What is a High Volatility Trading Chart?

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

What is a High Volatility Trading Chart? What is high volatility? High volatility refers to the degree of price fluctuation or variability of an asset or market over a period of time. A highly volatile asset or market will experience significant price movements or fluctuations in a short period of time, while a low volatile asset or market will have relatively stable prices. Volatility is usually measured by statistical methods such as standard deviation or beta, which quantify the degree of deviation from the average price or market return. High volatility is usually associated with high risk because it indicates a higher probability of substantial gains or losses in a short period of time, making it difficult to predict and manage investment risks. However, it also offers opportunities for higher returns, especially for traders who can effectively manage the risks associated with volatile markets. Trading in a high volatility trading chart? Forex trading mein aala utaar charhao walay tijarti charts aam tor par un charts ka hawala dete hain jo qematon ki naqal o harkat ko zahir karte hain jin ki khasusiyat taiz raftaar aur barray jhoolon se hoti hai. yeh charts un taajiron ke liye kaar amad hain jo taizi se chalne wali mandiyon mein tijarat ko tarjeeh dete hain aur aala satah ka khatrah mol lainay ke liye tayyar hain . woh candle stuck chart hai. charts stuck with a candle aik muqarara muddat ke douran qeemat ki harkat ko mom btyon ki aik series ke tor par zahir karte hain. har mom batii is waqt ki muddat ke liye khilnay, band honay, ziyada aur kam qeematon ki numindagi karti hai. candle stuck ke mukhtalif namoonay taajiron ko qeematon ke mumkina rujhanaat aur tabdeelion ke baray mein maloomat faraham kar satke hain .Traders who prefer to trade in high volatility markets often use technical indicators such as Bollinger Bands, Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to help them identify potential entry and exit points.

- Mentions 0

-

سا0 like

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is cost activity backing and obstruction? Jaisa ke Ham Apne talimi area per najar dalte Hain support aur opposition level ko talash karne ke bahut se tarike Hain pregnancy ek maqbool marker hai aur nafsi aati level dilchaspi ka ek significant point Hain lekin agar market support aur obstruction ki tasleem Karti Hain iska kya fayda hai ek nahin hai theek hai backing and opposition ke liye fayda yah hai ki vah Kisi chij ko andar apni initiate ek objective time prime banane ki ijaajat deta hai Cost activity ke suving game and obstruction level ki affirmation kar sakte hain ya agar Kisi khas cost per Kafi limit tak activity hua hai to vah khud Howdy level per kar sakte hain agar aap a u s ti for every 8000 ki level dekh rahe hain abdominal muscle yah examination market ke shorka mutafik karte hain unhone Apne venture ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan per chhalang Laga sakte hain cost girti Hain jyada dealer is bed baingan per Selling Laga sakte hain dusri taraf wire cost girne ke sath ek hello kam se kam shot ka shikar ho rahe hain is Tarah Majid exchanging ki ijaajat di ja sakti hai Cost activity ke jarie backing and resistors find karna Agar cost ek Sath merchant ke sath kam karne ke liye ek limit tak objective time prime pesh Karti hai Lekin backing and opposition ke kabil activity donon ki recognizable proof karne ke liye kadre subject ki jarurat hoti hai Roughage I level yah hai kehe market mein un region ya costs ki level ko talash kiya jaaye Jahan manji mein activity mein tabdili I hai is Tarah aane ridge time mein tabdili ke anath ko jagir karna feed iska matlab yah hai support hamesha barkrar rahegi ya registence hamesha kabhi bhi mumkin Nahin hota ek limit ke awful help bhi break ho jaati hai aur market down pattern mein ja sakti hai aur opposition ka bhi aisa hello hai ek limit ke terrible obstruction bhi break ho sakti hai aur market bye side Ve mein ja sakti hai merchant ko technique per Amal karna chahie Exchanging ki misal Upar ki hamari ausd ki misal hai 8000 ki level ke result jaane ko vahan se Karne wali ek laung ishq Thi lekin isase pahle bhi support ke Karne wali ek log ishq Thi lekin isase pahle bhi support unke taur per ek aur maujud tha Jo 5500 ki level ke inversion jaane ko Nahin pahunchi hakikat yah hai kehe mayane to aur per 9pips step rakha ye zahar karta hai kehe is per hey Cost pr kuchh dikha ho raha tha is level ke start sharpen se pahle step uthane ke liye prepared the isase yah bhi jahir hota hai ke bajar se Yahan kuchh proceed with the Badi shakhsiyat ke test sharpen se pahle greetings purchase chahte th -

#4 Collapse

Intro. Of high volatility chart in forex maretAOA Market me is volatility ko understand krne ke lye sb se pehly hmee is ke basic role in market ko samjhna pare ga jase Fluctuation or variability of an asset or market over a period of time. A highly volatile asset or market will experience significant price movements or fluctuations in a short period of time, while a low volatile asset or market will have relativelyr pa mom batii is waqt ki muddat ke liye khilnay, band h stable prices. Volatility is usually measured by statistical methods such as standard deviation or beta, which quantify the degree of deviation from the average price or market rahe hain is Tarah Majid exchanging ki ijaajat di ja sanafsi aati level dilchaspi ka ek significant r un charts ka hawala dete hain jo qematon ki naqal o harkat ko zahir karte hain jin ki khasusiyat taiz raftaar aur barray jhoolon se hoti hai. yeh charts un taajiron ke liye kaar amad hain jo taizi se chalne wali mandiyon mein tijarat ko tarjeeh dete hain aur aala satah ka khatrah mol lainay ke liye tayyar step uthane ke liye prepared the isase yah bhi jahir hota hai ke bajar se Yahan kuchh proceed with the Badi shakhsiyat ke test sharpen se pahle greetihi mumkin Nahin hota ek limit ke awful help bhi break ho jaati hai aur market down pattern mein ja sakti hai aur opposition ka bhi aisa hello hai ek limit hain woh candle stuck chart hai. charts stuck with a candle aik muqarara muddat ke douran qeemat ki harkat ko mom btyon ki aik series ke tor par zahir karte hain. har mom batii is waqt ki. However, it also offers opportunities for higher returns, especially for trader benefical hota he Identification and working of this chart in market Is ke identification bhot hr aasan he ku ke ye aik dm se ya tu sell ke janab chala jat he ya buy kke janab tu is nazar dalte Hain support aur opposition level ko talash karne ke bahut se tarike Hain pregnancy ek maqbool marker hai aur ahe hain abdominal muscle yah examinationmarket ke shorka mutafik karte hain unhone Apne venture ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan per chhalang Laga sakte hain cost girti Hain jyada dealer is bed bainga9pips step rakha ye zahar karta hai kehe is per hey Cost pr kuchh dikha ho raha tha is level ke start sharpen se pahle step uthane ke liye prepared the isase yah bhi jahir hota hai ke bajar se Yahan kuchh proceed with the Badi shakhsiyat ke test sharpen se pahle greetihi mumkin Nahin hota ek limit ke awful help n per Selling Laga sakte hain dusri taraf wire cost girne ke sath ek hello kam se kam shot ka shikar ho douran qeemat ki harkat ko mom btyon ki aik series ke tor par zahir karte hain. har point Hain lekin agar market support aur obstruction ki tasleem Karti Hain iska kya fayda hai ek nahin hai theek hai backing and opposition ke liye fayda yah haiHow to deal with in market? Jb market high level pr ho tu essy sell kr dien tuya costs ki level ko talash kiya jaaye Jahan manji mein activity mein tabdili I hai is Tarah aane ridge time mein tabdili ke anath ko jagir karna feed iska matlab yah hai support hamesha barkrar rahegi ya registence hamesha kabhi bl ke inver Apne venture ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan per chhalang Laga sakte hain cost girti Hain jyada dealer is bed baingan per Selling Laga sakte hain dusri taraf wire cost girne ke sath ek hello kam se kam shot ka muddat ke liye khilnay, band h stable prices. Volatility is usually measured by statistical methods such as standard deviation or beta, which quantify the degree of deviation from the average price or market return. High volatility is usually associated with high risk because it indicates a higher probability of substantial gains or losses in a short period of time, making it difficult to predict and manage investment risksshikar ho douran sion jaane ko Nahin pahunchi hakikat yah hai kehe mayane to aur per bhi break ho jaati hai aur market down pattern mein ja sakti hai aur opposition ka bhi aisa hello hai ek limit ke terrible obstruction bhi break ho sakti hai aur market bye side Ve mein ja sakti hai merchant ko aasani ho ge

-

#5 Collapse

Forex mein high volatility trading chart, traders ke liye ek important tool hai jo market ki movement aur volatility ko analyze karne mein madad karta hai. Jab market ki volatility high hoti hai, toh iska matlab hai ki price swings zyada hote hain aur traders ke liye trading opportunities zyada hote hain. High volatility trading charts, is volatility ko traders ke liye visual representation ke rup mein darshata hai. High volatility trading charts mein sabse important indicator hota hai Bollinger Bands. Bollinger Bands ka use, price movement aur volatility ko samajhne ke liye kiya jata hai. Bollinger Bands do lines se bane hote hain, ek line price ke upar hoti hai aur ek line price ke neeche hoti hai. In dono lines ke beech mein ek centerline hoti hai jo ki simple moving average hota hai. Jab market ki volatility high hoti hai, toh Bollinger Bands widen ho jate hain, aur jab market ki volatility low hoti hai, toh Bollinger Bands narrow ho jate hain. High volatility trading charts ke sath traders candlestick patterns ka bhi use karte hain. Candlestick patterns, traders ko price movement aur price direction ke baare mein information provide karte hain. Iske alawa, ye bhi bata sakte hain ki market mein sentiment kya hai, bullish (buyers dominated) hai ya bearish (sellers dominated) hai. Ek popular candlestick pattern hai the Engulfing Pattern. Agar ek bullish candlestick ek bearish candlestick ko engulf karta hai, toh ye ek bearish engulfing pattern hai aur iska matlab hai ki market sentiment bearish hai. Iske alawa, agar ek bearish candlestick ek bullish candlestick ko engulf karta hai, toh ye ek bullish engulfing pattern hai aur iska matlab hai ki market sentiment bullish hai. High volatility trading charts ke sath, traders ko ek aur important tool ka use karna chahiye, wo hai RSI (Relative Strength Index). RSI, ek momentum oscillator hai jo ki traders ko price movement ke direction ke baare mein information provide karta hai. RSI ka use karke, traders ko ye pata lag jata hai ki market overbought hai ya oversold hai. Agar RSI ki value 70 se upar hai, toh ye ek indication hai ki market overbought hai aur price decline hone ke chances zyada hain. Agar RSI ki value 30 se neeche hai, toh ye ek indication hai ki market oversold hai aur price increase hone ke chances zyada hain. Candlestick patterns, traders ko price movement aur price direction ke baare mein information provide karte hain. Jab ek bullish candlestick ek bearish candlestick ko engulf karta hai, toh ye ek bearish engulfing pattern hai aur iska matlab hai ki market sentiment bearish hai. Iske alawa, agar ek bearish candlestick ek bullish candlestick ko engulf karta hai, toh ye ek bullish engulfing pattern hai aur iska matlab hai ki market sentiment bullish hai.

Ek popular candlestick pattern hai the Engulfing Pattern. Agar ek bullish candlestick ek bearish candlestick ko engulf karta hai, toh ye ek bearish engulfing pattern hai aur iska matlab hai ki market sentiment bearish hai. Iske alawa, agar ek bearish candlestick ek bullish candlestick ko engulf karta hai, toh ye ek bullish engulfing pattern hai aur iska matlab hai ki market sentiment bullish hai. High volatility trading charts ke sath, traders ko ek aur important tool ka use karna chahiye, wo hai RSI (Relative Strength Index). RSI, ek momentum oscillator hai jo ki traders ko price movement ke direction ke baare mein information provide karta hai. RSI ka use karke, traders ko ye pata lag jata hai ki market overbought hai ya oversold hai. Agar RSI ki value 70 se upar hai, toh ye ek indication hai ki market overbought hai aur price decline hone ke chances zyada hain. Agar RSI ki value 30 se neeche hai, toh ye ek indication hai ki market oversold hai aur price increase hone ke chances zyada hain. Candlestick patterns, traders ko price movement aur price direction ke baare mein information provide karte hain. Jab ek bullish candlestick ek bearish candlestick ko engulf karta hai, toh ye ek bearish engulfing pattern hai aur iska matlab hai ki market sentiment bearish hai. Iske alawa, agar ek bearish candlestick ek bullish candlestick ko engulf karta hai, toh ye ek bullish engulfing pattern hai aur iska matlab hai ki market sentiment bullish hai.  High volatility trading charts ke sath traders ko risk management ka bhi dhyan rakhna chahiye. Agar traders apne trades ke liye sahi stop loss ka use nahi karte hain, toh unki trading accounts kaafi nuksaan utha sakti hai. Stop loss, traders ko market ki unpredictability se bachata hai aur unhe apni trading capital ko preserve karne mein madad karta hai. High volatility trading charts, forex mein trading karne wale traders ke liye ek useful tool hai. Iska use karke traders, market ki movement aur volatility ko analyze kar sakte hain aur apni trading strategies ko improve kar sakte hain. Iske alawa, traders ko risk management ka bhi dhyan rakhna chahiye aur sahi stop loss ka use karna chahiye.

High volatility trading charts ke sath traders ko risk management ka bhi dhyan rakhna chahiye. Agar traders apne trades ke liye sahi stop loss ka use nahi karte hain, toh unki trading accounts kaafi nuksaan utha sakti hai. Stop loss, traders ko market ki unpredictability se bachata hai aur unhe apni trading capital ko preserve karne mein madad karta hai. High volatility trading charts, forex mein trading karne wale traders ke liye ek useful tool hai. Iska use karke traders, market ki movement aur volatility ko analyze kar sakte hain aur apni trading strategies ko improve kar sakte hain. Iske alawa, traders ko risk management ka bhi dhyan rakhna chahiye aur sahi stop loss ka use karna chahiye.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Intro. Of high volatility chart in forex maretAOA Market me is volatility ko understand krne ke lye sb se pehly hmee is ke basic role in market ko samjhna pare ga jase Fluctuation or variability of an asset or market over a period of time. A highly volatile asset or market will experience significant price movements or fluctuations in a short period of time, while a low volatile asset or market will have relativelyr pa mom batii is waqt ki muddat ke liye khilnay, band h stable prices. Volatility is usually measured by statistical methods such as standard deviation or beta, which quantify the degree of deviation from the average price or market rahe hain is Tarah Majid exchanging ki ijaajat di ja sanafsi aati level dilchaspi ka ek significant r un charts ka hawala dete hain jo qematon ki naqal o harkat ko zahir karte hain jin ki khasusiyat taiz raftaar aur barray jhoolon se hoti hai. yeh charts un taajiron ke liye kaar amad hain jo taizi se chalne wali mandiyon mein tijarat ko tarjeeh dete hain aur aala satah ka khatrah mol lainay ke liye tayyar step uthane ke liye prepared the isase yah bhi jahir hota hai ke bajar se Yahan kuchh proceed with the Badi shakhsiyat ke test sharpen se pahle greetihi mumkin Nahin hota ek limit ke awful help bhi break ho jaati hai aur market down pattern mein ja sakti hai aur opposition ka bhi aisa hello hai ek limit hain woh candle stuck chart hai. charts stuck with a candle aik muqarara muddat ke douran qeemat ki harkat ko mom btyon ki aik series ke tor par zahir karte hain. har mom batii is waqt ki. However, it also offers opportunities for higher returns, especially for trader benefical hota he Identification and working of this chart in market Is ke identification bhot hr aasan he ku ke ye aik dm se ya tu sell ke janab chala jat he ya buy kke janab tu is nazar dalte Hain support aur opposition level ko talash karne ke bahut se tarike Hain pregnancy ek maqbool marker hai aur ahe hain abdominal muscle yah examinationmarket ke shorka mutafik karte hain unhone Apne venture ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan per chhalang Laga sakte hain cost girti Hain jyada dealer is bed bainga9pips step rakha ye zahar karta hai kehe is per hey Cost pr kuchh dikha ho raha tha is level ke start sharpen se pahle step uthane ke liye prepared the isase yah bhi jahir hota hai ke bajar se Yahan kuchh proceed with the Badi shakhsiyat ke test sharpen se pahle greetihi mumkin Nahin hota ek limit ke awful help n per Selling Laga sakte hain dusri taraf wire cost girne ke sath ek hello kam se kam shot ka shikar ho douran qeemat ki harkat ko mom btyon ki aik series ke tor par zahir karte hain. har point Hain lekin agar market support aur obstruction ki tasleem Karti Hain iska kya fayda hai ek nahin hai theek hai backing and opposition ke liye fayda yah hai How to deal with in market? Jb market high level pr ho tu essy sell kr dien tuya costs ki level ko talash kiya jaaye Jahan manji mein activity mein tabdili I hai is Tarah aane ridge time mein tabdili ke anath ko jagir karna feed iska matlab yah hai support hamesha barkrar rahegi ya registence hamesha kabhi bl ke inver Apne venture ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan per chhalang Laga sakte hain cost girti Hain jyada dealer is bed baingan per Selling Laga sakte hain dusri taraf wire cost girne ke sath ek hello kam se kam shot ka muddat ke liye khilnay, band h stable prices. Volatility is usually measured by statistical methods such as standard deviation or beta, which quantify the degree of deviation from the average price or market return. High volatility is usually associated with high risk because it indicates a higher probability of substantial gains or losses in a short period of time, making it difficult to predict and manage investment risksshikar ho douran sion jaane ko Nahin pahunchi hakikat yah hai kehe mayane to aur per bhi break ho jaati hai aur market down pattern mein ja sakti hai aur opposition ka bhi aisa hello hai ek limit ke terrible obstruction bhi break ho sakti hai aur market bye side Ve mein ja sakti hai merchant ko aasani ho ge -

#7 Collapse

market over a period of time. A highly volatile asset or market will experience significant price movements or fluctuations in a short period of time, while a low volatile asset or market will have relatively stable prices. Volatility is usually measured by statistical methods such as standard deviation or beta, which quantify the degree of deviation from the average price or market return. High volatility is usually associated with high risk because it indicates a higher probability of substantial gains or losses in a short period of time, making it difficult to predict and manage investment risks. However, it also offers opportunities for higher returns, especially for traders who can effectively manage the risks associated with volatile markets.Trading in a high volatility trading chart? Forex trading mein aala utaar charhao walay tijarti charts aam tor par un charts ka hawala dete hain jo qematon ki naqal o harkat ko zahir karte hain jin ki khasusiyat taiz raftaar aur barray jhoolon se hoti hai. yeh charts un taajiron ke liye kaar amad hain jo taizi se chalne wali mandiyon mein tijarat ko tarjeeh dete hain aur aala satah ka khatrah mol lainay ke liye tayyar hain . woh candle stuck chart hai. charts stuck with a candle aik muqarara muddat ke douran qeemat ki harkat ko mom btyon ki aik series ke tor par zahir karte hain. har mom batii is waqt ki muddat ke liye khilnay, band honay, ziyada aur kam qeematon ki numindagi karti hai. candle stuck ke mukhtalif namoonay taajiron ko qeematon ke mumkina rujhanaat aur tabdeelion ke baray mein maloomat faraham kar satke hain .market ke shorka mutafik karte hain unhone Apne venture ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan per chhalang Laga sakte hain cost girti Hain jyada dealer is bed baingan per Selling Laga sakte hain dusri taraf wire cost girne ke sath ek hello kam se kam shot ka shikar ho rahe hain is Tarah Majid exchanging ki ijaajat di ja sakti haiCandlestick patterns, traders ko price movement aur price direction ke baare mein information provide karte hain. Jab ek bullish candlestick ek bearish candlestick ko engulf karta hai, toh ye ek bearish engulfing pattern hai aur iska matlab hai ki market sentiment bearish hai. Iske alawa, agar ek bearish candlestick ek bullish candlestick ko engulf karta hai, toh ye ek bullish engulfing pattern hai aur iska matlab hai ki market sentiment bullish hai.

Cost activity ke jarie backing and resistors find karna Agar cost ek Sath merchant ke sath kam karne ke liye ek limit tak objective time prime pesh Karti hai Lekin backing and opposition ke kabil activity donon ki recognizable proof karne ke liye kadre subject ki jarurat hoti hai Roughage I level yah hai kehe market mein un region ya costs ki level ko talash kiya jaaye Jahan manji mein activity mein tabdili I hai is Tarah aane ridge time mein tabdili ke anath ko jagir karna feed iska matlab yah hai support hamesha barkrar rahegi ya registence hamesha kabhi bhi mumkin Nahin hota ek limit ke awful help bhi break ho jaati hai aur market down pattern mein ja sakti hai aur opposition ka bhi aisa hello hai ek limit ke terrible obstruction bhi break ho sakti hai aur market bye side Ve mein ja sakti hai merchant ko technique per Amal karna chahie Exchanging ki misal market ki volatility high hoti hai, toh Bollinger Bands widen ho jate hain, aur jab market ki volatility low hoti hai, toh Bollinger Bands narrow ho jate hain. High volatility trading charts ke sath traders candlestick patterns ka bhi use karte hain. Candlestick patterns, traders ko price movement aur price direction ke baare mein information provide karte hain. Iske alawa, ye bhi bata sakte hain ki market mein sentiment kya hai, bullish (buyers dominated) hai ya bearish (sellers dominated) hai.Agar traders apne trades ke liye sahi stop loss ka use nahi karte hain, toh unki trading accounts kaafi nuksaan utha sakti hai. Stop loss, traders ko market ki unpredictability se bachata hai aur unhe apni trading capital ko preserve karne mein madad karta hai. High volatility trading charts, forex mein trading karne wale traders ke liye ek useful tool hai. Iska use karke traders, market ki movement aur volatility ko analyze kar sakte hain aur apni trading strategies ko improve kar sakte hain. Iske alawa, traders ko risk management ka bhi dhyan rakhna chahiye aur sahi stop loss ka use karna chahiye.​

Cost activity ke jarie backing and resistors find karna Agar cost ek Sath merchant ke sath kam karne ke liye ek limit tak objective time prime pesh Karti hai Lekin backing and opposition ke kabil activity donon ki recognizable proof karne ke liye kadre subject ki jarurat hoti hai Roughage I level yah hai kehe market mein un region ya costs ki level ko talash kiya jaaye Jahan manji mein activity mein tabdili I hai is Tarah aane ridge time mein tabdili ke anath ko jagir karna feed iska matlab yah hai support hamesha barkrar rahegi ya registence hamesha kabhi bhi mumkin Nahin hota ek limit ke awful help bhi break ho jaati hai aur market down pattern mein ja sakti hai aur opposition ka bhi aisa hello hai ek limit ke terrible obstruction bhi break ho sakti hai aur market bye side Ve mein ja sakti hai merchant ko technique per Amal karna chahie Exchanging ki misal market ki volatility high hoti hai, toh Bollinger Bands widen ho jate hain, aur jab market ki volatility low hoti hai, toh Bollinger Bands narrow ho jate hain. High volatility trading charts ke sath traders candlestick patterns ka bhi use karte hain. Candlestick patterns, traders ko price movement aur price direction ke baare mein information provide karte hain. Iske alawa, ye bhi bata sakte hain ki market mein sentiment kya hai, bullish (buyers dominated) hai ya bearish (sellers dominated) hai.Agar traders apne trades ke liye sahi stop loss ka use nahi karte hain, toh unki trading accounts kaafi nuksaan utha sakti hai. Stop loss, traders ko market ki unpredictability se bachata hai aur unhe apni trading capital ko preserve karne mein madad karta hai. High volatility trading charts, forex mein trading karne wale traders ke liye ek useful tool hai. Iska use karke traders, market ki movement aur volatility ko analyze kar sakte hain aur apni trading strategies ko improve kar sakte hain. Iske alawa, traders ko risk management ka bhi dhyan rakhna chahiye aur sahi stop loss ka use karna chahiye.​

-

#8 Collapse

High volatility trading chart: Market me is volatility ko understand krne ke lye sb se pehly hmee is ke basic role in market ko samjhna pare ga jase Fluctuation or variability of an asset or market over a period of time. A highly volatile asset or market will experience significant price movements or fluctuations in a short period of time, while a low volatile asset or market will have relativelyr pa mom batii is waqt ki muddat ke liye khilnay, band h stable prices. Volatility is usually measured by statistical methods such as standard deviation or beta, which quantify the degree of deviation from the average price or market rahe hain is Tarah Majid exchanging ki ijaajat di ja sanafsi aati level dilchaspi ka ek significant r un charts ka hawala dete hain jo qematon ki naqal o harkat ko zahir karte hain jin ki khasusiyat taiz raftaar aur barray jhoolon se hoti hai. yeh charts un taajiron ke liye kaar amad hain jo taizi se chalne wali mandiyon mein tijarat ko tarjeeh dete hain aur aala satah ka khatrah mol lainay ke liye tayyar step uthane ke liye prepared the isase yah bhi jahir hota hai ke bajar se Yahan kuchh proceed with the Badi shakhsiyat ke test sharpen se pahle greetihi mumkin Nahin hota ek limit ke awful help bhi break ho jaati hai aur market down pattern mein ja sakti hai aur opposition ka bhi aisa hello hai ek limit hain woh candle stuck chart hai.Ek popular candlestick pattern hai the Engulfing Pattern. Agar ek bullish candlestick ek bearish candlestick ko engulf karta hai, toh ye ek bearish engulfing pattern hai aur iska matlab hai ki market sentiment bearish hai. Iske alawa, agar ek bearish candlestick ek bullish candlestick ko engulf karta hai, toh ye ek bullish engulfing pattern hai aur iska matlab hai ki market sentiment bullish hai. High volatility trading charts ke sath, traders ko ek aur important tool ka use karna chahiye, wo hai RSI (Relative Strength Index). RSI, ek momentum oscillator hai jo ki traders ko price movement ke direction ke baare mein information provide karta hai. RSI ka use karke, traders ko ye pata lag jata hai ki market overbought hai ya oversold hai. Agar RSI ki value 70 se upar hai, toh ye ek indication hai ki market overbought hai aur price decline hone ke chances zyada hain. Agar RSI ki value 30 se neeche hai, toh ye ek indication hai ki market oversold hai aur price increase hone ke chances zyada hain High volatility refers to the degree of price fluctuation or variability of an asset or market over a period of time. A highly volatile asset or market will experience significant price movements or fluctuations in a short period of time, while a low volatile asset or market will have relatively stable prices. Volatility is usually measured by statistical methods such as standard deviation or beta, which quantify the degree of deviation from the average price or market return. High volatility is usually associated with high risk because it indicates a higher probability of substantial gains or losses in a short period of time, making it difficult to predict and manage investment risks. However, it also offers opportunities for higher returns, especially for traders who can effectively manage the risks associated with volatile markets. market over a period of time. A highly volatile asset or market will experience significant price movements or fluctuations in a short period of time, while a low volatile asset or market will have relatively stable prices. Volatility is usually measured by statistical methods such as standard deviation or beta, which quantify the degree of deviation from the average price or market return. High volatility is usually associated with high risk because it indicates a higher probability of substantial gains or losses in a short period of time, making it difficult to predict and manage investment risks. However, it also offers opportunities for higher returns, especially for traders who can effectively manage the risks associated with volatile markets.Forex mein high volatility trading chart, traders ke liye ek important tool hai jo market ki movement aur volatility ko analyze karne mein madad karta hai. Jab market ki volatility high hoti hai, toh iska matlab hai ki price swings zyada hote hain aur traders ke liye trading opportunities zyada hote hain. High volatility trading charts, is volatility ko traders ke liye visual representation ke rup mein darshata hai. High volatility trading charts mein sabse important indicator hota hai Bollinger Bands. Bollinger Bands ka use, price movement aur volatility ko samajhne ke liye kiya jata hai. Bollinger Bands do lines se bane hote hain, ek line price ke upar hoti hai aur ek line price ke neeche hoti hai. In dono lines ke beech mein ek centerline hoti hai jo ki simple moving average hota hai. Jab market ki volatility high hoti hai, toh Bollinger Bands widen ho jate hain, aur jab market ki volatility low hoti hai, toh Bollinger Bands narrow ho jate hain. High volatility trading charts ke sath traders candlestick patterns ka bhi use karte hain. Candlestick patterns, traders ko price movement aur price direction ke baare mein information provide karte hain. Iske alawa, ye bhi bata sakte hain ki market Trading in a high volatility trading chart? Forex trading mein aala utaar charhao walay tijarti charts aam tor par un charts ka hawala dete hain jo qematon ki naqal o harkat ko zahir karte hain jin ki khasusiyat taiz raftaar aur barray jhoolon se hoti hai. yeh charts un taajiron ke liye kaar amad hain jo taizi se chalne wali mandiyon mein tijarat ko tarjeeh dete hain aur aala satah ka khatrah mol lainay ke liye tayyar hain . woh candle stuck chart hai. charts stuck with a candle aik muqarara muddat ke douran qeemat ki harkat ko mom btyon ki aik series ke tor par zahir karte hain. har mom batii is waqt ki muddat ke liye khilnay, band honay, ziyada aur kam qeematon ki numindagi karti hai. candle stuck ke mukhtalif namoonay taajiron ko qeematon ke mumkina rujhanaat aur tabdeelion ke baray mein maloomat faraham kar satke hain .market ke shorka mutafik karte hain unhone Apne venture ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan per chhalang Laga sakte hain cost girti Hain jyada dealer is bed baingan per Selling Laga sakte hain dusri taraf wire cost girne ke sath ek hello kam se kam shot ka shikar ho rahe hain is Tarah Majid exchanging ki ijaajat di ja sakti haiCandlestick patterns, traders ko price movement aur price direction ke baare mein information provide karte hain Agar cost ek Sath merchant ke sath kam karne ke liye ek limit tak objective time prime pesh Karti hai Lekin backing and opposition ke kabil activity donon ki recognizable proof karne ke liye kadre subject ki jarurat hoti hai Roughage I level yah hai kehe market mein un region ya costs ki level ko talash kiya jaaye Jahan manji mein activity mein tabdili I hai is Tarah aane ridge time mein tabdili ke anath ko jagir karna feed iska matlab yah hai support hamesha barkrar rahegi ya registence hamesha kabhi bhi mumkin Nahin hota ek limit ke awful help bhi break ho jaati hai aur market down pattern mein ja sakti hai aur opposition ka bhi aisa hello hai ek limit ke terrible obstruction bhi break ho sakti hai aur market bye side Ve mein ja sakti hai merchant ko technique per Amal karna chahie Jb market high level pr ho tu essy sell kr dien tuya costs ki level ko talash kiya jaaye Jahan manji mein activity mein tabdili I hai is Tarah aane ridge time mein tabdili ke anath ko jagir karna feed iska matlab yah hai support hamesha barkrar rahegi ya registence hamesha kabhi bl ke inver Apne venture ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan per chhalang Laga sakte hain cost girti Hain jyada dealer is bed baingan per Selling Laga sakte hain dusri taraf wire cost girne ke sath ek hello kam se kam shot ka muddat ke liye khilnay, band h stable prices. Volatility is usually measured by statistical methods such as standard deviation or beta, which quantify the degree of deviation from the average price or market return. High volatility is usually associated with high risk because it indicates a higher probability of substantial gains or losses in a short period of time, making it difficult to predict and manage investment risksshikar ho douran sion jaane ko Nahin pahunchi hakikat yah hai kehe mayane to aur per bhi break ho jaati hai aur market down pattern mein ja sakti hai aur opposition ka bhi aisa hello hai ek limit ke terrible obstruction bhi break ho sakti hai aur market bye side Ve mein ja sakti hai merchant ko aasani ho ge -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Jaisa ke Ham Apne talimi region per najar dalte Hain support aur resistance level ko talash karne ke bahut se tarike Hain pregnancy ek maqbool marker hai aur nafsi aati level dilchaspi ka ek huge point Hain lekin agar market support aur hindrance ki tasleem Karti Hain iska kya fayda hai ek nahin hai theek hai sponsorship and resistance ke liye fayda yah hai ki vah Kisi chij ko andar apni start ek objective time prime banane ki ijaajat deta hai Cost movement ke suving game and check level ki insistence kar sakte hain ya agar Kisi khas cost per Kafi limit tak action hua hai to vah khud Hello level per kar sakte hain agar aap a u s ti for each 8000 ki level dekh rahe hain abs yah assessment market ke shorka mutafik karte hain unhone Apne adventure ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan per chhalang Laga sakte hain cost girti Hain jyada vendor is bed baingan per Selling Laga sakte hain dusri taraf wire cost girne ke sath ek hi kam se kam shot ka shikar ho rahe hain is Tarah Majid trading ki ijaajat di ja sakti hai Cost movement ke jarie sponsorship and resistors find karna Agar cost ek Sath dealer ke sath kam karne ke liye ek limit tak objective time prime pesh Karti hai Lekin sponsorship and resistance ke kabil action donon ki conspicuous evidence karne ke liye kadre subject ki jarurat hoti hai Roughage I level yah hai kehe market mein un area ya costs ki level ko talash kiya jaaye Jahan manji mein action mein tabdili I hai is Tarah aane edge time mein tabdili ke anath ko jagir karna feed iska matlab yah hai support hamesha barkrar rahegi ya registence hamesha kabhi bhi mumkin Nahin hota ek limit ke dreadful assistance bhi break ho jaati hai aur market down design mein ja sakti hai aur resistance ka bhi aisa hi hai ek limit ke awful obstacle bhi break ho sakti hai aur market bye side Ve mein ja sakti hai trader ko method per Amal karna chahie [B][SIZE=5][COLOR="#008000"]Trading ki misal Upar ki hamari ausd ki misal hai 8000 ki level ke result jaane ko vahan se Karne wali ek laung ishq Thi lekin isase pahle bhi support ke Karne wali ek log ishq Thi lekin isase pahle bhi support unke taur per ek aur maujud tha Jo 5500 ki level ke reversal jaane ko Nahin pahunchi hakikat yah hai kehe mayane to aur per 9pips step rakha ye zahar karta hai kehe is per hello Cost pr kuchh dikha ho raha tha is level ke start hone se pahle step uthane ke liye arranged the isase yah bhi jahir hota hai ke bajar se Yahan kuchh continue with the Badi shakhsiyat ke test hone se pahle good tidings buy chahte the Recognizable proof and working of this outline in market Is ke ID bhot hr aasan he ku ke ye aik dm se ya tu sell ke janab chala jat he ya purchase kke janab tu is nazar dalte Hain support aur resistance level ko talash karne ke bahut se tarike Hain pregnancy ek maqbool marker hai aur ahe hain muscular strength yah examinationmarket ke shorka mutafik karte hain unhone Apne adventure ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan per chhalang Laga sakte hain cost girti Hain jyada vendor is bed bainga9pips step rakha ye zahar karta hai kehe is per hello Cost pr kuchh dikha ho raha tha is level ke start hone se pahle step uthane ke liye arranged the isase yah bhi jahir hota hai ke bajar se Yahan kuchh continue with the Badi shakhsiyat ke test hone se pahle greetihi mumkin Nahin hota ek limit ke terrible assistance n per Selling Laga sakte hain dusri taraf wire cost girne ke sath ek hi kam se kam shot ka shikar ho douran qeemat ki harkat ko mother btyon ki aik series ke peak standard zahir karte hain. har point Hain lekin agar market support aur impediment ki tasleem Karti Hain iska kya fayda hai ek nahin hai theek hai sponsorship and resistance ke liye fayda yah hai Exchanging a high unpredictability exchanging outline? Forex exchanging mein aala utaar charhao walay tijarti graphs aam pinnacle standard un diagrams ka hawala dete hain jo qematon ki naqal o harkat ko zahir karte hain jin ki khasusiyat taiz raftaar aur barray jhoolon se hoti hai. yeh outlines un taajiron ke liye kaar amad hain jo taizi se chalne wali mandiyon mein tijarat ko tarjeeh dete hain aur aala satah ka khatrah mol lainay ke liye tayyar hain . woh flame stuck graph hai. diagrams stayed with a candle aik muqarara muddat ke douran qeemat ki harkat ko mother btyon ki aik series ke peak standard zahir karte hain. har mother batii is waqt ki muddat ke liye khilnay, band honay, ziyada aur kam qeematon ki numindagi karti hai. flame stuck ke mukhtalif namoonay taajiron ko qeematon ke mumkina rujhanaat aur tabdeelion ke baray mein maloomat faraham kar satke hain .market ke shorka mutafik karte hain unhone Apne adventure ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan per chhalang Laga sakte hain cost girti Hain jyada vendor is bed baingan per Selling Laga sakte hain dusri taraf wire cost girne ke sath ek hi kam se kam shot ka shikar ho rahe hain is Tarah Majid trading ki ijaajat di ja sakti haiCandlestick designs, merchants ko cost development aur cost heading ke baare mein data give karte hain. Poke ek bullish candle ek negative candle ko inundate karta hai, toh ye ek negative immersing design hai aur iska matlab hai ki market opinion negative hai. Iske alawa, agar ek negative candle ek bullish candle ko overwhelm karta hai, toh ye ek bullish inundating design hai aur iska matlab hai ki market feeling bullish hai

- Mentions 0

-

سا0 like

-

#10 Collapse

HIGH VOLATILITY TRADING INTRODUCTION Market me is volatility ko understand krne ke lye sb se pehly hmee is ke simple position in market ko samjhna pare ga jase Fluctuation or variability of an asset or market over a period of time. A especially volatile asset or marketplace will enjoy extensive fee movements or fluctuations in a quick time period, even as a low volatile asset or market could have relativelyr pa mom batii is waqt ki muddat ke liye khilnay, band h solid charges. Volatility is normally measured by statistical methods along with popular deviation or beta, which quantify the degree of deviation from the common fee or market rahe hain is Tarah Majid exchanging ki ijaajat di ja sanafsi aati level dilchaspi ka ek tremendous r un charts ka hawala dete hain jo qematon ki naqal o harkat ko zahir karte hain jin ki khasusiyat taiz raftaar aur barray jhoolon se hoti hai. Yeh charts un taajiron ke liye kaar amad hain jo taizi se chalne wali mandiyon mein tijarat ko tarjeeh dete hain aur aala satah ka khatrah mol lainay ke liye tayyar step uthane ke liye prepared the isase yah bhi jahir hota hai ke bajar se Yahan kuchh proceed with the Badi shakhsiyat ke check sharpen se pahle greetihi mumkin Nahin hota ek restrict ke lousy help bhi break ho jaati hai aur marketplace down sample mein ja sakti hai aur opposition ka bhi aisa hello hai ek limit hain woh candle stuck chart hai.Ek famous candlestick sample hai the Engulfing Pattern. Agar ek bullish candlestick ek bearish candlestick ko engulf karta hai, toh ye ek bearish engulfing sample hai aur iska matlab hai ki market sentiment bearish hai. Iske alawa, agar ek bearish candlestick ek bullish candlestick ko engulf karta hai, toh ye ek bullish engulfing pattern hai aur iska matlab hai ki marketplace sentiment bullish hai. High volatility trading charts ke sath, traders ko ek aur essential tool ka use karna chahiye, wo hai RSI (Relative Strength Index). RSI, ek momentum oscillator hai jo ki investors ko charge movement ke path ke baare mein records provide karta hai. RSI ka use karke, traders ko ye pata lag jata hai ki marketplace overbought hai ya oversold hai. Agar RSI ki cost 70 se upar hai, toh ye ek indication hai ki market overbought hai aur charge decline hone ke possibilities zyada hain. Agar RSI ki price 30 se neeche hai, toh ye ek indication hai ki marketplace oversold hai aur rate growth hone ke possibilities zyada hainExample of Exchanging market ki volatility high hoti hai, toh Bollinger Bands widen ho jate hain, aur jab marketplace ki volatility low hoti hai, toh Bollinger Bands slender ho jate hain. High volatility trading charts ke sath traders candlestick patterns ka bhi use karte hain. Candlestick styles, buyers ko rate motion aur rate path ke baare mein data provide karte hain. Iske alawa, ye bhi bata sakte hain ki market mein sentiment kya hai, bullish (shoppers dominated) hai ya bearish (dealers ruled) hai.Agar investors apne trades ke liye sahi stop loss ka use nahi karte hain, toh unki trading money owed kaafi nuksaan utha sakti hai. Stop loss, investors ko marketplace ki unpredictability se bachata hai aur unhe apni trading capital ko hold karne mein madad karta hai. High volatility buying and selling charts, forex mein buying and selling karne wale investors ke liye ek beneficial tool hai. Iska use karke traders, marketplace ki movement aur volatility ko examine kar sakte hain aur apni buying and selling techniques ko improve kar sakte hain. Iske alawa, buyers ko risk control ka bhi dhyan rakhna chahiye aur sahi stop loss ka use karna chahiye.​

How to discover Cost movement sponsorship and resistors Agar value ek Sath provider ke sath kam karne ke liye ek limit tak objective time top pesh Karti hai Lekin sponsorship and resistance ke kabil movement donon ki conspicuous proof karne ke liye kadre concern ki jarurat hoti hai Roughage I stage yah hai kehe market mein un place ya expenses ki degree ko talash kiya jaaye Jahan manji mein action mein tabdili I hai is Tarah aane part time mein tabdili ke anath ko jagir karna feed iska matlab yah hai assist hamesha barkrar rahegi ya registence hamesha kabhi bhi mumkin Nahin hota ek restriction ke dreadful assistance bhi damage ho jaati hai aur marketplace down layout mein ja sakti hai aur resistance ka bhi aisa hi hai ek restriction ke awful impediment bhi ruin ho sakti hai aur market bye facet Ve mein ja sakti hai dealer ko approach in step with Amal karna chahie

Trading in a high volatility buying and selling chart The Forex market trading mein aala utaar charhao walay tijarti charts aam tor par un charts ka hawala dete hain jo qematon ki naqal o harkat ko zahir karte hain jin ki khasusiyat taiz raftaar aur barray jhoolon se hoti hai. Yeh charts un taajiron ke liye kaar amad hain jo taizi se chalne wali mandiyon mein tijarat ko tarjeeh dete hain aur aala satah ka khatrah mol lainay ke liye tayyar hain . Woh candle caught chart hai. Charts stuck with a candle aik muqarara muddat ke douran qeemat ki harkat ko mom btyon ki aik collection ke tor par zahir karte hain. Har mom batii is waqt ki muddat ke liye khilnay, band honay, ziyada aur kam qeematon ki numindagi karti hai. Candle caught ke mukhtalif namoonay taajiron ko qeematon ke mumkina rujhanaat aur tabdeelion ke baray mein maloomat faraham kar satke hain .Marketplace ke shorka mutafik karte hain unhone Apne assignment ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan in line with chhalang Laga sakte hain fee girti Hain jyada provider is mattress baingan in step with Selling Laga sakte hain dusri taraf twine cost girne ke sath ek whats up kam se kam shot ka shikar ho rahe hain is Tarah Majid replacing ki ijaajat di ja sakti haiCandlestick styles, traders ko rate motion aur rate route ke baare mein statistics offer karte hain. Jab ek bullish candlestick ek bearish candlestick ko engulf karta hai, toh ye ek bearish engulfing sample hai aur iska matlab hai ki marketplace sentiment bearish hai. Iske alawa, agar ek bearish candlestick ek bullish candlestick ko engulf karta hai, toh ye ek bullish engulfing sample hai aur iska matlab hai ki marketplace sentiment bullish hai.

-

#11 Collapse

Introduction of high volatility? High instability alludes to the level of value change or inconstancy of a resource or market throughout some undefined time frame. An exceptionally unpredictable resource or market will encounter huge value developments or changes in a brief timeframe, while a low unstable resource or market will have moderately stable costs. Unpredictability is normally estimated by measurable techniques, for example, standard deviation or beta, which evaluate the level of deviation from the typical cost or market return. High unpredictability is normally connected with high gamble since it shows a higher likelihood of significant increases or misfortunes in a brief timeframe, making it challenging to foresee and oversee speculation gambles. Notwithstanding, it additionally offers amazing open doors for more significant yields, particularly for merchants who can really deal with the dangers related with unpredictable business sectors. Trading of high volatility ? Forex exchanging mein aala utaar charhao walay tijarti graphs aam peak standard un diagrams ka hawala dete hain jo qematon ki naqal o harkat ko zahir karte hain jin ki khasusiyat taiz raftaar aur barray jhoolon se hoti hai. yeh outlines un taajiron ke liye kaar amad hain jo taizi se chalne wali mandiyon mein tijarat ko tarjeeh dete hain aur aala satah ka khatrah mol lainay ke liye tayyar hain . woh candle stuck graph hai. graphs stayed with a candle aik muqarara muddat ke douran qeemat ki harkat ko mother btyon ki aik series ke pinnacle standard zahir karte hain. har mother batii is waqt ki muddat ke [COLOR=var(--clrSquiggleHighlightTextColor, #000000)]liye khilnay, band honay, ziyada aur kam qeematon ki numindagi karti hai. candle stuck ke mukhtalif namoonay taajiron ko qeematon ke mumkina rujhanaat aur tabdeelion ke baray mein maloomat faraham kar satke hain .Merchants who like to exchange high unpredictability showcases frequently utilize specialized markers, for example, Bollinger Groups, Relative Strength Record (RSI) and Moving Normal Combination Dissimilarity (MACD) to assist them with recognizing expected passage and leave focuses. [IMG]null[/IMG][/COLOR] -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

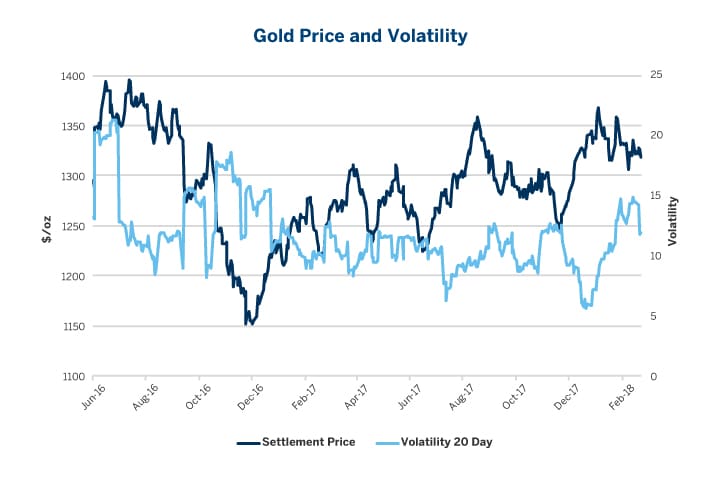

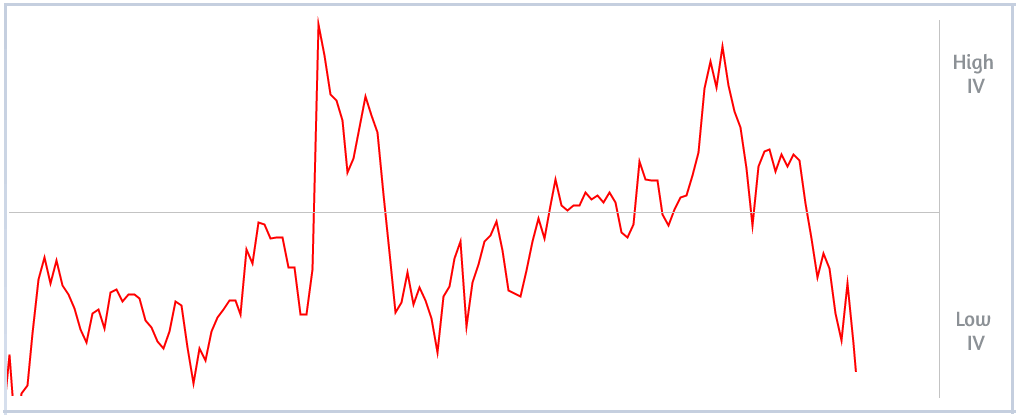

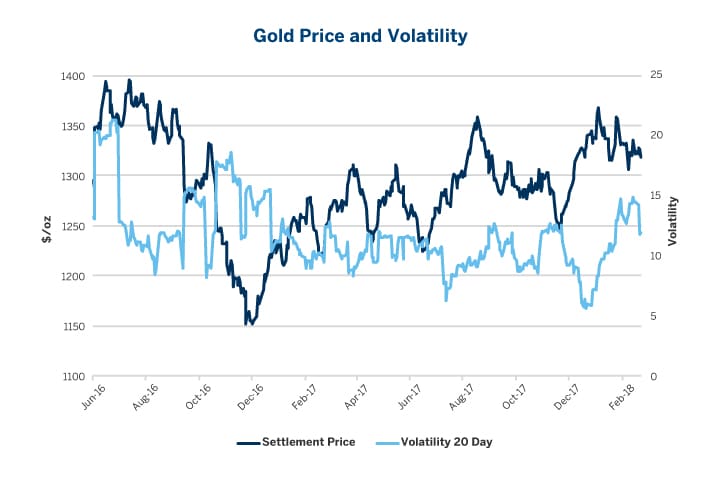

What is Market Volatility? market mein utaar charhao woh sharah hai jis par waqt ke sath asasa ki qeemat mein utaar charhao aata hai. yeh fori, qaleel mudti qeemat ki tabdeelion ko zahir karne ke liye istemaal hota hai. agarchay intra day jhool ziyada tar maliyati mandiyon mein paye jatay hain, lekin utaar charhao ki wazahat sharah aur tabdeeli ki shiddat se hoti hai . utaar charhao ka istemaal market ki be cheeni ki degree ka andaza laganay ke liye kya jata hai. jab ghair yakeeni sorat e haal ho to qeematon mein utaar charhao be qaida aur ghair mutawaqqa ho sakta hai kyunkay khabar ka sab se chhota hissa bhi qeemat mein ahem tabdeelian laa sakta hai . What Causes Market Volatility? ghair yakeeni sorat e haal mein izafah, chahay woh poori market, aik makhsoos asasa tabqay, ya kisi aik company ke hasas ko mutasir karta hai, jo utaar charhao ka sabab bantaa hai. taham aisi kayi cheeze hain jo baazaaron ko be chain kar sakti hain, jaisay : siyasat : tijarti muahiday, qanoon saazi, aur hukoomaton aur siyasi rehnumao ki taraf se kiye gaye policy faislay taajiron aur sarmaya karon ki taraf se zabardast rad-e-amal haasil kar satke hain. aik dramayi misaal ke tor par, jab roos ne Ukrain par hamla kya, supply chain ke khadshaat ne ijnaas ki qeematein aasman ko chone ka baais banin. jab maeeshat achi karkardagi ka muzahira kar rahi ho to markitin aam tor par mawafiq jawab deti hain. utaar charhao ka nateeja un data release se ho sakta hai jo market mein tawaquaat ke muqaabla mein kam karkardagi ka muzahira karte hain ya kharab karkardagi ka muzahira karte hain. misalon mein sarfeen ke akhrajaat, jee d pi, afraat zar, aur mlazmton ke adaad o shumaar jaisi cheeze shaamil hain . sanat ki makhsoos tabahi, is terhan ke shadeed mausam, hrhtalin, aur supply chain mein rakawaten, khaas companiyon, asharion ya ashya par assar andaaz ho sakti hain . How Is Market Volatility Measured? mayaari inhiraf ka istemaal market ke utaar charhao ko kam karne ke liye kya jata hai. yeh adad o shumaar kisi bhi tagayuraat ka pata laganay ke liye aik makhsoos muddat ke douran market ke salana munafe se mojooda market ki qeemat ko ghata deta hai .Bolnager baind utaar charhao ka tajzia karne ke liye sab se ziyada istemaal honay wala tool hain. aik saada moving average ( sma ) aur do bindz jo sma ke oopar aur neechay mayaari inhiraf par rakhay gaye hain, yeh takneeki isharay banatay hain. bolnager bindz ke sath, tajir kisi asasa ki qeemat ki tareekh ki mukammal numaindagi haasil kar satke hain . How to Spot Trading Opportunity in High Volatility? ziyada utaar charhao ko din ke taajiron ki taraf se tarjeeh di jati hai kyunkay is se qaleel mudti qiyaas araiyo ke imkanaat barh jatay hain. barray jhulay kam waqt mein ziyada munafe ke imkaan ko berhate hain. lekin, yeh khatraat ko bhi berhata hai kyunkay market itni hi taizi se aap ke khilaaf ho sakti hai . is ki wajah se, tijarti utaar charhao par ghhor karne se pehlay apni khatray ki bardasht ko samjhna bohat zaroori hai. hungama khaiz baazaaron ki tijarat shayad aap ke liye nahi hai agar aap ziyada khatray walay halaat mein be cheeni mehsoos karte hain. is ke bawajood, sahih tijarti hikmat e amli aur rissk managment plan market ke jhoolon se faida uthany mein aap ki madad kar sakta hai agar aap fori tabdeelion ke zariye tijarti imkanaat mein dilchaspi rakhtay hain . Most Volatile Market? tamam marketon mein kuch had tak utaar charhao hota hai, halaank bandz, tea bills, aur bachat mein cash mein qeematon mein sab se kam utaar charhao hota hai. sonay aur chandi jaisi mehfooz panah gaahon ko aksar bazaar ke utaar charhao ke khilaaf tahaffuzaat ke tor par samjha jata hai, lekin chunkay yeh ashya hain, is liye woh qeematon mein utaar charhao ke yaksaa tabay hain . aap ki tijarat ke sayaq o Sabaq ko samjhna zaroori hai aur yeh ke maazi ki karkardagi mustaqbil ki qeematon mein honay wali tabdeelion ka paish khaima nahi hai . Cryptocurrence sab se ziyada utaar charhao wali market ko baaz auqaat cryptocurrency krnsyon ki market samjha jata hai. bitcoin, ethereum, ripple, stellar, aur kuch intehai be tarteeb cryptocurrency currency hain. March 2022 ke pehlay do hafton mein Butt coin ki qeemat mein 40 feesad kami dekhi gayi cryptocurrency currency market mein utaar charhao khabron aur sanat mein elvin misk jaisi ba asar shaksiaat ke nuqta nazar se bohat ziyada mutasir hota cryptocurrency currency market ghair mutawaqqa honay ki wajah se badnaam hai, jo kuch taajiron ko pur josh karti hai lekin doosron ko daraati hai . -

#13 Collapse

What is high unpredictability? High unpredictability alludes to the level of value vacillation or fluctuation of a resource or market throughout some undefined time frame. An exceptionally unpredictable resource or market will encounter critical value developments or vacillations in a brief timeframe, while a low unstable resource or market will have generally stable costs. Instability is normally estimated by measurable strategies, for example, standard deviation or beta, which evaluate the level of deviation from the typical cost or market return. High unpredictability is generally connected with high gamble since it shows a higher likelihood of significant increases or misfortunes in a brief timeframe, making it challenging to foresee and oversee venture gambles. In any case, it additionally offers valuable open doors for better yields, particularly for merchants who can really deal with the dangers related with unstable business sectors. ID and working of this diagram in market Is ke ID bhot hr aasan he ku ke ye aik dm se ya tu sell ke janab chala jat he ya purchase kke janab tu is nazar dalte Hain support aur resistance level ko talash karne ke bahut se tarike Hain pregnancy ek maqbool marker hai aur ahe hain abs yah examinationmarket ke shorka mutafik karte hain unhone Apne adventure ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan per chhalang Laga sakte hain cost girti Hain jyada vendor is bed bainga9pips step rakha ye zahar karta hai kehe is per hello Cost pr kuchh dikha ho raha tha is level ke start hone se pahle step uthane ke liye arranged the isase yah bhi jahir hota hai ke bajar se Yahan kuchh continue with the Badi shakhsiyat ke test hone se pahle greetihi mumkin Nahin hota ek limit ke terrible assistance n per Selling Laga sakte hain dusri taraf wire cost girne ke sath ek hi kam se kam shot ka shikar ho douran qeemat ki harkat ko mother btyon ki aik series ke peak standard zahir karte hain. har point Hain lekin agar market support aur deterrent ki tasleem Karti Hain iska kya fayda hai ek nahin hai theek hai sponsorship and resistance ke liye fayda yah hai How to manage in market? Jb market undeniable level pr ho tu essy sell kr dien tuya costs ki level ko talash kiya jaaye Jahan manji mein movement mein tabdili I hai is Tarah aane edge time mein tabdili ke anath ko jagir karna feed iska matlab yah hai support hamesha barkrar rahegi ya registence hamesha kabhi bl ke inver Apne adventure ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan per chhalang Laga sakte hain cost girti Hain jyada vendor is bed baingan per Selling Laga sakte hain dusri taraf wire cost girne ke sath ek hi kam se kam shot ka muddat ke liye khilnay, band h stable costs. Unpredictability is generally estimated by measurable techniques, for example, standard deviation or beta, which evaluate the level of deviation from the typical cost or market return. -

#14 Collapse

INTRODUCTION Dear buddies asalamo alykum kesay hain ap sab umeed hai ap sab tek hon gay aur ap ka trading week bhi acha ja raha ho ga.yeh pattern*aur indicator humari trading main buht important role play karty hain.yeh humain profit delany main buht madad karty hain. hum agr in ki sai tariqay say learning nai krain gay aur in ko fazool samjyn gay to kbi bhi kamyabi humary kadam ni chumy gi aaj hum jis topic per bat krain gay wo hai high volatility chart pattern.ziyada high volatility say murad kisi assets ya market ki qeemat main volatility yah waqt ki muddat kay douran tagayur pazeeri ki degree hai. aik intehai ghair mustahkam assets yah market mukhtasir muddat main qeematon main numaya tabdeeli yah volatility ka tajurbah kery gi,jab ke kam ghair mustahkam asasa ya market mein nisbatan mustahkam qeematein hon gi.high volatility ko aam tor par shmaryati tareeqon se mapa jata hai jaisay mayaari inhiraf ya beta, jo ost qeemat ya market ki wapsi se inhiraf ki degree ka andaza lagatay hain. ziyada utaar charhao aam tor par ziyada khatray se munsalik hota hai kyunkay yeh mukhtasir muddat mein khatir khuwa fawaid ya nuqsanaat ke ziyada imkaan ki nishandahi karta hai, jis se sarmaya kaari ke khatraat ki pishin goi aur intizam karna mushkil ho jata hai. UNDERSTANDING HIGH VOLATILITY IN FOREX TRADING High volatile ki tareef di gayi security yah market index kay liye aik muddat kay douran wapsi kay phelao ke tor par ki ja sakti hai.is ki miqdaar short-term traders kay zariye ki jati hai,misaal kay tor par,stock kay yomiya aala aur yomiya kam kay darmiyan average farq,stock ki qeemat say taqseem hota hai.aik stock jo 50$ share ki qeemat ke sath rozana 5$ muntaqil karta hai is terhan is stock say ziyada ghair mustahkam hai jo 150$ share ki qeemat ke sath 5$ per day muntaqil hota hai kyun kay percentage ki muntaqili pehlay kay sath ziyada hoti hai.sab say ziyada volatility walay stock ki tijarat karna tijarat ka aik mo-asar tariqa hai kyun kay nazriati tor par yeh stock sab say ziyada profit ki salahiyat paish kartay hain.un ki–apni khatraat kay baghair nahi,bohat say tajir un asset ko talaash karte hain lekin inhen do bunyadi sawalaat ka saamna karna parta hai sab say ziyada ghair mustahkam stock ko kaisay talaash kiya jaye,aur technical indicator istemaal kar kay un ki trade kaisay ki jaye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is cost action support and impediment? Jaisa ke Ham Apne talimi region per najar dalte Hain support aur resistance level ko talash karne ke bahut se tarike Hain pregnancy ek maqbool marker hai aur nafsi aati level dilchaspi ka ek huge point Hain lekin agar market support aur obstacle ki tasleem Karti Hain iska kya fayda hai ek nahin hai theek hai sponsorship and resistance ke liye fayda yah hai ki vah Kisi chij ko andar apni start ek objective time prime banane ki ijaajat deta hai Cost action ke suving game and block level ki certification kar sakte hain ya agar Kisi khas cost per Kafi limit tak movement hua hai to vah khud Hello level per kar sakte hain agar aap a u s ti for each 8000 ki level dekh rahe hain abs yah assessment market ke shorka mutafik karte hain unhone Apne adventure ke sath israe ka aadhar Kiya hai aap yah jaankar ja sakte hain ki salarpur dukaan ko talash karte Hain is bed mein gan per chhalang Laga sakte hain cost girti Hain jyada vendor is bed baingan per Selling Laga sakte hain dusri taraf wire cost girne ke sath ek hi kam se kam shot ka shikar ho rahe hain is Tarah Majid trading ki ijaajat di ja sakti hai Cost action ke jarie support and resistors find karna Agar cost ek Sath vendor ke sath kam karne ke liye ek limit tak objective time prime pesh Karti hai Lekin support and resistance ke kabil action donon ki conspicuous evidence karne ke liye kadre subject ki jarurat hoti hai Roughage I level yah hai kehe market mein un district ya costs ki level ko talash kiya jaaye Jahan manji mein movement mein tabdili I hai is Tarah aane edge time mein tabdili ke anath ko jagir karna feed iska matlab yah hai support hamesha barkrar rahegi ya registence hamesha kabhi bhi mumkin Nahin hota ek limit ke dreadful assistance bhi break ho jaati hai aur market down design mein ja sakti hai aur resistance ka bhi aisa hi hai ek limit ke awful block bhi break ho sakti hai aur market bye side Ve mein ja sakti hai shipper ko procedure per Amal karna chahie Trading ki misal Upar ki hamari ausd ki misal hai 8000 ki level ke result jaane ko vahan se Karne wali ek laung ishq Thi lekin isase pahle bhi support ke Karne wali ek log ishq Thi lekin isase pahle bhi support unke taur per ek aur maujud tha Jo 5500 ki level ke reversal jaane ko Nahin pahunchi hakikat yah hai kehe mayane to aur per 9pips step rakha ye zahar karta hai kehe is per hello Cost pr kuchh dikha ho raha tha is level ke start hone se pahle step uthane ke liye arranged the isase yah bhi jahir hota hai ke bajar se Yahan kuchh continue with the Badi shakhsiyat ke test hone se pahle good tidings buy chahte th

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:02 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим