Carry Trade aur Rollover Trading Strategy kia hy

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

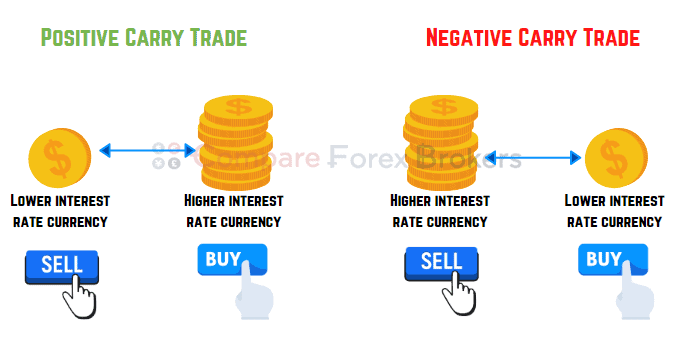

Carry Trade ka Tasawwur kia hota hy Carry Trade aik qisam ki trading Strategy hai jo forex market ke liye makhsoos hai. doosri Trading markets mein, traders sarmaye ki tareef se faida uthany ki niyat se tijarat karte hain. taham, carry trade ke muamlay mein, taajiron ko do tawaquaat hain .woh sarmaye ki tareef ke sath sath currency ki khareed o farokht se peda honay walay sood ki sharah ke farq se naqad raqam haasil karna chahtay hain. chunkay sharah sood ke farq forex market ke liye makhsoos hain, isi terhan carry trade ka tasawwur bhi hai .yeh samjhna zaroori hai ke rule over aur carry trade ka tasawwur settlement ke bilkul bar aks hai. lehaza, rule over sirf is soorat mein hota hai jab tasfia nah ho. yahi wajah hai ke qiyaas aarai karne walon ki taraf se rule over ko tarjeeh di jati hai jo asal bunyadi currency ki farahmi se guraiz karna chahtay hain aur aisi soorat e haal se bachney ke liye sirf sood ada karna chahtay hain. is mazmoon mein, hum is tasawwur ko mazeed tafseel se dekhen ge . Rollover Trade ka Tasawwur kia hyCarry Trade ka tasawwur Rollover ky tasawwur se gehra talluq rakhta hai. rollover raqam ki woh raqam hai jo aik sarmaya car ko haasil hota hai ya usay raton raat currency rakhnay ke liye ada karna parta hai yani aglay tijarti din tak. chunkay forex market 24 bayi 7 kaam karti hai, is liye ziyada tar mamlaat mein aik din mashriqi mayaari waqt ke mutabiq shaam 5 bujey khatam hota hai yani raqam 5 bujey est par wajib alada ho jati hai. lehaza agar is waqt koi position khuli ho to usay poooray din mein khula samjha jata hai .Roleover ke hawalay bhi lamha bah lamha tabdeel hotay rehtay hain. currency ke joron ki khareed o farokht ke liye rule over quotation ke sath darj hain. aik misbet number is baat ki nishandahi karta hai ke raqam lain deen ke nateejay mein wusool ki jaye gi jabkay aik manfi number is baat ki nishandahi karta hai ke raqam ada karni hogi. is ke ilawa, allag allag rule over hain jo khareed o farokht ke lain deen ke liye darj hain . Interest Rate ka Tasawwur kia hy Currencies ki Trading hamesha joron mein hoti hai. neez har currency ke sath sood ki sharah munsalik hoti hai. lehaza, jab forex trading hoti hai to hamesha do sood ki shrhin shaamil hoti hain. ab, zahir hai ke agar aik currency mein doosri currency se ziyada sharah sood hai, to tijarat ke aik fareeq ko currency rakhnay se faida hoga .aisa honay se bachney ke liye, kam sharah sood ke sath currency rakhnay walay fareeq ko counter party ko rule over ada karna parta hai taakay tijarat par sood ke assar ko kam kya ja sakay. ziyada tar mamlaat mein masool honay wali sood ki raqam intehai kam hai ( kahin ke 2 % salana ). taham, chunkay forex trading mein bohat ziyada leaveraged beats lagana shaamil hota hai, is liye rule over mein milnay wali dilchaspi ki miqdaar munafe par numaya assar daal sakti hai . Rollover and Carry Trade ky fawaid chunkay le jane walay taajiron ko sood ki thori si aamdani ke liye bohat ziyada khatrah mol lena parta hai, is liye inhen yeh yakeeni banana chahiye ke un ke paas khatray ko kam karne ka munasib tareeqa car mojood hai. is ka matlab yeh hai ke inhen sahih nakaat se aagah honay ki zaroorat hai jahan woh –apne nuqsanaat ko kam karen ge aur tijarat se bahar nikleen ge. agar mumkin ho to, amal daraamad ke douran aaprishnl masail se bachney ke liye khudkaar stap nuqsaan ya Trailing stop orders diye jayen .aisay poooray tijarti ghar hain jinhon ne apni hikmat e amli un sood ki shrhon ke gird banai hai aur tijarat karte hain. carry trade forex market mein qaleel mudti tijarat karne aur cash flow peda karne ka aik muaser tareeqa hai. taham, kisi ko bhi khatraat se aagah honay ki zaroorat hai . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 Collapse

WHAT IS CARRY TRADING STRATEGY Carry trading Ek trading strategy hai jo mostly forex market Mein istemal hoti hai Forex trader online trading ke zarie apni earning increase karna chahte hain carry trading Bhi Ek trading strategy hai jo online trading business Mein istemal hoti hai trader mostly currency pairs per trading ke sath sath carry trading ke zarie forex market mein online earning Hasil karna chahte hain aur vah carry trading ko use Karke earning Hasil Karte Hain forex market ke andar trading ke dauran mostlly interest fix Hota Hai ISI Tarah carry trading mein bhi traders ka interest fix Hota Hai carry trading aur role over trading strategy ke dauran is Baat Ko samajhna important hai ke yah trading strategy dusri trading ke bar Aks different hoti hai lekin trading ke dauran mostally trader carry trading ki nisbat roll over trading ko Jyada focus Dete Hain because carry trading ki nisbat roll over trading zyada profit Deti Hai. WHAT IS ROLLOVER TRADING STRATEGY Carry trading strategy ka roll over trading strateg se deeply link hota hai roll over money hoti hai jo mostly trader ko trading ke dauran Hasil hoti hai ya next day trading ke liye Jo Mani Ek trader per karta hai forex market mostly 24 over 7 hours work karti hai Aur Is Tarah Forex trading ka De ka Waqt 5 o'clock close ho jata hai aur is time ke bad Jo trade open hoti hai usko open Samjha jata hai aur jo close hoti hai usko close Samjha jata hai forex market Ki Tarah roll over trading bhi time Tu time change hoti rahti hai roll over trading strategy ke dauran mostally currency per trading karne ke liye quotation fix kiye Jaate Hain aur positive number ke dauran market ke andar money receive ki Jaati Hai aur negative number ke dauran Mani ko Sel out Kiya jata hai aur inhin numbers ki buniyad per trader market ke trend ko Maloom Karte Hain

WHAT IS ROLLOVER TRADING STRATEGY Carry trading strategy ka roll over trading strateg se deeply link hota hai roll over money hoti hai jo mostly trader ko trading ke dauran Hasil hoti hai ya next day trading ke liye Jo Mani Ek trader per karta hai forex market mostly 24 over 7 hours work karti hai Aur Is Tarah Forex trading ka De ka Waqt 5 o'clock close ho jata hai aur is time ke bad Jo trade open hoti hai usko open Samjha jata hai aur jo close hoti hai usko close Samjha jata hai forex market Ki Tarah roll over trading bhi time Tu time change hoti rahti hai roll over trading strategy ke dauran mostally currency per trading karne ke liye quotation fix kiye Jaate Hain aur positive number ke dauran market ke andar money receive ki Jaati Hai aur negative number ke dauran Mani ko Sel out Kiya jata hai aur inhin numbers ki buniyad per trader market ke trend ko Maloom Karte Hain  WHAT IS INTEREST RATIO Trading ke dauran mostly euro dollar ko paIrs Ki Surat Mein BUY aur sell Kiya jata hai iska matlab yah hota hai ki trading ke dauran Ham Euro buy kar rahe hote hain aur dollar ko Sell kar rahe Hote Hain aur ISI dauran Hamen Euro per 3% aur dollar per 1% interest Dena padta hai.

WHAT IS INTEREST RATIO Trading ke dauran mostly euro dollar ko paIrs Ki Surat Mein BUY aur sell Kiya jata hai iska matlab yah hota hai ki trading ke dauran Ham Euro buy kar rahe hote hain aur dollar ko Sell kar rahe Hote Hain aur ISI dauran Hamen Euro per 3% aur dollar per 1% interest Dena padta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:24 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим