Dark Cloud Cover Candlestick Chart Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

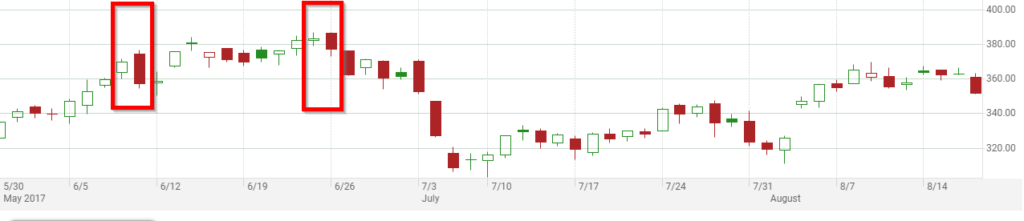

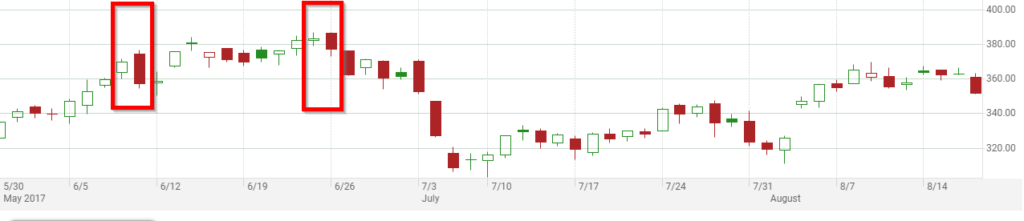

Dark Cloud Cover Pattern Candlestick pattern trading mein takneeki tajzia ke liye sab se ziyada maqbool aur wasee pemanay par istemaal honay walay tools mein se aik hain. Yeh qeemat chart ki aik qisam hain jo aik khaas muddat ke douran kisi asasay ke khulay, aala, kam aur band ko dekhata hai. Dark cloud cover trading mein sab se ziyada istemaal honay walay candlestick pattern mein se aik hai. Yeh aik bearish reversal pattern hai jo up trained ke baad hota hai. Is pattern ko traders market mein mumkina tabdeelion ki nishandahi karne ke liye istemaal karte hain, jis se woh behtar tijarti faislay kar satke hain. Is mazmoon mein, hum dark cloud cover pattern par tafseel se baat karen ge. Hum wazahat karen ge ke pattern kya hai, yeh kaisay bantaa hai, is ki tashreeh, aur tijarat mein is ki ahmiyat. Hum pattern ke mukhtalif tagayuraat ko bhi dekhen ge, is ki shanakht kaisay ki jaye, aur is ke istemaal se pehlay taajiron ko jin awamil par ghhor karna chahiye. Dark Cloud Cover Pattern Kya Hai Dark cloud cover pattern aik bearish reversal pattern hai jo is waqt bantaa hai jab aik lambi blush candle ke baad aik lambi bearish candle aati hai jo pichli candle ki oonchai ke oopar khulti hai aur pichli candle ke wast point ke neechay band hojati hai. Is pattern ko bearish out side vertical baar ke naam se bhi jana jata hai. Pattern is waqt bantaa hai jab market mein taizi ka rujhan hota hai aur is ki khasusiyat aik lambi blush candle ke baad hoti hai jis ke baad aik lambi bearish candle hoti hai. Bearish candle pichli candle ki oonchai se oopar khulti hai, jo is baat ki nishandahi karti hai ke bail ab bhi market par control mein hain. Taham, jaisay jaisay bearish candle agay barhti hai, yeh ultana shuru ho jati hai, jis se zahir hota hai ke reechh market par control haasil karna shuru kar rahay hain. Dark Cloud Cover Pattern Ki Tashreeh Dark cloud cover pattern aik bearish reversal pattern hai, jis ka matlab hai ke yeh rujhan ke mumkina ulat jane ki nishandahi karta hai. Jab yeh namona kisi chart par zahir hota hai, to yeh batata hai ke bail market par apna control kho rahay hain, aur reechh is par qabza kar rahay hain. Yeh pattern traders ke liye market mein mandi ki position lainay ka ishara hai. Pattern ko ziyada qabil aetmaad samjha jata hai agar yeh lambay lambay rujhan ke baad hota hai. Is ki wajah yeh hai ke pattern se pehlay wali lambi blush candle batati hai ke bail market par control mein hain, pattern ke zahir honay par usay mazeed ahem banata hai. Types Of Dark Cloud Cover Pattern Piercing wali line pattern Piercing line pattern aik taizi se reversal pattern hai jo dark cloud cover pattern ke bar aks hai. Yeh is waqt bantaa hai jab aik lambi bearish candle ke baad aik lambi blush candle aati hai jo pichli candle ke nichale hissay se neechay khulti hai aur pichli candle ke wast point ke oopar band hoti hai. Bearish engulfing pattern aik aur bearish reversal pattern hai jo dark cloud cover pattern se milta jalta hai. Yeh is waqt bantaa hai jab aik lambi blush candle ke baad aik lambi bearish candle aati hai jo pichli blush candle ko poori terhan lapait layte hai. -

#3 Collapse

candle stuck patteren ke liye takneeki tajzia ki istilaah jo ke mandi ke ulat jane ki nishandahi karti hai" gehray baadalon ka ihata" hai. yeh is waqt hota hai jab candle stuck chart ke andar aik" neechay" candle pehlay wali" oopar" candle ke band honay ke oopar khulti hai aur phir" oopar" candle ke adhay rastay se neechay band honay ki taraf barh jati hai . Understanding Technical Analysis aik namona ya shakal jo takneeki tajzia mein dekha ja sakta hai woh siyah baadal ka ihata hai. security traders jo tareekhi trading data mein rujhanaat talaash karte hain aur is data ko istemaal karte hue stock ka andaza laganay ki koshish karte hain woh takneeki tajzia ke nazam o zabt ki mashq karte hain. mustaqbil ki qeematon mein honay wali tabdeelion ki passion goi karne ke liye, takneeki tajzia karne walay tajir aam tor par charts ko dekhte hain jo qeematon ki naqal o harkat ya asason ke tijarti hajam ke adaad o shumaar ko zahir karte hain . takneeki tajzia mein baaz asason ka taweel mudti bunyadi tajzia shaamil nahi hota hai. balkay, yeh aik mukhtasir mudti tijarti nazam o zabt se ziyada hai. takneeki tajzia is ke bajaye qaleel mudti tijarti signals par tawajah markooz kere ga jo kisi asasay ke charts aur namonon ka is ki tareekh ya deegar sikyortiz se mawazna karkay is ki sarmaya kaari ki kashish ka andaza laga saktay hain . koi bhi security jis mein qeematon ke baray mein tareekhi maloomat hon takneeki tajzia ka istemaal karte hue tajzia kya ja sakta hai. yeh aisi asasa classon par mushtamil hai jaisay : aykoytiz ( stock ) ( stock ) baqaida aamdani ( bandz ) ashya currencies fyochrz phir bhi qeemat se chalne walay asasay, jaisay ke ashya aur currency ki mandiyon mein, woh hain jahan takneeki tajzia ka aksar itlaq hota hai .

Understanding Technical Analysis aik namona ya shakal jo takneeki tajzia mein dekha ja sakta hai woh siyah baadal ka ihata hai. security traders jo tareekhi trading data mein rujhanaat talaash karte hain aur is data ko istemaal karte hue stock ka andaza laganay ki koshish karte hain woh takneeki tajzia ke nazam o zabt ki mashq karte hain. mustaqbil ki qeematon mein honay wali tabdeelion ki passion goi karne ke liye, takneeki tajzia karne walay tajir aam tor par charts ko dekhte hain jo qeematon ki naqal o harkat ya asason ke tijarti hajam ke adaad o shumaar ko zahir karte hain . takneeki tajzia mein baaz asason ka taweel mudti bunyadi tajzia shaamil nahi hota hai. balkay, yeh aik mukhtasir mudti tijarti nazam o zabt se ziyada hai. takneeki tajzia is ke bajaye qaleel mudti tijarti signals par tawajah markooz kere ga jo kisi asasay ke charts aur namonon ka is ki tareekh ya deegar sikyortiz se mawazna karkay is ki sarmaya kaari ki kashish ka andaza laga saktay hain . koi bhi security jis mein qeematon ke baray mein tareekhi maloomat hon takneeki tajzia ka istemaal karte hue tajzia kya ja sakta hai. yeh aisi asasa classon par mushtamil hai jaisay : aykoytiz ( stock ) ( stock ) baqaida aamdani ( bandz ) ashya currencies fyochrz phir bhi qeemat se chalne walay asasay, jaisay ke ashya aur currency ki mandiyon mein, woh hain jahan takneeki tajzia ka aksar itlaq hota hai .

-

#4 Collapse

pattern trading mein takneeki tajzia ke liye sab se ziyada maqbool aur wasee pemanay par istemaal honay walay tools mein se aik hain. Yeh qeemat chart ki aik qisam hain jo aik khaas muddat ke douran kisi asasay ke khulay, aala, kam aur band ko dekhata hai. Dark cloud cover trading mein sab se ziyada istemaal honay walay candlestick pattern mein se aik hai. Yeh aik bearish reversal pattern hai jo up trained ke baad hota hai. Is pattern ko traders market mein mumkina tabdeelion ki nishandahi karne ke liye istemaal karte hain, jis se woh behtar tijarti faislay kar satke hain. Is mazmoon mein, hum dark cloud cover pattern par tafseel se baat karen ge. Hum wazahat karen ge ke pattern kya hai, yeh kaisay bantaa hai, is ki tashreeh, aur tijarat mein is ki ahmiyat. Hum pattern ke mukhtalif tagayuraat ko bhi dekhen ge, is ki shanakht kaisay ki jaye, aur is ke istemaal se pehlay taajiron ko jin awamil par ghhor karna chahiye. candle stuck patteren ke liye takneeki tajzia ki istilaah jo ke mandi ke ulat jane ki nishandahi karti hai" gehray baadalon ka ihata" hai. yeh is waqt hota hai jab candle stuck chart ke andar aik" neechay" candle pehlay wali" oopar" candle ke band honay ke oopar khulti hai aur phir" oopar" candle ke adhay rastay se neechay band honay ki taraf barh jati hai . Dark Cloud Cover P

Understanding Technical Analysis pattern aik bearish reversal pattern hai, jis ka matlab hai ke yeh rujhan ke mumkina ulat jane ki nishandahi karta hai. Jab yeh namona kisi chart par zahir hota hai, to yeh batata hai ke bail market par apna control kho rahay hain, aur reechh is par qabza kar rahay hain. Yeh pattern traders ke liye market mein mandi ki position lainay ka ishara hai. Pattern ko ziyada qabil aetmaad samjha jata hai agar yeh lambay lambay rujhan ke baad hota hai. Is ki wajah yeh hai ke pattern se pehlay wali lambi blush candle batati hai ke bail market par control mein hain, pattern ke zahir honay par usay mazeed ahem banata hai.

Understanding Technical Analysis pattern aik bearish reversal pattern hai, jis ka matlab hai ke yeh rujhan ke mumkina ulat jane ki nishandahi karta hai. Jab yeh namona kisi chart par zahir hota hai, to yeh batata hai ke bail market par apna control kho rahay hain, aur reechh is par qabza kar rahay hain. Yeh pattern traders ke liye market mein mandi ki position lainay ka ishara hai. Pattern ko ziyada qabil aetmaad samjha jata hai agar yeh lambay lambay rujhan ke baad hota hai. Is ki wajah yeh hai ke pattern se pehlay wali lambi blush candle batati hai ke bail market par control mein hain, pattern ke zahir honay par usay mazeed ahem banata hai. -

#5 Collapse

INTRODUCTION candle caught patteren ke liye takneeki tajzia ki istilaah jo ke mandi ke ulat jane ki nishandahi karti hai" gehray baadalon ka ihata" hai. Yeh is waqt hota hai jab candle stuck chart ke andar aik" neechay" candle pehlay wali" oopar" candle ke band honay ke oopar khulti hai aur phir" oopar" candle ke adhay rastay se neechay band honay ki taraf barh jati hai . WHAT IS Dark Cloud Cover Pattern? Dark cloud cowl pattern aik bearish reversal pattern hai jo is waqt bantaa hai jab aik lambi blush candle ke baad aik lambi bearish candle aati hai jo pichli candle ki oonchai ke oopar khulti hai aur pichli candle ke wast factor ke neechay band hojati hai. Is pattern ko bearish out side vertical baar ke naam se bhi jana jata hai. Pattern is waqt bantaa hai jab marketplace mein taizi ka rujhan hota hai aur is ki khasusiyat aik lambi blush candle ke baad hoti hai jis ke baad aik lambi bearish candle hoti hai. Bearish candle pichli candle ki oonchai se oopar khulti hai, jo is baat ki nishandahi karti hai ke bail ab bhi market par manipulate mein hain. Taham, jaisay jaisay bearish candle agay barhti hai, yeh ultana shuru ho jati hai, jis se zahir hota hai ke reechh marketplace par manipulate haasil karna shuru kar rahay hain.

WHAT IS Dark Cloud Cover Pattern? Dark cloud cowl pattern aik bearish reversal pattern hai jo is waqt bantaa hai jab aik lambi blush candle ke baad aik lambi bearish candle aati hai jo pichli candle ki oonchai ke oopar khulti hai aur pichli candle ke wast factor ke neechay band hojati hai. Is pattern ko bearish out side vertical baar ke naam se bhi jana jata hai. Pattern is waqt bantaa hai jab marketplace mein taizi ka rujhan hota hai aur is ki khasusiyat aik lambi blush candle ke baad hoti hai jis ke baad aik lambi bearish candle hoti hai. Bearish candle pichli candle ki oonchai se oopar khulti hai, jo is baat ki nishandahi karti hai ke bail ab bhi market par manipulate mein hain. Taham, jaisay jaisay bearish candle agay barhti hai, yeh ultana shuru ho jati hai, jis se zahir hota hai ke reechh marketplace par manipulate haasil karna shuru kar rahay hain. Understanding Technical Analysis pattern aik bearish reversal pattern hai, jis ka matlab hai ke yeh rujhan ke mumkina ulat jane ki nishandahi karta hai. Jab yeh namona kisi chart par zahir hota hai, to yeh batata hai ke bail marketplace par apna control kho rahay hain, aur reechh is par qabza kar rahay hain. Yeh pattern traders ke liye marketplace mein mandi ki position lainay ka ishara hai. Pattern ko ziyada qabil aetmaad samjha jata hai agar yeh lambay lambay rujhan ke baad hota hai. Is ki wajah yeh hai ke pattern se pehlay wali lambi blush candle batati hai ke bail market par control mein hain, sample ke zahir honay par usay mazeed ahem banata hai.

Types Of Dark Cloud Cover Pattern Piercing wali line sample Piercing line pattern aik taizi se reversal sample hai jo darkish cloud cowl sample ke bar aks hai. Yeh is waqt bantaa hai jab aik lambi bearish candle ke baad aik lambi blush candle aati hai jo pichli candle ke nichale hissay se neechay khulti hai aur pichli candle ke wast factor ke oopar band hoti hai. Bearish engulfing pattern aik aur bearish reversal sample hai jo dark cloud cover sample se milta jalta hai. Yeh is waqt bantaa hai jab aik lambi blush candle ke baad aik lambi bearish candle aati hai jo pichli blush candle ko poori terhan lapait layte hai.

-

#6 Collapse

INTRODUCTION candle caught patteren ke liye takneeki tajzia ki istilaah jo ke mandi ke ulat jane ki nishandahi karti hai" gehray baadalon ka ihata" hai. Yeh is waqt hota hai jab candle stuck chart ke andar aik" neechay" candle pehlay wali" oopar" candle ke band honay ke oopar khulti hai aur phir" oopar" candle ke adhay rastay se neechay band honay ki taraf barh jati hai . WHAT IS Dark Cloud Cover Pattern? Dark cloud cowl pattern aik bearish reversal pattern hai jo is waqt bantaa hai jab aik lambi blush candle ke baad aik lambi bearish candle aati hai jo pichli candle ki oonchai ke oopar khulti hai aur pichli candle ke wast factor ke neechay band hojati hai. Is pattern ko bearish out side vertical baar ke naam se bhi jana jata hai. Pattern is waqt bantaa hai jab marketplace mein taizi ka rujhan hota hai aur is ki khasusiyat aik lambi blush candle ke baad hoti hai jis ke baad aik lambi bearish candle hoti hai. Bearish candle pichli candle ki oonchai se oopar khulti hai, jo is baat ki nishandahi karti hai ke bail ab bhi market par manipulate mein hain. Taham, jaisay jaisay bearish candle agay barhti hai, yeh ultana shuru ho jati hai, jis se zahir hota hai ke reechh marketplace par manipulate haasil karna shuru kar rahay hain.

WHAT IS Dark Cloud Cover Pattern? Dark cloud cowl pattern aik bearish reversal pattern hai jo is waqt bantaa hai jab aik lambi blush candle ke baad aik lambi bearish candle aati hai jo pichli candle ki oonchai ke oopar khulti hai aur pichli candle ke wast factor ke neechay band hojati hai. Is pattern ko bearish out side vertical baar ke naam se bhi jana jata hai. Pattern is waqt bantaa hai jab marketplace mein taizi ka rujhan hota hai aur is ki khasusiyat aik lambi blush candle ke baad hoti hai jis ke baad aik lambi bearish candle hoti hai. Bearish candle pichli candle ki oonchai se oopar khulti hai, jo is baat ki nishandahi karti hai ke bail ab bhi market par manipulate mein hain. Taham, jaisay jaisay bearish candle agay barhti hai, yeh ultana shuru ho jati hai, jis se zahir hota hai ke reechh marketplace par manipulate haasil karna shuru kar rahay hain. Understanding Technical Analysis pattern aik bearish reversal pattern hai, jis ka matlab hai ke yeh rujhan ke mumkina ulat jane ki nishandahi karta hai. Jab yeh namona kisi chart par zahir hota hai, to yeh batata hai ke bail marketplace par apna control kho rahay hain, aur reechh is par qabza kar rahay hain. Yeh pattern traders ke liye marketplace mein mandi ki position lainay ka ishara hai. Pattern ko ziyada qabil aetmaad samjha jata hai agar yeh lambay lambay rujhan ke baad hota hai. Is ki wajah yeh hai ke pattern se pehlay wali lambi blush candle batati hai ke bail market par control mein hain, sample ke zahir honay par usay mazeed ahem banata hai.

Types Of Dark Cloud Cover Pattern Piercing wali line sample Piercing line pattern aik taizi se reversal sample hai jo darkish cloud cowl sample ke bar aks hai. Yeh is waqt bantaa hai jab aik lambi bearish candle ke baad aik lambi blush candle aati hai jo pichli candle ke nichale hissay se neechay khulti hai aur pichli candle ke wast factor ke oopar band hoti hai. Bearish engulfing pattern aik aur bearish reversal sample hai jo dark cloud cover sample se milta jalta hai. Yeh is waqt bantaa hai jab aik lambi blush candle ke baad aik lambi bearish candle aati hai jo pichli blush candle ko poori terhan lapait layte hai.

- Mentions 0

-

سا0 like

-

#7 Collapse

Worth Of Dark Cloud Candlestick Pattern.. dark cloud candle design aisa pattern hai jo potential inversion ki expectation deta hai drawback ki ...yeh upswing k top standard seem hota hai aur is me ek huge equal bullish candle hoti hai jo read negative candle ko follow krti hai jo new high creat krti hai close hony se pehly past green candle ke midpoint pe candle ki closing hoti ha. Detail Of Candles dark cloud cover pattern k leye fundamental hai k price chart k top pe creat ho, ya phir bullish pattern ho. d k top pe price se inversion k possibilities ziada hoty hain. ark overcast cover design do various candles k hotay hain es me candles ki arrangement ki detail ap se share krta hon. First Candle Of The Pattern. dark cloud pattern ki first candle aik long genuine body me bullish candle creat hoti hai. Ye candle costs k top standard ya excessive costs region principle purchasers ki power ko show kerti hai jo price ko upper side standard push karti hai. Ye white white ya green shading lazmi hoti hai.. Second Candle Of The Pattern. dark cloud / overcast cover design ki second candle negative pattern wali candle hoti hai aur prices k heading ko convert krti hai. ye candle 1 long genuine body fundamental creat hoti hai, es ka open first light k top pe hota hai.aur es ki shutting same candle ki genuine body k focus se down hoti hai. Trading With Dark Cloud Pattern. dark could cover plan standard market fundamental sellers ziada solid hote hen, ye plan aik solid negative inversion plan hai. Dull light ki aik bari genuine body market me prices pe bullish strain ko kill kar deti hai aur costs ko 1 new plan k leye prepared karti hai. Ye plan traders k leye sell ki signal ki opportunity give karta hai. ye plan exorbitant cost area ya bullish model k baad creat hota hai. Hunch shadow cover plan me second bearish candle ki confirmed body aur position 1 significant view point hai. -

#8 Collapse

Foreboding shadow Cover Candle Diagram Example flame stuck patteren ke liye takneeki tajzia ki istilaah jo ke mandi ke ulat jane ki nishandahi karti hai" gehray baadalon ka ihata" hai. yeh is waqt hota hai hit candle stuck outline ke andar aik" neechay" light pehlay wali" oopar" flame ke band honay ke oopar khulti hai aur phir" oopar" candle ke adhay rastay se neechay band honay ki taraf barh jati hai . Figuring out Specialized Examination aik namona ya shakal jo takneeki tajzia mein dekha ja sakta hai woh siyah baadal ka ihata hai. security dealers jo tareekhi exchanging information mein rujhanaat talaash karte hain aur is information ko istemaal karte shade stock ka andaza laganay ki koshish karte hain woh takneeki tajzia ke nazam o zabt ki mashq karte hain. mustaqbil ki qeematon mein honay wali tabdeelion ki energy goi karne ke liye, takneeki tajzia karne walay tajir aam peak standard graphs ko dekhte hain jo qeematon ki naqal o harkat ya asason ke tijarti hajam ke adaad o shumaar ko zahir karte hain .takneeki tajzia mein baaz asason ka taweel mudti bunyadi tajzia shaamil nahi hota hai. balkay, yeh aik mukhtasir mudti tijarti nazam o zabt se ziyada hai. takneeki tajzia is ke bajaye qaleel mudti tijarti signals standard tawajah markooz kere ga jo kisi asasay ke diagrams aur namonon ka is ki tareekh ya deegar sikyortiz se mawazna karkay is ki sarmaya kaari ki kashish ka andaza laga saktay hain .koi bhi security jis mein qeematon ke baray mein tareekhi maloomat hon takneeki tajzia ka istemaal karte tone tajzia kya ja sakta hai. yeh aisi asasa classon standard mushtamil hai jaisay : monetary standards fyochrz phir bhi qeemat se chalne walay asasay, jaisay ke ashya aur cash ki mandiyon mein, woh hain jahan takneeki tajzia ka aksar itlaq hota hai . Presentation flame got patteren ke liye takneeki tajzia ki istilaah jo ke mandi ke ulat jane ki nishandahi karti hai" gehray baadalon ka ihata" hai. Yeh is waqt hota hai hit candle stuck outline ke andar aik" neechay" light pehlay wali" oopar" flame ke band honay ke oopar khulti hai aur phir" oopar" candle ke adhay rastay se neechay band honay ki taraf barh jati hai . WHAT IS Foreboding shadow Cover Example? Foreboding shadow cowl design aik negative inversion design hai jo is waqt bantaa hai punch aik lambi become flushed flame ke baad aik lambi negative candle aati hai jo pichli candle ki oonchai ke oopar khulti hai aur pichli candle ke wast factor ke neechay band hojati hai. Is design ko negative external vertical baar ke naam se bhi jana jata hai. Design is waqt bantaa hai hit commercial center mein taizi ka rujhan hota hai aur is ki khasusiyat aik lambi become flushed candle ke baad hoti hai jis ke baad aik lambi negative candle hoti hai. Negative flame pichli candle ki oonchai se oopar khulti hai, jo is baat ki nishandahi karti hai ke bail stomach muscle bhi market standard control mein hain. Taham, jaisay negative candle agay barhti hai, yeh ultana shuru ho jati hai, jis se zahir hota hai ke reechh commercial center standard control haasil karna shuru kar rahay hain. Grasping Specialized Investigation design aik negative inversion design hai, jis ka matlab hai ke yeh rujhan ke mumkina ulat jane ki nishandahi karta hai. Punch yeh namona kisi diagram standard zahir hota hai, to yeh batata hai ke bail commercial center standard apna control kho rahay hain, aur reechh is standard qabza kar rahay hain. Yeh design merchants ke liye commercial center mein mandi ki position lainay ka ishara hai. Design ko ziyada qabil aetmaad samjha jata hai agar yeh lambay rujhan ke baad hota hai. Is ki wajah yeh hai ke design se pehlay wali lambi become flushed light batati hai ke bail market standard control mein hain, test ke zahir honay standard usay mazeed ahem banata hai. Sorts Of Foreboding shadow Cover Example Puncturing wali line test Penetrating line design aik taizi se inversion test hai jo darkish cloud cowl test ke bar aks hai. Yeh is waqt bantaa hai poke aik lambi negative light ke baad aik lambi become flushed flame aati hai jo pichli candle ke nichale hissay se neechay khulti hai aur pichli candle ke wast factor ke oopar band hoti hai. Negative immersing design aik aur negative inversion test hai jo foreboding shadow cover test se milta jalta hai. Yeh is waqt bantaa hai hit aik lambi become flushed candle ke baad aik lambi negative candle aati hai jo pichli become flushed candle ko poori terhan lapait layte hai. -

#9 Collapse

Define Dark Cloud Cover Pattern: Dear friends Jab Bhi candlestick ki moment upward trend mein ho tu sabse upar pattern Hogi uske sath jo bhi candle down mein Banegi bullish pattern ki aur vah candles Hamen thoda sa market ko down Lekar aane ka Ishara Degi to vahan per Agar Ham starting point se apni trade ko sell msin open Karte Hain To Hamen Kafi Achcha resistance Mil Jata hai aur ham apni trade ko lagakar is se fayda hasil kar sakte hain Dark cloud pattern Ek Aisa pattern hai jo ki aap ko bahut jyada profit To Nahin data but agar aap Thodi Si Badi lot size lagakar take profit Lekar trade ko open karte hain to aapko profit Achcha Mil Jata Hai Kyunki Jab Bhi markets high level per hoti hai hai to Uske bad Jo candles down Mein Banti Hain vah Hamen bearish trend Mein Lekar Jaati Hain Jis per Agar Ham sell ki trade lagaen To Hamen Kafi Achcha fayda mil sakta hai.Explanation: Dark cloud cover pattern "Bearish Belt-Hold Line Pattern" aur "Bearish Meeting Line Pattern" se melta julta pattern hai, jo same bullish trend ko bearish trend me reverse kia jata hai. Dark cloud cover pattern two days candles par mushtamil pattern hai, jis me pehlee aik long real body wali bullish candle hote hai, jis k baad dosree aik long real body wali bearish candle banti hai. Pehli candle prices k uptrend ki nishan-dahi kartti hai, ye candle size aur formation me normal long real body wali bullish candle hotti hai. Lekin dosre din ki candle aik long real body wali bearish candle hotee hai, jo k open to pehle din ki candle se upper gap me hotti hai, lekin close bullish candle k centre ya darmeyyan se thora sa lower pe hotti hai.

Trading Points: Is dark cloud cover candlestick pattern ka opposite ke traf huma market ka chart ma piercing candlestick pattern dakhna ko mil jay ya piercing candlestick pattern huma market ka chart ma downtrend ke traf dakhna ko mil jay ga or ya piercing candlestick pattern bhi do candles sa mil kar banay ga or ya pattern market ma lower ke traf kar market ko uptrend ke traf reversal karna ka kam kara ga. Is pattern ka bannay sa phalay market sharply lower ke traf ja rahe ho ge or is pattern ke jo first candle ho ge wo ak long real body bearish ke candle ho ge or is ma market ke price high sa low ke traf jay ge or is piercing pattern ke jo second candle ho ge is ka bannay sa phamay ak gap ay ga or ya ak small gap ho ga or is pattern ke jo second candle banay ge wo ak reversal candlestick ho ge or ya market ko lower sa high ke traf reversal karna ka kam kara ge ya second candel is piercing pattern ke ak long real body bullish ke candle ho ge or ya huma market ka upward ke traf jana ka batay ge. Is pattern ma traders ko market ka bull ka pressure sa high ke traf jana ka signal mila ga or is pattern ma traders buy ke trade ko enter kara ga or ya buy ke trade is pattern ke first candle ka lower sa enter kara ga or is buy ke trade ka jo stop loss ho ga wo is pattern ke first candle ka lower ma place kara ga. THanks You

-

#10 Collapse

The Dark Cloud Cover candlestick chart pattern is a bearish reversal pattern that appears after an uptrend. It consists of two candles, the first one being a long white candle followed by a long black candle that opens above the previous day's high and closes below the middle of the previous day's white candle. Here's a breakdown of the key elements of this pattern: Bullish Trend: The Dark Cloud Cover pattern appears after an established bullish trend in the market. The uptrend is characterized by a series of long white candles that indicate buying pressure and bullish sentiment among investors. Long White Candle: The first candle in the pattern is a long white candle that represents a continuation of the uptrend. The long white candle shows that the buyers are in control of the market and pushing the price higher. Gap Up: The second candle opens above the previous day's high, creating a gap up. This gap up indicates that the buyers are still in control of the market, and the price is likely to continue rising. Long Black Candle: The second candle in the pattern is a long black candle that represents a reversal of the uptrend. The long black candle shows that the sellers are taking control of the market and pushing the price lower. Close Below Middle of White Candle: The long black candle closes below the middle of the previous day's white candle, indicating a significant shift in sentiment from bullish to bearish. The close below the middle of the white candle shows that the sellers are gaining strength and the buyers are losing momentum. Confirmation: Traders should look for confirmation of the Dark Cloud Cover pattern before making any trading decisions. This confirmation can come in the form of lower lows or a break below a support level. In summary, the Dark Cloud Cover candlestick chart pattern is a bearish reversal pattern that appears after an uptrend. The pattern consists of a long white candle followed by a long black candle that opens above the previous day's high and closes below the middle of the previous day's white candle. Traders should look for confirmation of the pattern before making any trading decisions."Dream bigger. Do bigger"

(mahroosh) :1f607:

-

#11 Collapse

Dark Cloud Cover Candlestick Chart Pattern in Forex

Assalam o alikum Dear friends and fellows Jahan forex market ki movement per different candle stick patterns create hoty hein orr market same patterns ko follow kerty huey movement kerti hey wahan dark cloud cover pattern bhi create hota hey jo bahot important pattern hey ky agar ham isko follow kerty huey forex market main trade enter kerty hein tou hamari open trade main profit hasil hony ky chances increase ho jaty hey

Dark Cloud Cover Pattern

Jab ak candle uptrend main close hoti hey lekin next candle jab open hoti hey tou woh downward create hona shoru ho jati hey orr jab tak downward movement kerty huey close hoti hey tou previous candle ky middle level cross ker chuki hoti hey then next candle bhi down trend ki taraf movement kerna shoru ker deti hey tou aesy main jo pattern create hota hey usko dark cloud cover chart pattern kehty hein

How to Trade with Dark Cloud Cover Pattern

Jab hamain kisi bhi pair main dark cloud cover pattern milta hey tou hamain pehly yeh ensure ker lena chaheyy ky dark cover cloud pattern complete ho chuka hey orr market ab continue downtrend main movement kerna shoru ker chuki hey tab hamain sell main trade enter kerna hoti hey jab first bullish candle ky bahd second bearish candle create ho chuki hoti hey tab next candle per hamain trade open kerna hoti hey woh bhi jab downward movement kerna shoru ker deti hey warna aesa bhi possible hota hey ky market uptrend main movement kerty huey just one candle downward create kerti hey usky bahd market dobara uptrend ko follow kerna shoru ker deti hey tou aesy time per hamain bara loss ho sakta hey Success

Rate of Dark Cloud Cover Pattern in Forex

Forex market kisi bhi time kisi bhi direciton main movement ker sakti hey kyun ky jab market technical movement ker rehi hoti hey tou koi bhi fundamental effect technical movement ko change ker sakta hey isliay koi bhi pattern itna zyada reliable nehi hota ky market 100 percent usi ky mutabiq movement kerti ho lekin technical analysis ky mutabiq patterns effective hoty hein isi terha dark cloud cover bhi ak effective candlestick chart pattern hey jis ko follow kerny per profit hasil kia ja sakta hey lekin hamain her trade soch samajh ker apny balance ky mutabiq open kerni chahiay orr jo bhi trade open kerain usko secure zarur kerna chahiay ky ham stop loss orr take profit ko use kerty huey apni her open ki jany wali trade ko secure ker sakty hein jis sy hamain profit ya limited loss hota hey orr account wash hony sy bhi bach jata hey

-

#12 Collapse

**Dark Cloud Cover Candlestick Chart Pattern**

Forex trading mein, candlestick chart patterns ko samajhna bohot zaroori hai kyun ke yeh market ke behavior aur price action ko samajhne mein madad karte hain. Aaj hum ek aise hi pattern ke bare mein baat karenge jisse "Dark Cloud Cover" kehte hain. Yeh pattern reversal signals provide karta hai aur traders isse use karte hain taake market ke trend ko identify kar sakein.

### Dark Cloud Cover Pattern Kya Hai?

Dark Cloud Cover ek bearish reversal pattern hai jo usually uptrend ke end par banta hai. Yeh pattern do candlesticks se mil kar banta hai. Pehla candlestick bullish hota hai jo uptrend ka continuation dikhata hai, lekin doosra candlestick bearish hota hai jo pehle candlestick ke body ke andar close hota hai aur yeh indication hota hai ke market ke bulls apni strength lose kar rahe hain aur bears market control mein aa rahe hain.

### Pattern Ki Pehchan

Is pattern ko pehchanna aasaan hai agar aap in points par dhyan dein:

1. **Uptrend:** Yeh pattern tab banta hai jab market mein uptrend ho.

2. **First Candle:** Pehli candle ek lambi bullish candle hoti hai jo uptrend continuation dikhati hai.

3. **Second Candle:** Doosri candle bearish hoti hai aur yeh pehle candle ke closing ke ooper open hoti hai lekin uske halfway point se neeche close hoti hai.

4. **Gap:** Doosri candle pehli candle ke closing price se ooper open hoti hai, lekin neeche close hoti hai.

### Pattern Ka Matlab

Jab yeh pattern banta hai toh yeh indication hota hai ke buyers ab interest lose kar rahe hain aur sellers market par control hasil kar rahe hain. Yeh uptrend ke end aur downtrend ke shuru hone ka signal ho sakta hai. Is pattern ke baad, market mein downtrend aane ke chances barh jate hain.

### Trading Strategy

Dark Cloud Cover pattern ko identify karne ke baad, traders usually yeh karte hain:

1. **Confirmation:** Sabse pehle confirmation zaroori hai. Confirmation ka matlab hai ke agli candle bhi bearish honi chahiye taake yeh pattern validate ho sake.

2. **Entry Point:** Jab confirmation mil jaye, toh traders short position ya sell trade enter karte hain.

3. **Stop Loss:** Stop loss ko previous high ke ooper set karte hain taake agar market wapas reverse ho jaye toh loss limit kiya ja sake.

4. **Take Profit:** Profit target ko nearest support level par set karte hain taake maximum profit gain ho sake.

### Conclusion

Dark Cloud Cover candlestick chart pattern ek effective tool hai jo traders ko market reversals ko predict karne mein madad deta hai. Is pattern ko samajhne aur sahi tarah se apply karne se, traders apni trading strategies ko enhance kar sakte hain aur zyada profit kama sakte hain. Hamesha yaad rakhein ke market analysis aur risk management strategies ka istimaal karke hi aap trading mein success hasil kar sakte hain. -

#13 Collapse

Dark cloud cover candlestick chart pattern

Dark cloud cover candlestick chart pattern ek bearish reversal pattern hai jo technical analysis mein use hota hai. Ye pattern usually uptrend ke baad banta hai aur market mein potential reversal ya selling pressure ka indication deta hai. Is pattern ka naam iski formation se aata hai, jo bilkul aise hota hai jaise ek dark cloud upar se neeche aata hai aur bullish trend ko cover kar leta hai.

Is pattern ki pehchan do candles se hoti hai. Pehli candle ek lambi bullish candle hoti hai, jo ke uptrend ka continuation dikhati hai. Dusri candle bearish hoti hai jo ke pehli candle ke body ke midpoint se neeche close hoti hai. Dusri candle pehli candle ke high se bhi upar open hoti hai, lekin phir neeche girti hai aur pehli candle ke body ke andar close hoti hai, lekin isse upar nahi.

Dark cloud cover pattern ko samajhne ke liye yeh zaroori hai ke trader pehli candle ka volume dekhein. Agar pehli candle ka volume zyada hai aur dusri candle ka volume bhi high hai, to ye confirmation deta hai ke market mein sellers enter ho gaye hain aur price neeche ja sakti hai. Is pattern ka matlab yeh hota hai ke buyers ne shuru mein control liya, lekin end mein sellers ne market ko control mein le liya.

Yeh pattern usually support aur resistance levels ke aas paas banta hai. Agar yeh pattern resistance level par banta hai, to iski significance aur bhi badh jati hai. Traders is pattern ko use karte hain bearish trades ke liye ya phir apne long positions ko close karne ke liye.

Trading strategy ke tor par, jab dark cloud cover pattern banta hai, to trader dusri candle ke close hone ka wait karte hain. Agar dusri candle pehli candle ke midpoint ke neeche close hoti hai, to yeh ek strong signal hota hai ke market mein reversal hone wala hai. Iske baad trader apni short positions open kar sakte hain aur stop loss pehli candle ke high ke upar set kar sakte hain.

Dark cloud cover pattern ko doosre indicators ke sath bhi use kiya ja sakta hai jaise ke RSI (Relative Strength Index) aur MACD (Moving Average Convergence Divergence). Agar yeh indicators bhi overbought condition dikhate hain aur dark cloud cover pattern banta hai, to yeh ek strong bearish signal hota hai.

In conclusion, dark cloud cover candlestick pattern ek important tool hai technical analysis mein, jo traders ko market ke reversal aur potential selling pressure ka indication deta hai. Is pattern ko effectively use karne ke liye, traders ko price action, volume aur doosre technical indicators ka analysis karna chahiye. -

#14 Collapse

Dark Cloud Cover ek bearish candlestick chart pattern hai jo Forex aur doosri financial markets mein istemal hota hai. Yeh pattern bullish trend ke baad aata hai aur trend reversal ka signal deta hai. Aayiye isko tafseel se samajhte hain:

Structure of Dark Cloud Cover:- First Candle: Pehli candle ek strong bullish (green or white) candle hoti hai, jo indicate karti hai ke buyers market mein dominate kar rahe hain.

- Second Candle: Dusri candle bearish (red or black) hoti hai jo pehli candle ke high se khulti hai aur pehli candle ke body ke midpoint se neeche close hoti hai.

- Trend Reversal: Yeh pattern bullish trend ke baad aata hai aur indicate karta hai ke market direction ab change hone wali hai.

- Gap Up Opening: Dusri candle ka open price pehli candle ke close price se upar hota hai, lekin uske baad price neeche girta hai.

- Closing Below Midpoint: Dusri candle pehli candle ke midpoint se neeche close hoti hai, jo indicate karta hai ke sellers ab dominate kar rahe hain.

- Market Sentiment: Pehli candle bullish sentiment ko dikhati hai lekin dusri candle market mein bearish sentiment ko reflect karti hai.

- Entry Point: Jab dusri candle pehli candle ke midpoint se neeche close hoti hai, toh yeh short selling ke liye ek entry signal ho sakta hai.

- Confirmation: Yeh pattern tabhi zyada reliable hota hai jab agli candles bhi bearish trend ko support karti hain.

Agar pehli candle 1.2000 pe open hoti hai aur 1.2100 pe close hoti hai, phir dusri candle 1.2150 pe open hoti hai lekin 1.2050 pe close hoti hai, toh yeh ek Dark Cloud Cover pattern hai. Iska matlab hai ke bullish trend ke baad ab market mein bearish trend start ho sakta hai.

Conclusion:

Dark Cloud Cover ek important candlestick pattern hai jo trend reversal ko indicate karta hai. Traders isko dekhar apne trading decisions ko adjust kar sakte hain aur iske mutabiq apni positions ko manage kar sakte hain.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

**PZ Pivot Points Indicator: Ek Mukammal Guide**

PZ Pivot Points Indicator ek popular technical analysis tool hai jo traders ko market ke potential support aur resistance levels identify karne mein madad deta hai. Yeh indicator pivot points, support, aur resistance levels calculate karta hai jo trading decisions mein important role play karte hain. Yeh guide PZ Pivot Points Indicator ke key aspects ko cover karegi:

1. **PZ Pivot Points Kya Hai?**

Pivot points ek technical indicator hain jo market ke trend aur potential reversal points ko identify karte hain. PZ Pivot Points ek enhanced version hai jo pivot points ke calculation ko simplify aur automate karta hai, aur traders ko accurate levels provide karta hai.

2. **Pivot Point Calculation:**

Pivot point ko calculate karne ke liye, previous trading session ke high, low, aur close prices ka use kiya jata hai. Formula hai:

\[

\text{Pivot Point} = \frac{\text{High} + \text{Low} + \text{Close}}{3}

\]

Is formula se calculate kiye gaye pivot point ke aas-paas support aur resistance levels derive kiye jate hain.

3. **Support aur Resistance Levels:**

- **Support Levels:** Yeh levels woh points hain jahan price downtrend ke doran ruk sakti hai ya reverse ho sakti hai. PZ Pivot Points indicator typically do support levels calculate karta hai: Support 1 (S1) aur Support 2 (S2).

- **Resistance Levels:** Yeh levels woh points hain jahan price uptrend ke doran ruk sakti hai ya reverse ho sakti hai. Indicator do resistance levels provide karta hai: Resistance 1 (R1) aur Resistance 2 (R2).

4. **Use of Pivot Points:**

- **Trading Signals:** Agar price pivot point ke upar trade karti hai, to yeh bullish signal hota hai, aur agar price pivot point ke neeche hoti hai, to bearish signal hota hai.

- **Market Trends:** Pivot points market ke trend aur momentum ko assess karne mein madad karte hain. Support aur resistance levels traders ko entry aur exit points determine karne mein madad deti hain.

5. **Advantages of PZ Pivot Points:**

- **Automated Calculation:** PZ Pivot Points Indicator automatically pivot points aur support/resistance levels calculate karta hai, jo manual calculations se bachata hai.

- **Customization:** Indicator ko customize kiya ja sakta hai jisme different time frames aur settings ko adjust kiya ja sakta hai.

6. **Limitations:**

- **Static Levels:** Pivot points ek fixed set of levels provide karte hain jo market conditions ke sath change nahi hoti.

- **Lagging Indicator:** Pivot points past price data par based hote hain, jo market trends ko timely reflect nahi karte.

PZ Pivot Points Indicator ek useful tool hai jo market ke key levels ko identify karne aur trading decisions ko inform karne mein madad karta hai. Iska accurate calculation aur automated features traders ke liye trading strategy ko enhance karte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:02 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим