What is pullback and breakout

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

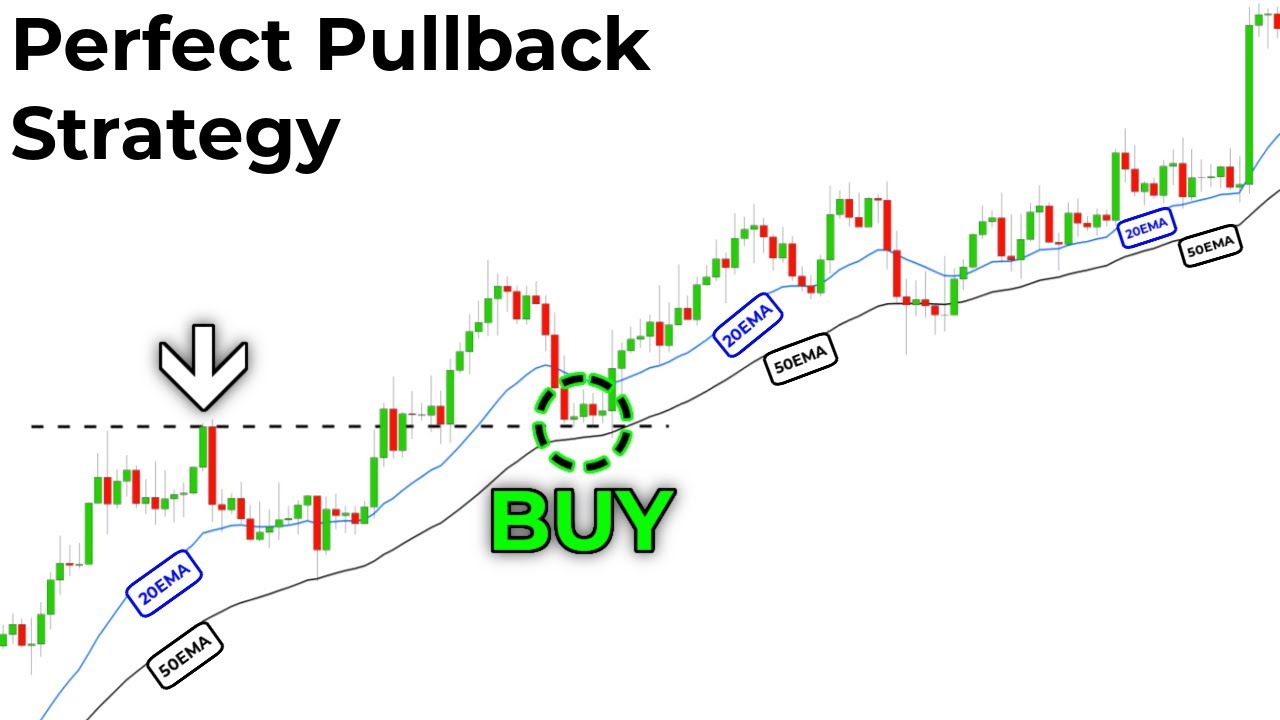

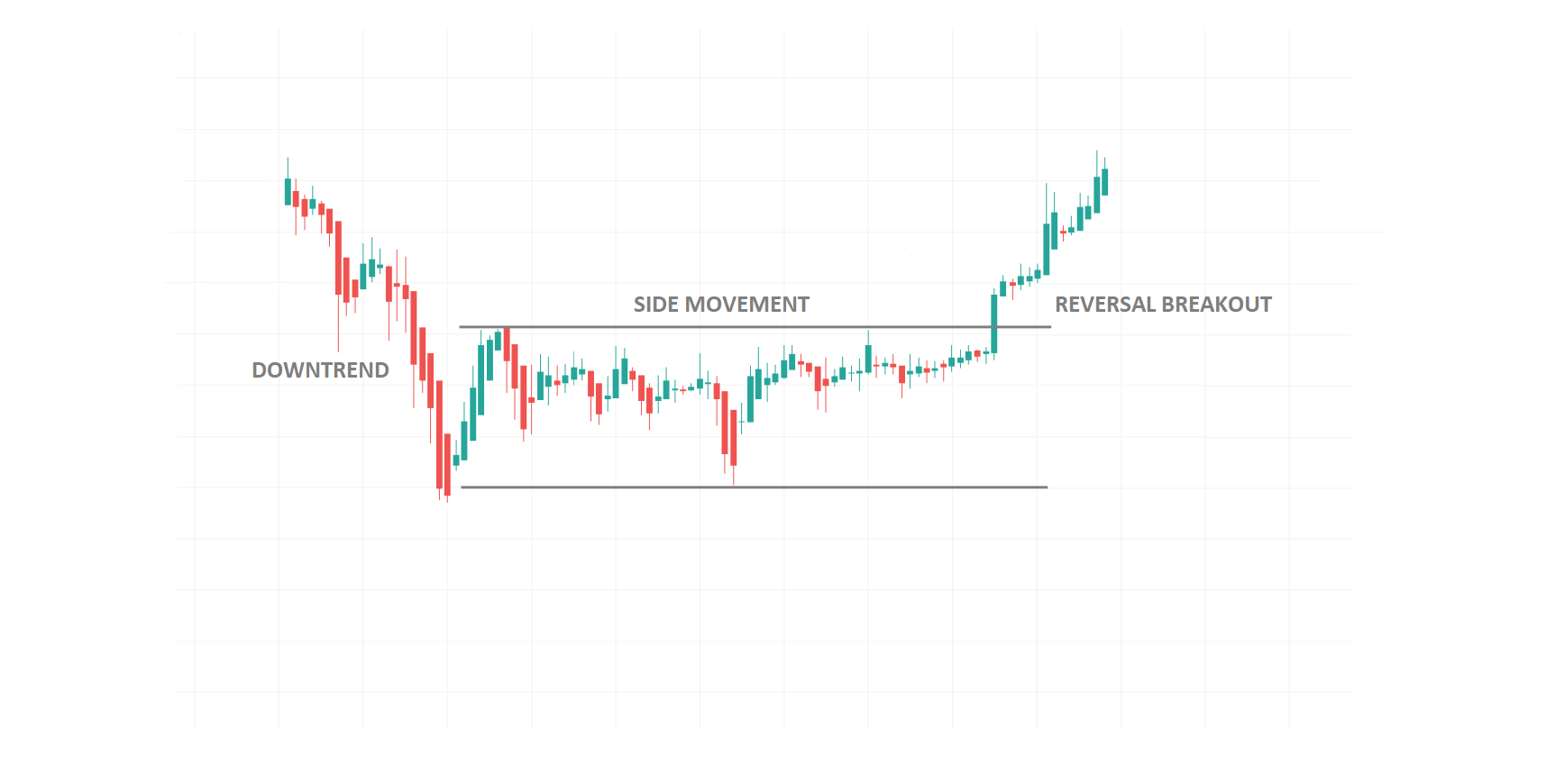

What is pullback and breakout Introduction Hello Forex member kaise ho ap aj hum pullback and breakout ke bare mien discuss kareng Pullback or breakout Aik fori yad dehani ke tor par break out khareedna is waqt khareedna hai jab qeemat muzahmat ke ilaqay se oopar aur oopar ki taraf barh rahi ho . - pal back khareedna is waqt khareedna hai jab qeemat support ki taraf barh rahi ho, aam tor par break out ziyada honay ke baad - farokht ke liye is ke bar aks un dono tareeqon ke fawaid aur nuqsanaat hain. bator tajir hamein apni tijarti hikmat e amli se mumkina nataij ki had ko poori terhan se samajhney aur qubool karne ki zaroorat hai. tab hi hum waqt ke sath sath usay baar baar injaam dainay mein aaraam mehsoos kar satke hain Selling pullback and breakout pal back baichnay ki pehli koshish nakaam ho jati hai kyunkay qeemat pichli chouti se peechay hatt jati hai jahan mantaqi tor par stop las rakha jaye ga . 2. pichlle kam se neechay break out baichnay ki pehli koshish nakaam hai kyunkay yeh ghalat break out hai. qeemat kam jari rakhnay ke bajaye side ways qeemat ki had mein wapas chali jati hai . 3. pal back farokht karne ki doosri koshish kamyaab hai kyunkay qeemat pichli chouti se pehlay kam ho jati hai jahan stap nuqsaan mantaqi tor par rakha jaye ga . 4. break out baichnay ki doosri koshish kamyaab hai kyunkay qeemat musalsal neechay ki taraf barh rahi hai . yeh samajhney ki ahem baat yeh hai ke dono tareeqon ( 1 aur 2 ) se honay walay chhootey nuqsaan ko mandarja zail jeet ( 3 aur 4 ) se aasani se girhan lag jata . yaqeenan bazaar hamesha' chart 1' ki terhan harkat nahi karte. kabhi kabhi ziyada khonay walay tijarat hon ge, kabhi kabhi koi nahi hoga. rujhan rivers bhi ho sakta hai lehaza mojooda rujhan ke mutabiq koi jeetnay wala break out ya pal back nahi hoga . is ke bawajood' chart 1' is baat ki aik achi misaal hai ke hum break out aur / ya pal back trading karte waqt kya honay ki tawaqqa kar satke hain. khayaal yeh hai ke woh chhootey nuqsanaat mutawaqqa aur qabil intizam hain aur tijarat ki aik series mein, barray faateh wohi hain jo munafe bakhash taajiron ko kamyaab honay mein madad karte hain . Difference between a reversal and pullback pal bacchus aur reversal dono mein security shaamil hoti hai jo is ki oonchai se hatti hai, lekin pal bacchus earzi hotay hain aur ulat palat taweel mudti hotay hain. to tajir dono mein farq kaisay kar satke hain? ziyada tar tabdeelion mein security ke bunyadi usoolon mein kuch tabdeeli shaamil hoti hai jo market ko is ki qeemat ka dobarah jaiza lainay par majboor karti hai. misaal ke tor par, aik company tabah kin kamaai ki ittila day sakti hai jis se sarmaya car stock ki khalis mojooda qeemat ka dobarah hisaab lagatay hain. isi terhan, yeh aik manfi tasfia ho sakta hai, aik naya hareef kisi numeral ko jari karta hai ya koi dosra waqea jis ka stock ke tehat company par taweel mudti assar parre ga . yeh waqeat, jab ke chart se bahar ho rahay hain, to baat karne ke liye, kayi sishnz mein zahir hon ge aur ibtidayi tor par aik pal back ki terhan lagen ge . Example pal bacchus aam tor par bunyadi bunyadi bayaniya ko tabdeel nahi karte hain jo chart par qeemat ki karwai ko agay barha raha hai. security ki qeemat mein zabardast izafay ke baad woh aam tor par munafe kamanay ke mawaqay hotay hain. misaal ke tor par, aik company baalo out aamdani ki ittila day sakti hai aur hasas mein 20 % izafah dekh sakta hai. stock ko aglay din wapsi ka saamna karna par sakta hai kyunkay qaleel mudti tajir apni kuch lambi pozishnin farokht karkay munafe mein band ho jatay hain. taham, mazboot aamdani ki report batati hai ke stock ke tehat kaarobar kuch theek kar raha hai. kharedo aur hold traders aur sarmaya car mumkina tor par mazboot aamdani ki reports ke zariye stock ki taraf mutwajjah hon ge, jo ke qareebi muddat mein musalsal izafay ke rujhan ki himayat karte hain -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

PULLBACK/BREAKOUT TRADING STRATEGY Forex market ke andar Jab market price sport ya resistance level ki madad se market trading range se out Ho Jaati Hai To is point ko break out point Kaha jata hai Lekin market Kuchh time ke bad Dobara trading range mein Wapas a Jaati Hai Aur Is Tarah forex market ke andar yah pattern repeat Hota rahata Hai to is pattern ko call back ya break out test Kaha jata hai. WHAT DOES THE TRADER LEARN FROM THIS STRATEGY? Basically Jab market price trading range se out Ho Jati Hai lekin yah price apni Momentum ko return rakhne mein Kamyab Nahin Hoti aur kuchh time ke bad Dobara trading range mein Wapas a Jaati Hai to trading wording Mein is pattern ko Falls break out Kaha jata hai lekin Agar call back pattern effect kar raha ho to break out prices trading range mein inter hone ki bajay Breakout point ke साथ-साथ Ruk Jaati Hain aur isliye is pattern ko call back pattern bhi Kahate Hain lekin Agar market ke andar break out test successful ho jata hai to mostally prices pattern ko Dobara repeat karna start kar deti hain aur yah pattern Kai bar repeat Hota Hai aur is se trader bahut Kuchh learn karte hain aur acchi arning bhi Hasil kar sakte hain

WHAT DOES THE TRADER LEARN FROM THIS STRATEGY? Basically Jab market price trading range se out Ho Jati Hai lekin yah price apni Momentum ko return rakhne mein Kamyab Nahin Hoti aur kuchh time ke bad Dobara trading range mein Wapas a Jaati Hai to trading wording Mein is pattern ko Falls break out Kaha jata hai lekin Agar call back pattern effect kar raha ho to break out prices trading range mein inter hone ki bajay Breakout point ke साथ-साथ Ruk Jaati Hain aur isliye is pattern ko call back pattern bhi Kahate Hain lekin Agar market ke andar break out test successful ho jata hai to mostally prices pattern ko Dobara repeat karna start kar deti hain aur yah pattern Kai bar repeat Hota Hai aur is se trader bahut Kuchh learn karte hain aur acchi arning bhi Hasil kar sakte hain  TRADING INFORMATION Yah pattern market ke andar Kai bar repeat hota hai aur kab aur handle pattern banaa deta hai isliye Kuchh trader is pattern ko kab and handle pattern bhi Kahate Hain pattern ko trader isliye important samajhte Hain Kyunki yah pattern market ke andar bar bar repeat Hota Hai Aur Is Tarah traders ko second trade ke liye signals ke Taur per use karte hain aur Market ka exact trend Maloom kar sakte hain market ke andar Baj aukat trader ko Breakout ya Pul back pattern ke liye real break out ki zarurat Nahin Hoti trader Falls Breakout ki madad se bhi exact trend Maloom kar sakte hain

TRADING INFORMATION Yah pattern market ke andar Kai bar repeat hota hai aur kab aur handle pattern banaa deta hai isliye Kuchh trader is pattern ko kab and handle pattern bhi Kahate Hain pattern ko trader isliye important samajhte Hain Kyunki yah pattern market ke andar bar bar repeat Hota Hai Aur Is Tarah traders ko second trade ke liye signals ke Taur per use karte hain aur Market ka exact trend Maloom kar sakte hain market ke andar Baj aukat trader ko Breakout ya Pul back pattern ke liye real break out ki zarurat Nahin Hoti trader Falls Breakout ki madad se bhi exact trend Maloom kar sakte hain

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Pullback aur Breakout dono forex trading ke bohot ahem terms hain. In dono terms ki samajh hona forex traders ke liye bohot zaroori hai kyunki ye dono indicators trading strategies ke liye bohot ahem hote hain. Pullback aur Breakout dono hi market ke movement ke related hote hain. Market mein movement hoti hai jab price kisi particular direction mein chal rahi hoti hai. Agar price upar jaa rahi hai toh usko bullish movement kehte hain aur agar price niche jaa rahi hai toh usko bearish movement kehte hain. Pullback ek aisa concept hai jisme price ki movement temporarily opposite direction mein hoti hai. Agar price upar jaa rahi hai toh pullback mein temporary downward movement hota hai aur agar price niche jaa rahi hai toh temporary upward movement hota hai. Pullback ko "retracement" bhi kehte hain. Yeh market mein common hai aur iski wajah hai ki traders kharidne aur bechne ke liye aise levels ke liye wait karte hain jahan se price ne pehle bounce kiya tha. Pullback traders ke liye ek opportunity hoti hai apne positions ko banaane ya strengthen karne ke liye. Breakout ek aisa concept hai jisme price ki movement kisi particular level ya range ke bahar nikal jaati hai. Agar price kisi particular range mein chal rahi hai aur phir uss range ke bahar nikal jaati hai toh usko breakout kehte hain. Breakout ko "escape" bhi kehte hain. Breakout traders ke liye ek opportunity hoti hai apne positions ko banaane ya strengthen karne ke liye. Pullback aur Breakout dono hi traders ke liye important hote hain kyunki inke through traders apni trading strategies ko define aur execute kar sakte hain. Forex trading mein risk management bohot zaroori hota hai. Traders ko apne positions ke liye stop loss aur take profit levels ko set karna chahiye. Stop loss traders ko loss se bachata hai jab market trend traders ke expectations ke against chal raha hota hai. Take profit levels traders ko profits se bachata hai jab market trend traders ke expectations ke hisaab se chal raha hota hai. Stop loss aur take profit levels ke baare mein traders ko achi understanding honi chahiye kyunki yeh traders ke liye bohot zaroori hote hain.

Breakout ek aisa concept hai jisme price ki movement kisi particular level ya range ke bahar nikal jaati hai. Agar price kisi particular range mein chal rahi hai aur phir uss range ke bahar nikal jaati hai toh usko breakout kehte hain. Breakout ko "escape" bhi kehte hain. Breakout traders ke liye ek opportunity hoti hai apne positions ko banaane ya strengthen karne ke liye. Pullback aur Breakout dono hi traders ke liye important hote hain kyunki inke through traders apni trading strategies ko define aur execute kar sakte hain. Forex trading mein risk management bohot zaroori hota hai. Traders ko apne positions ke liye stop loss aur take profit levels ko set karna chahiye. Stop loss traders ko loss se bachata hai jab market trend traders ke expectations ke against chal raha hota hai. Take profit levels traders ko profits se bachata hai jab market trend traders ke expectations ke hisaab se chal raha hota hai. Stop loss aur take profit levels ke baare mein traders ko achi understanding honi chahiye kyunki yeh traders ke liye bohot zaroori hote hain.  Pullback Trading Strategy: Pullback trading strategy mein traders kharidne ke liye pullback ka wait karte hain jab price ek uptrend mein hota hai. Jab price temporary downward movement karta hai toh traders ko ek opportunity milti hai kharidne ke liye aur phir price apne trend ke hisaab se upar chala jaata hai. Pullback trading strategy mein stop loss ko set karna bohot zaroori hota hai kyunki temporary movement kaafi strong ho sakta hai. Agar stop loss sahi jagah par set kiya gaya hai toh traders ko loss nahi hoga aur wo apne position ko strengthen kar sakte hain. Breakout Trading Strategy: Breakout trading strategy mein traders kharidne ke liye breakout ka wait karte hain jab price ek range mein chal raha hota hai. Jab price range ke bahar nikal jaata hai toh traders ko ek opportunity milti hai kharidne ke liye aur phir price apne trend ke hisaab se upar chala jaata hai. Breakout trading strategy mein bhi stop loss ko set karna bohot zaroori hota hai kyunki range se bahar nikalne ke baad price kuch samay ke liye volatile ho sakta hai. Agar stop loss sahi jagah par set kiya gaya hai toh traders ko loss nahi hoga aur wo apne position ko strengthen kar sakte hain.

Pullback Trading Strategy: Pullback trading strategy mein traders kharidne ke liye pullback ka wait karte hain jab price ek uptrend mein hota hai. Jab price temporary downward movement karta hai toh traders ko ek opportunity milti hai kharidne ke liye aur phir price apne trend ke hisaab se upar chala jaata hai. Pullback trading strategy mein stop loss ko set karna bohot zaroori hota hai kyunki temporary movement kaafi strong ho sakta hai. Agar stop loss sahi jagah par set kiya gaya hai toh traders ko loss nahi hoga aur wo apne position ko strengthen kar sakte hain. Breakout Trading Strategy: Breakout trading strategy mein traders kharidne ke liye breakout ka wait karte hain jab price ek range mein chal raha hota hai. Jab price range ke bahar nikal jaata hai toh traders ko ek opportunity milti hai kharidne ke liye aur phir price apne trend ke hisaab se upar chala jaata hai. Breakout trading strategy mein bhi stop loss ko set karna bohot zaroori hota hai kyunki range se bahar nikalne ke baad price kuch samay ke liye volatile ho sakta hai. Agar stop loss sahi jagah par set kiya gaya hai toh traders ko loss nahi hoga aur wo apne position ko strengthen kar sakte hain.  Dono strategies ke liye traders ko market ki movement ke baare mein bohot achi understanding honi chahiye. Yeh traders ke liye zaroori hai ki wo market trend aur price movement ko track karte rahein. Technical analysis tools jaise ki moving averages, trend lines aur support/resistance levels traders ko price movement ke baare mein information dete hain. In tools ke through traders pullback aur breakout levels ko identify kar sakte hain. Pullback aur Breakout trading strategies mein traders ko price action ke baare mein bhi achi understanding honi chahiye. Price action ka matlab hai ki traders ko price movement ko observe karna chahiye aur uss movement ke hisaab se trading decisions lena chahiye. Price action traders ko entry aur exit points ke baare mein information deta hai. Price action traders ko market ke behaviour ko samajhne mein help karta hai jaise ki market mein buying aur selling pressure.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Dono strategies ke liye traders ko market ki movement ke baare mein bohot achi understanding honi chahiye. Yeh traders ke liye zaroori hai ki wo market trend aur price movement ko track karte rahein. Technical analysis tools jaise ki moving averages, trend lines aur support/resistance levels traders ko price movement ke baare mein information dete hain. In tools ke through traders pullback aur breakout levels ko identify kar sakte hain. Pullback aur Breakout trading strategies mein traders ko price action ke baare mein bhi achi understanding honi chahiye. Price action ka matlab hai ki traders ko price movement ko observe karna chahiye aur uss movement ke hisaab se trading decisions lena chahiye. Price action traders ko entry aur exit points ke baare mein information deta hai. Price action traders ko market ke behaviour ko samajhne mein help karta hai jaise ki market mein buying aur selling pressure.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:15 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим