Homing pigeons Candles

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

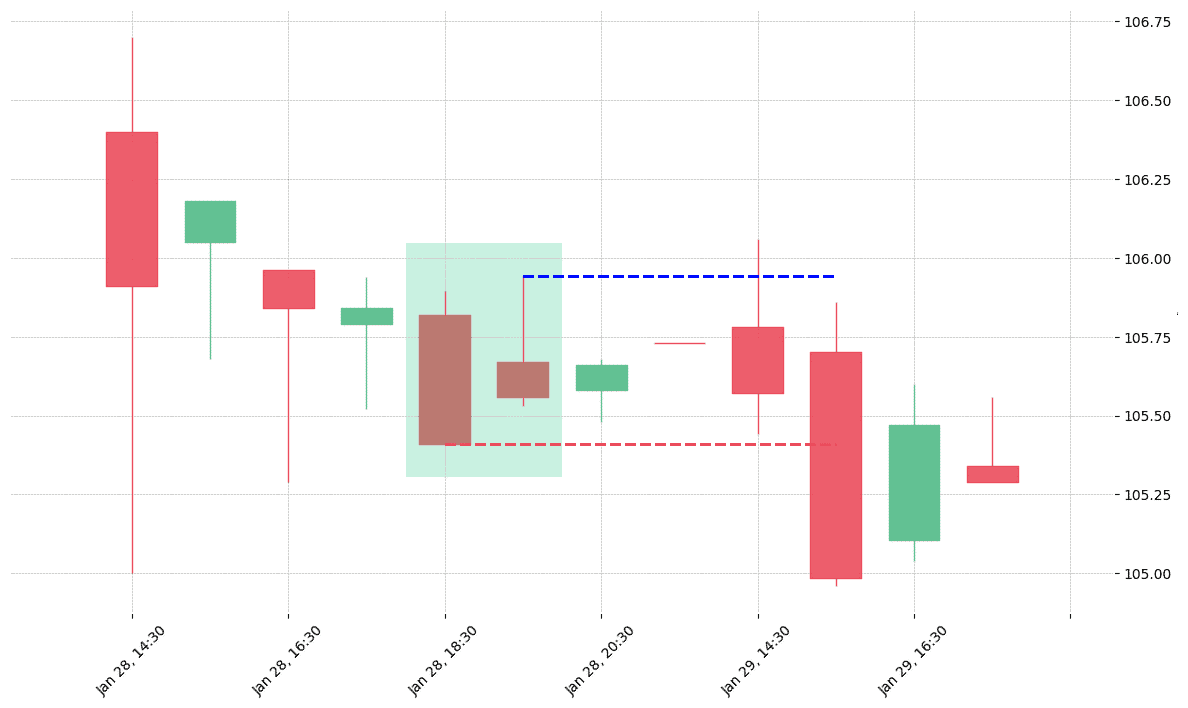

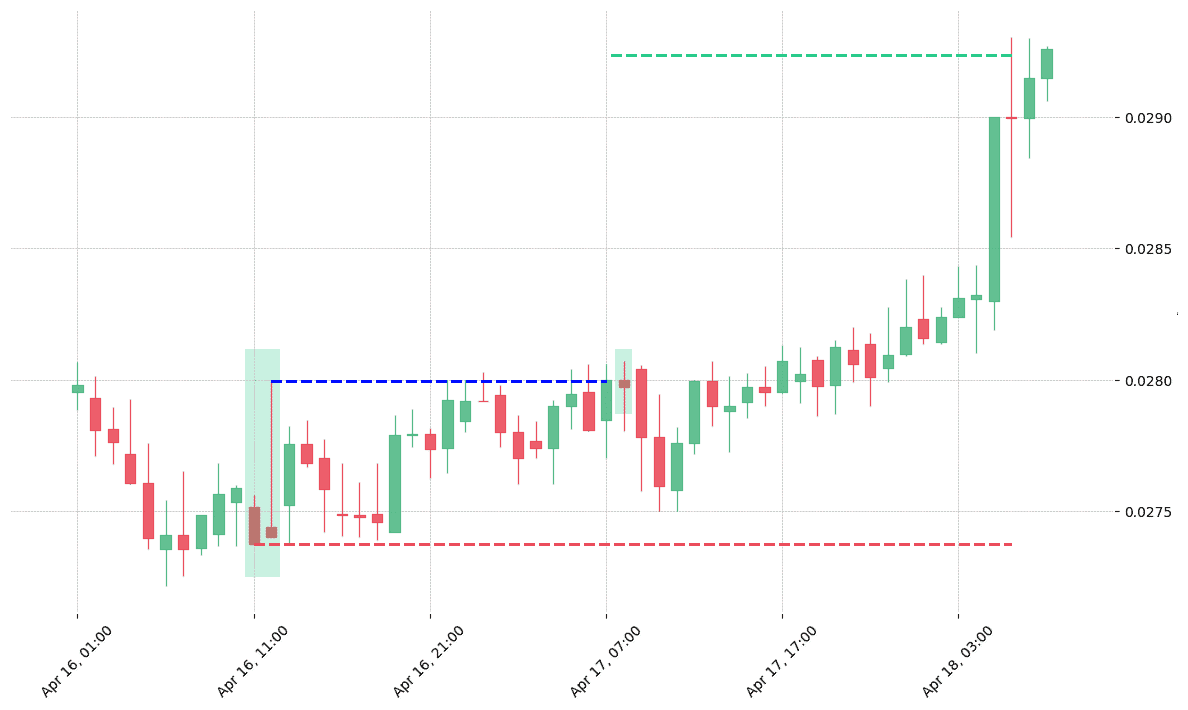

ager ham Homing and yeah Pigeon Example jo dekhne do negative candlesticks and chaart standard mushtamil aik bullish pattern inversion design hai, jiss k costs k base region ya negative pattern me bante dekha gaya hai. Design costs k base me banne ki waja se "Decending Falcon Candle Example" ka inverse ya backwards hota hai, q k wo costs k top standard banta hai. Design me shamil dono candles dark hoti hai...homing pegeon jis me first candle aik bari genuine body wali hoti hai, poke k seconnd light aik little genuine body wali hoti hai. Design ki khas baat ye hai k is me second light firsst candle k genuine body k bulkul mid (focus) me banti hai, jis tarah se harami design hota hai. Homing Pigeon Example costs k base ya negative pattern me banne ki waja se aik bullish pattern inversion design ka kaam karta hy... Clerification,, Dear Ess patteren say hi homing pegeons Agar ye same example market k qeematon k darmeyan me banta hai to ye negative pattern continuation design ka kaam karegaPattern do (2) dark candles standard mushtamil hota hai Example ki first candle aik bari dark genuine body wali bari flame hoti ha Example ki waja second light little dark genuine body wali hoti hai...

dear Sir, Bullesh Homing Pigeon design me costs k base ya negative pattern me banne ki waja do dark candles standard mushtamil aik bullish pattern inversion patternhai, jis me shamil first dark candle aik bari genuine body wali hoti hai, aur us k baad banni wali second dark light aik little genuine body wali hoti hai. second dark light ki open aur close first dark flame ki open aur close se kam hoti hai. Yani second dark flame first dark candle k genuine body me open bhi hoti hai.. Homing pigeons Candlesticks Pattern ki Types,, homing pegeon Ess Candles Isi tarah se second dark light ki high aur low cost bhi first dark candle k high aur low cost se kam hota hai. Homing Pigeon design aik aisa design hai, jo k pattern inversion ka kaam bhi karta hai aur homing pattern continuation ka bhi. Agar ye design low cost me banta hai to ye bullish pattern inversion ka kaam karta hai, hit k qeematon k darmeyan me banne standard ye negative pattern k tasalsul ka design bhi sabit ho sakta hai.... Trading With Homing pigeons candle stick pattern,, Dear Homing Pigeon Example pe exchanging se pehle humen is design ki market me position malom karni hogi. Agar Homing Pigeon design market ki darmeyan me banta hai to ye negative pattern k continuation ka kaam karega, is waja se brokers ko yahan pe "sell" ki passage karni chaheye, lekin agar ye design low cost region me banta hai to is position pe dealers ko "purchase" ki passage karni chaheye gy tu hi trading ho jay gii. homing pegeon Design pe exchanging se pehle affirmation signal ka hona zarori hai, is waja se brokers ko third flame ka intezar karna chaheye. Market me purchase ki section k leye third light "white" hogi, punch k sell ki passage k leye third flame "dark" hogi. Purchase signal pe stop misfortune first dark candle k least side pe hoga, punch k sell ki passage k lye first dark light k greatest cost pe hoga. Homing Pigeon Example costs k base principal banne ki waja se ye design decending Falcon Candle Example ka inverse hota hai, jo k costs k top me negative pattern inversion design ka kaam karta hai.....

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Homing Pigeon PatternHoming pigeon pattern two days candles par mushtamil aik bullish trend reversal pattern hai, jo k prices k bottom par ya bearish trend k akhtetam par banta hai. Pattern ki pehli aur dosri candle same bearish candles hoti hai jis main dosri candle pehli candle k andar open aur close hoti hai. Homing pigeon pattern ki dosri candle ki formation same "Bullish Harami Pattern" aur "Bullish Harami Cross Pattern" jaisi hai lekin aik to iss candle ka color black hoti hai, jo k "Bullish Harami Pattern" k candle main white hoti, dosra ye candle small real body ki hoti hai, jo k "Bullish Harami Cross Pattern" ki candle doji candle hoti hai, jiss ka open aur close same hota hai. Homing pigeon pattern aik bullish trend reversal pattern hai, jo k prices k bottom par ya bearish trend main banta hai. Ye pattern bearish k kamzori ki nishan dahi karta karta hai. Dosree candle aik aik small real body wali bearish candle hoti hai jo uptrend ka ikhtetaam karti hai, jiss k baad prices bullish trend reversal ka sabab banti hai.Candles FormationHoming pigeon pattern two days candles par mushtamil ek bullish trend reversal pattern hai, aur downtrend k baad main bhi bannta hai to us k leye candles ki darrjazel format honi chaheye ; 1. First Candle: Homing pigeon pattern main pehle din ki candle aik long real body wali black/red hotee hai, jo prices k downtrend ki turrjumani kartti hai. Ye candle normal size aur bearish trend k mutabiq banti hai. 2. Second Candle: Homing pigeon pattern main dosre din ki candle bhi same black ya red candle banti hai, jo k prices k bearish trend ka ikhtetaam kartti hai, dosre din ki candle pehle din ki candle k real body k andar open aur close hoti hai.ExplainationHoming pigeon pattern "Bullish Harami Pattern" aur "Bullish Harami Cross Pattern" se melta julta pattern hai, jo same bearish trend ko bullish trend me reverse kia jata hai. Homing pigeon pattern two days candles par mushtamil pattern hai, jis me pehlee aik long real body wali bearish candle hote hai, jis k baad dosree aik long real body wali small bearish candle banti hai. Pattern ki pehli candle prices k downtrend ki nishan-dahi kartti hai, ye candle size aur formation me normal long real body wali bearish candle hotti hai. Lekin dosre din ki candle aik small real body wali bearish candle hotee hai, jo k open aur close pehli candle k real body main hoti hai. Pattern ki dono candle bearish hone k bawajood bhi bullish trend reversal pattern ka kaam karta hai.TradingHoming pigeon pattern bhi dosre bullish trend reversal patterns ki tarah buy k signals deta hai. Pattern par trading ka tareeqay kar bhi "Bullish Harami Pattern" jaisa hai, jiss par market main buy ki entry ki jati hai. Pattern par trading se pehle prices ka baghawar study karlen k ya to ye downtrend me honni chaheye aur ya ye high level pe hon. Pattern ki pehlee candle normal long real body wali hotti hai, jis ko dosre din ki small bearish candle follow kartti hai. Homing pigeon pattern me dosre din ki candle ki formation bohut zarrori hai, jo k pehli candle k under honi chaheye, yanni candle ki open aur close dono pehli candle k open aur close se kam honi chaheye. Homing pigeon pattern k leye trend confirmation trade entry se pehle zarrori hai, jab bhi pattern k baad teesre din ki candle bearish ya white candle banne gi to ye market main me buy se entry karne ka time hoga. Stop Loss pattern k sab se lowest price ya bearish candle k bottom se aik ya do pips below resistance point par lagayen. -

#4 Collapse

Development OF Twofold TOp Example Twofold top example ke jo development hoti ha ya higher ke traf two prak ko banata hua long haul mama hoti ha is twofold top example ke development sa phalay jo stock ke cost hoti ha ya higher ke traf ja rahe ho ge or ya twofold top example market mama upswing ka high sa banay ga or market ko high mama la kar jay ga is design ka start hota hello market high ke traf jay ge or market high ke traf jati hoi ak top ko banya ge jo ka market mama higher ke traf obstruction level ko hit karta hua banay ge or is top ka banta hey market inversion hoti hoi same is design ka opening point standard a jay ge yani ka neck area level standard a jay ge or is neck area level sa market phir sa higher ke janab jay ge or ak or second pinnacle ko banay ge or ya top same first top ke traha sa banay ge is mama bhi market higher ke traf jati hoi opposition level standard chali jay ge or is opposition level sa is second top ka banta greetings market lower ke traf inversion ho kar ay ge or lower ke traf ati hoi same neck area level standard a jay ge hit market second top ko bana kar neck area level standard ay ge to is design ke arrangement complete ho jay ge. Track with Twofold Top Example Twofold top example dealers ko market ke cost ka higher sa descending ke traf inversion ho kar ana ka signal da rahi ho ge hit ya twofold top example banay ga to is sa phalay market mama purchasers ka merchants ka control ho ga or ya purchaser market ko high mama la ja raha ho ga or is ya design jasa hello there banay ga yo is ka start mama ya purchasers a kar market ko high ke traf la kar jay ga or ya purchasers market ko jigh mama la jata hua ak top ko banay ga or is top sa market mama jo purchasers ka brokers jo ga ya exit kar jay ga or market mama venders ka exchanges ka control a jay ga yani ka market mama venders ka merchants enter ho jay ga or jo ya dealers ka brokers ho ga ya market ko descending ke traf inversion karta hua la kar ay ga or neck area level standard market ko la ay ga or is neck area level sa market mama ak bar phir sa purchasers ka brokers ka control ay ga or ya purchasers market ko phir sa higher ke traf la kar jana slack jay ga or is design ak or second top ko banay ga or ya second top jasa greetings banay ga to jo purchasers ka dealers ho ga ya totally list ho jay ga or market mama completely dealers ka brokers enter ho kar in ka control a jay ga or ya dealers ka dealers market ko lower mama lata hua is neck area level ko break kar jay ga or is twofold top example mama jis point sa neck area level ka break ho ga is sa brokers sell ke exchange ko enter karay ga. -

#5 Collapse

Homing pigeon in forex Forex, jisay foreign exchange market bhi kaha jata hai, dunya bhar mein tarah tarah ki currencies ko khareedne aur bechne ke liye ek global marketplace hai. Yeh market 24 ghante khuli rehti hai aur ismein mukhtalif currency pairs, commodities aur indices ki trading hoti hai. Forex market mein trading karna chuninda hai kyun ke ismein bohat zyada potential hai paisay kamane ka. Lekin trading karne ke liye zaroori hai ke aapke paas sahi tajurba aur maharat ho. Homing Pigeons kya hote hain Homing Pigeons, jinhe kabootar bhi kaha jata hai, bohat intelligent birds hote hain. Yeh pigeons aam tor par mazeed hone ka rasta khojne ke liye istemaal kiye jate hain. Yeh birds kisi bhi jagah se 500 km ki doori tak jaa sakte hain aur phir wapas apne ghar tak laut aate hain. Yeh kamal ki khasiyat aapko shayad surprise kardegi lekin yeh fakt hai ke inka nazariya trading ke liye bhi kaam aa sakta hai. Homing Pigeons ki trading mein kya role hai Forex market mein, Homing Pigeons ki tarah sahi direction mein jaane ke liye traders ki madad karne wale signals hote hain. Yeh signals, technical analysis ke jariye dhoonde jaate hain aur traders ko sahi entry aur exit points batate hain. Homing Pigeon, ek bullish reversal signal hai jise jab chart par dekha jata hai to iska matlab hota hai ke market mein price ki downward trend ab upward trend mein badalne ke chances hain. Candles kya hote hain? Candles, chart analysis ke liye bohat important hote hain. Yeh charts, traders ko price ki movement ko samajhne mein madad karte hain. Candles, chart par price movement ko bar graph ki tarah represent karte hain. Har candle ke andar open, high, low aur close price ki information hoti hai. Homing Pigeons aur Candles ka istemaal in Forex Homing Pigeon candle, bullish reversal pattern hai. Iska matlab hota hai ke market mein price ki downward trend ke baad bullish trend ka aana shuru hoga. Jab aap chart par Homing Pigeon candle dekhte hain, to iska matlab hota hai ke market ka trend ab upward direction mein badalne ke chances hain. Traders, Homing Pigeon candle ke sath-sath dusre technical indicators aur tools ka istemaal bhi karte hain, jaise ke moving averages, RSI, aur Bollinger Bands. Jab aap in sabhi tools ko sahi tarah se istemaal karte hain, to aapko sahi entry aur exit points ke baare mein pata chal jata hai. Conclusion Homing Pigeon candles aur Forex trading ke beech ki talluqat ki tarah, Forex trading mein tajurba aur maharat ka -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Homing Pigeons Candles forex mein ek popular Japanese Candlestick pattern hai. Is pattern ke naam ka matlab hota hai ki jaise homing pigeons apne ghar ko dhoondhne ke liye udaan bharte hain, isi tarah is pattern mein bhi price ke fluctuations ke baad ek strong reversal signal dikhayi deta hai. Homing Pigeons Candles pattern mein, do candlesticks ek saath dikhte hain. Ek candlestick bullish hota hai, aur doosra candlestick bearish hota hai. Is pattern ka matlab hota hai ki bearish trend ke baad bullish trend start hone wala hai. Homing Pigeons Candles pattern ko recognize karna bahut important hai, kyunki yeh pattern ek strong reversal signal deta hai. Is pattern ko recognize karne ke liye, traders ko price action ko observe karna hoga, aur market trend ko analyze karna hoga. Homing Pigeons Candles pattern ka formation kaise hota hai? Homing Pigeons Candles pattern ka formation do candlesticks ke baad dikhta hai. Pehla candlestick bearish hota hai, aur doosra candlestick bullish hota hai. Dono candlesticks ke range ko compare karne ke baad, is pattern ko recognize kiya ja sakta hai. Homing Pigeons Candles pattern ko recognize karne ke liye, traders ko price action aur technical analysis ke concepts ko samajhna hoga. Is pattern ka formation do candlesticks ke baad hota hai, jiske baad traders is pattern ko identify kar sakte hain. Pehla candlestick bearish hota hai, aur doosra candlestick bullish hota hai. Dono candlesticks ke range ko compare karne ke baad, is pattern ko recognize kiya ja sakta hai. Homing Pigeons Candles pattern ko recognize karne ke liye, traders ko doosre bullish reversal patterns se compare karna chahiye. Jaise ki Bullish Engulfing, Piercing Line, Bullish Harami, etc. Is tarah ke patterns ke saath Homing Pigeons Candles pattern ko compare karne se traders ko is pattern ko recognize karne mein help milegi. Traders ko Homing Pigeons Candles pattern ko recognize karne ke liye, ek aur technique hai, jismein traders ko price action ke alawa bhi technical indicators ka use karna hota hai. Traders ko technical indicators jaise ki Moving Averages, Relative Strength Index (RSI), aur Stochastic Oscillator ka use karke market trend ko analyze karna hota hai. Homing Pigeons Candles pattern ko recognize karne ke liye, traders ko ek aur technique ka use karna hota hai, jismein traders ko trend lines ka use karna hota hai. Trend lines ko use karke traders ko market trend ke direction ko analyze karne mein help milegi. Homing Pigeons Candles pattern ka interpretation kaise karein? Homing Pigeons Candles pattern ko interpret karne ke liye, traders ko market trend ko analyze karna hoga. Agar market bearish trend mein hai aur Homing Pigeons Candles pattern formation dikh raha hai, toh yeh bullish reversal signal deta hai. Traders ko is pattern ke baad entry aur exit points ko identify karna hoga. Is pattern ke entry point ko identify karne ke liye, traders ko bullish candlestick ke high level ke above buy kiya ja sakta hai. Stop loss order ko low level ke below rakha ja sakta hai. Is pattern ke exit point ko identify karne ke liye, traders ko apne target price ke liye sell kar dena chahiye. Traders ko apne profits ko lock karne ke liye, trailing stop loss ka use kiya ja sakta hai. Homing Pigeons Candles pattern ke saath trading karne ke liye, traders ko risk management ko follow karna hoga. Stop loss order ka use kiya ja sakta hai, jisse ki traders apne losses ko minimize kar sakte hain. Traders ko apne trading plan ko follow karna hoga, aur emotions ko control karne ki zaroorat hai. Homing Pigeons Candles pattern ka use forex mein kaise karein? Homing Pigeons Candles pattern forex mein ek powerful trading tool hai. Traders is pattern ka use karke market trends ko identify kar sakte hain, aur apne trading plan ko accordingly adjust kar sakte hain. Traders ko Homing Pigeons Candles pattern ko recognize karne ke liye, price action aur technical analysis ke concepts ko samajhna hoga. Traders ko market trend ko analyze karna hoga, aur bullish ya bearish reversal signals ko identify karna hoga. Homing Pigeons Candles pattern ke saath trading karne se pehle, traders ko apne trading style aur risk appetite ko define karna hoga. Traders ko apne trading plan ko prepare karna hoga, aur trading strategy ko choose karna hoga.

Homing Pigeons Candles pattern ka interpretation kaise karein? Homing Pigeons Candles pattern ko interpret karne ke liye, traders ko market trend ko analyze karna hoga. Agar market bearish trend mein hai aur Homing Pigeons Candles pattern formation dikh raha hai, toh yeh bullish reversal signal deta hai. Traders ko is pattern ke baad entry aur exit points ko identify karna hoga. Is pattern ke entry point ko identify karne ke liye, traders ko bullish candlestick ke high level ke above buy kiya ja sakta hai. Stop loss order ko low level ke below rakha ja sakta hai. Is pattern ke exit point ko identify karne ke liye, traders ko apne target price ke liye sell kar dena chahiye. Traders ko apne profits ko lock karne ke liye, trailing stop loss ka use kiya ja sakta hai. Homing Pigeons Candles pattern ke saath trading karne ke liye, traders ko risk management ko follow karna hoga. Stop loss order ka use kiya ja sakta hai, jisse ki traders apne losses ko minimize kar sakte hain. Traders ko apne trading plan ko follow karna hoga, aur emotions ko control karne ki zaroorat hai. Homing Pigeons Candles pattern ka use forex mein kaise karein? Homing Pigeons Candles pattern forex mein ek powerful trading tool hai. Traders is pattern ka use karke market trends ko identify kar sakte hain, aur apne trading plan ko accordingly adjust kar sakte hain. Traders ko Homing Pigeons Candles pattern ko recognize karne ke liye, price action aur technical analysis ke concepts ko samajhna hoga. Traders ko market trend ko analyze karna hoga, aur bullish ya bearish reversal signals ko identify karna hoga. Homing Pigeons Candles pattern ke saath trading karne se pehle, traders ko apne trading style aur risk appetite ko define karna hoga. Traders ko apne trading plan ko prepare karna hoga, aur trading strategy ko choose karna hoga.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:58 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим