Wolf Wave Candlestick Pattern...

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

-

سا0 like

-

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

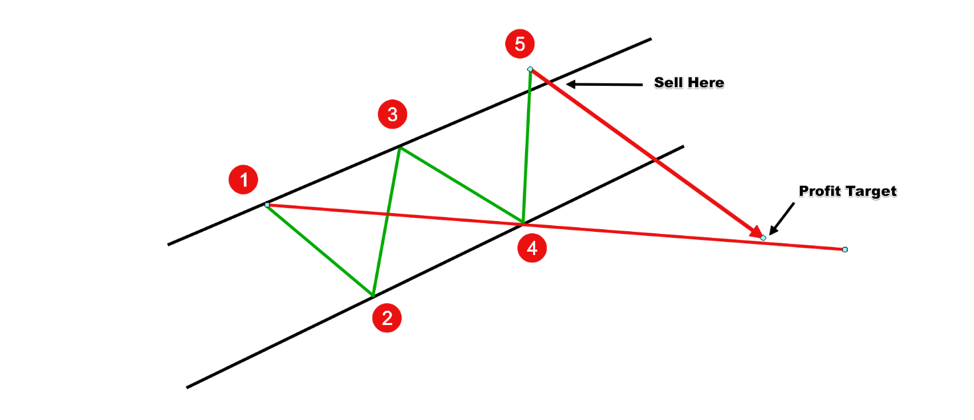

Explanation Of Wolf Wave Candlestick Pattern: Wolf Wave Candlestick, ya bas Wolf Wave, ek technical analysis tool hai jo candlestick charts mein use kiya jata hai. Ye chart pattern market trend ko predict karne ke liye istemal kiya jata hai. Wolf Wave pattern ek five-pointed structure hota hai jismein prices ki fluctuations ko show karta hai. Is pattern ke points ko waves kaha jata hai. Ye pattern aam taur par swing trading ke liye istemal kiya jata hai.Is pattern mein, wave 1 aur wave 2 downtrend mein hote hai aur wave 3 uptrend mein hota hai, jise wave 1 aur wave 2 ke low se measure kiya jata hai. Wave 4 normal range mein hota hai aur wave 5 wave 3 ke high se measure kiya jata hai. Wolf Wave pattern ko identify karne ke liye, traders trend lines aur Fibonacci retracement levels ka use karte hai. Agar is pattern ki sahi tarah se identification kiya jaye, to isse traders ko entry aur exit points ka idea milta hai. Wolf Wave Candlestick Pattern: Wolf Wave Candlestick pattern, candlestick charts ke zariye trading ke liye use kiya jane wala ek technical analysis pattern hai. Ye pattern price action analysis ke liye istemal kiya jata hai aur chart patterns ke category me ata hai. Wolf Wave pattern, 5 waves se bana hota hai, jismei 3 uptrending waves aur 2 downtrending waves hote hain. Is pattern ko samajhne ke liye trader ko chart ki trend lines aur Fibonacci retracement levels ka use karna hota hai. Is pattern ko spot karne ke liye, trader ko trend line ke zariey waves ko connect karne hote hain. Yeh waves Fibonacci retracement level ke sath sath merge hone chahiyein. Wolf Wave Candlestick pattern ka use trading signals ke liye kya jata hai. Agar trend line ke break ke bad price trend me move karta hai, to ye bullish signal hai, aur trader ko long position enter karna chahiye. Isi tarah, agar trend line ke break ke bad price trend me down move karta hai, to ye bearish signal hai, aur trader ko short position enter karna chahiye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Wolf Wave candlestick pattern forex mein ek popular trading strategy hai. Yeh price action aur technical analysis ke combination ke through traders dwara use kiya jata hai. Wolf Wave pattern ko develop kiya gaya hai Bill Wolfe ke taraf se, jo ek professional trader aur analyst hain. Wolfe Wave pattern, market trend reversal aur trend continuation ko identify karne ke liye use kiya jata hai. Wolf Wave pattern ek five-point structure se banata hai, jismein 1-4 tak ke points trend line ke through connect hote hain aur 5th point ko trend line se cross karne ke baad price movement ke further direction ke liye breakout kiya jata hai. Yeh pattern uptrend aur downtrend dono ke liye applicable hai. Uptrend mein, 1st point ko lowest low se connect kiya jata hai aur 2nd point ko highest high se connect kiya jata hai. 2nd point ko 1st point se neeche draw ki gayi trend line ke through connect kiya jata hai. 3rd point ko highest high se connect kiya jata hai aur 4th point ko highest high se connect kiya jata hai, jismein 3rd point aur 4th point ke beech ki trend line 1-2 tak ki trend line ke parallel hoti hai. 5th point ko trend line se cross karne ke baad price movement ka breakout hota hai, jismein price trend line se 1-4 tak ke length ke barabar move karta hai.Downtrend mein, 1st point ko highest high se connect kiya jata hai aur 2nd point ko lowest low se connect kiya jata hai. 2nd point ko 1st point se upar draw ki gayi trend line ke through connect kiya jata hai. 3rd point ko lowest low se connect kiya jata hai aur 4th point ko lowest low se connect kiya jata hai, jismein 3rd point aur 4th point ke beech ki trend line 1-2 tak ki trend line ke parallel hoti hai. 5th point ko trend line se cross karne ke baad price movement ka breakout hota hai, jismein price trend line se 1-4 tak ke length ke barabar move karta hai.

Uptrend mein, 1st point ko lowest low se connect kiya jata hai aur 2nd point ko highest high se connect kiya jata hai. 2nd point ko 1st point se neeche draw ki gayi trend line ke through connect kiya jata hai. 3rd point ko highest high se connect kiya jata hai aur 4th point ko highest high se connect kiya jata hai, jismein 3rd point aur 4th point ke beech ki trend line 1-2 tak ki trend line ke parallel hoti hai. 5th point ko trend line se cross karne ke baad price movement ka breakout hota hai, jismein price trend line se 1-4 tak ke length ke barabar move karta hai.Downtrend mein, 1st point ko highest high se connect kiya jata hai aur 2nd point ko lowest low se connect kiya jata hai. 2nd point ko 1st point se upar draw ki gayi trend line ke through connect kiya jata hai. 3rd point ko lowest low se connect kiya jata hai aur 4th point ko lowest low se connect kiya jata hai, jismein 3rd point aur 4th point ke beech ki trend line 1-2 tak ki trend line ke parallel hoti hai. 5th point ko trend line se cross karne ke baad price movement ka breakout hota hai, jismein price trend line se 1-4 tak ke length ke barabar move karta hai. Wolf Wave pattern ko identify karna trading ke liye important hai. Traders ko is pattern ke through price movement ka direction aur breakout points ko identify karne mein help milti hai. Wolfe Wave pattern ke through traders ko entry aur exit points ke baare mein bhi information milti hai. Wolf Wave pattern ko use karne ke liye traders ko price action aur technical analysis ke baare mein acchi understanding honi chahiye. Trend lines, support/resistance levels aur moving averages jaise technical analysis tools traders ko price movement ke baare mein information dete hain. Price action ke through traders ko market behaviour aur price movement ke baare mein information milti hai. Is pattern ko use karne ke liye traders ko price action aur technical analysis ke baare mein acchi understanding honi chahiye. Trend lines, support/resistance levels aur moving averages jaise technical analysis tools traders ko price movement ke baare mein information dete hain. Price action ke through traders ko market behaviour aur price movement ke baare mein information milti hai. Traders ko price movement ke baare mein information dete hue in tools se traders ko price movement ka direction aur breakout points ke baare mein information milta hai.

Wolfe Wave pattern ke alawa bhi kuch important points hain jo traders ko forex trading ke liye help karte hain.

Wolfe Wave pattern ke alawa bhi kuch important points hain jo traders ko forex trading ke liye help karte hain. - Risk management: Forex trading mein risk management bahut important hai. Traders ko apne trades ke liye ek risk management plan banane ki zaroorat hai. Risk management plan mein traders ko apne trades ke liye stop loss aur take profit levels set karna chahiye.

- Economic calendar: Economic calendar traders ke liye bahut useful hai kyunki isse traders ko important economic events ka pata chalta hai. Isse traders ko pata chalta hai ki kis event ke baad market mein volatility expect kiya ja sakta hai.

- Trading psychology: Trading psychology bahut important hai kyunki traders ke decisions unke emotions aur mindset par depend karte hain. Traders ko apne trades ke liye cool, calm aur collected rahna chahiye.

- Technical analysis tools: Forex trading mein technical analysis tools traders ke liye bahut important hai kyunki isse traders ko price movement ke baare mein information milta hai. Moving averages, trend lines, Fibonacci retracement aur support/resistance levels jaise tools traders ke liye bahut useful hai.

- Fundamental analysis: Fundamental analysis ke through traders ko economic news aur events ke baare mein information milta hai. Isse traders ko pata chalta hai ki market mein kis direction mein movement expect kiya ja sakta hai.

- Trading strategy: Traders ko apni trading strategy ko select karna chahiye. Yeh strategy traders ke trading style aur goals par depend karta hai. Trading strategy ko select karne se pehle traders ko apne trading style, goals aur risk tolerance ke baare mein sochna chahiye.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:09 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим