Forex vs Stock Exchange.

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

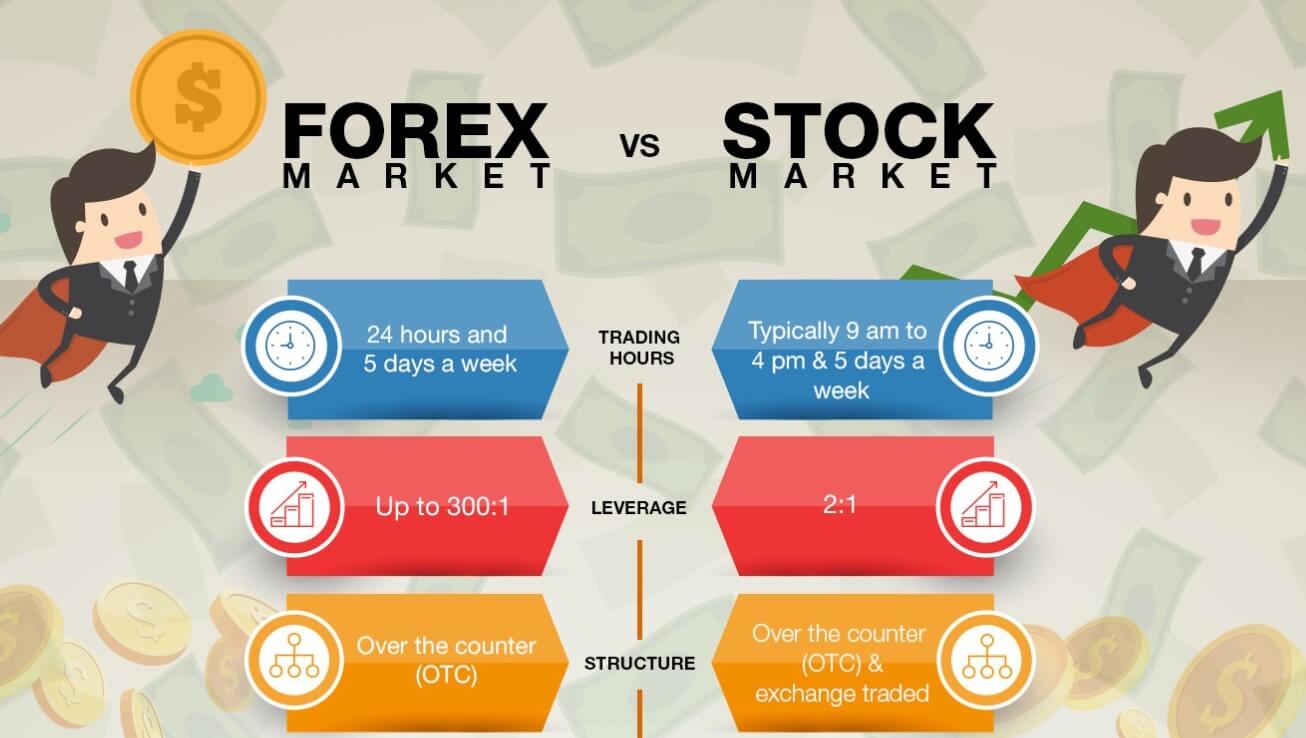

Introduction Forex aur Stock Exchange dono hi markets hain, jahan traders aur investors apne paise ko invest karke profit kamane ki koshish karte hain. Lekin dono markets mein kuch khaas farq hai Jin ke bar detailed discuss ke hai hay ayye jante hain Trading Hours: Stock Exchange ki trading hours fixed hoti hai, jaisa ki New York Stock Exchange ki trading hours 9:30 AM se 4:00 PM tak hain. Lekin forex market 24 ghante khulta hai aur hafton mein sirf ek din (Saturday aur Sunday) ke liye band hota hai. Instruments: Stock Exchange mein stocks, bonds, mutual funds aur exchange-traded funds (ETFs) jaisi instruments trade kiye jaate hain. Lekin forex market mein currencies trade ki jaati hain. Volatility: Forex market stock market se zyada volatile hota hai. Iska matlab hai ki currency prices ki fluctuations stock prices ki fluctuations se zyada hote hain. Iska mukhya karan yeh hai ki forex market mein leverage ka istemaal kiya jaata hai, jiski wajah se traders kam paise se zyada quantity ki trading kar sakte hain. Trading Cost: Forex trading ki transaction cost stock trading se kam hoti hai. Forex broker apne clients ko kam spread (buy aur sell price ke beech ka difference) offer karte hain, jabki stock brokers zyada spread charge karte hain. Risk: Dono markets mein investment karne ke risk hote hain. Lekin forex market mein leverage ka istemaal karne se risk aur bhi zyada ho jaata hai. Jabki stock market mein leverage ka istemaal nahi kiya jaata hai. Toh yeh tha forex aur stock exchange ke beech ka kuch farq. In dono markets mein investment karne se pehle, investors ko apne risk tolerance aur financial goals ka dhyan rakhna chahiye.Thank you for your attention -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex ba muqabla stock exchange Forex ( foreign exchange ) aur stock exchange dono maliyati mndyan hain jahan log asasay kharedtay aur baichtay hain, lekin un ke darmiyan kuch ahem farq hain : Trading Hours: Forex market din mein 24 ghantay, haftay ke 5 din khuli rehti hai, jabkay stock exchange haftay ke dinon mein sirf makhsoos auqaat mein khula rehta hai . Working: Forex market currency ke joron mein deal karti hai, jabkay stock exchange stock aur deegar sikyortiz mein deal karti hai forex market duniya ki sab se ziyada maya market hai, jahan har roz trilion dollar ka tabadlah hota hai. stock exchange bhi kaafi maya hai, lekin forex market ke tor par isi had tak nahi hai . Fluctuations: Forex market geographiyai siyasi waqeat, iqtisadi reports, aur sharah sood mein tabdeeli jaisay awamil ki wajah se apni aala utaar charhao ke liye jana jata hai. stock exchange bhi utaar charhao ka shikaar ho sakta hai, lekin company ki makhsoos khabron aur waqeat se ziyada mutasir hota hai . Leverage: Forex trading mein aksar lyorij ka istemaal shaamil hota hai, jis ka matlab hai ke traders chhootey sarmaye ke sath barri pozishnon ko control kar satke hain. stock exchange kuch faida uthany ki bhi ijazat deta hai, lekin yeh aam tor par is se kam hai jo forex market mein dastyab hai . majmoi tor par, forex aur stock exchange dono taajiron aur sarmaya karon ke liye sarmaya kaari ke munafe bakhash mawaqay ho satke hain, lekin un ke liye mukhtalif hikmat amlyon aur rissk managment تکنیکوں ki zaroorat hoti hai. yeh faisla karne se pehlay ke kis mein tijarat karni hai un dono baazaaron ke darmiyan farq ko samjhna zaroori hai . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Forex aur Stock Exchange dono hi tijarati markets mein aham aur mukhtalif hotay hain. Dono mein karobari faide hain lekin dono ke bhe kamzoriyaan aur tafawat bhi hoti hain. Forex aur Stock Exchange dono tijarati markets mein tijarat karne walon ke liye samajhna zaroori hai taaki woh apne paise ko behtar tareeqay se istemaal kar saken. Forex yani foreign exchange ka short form hai, jahan par currencies ki khareed-o-farokht hoti hai. Yahan par alag alag mulkon ke currencies, misaal ke tor par dollar, euro, yen aur pound waghera khareed o farokht hotay hain. Forex market duniya ki sabse bari tijarati market hai aur iski din bhar ki trading hoti hai, taqriban 6 trillion dollar tak rozana. Forex market 24 ghantay khuli rehti hai, iska matlab hai ke investors aur traders puri dunya mein kisi bhi waqt forex trading kar sakte hain. Forex market ki sabse bari tafawat stock market se ye hai ke forex market mein currencies ki khareed-o-farokht hoti hai, jabke stock market mein companies ke shares ki khareed-o-farokht hoti hain. Forex market mein currencies pairs ke roop mein trade hoti hain, jaise ke USD/EUR, GBP/JPY, AUD/CAD, etc. Aur yahan par leverage ka concept bhi hota hai, jiski madad se investors kam paise invest karke bade deals kar sakte hain, lekin iske sath sath bada risk bhi hota hai. Stock Exchange, jahan par companies ke shares khareed o farokht hote hain, bhi ek aham tijarati market hai. Yeh companies apne shares public ko offer karke apna capital generate karti hain. Stock Exchange par companies ke shares ko khareedne ya bechne wale investors ko share ki malikana hissa milta hai aur is tarah woh company ke hisse ke maalik ban jate hain. Stock market bhi samay par khulta aur band hota hai, aur iski timings usually limited hoti hain. Forex aur Stock Exchange mein kuch mukhtalif tafawat hain. Ek tafawat ye hai ke forex market 24/7 khula hota hai jabke stock market mein timings hoti hain. Iska matlab hai ke forex market mein investors aur traders kisi bhi waqt trading kar sakte hain, jabke stock market mein sirf timings ke dauran hi trading ho sakti hai. Forex market ki liquidity bhi zyada hoti hai, jiski wajah se traders ko aasani hoti hai apne orders execute karne mein. Stock market mein liquidity kam hoti hai aur order execution mein samay lag sakta hai.Doosri tafawat ye hai ke forex market mein leverage ka concept hota hai, jiski madad se traders kam paise invest karke bade positions le sakte hain. Lekin stock market mein leverage ki zaroorat nahi hoti aur investors apne paise ko poore shares ke hisab se invest karte hain. Leverage ki wajah se forex market mein kam paise se bade deals karne ki suvidha hoti hai, lekin iske sath sath bada risk bhi hota hai, kyunki agar trade loss mein chali gayi toh trader ko poore leverage amount ko khona pad sakta hai. Forex aur Stock Exchange ke risk factors bhi alag alag hotay hain. Forex market mein currency rates mein tabdeeliyan jaldi hoti hain, jiski wajah se currency pairs ki keemat mein tezi ya mandi aasani se ho sakti hai. Economic, geopolitical, aur other factors ki wajah se currency pairs mein volatility bhi hoti hai, jo traders ke liye samay par bade fayde ya nuksan bhi kar sakti hai. Stock market mein bhi companies ke performance, market sentiment, economic conditions, aur other factors ke wajah se share prices mein tabdeeliyan hoti hain, lekin ye usually forex market se kam volatile hoti hain.

Forex aur Stock Exchange mein kuch mukhtalif tafawat hain. Ek tafawat ye hai ke forex market 24/7 khula hota hai jabke stock market mein timings hoti hain. Iska matlab hai ke forex market mein investors aur traders kisi bhi waqt trading kar sakte hain, jabke stock market mein sirf timings ke dauran hi trading ho sakti hai. Forex market ki liquidity bhi zyada hoti hai, jiski wajah se traders ko aasani hoti hai apne orders execute karne mein. Stock market mein liquidity kam hoti hai aur order execution mein samay lag sakta hai.Doosri tafawat ye hai ke forex market mein leverage ka concept hota hai, jiski madad se traders kam paise invest karke bade positions le sakte hain. Lekin stock market mein leverage ki zaroorat nahi hoti aur investors apne paise ko poore shares ke hisab se invest karte hain. Leverage ki wajah se forex market mein kam paise se bade deals karne ki suvidha hoti hai, lekin iske sath sath bada risk bhi hota hai, kyunki agar trade loss mein chali gayi toh trader ko poore leverage amount ko khona pad sakta hai. Forex aur Stock Exchange ke risk factors bhi alag alag hotay hain. Forex market mein currency rates mein tabdeeliyan jaldi hoti hain, jiski wajah se currency pairs ki keemat mein tezi ya mandi aasani se ho sakti hai. Economic, geopolitical, aur other factors ki wajah se currency pairs mein volatility bhi hoti hai, jo traders ke liye samay par bade fayde ya nuksan bhi kar sakti hai. Stock market mein bhi companies ke performance, market sentiment, economic conditions, aur other factors ke wajah se share prices mein tabdeeliyan hoti hain, lekin ye usually forex market se kam volatile hoti hain.  Forex market mein trading karne wale traders ko currency pairs ki detailed analysis aur global economic events ki samajh honi chahiye. Currency pairs ke rates mein hone wali tabdeeliyan, economic indicators, central bank policies, geopolitical events, aur market sentiment, sabhi factors forex market mein trading ke liye mahatvapurna hoti hain. Forex traders ko chahiye hota hai ke woh kisi bhi trade ke liye stop loss aur take profit levels set karein, taki unko risk management ka khayal rakhne mein madad mil sake. Stock market mein trading karne wale investors ko companies ke financial reports, market trends, industry analysis, aur company ke future growth prospects par tafsili tajurba aur samajh honi chahiye. Share prices ki technical aur fundamental analysis, company ke performance, corporate governance, aur dividend history, sabhi factors stock market mein trading ke liye zaroori hain. Stock market mein long-term investment strategy aur diversification ka bhi zaroor khayal rakhna chahiye, taaki investors apne portfolio ko samay par balance kar sakein.

Forex market mein trading karne wale traders ko currency pairs ki detailed analysis aur global economic events ki samajh honi chahiye. Currency pairs ke rates mein hone wali tabdeeliyan, economic indicators, central bank policies, geopolitical events, aur market sentiment, sabhi factors forex market mein trading ke liye mahatvapurna hoti hain. Forex traders ko chahiye hota hai ke woh kisi bhi trade ke liye stop loss aur take profit levels set karein, taki unko risk management ka khayal rakhne mein madad mil sake. Stock market mein trading karne wale investors ko companies ke financial reports, market trends, industry analysis, aur company ke future growth prospects par tafsili tajurba aur samajh honi chahiye. Share prices ki technical aur fundamental analysis, company ke performance, corporate governance, aur dividend history, sabhi factors stock market mein trading ke liye zaroori hain. Stock market mein long-term investment strategy aur diversification ka bhi zaroor khayal rakhna chahiye, taaki investors apne portfolio ko samay par balance kar sakein.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:59 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим