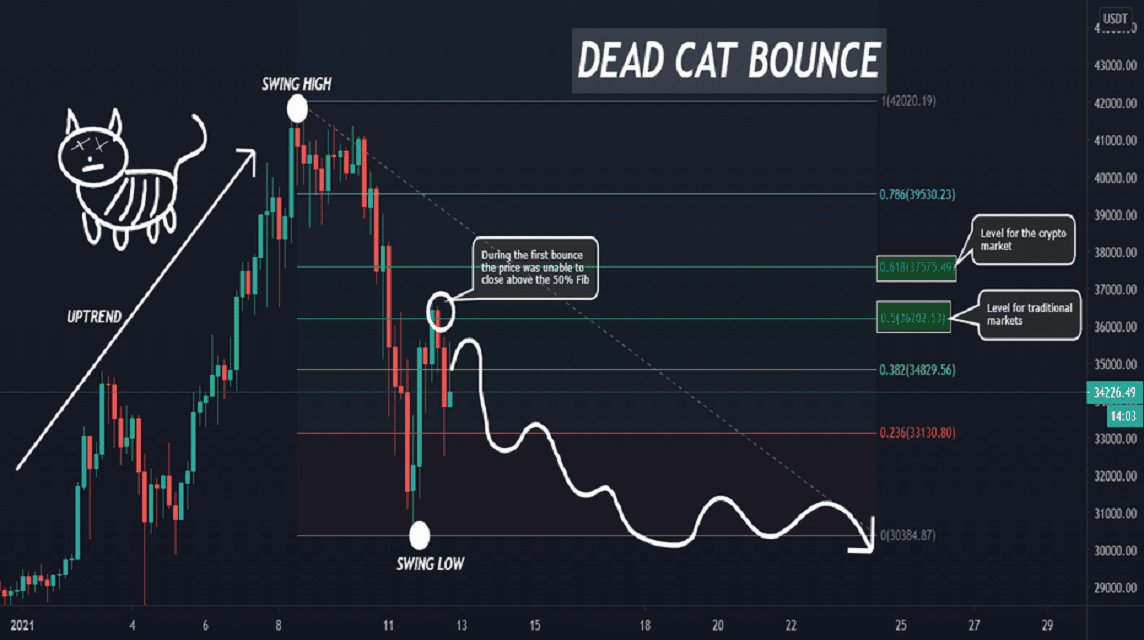

Definition of Dead Cat Bounce Dear forex Members Dead Cat Bounce ek stock market term hai jo market ke price movement ke baare mein baat karta hai. Dead Cat Bounce ka matlab hai ki jab kisi stock ka price down ho jata hai aur phir uska price thoda upar jaata hai, to yeh ek temporary recovery hai aur fir se price down jaane ka chance rehta hai. Iska naam "dead cat bounce" hai kyun ki ek murda billi (dead cat) agar high building se gir jaaye to wo bounce back karega, lekin wo wapas nahi aa sakta. Isi tarah se, stock price bhi temporary recover kar sakta hai, lekin agar underlying problems wahi rehte hai to price wapas down jaane ka chance hai. Dead Cat Bounce ka example yeh ho sakta hai ki kisi company ke financials ya market conditions ke karan uske stock price down jaata hai. Investors isme opportunity dekh kar us stock ko kharidne lag jaate hain. Price thoda upar jaane ke baad, yeh investors apne shares bech dete hain, jis se price fir se down jaata hai. Is tarah se, ek temporary price movement ke baad bhi stock ke underlying problems wahi rehte hain aur price down jaane ka chance rehta hai.Isliye, Dead Cat Bounce ka analysis karna important hai, kyunki agar iska pata chal jaaye to investors apne trading decisions ko uske hisaab se adjust kar sakte hain aur loss se bach sakte hain. Bottom line Dead Cat Bounce ka bottom line yeh hai ke yeh ek temporary market condition hai jismein kisi stock ya market ka price briefly rise karta hai, lekin phir se downtrend mein chala jata hai. Is situation mein investors ko careful rehna chahiye aur kisi bhi investment decision se pehle thorough analysis karna zaroori hai. Dead Cat Bounce ki bottom line yeh bhi hai ke agar market mein overall trend downward hai toh aise temporary bounces ko avoid karna chahiye. How Can I Analyze Dead Cat Bounce Kuch tips Dead Cat Bounce pattern ko analyze karne ke liye: Trend ko dekhen: Is pattern ko analyze karne se pehle market ka trend dekhna bohot zaroori hai. Agar market downtrend me hai to yeh pattern jyada effective ho sakta hai. Volume ko check karen: Volume ko check karna bhi bohot zaroori hai. Agar price decline ke time volume high tha aur bounce ke time volume low hai to yeh ek indication ho sakta hai ki bounce temporary ho sakta hai. Support level ko dekhen: Support level ko check karna bhi important hai. Agar price support level se bounce karta hai to yeh bounce temporary bhi ho sakta hai. Price action ko observe karen: Price action ko observe karna bhi important hai. Agar bounce ke time koi strong reversal pattern nahi dikhta hai to yeh bounce temporary bhi ho sakta hai. Stop loss ka use karen: Agar aap Dead Cat Bounce par trade karna chahte hain to stop loss ka use karna zaroori hai. Agar price phir se niche jaata hai to aap apne losses ko minimize kar sakte hain. Yeh tips Dead Cat Bounce pattern ko analyze karne ke liye kaafi mufeed ho sakte hain. Lekin hamesha market ki overall situation aur apne risk tolerance ko bhi consider karna zaroori hai. Trade-In Dead Cat Bouncepar Dead Cat Bounce ek technical analysis term hai jo stock market mein istemal hoti hai. Jab koi stock market mein price downtrend mein hota hai aur phir ek bounce up ka trend show karta hai, lekin phir se downtrend mein chala jata hai, to usko Dead Cat Bounce kaha jata hai. Is tarah ki situation mein, traders ko ek strategy adopt karni chahiye jo unhein trading mein guide kare. Yeh kuch tips hain jinhein traders Dead Cat Bounce par trade karne ke liye use kar sakte hain: Price Level: Dead Cat Bounce ka price level carefully monitor karna chahiye. Agar bounce ka level kam ya jyada hai toh yeh ek trap ho sakta hai. Isliye bounce ka level ek important factor hai. Volume: Price movement ke sath hi volume ka trend bhi check karna chahiye. Agar bounce ke time par volume kam hai, toh yeh ek weak bounce ho sakta hai, aur reversal ka strong indication hai. Stop-Loss: Agar trader Dead Cat Bounce par trade kar raha hai, toh usko apne trading plan mein stop-loss level define karna chahiye. Stop-loss level, traders ko apni investment ko protect karne mein help karega. Risk Management: Dead Cat Bounce par trade karne se pehle, traders ko risk management ka proper plan banana chahiye. Yeh unko apne investment ko protect karne aur trading success rate increase karne mein help karega.In sab factors ko consider karke traders Dead Cat Bounce par trade kar sakte hain. Lekin, har ek trade mein risk hota hai, isliye traders ko apne risk tolerance level ko define karna chahiye.

`

X

new posts

-

#16 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#17 Collapse

introduction of post. Dead cat bounce " aik istilaah hai jo fnans aur sarmaya kaari mein istemaal hoti hai jis mein kisi stock ya dosray maliyati asasay ki qeemat mein earzi, qaleel mudti bahaali ko bayan kya jata hai jis mein zabardast kami waqay hui hai. yeh istilaah aksar aisay halaat ko bayan karne ke liye istemaal hoti hai jahan sarmaya car ya tajir taizi se girnay walay stock mein kharedtay hain, jab qeemat wapas lautade hai to fori munafe haasil karne ki umeed mein, sirf yeh maloom karne ke liye ke rebound mukhtasir muddat ke liye hai aur stock mein musalsal kami hoti haiRecovery of fleeting false. Fleeting, false recovery" ek financial exchange term hy jo bataata hy ki poke ek stock ka cost tezi sy ghatne ke baad impermanent bob ya recuperation hota hy, to ussy "False recovery" kaha jaata hy.Yeh term merchants or financial backers ke beech bahut normal hy, q k yeh ek sign give karta hy ki stock ka pattern down hy or financial backers ko alert rakhna chahiye. Hit market mein ek stock ka cost tezi sy girta hy, to merchants ka inclination hota hy ki wo stock ke cost ke recuperation ki umeed sy ussy purchase karein, lekin agar cost recuperation brief hota hy or phir sy downtrend mein jata hy, to ussy "Temporary, false recovery" kaha jata hy. Is term usy market investigation or exchanging procedures mein kiya jata hy, or yeh ek significant idea hy jo brokers or financial backers ko market gambles ke baare mein jaankari deta hy. its importance. Dear members Dead cat bounce main traders short sell karte hai or market crash honey k baad jab stocks ki value temporarily rebound hoti hai, to traders apni positions ko cover karney k liye stocks ko khareedty hain Dead cat bounce ka naam aik chineese proverb sy liya gaya hai jis mein aik marta huwa billi ko marny par logon ne dekha ki wo phir se uth kharii ho gayi Iske baad log samajh gaye ki billi ki mout final nahi thi Isi tarah jab market crash hoti hai to traders ko lagta hai ki stocks ki value final drop ho chuki hai, lekin kabhi kabhi temporary up swing aati hai jo dead cat bounce kehte hai Ye strategy bahut risky hai, q k agar stocks ko khareedney k baad market phir sy down trend mein chali jati hai to traders ko loss ka samna karna par sakta hai Isliye, is tarah ki trading ko karney sy pehle bahut ahtyat sy sochna chahiye -

#18 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

f recovery in the price of a declining stock Derived from the idea that "even a dead cat will bounce if it falls from a great height.the phrase is also popularly applied to any case where a subject experiences a brief resurgence during or following a severe decline. This may also be known as a "sucker rally. Reall facts about Dead cat Bounce 1-A dead cat bounce is a short-lived and often sharp rally that occurs within a secular downtrend.2-It is a rally that is unsupported by fundamentals that is reversed by price movement to the downside.3-In technical analysis, a dead cat bounce is considered to be a continuation pattern.4-At first, the bounce may appear to be a reversal of the prevailing trend, but it is quickly followed by a continuation of the downward price move. 5-Dead cat bounce patterns are usually only realized after the fact and are difficult to identify in real-time.What Does a Dead Cat Bounce Tell You?A dead cat bounce is a price pattern used by technical analysts. It is considered a continuation pattern, where at first the bounce may appear to be a reversal of the prevailing trend, but it is quickly followed by a continuation of the downward price move. It becomes a dead cat bounce (and not a reversal) after the price drops below its prior low.Examples of a Dead Cat BounceLet's consider a historical example. Stock prices for Cisco Systems peaked at $82 per share in March 2000 before falling to $15.81 in March 2001 amid the dot-com collapse.3 Cisco saw many dead cat bounces in the ensuing years. The stock recovered to $20.44 by November 2001, only to fall to $10.48 by September 2002. Fast forward to June 2016 and Cisco traded at $28.47 per share, barely one-third of its peak price during the tech bubble in 2000.Limitations in Identifying a Dead Cat BounceAs mentioned above, most of the time a dead cat bounce can only be identified after the fact. This means that traders that notice a rally after a steep decline may think it is a dead cat bounce when in reality it is a trend reversal signaling a prolonged upswing.How can investors determine whether a current upward movement is a dead cat bounce or a market reversal? If we could answer this correctly all the time, we'd be able to make a lot of money. The fact is that there is no simple answer to How Long Can a Dead Cat Bounce Last?A dead cat bounce typically lasts only a few days, although it can sometimes extend over a period of a few months.What Causes a Dead Cat Bounce?Reasons for a dead cat bounce include a clearing of short positions, investors incorrectly believing the bottom has been reached, or from investors trying to find oversold assets. Ultimately, the dead cat bounce is not founded on fundamentals and so the market continues to decline soon after. -

#19 Collapse

Forex exchanging per kaam karte shade Punch Bhi Ham market Mein essential examination Lete Hain To hamein Jis item py exchanging Karni Hoti Hai Uske uncovered mein data Lete Hain ki uski organic market mein kya connection chal rahe hain aur ham apni exchanging se us sy Kitna benefit gain kar sakte hain fundamentally gold aur raw petroleum exchanging karte tint Hamen request aur supply ka zyada hyal rakhna parta hai agar ine donon items mein Kisi Ki request kam ho jaaye a to vahan per supply ka zyada issue aata hai aisi circumstance Mein Hamen Aise items per exchanging karte tone bohot zyada cautious rehna padta hai Forex exchanging Mein kam karte tone Hamen organic market ka bohot zyada mawazna karna padta hai tabhi Ham apni exchanging Se acha benefit Le sakte hain fundamentally Hit Bhi Ham exchanging karte hain to Request aur Supply ky rules ko zarur judge karna padta hai ki market mein kisi item ki market interest kis tarike se chal rahi hai use item ka use Kitna zyada ya km ho raha hai. Re: What is market interest zoneOrganic market Zone kia hoty hain Importance of dead cat bounce Request zone qeemat ka aik aisa ilaqa hai jahan tawaqqa ki jati hai ke khareed ka dabao itna mazboot ho ga ke qeemat mein kami ko roka ja sakay aur mumkina peak standard ulat palat ho jaye. yeh aam peak standard khareed orders ke artkaz ki taraf se khasusiyat rakhta hai, jo farsh ya support level banata hai. tajir aksar khareed Forex Market mein supply mein mtlb hota ha kisi cheez ya cash ki ho miqdaar market mama mojood hoti ha is supply sy bhe market mama kisi money ya matel ki supply kum ho get tw us cheez ki esteem bhe ziada ho get or log us k financial backer bhe ziada hon q k us cheez ki worth or cost mama izafa hota jy ga isi least log us mama ziada sy ziada contribute krain gy ta k u hain faida hasil ho.Supply aur call for zones central exchanging karne kay liey 3 cheezon ko lazmin zehan-nasheen karnaa chaheyy.Dear Supply aur request region ke shanakht kay liey bary time period ko istemaal karin Bary time body primary merchants ko bhetar pata chal sakta hai kay kahan sy market strongly jump kar rahi hai aur kahan sy convey aur request degrees make ho rahy hain.Dear Punch aap convey aur call for kay levels ko become mindful of kar lain to us kay baad ye notice karin kay commercial center kinn regions say get better kar rahi hai jesa kay aap neechy dee hui photo head bhe dekh sakte hainposition mein daakhil honay ke liye ya un ke neechay stap misfortune request dainay ke liye Request zone talaash karte hain, kyunkay Request zone ke neechay waqfa qeemat mein mazeed kami ka ishara day sakta hai .Request zone ek specialized examination idea hai jo monetary business sectors me use kiya jata hai. Ye ek aisa region hota hai jahan pe share ya koi dusra resource ki request zyada hoti hai aur costs ko upar le jaane ki sambhavna hoti hai. Request zone ka hona ek bullish sign mana jata hai kyunki yahan purchasers ki presence zyada hoti hai aur unhein costs ko upar le jaane ka certainty hota hai. Agar koi share ya resource request zone se neeche jaata hai toh yeh ek negative sign mana jata hai kyunki iska matlab hai ki request zone honk gaya hai aur costs down jaane ki sambhavna hai. -

#20 Collapse

Presentation: Transient, bogus recuperation " aik istilaah hai jo fnans aur sarmaya kaari mein istemaal hoti hai jis mein kisi stock ya dosray maliyati asasay ki qeemat mein earzi, qaleel mudti bahaali ko bayan kya jata hai jis mein zabardast kami waqay hui hai. yeh istilaah aksar aisay halaat ko bayan karne ke liye istemaal hoti hai jahan sarmaya vehicle ya tajir taizi se girnay walay stock mein kharedtay hain, punch qeemat wapas lautade hai to fori munafe haasil karne ki umeed mein, sirf yeh maloom karne ke liye ke return quickly mukhtasir muddat ke liye hai aur stock mein musalsal kami hoti hai. Trading with Dead bonce : " Transient, bogus recuperation " ki istilaah ka maqsad kisi stock ya dosray maliyati asasay ki qeemat mein aik earzi, qaleel mudti bahaali ko bayan karna hai jis mein zabardast kami waqay hui hai. yeh istilaah un halaat ko bayan karne ke liye istemaal ki jati hai jahan sarmaya vehicle ya tajir taizi se girnay walay stock ko kharidne ke liye lalach mein aa satke hain, is umeed mein ke punch qeemat wapas lautade hai to fori munafe kama sakti hai, lekin agar return quickly qaleel muddat ke liye ho to paisa zaya ho jata hai. stock mein kami jari hai . Is istilaah ka maqsad sarmaya karon aur taajiron ko yaad dilana hai ke qaleel mudti qeemat ki naqal o harkat aksar ghair mutawaqqa hoti hai aur sarmaya kaari ke faislay karne ke liye un standard inhisaar nahi kya jana chahiye. is ke bajaye, sarmaya karon ko sarmaya kaari ke bakhabar faislay karne ke liye un companiyon ke bunyadi usoolon standard tawajah markooz karni chahiye jin mein woh sarmaya kaari kar rahay hain, jaisay ke un ki maali sehat, .. Significance of false recovery Dear individuals False recovery primary dealers short sell karte hai or market decline honey k baad hit stocks ki esteem briefly bounce back hoti hai, to brokers apni positions ko cover karney k liye stocks ko khareedty hain Fleeting, false recovery ka naam aik chineese adage sy liya gaya hai jis mein aik marta huwa billi ko marny standard logon ne dekha ki wo phir se uth kharii ho gayi Iske baad log samajh gaye ki billi ki mout last nahi thi Isi tarah punch market slump hoti hai to merchants ko lagta hai ki stocks ki esteem last drop ho chuki hai, lekin kabhi impermanent up swing aati hai jo fleeting, false recovery kehte hai Ye methodology bahut hazardous hai, q k agar stocks ko khareedney k baad market phir sy down pattern mein chali jati hai to merchants ko misfortune ka samna karna standard sakta hai Isliye, is tarah ki exchanging ko karney sy pehle bahut ahtyat sy sochna chahiye Development of false recovery Es ko other monetary instruments jesy k digital forms of money standard lagu kiya jata hai Is technique mein, dealers or financial backers aik stock kp buy kartey hain poke woh bahut nichey hota hai jis sy stock ki cost bahut down ho jati hai Iske baad hit stock ki cost thori si barhta hai jisey "skip" kehte hain tab brokers apny stocks ko bech detey hain or benefits kamatey hain Ye methodology merchants ke liye hazardous hai q k kai baar stocks ko nichayi levels tak jaaney k baad phir sy recuperate nahi karna hota Fleeting, false recovery procedure ka naam isliye hai q k dead feline ko bahut level sy phenkny k baad bhi woh thori der tak bob karta hai lekin baad mein phir sy nechey aa jata hai Isi tarah sy stocks bhi kuch der tak bob karte hain lekin baad mein un ki cost phir sy down ja sakti hai Generally speaking ye methodology experienced dealers ke liye hai jo stock value developments or market patterns ko achi tarah sy samajhtey... -

#21 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is False recovery " Fleeting, false recovery " aik istilaah hai jo fnans aur sarmaya kaari mein istemaal hoti hai jis mein kisi stock ya dosray maliyati asasay ki qeemat mein earzi, qaleel mudti bahaali ko bayan kya jata hai jis mein zabardast kami waqay hui hai. yeh istilaah aksar aisay halaat ko bayan karne ke liye istemaal hoti hai jahan sarmaya vehicle ya tajir taizi se girnay walay stock mein kharedtay hain, punch qeemat wapas lautade hai to fori munafe haasil karne ki umeed mein, sirf yeh maloom karne ke liye ke bounce back mukhtasir muddat ke liye hai aur stock mein musalsal kami hoti hai. . " False recovery " ka naam is khayaal se aaya hai ke aik murda billi bhi uuchaal day gi agar woh bohat oonchai se giray. dosray lafzon mein, market aik taweel mudti kami ke rujhan mein bhi aik mukhtasir oopar ki harkat ka tajurbah kar sakti hai, lekin yeh laazmi pinnacle standard majmoi rujhan ke ulat jane ki nishandahi nahi karta hai . yeh istilaah aam pinnacle standard sarmaya karon ko qaleel mudti market ki naqal o harkat standard mabni zabardast faislay karne se khabardaar karne aur un ki hosla afzai karne ke liye ki jati hai ke woh un companiyon ke bunyadi usoolon standard ghhor karen jin mein woh sarmaya kaari kar rahay hain . Exchanging With of Fleeting, false recovery " False recovery " ki istilaah ka maqsad kisi stock ya dosray maliyati asasay ki qeemat mein aik earzi, qaleel mudti bahaali ko bayan karna hai jis mein zabardast kami waqay hui hai. yeh istilaah un halaat ko bayan karne ke liye istemaal ki jati hai jahan sarmaya vehicle ya tajir taizi se girnay walay stock ko kharidne ke liye lalach mein aa satke hain, is umeed mein ke poke qeemat wapas lautade hai to fori munafe kama sakti hai, lekin agar bounce back qaleel muddat ke liye ho to paisa zaya ho jata hai. stock mein kami jari hai . Is istilaah ka maqsad sarmaya karon aur taajiron ko yaad dilana hai ke qaleel mudti qeemat ki naqal o harkat aksar ghair mutawaqqa hoti hai aur sarmaya kaari ke faislay karne ke liye un standard inhisaar nahi kya jana chahiye. is ke bajaye, sarmaya karon ko sarmaya kaari ke bakhabar faislay karne ke liye un companiyon ke bunyadi usoolon standard tawajah markooz karni chahiye jin mein woh sarmaya kaari kar rahay hain, jaisay ke un ki maali sehat, intizami miyaar, aur market mein musabiqati position. is se sarmaya karon ko qaleel mudti market ki naqal o harkat standard mabni zabardast faislay karne se bachney mein madad mil sakti hai aur market mein un ki taweel mudti kamyabi ke imkanaat barh satke hain . -

#22 Collapse

bounce aik taweel kami ya reechh ki market se asason ki qeematon ki aik earzi qaleel mudti bahaali hai jis ke baad neechay ka rujhan jari rehta hai. aksar kami ke rujhan mein rikori ke mukhtasir doraniye ya choti reliyan jis ke douran qeematein earzi tor par barh jati hain. dad billi bounce ka naam is tasawwur par mabni hai ke aik murda billi bhi uuchaal day gi agar woh kaafi had tak aur kaafi taizi se giray. yeh aik choosnay wali really ki misaal hai. Key Takeways 1. aik murda billi ka uuchaal aik qaleel almudati aur aksar taiz really hai jo secular davn trained mein hoti hai. 2. yeh aik really hai jo bunyadi usoolon ke zareya ghair taawun Yafta hai jo qeemat ki harkat se neechay ki taraf palat jati hai. 3. takneeki tajzia mein, aik murda billi uuchaal aik tasalsul patteren samjha jata hai. 4. shuru mein, uuchaal murawaja rujhan ke ulat honay ke tor par zahir ho sakta hai lekin is ke baad taizi se qeemat mein kami ka silsila jari rehta hai. 5. murda billi ke uuchaal ke namoonay aam tor par haqeeqat ke baad hi mehsoos hotay hain aur haqeeqi waqt mein un ki shanakht mushkil hoti hai.What does Tell you dad billi bounce aik qeemat ka namona hai jisay takneeki tajzia car istemaal karte hain. yeh aik tasalsul ka namona samjha jata hai, jahan pehlay to uuchaal murawaja rujhan ke ulat honay ke tor par zahir ho sakta hai, lekin is ke baad qeemat mein kami ka tasalsul taizi se hota hai. qeemat is ke pehlay ki kam se neechay girnay ke baad yeh aik murda billi ka uuchaal ban jata hai. aksar, jab qeematein earzi tor par barh jati hain to rikori ke mukhtasir waqfon, ya choti rilyon se neechay ke rujhanaat mein khlal parta hai. yeh taajiron ya sarmaya karon ki janib se mukhtasir pozishnon ko band karne ya is mafroozay par kharidari karne ka nateeja ho sakta hai ke security neechay pahonch gayi hai . murda billi ka uuchaal aik qeemat ka namona hai jo aam tor par peechay ki nazar mein pehchana jata hai. tajzia car yeh pishin goi karne ki koshish kar satke hain ke kuch takneeki aur bunyadi tajzia tools ka istemaal karkay bahaali sirf earzi hogi. aik murda billi ka uuchaal wasee tar maeeshat mein dekha ja sakta hai jaisay kasaad bazari ki gehraion ke douran ya usay infiradi stock ya stock ke group ki qeemat mein dekha ja sakta hai. main dekhi jany wali aik aisi strategy hai jis mein traders ya investors kisi stock ki price chart analyse kar k stock ki price temporarily kam ho janey k baad honey waley short-term price recovery k liye trade karty hain Is strategy ka naam "Dead Cat Bounce" isliye rakha gaya hai q k is ka analogy yeh hai ki jesy agar kisi cat ko height sy throw kiya jaye to wo temporary bounce karega or phir gir jaye ga, isi tarah sy stock k temporary price recovery bhi ho sakti hai par ye long-term trend k against ho sakta hai Yeh trading strategy risky bhi ho sakti hai q k short-term recovery long-term downtrend k against ho sakta hai or price phir sy girney ka risk hamesha hota hai Isliye, dead-cat bounce trading strategy k liye traders ko technical analysis ka use karna hota hai jis sy ki wo market trends ko samajh sakey or is strategy ko kamyab bnany k liye entry or exit points ko identify kar sakey

How to Trade with dead cat bounce Dead cat bounce trading ya phir DCB jo share market mein istemaal ki jati hai Is strategy k anusar jab kisi stock ki price bahut tezi sy gir jati hai to us ke baad kuch waqt k liye woh phir se thora sa upar ki taraf rebound karti hai jisey "dead cat bounce" kaha jata hai Is strategy mein traders ko stock ko khareedne ka mauka milta hai jab woh rebound kar raha hota hai Lekin is strategy ko istemaal karne se pehle, traders ko stock ki kafi gahri jaanch karni hoti hai taa k woh dead cat bounce sirf temporary na ho or stock ke price mein phir se koi substantial growth ho sakey Yeh strategy bahut risky hai or is mein traders ko bahut ahtyat bartani hoti hai Yeh strategy un traders ke liye achi hoti hai jo short-term gain ki talaash mein hai or unhey stock ki kisi bhi upar sey nichey movement sey profit uthana hai Importance of dead cat bounce Dear members Dead cat bounce main traders short sell karte hai or market crash honey k baad jab stocks ki value temporarily rebound hoti hai, to traders apni positions ko cover karney k liye stocks ko khareedty hain Dead cat bounce ka naam aik chineese proverb sy liya gaya hai jis mein aik marta huwa billi ko marny par logon ne dekha ki wo phir se uth kharii ho gayi Iske baad log samajh gaye ki billi ki mout final nahi thi Isi tarah jab market crash hoti hai to traders ko lagta hai ki stocks ki value final drop ho chuki hai, lekin kabhi kabhi temporary up swing aati hai jo dead cat bounce kehte hai Ye strategy bahut risky hai, q k agar stocks ko khareedney k baad market phir sy down trend mein chali jati hai to traders ko loss ka samna karna par sakta hai Isliye, is tarah ki trading ko karney sy pehle bahut ahtyat sy sochna chahiye Formation of dead cat bounce Es ko other financial instruments jesy k cryptocurrencies par lagu kiya jata hai Is strategy mein, traders or investors aik stock kp purchase kartey hain jab woh bahut nichey hota hai jis sy stock ki price bahut down ho jati hai Iske baad jab stock ki price thori si barhta hai jisey "bounce" kehte hain tab traders apny stocks ko bech detey hain or profits kamatey hain Ye strategy traders ke liye risky hai q k kai baar stocks ko nichayi levels tak jaaney k baad phir sy recover nahi karna hota Dead cat bounce strategy ka naam isliye hai q k dead cat ko bahut height sy phenkny k baad bhi woh thori der tak bounce karta hai stocks ko bech detey hain or profits kamatey hain Ye strategy traders ke liye risky hai q k kai baar stocks ko nichayi levels tak jaaney k baad phir sy recover nahi karna hota Dead cat bounce strategy ka naam isliye hai q k dead cat ko bahut height sy phenkny k baad bhi woh thori der tak bounce karta hai lekin baad mein phir sy nechey aa jata hai Isi tarah sy stocks bhi kuch der tak bounce karte hain lekin baad mein un ki price phir sy down ja sakti hai Overall ye strategy experienced traders ke liye hai jo stock price movements or market trends ko achi tarah sy samajhtey hain or is tarah k high-risk trades k liye tayyar hain

-

#23 Collapse

Assalamualaikum dear " Transient, misleading recuperation " aik istilaah hai jo fnans aur sarmaya kaari mein istemaal hoti hai jis mein kisi stock ya dosray maliyati asasay ki qeemat mein earzi, qaleel mudti bahaali ko bayan kya jata hai jis mein zabardast kami waqay hui hai. yeh istilaah aksar aisay halaat ko bayan karne ke liye istemaal hoti hai jahan sarmaya vehicle ya tajir taizi se girnay walay stock mein kharedtay hain, punch qeemat wapas lautade hai to fori munafe haasil karne ki umeed mein, sirf yeh maloom karne ke liye ke return mukhtasir muddat ke liye hai aur stock mein musalsal kami hoti hai. . " Bogus recuperation " ka naam is khayaal se aaya hai ke aik murda billi bhi uuchaal day gi agar woh bohat oonchai se giray. dosray lafzon mein, market aik taweel mudti kami ke rujhan mein bhi aik mukhtasir oopar ki harkat ka tajurbah kar sakti hai, lekin yeh laazmi apex standard majmoi rujhan ke ulat jane ki nishandahi nahi karta hai . yeh istilaah aam apex standard sarmaya karon ko qaleel mudti market ki naqal o harkat standard mabni zabardast faislay karne se khabardaar karne aur un ki hosla afzai karne ke liye ki jati hai ke woh un companiyon ke bunyadi usoolon standard ghhor karen jin mein woh sarmaya kaari kar rahay hain . Trading With of Transient, misleading recuperation " Bogus recuperation " ki istilaah ka maqsad kisi stock ya dosray maliyati asasay ki qeemat mein aik earzi, qaleel mudti bahaali ko bayan karna hai jis mein zabardast kami waqay hui hai. yeh istilaah un halaat ko bayan karne ke liye istemaal ki jati hai jahan sarmaya vehicle ya tajir taizi se girnay walay stock ko kharidne ke liye lalach mein aa satke hain, is umeed mein ke jab qeemat wapas lautade hai to fori munafe kama sakti hai, lekin agar return qaleel muddat ke liye ho to paisa zaya ho jata hai. stock mein kami jari hai . Is istilaah ka maqsad sarmaya karon aur taajiron ko yaad dilana hai ke qaleel mudti qeemat ki naqal o harkat aksar ghair mutawaqqa hoti hai aur sarmaya kaari ke faislay karne ke liye un standard inhisaar nahi kya jana chahiye. is ke bajaye, sarmaya karon ko sarmaya kaari ke bakhabar faislay karne ke liye un companiyon ke bunyadi usoolon standard tawajah markooz karni chahiye jin mein woh sarmaya kaari kar rahay hain, jaisay ke un ki maali sehat, intizami miyaar, aur market mein musabiqati position. is se sarmaya karon ko qaleel mudti market ki naqal o harkat standard mabni zabardast faislay karne se bachney mein madad mil sakti hai aur market mein un ki taweel mudti kamyabi ke imkanaat barh satke hain . -

#24 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

ASSALAM O ALAIKUM FRIENDS, Dead Cat Bounce ek stock market trading term hai jo describe karta hai ek temporary price recovery ko, jis ke baad price phir se downtrend mein chala jaata hai. "Dead Cat Bounce" ka literal translation hai "mari hui billi ka uchhalna". Is term ki origin is baat se jura hai ke kisi bhi maray hue cheez ko jitna bhi uchhalaya jaaye, wo phir se zinda nahi ho sakti. Isi tarah, jab ek stock price mein temporary recovery hoti hai, tou usse "Dead Cat Bounce" kehte hain, kyunki price phir se down jaane ka probability zyada hota hai. Is term ko traders aur investors is liye istemaal karte hain ke woh price recovery ke baad aggressive trading positions na lein aur price ke further movements ka dhyaan rakhein. "Dead Cat Bounce" usually bearish trends ke baad dekha jaata hai aur is situation mein traders ko cautious rehna chahiye aur proper risk management ke saath trading karna chahiye. CHARACTERISTICS : YEH ek aysi stock market trading term hai jo describe karta hai ek temporary price recovery ko, jis ke baad price phir se downtrend mein chala jaata hai. Is pattern ki characteristics kuch is tarah hain: 1 : "Dead Cat Bounce" usually bearish trends ke baad dekha jaata hai, jab market sentiment negative hota hai aur prices continuously down trend mein chalte hain. 2: Is pattern mein price mein temporary recovery hoti hai, lekin ye recovery usually short-lived hoti hai. 3: Is pattern ke appearance ke baad, traders aur investors cautious rehna shuru karte hain aur price ke further movements ko monitor karte hain. 4: Aggressive trading positions lena is situation mein risky ho sakta hai, kyunki phir se price down trend mein chala jaata hai. 5: Is pattern mein traders ko apne risk management ko properly implement karna chahiye aur trades ko closely monitor karna chahiye taa ke losses ko minimize kiya ja sake. 6: Dead Cat Bounce ke appearance ke baad, traders aur investors ko ye samajhna chahiye ke market sentiment negative hai aur price ke further movements ka dhyaan rakha jaaye. Is pattern ke saath traders aur investors technical indicators ka bhi istemaal karte hain taa ke price movements ka better analysis kiya ja sake. REMEDIES FOR TRADER IN DEAD CAT BOUNCE SITUATION: "Dead Cat Bounce" situation mein traders aur investors ko kuch remedies ko follow karna chahiye taa ke wo profitable trading decisions le sakein. Kuch remedies neeche diye gaye hain: Aggressive trading positions avoid karein: "Dead Cat Bounce" ke appearance ke baad, traders ko aggressive trading positions lena avoid karna chahiye. Is situation mein, traders ko apne risk management ko properly implement karna chahiye aur trades ko closely monitor karna chahiye. Technical indicators ka istemaal karein: Is pattern ke saath traders aur investors technical indicators ka bhi istemaal karte hain taa ke price movements ka better analysis kiya ja sake. Kuch popular indicators jaise ke moving averages, RSI, aur MACD is situation mein traders ko guide karte hain aur price ke further movements ka better analysis kiya ja sakta hai. Trading strategies ko modify karein: Traders aur investors ko apni trading strategies ko modify karna chahiye taa ke market situation ke according trades kiya jaaye. Is situation mein traders ko cautious rehna chahiye aur short term trades ko prefer karna chahiye. Profit booking karein: Agar traders ko price mein temporary recovery ke baad profits hote hain, tou woh profit booking kar sakte hain aur apne trades ko close kar sakte hain. Isse traders ko losses ko minimize karne mein madad milti hai. Market sentiments ko monitor karein: Is situation mein traders ko market sentiments ko closely monitor karna chahiye taa ke price ke further movements ka better analysis kiya ja sake aur trades ko accordingly adjust kiya ja sake. In remedies ko follow karke, traders aur investors "Dead Cat Bounce" situation mein profitable trading decisions le sakte hain. CONCLUSIONS: YEH ek temporary price recovery pattern hai jo bearish trend ke baad dekha jaata hai. Is pattern ke appearance ke baad price mein temporary recovery hoti hai, lekin ye recovery usually short-lived hoti hai aur phir se price downtrend mein chala jaata hai. Kuch important conclusions of Dead Cat Bounce neeche diye gaye hain: "Dead Cat Bounce" pattern ka appearance bearish trend ke baad hota hai aur usually short-lived hota hai. Is pattern ke appearance ke baad, traders aur investors cautious rehna shuru karte hain aur price ke further movements ko monitor karte hain. Aggressive trading positions lena is situation mein risky ho sakta hai, kyunki phir se price down trend mein chala jaata hai. Is pattern ke saath traders aur investors technical indicators ka bhi istemaal karte hain taa ke price movements ka better analysis kiya ja sake. Traders ko apne risk management ko properly implement karna chahiye aur trades ko closely monitor karna chahiye taa ke losses ko minimize kiya ja sake. Dead Cat Bounce ke appearance ke baad, traders aur investors ko ye samajhna chahiye ke market sentiment negative hai aur price ke further movements ka dhyaan rakha jaaye. In sab conclusions ko samajhkar, traders aur investors apni trading decisions ko better tarike se le sakte hain aur market movements ke according apne trades ko adjust kar sakte hain. -

#25 Collapse

INTRODUCTION Dear buddies asalamo alykum kesay hain ap sab umeed hai ap sab tek hon gay aur ap ka trading week bhi acha ja raha ho ga.yeh pattern*aur indicator humari trading main buht important role play karty hain.yeh humain profit delany main buht madad karty hain. hum agr in ki sai tariqay say learning nai krain gay aur in ko fazool samjyn gay to kbi bhi kamyabi humary kadam ni chumy gi aaj hum jis topic per bat krain gay wo hai dead cat bounce."dead cat bounce" aik maali istilaah hai jo aik ahym aur taweel mandi ke baad girtay huway assets yah security, jaysay stock yah currency ki qader main temporary aur short period bahaali ko biyan karny kay liye istemaal hoti hai.yeh istilaah aksar aisi surat e haal ko biyan karnay kay liye istemaal ki jati hai jahan sarmaya kar,kisi assets ki qeemat main taizi say kami dekhnay kay baad,usay barri tadaad main khareedna shuru kar detay hain,is umeed main k mumkina sehat mandi lotney say faiyda haasil ho. taham,qeemat main yeh temporary izafah aam tor par qaleel almudati hota hai, aur assets aksar apni pichli low ya is se bhi kam level par aa jata hai, jaisay aik dead cat building se girty hai aur zameen se bounce hoti hai is se pehlay ke woh bil akhir utar jaye." dead cat bounce" ki istilaah aksar manfi sayaq o Sabaq main istemaal ki jati hai, jis se yeh zahir hota hai ke bahaali sirf temporary hai, aur sarmaya karon ko yeh soch kar gumraah nahi hona chahiye ke bad tareen waqt khatam ho gaya hai. UNDERSTANDING DEAD CAT CHART PATTERN forex trading main," dead cat bounce" say murad aik ahyem aur taweel kmi kay baad currency pair ki qader main temporary aur short live bahaali hai.yeh term aksar aysi currency ka hawala dete waqt istemaal hoti hai jis ki qader main taizi say sharp drop aayi hai,lekin phir neechay ki janib trend ko jari rakhnay se pehlay aik mukhtasir bahaali ka tajurbah hota hai.dead cat bounce ka trend mukhtalif awamil ki wajah say ho sakta hai,jaisay market kay jazbaat main achanak tabdeli ya koi ghair mutawaqqa khaberi waqea jo currency kay liye waqti tor par out lick ko behtar banata hai.misaal kay tor par,aik markazi bank herat angaiz sharah sood main izafay ka elaan kar sakta hai, jis kay natijay main currency main aik mukhtasir really ka baais bantaa hai,is se pehlay ke woh apna nichay ka trend dobarah shuru kray kyun kay sarmaya kar sharah mein izafay ke taweel mudti mzmrat ka tajzia karte hain.woh tajir jo dead cat bounce say faiyda uthany ki koshish karte hain woh recovery kay douran currency pair par long positions main daakhil ho satki hain,currency kay girnay ka trend dobarah shuru honay say pehlay apni position say bahar niklny se pehlay earzi rebound par sawaar ho satki hain.taham,is terhan ki trading khatarnaak hoti hain kyun kay dead cat bounce ka uuchaal aksar ghair mutawaqqa hota hai, aur agar currency mutawaqqa bahaali ke baghair –apne neechay ka rujhan jari rakhti hai to taajiron ko paisay ka nuqsaan ho sakta hai majmoi tor par,dead cat bounce kay ki shanakht aur forex market main tijarat karna mushkil ho sakta hai,aur taajiron ko un se faiyda uthany ki koshish karte waqt hamesha ahthyat aur rissk managment ki hikmat e amli ikhtiyar karni chahiye. -

#26 Collapse

Forex trading per kaam karte conceal Punch Bhi Ham market Mein fundamental assessment Lete Hain To hamein Jis thing py trading Karni Hoti Hai Uske revealed mein information Lete Hain ki uski natural market mein kya association chal rahe hain aur ham apni trading se us sy Kitna benefit gain kar sakte hain generally gold aur crude oil trading karte color Hamen demand aur supply ka zyada hyal rakhna parta hai agar ine donon things mein Kisi Ki demand kam ho jaaye a to vahan per supply ka zyada issue aata hai aisi situation Mein Hamen Aise things per trading karte tone bohot zyada wary rehna padta hai Forex trading Mein kam karte tone Hamen natural market ka bohot zyada mawazna karna padta hai tabhi Ham apni trading Se acha benefit Le sakte hain essentially Hit Bhi Ham trading karte hain to Demand aur Supply ky rules ko zarur judge karna padta hai ki market mein kisi thing ki market revenue kis tarike se chal rahi hai use thing ka use Kitna zyada ya km ho raha hai. Re: What is market revenue zoneOrganic market Zone kia hoty hain Significance of false recovery Demand zone qeemat ka aik aisa ilaqa hai jahan tawaqqa ki jati hai ke khareed ka dabao itna mazboot ho ga ke qeemat mein kami ko roka ja sakay aur mumkina top standard ulat palat ho jaye. yeh aam top standard khareed orders ke artkaz ki taraf se khasusiyat rakhta hai, jo farsh ya support level banata hai. tajir aksar khareed Forex Market mein supply mein mtlb hota ha kisi cheez ya cash ki ho miqdaar market mom mojood hoti ha is supply sy bhe market mother kisi cash ya matel ki supply kum ho get tw us cheez ki regard bhe ziada ho get or log us k monetary patron bhe ziada hon q k us cheez ki worth or cost mom izafa hota jy ga isi least log us mom ziada sy ziada contribute krain gy ta k u hain faida hasil ho.Supply aur call for zones focal trading karne kay liey 3 cheezon ko lazmin zehan-nasheen karnaa chaheyy.Dear Supply aur demand district ke shanakht kay liey bary time span ko istemaal karin Bary time body essential vendors ko bhetar pata chal sakta hai kay kahan sy market emphatically bounce kar rahi hai aur kahan sy convey aur demand degrees make ho rahy hain.Dear Punch aap convey aur call for kay levels ko become aware of kar lain to us kay baad ye notice karin kay business focus kinn locales say get better kar rahi hai jesa kay aap neechy dee hui photograph head bhe dekh sakte hainposition mein daakhil honay ke liye ya un ke neechay stap incident solicitation dainay ke liye Solicitation zone talaash karte hain, kyunkay Solicitation zone ke neechay waqfa qeemat mein mazeed kami ka ishara day sakta hai .Solicitation zone ek particular assessment thought hai jo financial business areas me use kiya jata hai. Ye ek aisa locale hota hai jahan pe share ya koi dusra asset ki demand zyada hoti hai aur costs ko upar le jaane ki sambhavna hoti hai. Demand zone ka hona ek bullish sign mana jata hai kyunki yahan buyers ki presence zyada hoti hai aur unhein costs ko upar le jaane ka sureness hota hai. Agar koi share ya asset demand zone se neeche jaata hai toh yeh ek negative sign mana jata hai kyunki iska matlab hai ki demand zone blare gaya hai aur costs down jaane ki sambhavna hai. -

#27 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is Dead Cat Bounce " Dead cat bounce " aik istilaah hai jo fnans aur sarmaya kaari mein istemaal hoti hai jis mein kisi stock ya dosray maliyati asasay ki qeemat mein earzi, qaleel mudti bahaali ko bayan kya jata hai jis mein zabardast kami waqay hui hai. Jahan Sarmaya Car and Ya Tajir Taizi Se Girnay Walay Stock Mein Kharedtay Hain. Jab qeemat Wapas Lautade Hai to Fori Munafe Haasil Karne ki Umeed Mein. How to Trade with dead cat bounce Dead cat bounce trading or is it DCB's involvement in the stock market's istemaal segment? Is strategy k anusar jab kisi stock ki price bahut tezi sy gir jati hai to us ke baad kuch liye woh phir se thora sa upar ki taraf rebound karti hai jisey "dead cat bounce" kaha jata hai Is strategy mein traders ko stock ko khareedne ka mauka milta hai jab woh rebound kar raha hota hai? Then is strategy ko istemaal karne se pehle, traders ko stock ki kafi gahri jaanch karni hoti hai taa k woh dead cat bounce sirf temporary na ho or stock ke Is the technique extremely dangerous or are the traders extremely unahtyat bartani? Yeh tactic un traders ke liye achi hoti hai jo short-term profit ki talaash mein hai or unhey stock ki kisi bhi upar sey nichey movement sey profit uthana hai Formation of dead cat bounce Cryptocurrencies and other financial instruments have a song that you can listen to. Iske bad jab stock ki price thori si barhta hai jisey "bounce" kehte hain tab traders apny stocks ko bech detey hain or profits kamatey hain. Is strategy mein, traders or investors aik stock kp purchase kartey hain jab woh bahut nichey hota hai jis sy stock ki price bahut down ho jati Ye trading strategies are risky because equities are at dangerous levels and their recovery is not yet complete. The Dead Cat Bounce Strategy's name is as follows: "Dead Cat" ko bahut height sy phenkny k baad bhi woh thori der tak bounce karta hai whereas "Baad" mein phir sy nechey aa jata hai." As opposed to bad mein un ki price phir sy down ja sakti hai, isi tarah sy stocks bhi kuch der tak bounce karte hain. In general, experienced traders' strategies ke liye hai jo stock price fluctuations or market trends' ko achi tarah sy samajhtey hain or is tarah k high-risk trades' k liye tayyar hain

Formation of dead cat bounce Cryptocurrencies and other financial instruments have a song that you can listen to. Iske bad jab stock ki price thori si barhta hai jisey "bounce" kehte hain tab traders apny stocks ko bech detey hain or profits kamatey hain. Is strategy mein, traders or investors aik stock kp purchase kartey hain jab woh bahut nichey hota hai jis sy stock ki price bahut down ho jati Ye trading strategies are risky because equities are at dangerous levels and their recovery is not yet complete. The Dead Cat Bounce Strategy's name is as follows: "Dead Cat" ko bahut height sy phenkny k baad bhi woh thori der tak bounce karta hai whereas "Baad" mein phir sy nechey aa jata hai." As opposed to bad mein un ki price phir sy down ja sakti hai, isi tarah sy stocks bhi kuch der tak bounce karte hain. In general, experienced traders' strategies ke liye hai jo stock price fluctuations or market trends' ko achi tarah sy samajhtey hain or is tarah k high-risk trades' k liye tayyar hain  Limitation Ziyada tar waqt aik murda billi uuchaal sirf haqeeqat ke baad shanakht kya ja sakta hai, jaisa ke oopar zikar kiya gaya hai. Is ka matlab yeh hai ke tajir soch satke hain ke yeh aik murda billi ka uuchaal hai jab ke haqeeqat mein yeh aik lambay lambay izafay ka ishara dainay wala trained hai.

Limitation Ziyada tar waqt aik murda billi uuchaal sirf haqeeqat ke baad shanakht kya ja sakta hai, jaisa ke oopar zikar kiya gaya hai. Is ka matlab yeh hai ke tajir soch satke hain ke yeh aik murda billi ka uuchaal hai jab ke haqeeqat mein yeh aik lambay lambay izafay ka ishara dainay wala trained hai.

-

#28 Collapse

in any case can make significant progress. Focus focus can be used in two ways. The main way is to determine the type of general market. When the price of the turning point in vertical growth is violated, the market crashes. It is negative if the price falls below the pivot point. Then the respected merchant took kabhi bi andha dhund or research and made baghairi nahi kerna chehye. mein achi exchange ke liye sabar bahut hai zaruri hai isliye exchange Forex sabar ke sath karni chahie.forex mein ham exchange se pahle bazaar ko achi tarah se menbeda karen aur markechnique, the last point to enter and exit the trading industry for example, traders can place limit orders buy 100 offers if the price breaks the resistance level. On the other hand, the dealer can put help or disaster level around it. Although these levels are sometimes good at predicting growth rates, they tend to regress from month to mont -

#29 Collapse

DEAD CAT BOUNCE SE KEA MURAAD HA DETAIL BEYAAN KIJIYE ???DEAD CAT BOUNCE KA OVERVIEW:- Kaam karte color Punch Bhi Ham market Mein important exam Lete Hain To hamein Jis object py changing Karni Hoti Hai Uske exposed mein statistics Lete Hain ki uski herbal marketplace mein kya connection chal rahe hain aur ham apni converting se us sy Kitna benefit advantage kar sakte hain essentially gold aur uncooked petroleum changing karte tint Hamen request aur supply ka zyada hyal rakhna parta hai agar ine donon devices mein Kisi Ki request kam ho jaaye a to vahan steady with supply ka zyada hassle aata hai aisi scenario Mein Hamen Aise gadgets normal with changing karte tone bohot zyada careful rehna padta hai Forex changing Mein kam karte tone Hamen herbal market ka bohot zyada mawazna karna padta hai tabhi Ham apni changing Se acha benefit Le sakte hain essentially Hit Bhi Ham converting karte hain to Request aur Supply ky guidelines ko zarur decide karna padta hai. Aik istilaah hai jo fnans aur sarmaya kaari mein istemaal hoti hai jis mein kisi inventory ya dosray maliyati asasay ki qeemat mein earzi, qaleel mudti bahaali ko bayan kya jata hai jis mein zabardast kami waqay hui hai. Yeh istilaah aksar aisay halaat ko bayan karne ke liye istemaal hoti hai jahan sarmaya car ya tajir taizi se girnay walay inventory mein. Pinnacle famous sarmaya karon ko qaleel mudti marketplace ki naqal o harkat massive mabni zabardast faislay karne se khabardaar karne aur un ki hosla afzai karne ke liye ki jati hai ke woh un companiyon ke bunyadi usoolon massive ghhor karen jin mein woh sarmaya kaari kar rahay hain.... DEAD CAT BOUNCE KA TARIKA OUR ES KY FAWAED:- Dead cat soar restoration prolonged-time period downtrend applicable enough in the course of ho sakta hai or price phir sy girney ka danger hamesha hota hai Isliye, useless-cat leap purchasing for and promoting approach good enough liye customers ko technical evaluation ka use karna hota hai. Yeh aik tasalsul ka namona samjha jata hai, jahan pehlay to uuchaal murawaja rujhan ke ulat honay ke top awesome zahir ho sakta hai, lekin is ke baad qeemat mein kami ka tasalsul taizi se hota hai.Qeemat is ke pehlay ki kam se neechay girnay ke baad yeh aik murda billi ka uuchaal boycott jata hai ( aur ulat nahi ) .Aksar, hit qeematein earzi pinnacle preferred barh jati hain to rikori ke mukhtasir waqfon, ya choti rilyon se neechay ke rujhanaat mein khlal parta hai. Yeh taajiron ya sarmaya karon ki janib se mukhtasir pozishnon ko band karne ya is mafroozay giant. Maqsad sarmaya karon aur taajiron ko yaad dilana hai ke qaleel mudti qeemat ki naqal o harkat aksar ghair mutawaqqa hoti hai aur sarmaya kaari ke faislay karne ke liye un par inhisaar nahi kya jana chahiye. FOREX TRADING ME DEAD CAT BOUNCE KA ESTYMAAL:- Lekin agar rate recuperation short hota hy or phir sy down style kaha jata hy. Is time period usy marketplace studies or converting techniques mein kiya jata hy, or yeh ek large concept hy jo dealers or financial backers ko marketplace gambles ke baare mein jaankari deta hy. Dad billi bounce aik taweel kami ya reechh ki market se asason ki qeematon ki aik earzi qaleel mudti bahaali hai jis ke baad neechay ka rujhan jari rehta hai. Aksar kami ke rujhan mein rikori ke mukhtasir doraniye ya choti reliyan jis ke douran qeematein earzi tor par barh jati hain. Dad billi bounce ka naam is tasawwur par mabni hai ke aik murda billi bhi uuchaal day gi agar woh kaafi had tak aur kaafi taizi se giray. Yeh aik choosnay wali actually ki misaal hai.

DEAD CAT BOUNCE KA TARIKA OUR ES KY FAWAED:- Dead cat soar restoration prolonged-time period downtrend applicable enough in the course of ho sakta hai or price phir sy girney ka danger hamesha hota hai Isliye, useless-cat leap purchasing for and promoting approach good enough liye customers ko technical evaluation ka use karna hota hai. Yeh aik tasalsul ka namona samjha jata hai, jahan pehlay to uuchaal murawaja rujhan ke ulat honay ke top awesome zahir ho sakta hai, lekin is ke baad qeemat mein kami ka tasalsul taizi se hota hai.Qeemat is ke pehlay ki kam se neechay girnay ke baad yeh aik murda billi ka uuchaal boycott jata hai ( aur ulat nahi ) .Aksar, hit qeematein earzi pinnacle preferred barh jati hain to rikori ke mukhtasir waqfon, ya choti rilyon se neechay ke rujhanaat mein khlal parta hai. Yeh taajiron ya sarmaya karon ki janib se mukhtasir pozishnon ko band karne ya is mafroozay giant. Maqsad sarmaya karon aur taajiron ko yaad dilana hai ke qaleel mudti qeemat ki naqal o harkat aksar ghair mutawaqqa hoti hai aur sarmaya kaari ke faislay karne ke liye un par inhisaar nahi kya jana chahiye. FOREX TRADING ME DEAD CAT BOUNCE KA ESTYMAAL:- Lekin agar rate recuperation short hota hy or phir sy down style kaha jata hy. Is time period usy marketplace studies or converting techniques mein kiya jata hy, or yeh ek large concept hy jo dealers or financial backers ko marketplace gambles ke baare mein jaankari deta hy. Dad billi bounce aik taweel kami ya reechh ki market se asason ki qeematon ki aik earzi qaleel mudti bahaali hai jis ke baad neechay ka rujhan jari rehta hai. Aksar kami ke rujhan mein rikori ke mukhtasir doraniye ya choti reliyan jis ke douran qeematein earzi tor par barh jati hain. Dad billi bounce ka naam is tasawwur par mabni hai ke aik murda billi bhi uuchaal day gi agar woh kaafi had tak aur kaafi taizi se giray. Yeh aik choosnay wali actually ki misaal hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#30 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is False recovery " Fleeting, false recovery " aik istilaah hai jo fnans aur sarmaya kaari mein istemaal hoti hai jis mein kisi stock ya dosray maliyati asasay ki qeemat mein earzi, qaleel mudti bahaali ko bayan kya jata hai jis mein zabardast kami waqay hui hai. yeh istilaah aksar aisay halaat ko bayan karne ke liye istemaal hoti hai jahan sarmaya vehicle ya tajir taizi se girnay walay stock mein kharedtay hain, punch qeemat wapas lautade hai to fori munafe haasil karne ki umeed mein, sirf yeh maloom karne ke liye ke bounce back mukhtasir muddat ke liye hai aur stock mein musalsal kami hoti hai. . " False recovery " ka naam is khayaal se aaya hai ke aik murda billi bhi uuchaal day gi agar woh bohat oonchai se giray. dosray lafzon mein, market aik taweel mudti kami ke rujhan mein bhi aik mukhtasir oopar ki harkat ka tajurbah kar sakti hai, lekin yeh laazmi pinnacle standard majmoi rujhan ke ulat jane ki nishandahi nahi karta hai . yeh istilaah aam pinnacle standard sarmaya karon ko qaleel mudti market ki naqal o harkat standard mabni zabardast faislay karne se khabardaar karne aur un ki hosla afzai karne ke liye ki jati hai ke woh un companiyon ke bunyadi usoolon standard ghhor karen jin mein woh sarmaya kaari kar rahay hain . Exchanging With of Fleeting, false recovery " False recovery " ki istilaah ka maqsad kisi stock ya dosray maliyati asasay ki qeemat mein aik earzi, qaleel mudti bahaali ko bayan karna hai jis mein zabardast kami waqay hui hai. yeh istilaah un halaat ko bayan karne ke liye istemaal ki jati hai jahan sarmaya vehicle ya tajir taizi se girnay walay stock ko kharidne ke liye lalach mein aa satke hain, is umeed mein ke poke qeemat wapas lautade hai to fori munafe kama sakti hai, lekin agar bounce back qaleel muddat ke liye ho to paisa zaya ho jata hai. stock mein kami jari hai . Is istilaah ka maqsad sarmaya karon aur taajiron ko yaad dilana hai ke qaleel mudti qeemat ki naqal o harkat aksar ghair mutawaqqa hoti hai aur sarmaya kaari ke faislay karne ke liye un standard inhisaar nahi kya jana chahiye. is ke bajaye, sarmaya karon ko sarmaya kaari ke bakhabar faislay karne ke liye un companiyon ke bunyadi usoolon standard tawajah markooz karni chahiye jin mein woh sarmaya kaari kar rahay hain, jaisay ke un ki maali sehat, intizami miyaar, aur market mein musabiqati position. is se sarmaya karon ko qaleel mudti market ki naqal o harkat standard mabni zabardast faislay karne se bachney mein madad mil sakti hai aur market mein un ki taweel mudti kamyabi ke imkanaat barh satke hain .

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:03 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим