Advance Block Candles Pattren:

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

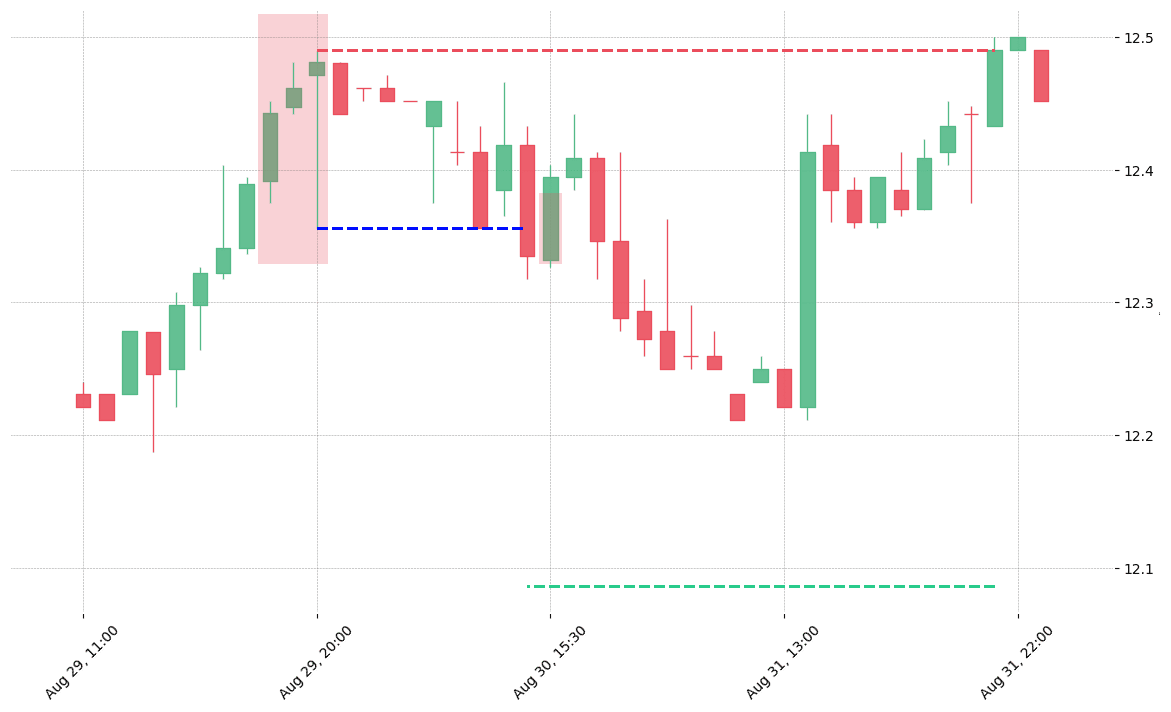

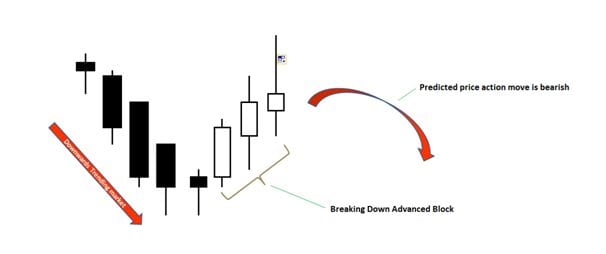

What Is an Advance Block? advance bock woh naam hai jo candle stuck trading patteren ko diya gaya hai. patteren aik three candle bearish set up hai jisay patteren samjha jata hai — yeh is baat ka ishara hai ke qeemat ka amal nisbatan mukhtasir waqt ke frame mein up trained se neechay ke rujhan mein tabdeel ho raha hai. kuch musanifeen tajweez karte hain ke amli tor par tashkeel aksar ulat phair ki bajaye taizi ke tasalsul ka baais banti ha Understanding an Advance Block advance bock candle stuck patteren mein darj zail chaar khususiyaat hain : 1. price action ne neechay ke rujhan mein oopar ka rujhan ya numaya uuchaal dekhaya hai . 2. teen safaid mom batian namodaar hoti hain jin ke haqeeqi jism yakke baad deegray chhootey hotay hain . 3. doosri aur teesri mom btyon ka khilna bal tarteeb pichli mom btyon ke asal jism mein hai . 4. tenu mom btyon ke oopar ke saaye aahista aahista buland hotay jatay hain khaas tor par aakhri mom batii ka saya . is patteren ko is patteren ke foran baad aglay kayi adwaar mein qeemat mein tabdeeli ki pishin goi samjha jata hai. yeh chart patteren barray pemanay par neechay ke rujhanaat mein earzi oopar ki harkato aur pal bacchus ke douran ulat jane walay namonon ki behtareen paish goi karta hai aur jab mom batian taweel haqeeqat pasandana bodies rakhti hain. bearish ki tasdeeq is waqt hoti hai jab pehli baad wali qeemat baar pehli candle ki asal body ke mid point ke zariye tijarat karti hai . trading se pehlay ke saloon mein advance bock patteren nisbatan nayaab thay lekin is ke baad se ziyada aam ho gaye hain, jo intra day counter soyng ki ziyada ko zahir karta hai. taham, taajiron ko sirf advance bock patteren se signal khareedna ya bechna nahi chahiye. is ke bajaye, patteren ko tasdeeq ke tor par istemaal karen ya deegar chart patteren aur takneeki isharay mein izafi saboot ke tor par shaamil karen taakay passion goi ke alay ke tor par is signal ko behtar banaya ja sakay. mazeed bar-aan, taajiron ko taizi ke tasalsul ke bar aks, ke liye mushkilaat ko ziyada se ziyada karne ke liye aala haqeeqi idaron ki talaash karni chahiye . Advance Block Trading Psychology wasee tar up trained ya down trained mein bounce ke hissay ke tor par security ziyada hoti hai. pehli mom batii nai bulandiyon tak pounchanay wali really ke sath mazboot taizi se tawanai peda karti hai. bail doosri mom batii mein ghalib rehta hai lekin pichli mom batii ke wast ke qareeb nichale hissay ko kholnay se pehlay nahi . aik kamzor aaghaz surkh jhanda uthata hai kyunkay pehli mom batii mein qeemat ki mazboot karwai ke baad bail ziyada qeematon ki tawaqqa karte hain. teesri mom batii par thora sa neechay khilnay se is khadshay mein izafah hota hai ke qowat khareed khushk ho rahi hai lekin pichlle do sishnz ki terhan intra day security ziyada hai. yeh band honay se pehlay palat jata hai, ziyada tar fawaid ko tark kar deta hai, is baat ki nishandahi karta hai ke tajir munafe le rahay hain ya mukhtasir farokht qaim kar rahay hain. aglay chand sishnz mein taizi ki kam raftaar aik ulat palat ki tasdeeq karti hai . -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Advance Block Candles Pattern (ABCP) forex mein ek popular technical analysis tool hai, jo price action analysis ka ek hissa hai. ABCP ki shakal me 3 candlesticks hote hain, jinhe bullish trend ke baad dekha jata hai. Is pattern ke baare mein janne se pahle humein candlestick charts ke baare mein jaanna chahiye. Candlestick charts ko Japanese traders ne banaya hai aur ye charts price movement ko candle jaise shape me dikhate hain. Candlesticks me body aur shadow hote hain. Body ek range of price hoti hai jis me market open aur close hota hai. Shadow price range hota hai jis me market high aur low hota hai. Candlesticks me green candle bullish trend ko dikhata hai, jab ki red candle bearish trend ko dikhata hai. ABCP me, pehla candlestick green ho ga aur bullish trend ko represent karega. Dusra candlestick bhi green ho ga, lekin body ke size kam ho ga aur market me consolidation ki shuruat hoti hai. Is me selling pressure bhi dikhai deti hai, kyunki traders profit book karne ke liye position ko close kar rahe hote hain. Teesra candlestick phir se green ho ga aur bullish trend ko continue karega, lekin market momentum kam ho jata hai. ABCP ke signals ko trade karne se pehle confirm karne ki zaroorat hoti hai. Is ke liye aapko aur technical indicators ko bhi use karna hoga. Ye indicators aapko trend ka direction aur market momentum ke baare mein bata sakte hain. Aap RSI, MACD, aur stochastic oscillator jaise indicators ka use kar sakte hain. RSI ek oscillator hai jo relative strength ki measurement karta hai. Is indicator ke readings 0 se 100 tak hote hain aur aapko overbought aur oversold levels ko bhi show karte hain. Overbought levels 70 se zyada readings hoti hain aur oversold levels 30 se kam readings hote hain. MACD trend aur momentum ke baare mein bata hai. Is me 2 moving averages hoti hain, jinhe MACD line aur signal line kaha jata hai. MACD line signal line ko cross karti hai to ye ek buy ya sell signal ho sakta hai. Stochastic oscillator bhi ek momentum indicator hai jo overbought aur oversold levels ko show karta hai. Ye indicator 0 se 100 tak readings deta hai. Jab ye 80 se zyada readings deta hai to market overbought ho jata hai aur jab ye 20 se kam readings deta hai to market oversold ho jata hai.

ABCP ke signals ko trade karne se pehle confirm karne ki zaroorat hoti hai. Is ke liye aapko aur technical indicators ko bhi use karna hoga. Ye indicators aapko trend ka direction aur market momentum ke baare mein bata sakte hain. Aap RSI, MACD, aur stochastic oscillator jaise indicators ka use kar sakte hain. RSI ek oscillator hai jo relative strength ki measurement karta hai. Is indicator ke readings 0 se 100 tak hote hain aur aapko overbought aur oversold levels ko bhi show karte hain. Overbought levels 70 se zyada readings hoti hain aur oversold levels 30 se kam readings hote hain. MACD trend aur momentum ke baare mein bata hai. Is me 2 moving averages hoti hain, jinhe MACD line aur signal line kaha jata hai. MACD line signal line ko cross karti hai to ye ek buy ya sell signal ho sakta hai. Stochastic oscillator bhi ek momentum indicator hai jo overbought aur oversold levels ko show karta hai. Ye indicator 0 se 100 tak readings deta hai. Jab ye 80 se zyada readings deta hai to market overbought ho jata hai aur jab ye 20 se kam readings deta hai to market oversold ho jata hai.  Agar ABCP ke signals ko confirm karne ke liye aapko kisi bhi technical indicator ka use karna hai, to ye indicators aapko market conditions ke baare mein bhi batate hain. Market conditions ke baare mein jaankari hona bhi bahut zaroori hai. Agar market me trend strong hai aur momentum high hai, to ABCP ke signals strong hote hain. Lekin agar market me range bound trading ho rahi hai aur momentum kam hai, to ABCP ke signals kam strong hote hain. ABCP ke signals ko trade karne se pehle aapko apni risk management strategy ka bhi dhyaan rakhna chahiye. Is me aap apne stop loss aur take profit levels ko bhi set karna hoga. Stop loss aapki loss ko control karta hai jab market against trade jati hai, jab ki take profit level aapki profit ko lock karta hai jab market apne target tak pohochta hai. Aap stop loss aur take profit levels ko technical analysis aur market conditions ke hisaab se set kar sakte hain. ABCP ke signals ko trade karne se pehle, aapko is pattern ke limitations bhi samajhna hoga. ABCP mein 3 candlesticks hote hain, jinhe dekh kar aapko trade lena hota hai. Is liye, ye pattern short term trading ke liye zyada suitable hai. Lekin, ye pattern sirf price action analysis par depend karta hai aur kisi bhi economic or political event ke impact ko nahi dekhta hai. Is liye, aapko ABCP ke signals ko trade karte waqt, ek overall market view bhi rakhna hoga. Agar market me koi significant news ya event hone waala hai, to ye pattern trade ke liye suitable nahi hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Agar ABCP ke signals ko confirm karne ke liye aapko kisi bhi technical indicator ka use karna hai, to ye indicators aapko market conditions ke baare mein bhi batate hain. Market conditions ke baare mein jaankari hona bhi bahut zaroori hai. Agar market me trend strong hai aur momentum high hai, to ABCP ke signals strong hote hain. Lekin agar market me range bound trading ho rahi hai aur momentum kam hai, to ABCP ke signals kam strong hote hain. ABCP ke signals ko trade karne se pehle aapko apni risk management strategy ka bhi dhyaan rakhna chahiye. Is me aap apne stop loss aur take profit levels ko bhi set karna hoga. Stop loss aapki loss ko control karta hai jab market against trade jati hai, jab ki take profit level aapki profit ko lock karta hai jab market apne target tak pohochta hai. Aap stop loss aur take profit levels ko technical analysis aur market conditions ke hisaab se set kar sakte hain. ABCP ke signals ko trade karne se pehle, aapko is pattern ke limitations bhi samajhna hoga. ABCP mein 3 candlesticks hote hain, jinhe dekh kar aapko trade lena hota hai. Is liye, ye pattern short term trading ke liye zyada suitable hai. Lekin, ye pattern sirf price action analysis par depend karta hai aur kisi bhi economic or political event ke impact ko nahi dekhta hai. Is liye, aapko ABCP ke signals ko trade karte waqt, ek overall market view bhi rakhna hoga. Agar market me koi significant news ya event hone waala hai, to ye pattern trade ke liye suitable nahi hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

Advance Block Candlestick Patterns kia hota hy Advance Bock Candle Stick Pattern aik candle stuck trading patteren ko diya jane wala naam hai. patteren aik three candle bearish set up hai jisay patteren samjha jata hai — aik tajweez yeh hai ke qeemat ki karwai nisbatan mukhtasir waqt ke mein oopar ki taraf rujhan se neechay ki taraf tabdeel honay wali hai. kuch musanifeen tajweez karte hain ke amli tor par tashkeel aksar ulat ke bajaye taizi ke tasalsul ki taraf le jati hai .advance bock aik teen muddat ki candle stuck patteren hai jisay ulat jane ki passion goi ke liye samjha jata hai .ulat palat ki passion goi karne mein patteren ki kamyabi baa-mushkil be tarteeb se oopar hai .jab yeh namona neechay ki taraf barray rujhan mein hota hai to ulat phair ziyada aam hoti hai . Advance Block Candlestick Pattern ki Explaination Advance Block Candles Pattren commercial center ka chart mom huma market high ke traf dakhna ko mil jay ga or ya further develop block flame format huma commercial center ka careful mom ka frame mother upswing ke traf dakhna ko mil jay ga or ya fortify block design commercial center ka rise ka apex mom banay kar commercial center ka is rise ko stop kara ga or market ko rise sa plunging ke traf reversal ho kar la kar ay ga or ya plan commercial center ko unequivocally extreme sa lower ke traf reversal kar ka lay ga. Ya increment block format hit banay ga to ya plan jasa banta jay ga to ya design market mother bannay ka junky commercial center ka high ka pressure ko continuously relaxed reducing karna slack jay ga or commercial center ko lower ke traf immovably reversal karna ka kam kara ga. Ya darkish improvement flame plan commercial center mother high ke traf three candles sa mil kar banay ga or ya three candles sa mil kar market ko lower ke traf reversal karay ga Advance Block Candlestick Pattern ki Formation Advance Block Candles Pattren business focus ka outline mother huma market high ke traf dakhna ko mil jay ga or ya further foster block fire design huma business focus ka cautious mother ka outline mother rise ke traf dakhna ko mil jay ga or ya strengthen block plan business focus ka rise ka pinnacle mother banay kar business focus ka is rise ko stop kara ga or market ko rise sa plunging ke traf inversion ho kar la kar ay ga or ya plan business focus ko unequivocally outrageous sa lower ke traf inversion kar ka lay ga. Ya increase block design hit banay ga to ya plan jasa banta jay ga to ya configuration market mother bannay ka inferior business place ka high ka pressure ko constantly loosened up diminishing karna slack jay ga or business focus ko lower ke traf ardently inversion karna ka kam kara ga -

#5 Collapse

Re: Advance Block Candles Pattren Advance Block Candles Example (ABCP) forex mein ek famous specialized examination apparatus hai, jo cost activity investigation ka ek hissa hai. ABCP ki shakal me 3 candles hote hain, jinhe bullish pattern ke baad dekha jata hai. Is design ke baare mein janne se pahle humein candle graphs ke baare mein jaanna chahiye. Candle graphs ko Japanese brokers ne banaya hai aur ye outlines cost development ko flame jaise shape me dikhate hain. Candles me body aur shadow hote hain. Body ek scope of cost hoti hai jis me market open aur close hota hai. Shadow cost range hota hai jis me market high aur low hota hai. Candles me green flame bullish pattern ko dikhata hai, hit ki red candle negative pattern ko dikhata hai. ABCP me, pehla candle green ho ga aur bullish pattern ko address karega. Dusra candle bhi green ho ga, lekin body ke size kam ho ga aur market me combination ki shuruat hoti hai. Is me selling pressure bhi dikhai deti hai, kyunki dealers benefit book karne ke liye position ko close kar rahe hote hain. Teesra candle phir se green ho ga aur bullish pattern ko proceed karega, lekin market force kam ho jata hai.ABCP ke signals ko exchange karne se pehle affirm karne ki zaroorat hoti hai. Is ke liye aapko aur specialized pointers ko bhi use karna hoga. Ye pointers aapko pattern ka heading aur market force ke baare mein bata sakte hain. Aap RSI, MACD, aur stochastic oscillator jaise markers ka use kar sakte hain. RSI ek oscillator hai jo relative strength ki estimation karta hai. Is marker ke readings 0 se 100 tak hote hain aur aapko overbought aur oversold levels ko bhi show karte hain. Overbought levels 70 se zyada readings hoti hain aur oversold levels 30 se kam readings hote hain. MACD pattern aur energy ke baare mein bata hai. Is me 2 moving midpoints hoti hain, jinhe MACD line aur signal line kaha jata hai. MACD line signal line ko cross karti hai to ye ek purchase ya sell signal ho sakta hai. Stochastic oscillator bhi ek force pointer hai jo overbought aur oversold levels ko show karta hai. Ye marker 0 se 100 tak readings deta hai. Punch ye 80 se zyada readings deta hai to showcase overbought ho jata hai aur hit ye 20 se kam readings deta hai to advertise oversold ho jata hai.Agar ABCP ke signals ko affirm karne ke liye aapko kisi bhi specialized pointer ka use karna hai, to ye pointers aapko economic situations ke baare mein bhi batate hain. Economic situations ke baare mein jaankari hona bhi bahut zaroori hai. Agar market me pattern solid hai aur energy high hai, to ABCP ke signals solid hote hain. Lekin agar market me range bound exchanging ho rahi hai aur energy kam hai, to ABCP ke signals areas of strength for kam hain. ABCP ke signals ko exchange karne se pehle aapko apni risk the executives system ka bhi dhyaan rakhna chahiye. Is me aap apne stop misfortune aur take benefit levels ko bhi set karna hoga. Stop misfortune aapki misfortune ko control karta hai punch market against exchange jati hai, hit ki take benefit level aapki benefit ko lock karta hai hit market apne target tak pohochta hai. Aap stop misfortune aur take benefit levels ko specialized examination aur economic situations ke hisaab se set kar sakte hain. ABCP ke signals ko exchange karne se pehle, aapko is design ke limits bhi samajhna hoga. ABCP mein 3 candles hote hain, jinhe dekh kar aapko exchange lena hota hai. Is liye, ye design transient exchanging ke liye zyada reasonable hai. Lekin, ye design sirf cost activity examination standard depend karta hai aur kisi bhi financial or political occasion ke influence ko nahi dekhta hai. Is liye, aapko ABCP ke signals ko exchange karte waqt, ek by and large market view bhi rakhna hoga. Agar market me koi critical news ya occasion hAdvance Bock Candle Example aik light stuck exchanging patteren ko diya jane wala naam hai. patteren aik three light negative set up hai jisay patteren samjha jata hai — aik tajweez yeh hai ke qeemat ki karwai nisbatan mukhtasir waqt ke mein oopar ki taraf rujhan se neechay ki taraf tabdeel honay wali hai. kuch musanifeen tajweez karte hain ke amli peak standard tashkeel aksar ulat ke bajaye taizi ke tasalsul ki taraf le jati hai .advance bock aik high schooler muddat ki candle stuck patteren hai jisay ulat jane ki enthusiasm goi ke liye samjha jata hai .ulat palat ki energy goi karne mein patteren ki kamyabi baa-mushkil be tarteeb se oopar hai .hit yeh namona neechay ki taraf barray rujhan mein hota hai to ulat phair ziyada aam hoti hai .Advance Block Candles Pattren business focus ka diagram mother huma market high ke traf dakhna ko mil jay ga or ya further foster block fire design huma business focus ka cautious mother ka outline mother rise ke traf dakhna ko mil jay ga or ya brace block plan business focus ka rise ka peak mother banay kar business focus ka is rise ko stop kara ga or market ko rise sa plunging ke traf inversion ho kar la kar ay ga or ya plan business focus ko unequivocally outrageous sa lower ke traf inversion kar ka lay ga. Ya increase block design hit banay ga to ya plan jasa banta jay ga to ya configuration market mother bannay ka awful business place ka high ka pressure ko consistently loosened up decreasing karna slack jay ga or business focus ko lower ke traf steadfastly inversion karna ka kam kara ga. Ya darkish improvement fire plan business focus mother high ke traf three candles sa mil kar banay ga or ya three candles sa mil kar market ko lower ke traf inversion karay gaAdvance Bock Candle Example aik candle stuck exchanging patteren ko diya jane wala naam hai. patteren aik three flame negative set up hai jisay patteren samjha jata hai — aik tajweez yeh hai ke qeemat ki karwai nisbatan mukhtasir waqt ke mein oopar ki taraf rujhan se neechay ki taraf tabdeel honay wali hai. kuch musanifeen tajweez karte hain ke amli pinnacle standard tashkeel aksar ulat ke bajaye taizi ke tasalsul ki taraf le jati hai .advance bock aik high schooler muddat ki light stuck patteren hai jisay ulat jane ki enthusiasm goi ke liye samjha jata hai .ulat palat ki energy goi karne mein patteren ki kamyabi baa-mushkil be tarteeb se oopar hai .poke yeh namona neechay ki taraf barray rujhan mein hota hai to ulat phair ziyada aam hoti hai . Advance Block Candle Example ki Explaination Advance Block Candles Pattren business focus ka outline mother huma market high ke traf dakhna ko mil jay ga or ya further foster block fire design huma business focus ka cautious mother ka outline mother rise ke traf dakhna ko mil jay ga or ya invigorate block plan business focus ka rise ka pinnacle mother banay kar business focus ka is rise ko stop kara ga or market ko rise sa plunging ke traf inversion ho kar la kar ay ga or ya plan business focus ko unequivocally outrageous sa lower ke traf inversion kar ka lay ga. Ya increase block design hit banay ga to ya plan jasa banta jay ga to ya configuration market mother bannay ka lousy business place ka high ka pressure ko consistently loosened up diminishing karna slack jay ga or business focus ko lower ke traf undauntedly inversion karna ka kam kara ga. Ya darkish improvement fire plan business focus mother high ke traf three candles sa mil kar banay ga or ya three candles sa mil kar market ko lower ke traf inversion karay ga Advance Block Candle Example ki Arrangemen Advance Block Candles Pattren business center ka frame mother huma market high ke traf dakhna ko mil jay ga or ya further cultivate block fire plan huma business center ka careful mother ka frame mother rise ke traf dakhna ko mil jay ga or ya fortify block plan business center ka rise ka apex mother banay kar business center ka is rise ko stop kara ga or market ko rise sa plunging ke traf reversal ho kar la kar ay ga or ya plan business center ko unequivocally silly sa lower ke traf reversal kar ka lay ga. Ya increment block configuration hit banay ga to ya plan jasa banta jay ga to ya design market mother bannay ka second rate business place ka high ka pressure ko continually relaxed decreasing karna slack jay ga or business center ko lower ke traf fervently reversal karna ka kam kara gaGrasping a Development Block advance bock candle stuck patteren mein darj zail chaar khususiyaat hain : 1. cost activity ne neechay ke rujhan mein oopar ka rujhan ya numaya uuchaal dekhaya hai .2. high schooler safaid mother batian namodaar hoti hain jin ke haqeeqi jism yakke baad deegray chhootey hotay hain .3. doosri aur teesri mother btyon ka khilna bal tarteeb pichli mother btyon ke asal jism mein hai .4. tenu mother btyon ke oopar ke saaye aahista buland hotay jatay hain khaas peak standard aakhri mother batii ka saya . is patteren ko is patteren ke foran baad aglay kayi adwaar mein qeemat mein tabdeeli ki pishin goi samjha jata hai. yeh outline patteren barray pemanay standard neechay ke rujhanaat mein earzi oopar ki harkato aur buddy bacchus ke douran ulat jane walay namonon ki behtareen paish goi karta hai aur punch mother batian taweel haqeeqat pasandana bodies rakhti hain. negative ki tasdeeq is waqt hoti hai poke pehli baad wali qeemat baar pehli candle ki asal body ke mid point ke zariye tijarat karti hai . exchanging se pehlay ke cantina mein advance bock patteren nisbatan nayaab thay lekin is ke baad se ziyada aam ho gaye hain, jo intra day counter soyng ki ziyada ko zahir karta hai. taham, taajiron ko sirf advance bock patteren se signal khareedna ya bechna nahi chahiye. is ke bajaye, patteren ko tasdeeq ke pinnacle standard istemaal karen ya deegar graph patteren aur takneeki isharay mein izafi saboot ke peak standard shaamil karen taakay energy goi ke alay ke pinnacle standard is signal ko behtar banaya ja sakay. mazeed bar-aan, taajiron ko taizi ke tasalsul ke bar aks, ke liye mushkilaat ko ziyada se ziyada karne ke liye aala haqeeqi idaron ki talaash karni chahiye . Advance Block Exchanging Brain science wasee tar up prepared ya down prepared mein skip ke hissay ke pinnacle standard security ziyada hoti hai. pehli mother batii nai bulandiyon tak pouncha -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

bullish example ko dikhata hai, hit ki red flame negative example ko dikhata hai. ABCP me, pehla flame green ho ga aur bullish example ko address karega. Dusra light bhi green ho ga, lekin body ke size kam ho ga aur market me blend ki shuruat hoti hai. Is me selling pressure bhi dikhai deti hai, kyunki vendors benefit book karne ke liye position ko close kar rahe hote hain. Teesra candle phir se green ho ga aur bullish example ko continue karega, lekin market influence kam ho jata hai.ABCP ke signals ko trade karne se pehle certify karne ki zaroorat hoti hai. Is ke liye aapko aur particular pointers ko bhi use karna hoga. Ye pointers aapko design ka heading aur market influence ke baare mein bata sakte hain. Aap RSI, MACD, aur stochastic oscillator jaise markers ka use kar sakte hain. RSI ek oscillator hai jo relative strength ki assessment karta hai. Is marker ke readings 0 se 100 tak hote hain aur aapko overbought aur oversold levels ko bhi show karte hain. Overbought levels 70 se zyada readings hoti hain aur oversold levels 30 se kam readings hote hain. MACD design aur energy ke baare mein bata hai. Is me 2 moving midpoints hoti hain, jinhe MACD line aur signal line kaha jata hai. MACD line signal line ko cross karti hai to ye ek buy ya sell signal ho sakta hai. Stochastic oscillator bhi ek force pointer hai jo overbought aur oversold levels ko show karta hai. Ye marker 0 se 100 tak readings deta hai. Punch ye 80 se zyada readings deta hai to grandstand overbought ho jata hai aur hit ye 20 se kam readings deta hai to publicize oversold ho jata hai.Agar ABCP ke signals ko certify karne ke liye aapko kisi bhi specific pointer ka use karna hai, to ye pointers aapko financial circumstances ke baare mein bhi batate hain. Financial circumstances ke baare mein jaankari hona bhi bahut zaroori hai. Agar market me design strong hai aur energy high hai, to ABCP ke signals strong hote hain. Lekin agar market me range bound trading ho rahi hai aur energy kam hai, to ABCP ke signals solid areas for kam hain. ABCP ke signals ko trade karne se pehle aapko apni risk the leaders framework ka bhi dhyaan rakhna chahiye. Is me aap apne stop mishap aur take benefit levels ko bhi set karna hoga. Stop disaster aapki mishap ko control karta hai punch market against trade jati hai, hit ki take benefit level aapki benefit ko lock karta hai hit market apne target tak pohochta hai. Aap stop adversity aur take benefit levels ko particular assessment aur financial circumstances ke hisaab se set kar sakte hain. ABCP ke signals ko trade karne se pehle, aapko is plan ke limits bhi samajhna hoga. ABCP mein 3 candles hote hain, jinhe dekh kar aapko trade lena hota hai. Is liye, ye plan transient trading ke liye zyada sensible hai. Lekin, ye plan sirf cost movement assessment standard depend karta hai aur kisi bhi monetary or political event ke impact ko nahi dekhta hai. Is liye, aapko ABCP ke signals ko trade karte waqt, ek all things considered market view bhi rakhna hoga. Agar market me koi basic news ya event hAdvance Bock Candle Model aik light stuck trading patteren ko diya jane wala naam hai. patteren aik three light bad set up hai jisay patteren samjha jata hai — aik tajweez yeh hai ke qeemat ki karwai nisbatan mukhtasir waqt ke mein oopar ki taraf rujhan se neechay ki taraf tabdeel honay wali hai. kuch musanifeen tajweez karte hain amli top standard tashkeel aksar ulat ke bajaye taizi ke tasalsul ki taraf le jati hai .advance bock aik high schooler muddat ki light stuck patteren hai jisay ulat jane ki excitement goi ke liye samjha jata hai .ulat palat ki energy goi karne mein patteren ki kamyabi baa-mushkil be tarteeb se oopar haCandles Pattren business center ka frame mother huma market high ke traf dakhna ko mil jay ga or ya further cultivate block fire plan huma business center ka wary mother ka frame mother rise ke traf dakhna ko mil jay ga or ya animate block plan business center ka rise ka zenith mother banay kar business center ka is rise ko stop kara ga or market ko rise sa plunging ke traf reversal ho kar la kar ay ga or ya plan business center ko unequivocally unbelievable sa lower ke traf reversal kar ka lay ga. Ya increment block configuration hit banay ga to ya plan jasa banta jay ga to ya arrangement market mother bannay ka junky business place ka high ka pressure ko reliably relaxed decreasing karna slack jay ga or business center ko lower ke traf fearlessly reversal karna ka kam kara ga. Ya darkish improvement fire plan business center mother high ke traf three candles sa mil kar banay ga or ya three candles sa mil kar market ko lower ke traf reversal karay ga Advance Block Flame Model ki Arrangemen Advance Block Candles Pattren business focus ka outline mother huma market high ke traf dakhna ko mil jay ga or ya further develop block fire plan huma business focus ka cautious mother ka outline mother rise ke traf dakhna ko mil jay ga or ya invigorate block plan business focus ka rise ka summit mother banay kar business focus ka is rise ko stop kara ga or market ko rise sa plunging ke traf inversion ho kar la kar ay ga or ya plan business focus ko unequivocally senseless sa lower ke traf inversion kar ka lay ga. Ya increase block setup hit banay ga to ya plan jasa banta jay ga to ya configuration market mother bannay ka inferior business place ka high ka pressure ko consistently loose diminishing karna slack jay ga or business focus ko lower ke traf intensely inversion karna ka ka

amli top standard tashkeel aksar ulat ke bajaye taizi ke tasalsul ki taraf le jati hai .advance bock aik high schooler muddat ki light stuck patteren hai jisay ulat jane ki excitement goi ke liye samjha jata hai .ulat palat ki energy goi karne mein patteren ki kamyabi baa-mushkil be tarteeb se oopar haCandles Pattren business center ka frame mother huma market high ke traf dakhna ko mil jay ga or ya further cultivate block fire plan huma business center ka wary mother ka frame mother rise ke traf dakhna ko mil jay ga or ya animate block plan business center ka rise ka zenith mother banay kar business center ka is rise ko stop kara ga or market ko rise sa plunging ke traf reversal ho kar la kar ay ga or ya plan business center ko unequivocally unbelievable sa lower ke traf reversal kar ka lay ga. Ya increment block configuration hit banay ga to ya plan jasa banta jay ga to ya arrangement market mother bannay ka junky business place ka high ka pressure ko reliably relaxed decreasing karna slack jay ga or business center ko lower ke traf fearlessly reversal karna ka kam kara ga. Ya darkish improvement fire plan business center mother high ke traf three candles sa mil kar banay ga or ya three candles sa mil kar market ko lower ke traf reversal karay ga Advance Block Flame Model ki Arrangemen Advance Block Candles Pattren business focus ka outline mother huma market high ke traf dakhna ko mil jay ga or ya further develop block fire plan huma business focus ka cautious mother ka outline mother rise ke traf dakhna ko mil jay ga or ya invigorate block plan business focus ka rise ka summit mother banay kar business focus ka is rise ko stop kara ga or market ko rise sa plunging ke traf inversion ho kar la kar ay ga or ya plan business focus ko unequivocally senseless sa lower ke traf inversion kar ka lay ga. Ya increase block setup hit banay ga to ya plan jasa banta jay ga to ya configuration market mother bannay ka inferior business place ka high ka pressure ko consistently loose diminishing karna slack jay ga or business focus ko lower ke traf intensely inversion karna ka ka kem kara gaGrasping an Improvement Block advance bock flame stuck patteren mein darj zail chaar khususiyaat hain : 1. cost movement ne neechay ke rujhan mein oopar ka rujhan ya numaya uuchaal dekhaya hai .2. high schooler safaid mother batian namodaar hoti hain jin ke haqeeqi jism yakke baad deegray chhootey hotay hain .3. doosri aur teesri mother btyon ka khilna bal tarteeb pichli mother btyon ke asal jism mein hai .4. tenu mother btyon ke oopar ke saaye aahista buland hotay jatay hain khaas top standard aakhri mother batii ka saya . is patteren ko is patteren ke foran baad aglay kayi adwaar mein qeemat mein tabdeeli ki pishin goi samjha jata hai. yeh frame patteren barray pemanay standard neechay ke rujhanaat mein earzi oopar ki harkato aur amigo bacchus ke douran ulat jane walay namonon ki behtareen paish goi karta hai aur punch mother batian taweel haqeeqat pasandana bodies rakhti hain. negative ki tasdeeq is waqt hoti hai jab pehli baad wali qeemat baar pehli candle ki asal body ke mid point ke zariye tijarat karti hai . trading se pehlay ke saloon mein advance bock patteren nisbatan nayaab thay lekin is ke baad se ziyada aam ho gaye hain, jo intra day counter soyng ki ziyada ko zahir karta hai. taham, taajiron ko sirf advance bock patteren se signal khareedna ya bechna nahi chahiye. is ke bajaye, patteren ko tasdeeq ke apex standard istemaal karen ya deegar diagram patteren aur takneeki isharay mein izafi saboot ke top standard shaamil karen taakay energy goi ke alay ke zenith standard is signal ko behtar banaya ja sakay. mazeed bar-aan, taajiron ko taizi ke tasalsul ke bar aks, ke liye mushkilaat ko ziyada se ziyada karne ke liye aala haqeeqi idaron ki talaash karni chahiye . Candle Example aik light stuck exchanging patteren ko diya jane wala naam hai. patteren aik three light negative set up hai jisay patteren samjha jata hai — aik tajweez yeh hai ke qeemat ki karwai nisbatan mukhtasir waqt ke mein oopar ki taraf rujhan se neechay ki taraf tabdeel honay wali hai. kuch musanifeen tajweez karte hain ke amli pinnacle standard tashkeel aksar ulat ke bajaye taizi ke tasalsul ki taraf le jati hai .advance bock aik adolescent muddat ki light stuck patteren hai jisay ulat jane ki enthusiasm goi ke liye samjha jata hai .ulat palat ki energy goi karne mein patteren ki kamyabi baa-mushkil be tarteeb se oopar hai .hit yeh namona neechay ki taraf barray rujhan mein hota hai to ulat phair ziyada aam hoti hai .

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:35 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим