Forex trading mein Trend Channel Chart Pattern kya hai?

Introduction.

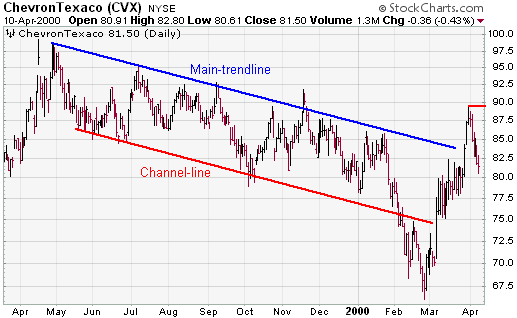

Forex trading mein Trend Channel Chart Pattern ek aisa chart pattern hai jo traders dwara use kiya jata hai trend ki direction aur strength ko determine karne ke liye. Is chart pattern mein price action ko ek channel ke andar plot kiya jata hai, jismein upper aur lower trend lines ke beech mein price movement hota hai.

Trend Channel Chart Pattern kaise banaya jata hai?

Trend Channel Chart Pattern banane ke liye, traders ko price action ko observe karna hota hai aur fir usse ek channel ke andar plot karna hota hai. Iske liye, traders ko trend ki direction aur strength ko identify karna hota hai. Agar trend up hai, to upper trend line ko draw kiya jata hai aur agar trend down hai, to lower trend line ko draw kiya jata hai.

Trend Channel Chart Pattern k use kaise kiya jata hai?

Trend Channel Chart Pattern ka use karne ke liye, traders ko price action ko monitor karna hota hai aur channel ke andar price movement ko track karna hota hai. Agar price channel ke andar hai, to traders ko trend ka continuation expect karna chahiye aur agar price channel ke bahar hai, to traders ko trend reversal ka indication milta hai.

Trend Channel Chart Pattern mein kya limitations hote hain?

Trend Channel Chart Pattern ki limitations ke andar, ye hai ki ye ek lagging indicator hai, jiske liye price movement ke baad hi trend ki direction aur strength identify ki jaati hai. Iske alawa, ye chart pattern sirf trending market conditions mein hi kaam karta hai aur sideways market mein iska use karna mushkil ho sakta hai.

Analysis:

Trend Channel Chart Pattern ek powerful tool hai, jiska use traders trend ki direction aur strength ko identify karne ke liye karte hain. Iske alawa, ye chart pattern traders ko trend reversal ka indication bhi provide karta hai. Lekin, iska use karne se pehle traders ko price action aur market conditions ke baare mein acchi tarah se samajh lena chahiye.

Introduction.

Forex trading mein Trend Channel Chart Pattern ek aisa chart pattern hai jo traders dwara use kiya jata hai trend ki direction aur strength ko determine karne ke liye. Is chart pattern mein price action ko ek channel ke andar plot kiya jata hai, jismein upper aur lower trend lines ke beech mein price movement hota hai.

Trend Channel Chart Pattern kaise banaya jata hai?

Trend Channel Chart Pattern banane ke liye, traders ko price action ko observe karna hota hai aur fir usse ek channel ke andar plot karna hota hai. Iske liye, traders ko trend ki direction aur strength ko identify karna hota hai. Agar trend up hai, to upper trend line ko draw kiya jata hai aur agar trend down hai, to lower trend line ko draw kiya jata hai.

Trend Channel Chart Pattern k use kaise kiya jata hai?

Trend Channel Chart Pattern ka use karne ke liye, traders ko price action ko monitor karna hota hai aur channel ke andar price movement ko track karna hota hai. Agar price channel ke andar hai, to traders ko trend ka continuation expect karna chahiye aur agar price channel ke bahar hai, to traders ko trend reversal ka indication milta hai.

Trend Channel Chart Pattern mein kya limitations hote hain?

Trend Channel Chart Pattern ki limitations ke andar, ye hai ki ye ek lagging indicator hai, jiske liye price movement ke baad hi trend ki direction aur strength identify ki jaati hai. Iske alawa, ye chart pattern sirf trending market conditions mein hi kaam karta hai aur sideways market mein iska use karna mushkil ho sakta hai.

Analysis:

Trend Channel Chart Pattern ek powerful tool hai, jiska use traders trend ki direction aur strength ko identify karne ke liye karte hain. Iske alawa, ye chart pattern traders ko trend reversal ka indication bhi provide karta hai. Lekin, iska use karne se pehle traders ko price action aur market conditions ke baare mein acchi tarah se samajh lena chahiye.

تبصرہ

Расширенный режим Обычный режим