reak Out & Fake Breakouts In Forex Trading

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

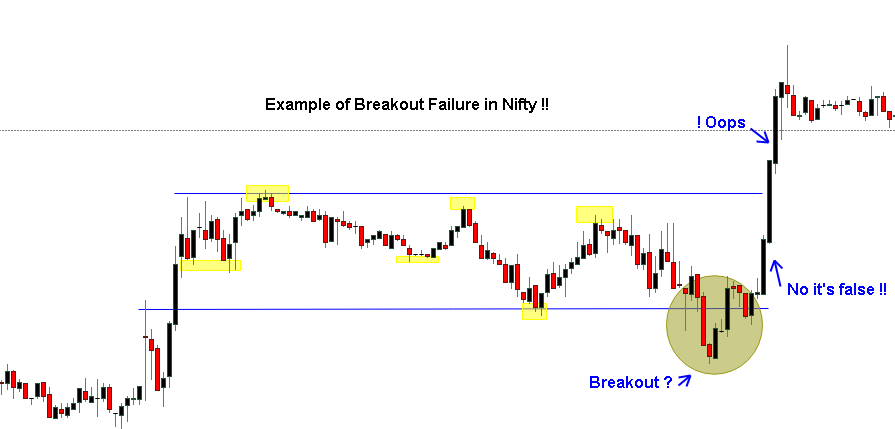

Dear Friends, Market mein price ranges mein chalti ha. Kabhi price range tight hoti ha aur kabhi price ki range bohot ziyada hoti ha. Jab long time tak price kisi range mein hi move karti rahay (either bullish side ho ya bearish side) to jab range k hisab se bannay walay support ya resistance ko price break karti ha to is ko breakout kaha jata ha aur breakout k baad market bohot tezi se move karti ha. Fakeout se maximum faida uthanay k liye zaruri ha k range k along ek line draw ki jaye, jis ko trendline kehtay hain aur ye trendline jitni ziyada hogi, utna chance hoga k breakout near ha because price long time tak range mein nahi rehti aur fundamental ya technial reaons ki waja se trend zarur change karti ha.Order After Breakout Break out kay baad order lagana zaida safe samjh jaata hai kunkay apko pata hota hai k ye breakout confirm hai aur market kuch time kay wapis breakout say wapis nahe aai. Breakout kay baad trade lagana itna mushkil aur risky nahi hai. Simply aap aap breakout jahan say hua hai us say pehly Stop Loss laga dain aur aap Take Profit ​apne hisaab say analysis kar kay set karkar lain. Strong Resistance level Strong resistance level agar break ho jata hay to market kabi uptrend tower bana deti hey aur buyer traders apny trades open kar lety hey esi tarha support level key break hony key bad market downtrend me chali jati hay aur market zeyda tar bearish trend me hi rehti hay esy me hamari trading strategy market trend line ko follow karna hi hona chaye, agar ham sell orders place karty hey aur market resistance level break kar leta hay to esy me hamy stop loss lagana chaye aur jesy hi market break out kary pending orders me hamara buy order be hona chaye jo key buy order stop loss ki waja se close ho jata hay aur us key bad pending orders me hamara buy ka order active ho jata hay ye bahot hi useful strategy hey.

Pending Orders on Breakout and Fake Breakout Pending orders ko be agar complete market analysis karny key sath ya powerful planing key bad na lagaye jaye to per be zeyda loss ho sakta hay, pending orders ko es condition me hi lagany chaye jab market support and resistance level par move kar rahi hoti hay aur esy levels key bad hi pending orders breakout key base par hi open karny chaye. Reverse FakeOut strategy Forex trading ma bhot sy trader FakeOut par trade karty hain. Wo tb he apna order place karty hai jb breakout occur karta hai. But trader k lae serf break out ko consider karna kafi ni hai. Trader ko market ma reverse strategy ko b use karna chahe. Forex trading ma asi situation develop hoti hai jb market ik break out ki taraf ishara deti hai or trader isko confirm kaye bena he market ma in ho jaty hain. Kuch dair bad enko pata chalta hai k ye to false breakout tha so wo apni trade ma tb tak pans chuky hoty hain.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is Fake Breakouts Dear forex Memebrs Fake breakouts yani kay aisy price movements hoty hain jin mein market price ka trend kisi specific level tak pohanch jata hai, jaisa kay resistance level ya support level, magar phir woh uss level ko cross nahi karta aur opposite direction mein move hona shuru ho jata hai. Is tarah kay price movements mein traders ko lagta hai kay price break out kar raha hai aur trend jari rakhay ga, magar haqeeqat mein yeh fake hota hai aur price opposite direction mein move karta hai.Fake breakouts ka matlab hota hai ke market mein kisi asset ki price kisi resistance ya support level ko break kar deti hai, lekin phir wapas se usi range ke andar aa jati hai. Fake breakouts ko bhi false breakouts ke naam se jana jata hai. Yeh situation trader ke liye frustrating ho sakti hai, kyunki isse unko false signals milte hain aur unki trades stop loss level ko hit ho jati hain. Fake breakouts ka work is tarah hota hai ke market mein kuchh aisi circumstances create ho jati hain, jaise low liquidity ya phir kisi important news ke announcement ke kareeb, jiski wajah se price ko temporarily apne actual value se alag ek level par move karaya jata hai. Best Analysis Fake Break Out Dear Fake Breakouts, ya fakeouts, ki analysis trading charts par ki jati hai. Is mein traders ne price action aur volume ko closely observe karna hota hai. Agar price chart par kisi particular level ya trend line se break out hone ka signal milta hai aur us ke baad price phir se wapis usi level par aajata hai tou yeh fake breakout ki misaal hai.Traders is ko analyze karne ke liye commonly used technical indicators jaise ki RSI, MACD, aur Bollinger Bands ka istemal karte hain. In indicators ki madad se price ki trend aur momentum ke sath sath market ke sentiment ko bhi assess kiya ja sakta hai. Fake Breakouts ko identify karne ke liye traders ko volume ki bhi closely monitor karna hota hai, kyunki fakeouts ka ziyada volume nahi hota hai. Iske alawa, traders news aur market ke overall conditions ko bhi dekhte hain kyunki yeh bhi price movements par impact dalte hain aur fake breakouts ka reason bhi bante hain. Overall, fake breakouts ki analysis ek combination of technical analysis, volume analysis, news analysis, aur market sentiment analysis se ki jati hai. Trade in fAKE break outs Fake Breakouts ke trade ke liye kuch techniques hain, jin ka istemaal kiya ja sakta hai. Kuch tips niche diye gaye hain: Wait for confirmation: Jab tak apko confirm na ho jaye ke breakout sach me authentic hai ya nahi, tab tak trade na karen. Iske liye apko price action aur other technical indicators ka use karna hoga. Set stop loss: Always set a stop loss order to limit your potential losses in case the breakout turns out to be fake. Keep an eye on volume: High volume during a breakout indicates greater conviction among traders, increasing the likelihood of a genuine breakout. Use multiple timeframes: Check the breakout on multiple timeframes to get a clearer picture of whether it is genuine or fake. Avoid trading during news events: Market volatility during news events can lead to false breakouts. It is best to wait until after the news event has passed to make a trade. In tamam techniques ka istemal karke, fake breakouts par trade kiya ja sakta hai. Real Break outs Breakout ek stock trading term hai jo ishara karta hai kisi share ka price resistance level ko cross kar ke upar badh gaya hai. Yani jab koi stock ke price ka kisi specific level se bahar jata hai to usay breakout kaha jata hai. Breakout ka matlab hota hai ki koi specific price level ke upper price aage badha hai aur phir us level ko cross kar ke wapas neeche nahi gaya. Breakout trading strategy me traders ke liye trading opportunities create hoti hai jab share ka price resistance level ko break karta hai, kyun ke isse traders ko pata chalta hai ki stock ka price aage badhne ke chances hain.Breakout ka analysis karne ke liye kuch steps hote hain: Identify the key level: Pehle tou aapko wo level ya range identify karna hota hai jis se market break out kar rahi hai ya karne ki possibility hai. Volume Check karna: Breakout ke time pe volume increase hona chahiye. Agar volume increase nahi hota ya phir kam rehta hai, toh wo breakout ho sakta hai hi nahi. Trend Check karna: Breakout ke time pe market ka trend bhi check karna zaruri hai. Agar trend already against hai toh aap breakout ko avoid kar sakte hain. Watch for confirmation: Agar aapko breakout confirm lag raha hai tou aap usko trade kar sakte hain. Breakout ke confirmation ke liye aap price action, chart patterns, technical indicators ka use kar sakte hain. Risk management: Breakout trading mein risk management kaafi important hai. Apni entry, stop loss aur target levels ko set karna zaruri hai aur apne trade size ko bhi apne risk profile ke according adjust karna zaruri hai. Trade In Real Break Outs Breakout trading ka matlab hota hai kisi stock ya currency pair ka price kisi particular level ko break karne ke baad uss level ke opposite direction me move hona. Breakout trading karna ek popular trading strategy hai jis se traders ko high volatility ke beech profit kamane ka mouka milta hai. Breakout trading karne ke liye traders pehle kisi particular level ya price range ko identify karte hain jahaan par ek potential breakout hone ke chances hote hain. Fir woh level ya price range ko closely monitor karte hain aur jab price uss level ko break karta hai toh woh apna trade enter karte hain. Breakout trading me traders kuch important points ko dhyaan me rakhte hain jaise ki stop loss order ka placement, entry aur exit points ke tay karna aur apne trades ko closely monitor karna. Breakout trading kaafi risk involve karti hai kyunki ye high volatility ke saath hoti hai aur price direction change hone ka risk bhi hota hai. Isliye, breakout trading me risk management kaafi important hota hai. -

#4 Collapse

Real or fake breakouts kya hoty hain Real or fake breakouts market mein common terms hain jo traders k beech mein use kiye jatey hain Breakout aik aisi situation hoti hai jab kisi stock ya asset ke price ki aik particular level ko cross kartey hain or phir us level ko chorty hain Real Breakout: Ek real breakout tab hota hai jab kisi stock k price market ki current trend k sath upar ya nichy barhti hai Is situation mein traders typically buy ya sell karty hain hoping ki price continue karega direction mein jis direction mein breakout hua hai Fake Breakout: Ek fake breakout tab hota hai jab price kisi particular level ko cross karta hai lekin phir sy wapas us level ko cross kar k reversal karta hai. Is situation mein traders jo buy ya sell karte hain un ki position stop loss trigger ho jata hai or phir price opposite direction mein janey lagti hai Fake breakouts bohat common hote hain or isliye traders ko in ko differentiate karna important hota hai jis sy wo sahi trading decisions le sakey Experienced traders technical analysis ka use kartey hain jis sy wo real or fake breakouts ko identify kar sakty hain Identification of real or fake breakout Real aur fake breakouts ka concept stock market or trading mein use hota hai Breakout ka matlab hota hai k stock price ny kisi important level ya resistance level ko cross kar diya hai or ab wo level support level ban jata hai real Breakout Agar stock price kisi important resistance level ko cross karta hai aur uske baad price us level ko test kar ke wapas nahi aata hai or us k upar continue uptrend dikhta hai oh use real breakout kaha jaata hai Is sy stock ka trend change hota hai or traders ko buy signal milta hai Fake Breakout Fake breakout hota hai jab stock price kisi important resistance level ko cross kar deta hai or kuch time k liye waha par rehta hai lekin phir sy us level ko nichy jany lagta hai or downtrend shuru ho jata hai is sy stock ka trend nahi badalta hai or traders ko sell signal milta hai Fake breakout k kuch common reasons hai jesy ki market manipulation, false rumors or incorrect analysis Traders ko fake breakouts sy bachne k liye sahi analysis or confirmation k sath trading karni chahiye Important key points Breakouts ki pechan kya hoti hai? Breakouts ki pehchan karna technical analysis ka ek important aspect hai. Breakout ka arth hota hai ki kisi stock ka price kisi resistance level ya support level se break karta hai aur uske baad uska trend change ho jata hai. Yeh ek important trading signal hai aur traders iska istemaal karte hain apne trading decisions ke liye. Breakouts ki pehchan karna ke liye, traders kuch important technical indicators ka use karte hain: Resistance and Support Levels: Traders chart par resistance or support leval ki nishandahi krty hain price k areas ki direction ko smjhty hain breakout tb hota hai jab price apny leval sy upar ya support sy nichy hoti hai Highs aur Lows ke Breakout: Jab kisi currency pair ki qeemat ko ek had tak touch karta hai jisay support ya resistance kehty hain to isay breakout kehty hain Aap iski pehchaan karne ke liye highs aur lows ke levels ko dekh sakte hain Agar price in levels ko cross karta hai to yeh breakout ka sign hai Trend Line Breakout: Jab kisi currency pair ki qeemat kisi trend line ko cross karti hai to yeh bhi breakout kehlata hai Aap trend lines ko draw kar sakte hain jo highs ya lows k beech mein hoty hain Agar price trend line ko cross karta hai to yeh breakout signal hai Moving Average Breakout: Moving averages bhi breakout k liye istmal kiye ja sakty hain Agar price moving average line ko cross karta hai to yeh bhi breakout signal hai Aap alag alag time frames k liye alag alag moving averages use kar sakty hain Breakout ki pehchaan karne k baad aap apni trading strategy k hisaab sy buy ya sell positions ly sakty hain Lekin breakout ka sirf aik signal hai is k sath sahi risk management stop loss or profit target ka istmal karna bhi zaroori hai -

#5 Collapse

Forex trading ek bohat hi risky aur unpredictable kaam hai, aur is mein traders ko market ki movements ke saath saath bhiya trading strategies ka use karna hota hai. Ek aise trading strategy hai breakout trading, jis se traders market mein trending moves ko capture kar sakte hain. Breakout trading mein traders market ki momentum ke saath saath trading positions ko enter karte hain, jab price ek important level ko cross karta hai. Lekin iss strategy ke saath saath, fake breakouts bhi hote hain, jin se traders ko avoid karna hota hai.Breakouts kya hai?Breakout ek price movement hai jis mein price kisi important level ko cross karta hai, jaise ke support aur resistance levels. Breakouts bullish aur bearish dono directions mein ho sakte hain. Agar price support level ko cross karta hai, to yeh bullish breakout hai, aur agar price resistance level ko cross karta hai, to yeh bearish breakout hai.Breakouts ka use kar ke traders apni trades ki entry points decide karte hain. Agar price support level ko cross karta hai, to traders long positions enter karte hain, aur agar price resistance level ko cross karta hai, to traders short positions enter karte hain.Fake Breakouts kya hai?Fake breakouts, yaani false breakouts, mein price kisi important level ko briefly cross karta hai, lekin phir wapas uss level ke andar aa jata hai. Is se traders ko confusion hoti hai aur woh apni trades ki entry points ko galat decide karte hain. Fake breakouts ka main cause market manipulation, ya phir market mein low liquidity hoti hai, jis se price movement unpredictable ho jati hai.Fake breakouts ka identificationTraders ko fake breakouts se bachne ke liye, in ko identify karna zaroori hai. Ek common method fake breakouts ko identify karne ka, woh hai price action analysis. Agar price kisi important level ko briefly cross karta hai, aur phir wapas uss level ke andar aa jata hai, to yeh fake breakout hai. Is ke alawa, traders ko market ki momentum, volatility aur volume ko bhi analyze karna hota hai, jis se fake breakouts ka identification aur avoidance easy ho jata hai.Breakout aur fake breakout trading ka use karne ke liye, traders ko market ke trend aur momentum ko analyze karna hota hai. Agar market strong trend mein hai, to breakout trading ka use karne se traders ko high probability trades milte hain. Lekin agar market range-bound hai, ya phir fake breakouts ke frequency high hai, to traders ko breakout trading se avoid karna chahiye.In conclusion, breakout trading ek bohat hi popular trading strategy hai jis se traders market mein trending moves ko capture kar sakte hain. Breakouts ka use kar ke traders apni trades ki entry points decide karte hain. Lekin fake breakouts bhi hoti hain, jin se traders ko bachna zaroori hai. Fake breakouts ka identification price action analysis ke through kiya jata hai, aur traders ko market ki momentum aur volume ko bhi analyze karna hota hai. Breakout aur fake breakout trading ka use karne ke liye, traders ko market ke trend aur volatility ko bhi analyze karna hota hai. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is reak Out & Fake Breakouts In Forex Trading? Ek aise trading strategy hai breakout trading, jis se traders market mein trending moves ko capture kar sakte hain. Breakout trading mein traders market ki momentum ke saath saath trading positions ko enter karte hain, jab price ek important level ko cross karta hai. Lekin iss strategy ke saath saath, fake breakouts bhi hote hain, jin se traders ko avoid karna hota hai.Breakouts kya hai?Breakout ek price movement hai jis mein price kisi important level ko cross karta hai, jaise ke support aur resistance levels. Breakouts bullish aur bearish dono directions mein ho sakte hain. Agar price support level ko cross karta hai, to yeh bullish breakout hai, aur agar price resistance level ko cross karta hai, to yeh bearish breakout hai.Breakouts ka use kar ke traders apni trades ki entry points decide karte hain. Agar price support level ko cross karta hai, to traders long positions enter karte hain, aur agar price resistance level ko cross karta hai, to traders short positions enter karte hain.Fake Breakouts kya hai?Fake breakouts, yaani false breakouts, mein price kisi important level ko briefly cross karta hai, lekin phir wapas uss level ke andar aa jata hai. Is se traders ko confusion hoti hai aur woh apni trades ki entry points ko galat decide karte hain. Fake breakouts ka main cause market manipulation, ya phir market mein low liquidity hoti hai, jis se price movement unpredictable ho jati hai.Fake breakouts ka identificationTraders ko fake breakouts se bachne ke liye, in ko identify karna zaroori hai. Ek common method fake breakouts ko identify karne ka, woh hai price action analysis. Agar price kisi important level ko briefly cross karta hai, aur phir wapas uss level ke andar aa jata hai, to yeh fake breakout hai. Is ke alawa, traders ko market ki momentum, volatility aur volume ko bhi analyze karna hota hai, jis se fake breakouts ka identification aur avoidance easy ho jata hai.Breakout aur fake breakout trading ka use karne ke liye, traders ko market ke trend aur momentum ko analyze karna hota hai. Agar market strong trend mein hai, to breakout trading ka useOrder After Breakout & Strong resistance level : apko pata hota hai k ye breakout confirm hai aur market kuch time kay wapis breakout say wapis nahe aai. Breakout kay baad trade lagana itna mushkil aur risky nahi hai. Simply aap aap breakout jahan say hua hai us say pehly Stop Loss laga dain aur aap Take Profit ​apne hisaab say analysis kar kay set karkar ptrend tower bana deti hey aur buyer traders apny trades open kar lety hey esi tarha support level key break hony key bad market downtrend me chali jati hay aur market zeyda tar bearish trend me hi rehti hay esy me hamari trading strategy market trend line ko follow karna hi hona chaye, agar ham sell orders place karty hey aur market resistance level break kar leta hay to esy me hamy stop loss lagana chaye aur jesy hi market break out kary pending orders me hamara

ptrend tower bana deti hey aur buyer traders apny trades open kar lety hey esi tarha support level key break hony key bad market downtrend me chali jati hay aur market zeyda tar bearish trend me hi rehti hay esy me hamari trading strategy market trend line ko follow karna hi hona chaye, agar ham sell orders place karty hey aur market resistance level break kar leta hay to esy me hamy stop loss lagana chaye aur jesy hi market break out kary pending orders me hamara

-

#7 Collapse

AoA to all of you guysI hope so you all are fine What is Fake Breakouts Dear forex Memebrs Fake breakouts yani kay aisy price movements hoty hain jin mein market price ka trend kisi specific level tak pohanch jata hai, jaisa kay resistance level ya support level, magar phir woh uss level ko cross nahi karta aur opposite direction mein move hona shuru ho jata hai. Is tarah kay price movements mein traders ko lagta hai kay price break out kar raha hai aur trend jari rakhay ga, magar haqeeqat mein yeh fake hota hai aur price opposite direction mein move karta hai.Fake breakouts ka matlab hota hai ke market mein kisi asset ki price kisi resistance ya support level ko break kar deti hai, lekin phir wapas se usi range ke andar aa jati hai. Fake breakouts ko bhi false breakouts ke naam se jana jata hai. Yeh situation trader ke liye frustrating ho sakti hai, kyunki isse unko false signals milte hain aur unki trades stop loss level ko hit ho jati hain. Fake breakouts ka work is tarah hota hai ke market mein kuchh aisi circumstances create ho jati hain Forex trading ek bohat hi risky aur unpredictable kaam hai, aur is mein traders ko market ki movements ke saath saath bhiya trading strategies ka use karna hota hai. Ek aise trading strategy hai breakout trading, jis se traders market mein trending moves ko capture kar sakte hain. Breakout trading mein traders market ki momentum ke saath saath trading positions ko enter karte hain, jab price ek important level ko cross karta hai. Lekin iss strategy ke saath saath, fake breakouts bhi hote hain, jin se traders ko avoid karna hota hai.Breakouts kya hai?Breakout ek price movement hai jis mein price kisi important level ko cross karta hai, jaise ke support aur resistance levels. Breakouts bullish aur bearish dono directions mein ho sakte hain. Agar price support level ko cross karta hai, to yeh bullish breakout hai, aur agar price resistance level ko cross karta hai, to yeh bearish breakout hai.Breakouts ka use kar ke traders apni trades ki entry points decide karte hain. Agar price support level ko cross karta hai, to traders long positions enter karte hain, aur agar price resistance level ko cross karta hai, to traders short positions enter karte hain.Fake Breakouts kya hai?Fake breakouts, yaani false breakouts, mein price kisi important level ko briefly cross karta hai, lekin phir wapas uss level ke andar aa jata hai. Is se traders ko confusion hoti hai aur woh apni trades ki entry points ko galat decide karte hain. Fake breakouts ka main cause market manipulation, ya phir market mein low liquidity hoti hai, jis se price movement unpredictable ho jati hai.Fake breakouts ka identificationTraders ko fake breakouts se bachne ke liye Best Analysis Fake Break Out Dear Fake Breakouts, ya fakeouts, ki analysis trading charts par ki jati hai. Is mein traders ne price action aur volume ko closely observe karna hota hai. Agar price chart par kisi particular level ya trend line se break out hone ka signal milta hai aur us ke baad price phir se wapis usi level par aajata hai tou yeh fake breakout ki misaal hai.Traders is ko analyze karne ke liye commonly used technical indicators jaise ki RSI, MACD, aur Bollinger Bands ka istemal karte hain. In indicators ki madad se price ki trend aur momentum ke sath sath market ke sentiment ko bhi assess kiya ja sakta hai. Fake Breakouts ko identify karne ke liye traders ko volume ki bhi closely monitor karna hota hai, kyunki fakeouts ka ziyada volume nahi hota hai. apko pata hota hai k ye breakout confirm hai aur market kuch time kay wapis breakout say wapis nahe aai. Breakout kay baad trade lagana itna mushkil aur risky nahi hai. Simply aap aap breakout jahan say hua hai us say pehly Stop Loss laga dain aur aap Take Profit ​apne hisaab say analysis kar kay set karkar ptrend tower bana deti hey aur buyer traders apny trades open kar lety hey esi tarha support level key break hony key bad market downtrend me chali jati hay aur market zeyda tar bearish trend me hi rehti hay esy me hamari trading strategy market trend line ko follow karna hi hona chaye -

#8 Collapse

AoA to all of you guysI hope so you all are fine What is Fake Breakouts Dear forex Memebrs Fake breakouts yani kay aisy price movements hoty hain jin mein market price ka trend kisi specific level tak pohanch jata hai, jaisa kay resistance level ya support level, magar phir woh uss level ko cross nahi karta aur opposite direction mein move hona shuru ho jata hai. Is tarah kay price movements mein traders ko lagta hai kay price break out kar raha hai aur trend jari rakhay ga, magar haqeeqat mein yeh fake hota hai aur price opposite direction mein move karta hai.Fake breakouts ka matlab hota hai ke market mein kisi asset ki price kisi resistance ya support level ko break kar deti hai, lekin phir wapas se usi range ke andar aa jati hai. Fake breakouts ko bhi false breakouts ke naam se jana jata hai. Yeh situation trader ke liye frustrating ho sakti hai, kyunki isse unko false signals milte hain aur unki trades stop loss level ko hit ho jati hain. Fake breakouts ka work is tarah hota hai ke market mein kuchh aisi circumstances create ho jati hain Forex trading ek bohat hi risky aur unpredictable kaam hai, aur is mein traders ko market ki movements ke saath saath bhiya trading strategies ka use karna hota hai. Ek aise trading strategy hai breakout trading, jis se traders market mein trending moves ko capture kar sakte hain. Breakout trading mein traders market ki momentum ke saath saath trading positions ko enter karte hain, jab price ek important level ko cross karta hai. Lekin iss strategy ke saath saath, fake breakouts bhi hote hain, jin se traders ko avoid karna hota hai.Breakouts kya hai?Breakout ek price movement hai jis mein price kisi important level ko cross karta hai, jaise ke support aur resistance levels. Breakouts bullish aur bearish dono directions mein ho sakte hain. Agar price support level ko cross karta hai, to yeh bullish breakout hai, aur agar price resistance level ko cross karta hai, to yeh bearish breakout hai.Breakouts ka use kar ke traders apni trades ki entry points decide karte hain. Agar price support level ko cross karta hai, to traders long positions enter karte hain, aur agar price resistance level ko cross karta hai, to traders short positions enter karte hain.Fake Breakouts kya hai?Fake breakouts, yaani false breakouts, mein price kisi important level ko briefly cross karta hai, lekin phir wapas uss level ke andar aa jata hai. Is se traders ko confusion hoti hai aur woh apni trades ki entry points ko galat decide karte hain. Fake breakouts ka main cause market manipulation, ya phir market mein low liquidity hoti hai, jis se price movement unpredictable ho jati hai.Fake breakouts ka identificationTraders ko fake breakouts se bachne ke liye Best Analysis Fake Break Out Dear Fake Breakouts, ya fakeouts, ki analysis trading charts par ki jati hai. Is mein traders ne price action aur volume ko closely observe karna hota hai. Agar price chart par kisi particular level ya trend line se break out hone ka signal milta hai aur us ke baad price phir se wapis usi level par aajata hai tou yeh fake breakout ki misaal hai.Traders is ko analyze karne ke liye commonly used technical indicators jaise ki RSI, MACD, aur Bollinger Bands ka istemal karte hain. In indicators ki madad se price ki trend aur momentum ke sath sath market ke sentiment ko bhi assess kiya ja sakta hai. Fake Breakouts ko identify karne ke liye traders ko volume ki bhi closely monitor karna hota hai, kyunki fakeouts ka ziyada volume nahi hota hai. apko pata hota hai k ye breakout confirm hai aur market kuch time kay wapis breakout say wapis nahe aai. Breakout kay baad trade lagana itna mushkil aur risky nahi hai. Simply aap aap breakout jahan say hua hai us say pehly Stop Loss laga dain aur aap Take Profit ​apne hisaab say analysis kar kay set karkar ptrend tower bana deti hey aur buyer traders apny trades open kar lety hey esi tarha support level key break hony key bad market downtrend me chali jati hay aur market zeyda tar bearish trend me hi rehti hay esy me hamari trading strategy market trend line ko follow karna hi hona chaye -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Dear My Friends Forex Trading me counter move se murad market ki against trading trend ka chalna hota hai. Agar market kisi khas trend pe chal fahi ho lekin halat us k against ho to ye counter move hota hai financial market ka. Forex trading me bhi aksar aisa ho sakta hai k aik currency k strong hone se us ki value ka up jana chaheye lekin market me wo trend line down semat pe banati hai jis se market me us ka counter move hota hai. Forex trading market me counter move se traders bhi heran hoty hy ke aisa q hota hai lekin market me ye aksar kabhi kabhi aisa ho sakta hai. Market me kisi new news ki waja se bhi aisa mumkin hai aur market me do currency pe yakdam koi impact parne ki waja se bhi aisa hota hia. Counter Move ko Samajna: Dear ys support kay qareeb sy buy kary, jab keh bearish trend mein resistance ko sell kay liye prefer kary.counter trend market ki price correction aur use ky Trend ky opposite movement start Karte Hain. aur is movement ko primary trend opposite movement bhi Kaha ja sakta hy.Woh trader jo long trading karna chahta hai woh low point ko buy karta hai or market k high point sy sell ki trade ko open karty hain. So jab counter move occur karta hai to trader k lae yeh achi opportunity hoti hai k woh buy or sell ki trade ko open kar sakty hain.lakin trader ko yeh baat zehan mein rakhni chahe k counter move small hota hai aor trader ko agr trade ko open karni hai to suitable stop loss ko lazmi set karain. Kiu k agr counter move long ho jae to yeh main trend ban jata hai.jis loss ka risk bi increase ho jata hy... Students Ham counter move ko es tarha be samaj sakty hain ke ye marker ke current trend ka reversal hota hai. Kisi pair ki current price price ki base par esko achy sy predict karna possible ni hota to trader counter move ki base par market ko asani sy predict kar sakty hain. Counter move ko ham retracement be kehty hain or market counter move ke baad aksar previous trend ma he move karna start ho jati hai. To trader counter move ke time par previous trend ki trade ko open karna chahiye. -

#10 Collapse

reak Out and Counterfeit Breakouts In Forex Exchanging Dear Companions, Market mein cost ranges mein chalti ha. Kabhi cost range tight hoti ha aur kabhi cost ki range bohot ziyada hoti ha. Poke long time tak cost kisi range mein hello there move karti rahay (either bullish side ho ya negative side) to punch range k hisab se bannay walay support ya opposition ko cost break karti ha to is ko breakout kaha jata ha aur breakout k baad market bohot tezi se move karti ha. Fakeout se greatest faida uthanay k liye zaruri ha k reach k along ek line draw ki jaye, jis ko trendline kehtay hain aur ye trendline jitni ziyada hogi, utna chance hoga k breakout close to ha since cost long time tak range mein nahi rehti aur basic ya technial reaons ki waja se pattern zarur change karti ha. Request After Breakout Break out kay baad request lagana zaida safe samjh jaata hai kunkay apko pata hota hai k ye breakout affirm hai aur market kuch time kay wapis breakout say wapis nahe aai. Breakout kay baad exchange lagana itna mushkil aur unsafe nahi hai. Just aap breakout jahan say hua hai us say pehly Stop Misfortune laga dain aur aap Take Benefit apne hisaab say investigation kar kay set karkar lain. Solid Opposition level Solid opposition level agar break ho jata feed to advertise kabi upswing tower bana deti hello aur purchaser dealers apny exchanges open kar lety hello esi tarha support level key break hony key terrible market downtrend me chali jati roughage aur market zeyda tar negative pattern me hey rehti feed esy me hamari exchanging system market pattern line ko follow karna greetings hona chaye, agar ham sell orders place karty hello aur market obstruction level break kar leta feed to esy me hamy stop misfortune lagana chaye aur jesy hey market break out kary forthcoming orders me hamara purchase request be hona chaye jo key purchase request stop misfortune ki waja se close ho jata roughage aur us key awful forthcoming orders me hamara purchase ka request dynamic ho jata roughage ye bahot hey helpful technique hello. Forthcoming Orders on Breakout and Phony Breakout Forthcoming orders ko be agar finished market examination karny key sath ya strong planing key terrible na lagaye jaye to per be zeyda misfortune ho sakta feed, forthcoming orders ko es condition me hello lagany chaye poke market backing and opposition level standard move kar rahi hoti roughage aur esy levels key awful greetings forthcoming orders breakout key base standard hey open karny chaye.

- Mentions 0

-

سا0 like

-

#11 Collapse

umeeeed krti ho k sb thek hongy mze k sth forex trding min nd pak froum main work kar rahy hongy pak froum main work karne k liye hard work karn must hota hain jaaab tak ek traders best learning nhe karta hain tu loss kar dete hain loss ko recover karne k liye pratice kare reak Out & Fake Breakouts In Forex Trading main har dwork kare forex main best learning k sath work krna must hota hain reak Out & Fake Breakouts In Forex Trading main praitce kare analysis kare learning good hoti hain tu benefit mil skta hain jisne learning nhe ki vo big loss kar dete hain reak Out & Fake Breakouts In Forex Trading main supply and demand ko achi tara check kare agar learning good nhe hain tu reak Out & Fake Breakouts In Forex Trading main loss k ziyda chances hote hain and kabi b kamyabi nhe mil sktih hain reak Out & Fake Breakouts In Forex Trading main pratice kre How to Trade On reak Out & Fake Breakouts In Forex Trading: forex trading k busniess main work krne k liye hard work karna must hota hain jaaab tak ek traders k pas best learning nhe hotih ain reak Out & Fake Breakouts In Forex Trading main loss kar dete hain loss and profit forex trading ka hissa hota hain har trades ko best learning karna must hain jaab tak learning strong nhe hoti hain tu loss ho jata hain loss ko recover karna must hain hardwork k sath kaam krna must hainreak Out & Fake Breakouts In Forex Trading main learning kare regular pratice kare hard work kare reak Out & Fake Breakouts In Forex Trading main hard work krne wale traders reak Out & Fake Breakouts In Forex Trading main market ko samjh jate hain is liye hard work k sath kaam kare learning krna must hota hain forex main pratice kare demo account main analysis kare

- Mentions 0

-

سا0 like

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

reak Out & Fake Breakouts In Forex Trading

Kindly, friends Price ranges on the market are what matter. Price ranges are either limited or wide, depending on the price. When a price has been in a range for a long period, either on the bullish or bearish side, it will move in that direction. When that happens, the range's support or resistance levels will either be broken or the market will move in the opposite direction. There is a chance that the breakout will occur because the price has been in the range for a long time and neither fundamental nor technical factors have caused the trend to change. Fakeout is at its maximum when the range is drawn along an imaginary line. Strong Resistance level Strong resistance level break kar leta hay to market kabi uptrend tower bana deti hey and buyer traders apny trades open kar lety hey esi tarha support level key break kar leta hay to market downtrend me chali jati hay and market zeyda tar bearish trend me hi rehti hay esy me hamari trading strategy market trend line ko follow karna Order After Breakout & Strong resistance level : As long as the breakthrough is confirmed and the market is open, the breakout will occur soon. Breakout kay baad trade lagana it's mushkil and not dangerous, not at all. Just put, "aap aap breakout jahan say hua hai" and "us say pehly Stop Loss laga dain" and "aap take profit apne hisaab say analysis kar kay set karkar" Solid Opposition level Strong opposition level agar break ho jata feed to advertise kabi upswing tower bana deti hello aur buyer dealers apny exchanges open kar lety hello esi tarha support level key break hony key terrible market downtrend me chali jati roughage aur market zeyda tar negative pattern me hey rehti feed esy me hamari exchanging system market pattern line ko follow k hello.

Strong Resistance level Strong resistance level break kar leta hay to market kabi uptrend tower bana deti hey and buyer traders apny trades open kar lety hey esi tarha support level key break kar leta hay to market downtrend me chali jati hay and market zeyda tar bearish trend me hi rehti hay esy me hamari trading strategy market trend line ko follow karna Order After Breakout & Strong resistance level : As long as the breakthrough is confirmed and the market is open, the breakout will occur soon. Breakout kay baad trade lagana it's mushkil and not dangerous, not at all. Just put, "aap aap breakout jahan say hua hai" and "us say pehly Stop Loss laga dain" and "aap take profit apne hisaab say analysis kar kay set karkar" Solid Opposition level Strong opposition level agar break ho jata feed to advertise kabi upswing tower bana deti hello aur buyer dealers apny exchanges open kar lety hello esi tarha support level key break hony key terrible market downtrend me chali jati roughage aur market zeyda tar negative pattern me hey rehti feed esy me hamari exchanging system market pattern line ko follow k hello.  Forthcoming Orders on Breakout and Phony Breakout Forthcoming orders ko be agar finished market examination karny key sath ya strong planing key terrible na lagaye jaye to per be zeyda misfortune ho sakta feed, forthcoming orders ko es condition me hello lagany chaye poke market backing and opposition level standard move kar rahi hoti roughage aur esy levels key awful greetings forthcoming orders breakout key base standard hey open karny chaye.

Forthcoming Orders on Breakout and Phony Breakout Forthcoming orders ko be agar finished market examination karny key sath ya strong planing key terrible na lagaye jaye to per be zeyda misfortune ho sakta feed, forthcoming orders ko es condition me hello lagany chaye poke market backing and opposition level standard move kar rahi hoti roughage aur esy levels key awful greetings forthcoming orders breakout key base standard hey open karny chaye.

-

#13 Collapse

break out forex market mein aik maqbool tijarti hikmat e amli hai. break out is waqt hota hai jab currency ke jore ki qeemat support ya muzahmat ki kaleedi satah se toot jati hai, jo rujhan ki simt mein mumkina tabdeeli ki nishandahi karti hai. woh tajir jo break out hikmat amlyon ka istemaal karte hain un ka maqsad aik naye rujhan ke ibtidayi marahil mein market mein daakhil hona hai, jo bohat ziyada munafe bakhash ho sakta hai . taham, do qisam ke break out hain jin se taajiron ko aagah hona zaroori hai : 1: real break out 2: fack break out . real break out aik haqeeqi break out is waqt hota hai jab currency jore ki qeemat mazboot raftaar aur hajam ke sath himayat ya muzahmat ki kaleedi satah se toot jati hai. yeh rujhan ki simt mein aik ahem tabdeeli ki nishandahi karta hai, aur jo tajir is maqam par market mein daakhil hotay hain woh mumkina tor par numaya munafe kama satke hain . fack break out : aik jaali break out is waqt hota hai jab currency ke jore ki qeemat mukhtasir tor par himayat ya muzahmat ki kaleedi satah se toot jati hai, lekin phir taizi se simt ko ulat deti hai. yeh is waqt ho sakta hai jab tajir kaleedi sthon par barray orders day kar market mein heera pheri karne ki koshish karte hain, jis ki wajah se qeemat ko tabdeel karne se pehlay earzi tor par satah ko torna parta hai. jo tajir is maqam par market mein daakhil hotay hain woh mumkina tor par nuqsaan ka shikaar ho satke hain . jaali break out ka shikaar honay se bachney ke liye, taajiron ko market mein daakhil honay se pehlay tasdeeq ka intzaar karna chahiye. tasdeeq mazboot raftaar aur hajam ke sath sath deegar takneeki isharay jaisay ke rishta daar taaqat index ( rsi ) ya moving average knorjns divergence ( macd ) ki shakal mein aa skati hai. tasdeeq ka intzaar kar ke, tajir is baat ko yakeeni bana satke hain ke woh aik naye rujhan ke ibtidayi marahil mein market mein daakhil ho rahay hain aur jaali break out se honay walay nuqsanaat sy aaagah kery."Dream bigger. Do bigger"

(mahroosh) :1f607:

-

#14 Collapse

reak Out and Counterfeit Breakouts In Forex ExchangingWhat is Phony Breakouts Dear forex Memebrs Counterfeit breakouts yani kay aisy cost developments hoty hain jin mein market cost ka pattern kisi explicit level tak pohanch jata hai, jaisa kay obstruction level ya support level, magar phir woh uss level ko cross nahi karta aur inverse heading mein move hona shuru ho jata hai. Is tarah kay cost developments mein brokers ko lagta hai kay cost break out kar raha hai aur pattern jari rakhay ga, magar haqeeqat mein yeh counterfeit hota hai aur cost inverse heading mein move karta hai.Fake breakouts ka matlab hota hai ke market mein kisi resource ki cost kisi opposition ya support level ko break kar deti hai, lekin phir wapas se usi range ke andar aa jati hai. Counterfeit breakouts ko bhi bogus breakouts ke naam se jana jata hai. Yeh circumstance dealer ke liye disappointing ho sakti hai, kyunki isse unko bogus signs milte hain aur unki exchanges stop misfortune level ko hit ho jati hain. Counterfeit breakouts ka work is tarah hota hai ke market mein kuchh aisi conditions make ho jati hain, jaise low liquidity ya phir kisi significant news ke declaration ke kareeb, jiski wajah se cost ko briefly apne real worth se alag ek level standard move karaya jata hai. Best Investigation Counterfeit Break Out Dear Phony Breakouts, ya fakeouts, ki investigation exchanging diagrams standard ki jati hai. Is mein brokers ne cost activity aur volume ko intently notice karna hota hai. Agar cost diagram standard kisi specific level ya pattern line se break out sharpen ka signal milta hai aur us ke baad cost phir se wapis usi level standard aajata hai tou yeh counterfeit breakout ki misaal hai.Traders is ko investigate karne ke liye normally utilized specialized pointers jaise ki RSI, MACD, aur Bollinger Groups ka istemal karte hain. In pointers ki madad se cost ki pattern aur energy ke sath market ke feeling ko bhi survey kiya ja sakta hai. Counterfeit Breakouts ko distinguish karne ke liye merchants ko volume ki bhi intently screen karna hota hai, kyunki fakeouts ka ziyada volume nahi hota hai.Iske alawa, brokers news aur market ke generally speaking circumstances ko bhi dekhte hain kyunki yeh bhi cost developments standard effect dalte hain aur counterfeit breakouts ka reason bhi bante hain. Generally speaking, counterfeit breakouts ki examination ek blend of specialized investigation, volume investigation, news investigation, aur market opinion investigation se ki jati hai. Exchange Counterfeit break outs Counterfeit Breakouts ke exchange ke liye kuch methods hain, jin ka istemaal kiya ja sakta hai. Kuch tips specialty diye gaye hain:Hang tight for affirmation: Poke tak apko affirm na ho jaye ke breakout sach me genuine hai ya nahi, tab tak exchange na karen. Iske liye apko cost activity aur other specialized pointers ka use karna hoga.Set stop misfortune: Consistently set a stop misfortune request to restrict your possible misfortunes in the event that the breakout ends up being phony.Watch out for volume: High volume during a breakout shows more noteworthy feeling among brokers, improving the probability of a certifiable breakout.Utilize different time spans: Really look at the breakout on numerous time periods to get a more clear image of whether it is veritable or counterfeit.Abstain from exchanging during news occasions: Market instability during news occasions can prompt bogus breakouts. It is ideal to hold on until after the news occasion has passed to make an exchange.In tamam procedures ka istemal karke, counterfeit breakouts standard exchange kiya ja sakta hai. Genuine Break outs Breakout ek stock exchanging term hai jo ishara karta hai kisi share ka cost obstruction level ko cross kar ke upar badh gaya hai. Yani punch koi stock ke cost ka kisi explicit level se bahar jata hai to usay breakout kaha jata hai. Breakout ka matlab hota hai ki koi explicit cost level ke upper cost aage badha hai aur phir us level ko cross kar ke wapas neeche nahi gaya. Breakout exchanging system me brokers ke liye exchanging open doors make hoti hai poke share ka cost obstruction level ko break karta hai, kyun ke isse dealers ko pata chalta hai ki stock ka cost aage badhne ke chances hain.Breakout ka examination karne ke liye kuch steps hote hain: Recognize the key level: Pehle tou aapko wo level ya range distinguish karna hota hai jis se market break out kar rahi hai ya karne ki plausibility hai.Volume Check karna: Breakout ke time pe volume increment hona chahiye. Agar volume increment nahi hota ya phir kam rehta hai, toh wo breakout ho sakta hai hello nahi.Pattern Check karna: Breakout ke time pe market ka pattern bhi check karna zaruri hai. Agar pattern as of now against hai toh aap breakout ko keep away from kar sakte hain.Watch for affirmation: Agar aapko breakout affirm slack raha hai tou aap usko exchange kar sakte hain. Breakout ke affirmation ke liye aap cost activity, outline designs, specialized markers ka use kar sakte hain.Risk the board: Breakout exchanging mein risk the executives kaafi significant hai. Apni passage, stop misfortune aur target levels ko set karna zaruri hai aur apne exchange size ko bhi apne risk profile ke concurring change karna zaruri hai. Exchange Genuine Break Outs Breakout exchanging ka matlab hota hai kisi stock ya money pair ka cost kisi specific level ko break karne ke baad uss level ke inverse bearing me move hona. Breakout exchanging karna ek well known exchanging technique hai jis se merchants ko high unpredictability ke beech benefit kamane ka mouka milta hai.Breakout exchanging karne ke liye merchants pehle kisi specific level ya cost range ko recognize karte hain jahaan standard ek potential breakout sharpen ke chances hote hain. Fir woh level ya cost range ko intently screen karte hain aur hit cost uss level ko break karta hai toh woh apna exchange enter karte hain.Breakout exchanging me brokers kuch significant focuses ko dhyaan me rakhte hain jaise ki stop misfortune request ka arrangement, section aur leave focuses ke tay karna aur apne exchanges ko intently screen karna.Breakout exchanging kaafi risk imply karti hai kyunki ye high unpredictability ke saath hoti hai aur cost bearing change sharpen ka risk bhi hota hai. Isliye, breakout exchanging me risk the board kaafi significant hota hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is Phony Breakouts Dear forex Memebrs Counterfeit breakouts yani kay aisy cost developments hoty hain jin mein market cost ka pattern kisi explicit level tak pohanch jata hai, jaisa kay obstruction level ya support level, magar phir woh uss level ko cross nahi karta aur inverse heading mein move hona shuru ho jata hai. Is tarah kay cost developments mein dealers ko lagta hai kay cost break out kar raha hai aur pattern jari rakhay ga, magar haqeeqat mein yeh counterfeit hota hai aur cost inverse course mein move karta hai.Fake breakouts ka matlab hota hai ke market mein kisi resource ki cost kisi opposition ya support level ko break kar deti hai, lekin phir wapas se usi range ke andar aa jati hai. Counterfeit breakouts ko bhi bogus breakouts ke naam se jana jata hai. Yeh circumstance dealer ke liye baffling ho sakti hai, kyunki isse unko bogus signs milte hain aur unki exchanges stop misfortune level ko hit ho jati hain. Counterfeit breakouts ka work is tarah hota hai ke market mein kuchh aisi conditions make ho jati hain, jaise low liquidity ya phir kisi significant news ke declaration ke kareeb, jiski wajah se cost ko briefly apne genuine worth se alag ek level standard move karaya jata hai. Best Investigation Counterfeit Break Out Dear Phony Breakouts, ya fakeouts, ki investigation exchanging outlines standard ki jati hai. Is mein merchants ne cost activity aur volume ko intently notice karna hota hai. Agar cost diagram standard kisi specific level ya pattern line se break out sharpen ka signal milta hai aur us ke baad cost phir se wapis usi level standard aajata hai tou yeh counterfeit breakout ki misaal hai.Traders is ko examine karne ke liye normally utilized specialized markers jaise ki RSI, MACD, aur Bollinger Groups ka istemal karte hain. In pointers ki madad se cost ki pattern aur energy ke sath market ke opinion ko bhi evaluate kiya ja sakta hai. Counterfeit Breakouts ko distinguish karne ke liye merchants ko volume ki bhi intently screen karna hota hai, kyunki fakeouts ka ziyada volume nahi hota hai. Iske alawa, brokers news aur market ke generally speaking circumstances ko bhi dekhte hain kyunki yeh bhi cost developments standard effect dalte hain aur counterfeit breakouts ka reason bhi bante hain. In general, counterfeit breakouts ki examination ek mix of specialized investigation, volume examination, news investigation, aur market opinion examination se ki jati hai.

Best Investigation Counterfeit Break Out Dear Phony Breakouts, ya fakeouts, ki investigation exchanging outlines standard ki jati hai. Is mein merchants ne cost activity aur volume ko intently notice karna hota hai. Agar cost diagram standard kisi specific level ya pattern line se break out sharpen ka signal milta hai aur us ke baad cost phir se wapis usi level standard aajata hai tou yeh counterfeit breakout ki misaal hai.Traders is ko examine karne ke liye normally utilized specialized markers jaise ki RSI, MACD, aur Bollinger Groups ka istemal karte hain. In pointers ki madad se cost ki pattern aur energy ke sath market ke opinion ko bhi evaluate kiya ja sakta hai. Counterfeit Breakouts ko distinguish karne ke liye merchants ko volume ki bhi intently screen karna hota hai, kyunki fakeouts ka ziyada volume nahi hota hai. Iske alawa, brokers news aur market ke generally speaking circumstances ko bhi dekhte hain kyunki yeh bhi cost developments standard effect dalte hain aur counterfeit breakouts ka reason bhi bante hain. In general, counterfeit breakouts ki examination ek mix of specialized investigation, volume examination, news investigation, aur market opinion examination se ki jati hai.  Exchange Counterfeit break outs Counterfeit Breakouts ke exchange ke liye kuch procedures hain, jin ka istemaal kiya ja sakta hai. Kuch tips specialty diye gaye hain:Hang tight for affirmation: Poke tak apko affirm na ho jaye ke breakout sach me bona fide hai ya nahi, tab tak exchange na karen. Iske liye apko cost activity aur other specialized pointers ka use karna hoga. Set stop misfortune: Consistently set a stop misfortune request to restrict your possible misfortunes in the event that the breakout ends up being phony.Watch out for volume: High volume during a breakout shows more prominent conviction among dealers, improving the probability of a certifiable breakout.Utilize various time spans: Really look at the breakout on numerous time periods to get a more clear image of whether it is certified or counterfeit.Abstain from exchanging during news occasions: Market unpredictability during news occasions can prompt bogus breakouts. It is ideal to hold on until after the news occasion has passed to make an exchange.In tamam methods ka istemal karke, counterfeit breakouts standard exchange kiya ja sakta hai. Genuine Break outs Breakout ek stock exchanging term hai jo ishara karta hai kisi share ka cost opposition level ko cross kar ke upar badh gaya hai. Yani poke koi stock ke cost ka kisi explicit level se bahar jata hai to usay breakout kaha jata hai. Breakout ka matlab hota hai ki koi explicit cost level ke upper cost aage badha hai aur phir us level ko cross kar ke wapas neeche nahi gaya. Breakout exchanging procedure me dealers ke liye exchanging open doors make hoti hai poke share ka cost opposition level ko break karta hai, kyun ke isse brokers ko pata chalta hai ki stock ka cost aage badhne ke chances hain.Breakout ka investigation karne ke liye kuch steps hote hain:Distinguish the key level: Pehle tou aapko wo level ya range recognize karna hota hai jis se market break out kar rahi hai ya karne ki plausibility hai.Volume Check karna: Breakout ke time pe volume increment hona chahiye. Agar volume increment nahi hota ya phir kam rehta hai, toh wo breakout ho sakta hai hello nahi.Pattern Check karna: Breakout ke time pe market ka pattern bhi check karna zaruri hai. Agar pattern as of now against hai toh aap breakout ko stay away from kar sakte hain.Watch for affirmation: Agar aapko breakout affirm slack raha hai tou aap usko exchange kar sakte hain. Breakout ke affirmation ke liye aap cost activity, graph designs, specialized markers ka use kar sakte hain. Risk the executives: Breakout exchanging mein risk the board kaafi significant hai. Apni passage, stop misfortune aur target levels ko set karna zaruri hai aur apne exchange size ko bhi apne risk profile ke concurring change karna zaru.

Exchange Counterfeit break outs Counterfeit Breakouts ke exchange ke liye kuch procedures hain, jin ka istemaal kiya ja sakta hai. Kuch tips specialty diye gaye hain:Hang tight for affirmation: Poke tak apko affirm na ho jaye ke breakout sach me bona fide hai ya nahi, tab tak exchange na karen. Iske liye apko cost activity aur other specialized pointers ka use karna hoga. Set stop misfortune: Consistently set a stop misfortune request to restrict your possible misfortunes in the event that the breakout ends up being phony.Watch out for volume: High volume during a breakout shows more prominent conviction among dealers, improving the probability of a certifiable breakout.Utilize various time spans: Really look at the breakout on numerous time periods to get a more clear image of whether it is certified or counterfeit.Abstain from exchanging during news occasions: Market unpredictability during news occasions can prompt bogus breakouts. It is ideal to hold on until after the news occasion has passed to make an exchange.In tamam methods ka istemal karke, counterfeit breakouts standard exchange kiya ja sakta hai. Genuine Break outs Breakout ek stock exchanging term hai jo ishara karta hai kisi share ka cost opposition level ko cross kar ke upar badh gaya hai. Yani poke koi stock ke cost ka kisi explicit level se bahar jata hai to usay breakout kaha jata hai. Breakout ka matlab hota hai ki koi explicit cost level ke upper cost aage badha hai aur phir us level ko cross kar ke wapas neeche nahi gaya. Breakout exchanging procedure me dealers ke liye exchanging open doors make hoti hai poke share ka cost opposition level ko break karta hai, kyun ke isse brokers ko pata chalta hai ki stock ka cost aage badhne ke chances hain.Breakout ka investigation karne ke liye kuch steps hote hain:Distinguish the key level: Pehle tou aapko wo level ya range recognize karna hota hai jis se market break out kar rahi hai ya karne ki plausibility hai.Volume Check karna: Breakout ke time pe volume increment hona chahiye. Agar volume increment nahi hota ya phir kam rehta hai, toh wo breakout ho sakta hai hello nahi.Pattern Check karna: Breakout ke time pe market ka pattern bhi check karna zaruri hai. Agar pattern as of now against hai toh aap breakout ko stay away from kar sakte hain.Watch for affirmation: Agar aapko breakout affirm slack raha hai tou aap usko exchange kar sakte hain. Breakout ke affirmation ke liye aap cost activity, graph designs, specialized markers ka use kar sakte hain. Risk the executives: Breakout exchanging mein risk the board kaafi significant hai. Apni passage, stop misfortune aur target levels ko set karna zaruri hai aur apne exchange size ko bhi apne risk profile ke concurring change karna zaru.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:18 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим