Symmetrical Triangle Chart Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Symmetrical Triangle Chart Pattern Aik matawazi masalas aik chart ka namona hai jo is waqt bantaa hai jab do converging trained lines kisi asasay ki qeemat mein bulandiyon aur kamiyon ki aik series ko judte hain. patteren ko"symmetrical" kaha jata hai kyunkay do trained linen aik dosray se taqreeban masawi hain, aik masalas ki shakal banati hain . Tajir aur tajzia car aksar sadool masalas ko tasalsul ke patteren ke tor par dekhte hain, jis ka matlab hai ke is se pichlle rujhan ke tasalsul ka imkaan hai. misaal ke tor par, agar up trained ke baad masalas bantaa hai, to yeh is baat ki nishandahi kar sakta hai ke qeemat ziyada jari rehne ka imkaan hai. is ke bar aks, agar neechay ke rujhan ke baad masalas bantaa hai, to yeh tajweez kar sakta hai ke qeemat kam honay ka imkaan hai . Sadool masalas patteren ko tijarat karne ke liye, tajir aksar break out talaash karte hain. aik break out is waqt hota hai jab qeemat trained linon mein se kisi aik se oopar ya neechay jati hai, jo rujhan ki simt mein mumkina tabdeeli ki nishandahi karti hai. agar qeemat oopri trained line ke oopar toot jati hai to tajir aik lambi position mein daakhil ho satke hain, ya agar qeemat nichli trained line se neechay nikal jaye to mukhtasir position mein daakhil ho satke hain . Yeh note karna zaroori hai ke tamam sadool masalas break out ka baais nahi bantay, aur kuch ghalat break out ka baais ban satke hain, jis ke baad mukhalif simt mein ulat phair ho sakti hai. kisi bhi tijarti hikmat e amli ki terhan, khatray ke intizam ki techniques ka istemaal karna aur tijarat ke intizam ke liye aik mansoobah banana zaroori hai agar patteren tawaqqa ke mutabiq nahi chalta hai . Identification of Symmetrical Triangle Chart Pattern Hum aahang masalas chart patteren aik takneeki tajzia ka aala hai jo maliyati mandiyon mein mumkina rujhan ke tasalsul ya rujhan ke ulat jane ki shanakht ke liye istemaal hota hai . Pattern is waqt bantaa hai jab kisi asasay ki qeemat onche neechi aur nichli oonchaiyon ki sakht had mein agay barh rahi hoti hai, aik masalas ki shakal banati hai. patteren se pata chalta hai ke market ghair faisla kin hai, khredar aur baichnay walay dono control ke liye jad-o-jehad kar rahay hain . Sadool masalas patteren ki shanakht ka maqsad break out ka andaza lagana hai, jo qeemat mein aik ahem iqdaam hai jo is waqt hota hai jab qeemat patteren ki trained lines ke oopar ya neechay toot jati hai. tajir aur sarmaya car is patteren ko break out ki mumkina simt ki bunyaad par tijarti faislay karne ke liye istemaal karte hain, aaya yeh taizi ya mandi ka hoga, aur is ke mutabiq –apne khatray ka intizam kaisay karen . Pattern ki oopri trained line ke oopar break out taizi ka ishara deta hai aur mumkina kharidari ke mauqa ki nishandahi kar sakta hai. is ke bar aks, patteren ki nichli trained line ke neechay break out aik mandi ka ishara deta hai aur mumkina farokht ke mauqa ki nishandahi kar sakta hai . Majmoi tor par, hum aahang masalas chart patteren ka maqsad mumkina tijarti mawaqay ki nishandahi karna aur maliyati mandiyon mein bakhabar faislay karte hue taajiron aur sarmaya karon ko –apne khatray ka intizam karne mein madad karna hai . -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Symmetrical Triangle Chart Pattern

Symmetrical triangle aik aham chart pattern hote hain kyun ke inhen asani se identity kia ja sakta hai, inka successful hone k chances zyada hoti hai, aur inhen mukhtalif tareeqon se trade kiya ja sakta hai. Symmetrical triangle ke patterns do aikat trend lines ke zariye banate hain jo symmetrical ke teen sire bana dete hain.

Symmetrical Triangle Pattern ek neutral chart pattern hai jo tab banta hai jab kisi asset ki keemat ek tang range ke andar hili mili hoti hai, do milte julte trendlines ko banate hue. Ye pattern ek triangle shape banata hai, jismein upper trendline resistance ka kaam karti hai aur lower trendline support ka. Ek symmetrical triangle ek market consolidation period ko darust karta hai jahan buyers aur sellers ek barabar ke halat mein hote hain. Jab keemat triangle ke andar rehti hai, to trendlines ke darmiyan ka fark kam hota hai, jo ek qareebi breakout ki taraf ishara karta hai.

Symmetrical triangle ke milti julti trendlines ka aik kareebi slope hona chahiye, aur pattern aam tor par kai hafton ya maheenon tak ka durust hota hai jo kisi maujooda uptrend ya downtrend ke doran banta hai. Pattern ki tasdiq tab hoti hai jab keemat triangle se bahar nikalti hai aur trading volume high hoti hai.

Traders symmetrical triangles ka istemal potential trading opportunities ko pehchanne ke liye karte hain, jahan pattern ek saaf dakhli aur nikli point faraham karta hai. Symmetrical triangle se breakout aksar kisi bhi rukh mein ahem keemat ki harkat ka sabab ban sakta hai, jo ke stocks, forex, cryptocurrencies, aur commodities jaise mukhtalif assey classes ke liye traders ke liye aik ahem tool banata hai.

Key Points:-

- [B] [FONT=Times New Roman] Symmetrical triangle pattern do aikat trend lines ki taraf milti hai jo tikon ke shakal bana deti hai. Traders isay entry aur exit points pehchane ke liye istemal kar sakte hain.

- [B] [FONT=Times New Roman] Symmetrical triangle ek neutral pattern hoti hai jismein koi horizontal line nahi hoti, iske baraks, bullish ascending aur bearish descending triangles mein hoti hai.

- [B] [FONT=Times New Roman] Symmetrical apni explaination ko tasdeeq karne ke liye, bohat se traders samanli triangles ko doosre technical analysis tools ke sath jorte hain.

Symmetrical Triangle

Symmetrical triangle pattern mein pattern ke border par do aikat trend lines hoti hain. Tikon jab banti hai to upar ki taraf girte hue line se milti hai aur neeche ki taraf chadhte hue line se milti hai. Symmetrical triangle banane ke liye kam se kam char points ki zarurat hoti hai - do top line par aur do bottom line par.

Isay aksar aik phansta hua spring ke tor par bhi kaha jata hai, Symmetrical triangle apex ke qareeb aati hai, jis se traders ka dilchaspi kam ho jati hai. Is price compression ke baad traders ke interest wapas aane se tezi se moves hone ka sabab ban sakta hai.

Iske bawajood ke Symmetrical triangle ko neutral pattern ke tor par classify kiya jata hai, ye uptrend mein bullish aur downtrend mein bearish hota hai, kyun ke asal trend jari rahega is se umumeen hota hai. Pattern tabhi confirm hota hai jab ek breakout hota hai. Is se pehle, pattern sirf aik potential samanli triangle ke tor par consider kiya jata hai.

Symmetrical triangle pattern illustration

Symmetrical triangle k mukhalif mein ascending aur descending triangles apne pattern border par aik horizontal line ke sath characterize hote hain, jahan price us line ke through move hone par breakout hota hai. Ascending triangle mein aik upper horizontal line hoti hai aur aik rising lower trend line hoti hai jo higher lows ko jorti hai, kyun ke buyers price weakness ke doran zyada aggressive ho jate hain. Jabke descending triangle mein aik bottom horizontal line hoti hai aur aik descending trend line hoti hai jo lower highs ko chhuti hai, jo ke seller ki aggression ko zahir karti hai, jo ke prices ko neeche daba deti hai.

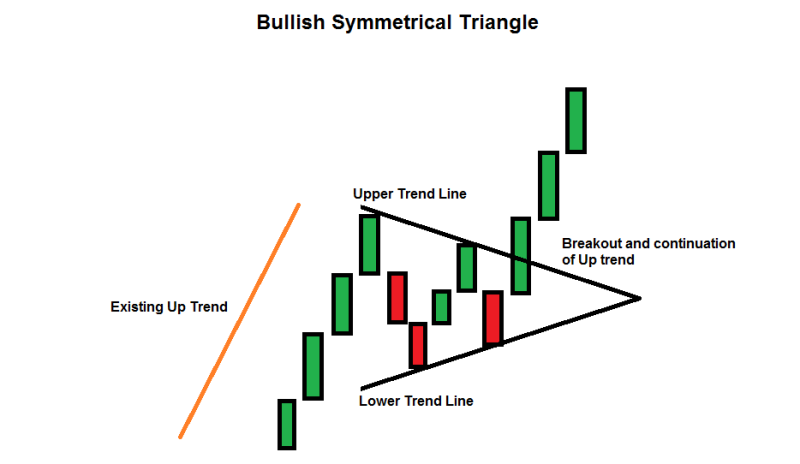

Bullish Symmetrical Triangle

Aik bullish Symmetrical triangle ke formation se pehle asal uptrend hoti hai. Top aur bottom trend lines draw karne ke liye do points ko pehchan kar pattern banaya jata hai. Jab price top line ke upar move karta hai, to ek breakout trigger hota hai, aur breakout line ke upar ek daily close ke sath confirm hota hai. Jab tak breakout nahi hota, pattern ek confirm Symmetrical triangle nahi hota, kyun ke hamesha kisi aur pattern mein tabdeel ho sakta hai.

Bearish Symmetrical Triangle

Aik bearish Symmetrical triangle ke formation se pehle asal downtrend hoti hai. Top aur bottom trend lines draw karne ke liye do points ko pehchan kar pattern banaya jata hai. Jab price bottom line ke neeche move karta hai, to ek breakout trigger hota hai, aur breakout line ke upar ek daily close ke sath confirm hota hai. Jab tak breakout nahi hota, pattern ek confirm Symmetrical triangle nahi hota, kyun ke hamesha kisi aur pattern mein tabdeel ho sakta hai.

Trading

Yahan hum Symmetrical triangle trading strategy banane ke teen manaziron - bear trend continuation, bull trend continuation, aur reversal - ko analyze karke isay kaise create kiya jaye, is bare mein baat karenge. Trading strategy ek entry trigger, aik shuruati protective stop, aur aik target ko shamil karegi, jo pattern structure se measuring objective calculate kar ke tayyar hota hai. Isay bottom aur top lines ke darmiyan ki vertical doori ko nap kar ke hasil karenge, aur phir breakout level se us price range ko jama ya ghatana hota hai.

Strategies

Kuch aam strategies jo traders forex trading mein symmetrical triangle pattern ka istemal karte hain, unmein shaamil hain:- Breakout Trading:

Traders aksar symmetrical triangle pattern se breakout ka intezar karte hain taake kisi potential trend continuation ya reversal ko tasdiq kiya ja sake.

Ek bullish breakout hota hai jab keemat upper trendline se bahar nikalti hai, jo kisi potential uptrend ki taraf ishara karta hai.

Ek bearish breakout tab hota hai jab keemat lower trendline se neeche nikalti hai, jo kisi potential downtrend ki taraf ishara karta hai. - Measuring Price Targets:

Traders symmetrical triangle pattern ke sabse wide point par uski unchai ko napa lete hain aur is measurement ka istemal potential price targets tay karte hain.

Triangle ka sabse uncha aur sabse neecha point ke darmiyan faasla keemat ke breakout ke baad keemat mein kis had tak ja sakti hai, yeh ek andaza faraham kar sakta hai. - Confirmation with Volume:

Traders breakout ki tasdiq ke liye trading volume mein izafa dekhte hain.

Aik breakout jo zyada volume ke sath hota hai, aksar kisi potential trend continuation ya reversal ka mazboot signal ke taur par dekha jata hai. - Risk Management:

Munasib stop-loss orders tay karna zaroori hai taake symmetrical triangle patterns trading ke doran khatra eftekhar kiya ja sake.

Traders aksar bullish breakout ke liye breakout point ke neeche aur bearish breakout ke liye breakout point ke upar stop-loss orders lagate hain. - Combining with Other Indicators:

Traders technical indicators jaise ke moving averages, RSI, ya MACD ka istemal karte hain taake symmetrical triangle pattern ke dwara diye gaye breakout signal ko tasdiq kiya ja sake.

Kai indicators ka istemal karke traders apne faislon ko behtar taur par samajh sakte hain.

In strategies ka istemal karke, traders symmetrical triangle patterns ko forex trading mein karobari taur par istemal kar sakte hain, potential breakouts ka faida utha sakte hain, aur risk ko manage karke apne karobari performance ko behtar bana sakte hain.

Symmetrical Triangle Aur Pennant Ke Darmiyan Farq

Is pattern ko effectively trade karne ke liye, traders ko Symmetrical triangle chart pattern aur pennant chart pattern ke darmiyan farq samjhna zaroori hai. Bawajood unki visual similarity ke, aik Symmetrical triangle aik pennant se bara hota hai, aur aksar teen hafte se zyada time leta hai banane mein. Jabke pennant kam waqt tak hoti hai, teen hafte tak develop hone ke liye. Is ke alawa, pennant aik sharp rally ya decline ke pesh-e-nazar hoti hai, jabke samanli triangle bas ek trend ki zaroorat rakhta hai, aur zaroori nahi ke ye aggressive ho.

Dono patterns trend continuation category mein aati hain, lekin Symmetrical triangle potential reversal ko bhi indicate kar sakta hai. Symmetrical triangle triangle ki shakal ko target tayyar karne ke liye istemal karta hai, jabke pennant pattern ke formation se pehle hone wale sharp trend ko napta hai.

Limitations

Symmetrical triangle pattern traders ke liye faydemand ho sakta hai, lekin iske kuch limitations hain jinhen traders ko maloom hona zaroori hai. Pattern ko sahi context mein istemal karna - aur doosre technical analysis tools ke sath milakar - ziada maloomati trading faislay lene mein ahem hai.- False Breakouts ko Identify Karen: Breakout ke baad kya hota hai, ismein pattern ke formation ke pehle trend ki quality ka bhi kafi ta'alluq hota hai. Aik waze aur mazboot trend jo improve horahi volume aur sath mein mowjood momentum ke sath hota hai, chahe to breakout ke baad trend ko jari rahe jane ki ihtimal ko barha deta hai. Trend indicators jaise ke moving averages trend ki quality ka andaza lagane mein madadgar ho sakte hain aur sahi trend lines banane mein madadgar hote hain.

- Multiple Time frames ka Istemal: Multiple time frame analysis istemal karne se madad milti hai. Agar mahina war, hafta war, aur din war charts sab ek hi taraf ja rahe hain, aur din war aapki mukhlis time frame hai, to asal price ke jaisa jari rehne ke imkanat ziada hote hain. Higher time frame charts lower time frames ko inform karte hain.

- Study Chart History: Apni salahiyat ko behtar banane ke liye samanli triangle patterns ko pehchanne aur ta'atilat ko pehchanne mein madad milti hai. Charts pe price history ka mutalia karein. Jab bhi mile, pattern draw karein, aur dekhein ke isse pehle aur baad mein kya hua.

- Use in Choppy Markets: Symmetrical triangle patterns sirf clearly trending markets mein istemal karein. Chahe aap kitne bhi mahir trader hon, choppy markets challenging hoti hain. Inse bachne ke liye inka istemal na karein.

Symmetrical Triangle Characteristics

Symmetrical triangle pattern ke characteristics forex trading mein kuch is tarah hote hain:- Formation:

Symmetrical triangle pattern do milte julte trendlines se banta hai, jismein ek series of lower highs (resistance) aur doosra series of higher lows (support) ko darust karta hai.

Yeh trendlines aik dusre ki taraf dheere dheere nazdik aate hain, jiski wajah se chart par aik triangle shape ban jata hai. - Neutral Nature:

Symmetrical triangle pattern buyers aur sellers ke darmiyan aik temporary equilibrium ko darust karta hai, jismein keemat ki harkat ka ek rukh hota hai.

Yeh aik consolidation period ko darust karta hai jahan na to buyers aur na hi sellers ko keemat ki direction par waziha control hota hai. - Price Movements:

Symmetrical triangle pattern ke andar keemat ki harkat jaise ke lateral taur par hoti hai, jo ke buyers ya sellers ka koi zahir control na hone ki wajah se hota hai.

Is phase of indecision mein traders agle move ko besabri se intezar karte hain. - Pre-existing Trend:

Mukhtalif trend symmetrical triangle ke banne se pehle aik background ke taur par kaam karta hai, jo ke agle breakout ke potential direction ke bare mein subtile hints faraham karta hai.

Symmetrical triangle pattern ko aksar ek continuation pattern ke taur par dekha jata hai, jo ke prevailing trend ko jari rakhta hai. - Breakout Anticipation:

Traders triangle ke andar keemat ki behavior ko nazdeek se nazar andaz karte hain, market sentiment ke signs ke liye dekhte hain.

Breakout waqt ek ahem mauqa faraham karta hai ke agle keemat ki harkat ka faida uthaya jaye. - Trading Strategy:

Aik acha executed trading strategy symmetrical triangles ke aas paas breakouts ko naapne ke tareeqon par mushtamil hoti hai taki pattern ke borders se nikalne ke baad potential target levels ka andaza lagaya ja sake.

Traders triangle ke shuru mein upper aur lower trendlines ke darmiyan vertical faasla ka istemal karte hain take price move ke potential magnitude ke bare mein maloomat hasil ki ja sake.

Symmetrical triangle pattern forex trading mein do milte julte trendlines, neutral nature jo market equilibrium ko darust karta hai, lateral price movements, aur breakout ki intezar ki zahmati harkat ko darust karta hai.

Conclusion

Symmetrical triangle pattern ek mashhoor technical analysis tool hai jise forex traders future price movements ka andaza lagane ke liye istemal kar sakte hain. Ye pattern waze entry aur exit points faraham karta hai, aur traders ko aik faide mand position qaim karne mein madadgar ho sakta hai. Lekin is pattern ke bhi kuch limitations hain, jaise galat breakouts aur subjectivity, aur ye sab market ki conditions mein acha kaam nahi kar sakta. Jaise ke kisi bhi technical analysis tool, symmetrical triangle pattern ko doosre indicators ke sath istemal karna ahem hai. Symmetrical triangle pattern ko sahi tareeqe se istemal karke, aap soch samajh kar trading faislay kar sakte hain - aur volatile forex markets mein munafa kama sakte hain.

- Mentions 0

-

سا0 like

-

#4 Collapse

Symmetrical triangle chart pattern forex trading mein ek technical analysis tool hai jo price action ke dauran banta hai. Is pattern ka formation tab hota hai jab market mein higher lows aur lower highs ka trend banta hai, jo ek converging triangle shape create karta hai.

Key Features:

Formation: Is pattern ke do trendlines hote hain—ek upward sloping (support line) aur ek downward sloping (resistance line)—jo ek point par converge hote hain.

Breakout: Jab price in trendlines ko todti hai, to ek strong movement hoti hai. Agar price upward breakout karta hai to bullish signal hota hai, aur agar downward breakout hota hai to bearish signal hota hai.

Volume: Volume ka analysis bhi zaroori hai. Breakout ke waqt agar volume high hai, to wo signal strong hota hai.

Trading Strategy:

Entry: Breakout ke baad entry karna.

Stop Loss: Pattern ke opposite side par stop loss lagana.

Target: Triangle ke height ke barabar target set karna.

Ye pattern market ke indecision aur potential direction reversal ko samajhne mein madad karta hai.

Symmetrical Triangle Pattern Ki Mazeed Tafseel:

1. Formation Process:

Initial Price Movement: Price pehle ek strong trend mein hota hai (bullish ya bearish).

Consolidation: Uske baad price ek range mein trade karne lagta hai, jahan higher lows aur lower highs bante hain.

Convergence: Yeh do trendlines ek point par milte hain, jo ek symmetrical triangle ka formation karti hai.

2. Pattern Duration:

Yeh pattern usually short to medium-term mein develop hota hai, kuch din se lekar kuch hafton tak.

3. Breakout ki Pehchan:

Bullish Breakout: Agar price upper trendline ko todti hai, to yeh bullish breakout hai. Is par aap buying position le sakte hain.

Bearish Breakout: Agar price lower trendline ko todti hai, to yeh bearish breakout hai. Is par aap selling position le sakte hain.

4. Volume Analysis:

Breakout ke waqt agar volume significant hai, to isse confirm hota hai ke movement zyada reliable hai.

Volume ke na hone par, breakout ko fakeout hone ka khatra hota hai.

5. Profit Target:

Profit target ke liye, triangle ki height ko measure karke use breakout point par add ya subtract karte hain.

Is method se aap potential target points identify kar sakte hain.

6. Risk Management:

Stop loss ko breakout point se thoda door rakhna chahiye, taake aap market ke noise se bach sakein.

7. Market Conditions:

Symmetrical triangle pattern market ke indecision ko darshata hai. Agar market zyada volatile ya uncertain hai, to yeh pattern zyada aata hai.

Yeh pattern ek effective trading strategy ka hissa ho sakta hai agar aap iski pehchan aur risk management ko achhe se samjhein. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

What is Symmetrical triangle pattern

Symmetrical Triangle Pattern ek neutral chart pattern hai jo tab banta hai jab kisi asset ki keemat ek tang range ke andar hili mili hoti hai, do milte julte trendlines ko banate hue. Ye pattern ek triangle shape banata hai, jismein upper trendline resistance ka kaam karti hai aur lower trendline support ka. Ek symmetrical triangle ek market consolidation period ko darust karta hai jahan buyers aur sellers ek barabar ke halat mein hote hain. Jab keemat triangle ke andar rehti hai, to trendlines ke darmiyan ka fark kam hota hai, jo ek qareebi breakout ki taraf ishara karta hai.Symmetrical triangle ke milti julti trendlines ka aik kareebi slope hona chahiye, aur pattern aam tor par kai hafton ya maheenon tak ka durust hota hai jo kisi maujooda uptrend ya downtrend ke doran banta hai. Pattern ki tasdiq tab hoti hai jab keemat triangle se bahar nikalti hai aur trading volume high hoti hai.Traders symmetrical triangles ka istemal potential trading opportunities ko pehchanne ke liye karte hain, jahan pattern ek saaf dakhli aur nikli point faraham karta hai. Symmetrical triangle se breakout aksar kisi bhi rukh mein ahem keemat ki harkat ka sabab ban sakta hai, jo ke stocks, forex, cryptocurrencies, aur commodities jaise mukhtalif assey classes ke liye traders ke liye aik ahem tool banata hai.

Bullish Symmetrical Triangle

Aik bullish Symmetrical triangle ke formation se pehle asal uptrend hoti hai. Top aur bottom trend lines draw karne ke liye do points ko pehchan kar pattern banaya jata hai. Jab price top line ke upar move karta hai, to ek breakout trigger hota hai, aur breakout line ke upar ek daily close ke sath confirm hota hai. Jab tak breakout nahi hota, pattern ek confirm Symmetrical triangle nahi hota, kyun ke hamesha kisi aur pattern mein tabdeel ho sakta hai.

Bullish Symmetrical Triangle

Bearish Symmetrical Triangle

Aik bearish Symmetrical triangle ke formation se pehle asal downtrend hoti hai. Top aur bottom trend lines draw karne ke liye do points ko pehchan kar pattern banaya jata hai. Jab price bottom line ke neeche move karta hai, to ek breakout trigger hota hai, aur breakout line ke upar ek daily close ke sath confirm hota hai. Jab tak breakout nahi hota, pattern ek confirm Symmetrical triangle nahi hota, kyun ke hamesha kisi aur pattern mein tabdeel ho sakta hai.

Treading strategies

Traders aksar symmetrical triangle pattern se breakout ka intezar karte hain taake kisi potential trend continuation ya reversal ko tasdiq kiya ja sake.

Ek bullish breakout hota hai jab keemat upper trendline se bahar nikalti hai, jo kisi potential uptrend ki taraf ishara karta hai.Ek bearish breakout tab hota hai jab keemat lower trendline se neeche nikalti hai, jo kisi potential downtrend ki taraf ishara karta hai.

Traders symmetrical triangle pattern ke sabse wide point par uski unchai ko napa lete hain aur is measurement ka istemal potential price targets tay karte hain.Triangle ka sabse uncha aur sabse neecha point ke darmiyan faasla keemat ke breakout ke baad keemat mein kis had tak ja sakti hai, yeh ek andaza faraham kar sakta hai.Traders breakout ki tasdiq ke liye trading volume mein izafa dekhte hain.

Aik breakout jo zyada volume ke sath hota hai, aksar kisi potential trend continuation ya reversal ka mazboot signal ke taur par dekha jata hai.Munasib stop-loss orders tay karna zaroori hai taake symmetrical triangle patterns trading ke doran khatra eftekhar kiya ja sake.Traders aksar bullish breakout ke liye breakout point ke neeche aur bearish breakout ke liye breakout point ke upar stop-loss orders lagate hain.Traders technical indicators jaise ke moving averages, RSI, ya MACD ka istemal karte hain taake symmetrical triangle pattern ke dwara diye gaye breakout signal ko tasdiq kiya ja sake.Kai indicators ka istemal karke traders apne faislon ko behtar taur par samajh sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:21 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим