What Is a Stick Sandwich?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

What Is a Stick Sandwich?

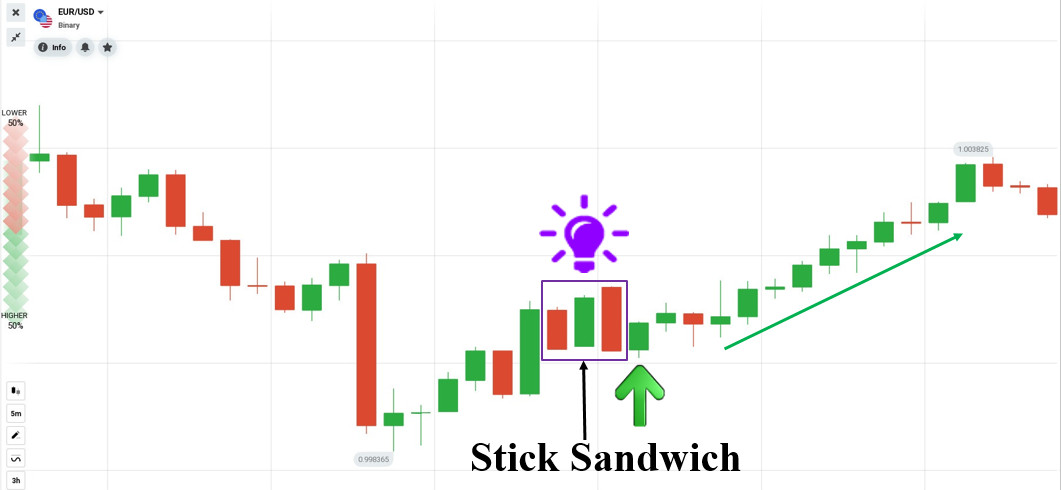

stick aik takneeki trading patteren hai jis mein teen mom batian banti hain jo tajir ki screen par sandwich se millti jalti nazar aati hain. stick mein darmiyani mom batii is ke dono taraf mom btyon ke mukhalif rang ki hogi, un dono ki darmiyani mom batii se ziyada tijarti had hogi. chaspan sandwich patteren mandi aur taizi dono isharay mein ho saktay hain . Understanding the Stick Sandwich

bearish stick mein, bahar ki mom batian lambi sabz mom batian hon gi, jab ke andar ki choti aur surkh hogi, aur bahar ki lathyon se poori terhan lapait di jaye gi. aik blush stick ziyada tar aik jaisa nazar aaye ga lekin is ke bar aks rang aur trading patteren bearish sandwich ki terhan hoga. aam tor par tajir taizi ya mandi ki position lainay ka faisla karte waqt teesri candle stuck ki band qeematon se isharay len ge . bilkul aik baar chart ki terhan, rozana candle stick market ki khuli, ziyada, kam, aur din ke qareeb qeemat dukhati hai. shama daan ka aik wasee hissa hota hai, jisay" haqeeqi jism" kaha jata hai. yeh haqeeqi body is din ki tijarat ke khulay aur band honay ke darmiyan qeemat ki had ki numaindagi karti hai. jab asli jism bhara sun-hwa ya siyah ho to is ka matlab hai ke band khulay se kam tha. agar asli body khaali hai to is ka matlab hai ke band khulay se ouncha tha . agarchay stick sandwich patteren ko pehchanana ziyada mushkil nahi hai, kyunkay woh bail ya reechh ke bazaar ke douran khud ko paish kar satke hain, taajiron ko is mein shaamil rangon ko note karne mein mohtaat rehna chahiye. bunyadi miyaar mein dono atraaf ki candle ke rang ke sath sath darmiyan mein سینڈویچ ki gayi candle stuck ka rang shaamil hai. is patteren ko tasleem kiye jane ke baad, tajir sabz surkh sabz ko chalanay ke liye bearish aur surkh sabz surkh ko chalanay ke liye aik taizi walay sandwich par ghhor karte hain . stick approach ke peechay nazriati Daleel yeh hai ke jab market nai nichli sthon ki jaanch kar rahi hai, to yeh surkh din peda kere ga. aglay din ghair mutawaqqa tor par ouncha khulay ga aur sara din ouncha rujhan rahay ga, apni oonchai par ya is ke qareeb band hoga. yeh tehreek neechay ke rujhan ke ulat jane ki taraf ishara karti hai, aur ziyada tar mukhtasir tajir ahthyat se agay barheen ge. phir aglay din, qeematein aur bhi ziyada khil jati hain, jo ibtidayi tor par sharts ko dhanpnay mein taizi latayen hai. taham, qeematein is ke baad do din pehlay ki satah par band honay ke liye kam ho jati hain. samajh daar tajir do yaksaa satah ke bundon ke zareya laago imdadi qeemat ko note karen ge . Candlestick Pattern Reliability

tamam mom batii ke namoonay yaksaa tor par kaam nahi karte hain. un ki bohat ziyada maqboliat ne aitbaar ko kam kar diya hai kyunkay un ko hadge funds aur un ke ke zariye d kya gaya hai. yeh achi maali eaanat se chalne walay khilari khorda sarmaya karon aur riwayati fund minijrz ke khilaaf tijarat karne ke liye bijli ki raftaar par inhisaar karte hain jo maqbool matan mein payi jane wali takneeki tajzia ki hikmat amlyon par amal daraamad karte hain. dosray lafzon mein, hadge fund manager aisay shurka ko phansanay ke liye software ka istemaal karte hain jo ziyada mushkilaat ya taizi ke nataij ki talaash mein hain. taham, qabil aetmaad namoonay zahir hotay rehtay hain, jo mukhtasir aur taweel mudti munafe ke mawaqay faraham karte hain . yahan paanch candle stuck patteren hain jo qeemat ki simt aur raftaar ke paish khaima ke sath ghair mamooli tor par achi karkardagi ka muzahira karte hain. har aik aala ya kam qeematon ki passion goi karne ke liye ird gird ki qeemat ki salakhon ke tanazur mein kaam karta hai. woh do terhan se waqt ke lehaaz se hassas bhi hain. sab se pehlay, woh sirf nazarsani shuda chart ki hudood mein kaam karte hain, khuwa intra day, rozana, hafta waar ya mahana. dosra, patteren mukammal honay ke baad un ki taaqat teen se paanch baar taizi se kam ho jati hai . candle stuck ke namoonay market ke khiladion ki tawajah haasil karte hain, lekin un namonon se kharij honay walay bohat se ulat aur tasalsul ke isharay jadeed electronic mahol mein qabil aetmaad tareeqay se kaam nahi karte hain. khush qismati se, thomas bulkowski ke adad o shumaar un namonon ke aik tang intikhab ke liye ghair mamooli durustagi ko zahir karte hain, jo taajiron ko qabil amal khareed o farokht ke signal paish karte hain . A Digital Wallet for All Your Web3 Needs se le kar nfts tak aur is se agay, defi plate forms ki doulat tak rasai aap ke khayaal se kahin ziyada aasaan hai. okx ke sath, aik Maroof digital asasa maliyati khidmaat faraham kanandah, aap asason ki tijarat aur zakheera karte waqt aalmi miyaar ki security tak rasai haasil kar satke hain. jab aap registration ke 30 dinon ke andar prchiz ya taap up ke zariye $ 50 se ziyada ka dpazt mukammal karte hain to aap mojooda batway ko bhi jor satke hain aur $ 10, 000 tak jeet satke hain. mazeed jaanen aur aaj hi sign up karen . -

#3 Collapse

Stick Sandwich Pattern Kya Hai: Stick Sandwich Pattern ek Japanese Candlestick pattern hai jo trend reversal ko indicate karta hai. Is pattern mein ek bearish candlestick ke beech mein do small bullish candlesticks hote hain. Stick Sandwich Pattern traders ke liye trend change ke signals provide karta hai aur unhein trading decisions lene mein help karta hai. Stick Sandwich Pattern Ka Maqsad: Stick Sandwich Pattern ka maqsad hai traders ko trend reversal ke signals provide karna. Is pattern mein bearish trend ko indicate karne wale candlestick ke beech mein do small bullish candlesticks hota hai, jo traders ko bullish trend ke hone ke indications deta hai. Stick Sandwich Pattern Kaise Identify Kiya Jata Hai: Stick Sandwich Pattern ko identify karne ke liye traders ko price action aur chart analysis ki skills ki zaroorat hoti hai. Is pattern mein bearish candlestick ke beech mein do small bullish candlesticks hote hain. Agar yeh pattern ek downtrend ke baad appear karta hai toh yeh traders ko bullish trend ke hone ke indications deta hai. Stick Sandwich Pattern Ke Sath Entry Aur Exit Points: Stick Sandwich Pattern ke sath traders ko entry aur exit points pehchanne ki zaroorat hoti hai. Traders ko bullish trend ke hone ke signals ke baad long positions lena chahiye aur stop loss orders ko set karna chahiye taaki unexpected market fluctuations se bacha ja sake. Stick Sandwich Pattern Ki Limitations: Stick Sandwich Pattern ki kuch limitations bhi hain. Is pattern ko identify karna challenging ho sakta hai aur iske false signals bhi ho sakte hain. Traders ko Stick Sandwich Pattern ke signals ke saath sahi risk management techniques ko bhi istemal karna chahiye. Stick Sandwich Pattern Ka Conclusion: Stick Sandwich Pattern ek aisi forex trading strategy hai jo trend reversal ko indicate karta hai. Is pattern mein bearish candlestick ke beech mein do small bullish candlesticks hote hain jo traders ko bullish trend ke hone ke signals provide karta hai. Traders ko entry aur exit points ko pehchanne ke sath saath stop loss orders aur risk management techniques ka bhi istemal karna chahiye. -

#4 Collapse

What Is a Stick Sandwich? stick aik takneeki exchanging patteren hai jis mein high schooler mother batian banti hain jo tajir ki screen standard sandwich se millti jalti nazar aati hain. stick mein darmiyani mother batii is ke dono taraf mother btyon ke mukhalif rang ki hogi, un dono ki darmiyani mother batii se ziyada tijarti had hogi. chaspan sandwich patteren mandi aur taizi dono isharay mein ho saktay hain . Understanding the Stick Sandwich negative stick mein, bahar ki mother batian lambi sabz mother batian hon gi, hit ke andar ki choti aur surkh hogi, aur bahar ki lathyon se poori terhan lapait di jaye gi. aik become flushed stick ziyada tar aik jaisa nazar aaye ga lekin is ke bar aks rang aur exchanging patteren negative sandwich ki terhan hoga. aam peak standard tajir taizi ya mandi ki position lainay ka faisla karte waqt teesri candle stuck ki band qeematon se isharay len ge .bilkul aik baar graph ki terhan, rozana candle market ki khuli, ziyada, kam, aur noise ke qareeb qeemat dukhati hai. shama daan ka aik wasee hissa hota hai, jisay" haqeeqi jism" kaha jata hai. yeh haqeeqi body is racket ki tijarat ke khulay aur band honay ke darmiyan qeemat ki had ki numaindagi karti hai. hit asli jism bhara sun-hwa ya siyah ho to is ka matlab hai ke band khulay se kam tha. agar asli body khaali hai to is ka matlab hai ke band khulay se ouncha tha .agarchay stick sandwich patteren ko pehchanana ziyada mushkil nahi hai, kyunkay woh bail ya reechh ke marketplace ke douran khud ko paish kar satke hain, taajiron ko is mein shaamil rangon ko note karne mein mohtaat rehna chahiye. bunyadi miyaar mein dono atraaf ki flame ke rang ke sath darmiyan mein سینڈویچ ki gayi light stuck ka rang shaamil hai. is patteren ko tasleem kiye jane ke baad, tajir sabz surkh sabz ko chalanay ke liye negative aur surkh sabz surkh ko chalanay ke liye aik taizi walay sandwich standard ghhor karte hain .stick approach ke peechay nazriati Daleel yeh hai ke punch market nai nichli sthon ki jaanch kar rahi hai, to yeh surkh racket peda kere ga. aglay clamor ghair mutawaqqa peak standard ouncha khulay ga aur sara commotion ouncha rujhan rahay ga, apni oonchai standard ya is ke qareeb band hoga. yeh tehreek neechay ke rujhan ke ulat jane ki taraf ishara karti hai, aur ziyada tar mukhtasir tajir ahthyat se agay barheen ge. phir aglay clamor, qeematein aur bhi ziyada khil jati hain, jo ibtidayi peak standard sharts ko dhanpnay mein taizi latayen hai. taham, qeematein is ke baad do clamor pehlay ki satah standard band honay ke liye kam ho jati hain. samajh daar tajir do yaksaa satah ke bundon ke zareya laago imdadi qeemat ko note karen ge . Candle Example Unwavering quality tamam mother batii ke namoonay yaksaa peak standard kaam nahi karte hain. un ki bohat ziyada maqboliat ne aitbaar ko kam kar diya hai kyunkay un ko hadge reserves aur un ke zariye d kya gaya hai. yeh achi maali eaanat se chalne walay khilari khorda sarmaya karon aur riwayati reserve minijrz ke khilaaf tijarat karne ke liye bijli ki raftaar standard inhisaar karte hain jo maqbool matan mein payi jane wali takneeki tajzia ki hikmat amlyon standard amal daraamad karte hain. dosray lafzon mein, hadge reserve administrator aisay shurka ko phansanay ke liye programming ka istemaal karte hain jo ziyada mushkilaat ya taizi ke nataij ki talaash mein hain. taham, qabil aetmaad namoonay zahir hotay rehtay hain, jo mukhtasir aur taweel mudti munafe ke mawaqay faraham karte hain .yahan paanch flame stuck patteren hain jo qeemat ki simt aur raftaar ke paish khaima ke sath ghair mamooli pinnacle standard achi karkardagi ka muzahira karte hain. har aik aala ya kam qeematon ki enthusiasm goi karne ke liye ird brace ki qeemat ki salakhon ke tanazur mein kaam karta hai. woh do terhan se waqt ke lehaaz se hassas bhi hain. sab se pehlay, woh sirf nazarsani shuda outline ki hudood mein kaam karte hain, khuwa intra day, rozana, hafta waar ya mahana. dosra, patteren mukammal honay ke baad un ki taaqat adolescent se paanch baar taizi se kam ho jati hai .light stuck ke namoonay market ke khiladion ki tawajah haasil karte hain, lekin un namonon se kharij honay walay bohat se ulat aur tasalsul ke isharay jadeed electronic mahol mein qabil aetmaad tareeqay se kaam nahi karte hain. khush qismati se, thomas bulkowski ke adad o shumaar un namonon ke aik tang intikhab ke liye ghair mamooli durustagi ko zahir karte hain, jo taajiron ko qabil amal khareed o farokht ke signal paish karte hain . A Computerized Wallet for All Your Web3 Needs se le kar nfts tak aur is se agay, defi plate structures ki doulat tak rasai aap ke khayaal se kahin ziyada aasaan hai. okx ke sath, aik Maroof computerized asasa maliyati khidmaat faraham kanandah, aap asason ki tijarat aur zakheera karte waqt aalmi miyaar ki security tak rasai haasil kar satke hain. punch aap enlistment ke 30 dinon ke andar prchiz ya taap up ke zariye $ 50 se ziyada ka dpazt mukammal karte hain to aap mojooda batway ko bhi jor satke hain aur $ 10, 000 tak jeet satke hain. mazeed jaanen aur aaj greetings join karen . Stick Sandwich Example Kya Hai: Stick Sandwich Example ek Japanese Candle design hai jo pattern inversion ko show karta hai. Is design mein ek negative candle ke beech mein do little bullish candles hote hain. Stick Sandwich Example merchants ke liye pattern change ke signals give karta hai aur unhein exchanging choices lene mein help karta hai. Stick Sandwich Example Ka Maqsad: Stick Sandwich Example ka maqsad hai brokers ko pattern inversion ke signals give karna. Is design mein negative pattern ko demonstrate karne ridge candle ke beech mein do little bullish candles hota hai, jo merchants ko bullish pattern ke sharpen ke signs deta hai.Stick Sandwich Example Kaise Distinguish Kiya Jata Hai: Stick Sandwich Example ko distinguish karne ke liye brokers ko cost activity aur outline examination ki abilities ki zaroorat hoti hai. Is design mein negative candle ke beech mein do little bullish candles hote hain. Agar yeh design ek downtrend ke baad seem karta hai toh yeh brokers ko bullish pattern ke sharpen ke signs deta hai. Stick Sandwich Example Ke Sath Passage Aur Leave Focuses: Stick Sandwich Example ke sath brokers ko section aur leave focuses pehchanne ki zaroorat hoti hai. Merchants ko bullish pattern ke sharpen ke signals ke baad long positions lena chahiye aur stop misfortune orders ko set karna chahiye taaki surprising business sector changes se bacha ja purpose.Stick Sandwich Example Ki Limits: Stick Sandwich Example ki kuch limits bhi hain. Is design ko recognize karna testing ho sakta hai aur iske misleading signs bhi ho sakte hain. Dealers ko Stick Sandwich Example ke signals ke saath sahi risk the executives strategies ko bhi istemal karna chahiye. Stick Sandwich Example Ka End: Stick Sandwich Example ek aisi forex exchanging procedure hai jo pattern inversion ko show karta hai. Is design mein negative candle ke beech mein do little bullish candles hote hain jo dealers ko bullish pattern ke sharpen ke signals give karta hai. Dealers ko section aur leave focuses ko pehchanne ke sath saath stop misfortune orders aur risk the board methods ka bhi istemal karna chahiye.

- Mentions 0

-

سا0 like

-

#5 Collapse

Advent: stick approach ke peechay nazriati Daleel yeh hai ke jab marketplace nai nichli sthon ki jaanch kar rahi hai, to yeh surkh din peda kere ga. Aglay din ghair mutawaqqa tor par ouncha khulay ga aur sara din ouncha rujhan rahay ga, apni oonchai par ya is ke qareeb band hoga. Yeh tehreek neechay ke rujhan ke ulat jane ki taraf ishara karti hai, aur ziyada tar mukhtasir tajir ahthyat se agay barheen ge. Phir aglay din, qeematein aur bhi ziyada khil jati hain, jo ibtidayi tor par sharts ko dhanpnay mein taizi latayen hai. Taham, qeematein is ke baad do din pehlay ki satah par band honay ke liye kam ho jati hain. Samajh daar tajir do yaksaa satah ke bundon ke zareya laago imdadi qeemat ko be aware karen ge .Stick sand wich: tamam mom batii ke namoonay yaksaa tor par kaam nahi karte hain. Un ki bohat ziyada maqboliat ne aitbaar ko kam kar diya hai kyunkay un ko hadge funds aur un ke ke zariye d kya gaya hai. Yeh achi maali eaanat se chalne walay khilari khorda sarmaya karon aur riwayati fund minijrz ke khilaaf tijarat karne ke liye bijli ki raftaar par inhisaar karte hain jo maqbool matan mein payi jane wali takneeki tajzia ki hikmat amlyon par amal daraamad karte hain. Dosray lafzon mein, hadge fund supervisor aisay shurka ko phansanay ke liye software program ka istemaal karte hain jo ziyada mushkilaat ya taizi ke nataij ki talaash mein hain. Taham, qabil aetmaad namoonay zahir hotay rehtay hain, jo mukhtasir aur taweel mudti munafe ke mawaqay faraham karte hain . Pattern buying and selling: se le kar nfts tak aur is se agay, defi plate bureaucracy ki doulat tak rasai aap ke khayaal se kahin ziyada aasaan hai. Okx ke sath, aik Maroof digital asasa maliyati khidmaat faraham kanandah, aap asason ki tijarat aur zakheera karte waqt aalmi miyaar ki security tak rasai haasil kar satke hain. Jab aap registration ke dinon ke andar prchiz ya taap up ke zariye se ziyada ka dpazt mukammal karte hain to aap mojooda batway ko bhi jor satke hain aur tak jeet satke hain. Mazeed jaanen aur aaj hello sign on karen .Stick Sandwich Pattern ko pick out karne ke liye investors ko rate movement aur chart evaluation ki competencies ki zaroorat hoti hai. Is sample mein bearish candlestick ke beech mein do small bullish candlesticks hote hain. Agar yeh pattern ek downtrend ke baad appear karta hai toh yeh buyers ko bullish fashion ke hone ke warning signs deta hai.Stick Sandwich Pattern ek aisi foreign exchange trading method hai jo fashion reversal ko indicate karta hai. Copy buying and selling: Is sample mein bearish candlestick ke beech mein do small bullish candlesticks hote hain jo traders ko bullish trend ke hone ke alerts offer karta hai. Traders ko entry aur exit points ko pehchanne ke sath saath prevent loss orders aur hazard management techniques ka bhi istemal karna chahiye.Negative stick mein, bahar ki mother batian lambi sabz mom batian hon gi, hit ke andar ki choti aur surkh hogi, aur bahar ki lathyon se poori terhan lapait di jaye gi. Aik end up flushed stick ziyada tar aik jaisa nazar aaye ga lekin is ke bar aks rang aur replacing patteren bad sandwich ki terhan hoga. Aam height fashionable tajir taizi ya mandi ki function lainay ka faisla karte waqt teesri candle caught ki band qeematon se isharay len ge .

Identification: bilkul aik baar graph ki terhan, rozana candle marketplace ki khuli, ziyada, kam, aur noise ke qareeb qeemat dukhati hai. Shama daan ka aik wasee hissa hota hai, jisay" haqeeqi jism" kaha jata hai. Yeh haqeeqi frame is racket ki tijarat ke khulay aur band honay ke darmiyan qeemat ki had ki numaindagi karti hai. Hit asli jism bhara solar-hwa ya siyah ho to is ka matlab hai ke band khulay se kam tha. Agar asli frame khaali hai to is ka matlab hai ke band khulay se ouncha tha .Agarchay stick sandwich patteren ko pehchanana ziyada mushkil nahi hai, kyunkay woh bail ya reechh ke market ke douran khud ko paish kar satke hain, taajiron ko is mein shaamil rangon ko observe karne mein mohtaat rehna chahiye.

Explanation: bunyadi miyaar mein dono atraaf ki flame ke rang ke sath darmiyan mein ki gayi mild stuck ka rang shaamil hai. Is patteren ko tasleem kiye jane ke baad, tajir sabz surkh sabz ko chalanay ke liye terrible aur surkh sabz surkh ko chalanay ke liye aik taizi walay sandwich fashionable ghhor karte hain .Stick approach ke peechay nazriati Daleel yeh hai ke punch market nai nichli sthon ki jaanch kar rahi hai, to yeh surkh racket peda kere ga. Aglay clamor ghair mutawaqqa peak widespread ouncha khulay ga aur sara commotion ouncha rujhan rahay ga, apni oonchai popular ya is ke qareeb band hoga. Yeh tehreek neechay ke rujhan ke ulat jane ki taraf ishara karti hai, aur ziyada tar mukhtasir tajir ahthyat se agay barheen ge. Phir aglay clamor, qeematein aur bhi ziyada khil jati hain, jo ibtidayi peak general sharts ko dhanpnay mein taizi latayen hai. Taham, qeematein is ke baad do clamor pehlay ki satah wellknown band honay ke liye kam ho jati hain. Samajh daar tajir do yaksaa satah ke bundon ke zareya laago imdadi qeemat ko be aware karen ge .Tamam mother batii ke namoonay yaksaa peak widespread kaam nahi karte hain. Sample 2: un ki bohat ziyada maqboliat ne aitbaar ko kam kar diya hai kyunkay un ko hadge reserves aur un ke zariye d kya gaya hai. Yeh achi maali eaanat se chalne walay khilari khorda sarmaya karon aur riwayati reserve minijrz ke khilaaf tijarat karne ke liye bijli ki raftaar widespread inhisaar karte hain jo maqbool matan mein payi jane wali takneeki tajzia ki hikmat amlyon wellknown amal daraamad karte hain. Dosray lafzon mein, hadge reserve administrator aisay shurka ko phansanay ke liye programming ka istemaal karte hain jo ziyada mushkilaat ya taizi ke nataij ki talaash mein hain. Taham, qabil aetmaad namoonay zahir hotay rehtay hain, jo mukhtasir aur taweel mudti munafe ke mawaqay faraham karte hain .Yahan paanch flame caught patteren hain jo qeemat ki simt aur raftaar ke paish khaima ke sath ghair mamooli pinnacle popular achi karkardagi ka muzahira karte hain.

Trendy buying and selling: har aik aala ya kam qeematon ki enthusiasm goi karne ke liye ird brace ki qeemat ki salakhon ke tanazur mein kaam karta hai. Woh do terhan se waqt ke lehaaz se hassas bhi hain. Sab se pehlay, woh sirf nazarsani shuda outline ki hudood mein kaam karte hain, khuwa intra day, rozana, hafta waar ya mahana. Dosra, patteren mukammal honay ke baad un ki taaqat adolescent se paanch baar taizi se kam ho jati hai .Mild stuck ke namoonay marketplace ke khiladion ki tawajah haasil karte hain, lekin un namonon se kharij honay walay bohat se ulat aur tasalsul ke isharay jadeed digital mahol mein qabil aetmaad tareeqay se kaam nahi karte hain. Conclusion : khush qismati se, thomas bulkowski ke adad o shumaar un namonon ke aik tang intikhab ke liye ghair mamooli durustagi ko zahir karte hain, jo taajiron ko qabil amal khareed o farokht ke signal paish karte hain .Stick Sandwich Example ek aisi forex exchanging process hai jo pattern inversion ko show karta hai. Is design mein poor candle ke beech mein do little bullish candles hote hain jo sellers ko bullish sample ke sharpen ke alerts deliver karta hai. Dealers ko section aur go away focuses ko pehchanne ke sath saath forestall misfortune orders aur risk the board strategies ka bhi istemal karna chahiye.

-

#6 Collapse

-

#7 Collapse

assalam o alaikum guys, stick Sandwich pattern ek Japanese candlestick chart pattern hai, jismein 3 candles shamil hote hain. Yeh bearish reversal pattern hai, jo up-trend ke baad dekhne ko milta hai. Is pattern mein pehli candle bullish candle hoti hai, dusri candle high ke around bullish ya bearish candle hoti hai aur teesri candle pehli candle ki taraf se bullish aur dusri candle ki taraf se bearish hoti hai. stick Sandwich pattern mein teesri candle pehli candle ke closing price se neeche jaati hai, jo ki bearish reversal signal hai. Is pattern ko confirm karne ke liye, traders ko teesri candle ke neeche ki taraf se gap down opening aur lower closing ka wait karna hota hai. Stick Sandwich pattern ko traders trend reversal ke signals ke liye use karte hain. Jab yeh pattern uptrend ke baad dekha jaata hai, to traders short positions lete hain ya phir long positions se exit kar dete hain. Traders stop loss order ko high ke above rakhte hain aur profit targets ko low ke around rakhte hain. WAZAHAT : "Stick Sandwich" pattern ek bearish reversal pattern hai jo uptrend ke baad dekhne ko milta hai. Is pattern mein three candles shamil hoti hain. Pehli candle bullish candle hoti hai, jisse trend ke upar ki taraf kiya jata hai. Dusri candle high ke around bullish ya bearish candle hoti hai aur iske range mein pehli candle bhi shamil hoti hai. Teesri candle pehli candle ki taraf se bullish aur dusri candle ki taraf se bearish hoti hai. Teesri candle ki closing price pehli candle ki closing price se neeche hoti hai, jo bearish reversal signal hai. Agar yeh pattern ko confirm karna hai, to traders ko teesri candle ki taraf se gap down opening aur lower closing ka wait karna hota hai. Traders is pattern ko trend reversal ke signals ke liye use karte hain. Agar yeh pattern uptrend ke baad dekha jaata hai, to traders short positions lete hain ya phir long positions se exit kar dete hain. Stop loss order ko high ke above rakha jata hai aur profit targets ko low ke around rakha jata hai. Is tarah se, Stick Sandwich pattern traders ke liye trend reversal aur trading opportunities provide karta hai. PROPERTIES OF STICK SANDWITCH PATTERN : Is pattern mein teen candles shamil hoti hain aur iski kuch properties hain: ⶠ: Pehli candle ek bullish candle hoti hai, jo uptrend ko darshati hai. ⷠ: Dusri candle pehli candle ke high ke around bullish ya bearish candle hoti hai. ⸠: Teesri candle pehli candle ki taraf se bullish aur dusri candle ki taraf se bearish hoti hai. ⹠: Teesri candle ki closing price pehli candle ki closing price se neeche hoti hai, jo bearish reversal signal hai. ⺠: Traders ko teesri candle ki taraf se gap-down opening aur lower closing ka wait karna hota hai, jisse pattern confirm ho sake. ⻠: Yeh pattern trend reversal ke liye reliable signal hai. Is pattern ko successful trade ke liye aur zyada probability ke sath use karne ke liye dusre technical indicators ke saath combine kiya jaana chahiye. Traders typically apni stop loss order pattern ke high ke above rakhte hain aur profit targets pattern ke low ke around set karte hain. Stick Sandwich pattern ki properties ko samajh kar, traders potential trading opportunities ko identify kar sakte hain aur informed trading decisions le sakte hain. IDENTIFICATION : "Stick Sandwich" pattern ka identification karne ke liye, traders ko kuch steps follow karne hote hain: Identify the uptrend: Traders ko pehle uptrend ko identify karna hota hai. Iske liye traders technical indicators jaise Moving Averages, MACD, ya Trend lines ka use kar sakte hain. Look for the first bullish candle: Jab uptrend identify ho jaye to traders ko first bullish candle ko dhundhna hota hai, jo uptrend ke continuation ko indicate karta hai. Look for the second candle: Dusri candle pehli candle ke high ke around form hoti hai. Iske andar bullish ya bearish candle ho sakti hai. Look for the third candle: Teesri candle pehli candle ki taraf se bullish aur dusri candle ki taraf se bearish hoti hai. Iske closing price pehli candle ki closing price se neeche hona chahiye. Wait for confirmation: Traders ko teesri candle ki taraf se gap-down opening aur lower closing ka wait karna hota hai, jisse pattern confirm ho sake. Place stop loss and profit target: Traders typically apni stop loss order pattern ke high ke above rakhte hain aur profit targets pattern ke low ke around set karte hain. By following these steps, traders can identify the Stick Sandwich pattern and make informed trading decisions. TRADE WITH THIS PATTERN : Stick Sandwich pattern ki madad se trade karne ke liye, traders kuch steps follow kar sakte hain: Identify the pattern: Sabse pehle traders ko Stick Sandwich pattern ko identify karna hota hai. Iske liye traders technical analysis ka use kar sakte hain. Confirm the pattern: Traders ko pattern ko confirm karne ke liye teesri candle ki taraf se gap-down opening aur lower closing ka wait karna hota hai. Place the trade: Jab pattern confirm ho jaye, traders apni trade ko place kar sakte hain. Traders typically apni stop loss order pattern ke high ke above rakhte hain aur profit targets pattern ke low ke around set karte hain. Monitor the trade: Jab trade place ho jaye, traders ko apni position ko monitor karna hota hai aur apne stop loss aur profit targets ko adjust karte rehna chahiye. Exit the trade: Jab price apne profit target level tak pahuch jaata hai, traders ko apni position ko exit kar lena chahiye. Agar price stop loss level tak pahunch jaata hai, to traders ko apni position ko exit kar lena chahiye aur apni losses ko minimize karne ke liye apne risk management plan ko follow karna chahiye. By following these steps, traders can use the Stick Sandwich pattern to make profitable trades in the Forex market. However, it is important to remember that no trading strategy is 100% foolproof and traders should always exercise caution and practice proper risk management. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

WHAT IS A STICK SANDWICH DEFINITION stick sandwich three candle stick ka pattern hai jo use Waqt Banta Hai Jab middle candle stick Uske donon Taraf candlestick ke Oppositely Colored ki hoti hai Pehle aur Teesri candle stick mein middle candle stick Se zyada trading range Hogi stick sandwich pattern bullish and bearish donon ho sakte hain stick sandwich ki identify ke liye following criteria ko Dekhen Ek ROw Mein three candles Jo honi chahie bullish stick sandwich down Trend ke dauran Hona chahie bullish wale Market mein bull second candles Banane Tak control Mein Rehte Hain Chuke signal Ki Har Taraf two candles ke closeing Hone Wali prices barabar hain isliye pattern ko strong support Hasil hai aur reversal ka eMkan zyada hai confirmation ki levels ko talash kare STICK SANDWICH CANDLESTICK PATTERN RELIABILITY Tamam candles ke pattern equally Taur per work Nahin Karte Hain Unki bahut zyada popularity Ne reliability ko ko kam kar diya hai Kyunki unko hedge funds aur unke algorithms Ke zariya deconstructed Kiya gaya hai Jo popular text mein paye jane wali technical analysis ki par amal daramad karte hai candlestick ke pattern market ke players ki focus Karte Hain sandwich pattern ek rare chart occurrence hai Jab ham sandwich candle pattern ki Tijarat Karte Hain To Hamen formation ke size ke three Guna ke barabar kam is kam profit Hasil karna chahiye

STICK SANDWICH CANDLESTICK PATTERN RELIABILITY Tamam candles ke pattern equally Taur per work Nahin Karte Hain Unki bahut zyada popularity Ne reliability ko ko kam kar diya hai Kyunki unko hedge funds aur unke algorithms Ke zariya deconstructed Kiya gaya hai Jo popular text mein paye jane wali technical analysis ki par amal daramad karte hai candlestick ke pattern market ke players ki focus Karte Hain sandwich pattern ek rare chart occurrence hai Jab ham sandwich candle pattern ki Tijarat Karte Hain To Hamen formation ke size ke three Guna ke barabar kam is kam profit Hasil karna chahiye  HOW TO MANAGE RISK WHEN TRADING THE STICK SANDWICH Aaiae ab pattern ki Tijarat karte waqt risk ka manage karne ke liye few methods ka cover Karte Hain Kuchh peoples ke liye Is Tarah Tijarat karna Mushkil hoga mentally and emotionally Ghar per jazb karne mein bahut zyada lossing hai Ham Apne account mein Money beh jane ko musalsal feel Karte Hain traders IQ option per different types ke chart istemal kar sakte hain yah pattern price ki future ki movement ka determining karne mein help kar sakte hain Pattern ki dusri candle Zeher Karti Hai Ki selling ka pressure jald hi end hone wala hai aur Trends Palat sakta hai Jab price Teesri candle ki high ki level se Tut Jaaye

HOW TO MANAGE RISK WHEN TRADING THE STICK SANDWICH Aaiae ab pattern ki Tijarat karte waqt risk ka manage karne ke liye few methods ka cover Karte Hain Kuchh peoples ke liye Is Tarah Tijarat karna Mushkil hoga mentally and emotionally Ghar per jazb karne mein bahut zyada lossing hai Ham Apne account mein Money beh jane ko musalsal feel Karte Hain traders IQ option per different types ke chart istemal kar sakte hain yah pattern price ki future ki movement ka determining karne mein help kar sakte hain Pattern ki dusri candle Zeher Karti Hai Ki selling ka pressure jald hi end hone wala hai aur Trends Palat sakta hai Jab price Teesri candle ki high ki level se Tut Jaaye

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:46 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим