How to identify a Market Trend?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Market trend ko hum 2 mukhtalif technical analysis k zariy pehchan skty hyn Technical Analysis Tool 1. Trendline 2. Relative Strength Index 3. Moving Average Trendline Trendline aik seedhi lakeer hai jo qeemat points ki aik series ko jurte hai, oonchai aur kam aur mustaqbil mein phelti hai . Ik up trendline jo up aur down ke silsilay ko jurte hai mustaqbil ki qeematon ki naqal o harkat ke liye support level banati hai. Is ke bar aks, neechay ki oonchaiyon ke silsilay ko jornay wali aik down trend line support level ki nishandahi karti hai . Relative Strength Index(RSI) RSI qeemat mein tabdeeli ki raftaar aur shiddat ki pemaiesh kar ke taayun karta hai ke aaya koi stockk ziyada khareeda gaya hai ya ziyada farokht hwa hai . 30 ya is se neechay ki RSI reading is baat ki nishandahi karti hai ke market ziyada farokht hui hai jabkay 70 ya is se oopar ki reading ziyada kharidi gayi haalat ko zahir karti hai. Yeh dono readingz ishara karti hain ke trend mein tabdeeli ka imkaan hai . Moving Average Moving average ka istemaal market ke start se wazeh qeemat ki karwai ko allag karne ke liye kya jata hai. Two moving average hain : Simple Moving Average ( SMA ) aur Exponential moving average ( EMA ) . SMA maazi mein aik makhsoos muddat ke douran qeematon ke set ke average ka hisaab lagaata hai. Misaal ke tor par, SMA pichlle 20-days, 50-days, 100-days aur isi terhan ki qeematon ke average ka hisaab lagaata hai. Darin Isna , EMA aik wazni average hai jo haliya dinon mein stock ki qeemat par zor deta hai, jo usay nai maloomat ke liye ziyada jawabdeh isharay banata hai . Moving average ka istemaal kisi asasa ki qeemat ki himayat aur muzahmat ki satah aur qeemat ke majmoi rujhan ka taayun karne ke liye bhi kya jata hai . Fundamental Analysis Srmaya car kaarobar ya muashi matrix mein tabdeelion ko dekh kar market ke trend ki nishandahi karne ke liye bunyadi tajzia bhi istemaal kar satke hain, jaisay ke aamdani aur aamdani mein izafah . Jab koi company musalsal kayi sah mahyon mein musbet aamdani mein izafah record karti hai, to yeh market ke musbet trend ki misaal paish karti hai. Doosri taraf, jab kisi company ki aamdani aik khaas muddat mein musalsal girty hai, to yeh manfi trend ko zahir karta hai . -

#3 Collapse

Market trends ki pehchan ke tareeqon mein dakhil hone se pehle, forex market mein trends ka tasavvur hoona zaroori hai. Ek market trend ek currency pair ke daam ka raasta hai jo kisi khaas doraan mein move karta hai. Trends ko teen mukhtalif qisam mein qataar diya ja sakta hai: uptrend, downtrend, aur sideways (ya range) trend.- Uptrend: Ek uptrend tab hota hai jab currency pair ke daam mukhtalif doraan mein buland tareen bulandiyan aur buland tareen ghar par musalsal taur par bante hain. Ye ek bullish market sentiment ko darust karta hai, jahan khareedne walay farokht karne walay se zyada hote hain, daam ko buland kartay hain.

- Downtrend: Mokhtalif, ek downtrend ko currency pair ke daam mukhtalif doraan mein kamtar tareen kamiyon aur kamtar tareen unchon ke musalsal banne ki nishani hai. Ye ek bearish market sentiment ko darust karta hai, jahan farokht karne walay market ko apni taraf mutawajjah karte hain aur daam ko neechay dabaate hain.

- Sideways (Ranging) Trend: Sideways ya range trend mein, currency pair ke daam mukhtalif doraan mein kam range mein idhar udhar hotay hain bina kisi nami tarz mein buland ya neechay chalne ke. Ye market mein koi wazeh rukh ki kami ko darust karta hai, aksar musalsal hone wale tawazun ya ghair yaqeeni daurat ke doraan waqe hone wale.

Market Trends Ki Pehchan Ke Tareeqe

Ab humein market trends ki pehchan ke mukhtalif tareeqon aur techniques ko samajhna hai:

Moving Averages:

Moving averages market trends ki pehchan ke liye sab se zyada istemal hone wale aalaat mein se hain. Ye daam ki data ko samet kar aik musalsal line banate hain, jisse trend ka rukh darust karne mein asani hoti hai. Aam istemal hone wale moving averages mein shamil hain simple moving average (SMA) aur exponential moving average (EMA). Traders aksar mukhtalif moving averages ke darmiyan crossover signals ka istemal trend ka rukh darust karne ke liye karte hain.

Trendlines:

Trendlines market trends ki pehchan ke liye ek aur asar daar aalaat hain. A trendline ko ek uptrend mein ghatte unchon ko jod kar banaya jata hai ya ek downtrend mein unchon ko jod kar banaya jata hai. Ek uptrend mein, trendline support ka kaam karta hai, jabke ek downtrend mein ye resistance ka kaam karta hai. Trendlines ke upar ya niche breakouts trend reversals ya continuations ko darust kar sakte hain.

Price Action Analysis:

Price action analysis asar daar trading ke raw daamon ke rukh par nazar daalne ko kehta hai bina indicators ya oscillators ke. Traders candlestick patterns, chart patterns, aur support aur resistance levels ka tajziya karke market trends ko pehchan sakte hain. Bullish candlestick patterns, jaise bullish engulfing ya hammer patterns, aksar potential uptrends ko darust karte hain, jabke bearish patterns jaise shooting stars ya evening stars potential downtrends ko darust karte hain.

Relative Strength Index (RSI):

Relative Strength Index (RSI) ek momentum oscillator hai jo daam ke movement ki raftaar aur tabadla ko naapta hai. Ye 0 se 100 tak oscillate hota hai aur market mein overbought aur oversold shiraae ko pehchanne ke liye istemal hota hai. Ek uptrend mein, RSI aksar 50 ke upar rehta hai, jabke ek downtrend mein ye aksar 50 ke neeche rehta hai. Price aur RSI ke darmiyan farq trend reversals ko darust karne ke liye istemal kiya ja sakta hai.

Moving Average Convergence Divergence (MACD):

Moving Average Convergence Divergence (MACD) ek aur mashhoor momentum oscillator hai jo trend ka rukh darust karta hai aur potential trend reversals ko darust karta hai. Ye do lines se bana hota hai: MACD line aur signal line. Jab MACD line signal line ke upar se cross karta hai, ye potential uptrend ko darust karta hai, jab ek cross signal line ke neeche hota hai to ye potential downtrend ko darust karta hai.

Fibonacci Retracement Levels:

Fibonacci retracement levels Fibonacci sequence par mabni hotay hain aur market mein potential support aur resistance levels ko pehchane ke liye istemal kiye jaate hain. Traders in levels ko daam ka area darust karne ke liye istemal karte hain jahan currency pair ka daam apna rukh wapas le sakta hai phir se apne trend ko jaari karne se pehle. Aam Fibonacci retracement levels mein shamil hain 23.6%, 38.2%, 50%, 61.8%, aur 100%.

Volume Analysis:

Volume analysis market mein trading ki shughal ka tajziya karte hue trend ki mazbooti ko darust karne ke liye istemal hota hai. Ek uptrend ya downtrend ke doraan barhne wala volume mazboot khareedne ya farokht karne ki dabao ko darust karta hai, jo trend ki maane ko darust karta hai. Barhne wala volume aik trend ke doran kam hone ke baad rukhsat hone ki nishani ho sakti hai aur potential trend reversal ko darust karta hai.

Market trends ki pehchan forex trading mein kamiyabi ka ahem pehlu hai. Technical indicators, chart patterns, aur price action analysis ke ek mishrafiyat ka istemal karke traders market ka rukh ki samajh hasil kar sakte hain aur mutakallim faisla lene mein kamiyab ho sakte hain. Lekin, yaad rakhna zaroori hai ke koi bhi ek method foolproof nahi hai, aur traders ko hamesha ek trend ke darustai ke liye mukhtalif indicators aur techniques ka istemal karna chahiye. Is ke ilawa, nuqsan se bachne ke liye hamesha risk management strategies ka istemal karna zaroori hai. Mashq aur tajurba ke sath, traders market trends ki pehchan ke liye zaroori hunar ko hasil kar sakte hain aur forex market mein apne kul trading performance ko behtar banate hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

Market Trend Ki Pehchan Kaise Karein?

1. Introduction: Market trend ka pata lagana ek mukhtalif aur zaroori fun hai jise har investor ko samajhna chahiye. Yeh ek aham qadam hai jo har shakhs ko apni invest karnay ki strategy banatay waqt lena chahiye. Market trend ka pata lagana asan nahi hai, lekin agar sahi tarika istemal kiya jaye to investors ko mazeed nafay ki ummeed ho sakti hai.

2. Market Trend Kya Hai? Market trend ek specific samay par market mein hone wale mukhtalif price movements ko dekhnay ka tareeqa hai. Yeh upar ya neeche ki taraf ho sakti hai aur yeh short-term, medium-term, ya long-term ho sakti hai. Market trend ko samajhna zaroori hai taake investors apni trading aur investing strategies ko sahi tareeqay se tay karsakain.

3. Market Trend Ki Pehchan: Market trend ki pehchan karne ke liye kuch ahem cheezein hain:- Price Action: Price action ko dekh kar market trend ka andaza lagaya ja sakta hai. Agar prices upward trajectory mein hain, to yeh bullish trend ko darust kar sakta hai, jabke downward trajectory bearish trend ki nishandahi kar sakta hai.

- Moving Averages: Moving averages bhi market trend ko samajhne mein madadgar hoti hain. Agar short-term moving average long-term moving average ko upar se cross karta hai, to yeh ek bullish signal hai. Jabke agar short-term moving average long-term moving average ko neeche se cross karta hai, to yeh ek bearish signal hai.

- Volume: Volume bhi market trend ko samajhne mein ahem kirdar ada karta hai. Agar volume ko dekhte hue prices mein izafa hota hai, to yeh ek strong trend ki nishandahi hai. Kam volume ke sath agar prices mein izafa hota hai, to yeh trend weak ho sakta hai.

- Technical Indicators: Market trend ko samajhne ke liye technical indicators ka istemal bhi kiya jata hai jaise RSI, MACD, aur Bollinger Bands. In indicators ki madad se investors market trend ko analyze kar sakte hain aur trading decisions le sakte hain.

4. Market Trend Ka Asar: Market trend ka asar har investor aur trader par hota hai. Agar sahi tareeqay se market trend ka pata lagaya jaye aur uske mutabiq trade kiya jaye, to isse investors ko faida hota hai. Market trend ko ignore karna ya galat samajhna ghalti ho sakti hai aur nuqsan ka bais ban sakta hai.

5. Market Trend Aur Risk Management: Market trend ko samajhne ke sath-sath risk management bhi ahem hai. Agar market trend ko sahi tarah se identify kiya gaya hai, lekin risk management nahi ki gayi hai, to isse investors ko nuqsan ho sakta hai. Risk management ke tareeqay jaise stop-loss orders aur position sizing ka istemal karke investors apne nuqsanat ko kam kar sakte hain.

Ikhtitami Guftagu: Market trend ka pata lagana har investor ke liye zaroori hai taake woh apni trading aur investing decisions ko sahi tareeqay se le sakein. Market trend ko samajhne ke liye mukhtalif tools aur techniques ka istemal kiya jata hai. Sahi tareeqay se market trend ko samajh kar aur risk management ke sath-sath, investors apni investments ko behtar tareeqay se manage kar sakte hain. -

#5 Collapse

**Market Trend Ko Kaise Identify Karein?**

Forex aur stock trading mein, market trend ko accurately identify karna ek ahem skill hai jo successful trading decisions ko banane mein madad karta hai. Trend identification ke bina, traders market ke price movements ko sahi se predict nahi kar sakte aur trading strategies ko optimize nahi kar sakte. Is post mein, hum market trend ko identify karne ke different methods aur techniques ko detail mein discuss karenge.

**Market Trend Kya Hai?**

Market trend wo direction hai jahan market ke price movements consistently move kar rahe hote hain. Trend ko teen main categories mein classify kiya jata hai:

1. **Uptrend:** Jab market ke prices consistently upar ki taraf move kar rahe hote hain.

2. **Downtrend:** Jab market ke prices consistently neeche ki taraf move kar rahe hote hain.

3. **Sideways Trend:** Jab market ke prices ek narrow range ke andar move kar rahe hote hain, bina clear upward ya downward direction ke.

**Trend Identification Techniques:**

1. **Trend Lines:**

- **Formation:** Trend lines price chart par draw ki jati hain jo market ke high aur low points ko connect karti hain. Uptrend ke case mein, trend line lows ko connect karti hai, jabki downtrend ke case mein, trend line highs ko connect karti hai.

- **Analysis:** Trend lines market ke trend ko visually represent karte hain aur trend ke strength aur duration ko assess karne mein madad karte hain.

2. **Moving Averages:**

- **Simple Moving Average (SMA):** SMA ek average price level ko calculate karta hai ek specific time period ke liye. Jab price moving average se upar hoti hai, to market uptrend ko show karta hai; jab price moving average se neeche hoti hai, to downtrend ko show karta hai.

- **Exponential Moving Average (EMA):** EMA bhi price average ko calculate karta hai, lekin recent prices ko zyada weightage deta hai. EMA trends ke changes ko jaldi detect karta hai aur trend identification ko enhance karta hai.

3. **Technical Indicators:**

- **Relative Strength Index (RSI):** RSI ek momentum oscillator hai jo overbought aur oversold conditions ko measure karta hai. RSI ke 70 ke upar hone par market overbought aur 30 ke neeche hone par oversold hota hai, jo trend reversal signals provide karta hai.

- **Moving Average Convergence Divergence (MACD):** MACD ek trend-following momentum indicator hai jo moving averages ke beech ke relationship ko measure karta hai. MACD ke positive aur negative crossovers trend changes ko identify karne mein madad karte hain.

4. **Price Action:**

- **Candlestick Patterns:** Candlestick patterns, jaise ki Doji, Engulfing, aur Hammer, price action ko represent karte hain aur trend reversal signals provide karte hain. Yeh patterns market ke psychological sentiment ko indicate karte hain aur trend identification ko enhance karte hain.

- **Chart Patterns:** Chart patterns, jaise Head and Shoulders, Double Top, aur Triple Bottom, market ke trend reversals aur continuations ko identify karne mein madadgar hote hain.

**Trend Confirmation:**

1. **Volume Analysis:** Volume analysis trend confirmation ke liye use kiya jata hai. High trading volumes ke saath trend ki confirmation hoti hai, jabki low volumes ke saath trend weak hota hai. Volume trends ko validate karta hai aur market ke trend strength ko confirm karta hai.

2. **Divergence:** Divergence analysis price aur technical indicators ke beech ke differences ko measure karta hai. Positive divergence uptrend aur negative divergence downtrend ke signals provide karti hai.

**Conclusion:**

Market trend ko accurately identify karna successful trading decisions ke liye zaroori hai. Trend lines, moving averages, technical indicators, aur price action techniques ka use karke traders market ke trends ko effectively analyze kar sakte hain. Trend confirmation ke liye volume analysis aur divergence techniques ka use karke, traders apne trading strategies ko optimize kar sakte hain aur market ke price movements se maximum benefit utha sakte hain. Accurate trend identification ke saath, traders better trading decisions le sakte hain aur apne trading performance ko improve kar sakte hain.

-

#6 Collapse

Market trend ko identify karna kisi bhi trader ke liye bohot zaroori skill hoti hai, chahe aap forex, stocks ya cryptocurrencies mein trade kar rahe hoon. Market trends humein yeh samajhne mein madad karte hain ke price kis direction mein move kar rahi hai, taake aap samajhdari se buy ya sell decisions le sakein. Agar aap yeh samajh lein ke market upar ja raha hai (bullish), neeche ja raha hai (bearish), ya side mein move kar raha hai (ranging), to aapke trades ke successful hone ke chances bohot zyada ho jate hain.

1. Price Action Analysis

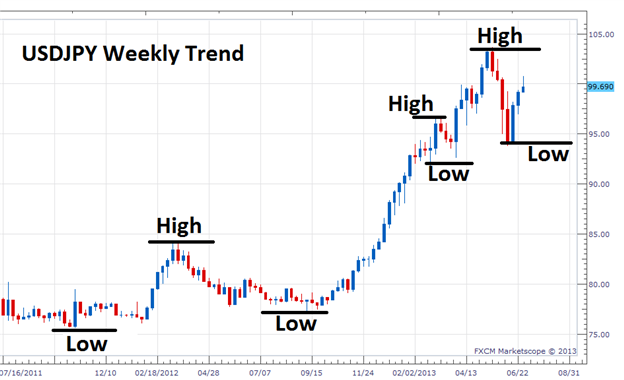

Market trend ko pehchanne ka sabse seedha tareeqa price action ko dekhna hai. Price action ka matlab hai price ka waqt ke sath move karna, jisko hum charts par candlesticks ya line chart ke zariye dekhte hain. Yeh kuch tareeqe hain price action ke through trend identify karne ke:- Uptrend (Bullish Market): Agar price higher highs aur higher lows bana raha hai, to market uptrend mein hota hai. Yani har naya high, pichlay high se zyada hota hai, aur har low, pichlay low se upar hota hai. Iska matlab hota hai ke buyers zyada active hain aur price upar jane ka chance hai.

- Downtrend (Bearish Market): Downtrend mein price consistently lower highs aur lower lows banata hai. Yani har new high pichlay high se neeche hota hai, aur har low pichlay low se neeche hota hai. Iska matlab hota hai ke sellers dominate kar rahe hain aur price girne ka chance zyada hai.

- Sideways Market (Ranging): Jab price ek certain range ke andar move kar raha hota hai, yani na upar ja raha hai na neeche, to market range-bound hota hai. Is condition mein price ek specific support aur resistance level ke beech mein rehta hai.

2. Moving Averages Ka Istemaal

Moving averages (MA) market trends ko identify karne ka ek reliable tool hai. Moving average ek indicator hota hai jo price ke average ko ek specific time period ke liye calculate karta hai. Dono simple moving average (SMA) aur exponential moving average (EMA) ko trend ko pehchanne ke liye use kiya ja sakta hai.- Uptrend: Jab price moving average ke upar trade kar rahi hoti hai, aur moving average ka slope upar ki taraf hota hai, to market uptrend mein hota hai.

- Downtrend: Agar price moving average ke neeche ho aur moving average ka slope neeche ki taraf ho, to market downtrend mein hota hai.

Aap short-term (20-period) aur long-term (50-period) moving averages ko cross-over strategy ke liye bhi use kar sakte hain. Jab short-term MA long-term MA ko upar se cross karta hai, to yeh bullish signal hota hai (buy). Jab short-term MA long-term MA ko neeche se cross karta hai, to yeh bearish signal hota hai (sell).

3. Trendlines Draw Karna

Trendlines draw karna ek aur powerful technique hai jo aapko market trend ko dekhne mein madad deti hai. Trendline ko price ke higher lows (uptrend) ya lower highs (downtrend) ko connect karke draw kiya jata hai. Yeh ek visual guide deti hai ke market kis direction mein move kar raha hai.- Uptrend Trendline: Jab price consistently higher lows bana raha ho, to aap ek upward sloping line draw kar sakte hain jo yeh dikhata hai ke market uptrend mein hai.

- Downtrend Trendline: Agar price lower highs bana raha hai, to aap downward sloping trendline draw karte hain jo bearish market ko show karta hai.

4. RSI (Relative Strength Index) Ka Istemaal

RSI ek popular momentum indicator hai jo overbought aur oversold conditions ko measure karta hai. RSI 0 se 100 ke scale par move karta hai.- Uptrend Confirmation: Agar RSI 50 se upar ho aur 70 ke kareeb pahunch raha ho, to market uptrend mein hota hai. Lekin agar RSI 70 se zyada ho, to market overbought condition mein ho sakta hai, jiska matlab hai ke price mein thoda correction aa sakta hai.

- Downtrend Confirmation: Jab RSI 50 se neeche ho aur 30 ke kareeb ho, to market downtrend mein hota hai. Lekin agar RSI 30 se neeche ho, to market oversold ho sakta hai, aur wahan se ek reversal possible hota hai.

5. MACD (Moving Average Convergence Divergence)

MACD ek advanced indicator hai jo trend-following aur momentum ko measure karta hai. MACD ke andar ek signal line aur ek MACD line hoti hai jo jab cross karti hain to yeh trend reversal ka signal hota hai.- Uptrend: Jab MACD line signal line ko neeche se cross karti hai, to yeh ek bullish signal hota hai, aur market uptrend mein ja sakta hai.

- Downtrend: Jab MACD line signal line ko upar se cross karti hai, to yeh bearish signal hota hai, aur market downtrend mein jane ka chance hota hai.

Conclusion

Market trend ko identify karna forex ya kisi bhi trading market mein ek basic lekin bohot zaroori skill hai. Aap price action, moving averages, trendlines, RSI, aur MACD jaise tools ka istemal karke market trend ko accurately identify kar sakte hain. Trend ko pehchan kar aap better buy/sell decisions le sakte hain aur apni trading strategies ko improve kar sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

How to identify a market trend in forex

Forex trading mein market trend ka pata lagana bohat zaroori hai. Agar aap market trend ko samajh lenge to ap apni trading strategy ko improve kar sakte hain aur zyada paise kama sakte hain. Lekin market trend ka pata lagana asan nahi hai. Is k liye ap ko market ki movement ko samajhna ho ga. Is article mein hum aapko batayenge kuch tips jisse aap market trend ka pta laga sakte hain.

1. Chart Analysis

Forex trading me chart analysis ka bht bada role hota hai. Aapko chart analysis karke market trend ka pata lagana hoga. Iske liye aap daily, weekly aur monthly charts ko dekh sakte hain. Chart analysis sy ap ko market ka direction pata chal jayega.

2. Moving Averages

Moving averages aapko market trend ka pata lagane mein madad karte hain. Iske liye aapko 50 day aur 200 day moving averages ki madad se market trend ka pata lga skte hain. Agar 50 day moving average 200 day moving average se upar hai to market uptrend mein hai aur agar 50 day moving average 200 day moving average se neeche h to market downtrend mein hai.

3. Support and Resistance

Support aur resistance levels ko dekh kar aap market trend ka pata laga sakte hain. Agar market support level sy upr jta hai to market uptrend mein hai aur agar market resistance level se neeche ata h to market downtrend mein hai.

4. Economic Indicators

Economic indicators jaise ki GDP, inflation, interest rates, aur unemployment rate aapko market trend ka pata lagane mein madad karte hain. Agr economic indicators achhe hain to market uptrend mein hai aur agar economic indicators bure hen to market downtrend mein hai.

Final words

In sab tips ki madad se aap market trend ka pata laga sakte hain aur apni trading strategy ko improve kar sakte hen. Lekin market trend ka pata lagana puri tarah se guarantee nahi hota. Is liye ap hamesha apni trading strategy ko improve karke market movement ko samajhne ki koshish krte rahen.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:43 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим