Grid Trading Strategy Kia Hai..??

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Assalam o Alikum Dears Pakistan Forex From Members Umeed karta hun ap sab loog khair Khariyat sy hungy or enjoy kr rhy hungy apni training life ko dosto forex market main trade kerny ky liay jahan ham breakout aur breakdown trading strategy ko use kerty hain wahan per ham risk level ko minimize kerny ky liay grid trading strategy ko use kerty hain ky agar market kisi bhi direction main move ker jati hai tou same time per hamari trade open ho jaey aur hamain profit bhi hasil ho jaey grid trading main hamain breakout ya breakdown ka wait nehi kerna perta ky jab bhi market jis direction main big movement kerti hai hamari trade open hoti hai aur hamain profit hasil ho jata haiGrid Strategy Ksy Apply KrynDosto jab market support aur resistance ky darmian movement ker rehi hoti hai tou kisi bhi time kisi bhi direction main support ya resistance ko break ker sakti hai tou aesy time per hamari trade open ho jaey is ky liay ham support break per sell stop jab ky resistance break per buy stop set ker dety hain then ham profit ka same order main target bhi set ker dety hain ky jab market breakout kerti hai tou woh big movement kerti hai tou aesi surat main hamara profit ka target hit ho jata hai aur hamain acha profit hasil ho jata hai hamain trade open aur close bhi nehi kerna pertiGrid Trading sy Profit ksy krynDosto grid trading hamesha hi profitable hoti hai lekin agar ham same trading strategy ko news time per apply kerty hain tou jab koi important even ya news release hoti hai tou aesy time per market kisi bhi direction main big movement kerti hai tou same time per hamara sell stop ya buy stop active hota hai aur short time main hamara profit ka target bhi hit ho jata hai so hamain specially news time per grid trading strategy ko zarur apply kerna chahiay taky news time per market ki big movement per bary loss sy bhi hamara capital secure rehy aur hamain acha profit bhi hasil ho jaeySuccessful Trading ka asoolDosto grid trading ka sab sy bara fiada yeh hai ky yeh bahot hi easy strategy hai jis terha ky other kuch trading strategies complicated hoti hai isterha grid tading complicated nehi hai just hamain support aur resistance ko identify kerna hota hai aur both ky breakout per stops orders set kerny hoty hain usky bahd market khud hi order open bhi kerti hai aur target hit hony per hamain profit bhi hasil ho jata hai hamain bar bar trading strategy ko change ya adjust nehi kerna perta jo other trading strategies main kerna perta hai so grid trading strategy is best amongst many other trading strategies -

#3 Collapse

Assalamu Alaikum Dosto!

Forex Grid Trading

Forex grid system traders mein kafi maqbool ho gaya hai kyunki isay visualise karna mumkin hai aur ismein kuch dilkash faiday hain jo pehle nazar mein attract karte hain. In mein shamil hain:- Yeh qismatan aik automated system hai: Aap manually ek grid set up karte hain (manual grid trading strategy). Baad mein, yeh kuch automated strategy jese ban jata hai buy aur sell stop orders ka istemal karke, jo un trading strategies ka stress khatam kar deta hai jismein trader ko manually positions open aur close karni parti hain.

- Yeh volatile markets mein maqbool hai: Ek aur great baat is system ki yeh hai ke yeh volatile market conditions mein bhi investment opportunities de sakta hai. Is tarah, yeh market ki direction predict karne ki zaroorat ko khatam kar deta hai. Trader ko bas yeh maloom hona chahiye ke market move karegi, aur strategy baqi ka kaam khud sambhal legi.

- Yeh trending markets mein bhi investment opportunities deti hai: Trading is strategy ke sath zyada instruments pe apply kiya ja sakta hai.

Jab ke yeh features attractive lagte hain, yeh samajhna zaroori hai ke koi guarantee nahi hai. Agar aap manually ek successful grid trading strategy develop karna chahte hain, to aapko system ko sahi tarike se execute karna ana chahiye. Aapko maloom hona chahiye:- Market ka kaise kaam karti hai

- Current market dynamics

- Broker ki trading commissions aur margin

Yeh zaroori hai ke aap aise broker ka istemal karen jinki trading commissions reasonable ho. Yeh conditions grid trading system ke maximum levels ko limit karengi. Jabke grid trading Forex strategy trending markets mein bhi kaam karti hai, downside yeh hai ke trader ko hamesha available margin ko mind mein rakhna parta hai - khas taur par trending markets mein.

Margin wo collateral hai jo aapko apne broker ke sath deposit karna parta hai taake aapke generated risk ko cover kiya ja sake. Yeh aksar aapke open trading positions ka ek fraction hota hai aur percentage ke taur par defined hota hai. Margin ko apne open trades pe deposit ke taur par sochna madadgar hota hai.

Yeh bhi madadgar ho sakta hai ke aap dusri trading strategies aur indicators ka istemal kaise kar sakte hain apni grid ko mazboot karne ke liye. Misaal ke taur par, Gann lines ka istemal kar ke Gann grid trading strategy develop karna ya Average True Range (ATR) indicator ka istemal kar ke ATR grid trading strategy develop karna. Mein isay baad mein tafseel se discuss karunga.

Forex Grid Trading Strategy: Grid kya hai?

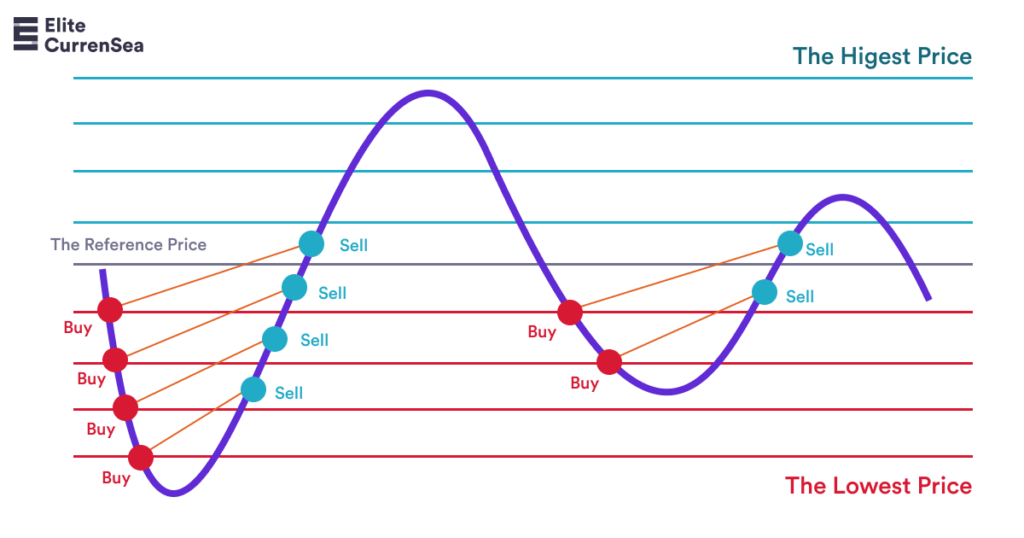

Grid kya hai aur grid trading strategy kya hai? Forex grid trading strategy ek technique hai jo market ke natural movement pe profit kamaane ki koshish karti hai buy stop orders aur sell stop orders ko mukhtalif intervals pe set price ke upar aur neeche position karke. Kyunki levels dono sides pe set hote hain, isay kabhi kabhi double grid trading strategy bhi kaha jata hai.

Aap apni grid bana sakte hain taake ranges ya trends se profit kama sakein. Misaal ke taur par, ek trader buy orders place kar sakta hai har 15 pip interval pe set price ke upar, jabke sell orders place kar sakta hai har 15 pip interval pe set price ke neeche. Yeh trends ka faida uthayega. Neeche chart aisi grid ka visualization deta hai.

Ek successful grid trading strategy with the trend ka principle yeh hai ke agar market price consistently ek direction mein move karti hai, to aapka position is par faida uthana zyada hota jata hai. Jese jese price barhti hai, grid zyada buy orders trigger karti hai jis se aapka position barhta jata hai. Aapka position barhta jayega aur zyada profitable hoga agar price isi direction mein chalti rahe.

Magar, yeh traders ke liye ek dilemma create karti hai. Aakhirat mein, trader ko decide karna parta hai ke kab grid close karni hai, apni sari open trades exit karni hain aur apne profits collect karne hain. Kisi point pe price reverse kar sakti hai aur aapke profits gaib ho sakte hain. Aapke losses ko aapke sell orders control karenge, jo equally spaced apart hain. Magar, jab tak price un orders tak pohanchti hai aur trigger hoti hai, aapka position shayad profit se loss mein chala gaya ho.

Grid trading Forex strategy ke sath, aksar best yeh hota hai ke puri grid ko ek "system" ke taur par dekha jaye, bajaye ke har trade ko individually manage karne ki koshish karein. Yeh perspective bhi aapki trades ki management ko simplify karta hai.

Trend Market Mein Grid Trading

Grid trading Forex strategy ke sath, aapki grid ke liye ideal outcome yeh hai ke price ya to top ya bottom half of grid ke sari levels tak pohanch jaye, magar dono nahi.

Agar price turn hoti hai aur steadily ek direction mein move karti hai, to aapko reversal ke chances consider karne chahiye, jo aapko lose karwa sakti hai koi bhi profits jo aapne kamaaye hain. Ideally, aap apne orders ko reversal se pehle close karte hain.

Reversal se bachane ke liye, traders aksar apni grid ko kuch specific number of orders tak limit karte hain. Misaal ke taur par, paanch. Woh paanch buy orders apni set price ke upar place karte hain. Agar price phir un paanch buy orders ke through jati hai, to woh apni trade ko profit ke sath exit karte hain. Traders apni positions ko ek saath exit kar sakte hain ya ek sell grid create kar sakte hain jo target level se shuru hoti hai.

Ek aur approach mein grid trading Forex strategy ka istemal karte hue, aap kuch trade pairs ko close karte hain jab wo ek specific profit target tak pohanchti hain. Is approach ke sath, aap higher profit targets tak pohanch sakte hain apne profits ko run karne de kar.

Is approach ka disadvantage yeh hai, ke aap nahi jaan sakte ke trades ko run karne mein kitna waqt lagega. Iska natija yeh hota hai ke aapka capital aur margin aapke account mein held rahte hain.

Grid trading mein, ek level execute hone ke baad, kuch traders decide karte hain ke opposite level pe order cancel kar dein. Yeh unnecessary costs (swap aur spread fees mein) ko prevent karta hai jo dono opposite trades open rakhne se hoti hain fixed profit outcome ke sath. Kyunki opposing pairs ek doosre ko cancel karte hain, traders ko dono sides open rakhne ka faida nahi hota.

Ranging Market Mein Grid Trading

Agar price action volatile hai aur range mein trade kar raha hai, yeh aapke set price ke neeche sell orders aur upar buy orders dono ko trigger kar sakta hai, jo loss mein result karta hai. Is case mein, upar discussed trend strategy ek successful grid trading strategy nahi hoti. Yeh fail kar jati hai. Price ka up aur down bounce hona aksar is strategy ke expected results nahi deta.

Volatile ya range markets mein, forex grid trading strategy jo trend ke against trade karti hai aksar zyada effective hoti hai. Misaal ke taur par, ek trader buy orders place kar sakta hai common intervals pe apni set price ke neeche, aur sell orders common intervals pe set price ke upar. Jese jese price girti hai, trader long jata hai. Jese jese price barhti hai, sell orders activate hoti hain taake long position minimize ho aur short jata hai. Trader profit kama sakta hai agar price continue kare upar neeche move karte hue sideways range mein, sell aur buy orders trigger karte hue.

Is qism ki forex grid trading strategy ka main problem yeh hai ke aapka risk control nahi hota. Price kuch positions ko trigger kar sakti hai bina aapke take-profit tak pohanche aur phir opposite direction mein retreat kar sakti hai. Iska natija yeh hota hai ke ek position open reh jati hai aur loss accumulate hota hai. Agar price ek direction mein move karti rahe instead of oscillating in a range, trader ek losing position ke sath phase ga jo barhta rahega. Trader ko stop loss set karna parta hai, kyunke woh nahi chahte ke ek indefinitely barhta hua losing position hold karein.

Kya Grid ek Hedged System hai?

Ek grid direction of price move ko maloom karne ka variable hata deti hai. Magar, iska matlab yeh bhi hai ke bahut complex money management conditions banti hain. Iske ilawa, yeh margin of error ko barhati hai, kyunke aapko multiple trades ko manage karna parta hai ek waqt mein.

Ek manual grid trading strategy ko ek hedged system consider kiya ja sakta hai - kyunke yeh loss protection ka system entail karti hai. Idea yeh hai ke kuch losing trades profitable trades se offset ho jati hain.

Ideal situation mein, puri system of trades positive ban jati hai. Is point par, aap baki positions ko close kar sakte hain aur profit realize kar sakte hain.

Magar, koi guarantee nahi hai ke aapka system of trades is forex grid trading strategy mein hamesha net profit degi. Isliye ek strong strategy ka istemal based on education aur experience yahan bhi utna hi zaroori hai jitna kisi aur prediction-based forex trading strategy mein hota hai.

Forex Grid System Implement karna

Yahan ek example hai ke manual grid trading strategy kaise construct ki jaye. Jaise maine upar mention kiya, isay double grid trading strategy bhi consider kiya ja sakta hai. Trending market ke liye grid set up karne ke steps hain:- Ek interval select karein: 5, 10, 50, ya 100 pips, misaal ke taur par.

- Apni grid ke liye starting price choose karein.

- Decide karein ke aap with-the-trend grid set up karna chahte hain ya against-the-trend grid.

Agar market trend mein move karne lagti hai, with-the-trend forex grid trading strategy ka starting point 1.1660 ho sakta hai 10-pip intervals ke sath. Trader buy orders set kar sakta hai:

1.1670

1.1680

1.1690

1.1700

1.1710

Sell orders yeh set karega:

1.1650

1.1640

1.1630

1.1620

1.1610

Is forex grid trading strategy ke sath, trader ko apni position ko exit karna parta hai jab yeh profitable ban jaye taake profits ko lock in karein. Agar market us direction mein move kare jesa anticipate kiya gaya tha, position barhta jata hai aur trader waqt pe exit karke profits collect karta hai.

Agar aap against-the-trend forex grid trading strategy ka option choose karte hain. Aur 1.1660 ka starting point select karte hain 10-pip interval ke sath. Aap buy orders set karte hain:

1.1650

1.1640

1.1630

1.1620

1.1610

Aur sell orders set karte hain:

1.1670

1.1680

1.1690

1.1700

1.1710

Aisi strategy tab profit secure karegi jab dono sell aur buy orders activate ho jati hain. Magar, yeh strategy ko ek stop loss ki zaroorat hai aapko protect karne ke liye agar price ek direction mein move karti hai. Agar price volatile reh kar sell aur buy orders ko trigger karti hai bina ek direction mein trend kiye aur stop loss ko trigger kiye, trader apni position exit karke profits collect kar sakta hai. Trading high level ka risk carry karti hai aur loss mein result ho sakti hai yeh yad rakhen.

Examine karen k ek day trader dekhta hai ke EURUSD 1.1500 aur 1.1600 ke range mein hai aur current price 1.1550 ke kareeb hai, isliye woh 10-pip interval ke sath ek against-the-trend forex grid trading strategy choose karta hai taake is range ka faida utha sake.

Woh sell orders place karta hai:

1.1560

1.1570

1.1580

1.1590

1.1600

1.1610

Aur ek stop loss set karta hai 1.1630 pe. Yeh unki risk ko cap karta hai. Unka risk 270 pips hoga agar har sell order trigger hoti hai, magar koi buy orders trigger nahi hoti aur yeh stop loss tak pohanchti hai.

Phir woh buy orders set karte hain:

1.1540

1.1530

1.1520

1.1510

1.1500

1.1490

Aur stop loss set karte hain 1.1470 pe. Risk bhi 270 pips hota hai agar har buy order trigger hoti hai magar koi sell orders trigger nahi hoti aur yeh stop loss tak pohanchti hai.

Yeh trader anticipate kar raha hai ke price lower aur higher move karegi 1.1610 aur 1.1490 range mein. Woh yeh bhi anticipate karte hain ke price is range se zyada move nahi karegi. Agar yeh karegi, woh apni position exit karenge loss ke sath taake apna risk minimize karein.

Market ki unpredictability Forex grid strategy ka sabse bada drawback highlight karti hai aur ek important general point bhi traders ke liye. Yani, aapko psychologically losing positions se deal karna ana chahiye. Acha trader banne ka matlab sirf overall profitability nahi, balki yeh ability ke learning ke liye. Acha trader hamesha loss ko ek positive learning experience mein badal sakta hai.

Apna Risk Set Karna

Yahan kuch ahem points hain jo traders apne trading mein ek mazboot khatra prabandhan strategy ka istemal karte hain, jo ke trading grid strategy mein shaamil hai:- Yeh yaad rakhen ke agar non-opposing trade pairs alag alag band kiye jate hain to system apna hedging feature kho sakta hai aur unlimited losses ko allow kar sakta hai. Isi wajah se traders apni trades pe wide stop losses set karte hain - ek suraksha ke taur par.

- Agar aap ek bhagte hue market mein ya liquidity kam currencies ke sath operate kar rahe hain, to trades grid mein exact levels pe execute nahi ho sakti, jo aapko bade exposure ke sath chor sakti hai.

- Yeh zaroori hai ke aapko market ka sab se zyada mumkin range ka saaf andaza ho taake aap apne exit levels ko sahi taur pe set kar sakein.

- Jab aap apne lot sizes aur grid configuration set kar rahe hain, to dhyan dein ke aapka account kisi bhi point pe overexposed na ho jo margin call ka bais ban sakta hai.

- Is grid system ka pehla faida aapke exit aur entry prices ka averaging hai. Yeh aik tareeqa hai jo aapka khatra level barhane ki bajaye kam kar sakta hai.

- Aakhri mein, kisi bhi market mein trading grid strategy ke sath, yeh zaroori hai ke aap apne order volume aur apne khatra limits se zyada exposure ko multiply karne ka shauq na karein.

Doosri Grid Trading Strategies

Aap apni manual grid trading strategy ko mazboot karne ke liye doosri trading strategies ko shaamil kar sakte hain.- Average True Range + Grid

Misaal ke taur par, aap Average True Range (ATR) indicator ka istemal karke market mein price range volatility ko napne mein madad le sakte hain pehle apni forex grid system set karne se. Yeh ek ATR grid trading strategy kehlaya ja sakta hai. - Gann Lines + Grid

Ek aur strategy Gann lines ka istemal karti hai. Ye trading chart par intersecting lines hote hain jo potential upward ya downward price trends ko map karte hain. Kuch lines price ke direction tendency ko represent karte hain, jabke doosri support aur resistance ki lines ko indicate karte hain. Yeh samajhna ke price kis direction mein trend kar sakta hai ya nahi aapko trading strategy develop karne mein zyada insight de sakta hai. Isko aap Gann grid trading strategy kehte hain.

Grid System Trader k leye Conclusion

Mai aapko grid trading system ke kuch faide aur nuksan chhod deta hoon, taake aapko yeh samajhne mein madad ho ke yeh kya hai aur yeh aapke liye hai ya nahi.- Fawaid:

- Kam Screen Time: Forex grid strategy ka istemal karte hue, aapko sirf apni grid set up karni hoti hai, jo aam tor par kuch minutes leti hai. Iske baad, aapki grid aapke buy aur sell stop orders ke tay kiye gaye hadood ke andar aapke liye trade karegi.

- Strategy bar bar nahi badalni parti: Market ek alag direction mein le gaya ya agar aapke equity mein koi changes aaye, to aapko apne forex grid system ki configuration badalni hogi. Magar, agar aap ek strong grid trading method ka istemal karke apni grid ko set karte hain, toh shayad woh weeks, months ya saalon tak wahi settings ke saath trade kar sake.

- Market k Sare Direction k leye hai: Kisi bhi tajwezah wali trade ki tarah, yeh strategy market ke mukhtalif rukh ko predict karne ki bhi zaroorat nahi hai. Is grid trading method ke saath, aap ek trading direction chun sakte hain aur agar aapki prediction ke mutabiq market ghalt sabit ho gayi to aapko kareeb aik hazar pips tak fikr karne ki zaroorat nahi hai.

- Timeframe ki zarorat nahi hoti hai: Kisi bhi time frame ke baghair, forex grid strategy high, low, close aur open prices ko analyze karne ke liye nahi bana. Forex grid system ka rawayya badal nahi sakta, chahe chart ka time frame kuch bhi ho. Dosron ki tarah, traders apne chart pe time frame change kar sakte hain bina apne trading ko effect kiye.

- Aik forex grid strategy trades ko bar bar aur real taur pe band karti hai. Jab spacing puri hoti hai, trades execute hoti hain. Agar aap wide spacing ka istemal karke wide price ranges tak pohochne ki koshish kar rahe hain, toh aap regularly trades execute kar rahe hain.

- Pehle hi risk tay: Ek forex grid system ke saath, aap apne estimated total exposure aur apne trades ke size ko pehle se calculate kar lete hain usse trading shuru hone se pehle.

- Kisi bhi rukh mein faida: Forex grid strategy traders ko market kisi bhi direction mein jaate waqt faida kamane ki koshish karne ki ijaazat deti hai. Misaal ke taur par, agar aapne ek long grid set kiya aur market gir gaya, agar market ke us girne mein kafi fluctuation ho, toh aap us movement mein faida utha sakte hain.

- Nuksanat:

- Pehli baar yeh samajhna thoda mushkil aur be-logic lagta hai: Aam tor par, log ek trade place karne mein apni prediction ke mutabiq hote hain, stop-loss aur take-profit order ka istemal karte hain. Ek grid forex strategy ke saath, aap bina kisi take-profit aur stop-loss ke kai trades place karte hain aur, Aur, ek trade pe dhyan nahi dete, balki aap apne cover kiye gaye price range ki validitry pe dhyan dete hain.

- Galat grids bade nuksan pahuncha sakte hain: Agar aap apna grid system forex mein aggressive tareeke se perform karne ke liye set karte hain, toh aap margin call mein khud ko pa sakte hain. Isliye zaroori hai ke aap apna risk measure karein pehle apna grid establish karne se. Kuch traders apne sath ek grid trading strategy ea ka istemal karte hain jisse unhe madad milti hai.

Halanki, jabki automated trading khushkismati lag sakti hai, yeh hamesha profitable nahi hoti. Ismein apne hi khatron ke saath aati hai jo kisi bhi strategy ko rokte hain, including grid trading method, aur nuqsan aur waqt ka bais bana sakti hain. Koi bhi trader ko kisi bhi bot ki vaality ki tafteesh karni chahiye aur sochna chahiye ke kya woh in khatron ka saamna kar sakte hain ya nahi, phir wo kisi ko kharidne ka faisla karein.

Grids ek set-and-forget strategy nahi hain. Grids acha perform karne ke liye, educated traders chahiye. Koi bhi grid settings nahi hai jo hamesha profitable hoti hai. Iska wajah hai ke aapka equity aur market trading range kuch waqt ke baad badal jate hain. Metatrader Tester ka istemal karna achha hai, lekin traders ko aise setting nahi milengi jo hamesha profits generate kare. - Bardasht karna zaroori hai: Kabhi kabhi, grid bina kisi faida ke expand ho jata hai. Wahi samay, ek grid ko band karna saptahon ya mahinon tak lag sakta hai. Grid trading method ka istemal karne ke liye, aapko grid trading kaam kaise karta hai ko samajhne ke liye sabar ki zaroorat hoti hai. Grid trading method woh traders ke liye nahi hai jo sirf trading ke liye thrill mein hain.

- Ye ek paradigm shift ko shamil karta hai: Traders ek single prediction-based trade pe focus karne ke aadi hote hain. Grid trading method ka istemal shuru karte waqt, unhe apni paradigm ko ek trading range aur grid ko ek forex grid system ke roop mein sochne ke liye badalna padta hai.

- Iske liye ek bara balance ki zaroorat hai: Grid trading method low balance wale accounts ke liye suitable nahi hai, keval agar trader ek cent account ka istemal kar rahe hain, jismein ek pip ki tabdeeli das mein taqseem ki jati hai. Agar aapka account balance bahut kam hai, toh aapko apni trades ke beech zyada spacing ka istemal karna padega, jo aapki cash-in frequency ko kam karega.

-

#4 Collapse

Grid Trading Strategy Kia Hai..??

Grid Trading Strategy: Ek Comprehensive Guide

**Introduction:**

Grid trading ek popular trading strategy hai jo market volatility aur range-bound markets mein istemal ki jati hai. Ye strategy traders ko multiple buy aur sell orders lagane ki anumati deta hai taaki woh market ke fluctuations se fayda utha sakein.

**Grid Trading Kaam Kaise Karta Hai:**

Grid trading mein, traders ek grid ya network of buy aur sell orders set karte hain jo market ke specific price levels par execute hote hain. Har order ke beech mein fixed distance hota hai, jise grid kehte hain. Jab market price grid ke kisi level tak pahunchti hai, ek order execute hota hai, aur jab market price doosre level tak pahunchti hai, doosra order execute hota hai, aur yeh cycle chalti rahti hai.

**Grid Trading Ke Mukhya Fayde:**

1. **Automation:** Grid trading ko automate kiya ja sakta hai, jisse traders ko manually orders lagane ki zarurat nahi hoti.

2. **Range-Bound Markets Mein Effective:** Ye strategy range-bound markets mein khas karke effective hai, jahan market ek specific price range mein move karta hai.

3. **Risk Management:** Grid trading strategy mein risk management ka aspect strong hota hai, kyun ki traders fixed distance par orders lagate hain, jisse risk spread hota hai.

**Grid Trading Ke Mukhya Nuksan:**

1. **Trend Markets Mein Loss:** Agar market trend mein hai aur continuously ek direction mein move kar raha hai, to grid trading losses generate kar sakta hai.

2. **Market Volatility:** Agar market excessively volatile hai, to grid trading strategy effective nahi hoti kyunki orders frequently execute hote hain aur losses ho sakte hain.

3. **High Capital Requirement:** Grid trading strategy ko effectively implement karne ke liye high capital requirement hoti hai kyunki multiple orders lagane padte hain.

**Grid Trading Ka Example:**

Maan lo, current market price $100 hai. Ek trader ne ek grid set kiya hai jismein wo har $10 ke distance par buy aur sell orders lagata hai. To uska grid kuch aise dikhega:

- Buy Order 1: $90

- Sell Order 1: $110

- Buy Order 2: $80

- Sell Order 2: $120

Aur yeh process continue hoti rahegi.

**Conclusion:**

Grid trading strategy ek effective tool ho sakti hai market volatility aur range-bound markets mein. Lekin, isko samajhna aur effectively implement karna traders ke liye zaruri hai, aur ismein risk management ka dhyan rakhna bhi important hai. Is strategy ko samajhne ke liye demo trading accounts ka istemal kiya ja sakta hai.

- CL

- Mentions 0

-

سا2 likes

-

#5 Collapse

Grid Trading Strategy brief and details

Grid Trading Strategy ek aisi trading strategy hai jismein trader market ki fluctuations se faida uthata hai. Is strategy mein trader ek grid system ko use karta hai jismein wo multiple orders place karta hai, jin ki price levels ek fixed distance par hoti hain. Is ki price jtna distance fix kren gy us k brabar apko mlti rhy gi.

Is strategy mein trader ko kisi specific direction par market movement ka wait nahi karna hota, balkay wo market ki up-down movement se faida uthata hai. Jab market price levels ki upper ya lower side par jaata hai, to trader apni open orders ko close kar leta hai aur is tarah se profit earn karta hai.is me ap hr trah ka profit ly skty hen jo apko ml rha ho us pe achi trading ho skti h.

Market level

Grid Trading Strategy mein trader ko market ki volatility aur price levels ke beech ka distance ka khayal rakhna hota hai. Is strategy ko sahi tareeqe se use karne se trader ko long-term profits mil sakte hain.

Risk management

Is strategy mein risk management ka bhi bohat ahem role hota hai. Trader ko apni investments ko manage karte hue apni risk ko kam karna hota hai.

Conclusion

Agar aap forex mein Grid Trading Strategy ka use karna chahtay hain, to aap ko market ki fluctuations aur price levels ke beech ka distance par focus karna hoga. Is strategy ko sahi tareeqe se use karne se aap long-term profits earn kar saktay hain. -

#6 Collapse

Grid Trading Strategy Kia Hai..??

1. Grid Trading Strategy ka Taaruf

Grid Trading ek automated trading strategy hai jo market ke ups aur downs ka faida uthati hai. Is strategy ka mansooba yeh hai ke trader different price levels par buy aur sell orders ko set kare, is tarah ke ek grid create ho jaye. Jab bhi market kisi bhi level ko hit karta hai, order execute hota hai aur profits generate hote hain. Is strategy ka faida yeh hai ke yeh trader ko har tarah ki market conditions mein profit kamaane ka mauqa deti hai, chaahe market uptrend mein ho ya downtrend mein.

2. Grid Trading ka Basic Concept

Grid trading ka basic concept yeh hai ke market fluctuations se faida uthaya jaye, bina market direction ka andaza lagaye. Yeh strategy us time achi tarah se kaam karti hai jab market ek range-bound phase mein hota hai. Price grid predefined intervals par set ki jati hai. Agar market price upar jata hai toh sell orders trigger hote hain aur agar price neeche aata hai toh buy orders trigger hote hain. Is tarah se trader har price movement se profit kamane ki koshish karta hai.

3. Kaise Kaam Karta Hai Grid Trading

Is strategy mein trades ko price grid ke mutabiq set kiya jata hai. Pehle trader decide karta hai ke kaunsa asset trade karna hai aur phir uske liye ek price range define karta hai. Us range ko different levels mein divide kiya jata hai, aur har level par buy aur sell orders place kiye jate hain. Jab market price in levels par pohanchti hai toh orders automatically execute hote hain. Is tarah trader har price movement ka faida uthata hai bina market ki overall direction ki fikr kiye.

4. Grid Trading ki Types

Grid trading ki do main types hain: Classic Grid aur Martingale Grid.

Classic Grid

Classic Grid mein trades fixed price intervals par set kiye jate hain. Har trade ka ek specific profit target hota hai. Yeh strategy un traders ke liye best hai jo low risk aur consistent profit chahte hain.

Martingale Grid

Martingale Grid strategy losses ko recover karne ke liye larger positions use karti hai. Har loss ke baad next trade ko double size ka set kiya jata hai, taake overall profit maximize ho sake. Yeh strategy high risk aur high reward ke liye use hoti hai aur advanced traders ke liye suitable hai jo apne risk ko manage kar sakte hain.

5. Classic Grid Strategy

Classic Grid mein trades fixed price intervals par set kiye jate hain. Yeh intervals typically equal distance par hote hain, jaisay ke har $10 ki movement par ek order set kiya jaye. Har order ka ek specific profit target hota hai jo ke predefined hota hai. Agar price upar jata hai toh sell orders execute hote hain aur agar price neeche aata hai toh buy orders execute hote hain. Har trade ka profit alag alag collect hota hai aur yeh overall trading portfolio mein add hota jata hai.

6. Martingale Grid Strategy

Martingale Grid strategy losses ko recover karne ke liye larger positions use karti hai. Jab ek trade loss mein jata hai, agla trade us loss ko recover karne ke liye double size ka hota hai. Is tarah agar pehla trade $10 loss karta hai toh agla trade $20 ka hota hai, aur agar yeh bhi loss karta hai toh uske baad wala trade $40 ka hota hai. Yeh strategy high risk hai kyun ke agar market continuously ek direction mein move karta hai toh losses bohot rapidly accumulate ho sakte hain. Magar, agar market reverse karta hai toh bohot quickly profits generate ho sakte hain.

7. Grid Trading ke Fayde

Grid trading ke bohot se fayde hain:- Non-Directional Trading: Isme market direction predict karne ki zarurat nahi hoti. Trader sirf price movements se profit kama sakta hai.

- Automation: Grid trading strategies ko easily automate kiya ja sakta hai. Bots aur software isko manage kar sakte hain.

- Consistent Profits: Yeh strategy small price movements se consistent profits generate kar sakti hai.

- Diversification: Multiple grids ko different assets par set karke diversification kiya ja sakta hai.

- Risk Management: Properly managed grids ke saath, risk ko effectively control kiya ja sakta hai.

8. Grid Trading ke Nuqsanat

Iske kuch nuqsanat bhi hain:- Large Market Movements: Agar market ek direction mein bohot tezi se move kare toh significant losses ho sakte hain.

- Complexity: Is strategy ko effectively implement karna complex ho sakta hai aur proper understanding aur monitoring ki zarurat hoti hai.

- Capital Requirement: Initial capital ka requirement zyada hota hai, khas taur par Martingale Grid mein.

- Market Conditions: Yeh strategy sirf range-bound markets mein zyada effective hoti hai. Trending markets mein losses ho sakte hain.

9. Risk Management

Risk management grid trading mein bohot important hai. Kuch important points hain:- Capital Allocation: Apne capital ka sirf ek chota hissa use karein aur kabhi bhi over-leverage na karein.

- Stop-Loss Orders: Proper stop-loss orders set karein taake unexpected market movements se bacha ja sake.

- Diversification: Apne trades ko diversify karein taake risk spread ho jaye.

- Regular Monitoring: Apni trades ko regularly monitor karein aur market conditions ke mutabiq adjustments karein.

- Backtesting: Strategy ko implement karne se pehle uski backtesting zaruri hai.

10. Automation aur Bots

Grid trading mein automation ka bohot bara role hota hai. Traders specialized bots ya software use karte hain jo automatically trades execute karte hain. Yeh bots predefined rules ke mutabiq kaam karte hain aur human emotions ko eliminate karte hain. Automation se time save hota hai aur trading 24/7 possible hoti hai. Popular trading platforms jaise ke MetaTrader aur TradingView different bots aur scripts provide karte hain jo grid trading ko automate kar sakti hain.

11. Grid Trading ka Capital Requirement

Grid trading ko effectively use karne ke liye acha khasa capital chahiye hota hai. Kam capital se zyada risk hota hai aur large losses ho sakte hain. Classic Grid strategy ke liye bhi initial capital required hota hai taake multiple trades ko manage kiya ja sake. Martingale Grid strategy ke liye aur bhi zyada capital chahiye hota hai kyun ke isme losses ko cover karne ke liye larger positions use hoti hain. Traders ko apne risk tolerance aur financial goals ke mutabiq capital allocate karna chahiye.

12. Kaun Se Markets Mein Grid Trading

Grid trading ko multiple markets mein use kiya ja sakta hai, jaise ke:- Forex: Forex market mein grid trading bohot popular hai. Currency pairs ki high volatility aur liquidity is strategy ke liye suitable hai.

- Stocks: Stocks ki trading mein bhi grid strategy use ki ja sakti hai, khas taur par high volume stocks mein.

- Commodities: Gold, Silver aur Oil jaise commodities mein grid trading kar ke consistent profits kamaye ja sakte hain.

- Cryptocurrencies: Crypto market ki high volatility grid trading ke liye ideal hoti hai. Bitcoin aur Ethereum jaise major coins par yeh strategy bohot effectively use hoti hai.

13. Backtesting aur Strategy Optimization

Grid trading strategy ko implement karne se pehle uski backtesting aur optimization zaruri hai. Backtesting se past market conditions mein strategy ke performance ka andaza lagaya ja sakta hai. Yeh ensure karta hai ke strategy historically profitable rahi hai. Optimization se strategy ko current market conditions ke liye adjust kiya jata hai. Trading platforms jaise ke MetaTrader aur TradingView backtesting aur optimization tools provide karte hain.

14. Common Mistakes

Grid trading mein kuch common mistakes hain jo avoid karni chahiye:- Over-Leveraging: Bohot zyada leverage use karna dangerous ho sakta hai. Yeh quickly large losses lead kar sakta hai.

- Improper Risk Management: Stop-loss orders na set karna ya capital ka sahi allocation na karna significant losses ka sabab ban sakta hai.

- Ignoring Market Conditions: Market conditions ke mutabiq strategy ko adjust na karna. Trendy markets mein grid trading risky ho sakti hai.

- Emotional Trading: Emotions ko trading decisions mein involve karna bohot bura ho sakta hai. Automation aur discipline is liye zaruri hain.

15. Conclusion

Grid trading strategy ek powerful tool hai jo disciplined traders ke liye profitable ho sakti hai. Proper risk management aur automation ke sath yeh strategy market fluctuations se consistent profits generate kar sakti hai. Iske fayde aur nuqsanat ko samajhna zaruri hai aur is strategy ko effectively implement karne ke liye achi understanding aur regular monitoring ki zarurat hoti hai. Is article ne aapko grid trading strategy ke har pehlu se mutaliq detail mein bataya hai taake aap informed trading decisions le sakain aur apni trading performance ko improve kar sakain. -

#7 Collapse

Grid Trading Strategy Kia Hai..??

1. Samajh:

Grid trading strategy ka maqsad hota hai market ke range-bound (mamooli se mamil) movements se faida uthana. Yeh strategy market mein horizontal lines (grid) ko istemal karti hai, jinhein buy aur sell orders ke liye rakha jata hai.

2. Grid Banane Ka Tareeqa:

Grid trading mein traders horizontal lines ya levels banate hain, jinhein "grid" kehte hain. Har level par ek order place kiya jata hai. Masalan, agar market 1.1000 se 1.1200 tak range-bound hai, to traders 1.1000, 1.1050, 1.1100, aur 1.1150 jaise levels par orders place karenge.

3. Buy aur Sell Orders:

Grid trading mein typically do tarah ke orders hote hain: buy orders aur sell orders. Agar market neechay ja raha hai, to buy orders place kiye jate hain, aur agar market oopar ja raha hai, to sell orders place kiye jate hain.

4. Take Profit aur Stop Loss:

Har level par ek take profit aur ek stop loss set kiya jata hai. Take profit level par order execute hota hai jab market us level tak pohanch jata hai aur profit hasil hota hai. Stop loss level par order execute hota hai agar market against trade chal rahi hai, taake nuksan kam ho.

5. Automation:

Grid trading ko automate karne ke liye trading bots ya expert advisors (EAs) ka istemal kiya ja sakta hai. Yeh EAs grid ke levels ko set karte hain aur orders place karte hain according to predefined rules.

6. Risk Management:

Grid trading mein risk management ka bohot ahem kirdar hota hai. Har level par take profit aur stop loss set kar ke traders apne nuksan ko control karte hain. Iske ilawa, proper position sizing aur capital management bhi zaroori hota hai.

Grid trading strategy ek consistent aur systematic approach hai market mein trading karne ka. Lekin, ismein bhi risks hote hain aur har trader ko apne risk tolerance ke mutabiq isey istemal karna chahiye.

-

#8 Collapse

Forex Market Mein Grid Trading Strategy:!:!:!:!

Forex market mein "grid trading strategy" ek common trading technique hai jisme traders apne positions ko predefined price levels par place karte hain, jinhe grid kehte hain. Yeh strategy typically range-bound markets mein use hoti hai, matlab jab price ek particular range mein fluctuate kar rahi hoti hai.

Yeh strategy usually automated trading systems ke through implement ki jaati hai, jo predefined rules ke according buy aur sell orders execute karte hain.

Forex Market Mein Grid Trading Strategy Ke Components:!:!:!:!

Yeh kuch key components include karti hai:- Grid Levels: Traders decide karte hain ke wo kis price levels par apne buy aur sell orders place karenge. Typically, grid ke levels equal intervals par set kiye jaate hain.

- Order Placement: Har grid level par, trader multiple buy aur sell orders place karte hain. Jaise agar koi trader ne 100 pip ke intervals par grid set kiya hai, to wo har 100 pips par ek buy order aur ek sell order place karega.

- Take Profit aur Stop Loss Levels: Har ek order ke liye take profit aur stop loss levels set kiye jaate hain. Take profit level usually grid ke opposite side par set kiya jaata hai, jabki stop loss level usually grid ke same side par set kiya jaata hai.

- Grid Size: Yeh define karta hai ke kitne pips ke intervals par grid levels set kiye jaate hain. Grid size ki choice market conditions aur trader ki risk tolerance par depend karti hai.

Grid trading strategy ke advantages mein ye include hote hain ki ye relatively simple hai aur automate kiya ja sakta hai. Lekin, ismein bhi kuch risks hote hain, jaise ki market ke unexpected movements, jo agar grid ke levels se bahar ho jaati hain, to losses generate ho sakte hain. Isliye, is strategy ko implement karne se pehle thorough backtesting aur risk management ki zarurat hoti hai.

- CL

- Mentions 0

-

سا3 likes

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 Collapse

Grid Trading Strategy: Ek Tafseeli Jaiza

Grid trading strategy ek popular trading method hai jo financial markets mein, khas tor par forex trading mein, kaafi use hoti hai. Yeh strategy market ke trend se baghair bhi profit generate karne mein madadgar hoti hai. Aayiye, is strategy ko tafseel se samajhte hain.

Grid Trading Strategy Ka Mafaheem

Grid trading strategy ka asal maqsad market ke upward aur downward movements se munafa kamana hai. Is strategy mein, trader pre-defined intervals par buy aur sell orders place karta hai, ek grid pattern mein. Yeh intervals fixed distance par hote hain, jise grid spacing kehte hain.

Grid Trading Strategy Kaise Kaam Karti Hai?- Initial Setup: Sab se pehle, trader ko ek base price tay karna hota hai jahan se grid start hogi. Phir trader grid spacing define karta hai, yani har buy aur sell order ke darmiyan ka distance.

- Buy Aur Sell Orders: Grid setup ke baad, trader alternate buy aur sell orders place karta hai. For example, agar base price 1.2000 hai aur grid spacing 50 pips hai, to orders kuch is tarah place honge:

- Buy order at 1.1950, 1.1900, 1.1850, etc.

- Sell order at 1.2050, 1.2100, 1.2150, etc.

- Market Movements: Jab market upward ya downward move karti hai, orders activate hote hain. Jab price buy order tak pohanchti hai, wo execute hota hai aur uske next sell order tak pohanchne par profit realize hota hai. Isi tarah, jab price sell order tak pohanchti hai, wo execute hota hai aur uske next buy order tak pohanchne par profit realize hota hai.

- Non-Directional Strategy: Yeh strategy market ke trend se independent hoti hai. Chahay market uptrend mein ho ya downtrend mein, grid trading munafa hasil kar sakti hai.

- Automated Trading: Grid trading ko automation ke zariye implement karna asan hota hai. Kai trading platforms par expert advisors (EAs) ya trading bots available hain jo grid trading strategy ko automate kar sakte hain.

- Risk Management: Grid trading strategy mein, traders apne risk ko predefined intervals aur orders ke zariye control kar sakte hain. Yeh strategy traders ko multiple positions open karne ka moka deti hai, jo risk diversification mein madadgar hoti hai.

- Large Capital Requirement: Grid trading strategy ko implement karne ke liye significant capital ki zarurat hoti hai. Market ke extreme movements ko absorb karne ke liye, traders ko kafi margin reserve mein rakhna padta hai.

- Drawdown Risk: Agar market ek extended trend mein move kare, to grid trading strategy mein significant drawdown ho sakta hai. Yeh strategy trending markets mein ziyada profitable nahi hoti.

- Complex Management: Grid trading ka manual management mushkil ho sakta hai, khas tor par agar market unexpected movements kare. Automated trading tools ka istemal karna behtar hota hai, lekin unko sahi tarah se configure karna bhi zaroori hota hai.

Grid trading strategy ek powerful tool hai jo forex aur financial markets mein munafa hasil karne ke liye use hota hai. Yeh non-directional strategy hai jo market ke uptrend aur downtrend movements dono mein profitable ho sakti hai. Iske fayde aur nuqsanat ko samajh kar, traders apne trading plan mein grid trading ko shamil kar sakte hain aur apni trading performance ko enhance kar sakte hain.

Umeed hai yeh article aapki zarooriyat ko pura karta hai. Agar aapko mazeed maloomat chahiye ho ya kisi aur topic par article chahiye ho, to batayein.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:58 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим