hai. Iska best use tab hota hai jab aap isse kisi aur indicator ke saath combine karte hain, jaise ke Positive Volume Index (PVI) ya Moving Averages.

Bullish Signals (Positive Trend Confirmation)

Agar NVI consistently increase hota hai, to yeh indicate karta hai ke smart money market mein buying kar rahi hai aur trend bullish hai. Iska matlab yeh hota hai ke price bhi aage chalkar upar ja sakta hai, aur aap long position le sakte hain.

Bearish Signals (Negative Trend Confirmation)

Agar NVI consistently decline hota hai, to iska matlab yeh hota hai ke smart money market se exit kar rahi hai, aur yeh ek bearish signal ho sakta hai. Aise mein aap short position le sakte hain ya apne existing longs ko cut kar sakte hain.

Trend Confirmation with Moving Averages

NVI ka comparison moving averages ke saath kiya jata hai. Agar NVI apne 255-day moving average se upar trade kar raha hai, to yeh bullish signal hai aur trend upward ho sakta hai. Agar NVI apne 255-day moving average se neeche hota hai, to yeh bearish trend ka signal ho sakta hai.

Is tarah NVI ko long-term trend-following strategies ke liye use kiya jata hai, aur iska best use tab hota hai jab aap isse doosre technical indicators ke saath combine karte hain.

NVI aur PVI ka Comparison

Jaisa ke maine pehle mention kiya, Negative Volume Index (NVI) ka focus low-volume days par hota hai, jabke Positive Volume Index (PVI) ka focus high-volume days par hota hai. Dono indicators ka combination use karke aap market ke different phases ko better samajh sakte hain.- NVI: Jab market volume ghatta hai, to NVI ka use hota hai. Yeh smart money ke behavior ko reflect karta hai.

- PVI: Jab market volume badhta hai, to PVI ka use hota hai. Yeh aam logon (retail traders) ke behavior ko reflect karta hai.

Agar NVI aur PVI dono ek hi direction mein move karte hain (upar ya neeche), to yeh strong trend ka indication ho sakta hai. Agar NVI aur PVI opposite direction mein move kar rahe hain, to yeh market mein indecision ya trend reversal ka signal ho sakta hai.

NVI ko Trading Strategies mein Kaise Use Karein

Ab hum baat karte hain ke aap NVI ko apni trading strategies mein kaise incorporate kar sakte hain. NVI ka istemal zyada tar trend-following aur trend-confirmation ke liye hota hai. Yeh aapko market ke lambe trends ko identify karne mein madad deta hai, aur aapko yeh samajhne mein madad karta hai ke market ka direction kahan ja raha hai.

1. Trend Confirmation

NVI ka sabse zyada effective use trend confirmation ke liye hota hai. Agar NVI aur price dono increase kar rahe hain, to yeh ek confirmation hota hai ke trend bullish hai. Aap apne existing long trades ko hold kar sakte hain ya naye longs enter kar sakte hain.

2. Trend Reversals

Agar NVI continuously decline kar raha hai lekin price upar ja raha hai, to yeh divergence ka signal ho sakta hai, jo indicate karta hai ke trend reverse ho sakta hai. Aap is situation mein apne existing longs ko exit kar sakte hain ya short positions le sakte hain.

3. Moving Average Crossover

NVI ka use moving averages ke saath karna ek popular strategy hai. Agar NVI apne 255-day moving average ke upar cross karta hai, to yeh bullish signal hota hai, aur agar neeche cross karta hai to yeh bearish signal hota hai.

4. Combination with Other Indicators

NVI ko kisi aur indicator ke saath combine karke zyada accurate signals generate kiye ja sakte hain. Jaise ke Relative Strength Index (RSI), Moving Averages, ya Bollinger Bands ke saath use karna.

Negative Volume Index (NVI) ek powerful tool hai jo smart money ke market mein behavior ko track karne mein madad karta hai, khaaskar jab market volume ghat rahi hoti hai. Yeh indicator traders ko long-term trends ko samajhne aur trade karne mein madad deta hai. Agar aap ek trend-following strategy use karte hain, to NVI aapko market ke lambe aur sustainable trends ko identify karne mein kaafi helpful ho sakta hai.

Trading mein NVI ka use karte waqt aapko isse aur doosre indicators ke saath compare karna chahiye taki aapke trading signals zyada reliable ho sakein. Diversification aur proper risk management ke saath agar NVI ka sahara liya jaye to aap trading mein better decisions le sakte hain aur apni success ka chance barha sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#7 Collapse

Trading at Negative Volume Index:

Negative Volume Index (NVI) ek ahem technical indicator hai jo traders ko market ke volume ke sath price movements samajhne mein madad deta hai. Yeh indicator un periods ko highlight karta hai jab trading volume kam hoti hai, lekin price movement mein koi ahmiyat hoti hai. Roman Urdu mein yeh samjhaane ki koshish karte hain ke Negative Volume Index kya hai, iska kaise use hota hai aur trading mein iska kya role hai.

1. Negative Volume Index Kya Hai?

Negative Volume Index (NVI) ka concept yeh hai ke jab market mein volume kam hota hai, lekin price still move karta hai, to smart money ya institutional investors is waqt market mein shamil hotay hain. Iska matlab yeh hota hai ke low-volume days mein bhi price ki movement ko nazarandaz nahi karna chahiye, kyunki yeh bohot ahmiyat rakh sakti hai.

Jab volume girta hai aur price move karta hai, to Negative Volume Index is movement ko capture karta hai. Agar NVI barh raha ho, to iska matlab hota hai ke price mein upward movement ki possibility hai, chahay market volume kam ho. Iske baraks, agar NVI gir raha ho, to yeh bearish sign hota hai.

2. Negative Volume Index Ko Kaise Calculate Karte Hain?

NVI ko calculate karna itna mushkil nahi hai. Simple terms mein, agar aaj ka volume kal ke volume se kam hai, to NVI mein change hota hai. Agar volume kam hai lekin price barh raha hai, to NVI mein increase hota hai, aur agar price gir raha hai to NVI mein decrease hota hai. Is process ko bar bar follow karke hum ek continuous NVI line draw karte hain, jo price movements ke sath fluctuate karti hai.

Formula kuch is tarah hota hai:- Agar aaj ka volume kal ke volume se kam hai, to:

NVI = NVI(previous) + [(Price Change % × NVI(previous)] - Agar volume barabar ya zyada ho, to:

NVI(previous) = NVI(today) (yani koi change nahi hota)

NVI ko aksar traders long-term trends identify karne ke liye use karte hain. Yeh indicator un periods mein bohot effective hota hai jab market mein low volume hoti hai, aur traders ko pata nahi hota ke price ki movement ka kya matlab hai. NVI aapko yeh batata hai ke low-volume periods mein bhi price movement ko ignore nahi karna chahiye, kyunki smart money ki shamilat hoti hai.

Agar NVI ka level barh raha hai, to yeh bullish sign hota hai, jo yeh darshaata hai ke price barhne wala hai, chahay volume kam ho. Iska matlab yeh hai ke aapko buying ka opportunity dekhna chahiye. Agar NVI gir raha hai, to yeh bearish signal hota hai, jo yeh darshaata hai ke price gir sakta hai.

4. NVI Ko Dosre Indicators Ke Sath Combine Karna

Negative Volume Index akela hi trading decision lene ke liye kafi nahi hota. Isko aksar dosre technical indicators ke sath mila kar use kiya jata hai, jaise ke Moving Averages, Relative Strength Index (RSI), aur MACD. Is combination ka faida yeh hota hai ke aap market ke price aur volume ka ek clear picture dekh sakte hain.

Agar NVI ka indicator aur RSI dono bullish signal de rahe hain, to yeh ek strong buying opportunity hoti hai. Isi tarah, agar NVI aur Moving Average crossover ho jata hai, to aapko price reversal ka idea ho sakta hai.

5. Risk Aur Caution

Forex ya stock market mein trading hamesha risk ke sath hoti hai. Negative Volume Index ek useful tool hai, lekin hamesha accurate nahi hota. Market bohot si unexpected cheezon par react karti hai, aur sirf NVI par depend karna aapko nuksan de sakta hai. Isliye, aapko hamesha dosre indicators aur market analysis ka sahara lena chahiye.

Conclusion

Negative Volume Index ek ahem indicator hai jo low-volume market periods mein price movement ko analyze karne mein madad deta hai. Yeh aapko smart money ka signal deta hai aur low volume days ke dauran trading decision lene mein madadgar sabit hota hai. Magar hamesha yaad rahein ke trading mein koi bhi indicator akela kaafi nahi hota, isliye isko dosre analysis tools ke sath combine karna zaroori hai.

- Agar aaj ka volume kal ke volume se kam hai, to:

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

Trading at Negative Volume Index

Negative Volume Index Ka Taaruf

Negative Volume Index (NVI) ek aisa technical analysis tool hai jo market ke volume aur price movements ko analyze karta hai. Yeh indicator khas taur par volume ke fluctuations par focus karta hai. NVI ka maqsad yeh hai ke market trends aur potential price changes ko identify kiya ja sake. Iska basic principle yeh hai ke jab trading volume kam hota hai, tab market ke price movements zyada meaningful aur reliable hotay hain.

NVI Kaise Kaam Karta Hai?

NVI ka calculation kaafi simple hai. Isme ek baseline set ki jati hai jo ke pehle trading day ke volume par depend karti hai. Har agle trading day ke liye, agar volume pehle din ke volume se kam hota hai, to NVI ko previous value ke saath add kar diya jata hai. Agar volume zyada hota hai, to NVI ko unchanged rakha jata hai. Yeh process aapko market ke trends aur investor sentiment ko samajhne mein madad karta hai.

NVI Aur Market Trends

NVI ko use karke aap market ke bullish aur bearish trends ko identify kar sakte hain. Jab NVI steadily increase karta hai, to yeh bullish trend ko indicate karta hai. Iska matlab hai ke market mein positive sentiment hai aur price levels increase hone ke chances hain. Iske opposite, agar NVI decrease kar raha hai, to yeh bearish trend ko indicate karta hai aur price levels ke girne ke chances hote hain.

Negative Volume Index Ka Analysis

NVI ka analysis karte waqt, aapko kuch key factors par dhyan dena zaroori hai. Pehla factor yeh hai ke NVI ka trend aur price trend ke beech correlation ko samajhna. Jab NVI aur price trends align karte hain, to yeh confirmation hota hai ke market trend ke saath sahi direction mein move karna chahiye. Agar NVI aur price trends opposite directions mein move kar rahe hain, to yeh ek divergence ko indicate karta hai jo market ke potential reversal ki indication ho sakta hai.

NVI Ke Saath Other Indicators Ka Use

NVI ko apne trading strategy mein integrate karna kaafi beneficial ho sakta hai agar aap ise other indicators ke saath use karein. Jaise ke Moving Averages, Relative Strength Index (RSI), aur Moving Average Convergence Divergence (MACD) ko combine karke aap apne trading decisions ko aur zyada accurate bana sakte hain. Moving Averages aapko market ke long-term trends ko samajhne mein madad dete hain, jabke RSI aur MACD short-term momentum aur price changes ko measure karte hain. In indicators ka combination aapko better trading signals aur risk management strategies provide kar sakta hai.

NVI Ki Limitations

Jab ke NVI ek powerful tool hai, lekin iski kuch limitations bhi hain. Sabse pehli limitation yeh hai ke NVI volume ke changes ko hi consider karta hai aur price movements ko directly reflect nahi karta. Iska matlab hai ke NVI alone se market ka complete picture nahi milta. Aapko isse combine karke other technical indicators aur fundamental analysis use karna chahiye taake aapke trading decisions zyada informed aur accurate ho.

Dusri limitation yeh hai ke NVI ko short-term fluctuations aur noise se bhi effect ho sakta hai. Jab market mein sudden changes aati hain, to NVI ko adjust karna thoda challenging ho sakta hai. Isliye, long-term trends ko analyze karte waqt, NVI ka use zyada effective hota hai.

NVI Ko Trading Strategy Mein Integrate Karna

Agar aap apni trading strategy mein NVI ko include karna chahte hain, to sabse pehle aapko apni trading goals aur market conditions ko samajhna zaroori hai. NVI ko ek standalone indicator ke taur par use karna bhi possible hai, lekin jab aap ise combine karte hain other indicators ke saath, to aapko zyada accurate aur reliable trading signals mil sakte hain.

Conclusion

Negative Volume Index ek valuable tool hai jo aapko market ke volume aur price movements ko analyze karne mein madad karta hai. Iska use karke aap market trends ko identify kar sakte hain aur apne trading decisions ko improve kar sakte hain. Lekin, NVI ka effective use karne ke liye, aapko iski limitations ko bhi samajhna hoga aur ise other technical indicators ke saath combine karna hoga. Is tarah se aap apni trading strategy ko enhance kar sakte hain aur market ke changes se better cope kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:26 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим