What is pullback and breakout

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

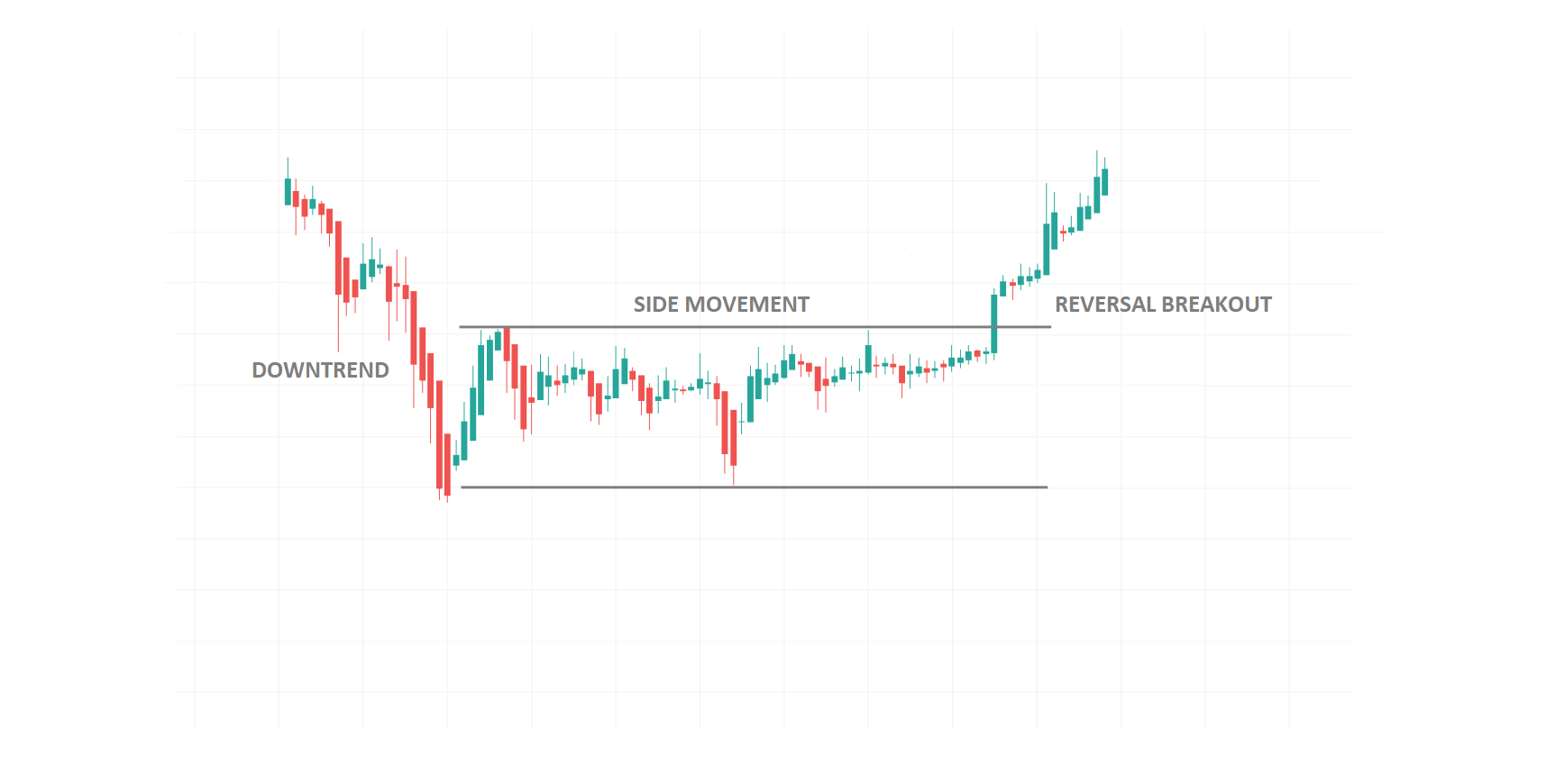

dono forex trading ke bohot ahem terms hain. In dono terms ki samajh hona forex traders ke liye bohot zaroori hai kyunki ye dono indicators trading strategies ke liye bohot ahem hote hain. Pullback aur Breakout dono hi market ke movement ke related hote hain. Market mein movement hoti hai jab price kisi particular direction mein chal rahi hoti hai. Agar price upar jaa rahi hai toh usko bullish movement kehte hain aur agar price niche jaa rahi hai toh usko bearish movement kehte hain. Pullback ek aisa concept hai jisme price ki movement temporarily opposite direction mein hoti hai. Agar price upar jaa rahi hai toh pullback mein temporary downward movement hota hai aur agar price niche jaa rahi hai toh temporary upward movement hota hai. Pullback ko "retracement" bhi kehte hain. Yeh market mein common hai aur iski wajah hai ki traders kharidne aur bechne ke liye aise levels ke liye wait karte hain jahan se price ne pehle bounce kiya tha. Pullback traders ke liye ek opportunity hoti hai apne positions ko banaane ya strengthen karne ke liye. Breakout ek aisa concept hai jisme price ki movement kisi particular level ya range ke bahar nikal jaati hai. Agar price kisi particular range mein chal rahi hai aur phir uss range ke bahar nikal jaati hai toh usko breakout kehte hain. Breakout ko "escape" bhi kehte hain. Breakout traders ke liye ek opportunity hoti hai apne positions ko banaane ya strengthen karne ke liye. Pullback aur Breakout dono hi traders ke liye important hote hain kyunki inke through traders apni trading strategies ko define aur execute kar sakte hain. Forex trading mein risk management bohot zaroori hota hai. Traders ko apne positions ke liye stop loss aur take profit levels ko set karna chahiye. Stop loss traders ko loss se bachata hai jab market trend traders ke expectations ke against chal raha hota hai. Take profit levels traders ko profits se bachata hai jab market trend traders ke expectations ke hisaab se chal raha hota hai. Stop loss aur take profit levels ke baare mein traders ko achi understanding honi chahiye kyunki yeh traders ke liye bohot zaroori hote hain.

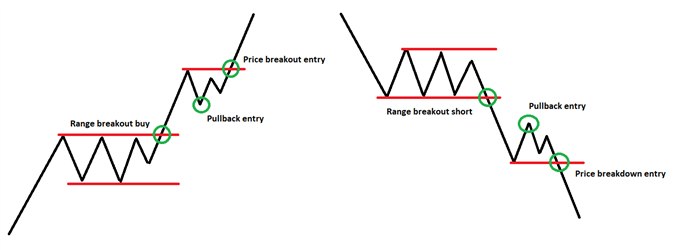

Breakout ek aisa concept hai jisme price ki movement kisi particular level ya range ke bahar nikal jaati hai. Agar price kisi particular range mein chal rahi hai aur phir uss range ke bahar nikal jaati hai toh usko breakout kehte hain. Breakout ko "escape" bhi kehte hain. Breakout traders ke liye ek opportunity hoti hai apne positions ko banaane ya strengthen karne ke liye. Pullback aur Breakout dono hi traders ke liye important hote hain kyunki inke through traders apni trading strategies ko define aur execute kar sakte hain. Forex trading mein risk management bohot zaroori hota hai. Traders ko apne positions ke liye stop loss aur take profit levels ko set karna chahiye. Stop loss traders ko loss se bachata hai jab market trend traders ke expectations ke against chal raha hota hai. Take profit levels traders ko profits se bachata hai jab market trend traders ke expectations ke hisaab se chal raha hota hai. Stop loss aur take profit levels ke baare mein traders ko achi understanding honi chahiye kyunki yeh traders ke liye bohot zaroori hote hain.  Pullback Trading Strategy: Pullback trading strategy mein traders kharidne ke liye pullback ka wait karte hain jab price ek uptrend mein hota hai. Jab price temporary downward movement karta hai toh traders ko ek opportunity milti hai kharidne ke liye aur phir price apne trend ke hisaab se upar chala jaata hai. Pullback trading strategy mein stop loss ko set karna bohot zaroori hota hai kyunki temporary movement kaafi strong ho sakta hai. Agar stop loss sahi jagah par set kiya gaya hai toh traders ko loss nahi hoga aur wo apne position ko strengthen kar sakte hain. Breakout Trading Strategy: Breakout trading strategy mein traders kharidne ke liye breakout ka wait karte hain jab price ek range mein chal raha hota hai. Jab price range ke bahar nikal jaata hai toh traders ko ek opportunity milti hai kharidne ke liye aur phir price apne trend ke hisaab se upar chala jaata hai. Breakout trading strategy mein bhi stop loss ko set karna bohot zaroori hota hai kyunki range se bahar nikalne ke baad price kuch samay ke liye volatile ho sakta hai. Agar stop loss sahi jagah par set kiya gaya hai toh traders ko loss nahi hoga aur wo apne position ko strengthen kar sakte hain.

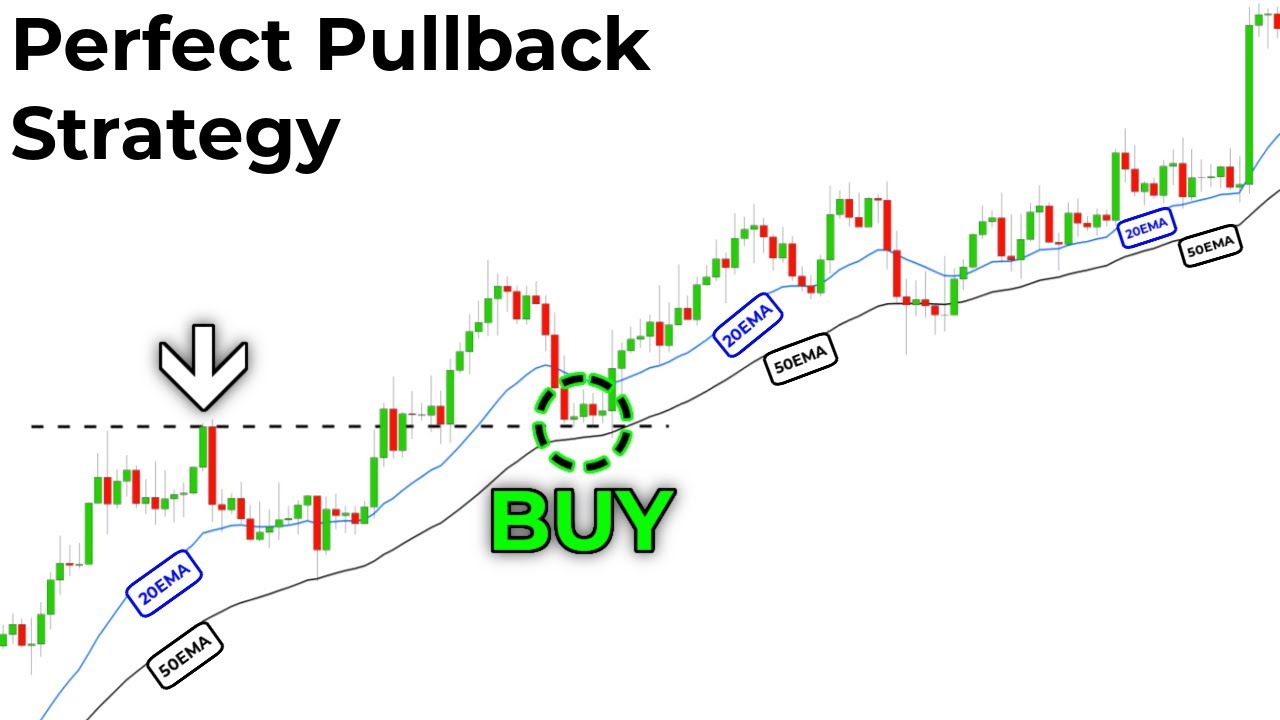

Pullback Trading Strategy: Pullback trading strategy mein traders kharidne ke liye pullback ka wait karte hain jab price ek uptrend mein hota hai. Jab price temporary downward movement karta hai toh traders ko ek opportunity milti hai kharidne ke liye aur phir price apne trend ke hisaab se upar chala jaata hai. Pullback trading strategy mein stop loss ko set karna bohot zaroori hota hai kyunki temporary movement kaafi strong ho sakta hai. Agar stop loss sahi jagah par set kiya gaya hai toh traders ko loss nahi hoga aur wo apne position ko strengthen kar sakte hain. Breakout Trading Strategy: Breakout trading strategy mein traders kharidne ke liye breakout ka wait karte hain jab price ek range mein chal raha hota hai. Jab price range ke bahar nikal jaata hai toh traders ko ek opportunity milti hai kharidne ke liye aur phir price apne trend ke hisaab se upar chala jaata hai. Breakout trading strategy mein bhi stop loss ko set karna bohot zaroori hota hai kyunki range se bahar nikalne ke baad price kuch samay ke liye volatile ho sakta hai. Agar stop loss sahi jagah par set kiya gaya hai toh traders ko loss nahi hoga aur wo apne position ko strengthen kar sakte hain.  Dono strategies ke liye traders ko market ki movement ke baare mein bohot achi understanding honi chahiye. Yeh traders ke liye zaroori hai ki wo market trend aur price movement ko track karte rahein. Technical analysis tools jaise ki moving averages, trend lines aur support/resistance levels traders ko price movement ke baare mein information dete hain. In tools ke through traders pullback aur breakout levels ko identify kar sakte hain. Pullback aur Breakout trading strategies mein traders ko price action ke baare mein bhi achi understanding honi chahiye. Price action ka matlab hai ki traders ko price movement ko observe karna chahiye aur uss movement ke hisaab se trading decisions lena chahiye. Price action traders ko entry aur exit points ke baare mein information deta hai. Price action traders ko market ke behaviour ko samajhne mein help karta hai jaise ki market mein buying aur selling pressure.

Dono strategies ke liye traders ko market ki movement ke baare mein bohot achi understanding honi chahiye. Yeh traders ke liye zaroori hai ki wo market trend aur price movement ko track karte rahein. Technical analysis tools jaise ki moving averages, trend lines aur support/resistance levels traders ko price movement ke baare mein information dete hain. In tools ke through traders pullback aur breakout levels ko identify kar sakte hain. Pullback aur Breakout trading strategies mein traders ko price action ke baare mein bhi achi understanding honi chahiye. Price action ka matlab hai ki traders ko price movement ko observe karna chahiye aur uss movement ke hisaab se trading decisions lena chahiye. Price action traders ko entry aur exit points ke baare mein information deta hai. Price action traders ko market ke behaviour ko samajhne mein help karta hai jaise ki market mein buying aur selling pressure.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Pullback And Breakout

Forex trading mein running trend jab aik makhsos support ya resistance tak pohunch jata hai, to uss k baad yaqeeni tawar par uss trend k pullback ya breakout k chances hote hen. Trends k mutabiq trading forex market main agay rehne aur faida mand mawaqay peda karne ka aik behtareen tareeqa hai. Yeh tareeqa aap ko price k trend ki nishan-dahi karne, un ki khobiyon k analysis karne aur is ke mutabiq trading plot karne ki ijazat deta hai. Trend trading bohut si marketon ke liye mozoon hai, jaisay ke stock ya forex trading, aur iss ko new ya expert dono tarah traders istemal kar sakte hen. Aik behtar technique jab trading k trends mein pullback hota hai, to uss waqat market mein enter hona hai, q k prices apne asal trend ki taraf wapis chali jaye gi. Taham, aik aur maqbool technique breakout k baad market main daakhil honay ka tareeqa hai, jo pullback ki nisbat ziyada faida mand sabit ho sakti hai.

Pullback aur breakout par trading se pehle market main trend ko pehchanna bohut zyada zarori aur aham hai. Market k trends ko pehchanney ke liye kayi tareeqay istemaal kiye ja satke hain, jin mein se bohat si techniques mushkil hain, lekin kamyabi k liye un ka hona zaroori nahi hai. Trend ki nishandahi karne ke aasaan tareen tareeqon mein se aik yeh tay karna hai ke aaya price aik khaas peroid ke dowran is ki average se ziyada hai ya kam. Yeh tareeqa akailey future price ki movement ki simat ka andaza laganay mein madad kere ga. Ye time period one to six months tak kahin bhi ho sakti hai, jo in main sab se latest time period hoga, wo sab se ziada moasar hoga.

Pullbacks Entries

Jab bhi aik bullish trend k dowran prices din k lowest area main a jaye ya aik bearish trend k dowran din k highest position par chali jati hai, to uss waqat prices ka ye reaction aik pullback kehlata hai. Pullback uss waqat hota hai, jab mojooda trend ke dowran price aarzi tor par opposite simat mein ghoom jati hai, ye teen ya chay mahino ke douran ban'nay walay trends ho satke hain. Pullback pichlle low ya high se up ya down hoga.

Pullback ko maloom karne k leye aik four hourly timeframes ki selection karen, jiss main dekhen k prices apne maojoda trend k dowran kia reaction deti hai, agar aik qeematen four hourly timeframes main kam back karti hai, to uss waqat ye aik pullback hoga, jo apne sabeqa trend ko hi follow karna shoro karega, nahi to prices ka trend reversal bhi ho sakta hai.

Constructive Pullback

Aik constructive pullback tab hota hai jab aik stock breakout hota hai aur phir wapas apne breakout pivot par laut'ta hai - wo price level jahan pehle breakout hua tha. Ye wapas chalayi nahi palat ki alamat hoti hai, balki ye ek sehatmand ittifaq hai jo investors ko dobara market mein dakhil hone ka mauqa deti hai, shayad pehle breakout se behtar keemat par.- Period (Duration) aur Raftar:

Asli constructive pullback kayi dino mein hota hai, aik tez, ek din ka palat jo breakout ki khalwat ko nuksan pahuncha sakta hai se bachta hai. - Volume Patterns:

Volume ka khel bari hawala rakhta hai. Constructive pullback mein, volume breakout ke dauran se khaas farq karta hai, jo darust hai ke bechnay ka dabav kharidne ki tezi ko maat de raha hai. Jab keemat volume support - wo level jahan pehle badi miqdar mein kharidari hui thi - ke qareeb pahunchti hai, volume kam hona chahiye, jise chart par 'Volume U' pattern ban jata hai. Ye ishara karta hai ke bechnay ka dabav kam ho raha hai, aur kharidne walay tayar hain dobara dakhil hone ke liye. - Mutabaqat Se Bhari Quwat:

Stocks ki jamaat ke andar, un leaders ko talash karen jo relative strength dikhate hain. Ye stocks apne dosto se kam pullback karte hain, ishara karte hain ke unki mazbooti aur phir se ubharne ki kshamata hai. Wo aksar sector ki quwat ka hamil hote hain aur constructive pullback strategy ke liye pasand kiye jate hain. - Enter Hone Ka Waqt:

Ye sabar karna zaroori hai ke pullback ko kayi dino tak pakne dena aur tasdeeq shuda volume support levels tak pahunchne mein. Ye waqt par entry karne ka ikhtiyar mein farq laata hai, jo achi tarah se tay kare gaye dhaare se alag hota hai. Ye zaroori hai ke overall market ke halat ko mad-e-nazar rakha jaye jo stocks ke rawaiye par badi asar daal sakte hain. Constructive pullback ko tanha mein nahi dekha jana chahiye, balki ise apni puri market analysis ke tanazur mein dekha jana chahiye.

Breakout Entries

Breakout technique aksar stock aur commodity trading mein istemaal hoti hain aur yeh bohat munafe bakhash saabit ho sakti hen, lekin forex market mein un ka istemaal kam hi hota hai. Pullback aksar is market ke liye aik behtar intikhab hai, khaas tor par price ki movement k peechay psychological tareeqon ki wajah se. Taham, pullback k sath aik kami payi jati hai : false starts. whipsaws ke naam se bhi jana jata hai, yeh un sab se big problems mein se aik hain, jo traders ko trading ke douran paish atay hain. Yeh uss waqat hota hai jab aap ki technique trading signal send karti hai, jis ke baad sirf aik reversal jana parta hai, jis ki wajah se aap ki position stop loss ki waja se stop ki jati hai.

Breakout techniques mehfooz filters k istemaal se is problem se bach sakti hai, jis se aap trends mein enter honay ke liye behtareen position ki identification kar satke hain. Breakout hamesha aik trend ki semat ko wazih karta hai, jo price chart par up and down dono sematon main ho sakta hai. Breakout ki madad long term ki trading ki ja sakti hai, jiss se munafa bhi ziada melta hai.

Breakout Key Points

Breakout k leye hamesha long timeframes ka intekhab zarori hai, jo kam az kam four hourly price chart ka hona chaheye, jiss par market main entry ki ja sakti hai. Forex breakout, jab ek currency pair ke price ek specific level ko paar karta hai, woh ek ahem trading strategy hai. Yahan kuch key points hain jo Forex breakout ke hawale se ahem hain:- Breakout Ka Matlab:

Forex breakout ka matlab hai jab currency pair ka price ek resistance ya support level ko paar karta hai. Ye usually ek strong price movement ke saath hota hai aur isse naya trend shuru hota hai. - Breakout Levels Ka Chayan:

Breakout levels ka chayan karna ahem hai. Traders support aur resistance levels ka istemal karte hain taki woh ye decide kar sakein ke breakout hone wala hai ya nahi. Breakout level ko accurately tay karna trading success mein ahem hota hai. - Volume Ka Tawon:

Breakout ke waqt volume ka tawon bhi dekha jata hai. Agar breakout volume ke saath hota hai, toh ye us breakout ko confirm karta hai. Volume ki kam ho jaane ki soorat mein breakout ke bharosemand hone ki sambhavna kam ho sakti hai. - Trend Ki Tafteesh:

Breakout trading mein trend ki tafteesh bhi zaroori hai. Agar market already ek trend mein hai aur breakout uss trend ki continuation ko indicate karta hai, toh ye breakout mazboot hota hai. - False Breakouts Se Hifazati Tadabeer:

False breakouts se bachne ke liye hifazati tadabeer bohot zaroori hain. False breakout tab hota hai jab price briefly breakout karta hai lekin phir wapas original range mein wapas aajata hai. Isse bachne ke liye traders stop-loss orders ka istemal karte hain. - Risk aur Reward Ka Tawon:

Breakout trading mein risk aur reward ka tawon tay karna mushkil hota hai. Traders ko ye decide karna chahiye ke unka risk kitna hai aur kitna reward mil sakta hai. Aksar traders breakout ke baad hone wale trend ka faida uthane ke liye position lete hain. - News aur Economic Events Ka Asar:

Breakout trading mein market mein hone wale kisi bhi bade news ya economic event ka asar bhi dekha jata hai. Aise events se breakout levels toot sakte hain aur market mein tezi ya mandi aayegi. - Time Frame Ka Chayan:

Breakout trading ke liye sahi time frame ka chayan karna bhi zaroori hai. Alag alag time frames par breakout ka asar alag hota hai, is liye trader ko apni trading strategy ke mutabiq sahi time frame ka intekhab karna chahiye. - Risk Management:

Breakout trading mein risk management ka bada hissa hai. Stop-loss orders ka istemal karna, position size ka tay karna, aur overall risk ko control mein rakhna bohot zaroori hai. - Technical Indicators Ka Istemal:

Traders breakout ko confirm karne ke liye kuch technical indicators ka istemal bhi karte hain, jese ke moving averages, RSI, aur MACD. Ye indicators unhe trend ka pata lagane mein aur false breakouts se bachne mein madad karte hain.

- Period (Duration) aur Raftar:

-

#4 Collapse

Trading ke field mein pullback aur breakout do ahem concepts hain jo traders ko market ki movements aur trends ko samajhne mein madad karte hain. In concepts ko samajhna aur unhe effectively apply karna trading success ke liye bohot zaruri hai. Pullback ek temporary reversal ya correction hoti hai jo ke prevailing trend ke direction ke against hoti hai. Matlab, agar market ek uptrend mein hai aur prices upar ja rahi hain, toh pullback ek short-term dip hota hai jahan prices temporarily neeche aati hain.

Pullback Ki Importance

Pullbacks ko samajhna aur identify karna trading ke liye bohot zaruri hai kyunki yeh traders ko favorable entry points provide karte hain. Ek uptrend mein, pullback ek acha mauka hota hai buying ke liye jab ke prices temporarily neeche aayi hoti hain. Isi tarah, ek downtrend mein, pullback ek acha mauka hota hai selling ya shorting ke liye jab ke prices temporarily upar gayi hoti hain.

Pullback Kaise Identify Hota Hai?

Pullbacks ko identify karne ke liye traders various technical analysis tools aur methods use karte hain:- Moving Averages: Moving averages, jaise ke 50-day ya 200-day moving averages, ko use karke pullbacks ko identify kiya jata hai. Jab price moving average ke paas aati hai aur phir trend ke direction mein wapas jaati hai, yeh pullback hota hai.

- Fibonacci Retracement Levels: Fibonacci retracement levels bhi pullbacks ko identify karne mein madadgar hote hain. In levels ko use karke predict kiya jata hai ke price kin levels tak retrace kar sakti hai before resuming the trend.

- Trend Lines: Trend lines draw karke bhi pullbacks ko identify kiya jata hai. Ek uptrend mein, trend line ko price ke neeche draw kiya jata hai, aur jab price wapas is line ke paas aati hai, yeh pullback hota hai.

Pullback trading strategies mein traders yeh anticipate karte hain ke price temporarily retrace karegi aur phir trend ke direction mein continue karegi. Kuch common pullback trading strategies yeh hain:- Buy the Dip (Uptrend): Jab market uptrend mein hoti hai aur price pullback karti hai, traders is pullback ko buying opportunity ke taur pe use karte hain. Moving averages ya trend lines pe support levels ko identify karke buy positions li ja sakti hain.

- Sell the Rally (Downtrend): Jab market downtrend mein hoti hai aur price pullback karti hai, traders is pullback ko selling ya shorting opportunity ke taur pe use karte hain. Moving averages ya trend lines pe resistance levels ko identify karke sell positions li ja sakti hain.

Ek stock XYZ Corporation ka price uptrend mein hai aur $100 se $150 tak gaya hai. Iske baad price temporarily wapas $130 tak aata hai aur phir se upar jaata hai. Yeh $130 tak ka move pullback kehlata hai. Traders is level pe buying opportunity dhoondhte hain taake woh low price pe entry le sakain aur trend ke continuation ka benefit utha sakain.

Breakout Kya Hai?

Breakout tab hota hai jab price ek defined support ya resistance level ko cross kar leti hai aur uske baad ek significant movement dekhi jati hai. Breakout trading ka aim yeh hota hai ke yeh identify kiya jaye ke kab price ek significant level ko cross kar rahi hai aur uske baad kis direction mein move karegi. Breakouts strong price movements ko signal karte hain aur trading ke bohot acha opportunities provide karte hain.

Breakout Ki Importance

Breakouts ko samajhna aur identify karna trading ke liye bohot zaruri hai kyunki yeh strong price movements ke signals hote hain. Ek breakout indicate karta hai ke market mein nayi demand ya supply shamil ho rahi hai jo ke price ko significant direction mein move karne pe majboor kar rahi hai.

Breakout Kaise Identify Hota Hai?

Breakouts ko identify karne ke liye traders various technical analysis tools aur methods use karte hain:- Support and Resistance Levels: Support aur resistance levels ko identify karke breakout points ko predict kiya jata hai. Jab price in levels ko cross kar leti hai, toh breakout hota hai.

- Chart Patterns: Chart patterns jaise ke triangles, head and shoulders, aur rectangles bhi breakouts ko identify karne mein madadgar hote hain. In patterns ke completion pe price aksar significant move karti hai.

- Volume Analysis: Volume analysis bhi breakout ko confirm karne ke liye use ki jati hai. High volume pe breakout hona strong signal hota hai ke price trend ko follow karegi.

Breakout trading strategies mein traders anticipate karte hain ke price ek significant level ko cross karke strong move karegi. Kuch common breakout trading strategies yeh hain:- Buy the Breakout (Bullish Breakout): Jab price ek resistance level ko cross karti hai, traders isko bullish signal samajh kar buy positions le sakte hain. High volume pe breakout hone par yeh strategy aur bhi effective hoti hai.

- Sell the Breakout (Bearish Breakout): Jab price ek support level ko cross karti hai, traders isko bearish signal samajh kar sell ya short positions le sakte hain. High volume pe breakout hone par yeh strategy aur bhi effective hoti hai.

Ek stock ABC Limited ka price $50 aur $60 ke beech mein consolidate ho raha hai. Agar price $60 ka resistance level cross kar leta hai aur high volume pe $62 tak chala jata hai, toh yeh breakout kehlata hai. Traders is level pe buy positions le sakte hain taake breakout ka benefit utha sakain.

Combining Pullbacks aur Breakouts with Other Indicators

Pullbacks aur breakouts ko other technical indicators ke saath combine karke aur bhi strong trading strategies banayi ja sakti hain. Kuch common indicators hain:- Relative Strength Index (RSI): RSI ek momentum oscillator hai jo ke price ki speed aur change ko measure karta hai. Agar RSI overbought ya oversold zones mein ho aur price pullback ya breakout level pe ho, toh yeh strong signal ho sakta hai.

- Moving Average Convergence Divergence (MACD): MACD trend-following momentum indicator hai jo ke moving averages ke beech ke relationship ko show karta hai. Agar MACD bullish ya bearish crossover show kare aur price pullback ya breakout level pe ho, toh yeh trading decision ko support kar sakta hai.

- Bollinger Bands: Bollinger Bands price volatility ko measure karte hain. Pullbacks aksar Bollinger Bands ke middle band ya lower band pe dekhe jate hain, aur breakouts Bollinger Bands ke upper ya lower band ko cross karte hain.

Example 1: Pullback with RSI

Ek stock XYZ Corporation ka price uptrend mein hai aur $100 se $150 tak gaya hai. Price wapas $130 tak aata hai aur RSI oversold zone mein hota hai. Yeh strong signal hota hai ke price ab wapas upar jayegi aur traders is pullback ko buying opportunity ke taur pe use karte hain.

Example 2: Breakout with MACD

Ek stock ABC Limited ka price $50 aur $60 ke beech mein consolidate ho raha hai. MACD bullish crossover show karta hai aur price $60 ka resistance level cross kar leta hai. Yeh strong signal hota hai ke breakout sustainable hoga aur traders is level pe buy positions lete hain.

Risks aur Challenges in Pullback aur Breakout Trading

Pullback aur breakout trading strategies ke saath kuch risks aur challenges bhi hote hain jo traders ko madad karte hain behtar decision making mein:- False Breakouts: False breakouts tab hote hain jab price temporarily ek significant level ko cross kar leta hai lekin phir wapas aajata hai. False breakouts ko avoid karne ke liye confirmation signals ka wait karna zaruri hota hai, jaise ke high volume pe breakout hona.

- Market Volatility: High volatility markets mein pullbacks aur breakouts ko accurately predict karna mushkil hota hai. Is liye risk management strategies jaise ke stop-loss orders ka use karna bohot zaruri hota hai.

- Emotional Trading: Pullback aur breakout trading mein emotions ko control karna mushkil hota hai, kyunki price movements bohot fast hoti hain. Is liye disciplined approach aur pre-defined trading plans bohot zaruri hote hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

what is pullback an breakout trading in forex market

forex market mein trading breakout support or resistance kay sath ke trading hote hey pullback trading technical analysis ke maqbol tareen hote hey yahan par dono ka maksad forex market ke price ke movement say faida hasell karna hota hey lake khasoseyat kay tahofzat mokhtalef hotay hein aay har strategy kay important pehlon par ghor karna chihay

Trading Breakout

forex market ke breakout trading mein enter hona bhe shamel hota hey es say forex market mein support ya resistance level say agay barah sakte hey yeh forex market kay e kheyal par mobne hota hey forex market kay es level kay opposite trade karna hote hey forex market ke price ko es level ke direction mein agay barhnay ka imkan hota hey

Entry and Exit Point

trader aam tor ar breakout trade mein enter hotay hein jab market mein price support say oper break ho jate hey ya phir support say nechay breakout ho jate hey market order breakout level say nechay rakha jata hey or take profit order omeed par he rakh deya jata hey market mein price ke omeed par set ho sakta hey

Volatility

forex market mein breakout trading bhe market ke higher volatility ke wajah say he hote hey key level ke breakout ke planning he forex market mein movement ke analysis hota hey ager forex market mein key level breakout ho jata hey to enter hona chihay fake breakout say bhe avoid karna chihay

Risk management

forex market mein breakout ke trading kay ley bhe risk management karna bhe bay had zaroore hota hey fake breakout kay chances zyada hotay hein es ley forex market mein risk ko manage kar kay ache trading karne chihay

Pullback Trading

pullback trading breakout kay bad strong trend ko identify kar sakte hey trend kaybad support ya resistance kaybad forex market mein price wapees chale jate hey kheyal yeh hota hey keh forex trade enter hona chihay jab forex market ke price wapes chal jatee hey yeh heyal kartay hovay keh yeh qaim rahay ge

Entry and Exit

forex trader jab market support ya resistance level par enter ho jate hey stop loss order zyada long trade kay ley support kay necay hota hey or sell ke sorat mein stop loss ko resistance kay oper rakh deya jata hey

Risk Management

forex market ke pullback trading mein breakout kay competition bohut he ka risk hota hey kunkeh trader kaim kardah support ya resistance say bohut he qareeb mein trade close kar dayta hey jo care karte trading ke bhe tahum fake pullback ke sorat mein nakam honay ka bhe chance hota hey

bhali kay badlay bhali

bhali kay badlay bhali

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:19 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим