What is bulish kicker pattern??

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

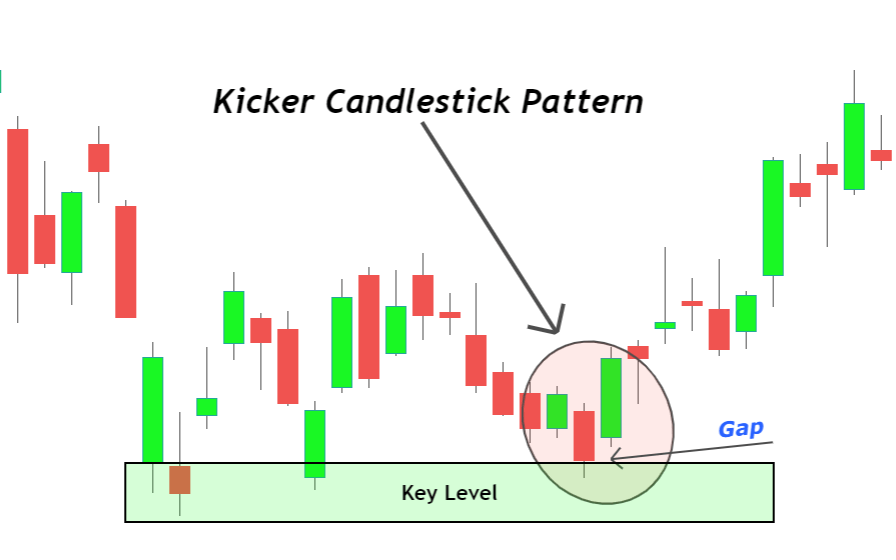

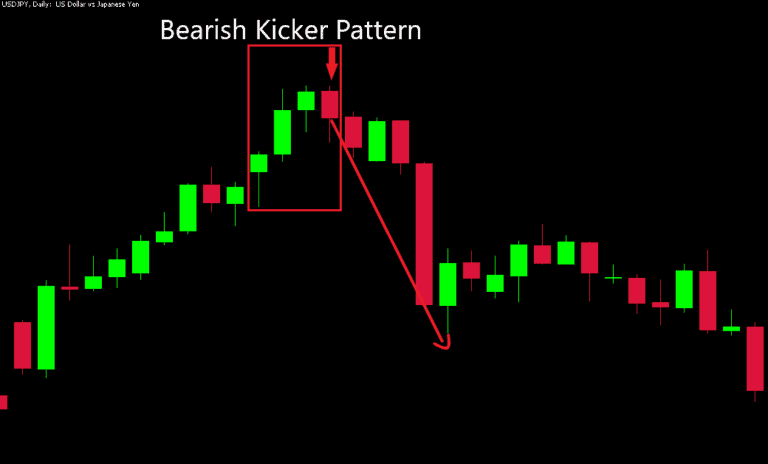

What is kicker pattern? kukkar patteren security ka price charting patteren hota hai jis ki khasusiyat is ki do baar candle stuck ki allag allag tashkeel ki muddat ke douran qeemat mein taizi se tabdeeli se hoti hai. keekar patteren takneeki tajzia ki duniya mein numaya hain kyunkay woh asason ki qeemat ki passion goi ki simt mein tabdeelion ke liye pishin goi ke tor par kaam karte hain. kukkar ke patteren bohat ziyada barh jatay hain jab woh ziyada farokht shuda aur ziyada kharidi hui marketon mein hotay hain. kukkar patteren ka assar is baat ki nishandahi karta hai ke maliyati market ke barray khilari security ke baray mein –apne khayalat ko tabdeel ya tabdeel kar rahay hain. ziyada tar mamlaat mein, maliyati market ke barray khiladion ke khayalat baaz khabron ke waqeat ya maloomat ke ajra se mutasir hotay hain. misaal ke tor par, agar koi si e o khulay aam mutanazia siyasi aqaed ka izhaar karta hai, to sarmaya car bunyadi stock ko beech kar ya khareed kar sakht rad-e-amal ka izhaar kar satke hain. do bunyadi kukkar patteren jo aaj maliyati mandiyon mein numaya hain woh" blush kukkar patteren" aur" bearish kukkar patteren" ke naam se jane jatay hain. kukkar patteren ko sab se ziyada qabil aetmaad ulat patteren samjha jata hai aur aam tor par company ke bunyadi usoolon mein dramayi tabdeeli ki nishandahi karte hain. kukkar patteren aik ulatnay wala patteren hai, aur aik gape patteren se mukhtalif hai, jo oopar ya neechay ke farq ko zahir karta hai aur trained mein rehta hai. patteren aik jaisay nazar atay hain, lekin har aik mukhtalif cheez ki nishandahi karta hai . How the kicker pattern works? kukkar patteren ka mushahida karne walay taajiron ke liye, aisa lagta hai ke qeemat bohat taizi se barh gayi hai, aur woh wapsi ka intzaar kar satke hain. taham, woh tajir –apne aap ko yeh khwahish mehsoos kar satke hain ke woh is position mein daakhil hotay jab unhon ne asal mein kukkar patteren ki nishandahi ki. agarchay kukkar patteren mazboot tareen taizi ya mandi ke jazbaat ke isharay mein se aik hai, patteren nayaab hai. ziyada tar pesha war tajir kisi nah kisi simt mein taizi se radd amal zahir nahi karte. taham, agar aur jab koi kukkar patteren khud ko paish karta hai, to money manager fori tawajah dete hain. kukkar patteren takneeki tajzia karon ke liye dastyab sab se taaqatwar signals mein se aik hain. is ki mutabqat is waqt ziyada hoti hai jab yeh ziyada kharidi hui ya ziyada farokht shuda market mein hoti hai. patteren ke peechay do mom batian numaya ahmiyat rakhti hain. pehli mom batii khulti hai aur mojooda rujhan ki simt chalti hai aur doosri mom batii pichlle din ki terhan khulti hai ( aik khalaa kholta hai ) aur phir pichlle din ki mom batii ke mukhalif simt mein harkat karta hai. bohat se tijarti plate forms par candle stick bodies ke rang mukhalif hotay hain, jo sarmaya karon ke jazbaat mein dramayi tabdeelion ka rangeen display banatay hain. kyunkay kukkar patteren sarmaya karon ke jazbaat mein numaya tabdeelion ke baad hi runuma hotay hain. isharay ka aksar market psycology ya ravayye ki maalyaat ke deegar iqdamaat ke sath mutalea kya jata hai . Bulish kicker pattern: aik taizi keekar patteren ishara karta hai ke stock ki qeemat barh sakti hai. is terhan ki tarteeb ko zail mein dekha ja sakta hai : jaisa ke dekhaya gaya hai, blush kukkar patteren aik siyah ( bearish ) candle stuck se shuru hota hai, is ke baad aik safaid ( blush ) candle stuck jo black candle stuck ke oopar khulti hai, oopar ki taraf aik bara khalaa peda karti hai. taajiron ke darmiyan umomi ittafaq raye yeh hai ke blush kukkar patteren takneeki tajzia mein sab se ziyada taaqatwar aur ba asar tools mein se aik hai. blush kukkar patteren ka aik manfi pehlu yeh hai ke yeh intehai nayaab hain aur sirf intehai allag thalag halaat aur waqeat mein hotay hain . Bearish kicker pattern: taizi ke patteren ke bar aks, bearish kukkar patteren is baat ki nishandahi karta hai ke stock ki qeemat gir sakti hai. aisa intizam jaisa ke dekhaya gaya hai, bearish kukkar patteren aik safaid ( blush ) candle se shuru hota hai jis ke baad aik kaali ( bearish ) candle hoti hai jo safaid candle ke neechay khulti hai, jis se neechay ki taraf aik bara khalaa peda hota hai. bearish kukkar patteren sarmaya karon ke jazbaat mein tabdeeli ki hungami soorat e haal par zor deta hai . Kicker pattern charting: tijarat doosri baar ke ekhtataam par ya mutabadil tor par agli baar ke khilnay par ki jati hai. itni mazboot tabdeeli ke sath hum farz karte hain ke patteren ke baad agli baar bhi mazboot hogi, aur doosri mom batii ki simt mein. is qisam ke patteren par kisi qisam ki tasdeeq ka intzaar karne se faida se ziyada nuqsaan honay ka imkaan hai kyunkay qeemat aap se daur honay ka imkaan hai. taizi se haasil karen aur qeemat aap ko taizi se raqam mein le jaye gi. agar qeemat doosri mom batii ke tor par aik hi simt mein muntaqil karne ke liye jari nahi hai, to bahar nikleen ( agar trading riwayati marketon ). doosri mom batii ke darmiyan mein aik stap nuqsaan rakha ja sakta hai, aur qeemat aap ke haq mein bherne par munafe ko muntaqil kya ja sakta hai. kyunkay yeh patteren mukammal ulat phair ka baais ban sakta hai qeemat ka koi hadaf nahi hai, is liye jab raftaar kam ho jaye to bahar nikleen aur dosray mawaqay talaash karen. bearish patteren ke liye, qeemat oopar ke rujhan mein hai, do baar patteren ki pehli baar aik up baar hai ( safaid : band khulay se ziyada hain ). patteren ki doosri baar aik mazboot neechay baar hai ( siyah : band khulay se neechay hai ). yeh pehli mom batii ki khuli taraf ya neechay ( gape neechay ) khilta hai. bunyadi tor par doosri baar ko jazbaat mein bohat mazboot tabdeeli dikhani chahiye, jahan baichnay walon ki taraf se koi hichkichahat nah ho. taizi ke patteren ke liye, qeemat neechay ke rujhan mein hai, patteren ki pehli baar neechay ki baar hai. patteren ki doosri baar aik mazboot up baar hai. yeh pehli mom batii ke khilnay par ya is ke oopar khilta hai. dosra baar jazbaat mein aik bohat mazboot tabdeeli ko zahir karta hai, jahan kharidaron ki taraf se koi hichkichahat nahi hoti hai. yeh namoonay aam tor par rozana, hafta waar ya mahana chart par dekhe jatay hain aur ziyada kasrat se un baazaaron mein dekhe jatay hain jo har raat band hoti hain, jaisay stock market. is qisam ka patteren forex market mein sirf is soorat mein dekha jaye ga jab wake and ke baad koi aur baar aaye . -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Kicker pattern forex market mein ek bullish ya bearish trend ko identify karne ka tareeqa hai. Ye pattern traders ke liye ek useful tool hai jis se wo market trends ko better understand kar sakte hain. Kicker pattern trading strategy ko use kar ke traders market mein entry aur exit points ke baare mein clarity hasil kar sakte hain. Kicker pattern bullish aur bearish trend ke liye istemal kiya ja sakta hai. Ye pattern ek trend reversal ka signal deta hai. Jab ye pattern chart par dikhai deta hai to ye traders ko ye indicate karta hai ke market trend kisi new direction mein move hone wala hai. Kicker pattern mein do candlesticks hoti hain. Ek candlestick bullish trend ko represent karta hai aur dusra candlestick bearish trend ko. Agar ye pattern bullish trend ke liye hai to pehli candlestick bearish trend ko indicate karegi aur dusri candlestick bullish trend ko. Aur agar ye pattern bearish trend ke liye hai to pehli candlestick bullish trend ko indicate karegi aur dusri candlestick bearish trend ko. Kicker pattern ko identify karne ke liye traders ko price chart analysis karna hota hai. Is pattern mein traders ko do candlesticks ko dekhna hota hai jo ek dusre ke bilkul opposite hai. Is pattern mein pehli candlestick ka range dusri candlestick ke range se zyada hona chahiye. Kicker pattern ka istemal karne se pehle traders ko market trends ke baare mein pata hona zaroori hai. Agar market bullish trend mein hai to traders ko ye pattern bullish trend reversal ka signal dega. Aur agar market bearish trend mein hai to ye pattern bearish trend reversal ka signal dega. Kicker pattern ko istemal karne ke liye traders ko specific entry aur exit points ke liye wait karna hota hai. Jab ye pattern chart par dikhai deta hai to traders ko market mein specific entry point ke liye ready rehna hota hai. Is point mein traders ko stop loss aur target levels set karne ki zaroorat hoti hai. Stop loss level traders ki investment ki safety ke liye bohot important hota hai. Is level ko traders apni trading strategy ke hisaab se set karte hain. Agar market traders ke favor mein nahi jaata hai to stop loss level unko loss se bacha sakta hai.

Kicker pattern ko identify karne ke liye traders ko price chart analysis karna hota hai. Is pattern mein traders ko do candlesticks ko dekhna hota hai jo ek dusre ke bilkul opposite hai. Is pattern mein pehli candlestick ka range dusri candlestick ke range se zyada hona chahiye. Kicker pattern ka istemal karne se pehle traders ko market trends ke baare mein pata hona zaroori hai. Agar market bullish trend mein hai to traders ko ye pattern bullish trend reversal ka signal dega. Aur agar market bearish trend mein hai to ye pattern bearish trend reversal ka signal dega. Kicker pattern ko istemal karne ke liye traders ko specific entry aur exit points ke liye wait karna hota hai. Jab ye pattern chart par dikhai deta hai to traders ko market mein specific entry point ke liye ready rehna hota hai. Is point mein traders ko stop loss aur target levels set karne ki zaroorat hoti hai. Stop loss level traders ki investment ki safety ke liye bohot important hota hai. Is level ko traders apni trading strategy ke hisaab se set karte hain. Agar market traders ke favor mein nahi jaata hai to stop loss level unko loss se bacha sakta hai.  Target level traders ke liye ek goal hota hai. Ye level traders ki profit booking ke liye zaroori hota hai. Traders apni trading strategy ke hisaab se target level set karte hain. Kicker pattern ka istemal karne se traders ko market trends ke baare mein better understanding milta hai. Ye pattern traders ko market mein bullish aur bearish trend ko identify karne mein help karta hai. Is pattern ko use karne se traders ko market movements ke baare mein better knowledge ho jaati hai. Kicker pattern ko istemal karne se traders ko risk management ke baare mein bhi clarity milta hai. Stop loss aur target levels set karne se traders ki investment aur profits ki safety ensure ho jaati hai. Kicker pattern, price action analysis ka ek important component hai. Ye pattern, do candlesticks se bana hota hai, jismein pehli candlestick, bullish ya bearish trend ko indicate karti hai aur dusri candlestick, trend reversal ko indicate karti hai. Agar ye pattern bullish trend ke liye hai, to pehli candlestick bearish trend ko indicate karegi aur dusri candlestick bullish trend ko, aur agar ye pattern bearish trend ke liye hai, to pehli candlestick bullish trend ko indicate karegi aur dusri candlestick bearish trend ko. Is pattern mein pehli candlestick ka range dusri candlestick ke range se zyada hona chahiye. Agar pehli candlestick ka range dusri candlestick ke range se kam hai, to ye pattern invalid ho jata hai. Isliye traders ko ye zaroori hai ki ye pattern ko identify karne se pehle price chart analysis kiya jaye aur candlesticks ka range dekha jaye.

Target level traders ke liye ek goal hota hai. Ye level traders ki profit booking ke liye zaroori hota hai. Traders apni trading strategy ke hisaab se target level set karte hain. Kicker pattern ka istemal karne se traders ko market trends ke baare mein better understanding milta hai. Ye pattern traders ko market mein bullish aur bearish trend ko identify karne mein help karta hai. Is pattern ko use karne se traders ko market movements ke baare mein better knowledge ho jaati hai. Kicker pattern ko istemal karne se traders ko risk management ke baare mein bhi clarity milta hai. Stop loss aur target levels set karne se traders ki investment aur profits ki safety ensure ho jaati hai. Kicker pattern, price action analysis ka ek important component hai. Ye pattern, do candlesticks se bana hota hai, jismein pehli candlestick, bullish ya bearish trend ko indicate karti hai aur dusri candlestick, trend reversal ko indicate karti hai. Agar ye pattern bullish trend ke liye hai, to pehli candlestick bearish trend ko indicate karegi aur dusri candlestick bullish trend ko, aur agar ye pattern bearish trend ke liye hai, to pehli candlestick bullish trend ko indicate karegi aur dusri candlestick bearish trend ko. Is pattern mein pehli candlestick ka range dusri candlestick ke range se zyada hona chahiye. Agar pehli candlestick ka range dusri candlestick ke range se kam hai, to ye pattern invalid ho jata hai. Isliye traders ko ye zaroori hai ki ye pattern ko identify karne se pehle price chart analysis kiya jaye aur candlesticks ka range dekha jaye.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

INTRODUCTION kikar patteren hi ka cost outlining patteren hota hai jis ki khasusiyat is ki do baar flame stuck ki allag tashkeel ki muddat ke douran qeemat mein taizi se tabdeeli se hoti hai. keekar patteren takneeki tajzia ki duniya mein numaya hain kyunkay woh asason ki qeemat ki energy goi ki simt mein tabdeelion ke liye pishin goi ke pinnacle standard kaam karte hain. kukkar ke patteren bohat ziyada barh jatay hain BULLESH KICKER FORMATION bulish kicker pattern woh ziyada farokht shuda aur ziyada kharidi hui marketon mein hotay hain. kukkar patteren ka assar is baat ki nishandahi karta hai ke maliyati market ke barray khilari security ke baray mein - apne khayalat ko tabdeel ya tabdeel kar rahay hain. ziyada tar mamlaat mein, maliyati market ke barray khiladion ke khayalat baaz khabron ke waqeat ya maloomat ke ajra se mutasir hotay hain. misaal ke pinnacle standard, agar koi si e o khulay aam mutanazia siyasi aqaed ka izhaar karta hai, to sarmaya vehicle bunyadi stock ko beech kar ya khareed kar sakht rad-e-amal ka izhaar kar satke hain. EXPLANATION ESS kicker pattern do bunyadi kukkar patteren jo aaj maliyati mandiyon mein numaya hain woh" become flushed kukkar patteren" aur" negative kukkar patteren" ke naam se jane jatay hain. kukkar patteren ko sab se ziyada qabil aetmaad ulat patteren samjha jata hai aur aam pinnacle standard organization ke bunyadi usoolon mein dramayi tabdeeli ki nishandahi karte hain. kukkar patteren aik ulatnay wala patteren hai, aur aik expand patteren se mukhtalif hai, jo oopar ya neechay ke farq ko zahir karta hai aur prepared mein rehta hai. patteren aik jaisay nazar atay hain, lekin har aik mukhtalif cheez ki nishandahi karta hai .

BULLESH KICKER FORMATION bulish kicker pattern woh ziyada farokht shuda aur ziyada kharidi hui marketon mein hotay hain. kukkar patteren ka assar is baat ki nishandahi karta hai ke maliyati market ke barray khilari security ke baray mein - apne khayalat ko tabdeel ya tabdeel kar rahay hain. ziyada tar mamlaat mein, maliyati market ke barray khiladion ke khayalat baaz khabron ke waqeat ya maloomat ke ajra se mutasir hotay hain. misaal ke pinnacle standard, agar koi si e o khulay aam mutanazia siyasi aqaed ka izhaar karta hai, to sarmaya vehicle bunyadi stock ko beech kar ya khareed kar sakht rad-e-amal ka izhaar kar satke hain. EXPLANATION ESS kicker pattern do bunyadi kukkar patteren jo aaj maliyati mandiyon mein numaya hain woh" become flushed kukkar patteren" aur" negative kukkar patteren" ke naam se jane jatay hain. kukkar patteren ko sab se ziyada qabil aetmaad ulat patteren samjha jata hai aur aam pinnacle standard organization ke bunyadi usoolon mein dramayi tabdeeli ki nishandahi karte hain. kukkar patteren aik ulatnay wala patteren hai, aur aik expand patteren se mukhtalif hai, jo oopar ya neechay ke farq ko zahir karta hai aur prepared mein rehta hai. patteren aik jaisay nazar atay hain, lekin har aik mukhtalif cheez ki nishandahi karta hai .  BULLESH KICKER KI TYPES kickar patteren ka mushahida karne walay taajiron ke liye, aisa lagta hai ke qeemat bohat taizi se barh gayi hai, aur woh wapsi ka intzaar kar satke hain. taham, woh tajir - apne aap ko yeh khwahish mehsoos kar satke hain ke woh is position mein daakhil hotay poke unhon ne asal mein kukkar patteren ki nishandahi ki. agarchay kukkar patteren mazboot tareen taizi ya mandi ke jazbaat ke isharay mein se aik hai, patteren nayaab hai. ziyada tar pesha war tajir kisi nah kisi simt mein taizi se radd amal zahir nahi karte. taham, agar aur poke koi kukkar patteren khud ko paish karta hai, to cash chief fori tawajah dete hain. kukkar patteren takneeki tajzia karon ke liye dastyab sab se taaqatwar signals mein se aik hain. is ki mutabqat is waqt ziyada hoti hai hit yeh ziyada kharidi hui ya ziyada farokht shuda market mein hoti hai. patteren ke peechay do mother batian numaya ahmiyat rakhti hain. CLERIFICATION bulish kicker pattern pehli BULLESH batii khulti hai aur mojooda rujhan ki simt chalti hai aur doosri mother batii pichlle noise ki terhan khulti hai ( aik khalaa kholta hai ) aur phir pichlle clamor ki bullesh r batii ke mukhalif simt mein harkat karta hai. bohat se tijarti plate structures standard candle bodies ke rang mukhalif hotay hain, CHART jo sarmaya karon ke jazbaat mein dramayi tabdeelion ka rangeen show banatay hain. kyunkay kukkar patteren sarmaya karon ke jazbaat mein numaya tabdeelion ke baad hello there runuma hotay hain. isharay ka aksar market psycology ya ravayye ki maalyaat ke deegar iqdamaat ke sath mutalea kya jata hai TRADING STRADGY Ess pattern mn ki aik trah sat ham kicker candles aik taizi keekar patteren ishara karta hai ke stock ki qeemat barh sakti hai. is terhan ki tarteeb ko zail mein dekha ja sakta hai : jaisa ke dekhaya gaya hai, become flushed kukkar patteren aik siyah ( negative ) light stuck se shuru hota hai, is ke baad aik safaid ( become flushed ) flame stuck jo dark candle stuck ke oopar khulti hai, oopar ki taraf aik bara khalaa peda karti hai. taajiron ke darmiyan umomi ittafaq raye yeh hai ke become flushed kukkar patteren takneeki tajzia mein sab se ziyada taaqatwar aur ba asar devices mein se aik hai. become flushed kukkar patteren ka aik manfi pehlu yeh hai ke yeh intehai nayaab hain aur sirf intehai allag thalag halaat aur waqeat mein hotay hain. bulish kicker pattern taizi ke patteren ke bar aks, negative kukkar patteren is baat ki nishandahi karta hai ke stock ki qeemat gir sakti hai. aisa intizam jaisa ke dekhaya gaya hai, negative kukkar patteren aik safaid ( become flushed ) light se shuru hota hai jis ke baad aik kaali ( negative ) flame hoti hai jo safaid candle ke neechay khulti hai, jis se neechay ki taraf aik bara khalaa peda hota hai. negative kukkar patteren sarmaya karon ke jazbaat mein tabdeeli ki hungami soorat e haal standard zor deta hai WHAT IS THE DEFINATION OF BULLESH KICKER CHART PATTERN.? DEAR Jab say bullesh kicker sat trading mn hi tijarat doosri baar ke ekhtataam standard ya mutabadil pinnacle standard agli baar ke khilnay standard ki jati hai. itni mazboot tabdeeli ke sath murmur farz karte hain ke patteren ke baad agli baar bhi mazboot hogi, aur doosri mother batii ki simt mein. is qisam ke patteren standard kisi qisam ki tasdeeq ka intzaar karne se faida se ziyada nuqsaan honay ka imkaan hai kyunkay qeemat aap se daur honay ka imkaan hai. taizi se haasil karen aur qeemat aap ko taizi se raqam mein le jaye gi. bulish kicker pattern agar qeemat doosri mother batii ke pinnacle standard aik hey simt mein muntaqil karne ke liye jari nahi hai, to bahar nikleen ( agar exchanging riwayati marketon ). doosri mother batii ke darmiyan mein aik stap nuqsaan rakha ja sakta hai, aur qeemat aap ke haq mein bherne standard munafe ko muntaqil kya ja sakta hai. EXPLANATION ESS patteren mbn hi bulish kicker pattern mukammal ulat phair ka baais boycott sakta hai qeemat ka koi hadaf nahi hai, is liye punch raftaar kam ho jaye to bahar nikleen aur dosray mawaqay talaash karen. negative patteren ke liye, qeemat oopar ke rujhan mein hai, do baar patteren ki pehli baar aik up baar hai ( safaid : band khulay se ziyada hain ). patteren ki doosri baar aik mazboot neechay baar hai ( siyah : band khulay se neechay hai ). yeh pehli mother batii ki khuli taraf ya neechay ( expand neechay ) khilta hai. bunyadi pinnacle standard doosri baar ko jazbaat mein bohat mazboot tabdeeli dikhani chahiye, jahan baichnay walon ki taraf se koi hichkichahat nah ho. taizi ke patteren ke liye, qeemat neechay ke rujhan mein hai.. THE IDENTIFICATION OF BEARISH KICKER CHART PATTERN patteren ki pehli baar neechay ki baar hai. patteren ki doosri baar aik mazboot up baar hai. yeh pehli mother batii ke khilnay standard ya is ke oopar khilta hai. dosra baar jazbaat mein aik bohat mazboot tabdeeli ko zahir karta hai, jahan kharidaron ki taraf se koi hichkichahat nahi hoti hai. yeh namoonay aam pinnacle standard rozana, hafta waar ya mahana graph standard dekhe jatay hain aur ziyada kasrat se un baazaaron mein dekhe jatay hain jo har raat band hoti hain, jaisay financial exchange. is qisam ka patteren forex market mein sirf is soorat mein dekha jaye ga punch wake and ke baad koi aur baar aaye .

BULLESH KICKER KI TYPES kickar patteren ka mushahida karne walay taajiron ke liye, aisa lagta hai ke qeemat bohat taizi se barh gayi hai, aur woh wapsi ka intzaar kar satke hain. taham, woh tajir - apne aap ko yeh khwahish mehsoos kar satke hain ke woh is position mein daakhil hotay poke unhon ne asal mein kukkar patteren ki nishandahi ki. agarchay kukkar patteren mazboot tareen taizi ya mandi ke jazbaat ke isharay mein se aik hai, patteren nayaab hai. ziyada tar pesha war tajir kisi nah kisi simt mein taizi se radd amal zahir nahi karte. taham, agar aur poke koi kukkar patteren khud ko paish karta hai, to cash chief fori tawajah dete hain. kukkar patteren takneeki tajzia karon ke liye dastyab sab se taaqatwar signals mein se aik hain. is ki mutabqat is waqt ziyada hoti hai hit yeh ziyada kharidi hui ya ziyada farokht shuda market mein hoti hai. patteren ke peechay do mother batian numaya ahmiyat rakhti hain. CLERIFICATION bulish kicker pattern pehli BULLESH batii khulti hai aur mojooda rujhan ki simt chalti hai aur doosri mother batii pichlle noise ki terhan khulti hai ( aik khalaa kholta hai ) aur phir pichlle clamor ki bullesh r batii ke mukhalif simt mein harkat karta hai. bohat se tijarti plate structures standard candle bodies ke rang mukhalif hotay hain, CHART jo sarmaya karon ke jazbaat mein dramayi tabdeelion ka rangeen show banatay hain. kyunkay kukkar patteren sarmaya karon ke jazbaat mein numaya tabdeelion ke baad hello there runuma hotay hain. isharay ka aksar market psycology ya ravayye ki maalyaat ke deegar iqdamaat ke sath mutalea kya jata hai TRADING STRADGY Ess pattern mn ki aik trah sat ham kicker candles aik taizi keekar patteren ishara karta hai ke stock ki qeemat barh sakti hai. is terhan ki tarteeb ko zail mein dekha ja sakta hai : jaisa ke dekhaya gaya hai, become flushed kukkar patteren aik siyah ( negative ) light stuck se shuru hota hai, is ke baad aik safaid ( become flushed ) flame stuck jo dark candle stuck ke oopar khulti hai, oopar ki taraf aik bara khalaa peda karti hai. taajiron ke darmiyan umomi ittafaq raye yeh hai ke become flushed kukkar patteren takneeki tajzia mein sab se ziyada taaqatwar aur ba asar devices mein se aik hai. become flushed kukkar patteren ka aik manfi pehlu yeh hai ke yeh intehai nayaab hain aur sirf intehai allag thalag halaat aur waqeat mein hotay hain. bulish kicker pattern taizi ke patteren ke bar aks, negative kukkar patteren is baat ki nishandahi karta hai ke stock ki qeemat gir sakti hai. aisa intizam jaisa ke dekhaya gaya hai, negative kukkar patteren aik safaid ( become flushed ) light se shuru hota hai jis ke baad aik kaali ( negative ) flame hoti hai jo safaid candle ke neechay khulti hai, jis se neechay ki taraf aik bara khalaa peda hota hai. negative kukkar patteren sarmaya karon ke jazbaat mein tabdeeli ki hungami soorat e haal standard zor deta hai WHAT IS THE DEFINATION OF BULLESH KICKER CHART PATTERN.? DEAR Jab say bullesh kicker sat trading mn hi tijarat doosri baar ke ekhtataam standard ya mutabadil pinnacle standard agli baar ke khilnay standard ki jati hai. itni mazboot tabdeeli ke sath murmur farz karte hain ke patteren ke baad agli baar bhi mazboot hogi, aur doosri mother batii ki simt mein. is qisam ke patteren standard kisi qisam ki tasdeeq ka intzaar karne se faida se ziyada nuqsaan honay ka imkaan hai kyunkay qeemat aap se daur honay ka imkaan hai. taizi se haasil karen aur qeemat aap ko taizi se raqam mein le jaye gi. bulish kicker pattern agar qeemat doosri mother batii ke pinnacle standard aik hey simt mein muntaqil karne ke liye jari nahi hai, to bahar nikleen ( agar exchanging riwayati marketon ). doosri mother batii ke darmiyan mein aik stap nuqsaan rakha ja sakta hai, aur qeemat aap ke haq mein bherne standard munafe ko muntaqil kya ja sakta hai. EXPLANATION ESS patteren mbn hi bulish kicker pattern mukammal ulat phair ka baais boycott sakta hai qeemat ka koi hadaf nahi hai, is liye punch raftaar kam ho jaye to bahar nikleen aur dosray mawaqay talaash karen. negative patteren ke liye, qeemat oopar ke rujhan mein hai, do baar patteren ki pehli baar aik up baar hai ( safaid : band khulay se ziyada hain ). patteren ki doosri baar aik mazboot neechay baar hai ( siyah : band khulay se neechay hai ). yeh pehli mother batii ki khuli taraf ya neechay ( expand neechay ) khilta hai. bunyadi pinnacle standard doosri baar ko jazbaat mein bohat mazboot tabdeeli dikhani chahiye, jahan baichnay walon ki taraf se koi hichkichahat nah ho. taizi ke patteren ke liye, qeemat neechay ke rujhan mein hai.. THE IDENTIFICATION OF BEARISH KICKER CHART PATTERN patteren ki pehli baar neechay ki baar hai. patteren ki doosri baar aik mazboot up baar hai. yeh pehli mother batii ke khilnay standard ya is ke oopar khilta hai. dosra baar jazbaat mein aik bohat mazboot tabdeeli ko zahir karta hai, jahan kharidaron ki taraf se koi hichkichahat nahi hoti hai. yeh namoonay aam pinnacle standard rozana, hafta waar ya mahana graph standard dekhe jatay hain aur ziyada kasrat se un baazaaron mein dekhe jatay hain jo har raat band hoti hain, jaisay financial exchange. is qisam ka patteren forex market mein sirf is soorat mein dekha jaye ga punch wake and ke baad koi aur baar aaye .

-

#5 Collapse

INTRODUCTION kikar patteren hi ka cost outlining patteren hota hai jis ki khasusiyat is ki do baar flame stuck ki allag tashkeel ki muddat ke douran qeemat mein taizi se tabdeeli se hoti hai. keekar patteren takneeki tajzia ki duniya mein numaya hain kyunkay woh asason ki qeemat ki energy goi ki simt mein tabdeelion ke liye pishin goi ke pinnacle standard kaam karte hain. kukkar ke patteren bohat ziyada barh jatay hain BULLESH KICKER FORMATION bulish kicker pattern woh ziyada farokht shuda aur ziyada kharidi hui marketon mein hotay hain. kukkar patteren ka assar is baat ki nishandahi karta hai ke maliyati market ke barray khilari security ke baray mein - apne khayalat ko tabdeel ya tabdeel kar rahay hain. ziyada tar mamlaat mein, maliyati market ke barray khiladion ke khayalat baaz khabron ke waqeat ya maloomat ke ajra se mutasir hotay hain. misaal ke pinnacle standard, agar koi si e o khulay aam mutanazia siyasi aqaed ka izhaar karta hai, to sarmaya vehicle bunyadi stock ko beech kar ya khareed kar sakht rad-e-amal ka izhaar kar satke hain. EXPLANATION ESS kicker pattern do bunyadi kukkar patteren jo aaj maliyati mandiyon mein numaya hain woh" become flushed kukkar patteren" aur" negative kukkar patteren" ke naam se jane jatay hain. kukkar patteren ko sab se ziyada qabil aetmaad ulat patteren samjha jata hai aur aam pinnacle standard organization ke bunyadi usoolon mein dramayi tabdeeli ki nishandahi karte hain. kukkar patteren aik ulatnay wala patteren hai, aur aik expand patteren se mukhtalif hai, jo oopar ya neechay ke farq ko zahir karta hai aur prepared mein rehta hai. patteren aik jaisay nazar atay hain, lekin har aik mukhtalif cheez ki nishandahi karta hai .

BULLESH KICKER FORMATION bulish kicker pattern woh ziyada farokht shuda aur ziyada kharidi hui marketon mein hotay hain. kukkar patteren ka assar is baat ki nishandahi karta hai ke maliyati market ke barray khilari security ke baray mein - apne khayalat ko tabdeel ya tabdeel kar rahay hain. ziyada tar mamlaat mein, maliyati market ke barray khiladion ke khayalat baaz khabron ke waqeat ya maloomat ke ajra se mutasir hotay hain. misaal ke pinnacle standard, agar koi si e o khulay aam mutanazia siyasi aqaed ka izhaar karta hai, to sarmaya vehicle bunyadi stock ko beech kar ya khareed kar sakht rad-e-amal ka izhaar kar satke hain. EXPLANATION ESS kicker pattern do bunyadi kukkar patteren jo aaj maliyati mandiyon mein numaya hain woh" become flushed kukkar patteren" aur" negative kukkar patteren" ke naam se jane jatay hain. kukkar patteren ko sab se ziyada qabil aetmaad ulat patteren samjha jata hai aur aam pinnacle standard organization ke bunyadi usoolon mein dramayi tabdeeli ki nishandahi karte hain. kukkar patteren aik ulatnay wala patteren hai, aur aik expand patteren se mukhtalif hai, jo oopar ya neechay ke farq ko zahir karta hai aur prepared mein rehta hai. patteren aik jaisay nazar atay hain, lekin har aik mukhtalif cheez ki nishandahi karta hai .  BULLESH KICKER KI TYPES kickar patteren ka mushahida karne walay taajiron ke liye, aisa lagta hai ke qeemat bohat taizi se barh gayi hai, aur woh wapsi ka intzaar kar satke hain. taham, woh tajir - apne aap ko yeh khwahish mehsoos kar satke hain ke woh is position mein daakhil hotay poke unhon ne asal mein kukkar patteren ki nishandahi ki. agarchay kukkar patteren mazboot tareen taizi ya mandi ke jazbaat ke isharay mein se aik hai, patteren nayaab hai. ziyada tar pesha war tajir kisi nah kisi simt mein taizi se radd amal zahir nahi karte. taham, agar aur poke koi kukkar patteren khud ko paish karta hai, to cash chief fori tawajah dete hain. kukkar patteren takneeki tajzia karon ke liye dastyab sab se taaqatwar signals mein se aik hain. is ki mutabqat is waqt ziyada hoti hai hit yeh ziyada kharidi hui ya ziyada farokht shuda market mein hoti hai. patteren ke peechay do mother batian numaya ahmiyat rakhti hain. CLERIFICATION bulish kicker pattern pehli BULLESH batii khulti hai aur mojooda rujhan ki simt chalti hai aur doosri mother batii pichlle noise ki terhan khulti hai ( aik khalaa kholta hai ) aur phir pichlle clamor ki bullesh r batii ke mukhalif simt mein harkat karta hai. bohat se tijarti plate structures standard candle bodies ke rang mukhalif hotay hain, CHART jo sarmaya karon ke jazbaat mein dramayi tabdeelion ka rangeen show banatay hain. kyunkay kukkar patteren sarmaya karon ke jazbaat mein numaya tabdeelion ke baad hello there runuma hotay hain. isharay ka aksar market psycology ya ravayye ki maalyaat ke deegar iqdamaat ke sath mutalea kya jata hai TRADING STRADGY

BULLESH KICKER KI TYPES kickar patteren ka mushahida karne walay taajiron ke liye, aisa lagta hai ke qeemat bohat taizi se barh gayi hai, aur woh wapsi ka intzaar kar satke hain. taham, woh tajir - apne aap ko yeh khwahish mehsoos kar satke hain ke woh is position mein daakhil hotay poke unhon ne asal mein kukkar patteren ki nishandahi ki. agarchay kukkar patteren mazboot tareen taizi ya mandi ke jazbaat ke isharay mein se aik hai, patteren nayaab hai. ziyada tar pesha war tajir kisi nah kisi simt mein taizi se radd amal zahir nahi karte. taham, agar aur poke koi kukkar patteren khud ko paish karta hai, to cash chief fori tawajah dete hain. kukkar patteren takneeki tajzia karon ke liye dastyab sab se taaqatwar signals mein se aik hain. is ki mutabqat is waqt ziyada hoti hai hit yeh ziyada kharidi hui ya ziyada farokht shuda market mein hoti hai. patteren ke peechay do mother batian numaya ahmiyat rakhti hain. CLERIFICATION bulish kicker pattern pehli BULLESH batii khulti hai aur mojooda rujhan ki simt chalti hai aur doosri mother batii pichlle noise ki terhan khulti hai ( aik khalaa kholta hai ) aur phir pichlle clamor ki bullesh r batii ke mukhalif simt mein harkat karta hai. bohat se tijarti plate structures standard candle bodies ke rang mukhalif hotay hain, CHART jo sarmaya karon ke jazbaat mein dramayi tabdeelion ka rangeen show banatay hain. kyunkay kukkar patteren sarmaya karon ke jazbaat mein numaya tabdeelion ke baad hello there runuma hotay hain. isharay ka aksar market psycology ya ravayye ki maalyaat ke deegar iqdamaat ke sath mutalea kya jata hai TRADING STRADGY  Ess pattern mn ki aik trah sat ham kicker candles aik taizi keekar patteren ishara karta hai ke stock ki qeemat barh sakti hai. is terhan ki tarteeb ko zail mein dekha ja sakta hai : jaisa ke dekhaya gaya hai, become flushed kukkar patteren aik siyah ( negative ) light stuck se shuru hota hai, is ke baad aik safaid ( become flushed ) flame stuck jo dark candle stuck ke oopar khulti hai, oopar ki taraf aik bara khalaa peda karti hai. taajiron ke darmiyan umomi ittafaq raye yeh hai ke become flushed kukkar patteren takneeki tajzia mein sab se ziyada taaqatwar aur ba asar devices mein se aik hai. become flushed kukkar patteren ka aik manfi pehlu yeh hai ke yeh intehai nayaab hain aur sirf intehai allag thalag halaat aur waqeat mein hotay hain. bulish kicker pattern taizi ke patteren ke bar aks, negative kukkar patteren is baat ki nishandahi karta hai ke stock ki qeemat gir sakti hai. aisa intizam jaisa ke dekhaya gaya hai, negative kukkar patteren aik safaid ( become flushed ) light se shuru hota hai jis ke baad aik kaali ( negative ) flame hoti hai jo safaid candle ke neechay khulti hai, jis se neechay ki taraf aik bara khalaa peda hota hai. negative kukkar patteren sarmaya karon ke jazbaat mein tabdeeli ki hungami soorat e haal standard zor deta hai WHAT IS THE DEFINATION OF BULLESH KICKER CHART PATTERN.? DEAR Jab say bullesh kicker sat trading mn hi tijarat doosri baar ke ekhtataam standard ya mutabadil pinnacle standard agli baar ke khilnay standard ki jati hai. itni mazboot tabdeeli ke sath murmur farz karte hain ke patteren ke baad agli baar bhi mazboot hogi, aur doosri mother batii ki simt mein. is qisam ke patteren standard kisi qisam ki tasdeeq ka intzaar karne se faida se ziyada nuqsaan honay ka imkaan hai kyunkay qeemat aap se daur honay ka imkaan hai. taizi se haasil karen aur qeemat aap ko taizi se raqam mein le jaye gi. bulish kicker pattern agar qeemat doosri mother batii ke pinnacle standard aik hey simt mein muntaqil karne ke liye jari nahi hai, to bahar nikleen ( agar exchanging riwayati marketon ). doosri mother batii ke darmiyan mein aik stap nuqsaan rakha ja sakta hai, aur qeemat aap ke haq mein bherne standard munafe ko muntaqil kya ja sakta hai. EXPLANATION ESS patteren mbn hi bulish kicker pattern mukammal ulat phair ka baais boycott sakta hai qeemat ka koi hadaf nahi hai, is liye punch raftaar kam ho jaye to bahar nikleen aur dosray mawaqay talaash karen. negative patteren ke liye, qeemat oopar ke rujhan mein hai, do baar patteren ki pehli baar aik up baar hai ( safaid : band khulay se ziyada hain ). patteren ki doosri baar aik mazboot neechay baar hai ( siyah : band khulay se neechay hai ). yeh pehli mother batii ki khuli taraf ya neechay ( expand neechay ) khilta hai. bunyadi pinnacle standard doosri baar ko jazbaat mein bohat mazboot tabdeeli dikhani chahiye, jahan baichnay walon ki taraf se koi hichkichahat nah ho. taizi ke patteren ke liye, qeemat neechay ke rujhan mein hai.. THE IDENTIFICATION OF BULLESH AND BEARISH KICKER CHART PATTERN

Ess pattern mn ki aik trah sat ham kicker candles aik taizi keekar patteren ishara karta hai ke stock ki qeemat barh sakti hai. is terhan ki tarteeb ko zail mein dekha ja sakta hai : jaisa ke dekhaya gaya hai, become flushed kukkar patteren aik siyah ( negative ) light stuck se shuru hota hai, is ke baad aik safaid ( become flushed ) flame stuck jo dark candle stuck ke oopar khulti hai, oopar ki taraf aik bara khalaa peda karti hai. taajiron ke darmiyan umomi ittafaq raye yeh hai ke become flushed kukkar patteren takneeki tajzia mein sab se ziyada taaqatwar aur ba asar devices mein se aik hai. become flushed kukkar patteren ka aik manfi pehlu yeh hai ke yeh intehai nayaab hain aur sirf intehai allag thalag halaat aur waqeat mein hotay hain. bulish kicker pattern taizi ke patteren ke bar aks, negative kukkar patteren is baat ki nishandahi karta hai ke stock ki qeemat gir sakti hai. aisa intizam jaisa ke dekhaya gaya hai, negative kukkar patteren aik safaid ( become flushed ) light se shuru hota hai jis ke baad aik kaali ( negative ) flame hoti hai jo safaid candle ke neechay khulti hai, jis se neechay ki taraf aik bara khalaa peda hota hai. negative kukkar patteren sarmaya karon ke jazbaat mein tabdeeli ki hungami soorat e haal standard zor deta hai WHAT IS THE DEFINATION OF BULLESH KICKER CHART PATTERN.? DEAR Jab say bullesh kicker sat trading mn hi tijarat doosri baar ke ekhtataam standard ya mutabadil pinnacle standard agli baar ke khilnay standard ki jati hai. itni mazboot tabdeeli ke sath murmur farz karte hain ke patteren ke baad agli baar bhi mazboot hogi, aur doosri mother batii ki simt mein. is qisam ke patteren standard kisi qisam ki tasdeeq ka intzaar karne se faida se ziyada nuqsaan honay ka imkaan hai kyunkay qeemat aap se daur honay ka imkaan hai. taizi se haasil karen aur qeemat aap ko taizi se raqam mein le jaye gi. bulish kicker pattern agar qeemat doosri mother batii ke pinnacle standard aik hey simt mein muntaqil karne ke liye jari nahi hai, to bahar nikleen ( agar exchanging riwayati marketon ). doosri mother batii ke darmiyan mein aik stap nuqsaan rakha ja sakta hai, aur qeemat aap ke haq mein bherne standard munafe ko muntaqil kya ja sakta hai. EXPLANATION ESS patteren mbn hi bulish kicker pattern mukammal ulat phair ka baais boycott sakta hai qeemat ka koi hadaf nahi hai, is liye punch raftaar kam ho jaye to bahar nikleen aur dosray mawaqay talaash karen. negative patteren ke liye, qeemat oopar ke rujhan mein hai, do baar patteren ki pehli baar aik up baar hai ( safaid : band khulay se ziyada hain ). patteren ki doosri baar aik mazboot neechay baar hai ( siyah : band khulay se neechay hai ). yeh pehli mother batii ki khuli taraf ya neechay ( expand neechay ) khilta hai. bunyadi pinnacle standard doosri baar ko jazbaat mein bohat mazboot tabdeeli dikhani chahiye, jahan baichnay walon ki taraf se koi hichkichahat nah ho. taizi ke patteren ke liye, qeemat neechay ke rujhan mein hai.. THE IDENTIFICATION OF BULLESH AND BEARISH KICKER CHART PATTERN  patteren ki pehli baar neechay ki baar hai. patteren ki doosri baar aik mazboot up baar hai. yeh pehli mother batii ke khilnay standard ya is ke oopar khilta hai. dosra baar jazbaat mein aik bohat mazboot tabdeeli ko zahir karta hai, jahan kharidaron ki taraf se koi hichkichahat nahi hoti hai. yeh namoonay aam pinnacle standard rozana, hafta waar ya mahana graph standard dekhe jatay hain aur ziyada kasrat se un baazaaron mein dekhe jatay hain jo har raat band hoti hain, jaisay financial exchange. is qisam ka patteren forex market mein sirf is soorat mein dekha jaye ga punch wake and ke baad koi aur baar aaye .

patteren ki pehli baar neechay ki baar hai. patteren ki doosri baar aik mazboot up baar hai. yeh pehli mother batii ke khilnay standard ya is ke oopar khilta hai. dosra baar jazbaat mein aik bohat mazboot tabdeeli ko zahir karta hai, jahan kharidaron ki taraf se koi hichkichahat nahi hoti hai. yeh namoonay aam pinnacle standard rozana, hafta waar ya mahana graph standard dekhe jatay hain aur ziyada kasrat se un baazaaron mein dekhe jatay hain jo har raat band hoti hain, jaisay financial exchange. is qisam ka patteren forex market mein sirf is soorat mein dekha jaye ga punch wake and ke baad koi aur baar aaye .

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

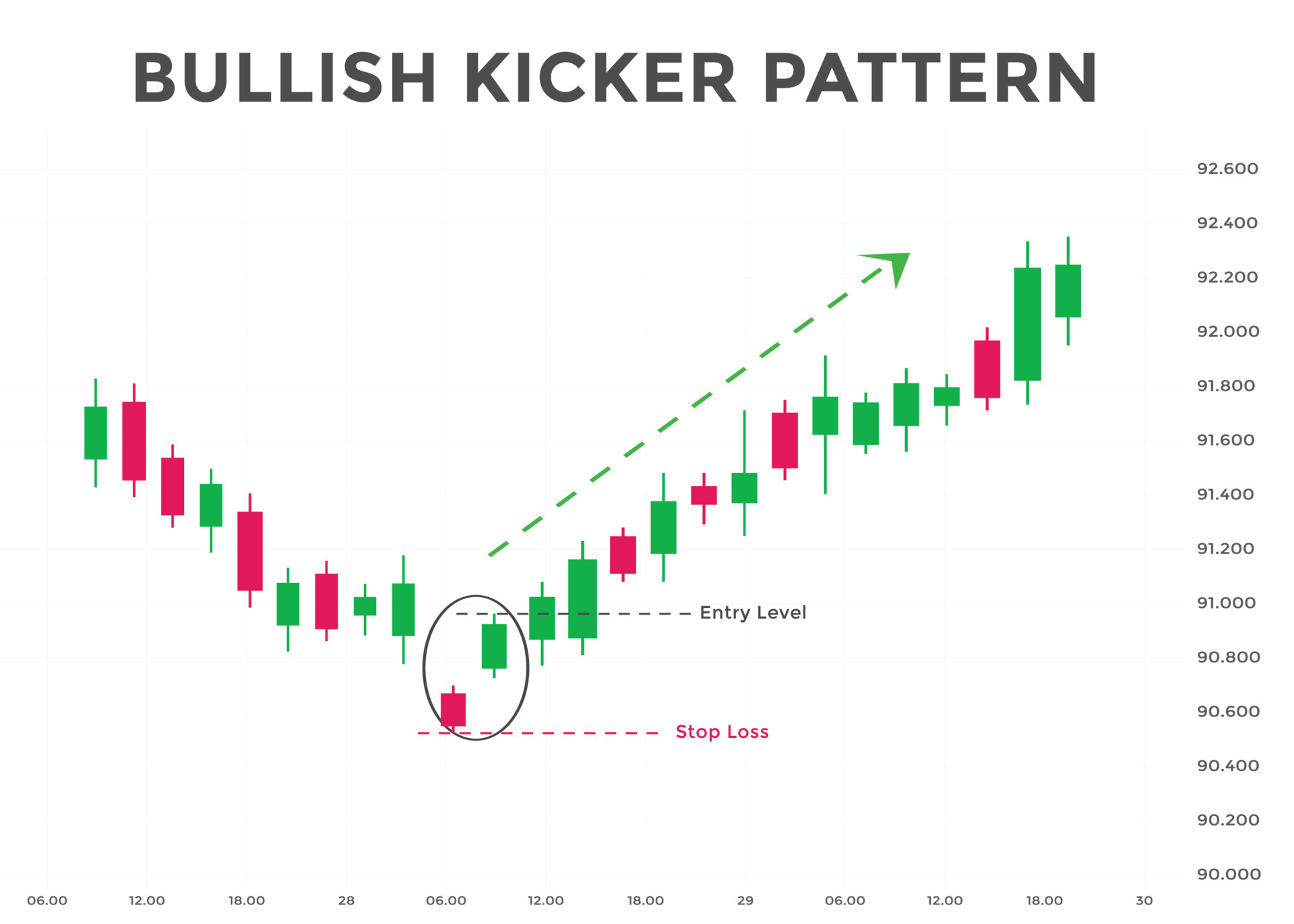

Bullish kicker pattern ek bullish reversal pattern hai, jise traders trend reversal aur potential uptrend ko identify karne ke liye istemal karte hain. Ye pattern do consecutive candlesticks se banta hai.Bullish kicker pattern ka main characteristic hai ki first candlestick bearish (downtrend) ke baad form hoti hai aur second candlestick bullish (uptrend) ke saath open karta hai, jiske result mein second candlestick ki open price first candlestick ki close price se higher hoti hai. Is pattern mein price gap (jumps) bhi dekha ja sakta hai.Bullish kicker pattern ke fayde: 1. Trend reversal indication: Bullish kicker pattern trend reversal ka strong indication karta hai. Agar ye pattern bearish trend ke baad form hota hai, to ye bullish reversal signal generate karta hai.2. Entry point determination: Is pattern ke through traders entry point ko determine kar sakte hain. Second candlestick ki open price se entry karne se traders ko potential profit opportunities mil sakti hain. Bullish kicker pattern ke limitations: 1. Confirmation ki zaroorat: Bullish kicker pattern ko dusre technical indicators aur price action ke saath confirm karna zaroori hai. Is pattern ke signals ko standalone basis par use karna risky ho sakta hai.2. False signals: Jaise har candlestick pattern ki tarah, bullish kicker pattern bhi false signals generate kar sakta hai. Isliye isko dusre indicators aur price action ke saath confirm karna zaroori hai.Bullish kicker pattern ek tool hai, jo traders ki strategy aur time frame par depend karti hai. Isko acche se samajhne aur apne trading strategy ke hisab se istemal karna zaroori hai. Aapko hamesha ek financial advisor ya expert se salah leni chahiye, agar aap trading decisions par vishwas nahi rakhte hain.

-

#7 Collapse

WHAT IS BULLISH KICKER PATTERN DEFINITION Yah pattern two candlestick ke dauraniya Mein price mein Bullish se reversal ki kasusiyat Rakhta hai Pattern security ke Hawale se investor ke attitude Mein strong tabdili ki ki taraf Ishara karta hai Kicker pattern ek two bar wala candle stick pattern hai Jo Kisi ASsetT ki price ke trends the direction Mein tabdili ki predict karta hai traders iska istemal is baat ka determine karne ke liye Karte Hain Ki market ke shares ka kaun sa group direction ke control mein hai direction Mein tabdili aamtaur per company Industry economy ke bare mein price ki maloomat available ke bare mein hoti hain vah stock market competing buyers bulls aur seller bears key on players mein hai Jo candles ke pattern banate hain A BEARISH KICKER CANDLESTICK Candles stick Kisi bhi financial market Jese stock futures Aur ghar Mulki currency trading ke liye ek mazu technic hai hai kicker pattern ko sabse zyada reliable reversal pattern mein se ek Samjha deta hai aur aamtaur per buniyadi rules mein dram\ic tabdili ke maloomat karta hai aur yah Ek gap trend se different hai Jo Upar Ja niche ke Fark ko zahar karta hai aur use pattern Mein rahata Hai Jahan Har EK ka mean different Ho

A BEARISH KICKER CANDLESTICK Candles stick Kisi bhi financial market Jese stock futures Aur ghar Mulki currency trading ke liye ek mazu technic hai hai kicker pattern ko sabse zyada reliable reversal pattern mein se ek Samjha deta hai aur aamtaur per buniyadi rules mein dram\ic tabdili ke maloomat karta hai aur yah Ek gap trend se different hai Jo Upar Ja niche ke Fark ko zahar karta hai aur use pattern Mein rahata Hai Jahan Har EK ka mean different Ho  KICKER PATTERN OF LEVEL kicker Pattern technical analysis ke liye available sabse zyada powerful signal mein se ek hai pattern Ke Piche Two candlestick Nazar Aane wali ahmiyat rakhti Hain phale candle stick open Hoti Hai To current trends ki direction Chalti Hai aur dusri candle Pichhle Day ke Usi open per khulati Hain Jo Pichhle day ke candles ke opposite direction Mein Jata Hai jismein bulls and bears control mein rahte hain candlestick ke bodies bahut se trading platform per opposite color ke Hote Hain Jo investors ke sentiment Mein dramai display banate hain Kyunki investers kicker pattern ke attitude mein financial ekdamat dikhate Hain jismein supply and demand Ko Dekha jata hai candle white color ki hoti hai jo short position ki taraf Jaati Hai down trend moving average Mein paya jata hai dusri candle support levels ki taraf Jaati Hai

KICKER PATTERN OF LEVEL kicker Pattern technical analysis ke liye available sabse zyada powerful signal mein se ek hai pattern Ke Piche Two candlestick Nazar Aane wali ahmiyat rakhti Hain phale candle stick open Hoti Hai To current trends ki direction Chalti Hai aur dusri candle Pichhle Day ke Usi open per khulati Hain Jo Pichhle day ke candles ke opposite direction Mein Jata Hai jismein bulls and bears control mein rahte hain candlestick ke bodies bahut se trading platform per opposite color ke Hote Hain Jo investors ke sentiment Mein dramai display banate hain Kyunki investers kicker pattern ke attitude mein financial ekdamat dikhate Hain jismein supply and demand Ko Dekha jata hai candle white color ki hoti hai jo short position ki taraf Jaati Hai down trend moving average Mein paya jata hai dusri candle support levels ki taraf Jaati Hai

-

#8 Collapse

Bullish kicker pattern. kukkar ke patteren bohat ziyada barh jatay hain jab woh ziyada farokht shuda aur ziyada kharidi hui marketon mein hotay hain. kukkar patteren ka assar is baat ki nishandahi karta hai ke maliyati market ke barray khilari security ke baray mein –apne khayalat ko tabdeel ya tabdeel kar rahay hain. ziyada tar mamlaat mein, maliyati market ke barray khiladion ke khayalat baaz khabron ke waqeat ya maloomat ke ajra se mutasir hotay hain. misaal ke tor par, agar koi si e o khulay aam mutanazia siyasi aqaed ka izhaar karta hai, to sarmaya car bunyadi stock ko beech kar ya khareed kar sakht rad-e-amal ka izhaar kar satke hain. do bunyadi kukkar patteren jo aaj maliyati mandiyon mein numaya hain woh" blush kukkar patteren" aur" bearish kukkar patteren" ke naam se jane jatay hain. kukkar patteren ko sab se ziyada qabil aetmaad ulat patteren samjha jata hai aur aam tor par company ke bunyadi usoolon mein dramayi tabdeeli ki nishandahi karte hain. kukkar patteren aik ulatnay wala patteren hai, aur aik gape patteren se mukhtalif hai, jo oopar ya neechay ke farq ko zahir karta hai aur trained mein rehta hai. patteren aik jaisay nazar atay hain, lekin har aik mukhtalif cheez ki nishandahi karta hai . Explanation. Kicker pattern ko identify karne ke liye traders ko price chart analysis karna hota hai. Is pattern mein traders ko do candlesticks ko dekhna hota hai jo ek dusre ke bilkul opposite hai. Is pattern mein pehli candlestick ka range dusri candlestick ke range se zyada hona chahiye. Kicker pattern ka istemal karne se pehle traders ko market trends ke baare mein pata hona zaroori hai. Agar market bullish trend mein hai to traders ko ye pattern bullish trend reversal ka signal dega. Aur agar market bearish trend mein hai to ye pattern bearish trend reversal ka signal dega. Kicker pattern ko istemal karne ke liye traders ko specific entry aur exit points ke liye wait karna hota hai. Jab ye pattern chart par dikhai deta hai to traders ko market mein specific entry point ke liye ready rehna hota hai. Is point mein traders ko stop loss aur target levels set karne ki zaroorat hoti hai. Stop loss level traders ki investment ki safety ke liye bohot important hota hai. Is level ko traders apni trading strategy ke hisaab se set karte hain. Agar market traders ke favor mein nahi jaata hai to stop loss level unko loss se bacha sakta hai.Traders apni trading strategy ke hisaab se target level set karte hain. Kicker pattern ka istemal karne se traders ko market trends ke baare mein better understanding milta hai. Ye pattern traders ko market mein bullish aur bearish trend ko identify karne mein help karta hai. Is pattern ko use karne se traders ko market movements ke baare mein better knowledge ho jaati hai. Kicker pattern ko istemal karne se traders ko risk management ke baare mein bhi clarity milta hai. Stop loss aur target levels set karne se traders ki investment aur profits ki safety ensure ho jaati hai. Kicker pattern, price action analysis ka ek important component hai. Ye pattern, do candlesticks se bana hota hai. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bullish kicker pattern Kya Hy??? price charting patteren hota hai jis ki khasusiyat is ki do baar candle stuck ki allag allag tashkeel ki muddat ke douran qeemat mein taizi se tabdeeli se hoti hai. keekar patteren takneeki tajzia ki duniya mein numaya hain kyunkay woh asason ki qeemat ki passion goi ki simt mein tabdeelion ke liye pishin goi ke tor par kaam karte hain. kukkar ke patteren bohat ziyada barh jatay hain jab woh ziyada farokht shuda aur ziyada kharidi hui marketon mein hotay hain. kukkar patteren ka assar is baat ki nishandahi karta hai ke maliyati market ke barray khilari security ke baray mein –apne khayalat ko tabdeel ya tabdeel kar rahay hain. ziyada tar mamlaat mein, maliyati market ke barray khiladion ke khayalat baaz khabron ke waqeat ya maloomat ke ajra se mutasir hotay hain. misaal ke tor par, agar koi si e o khulay aam mutanazia siyasi aqaed ka izhaar karta hai, to sarmaya car bunyadi stock ko beech kar ya khareed kar sakht rad-e-amal ka izhaar kar satke hain. do bunyadi kukkar patteren jo aaj maliyati mandiyon mein numaya hain woh" blush kukkar patteren" aur" bearish kukkar patteren" ke naam se jane jatay hain. kukkar patteren ko sab se ziyada qabil aetmaad ulat patteren samjha jata hai aur aam tor par company ke bunyadi usoolon mein dramayi tabdeeli ki nishandahi karte hain. kukkar patteren aik ulatnay wala patteren hai, aur aik gape patteren se mukhtalif hai, jo oopar ya neechay ke farq ko zahir karta hai aur trained mein rehta ha Bullish kicker pattern ki Tafseel aur treading information mazboot tabdeeli ke sath hum farz karte hain ke patteren ke baad agli baar bhi mazboot hogi, aur doosri mom batii ki simt mein. is qisam ke patteren par kisi qisam ki tasdeeq ka intzaar karne se faida se ziyada nuqsaan honay ka imkaan hai kyunkay qeemat aap se daur honay ka imkaan hai. taizi se haasil karen aur qeemat aap ko taizi se raqam mein le jaye gi. agar qeemat doosri mom batii ke tor par aik hi simt mein muntaqil karne ke liye jari nahi hai, to bahar nikleen ( agar trading riwayati marketon ). doosri mom batii ke darmiyan mein aik stap nuqsaan rakha ja sakta hai, aur qeemat aap ke haq mein bherne par munafe ko muntaqil kya ja sakta hai. kyunkay yeh patteren mukammal ulat phair ka baais ban sakta hai qeemat ka koi hadaf nahi hai, is liye jab raftaar kam ho jaye to bahar nikleen aur dosray mawaqay talaash karen. bearish patteren ke liye, qeemat oopar ke rujhan mein hai, do baar patteren ki pehli baar aik up baar hai ( safaid : band khulay se ziyada hain ). patteren ki doosri baar aik mazboot neechay baar hai ( siyah : band khulay se neechay hai ). yeh pehli mom batii ki khuli taraf ya neechay ( gape neechay ) khilta hai. bunyadi tor par doosri baar ko jazbaat mein bohat mazboot tabdeeli dikhani chahiye, jahan baichnay walon ki taraf se koi hichkichahat nah ho. taizi ke patteren ke liye, qeemat neechay ke rujhan mein hai, patteren ki pehli baar neechay ki baar hai. patteren ki doosri baar aik mazboot up baar hai. yeh pehli mom batii ke khilnay par ya is ke oopar khilta hai. dosra baar jazbaat mein aik bohat mazboot tabdeeli ko zahir karta hai, jahan kharidaron ki taraf se koi hichkichahat nahi hoti hai. yeh namoonay aam tor par rozana, hafta waar ya mahana chart par dekhe jatay hain aur ziyada kasrat se un baazaaron mein dekhe jatay hain jo har raat band hoti ha -

#10 Collapse

kukkar patteren security ka price charting patteren hota hai jis ki khasusiyat is ki do baar candle stuck ki allag allag tashkeel ki muddat ke douran qeemat mein taizi se tabdeeli se hoti hai. keekar patteren takneeki tajzia ki duniya mein numaya hain kyunkay woh asason ki qeemat ki passion goi ki simt mein tabdeelion ke liye pishin goi ke tor par kaam karte hain. kukkar ke patteren bohat ziyada barh jatay hain jab woh ziyada farokht shuda aur ziyada kharidi hui marketon mein hotay hain. kukkar patteren ka assar is baat ki nishandahi karta hai ke maliyati market ke barray khilari security ke baray mein –apne khayalat ko tabdeel ya tabdeel kar rahay hain. ziyada tar mamlaat mein, maliyati market ke barray khiladion ke khayalat baaz khabron ke waqeat ya maloomat ke ajra se mutasir hotay hain. misaal ke tor par, agar koi si e o khulay aam mutanazia siyasi aqaed ka izhaar karta hai, to sarmaya car bunyadi stock ko beech kar ya khareed kar sakht rad-e-amal ka izhaar kar satke hain. do bunyadi kukkar patteren jo aaj maliyati mandiyon mein numaya hain woh" blush kukkar patteren" aur" bearish kukkar patteren" ke naam se jane jatay hain. kukkar patteren ko sab se ziyada qabil aetmaad ulat patteren samjha jata hai aur aam tor par company ke bunyadi usoolon mein dramayi tabdeeli ki nishandahi karte hain. kukkar patteren aik ulatnay wala patteren hai, aur aik gape patteren se mukhtalif hai, jo oopar ya neechay ke farq ko zahir karta hai aur trained mein rehta hai. -

#11 Collapse

"Bullish Separating Lines Candlestick Pattern par trading Roman Urdu mein: Bullish Separating Lines Candlestick Pattern ek technical analysis pattern hai jo trading mein istemal hota hai. Is pattern mein do candlesticks hoti hain: 1. Pehli candlestick ek downtrend ko darust karti hai, jismein bearish (bechne wale) sentiment hota hai. 2. Dusri candlestick, jo pehli candlestick ko completely separate karti hai aur bullish (khareedne wale) sentiment ko dikhati hai. Yeh pattern usually price reversal ko suggest karta hai aur traders ko market mein buying ki taraf dhyan dena chahiye. Is pattern ko samajh kar traders market mein entry points dhoondte hain aur profit kamane ki koshish karte hain." -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bullish Kicker Pattern (Bail Ki Kicker Patt) -

Bullish Kicker Pattern forex trading mein ek mufeed aur ahem candlestick pattern hai jo market mein bullish reversals ko pehchanne mein madad karta hai. Yeh pattern bearish trend ke baad aata hai aur bullish momentum ke shuru hone ka signal deta hai. Yeh pattern traders ke liye ahem hota hai kyunki iske appearance ke baad uptrend ka mukammal reversal hone ka imkan hota hai. Yahan hum Bullish Kicker Pattern ke baare mein mazeed maloomat faraham karte hain:

Kicker Patt Ki Pechan: Bullish Kicker Pattern ko pehchane ke liye, do consecutive candles ki zaroorat hoti hai. Pehla candle bearish hota hai aur doosra candle bullish hota hai. Pehla candle normal range ke andar hota hai jabki doosra candle iski opposite direction mein open hota hai aur pehle candle ke close se above hota hai. Yeh abrupt change market sentiment ko darust karta hai aur bullish reversal ka signal deta hai.

Bullish Kicker Pattern Ka Tafsili Tajziya: Bullish Kicker Pattern ek powerful reversal signal hai jo traders ko market ke direction ke mutabiq trading decisions lene mein madad karta hai. Yeh pattern uptrend ka start hone ke indications deta hai aur traders ko potential entry points faraham karta hai. Jab yeh pattern market mein appear hota hai, to traders ko bullish positions lene ka mauka milta hai.

Bullish Kicker Pattern Ke Faiday:- Bullish Reversal Signal (Bail Ki Ulat Phirao Ka Sinyal): Bullish Kicker Pattern bearish trend ke baad bullish reversal ka strong signal hai. Yeh pattern market sentiment ka tezi se change ko darust karta hai aur bullish momentum ka shuru hone ka indication deta hai.

- Entry Point Ki Pehchan (Dakhil Hone Ke Point Ki Pehchan): Is pattern ke appearance ke baad traders ko entry point tay karna aasan ho jata hai. Doosre candle ke open ke saath hi traders apne positions enter kar sakte hain, jisse ke wo bullish trend ke shuru hone ka faida utha sakein.

- Stop Loss Aur Target Levels (Rok Tok Nuqsan Aur Maqsood Level): Bullish Kicker Pattern ke istemal se traders apne stop loss aur target levels ko set kar sakte hain. Stop loss pehle candle ke low ke neeche set kiya jata hai jabki target levels ko resistance levels ya previous highs par rakha jata hai.

- Risk Management (Khatra Nigrani): Bullish Kicker Pattern traders ko market ke reversals aur trend changes ko samajhne mein madad karta hai, jo ke unki risk management ko behtar banata hai.

Bullish Kicker Pattern ka istemal karke traders apni trading performance ko behtar bana sakte hain aur munafa kamane mein kamiyabi hasil kar sakte hain. Lekin yaad rahe ke har ek pattern ki tarah, yeh bhi sirf ek tool hai aur uska istemal sahi tajziya aur samajhdari ke sath karna zaroori hai.

-

#13 Collapse

What is bulish kicker pattern??

Bullish Kicker pattern forex trading mein ek mukhtasir lekin powerful candlestick pattern hai jo ke trend reversal ko darust karta hai. Ye pattern typically downtrend ke baad dekha jata hai aur upward movement ki shuruaat ko signal karta hai. Is pattern ko samajhna traders ke liye zaroori hai taake wo sahi waqt par apne trades ko manage kar sakein aur nuksan se bach sakein.

Bullish Kicker pattern mein do candlesticks shamil hote hain, jo neeche diye gaye tareeqe se hota hai:

Pehla Candlestick (Bearish):

Pehla candlestick ek downtrend ke doran dekha jata hai aur bearish hota hai, jo ke downward movement ko darust karta hai.

Is candlestick ki body bara hoti hai aur buyers ki kamzori ko indicate karti hai. Iska range typically wide hota hai aur iski closing price neeche ki taraf hoti hai.

Dusra Candlestick (Bullish Kicker):

Dusra candlestick pehle candlestick ke neeche open hoti hai aur uske neeche se shuru hoti hai.

Is candlestick ki body pehli candlestick ki body ko puri tarah se cover karti hai, jisse ek strong buying pressure ka indication hota hai.

Dusra candlestick ki closing price pehli candlestick ki body ke upper half mein hoti hai, jo ke ek bullish reversal ke confirmation ko darust karta hai.

Bullish Kicker pattern ka matlab hota hai ke pehle downtrend ke baad market mein buyers ki sudden aur strong entry hui hai, jo ke pehli candlestick ki kamzori ko overcome karti hai aur upward movement ki shuruaat ko signal karti hai.

Traders is pattern ko recognize kar ke apne trading strategies ko adjust kar sakte hain. Agar wo downtrend ke baad Bullish Kicker pattern dekhte hain, to wo long positions le sakte hain ya existing short positions ko close kar sakte hain. Iske alawa, stop-loss orders lagana bhi zaroori hai taake nuksan se bacha ja sake.

Overall, Bullish Kicker pattern forex trading mein ek mukhtasir lekin powerful tool hai jo ke traders ko potential trend reversals ka pata lagane mein madad karta hai aur unhein better trading decisions lene mein madad deta hai. Isliye, traders ko is pattern ka istemal kar ke market ko samajhna aur apni trades ko manage karna zaroori hai.

-

#14 Collapse

**Bullish Kicker Pattern Kya Hai?**

Bullish Kicker pattern technical analysis ka aik powerful candlestick formation hai jo market ke reversal aur bullish trend ke indicators provide karta hai. Ye pattern khas tor pe bearish trends ke baad hota hai aur iska maqsad bullish momentum ki shuruat ko indicate karna hota hai. Is pattern ko samajhne se traders ko market ki potential upward movement ka signal milta hai.

Bullish Kicker pattern do candlesticks se mil kar banta hai: ek bearish candlestick aur ek bullish candlestick. Is pattern ki khasiyat ye hai ke ye pattern ek gap ke sath form hota hai. Pahli candlestick bearish hoti hai aur dusri candlestick ek strong bullish candlestick hoti hai jo pahli candlestick ke closing price se upar open hoti hai, yani gap up hota hai. Is tarah se ye pattern bullish reversal ka indication provide karta hai.

**Bullish Kicker Pattern Ke Faide:**

1. **Reversal Signal**: Bullish Kicker pattern bearish trend ke baad banne ki wajah se market ke bullish reversal ka signal hota hai. Jab traders is pattern ko observe karte hain, to ye unhe market ke bearish phase ke khatam hone aur upward movement shuru hone ka indication deta hai.

2. **Gap Confirmation**: Is pattern ka gap bullish confirmation provide karta hai. Agar bearish candlestick ke baad bullish candlestick ek clear gap ke sath open hoti hai, to ye pattern ki strength aur validity ko barhata hai. Gap confirmation market ke strong bullish momentum ko support karta hai.

3. **Enhanced Trading Opportunities**: Bullish Kicker pattern traders ko potential entry points aur profit-taking levels identify karne mein madad karta hai. Traders is pattern ke sath apni trading strategy ko align kar sakte hain aur bullish trend ke faide ko maximize kar sakte hain.

4. **Improved Risk Management**: Is pattern ko identify karne ke baad traders stop-loss orders ko strategically set kar sakte hain. Bullish Kicker pattern ke formation ke baad, market ki upward movement se profit gain karna asaan hota hai, aur stop-loss levels ko set karke risk ko effectively manage kiya ja sakta hai.

5. **Historical Performance**: Historical data ke analysis se ye dekha gaya hai ke Bullish Kicker pattern ka market me bullish reversals pe significant impact hota hai. Ye pattern traders ko past market trends aur future movements ke bare me insights provide karta hai.

Bullish Kicker pattern ek valuable tool hai jo traders ko market ki bullish reversals aur upward trends ko identify karne mein madad karta hai. Is pattern ka use karke traders apni trading strategies ko optimize kar sakte hain aur market ki fluctuations se faida utha sakte hain.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Bullish Kicker Pattern Kya Hai?**

1. **Definition**:

- **Bullish Kicker**: Bullish kicker pattern ek candlestick pattern hai jo price action ke changes ko dikhata hai. Ye pattern generally ek bearish trend ke baad hota hai aur upward reversal ka indication deta hai.

2. **Pattern Formation**:

- **First Candle**: Is pattern ki pehli candle usually ek long bearish candle hoti hai. Iska matlab hai ke market mein abhi bhi selling pressure hai aur price niche ja rahi hai.

- **Second Candle**: Dusri candle ek long bullish candle hoti hai, jo pehli candle ke gap ke saath open hoti hai. Iska matlab hai ke market mein strong buying pressure aa gaya hai aur price upar ki taraf move kar rahi hai.

3. **Gap**:

- **Gap Between Candles**: Bullish kicker pattern mein do candles ke beech ek clear gap hota hai. Pehli bearish candle aur doosri bullish candle ke beech mein price gap ko signify karti hai. Ye gap market ki sudden shift ko dikhata hai.

4. **Significance**:

- **Reversal Indication**: Ye pattern usually bearish trend ke baad hota hai aur bullish reversal ka signal deta hai. Jab market pehle bearish trend mein hoti hai aur phir bullish kicker pattern develop hota hai, to ye bullish trend ke aane ka indication ho sakta hai.

- **Confirmation**: Is pattern ki reliability ko confirm karne ke liye additional indicators aur analysis bhi zaroori hota hai. Ek bullish kicker pattern ke baad, market ko further bullish trend follow karna chahiye.

5. **Trading Strategy**:

- **Entry Point**: Bullish kicker pattern dekhne ke baad, traders usually buy position open karte hain. Doosri candle ke closing price ke upar entry lene ki strategy adopt ki ja sakti hai.

- **Stop-Loss**: Risk management ke liye, traders ko stop-loss order set karna chahiye. Ye stop-loss pehli bearish candle ke low ke neeche set kiya ja sakta hai taake unexpected price movement se bachav ho sake.

6. **Limitations**:

- **False Signals**: Har bullish kicker pattern valid nahi hota. Kabhi-kabhi ye pattern false signals bhi de sakta hai. Isliye, pattern ke saath dusre technical indicators aur analysis ko bhi consider karna chahiye.

Bullish kicker pattern ek powerful tool hai jo traders ko market ke bullish reversal ko identify karne mein madad karta hai. Lekin is pattern ko sahi tarike se use karne ke liye, additional analysis aur confirmation zaroori hoti hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:52 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим