Trading Flat in Forex Trading

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Security market main flat aisi price ko kehtay Hain Jis ki value na barh Rai ho na km ho.Fixed income term main aisa bond Jo accrued interest Kay bina kaam kr Raha ho flat kehlata hay.Forex term main flat aisi condition ko kehtay Hain Jo particular security main na long ho aur na hi short ho aur isko square bi kehtay Hain. Key Features of Trading Flat in Forex Trading Flat aik aisi situation ko kehtay Hain Jis main security na rise ho na decline ho.Price ya valuation main rise ya decline na ho. Securities Kay context main ye aisi market ko refer krta hay Jahan profit ki opportunity na ho. Traders individual stock se profit Le saktay Hain instead Kay wo market indices per depend krien. Bond Market main Trading Flat tab ho ga jab bond buyers accrued interest payment Kay liay responsible na Hoon. Forex Trading main trading flat tab ho ga jab trader opposing position leta hay and cancel each other. Understanding Flat Stocks Jab stock market Kam ya na minimum movement kray over period of time isko flat Market kehtay Hain.Is ka ye Matlab nai Kay tamam publicly listed security main main movement na ho.Kisi sector ya industry ki increasing price movement Kisi decking movement se offset ho sakti hay.Investors and traders Jo flat market main profits Lena chahtay Hain upward momentum main individual trading ko prefer krien gay instead Kay market indices main trade krien. Individual stocks bi flat ho saktay Hain agar last month se 30 per trade kr Raha ho isko flat trading kaha jata hay.Covered cells ko write krna aik achi strategy jis se profit Lia ja sakta hay. Understanding Flat Bonds Bond ko flat trading kahien gay agar uska buyer interest pay main kray ga.In short flat bond aik aisay bond ko kahien gay jis main accured interest na pay krna ho.Flat bond ki price ko flat price or clean price kaha jata hay. Bond tab bi flat trade kray ga agar is per interest due hay lakin bond issuer default main ho.Aisay bonds Jo default main Hoon flat traded ki jata hay jis main accrued interest ki koi calculation nai hoti. Flat position in Forex Trading Flat forex trading main aisi positions ko kehtay Hain Jahan per traders currency ki market main movements se unsure Hoon.Agar ap ki US Dollars main koi short or long term position nai Hain to aisi condition ko flat kehtay Hain.Flat position ko positive consider kia jata hay jis ki reason ye hay Kay although traders profit nai Le rae lakin wo koi loss bi nai kr rae hotay. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Flat Trading Market

"Trend is Your Friend", Ye wo famous (mashhoor) kahawat hai jo trading ke duniya mein sirf trend ke saath hi trade karne ko kehti hai. Lekin agar market 70% waqt flat hai aur sirf 30% waqt trending hai, to phir kya karna chahiye? Jawab ye hai ke flat market mein bhi munafa kamana mumkin hai. Flat wo haalat hoti hai jab price ek muayyan range mein bina kisi wazeh direction ke move karta hai. Flat ka khatam hone aur naye trend ka aghaz hamesha boundary breakout ke zariye hota hai.

Aksar traders ke darmiyan consolidation, sideways trend, aur lateral trend jaise terms suni ja sakti hain. Ye sab flat ke liye synonyms hain aur iske barabar hain.

Flat Q Hota Hai

Consolidation ke kuch reasons hote hain:- Trading Session:

Agar hum currency markets ka example lein to Asian session American aur European currencies ke liye flat conditions ka waqt hota hai. Is doran sab se active trades yen ke sath hote hain. - Important Economic News Ki Expectation:

News release se pehle often sideways movement hoti hai. Traders naye positions mein dakhil hone ka risk nahi lete kyun ke news release ke baad ek taqatwar breakthrough hone ki high probability hoti hai. - Interest Rate Ki Expectation:

Central bank ki interest rate par faisla hone ki bhi yehi asar hota hai. - Low Liquidity:

Kisi khaas instrument ke liye buyers aur sellers ki kami ek flat ko cause karsakti hai. - Holidays Par Kam Trading Contracts:

Exchange par high volatility sirf ziada funds se hi possible hai, aur chhote volumes par sideways movement hota hai.

Narrow Aur Wide Flat

Flat narrow ya wide dono ho sakta hai. Iski measurement points mein hoti hai, jo sideways trend ke lower boundary se upper boundary tak ki doori ko darust karti hai.

Narrow flat tab hota hai jab market par demand aur supply barabar hoti hai, yaani buyers aur sellers ki taqat barabar hoti hai. Is doran aam tor par koi significant news ya events nahi hote.

Wide flat tab banta hai jab price strong support aur resistance levels ke beech dab gaya hota hai. Is halat mein na to bulls aur na hi bears mein naye trend shuru karne ke liye taqat hoti hai.

Sideways Trend Ke Kya Loss Hain?

Zyadatar traders prefer karte hain ke woh clearly defined trend mein trade karein aur flat trades se bachte hain. Consolidation ke doran trading ek narrow price range aur anjaane direction ke liye limited hoti hai. Flat market mein trading mein hamesha nazar rakhna parta hai taake aap kabhi bhi trades ko khol ya band kar sakein. Ek alternative hai positions kholne ke liye badi tadad mein orders place karna sath hi Stop Loss aur Take Profit ke saath, lekin ye zyada convenient nahi hota.

Professional traders ne bohat se indicators aur systems banaye hain jo exchange ki situation ko sahi taur par assess karne mein aur munafa kamane mein madad karti hain.

Flat Ko Identify Kaise Karein: Indicators Aur Signs

Consolidation ko determine karne ke liye neeche diye gaye tools istemaal kiye ja sakte hain:- Stochastic Oscillator:

Ye chart par current price ko ek muayyan period ke past prices ke sath darust karti hai. Agar ye chart middle mein hai to ye consolidation ka ek sign hai. - RSI (Relative Strength Index):

Ye ek oscillator hai jo trend ki taqat dikhata hai. Jab ye range ke beech hai to yeh samjha jata hai ke market consolidation mein ja raha hai. - Moving Average:

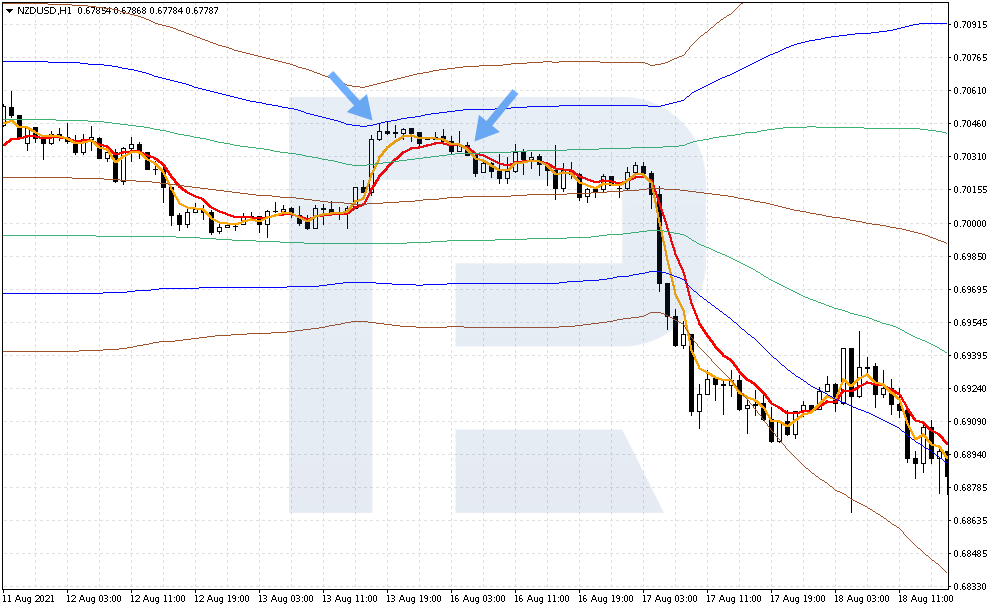

Ye trend indicator hai jo ek muayyan period ke liye financial market ke asset price ka average value dikhata hai. Moving Averages ka interlacing ek flat ko signal karta hai. - Bollinger Bands:

Ye market ki volatility aur trend direction dikhata hai. Indicator teen lines se bana hota hai, jo ek channel banate hain. Channel ka narrow hona consolidation ko indicate karta hai.

Flat Trading Methods

Flat ke doran trading ke liye kayi tareeqe hote hain. Hum yahaan do tareeqon par ghaur karenge.- Flat Boundaries Se Bounce Trading:

Ye consolidation ka continuation hota hai. Is approach mein, important news ke absence ko madde nazar rakha jata hai jo powerful movement ko provoke kar sakti hai. Iske alawa, range boundaries ke upar Stop Losses place karna bhi ek additional protection hai. - Flat Boundaries Breakout Se Trading:

Ye is par mabni hota hai ke flat khatam ho raha hai aur ek naya trend shuru hone wala hai. Aam taur par, price flat ko breakout karta hai aur range ko ek tez movement ke saath chhod deta hai. Jab price sideways trend ke boundaries chhodti hai, to ye successful trade ka key hota hai. Is mauqay ko miss na karne ke liye Stop orders ka istemaal karna chahiye.

Chahe trading method jo bhi ho, ye yaad rakhna zaroori hai ke sirf indicators par pura bharosa na karein. Munafa kamane ke liye, behtar hai ke aap technical analysis ko fundamental analysis ke saath mila kar istemal karein."

Conclusion

Financial ke duniya mein, strategies jo inaam dene ka daawa karte hain, woh aksar inherent risks ke saath aati hain. Martingale approach, jo progressive betting ke khaas tareeqe ke liye mashhoor hai, yeh bhi ek misal hai. Martingale Trading Approach ke bunyadi asoolon aur strategies ko controlled risk ke daayre mein samajh kar, traders iske potential faide ko behtar taur par samajh sakte hain. Yeh ilm traders ko apne trading journeys mein achi faislay karne mein madadgar banata hai. Is article mein, humne Martingale Trading Approach ko hosh o hawas aur soch samajh ke saath istemaal karne ka tajruba kia hai, jo ke risk lene ka ek zyada soch samajh ke taur par hai.

Aakhir mein, chahe Martingale strategy forex mein istemal ho ya kisi aur market mein, ek ahem factor hamesha barqarar rehta hai - strategy ke complications ko samajhna aur uske saath judi hui risks ko madde nazar rakhna. Trading ke daur mein, hushyar, adjust ho sakne wale, aur hamesha seekhne ke liye tayar rehne ka kaam karte huye, prudent trading principles aur successful risk management ki taraf le jane wale raushniyan hain. - Trading Session:

-

#4 Collapse

Forex Trading Mein Flat Trading

Flat Trading Kya Hai?

Flat trading ek situation hai jahan market mein koi significant price movement nahi hota hai aur prices mein koi change nahi hota hai. Yeh ek temporary phase hoti hai jab market ke participants uncertainty ke baare mein hote hain aur kisi specific direction mein move nahi karte hain. Flat trading mein prices typically ek tight range mein remain karte hain aur volatility kam hoti hai.

Flat Trading Ke Pehchan (Identification)- Tight Range: Flat trading ke doran prices typically ek tight range mein remain karte hain, jismein highs aur lows ke darmiyan kam farq hota hai.

- Low Volatility: Flat trading ke doran volatility kam hoti hai aur market mein movement ki kami hoti hai.

- Consolidation: Flat trading mein prices mein koi significant trend ya movement nahi hoti hai, balki wo ek consolidation phase mein rehte hain.

- Lack of Clear Trend: Flat trading ke doran koi clear trend ya direction nahi hota hai. Prices typically sideways move karte hain.

Flat Trading Ka Istemal- Range-Bound Trading Strategies: Flat trading ke doran traders range-bound trading strategies ka istemal karte hain. Ismein wo support aur resistance levels ke darmiyan positions lete hain aur price range ke andar hi trade karte hain.

- Waiting for Breakout: Flat trading ke doran traders breakout ka wait karte hain. Breakout ke baad prices mein significant movement hota hai, jise traders exploit kar sakte hain.

- Patience and Discipline: Flat trading mein patience aur discipline ka hona zaroori hai. Traders ko apne positions ko monitor karte rehna chahiye aur overtrading se bachna chahiye.

Flat Trading Ke Faide- Low Risk: Flat trading mein risk typically low hota hai kyunke volatility kam hoti hai aur prices mein kam movement hota hai.

- Opportunities for Scalping: Flat trading ke doran traders ko scalping opportunities mil sakti hain jahan wo chhoti profits earn kar sakte hain.

- Preparation for Breakout: Flat trading ke doran traders breakout ke liye prepare ho sakte hain. Ismein wo market ko closely monitor kar sakte hain aur breakout ke direction ke liye ready ho sakte hain.

Ikhtitami Alfaz

Flat trading ek temporary phase hai jahan market mein prices mein koi significant movement nahi hota hai. Traders ko is phase mein patience aur discipline maintain karna zaroori hai. Is phase ke doran traders range-bound trading strategies ka istemal karte hain aur breakout ka wait karte hain. Flat trading ke doran risk typically low hota hai aur traders ko opportunities scalping ke liye bhi mil sakti hain.

- CL

- Mentions 0

-

سا0 like

-

#5 Collapse

Forex Trading Mein Flat Trading

Forex trading mein flat trading ka matlab hai jab market mein kisi bhi directional trend ya movement ka na hona. Yeh woh waqt hota hai jab currency pairs ka rate stable rehta hai aur koi significant up ya down movement nahi hota.

Flat trading ka mukhtalif wajohat ho sakti hain. Kabhi kabhi yeh market ka natural phase hota hai jab koi major news ya event nahi hota, ya phir traders uncertainty mein rehte hain aur market ko observe kar rahe hote hain.

Flat trading mein traders ko cautious rehna chahiye. Kyunki jab market mein koi clear trend nahi hota, to trading positions ko maintain karna challenging ho sakta hai. Is wajah se, flat trading mein risk management ka bohot ahem role hota hai.

Ek strategy flat trading ke liye yeh ho sakti hai ke traders range-bound markets mein trade karein, matlab jab rates kisi specific range mein move kar rahe hon jaise ke ek support aur ek resistance level ke darmiyan.

Flat trading mein patience bhi zaroori hai. Jab market mein koi clear direction nahi hoti, to traders ko wait karna chahiye jab tak koi clear trend develop na ho.

Flat trading ki samajh bohot zaroori hai forex trading mein success ke liye. Jab market mein flat phase hai, to traders ko flexibility aur adaptability dikhani hoti hai apni strategies ko adjust karne ke liye.

Is tarah, flat trading forex market mein ek common phenomenon hai jo traders ko samajhna aur handle karna zaroori hai trading journey mein.

Flat trading ka matlab hai jab market mein kisi bhi directional trend ya movement ka na hona. Yeh woh waqt hota hai jab currency pairs ka rate stable rehta hai aur koi significant up ya down movement nahi hota. Flat trading ka kaam hai market ke is phase ko samajhna aur is situation mein trading strategies ko adjust karna.

Flat trading samajhne ka tareeqa:

1. Market Analysis: Pehle toh aapko market ki analysis karni hogi. Iska matlab hai current market conditions ko samajhna, including currency pairs ka movement, volumes, aur overall market sentiment.

2. Identify Flat Markets: Flat markets ko pehchan'na zaroori hai. Iske liye aapko dekhnay ki zaroorat hai ke currency pair ka rate kisi specific range mein move kar raha hai, jahan par koi clear trend ya direction na ho.

3. Fundamental Factors: Fundamental factors ko bhi ghor se dekhiye. Kya koi major news event hone wala hai jo market ko influence kar sakta hai? Kya koi economic data release hone wala hai jo market mein movement la sakta hai?

4. Technical Analysis: Technical analysis se bhi flat markets ko analyze kiya ja sakta hai. Support aur resistance levels ko identify karein, aur dekhein ke price kitni der se ek specific range mein stable hai.

5. Risk Management: Har trading decision ke sath risk management ka bhi dhyan rakhein. Flat markets mein trading karna risky ho sakta hai, is liye apni position sizes ko control mein rakhein aur stop-loss orders ka istemal karein.

6. Patience and Adaptability: Flat markets mein patience bohot zaroori hai. Kabhi kabhi traders ko wait karna padta hai jab tak koi clear trend develop na ho. Iske sath hi, adaptability bhi important hai - agar market conditions change ho jaayein toh apni strategies ko adjust karna seekhein.

7. Learning from Experience: Flat trading ko samajhne ka sab se behtareen tareeqa hai experience. Apni trades ko monitor karein, dekhein ke kis tarah ke flat markets mein aapki strategies kaam karti hain aur kis tarah ke mein nahi.

Yeh tarika follow kar ke, aap flat trading ko samajh sakte hain aur is mein kamyaabi haasil kar sakte hain.

Is waqt traders ko market ko observe karna chahiye aur samajhna chahiye ke kyun market flat hai. Kabhi kabhi yeh market ka natural phase hota hai jab koi major news ya event nahi hota, ya phir traders uncertainty mein rehte hain aur market ko observe kar rahe hote hain. Flat trading mein traders ko cautious rehna chahiye aur apni trading positions ko maintain karne ke liye risk management ka istemal karna chahiye.

1. Market Observation: Sab se pehle toh aapko market ko closely observe karna hota hai. Aapko dekhna hota hai ke market mein koi clear trend hai ya nahi, aur currency pairs ka rate kis tarah se behave kar raha hai.

2. Range Identification: Flat markets mein, currency pairs ek specific range mein move karte hain. Aapko yeh range identify karna hota hai jahan par price stable rehta hai aur koi significant movement nahi hoti.

3. Trade Planning: Jab aap flat market ko identify kar lete hain, toh aapko apni trading strategy ko plan karna hota hai. Aap decide karte hain ke aap kis price range mein trade karna chahte hain, aur support aur resistance levels ka istemal karte hue entry aur exit points ko determine karte hain.

4. Risk Management: Har trading decision ke sath risk management ka bhi dhyan rakha jata hai. Aapko apni position sizes ko control mein rakna hota hai aur stop-loss orders ka istemal karna hota hai taake aapko nuksan se bachaya ja sake.

5. Patience: Flat markets mein trading karne mein patience bohot zaroori hai. Kabhi kabhi market mein koi clear direction nahi hoti, aur traders ko wait karna padta hai jab tak koi clear trend develop na ho.

6. Adaptability: Market conditions badalne ke sath sath, aapko apni strategies ko adapt karna bhi zaroori hota hai. Agar market conditions change ho jaayein toh aapko apni trading approach ko adjust karna chahiye taake aap market ke sath sath chal sakein.

7. Monitoring and Learning: Apni trades ko monitor karte hue, aapko dekhna hota hai ke aapki strategies kis tarah se kaam kar rahi hain. Aapko apni mistakes se seekhna hota hai aur apni skills ko improve karna hota hai taake aap future mein bhi flat trading mein kamyaabi haasil kar sakein.

Is tarah se, flat trading kaam karne ka tareeqa yeh hota hai ke aap market ko samajhte hue apni trading strategies ko plan karte hain aur apni positions ko manage karte hain taake aap market ke is phase mein bhi successful ho sakein.

Ek strategy flat trading ke liye yeh ho sakti hai ke traders range-bound markets mein trade karein, matlab jab rates kisi specific range mein move kar rahe hon jaise ke ek support aur ek resistance level ke darmiyan. Flat trading mein patience bhi zaroori hai aur traders ko wait karna chahiye jab tak koi clear trend develop na ho.

Flat trading ki kuch properties niche di gayi hain:

1. Stable Market Conditions: Flat trading ka sabse prominent property hai ke market conditions stable hote hain. Yani ke currency pairs ka rate ek specific range mein move karta hai aur koi significant directional movement nahi hota.

2. Low Volatility: Flat markets mein volatility generally low hoti hai. Volatility ki kammi ki wajah se traders ko kam uncertainty hoti hai aur unko trading decisions lene mein madad milti hai.

3. Horizontal Price Movement: Flat markets mein price movement horizontal hota hai, matlab ke price levels ek dusre ke kareeb rehte hain aur koi clear trend ka indication nahi hota.

4. Tight Trading Ranges: Flat markets mein trading ranges tight hoti hain, yani ke support aur resistance levels ke darmiyan ka difference kam hota hai.

5. Reduced Trading Opportunities: Flat trading mein trading opportunities kam ho sakti hain compared to trending markets. Iski wajah hai ke market mein koi clear trend nahi hota, jiski vajah se traders ko suitable entry aur exit points find karna challenging ho sakta hai.

6. Increased Importance of Range Trading Strategies: Flat markets mein range trading strategies ka istemal zyada hota hai. Range trading strategies mein traders support aur resistance levels ke darmiyan trade karte hain aur price ka movement range ke andar hi rehta hai.

7. Patience and Discipline Required: Flat trading mein patience aur discipline bohot zaroori hoti hai. Kyunki market mein koi clear trend nahi hota, isliye traders ko wait karna padta hai jab tak koi opportunity develop na ho.

Flat trading, jab market mein kisi bhi directional trend ka na hona, ek important aspect hai forex trading ka. Is phase mein, currency pairs ka rate stable hota hai aur price movement horizontal hoti hai.

nateeja

Flat trading mein, traders ko patience, discipline, aur adaptability ki zaroorat hoti hai.

Flat trading ka mukhtasir nateeja yeh hai ke traders ko market ke is phase mein bhi trading opportunities mil sakti hain agar woh sahi tareeqe se approach karein. Range trading strategies ka istemal, risk management, aur market understanding flat trading mein mahatvapurna hota hai.

Is tareeqe se, flat trading ke through traders apni skills ko improve kar sakte hain aur consistent profits haasil kar sakte hain, jo unke overall trading journey ko enhance karta hai. Patience, discipline, aur adaptability ke saath, traders flat markets mein bhi kamyaab ho sakte hain aur apne trading goals ko achieve kar sakte hain.

Yeh properties flat trading ke characteristic features hain jo traders ko samajhne aur handle karne mein madad karte hain jab market mein koi clear trend na ho.

Is tarah, flat trading ka kaam hai traders ko market ke is phase ko samajhna aur is ke mutabiq apni trading strategies ko adapt karna. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Forex Trading Mein Flat Market: Samajhne Aur Deal Karne Ke Tareeqe**

Forex trading mein “Flat Market” wo period hota hai jab currency pairs ki price me major fluctuations nahi hote aur market ek range-bound movement dikhati hai. Is situation ko samajhna aur effectively handle karna zaroori hai, kyunki flat market mein trading strategies alag hoti hain.

Flat market ka matlab hai ke price ek specific range ke andar hi movement karti hai aur major trends ya directional moves nahi dikhati. Yeh situation tab hoti hai jab buyers aur sellers ke beech balance bana hota hai aur market kis taraf bhi major shift nahi dikhati.

**Flat Market Ki Pehchaan Kaise Karein?**

1. **Support Aur Resistance Levels**: Flat market ko pehchanne ke liye aapko support aur resistance levels ko analyze karna padta hai. Jab price in levels ke beech me move karti hai aur isse break nahi karti, tab market flat hoti hai.

2. **Price Action Analysis**: Price action ko observe karke bhi aap identify kar sakte hain ke market flat hai ya nahi. Agar price bar-bar ek hi range ke andar move kar rahi ho, to yeh flat market ka indication hota hai.

3. **Technical Indicators**: Moving averages aur Bollinger Bands jese indicators bhi flat market ko identify karne mein madadgar ho sakte hain. Jab indicators bhi ek narrow range ke andar move kar rahe ho, to yeh flat market ko indicate karta hai.

**Flat Market Mein Trading Strategies**

1. **Range Trading**: Flat market ke dauran range trading ek effective strategy ho sakti hai. Is strategy ke tehat, traders support aur resistance levels ke beech me buy aur sell orders place karte hain. Yeh strategy tab achi hoti hai jab market range-bound ho aur major trends na ho.

2. **Breakout Trading**: Agar aapko lagta hai ke market flat phase se nikalne wali hai, to aap breakout trading strategy use kar sakte hain. Yeh strategy tab use hoti hai jab price support ya resistance levels ko break karti hai aur new trends create hoti hain.

3. **Risk Management**: Flat market mein trading karte waqt risk management zaroori hai. Stop-loss aur take-profit levels set karna chahiye taake aap unexpected market moves se bacha rahe.

Forex trading mein flat market ek challenging phase ho sakta hai, lekin sahi strategies aur market analysis se aap is situation ka faida utha sakte hain.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:33 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим