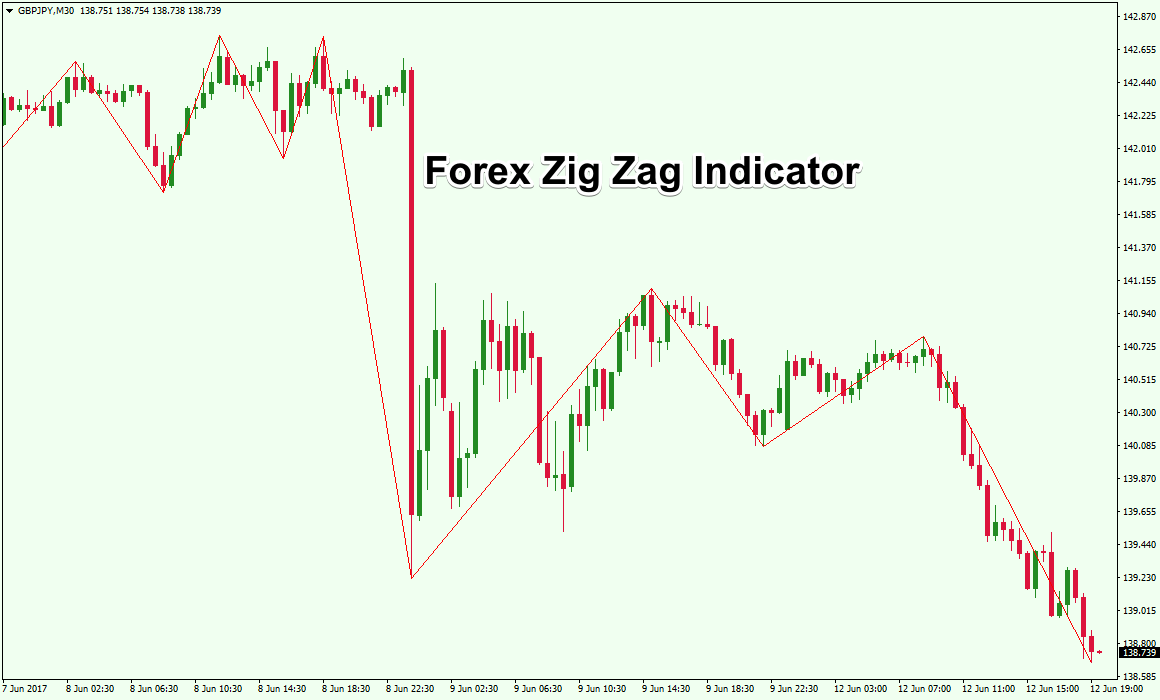

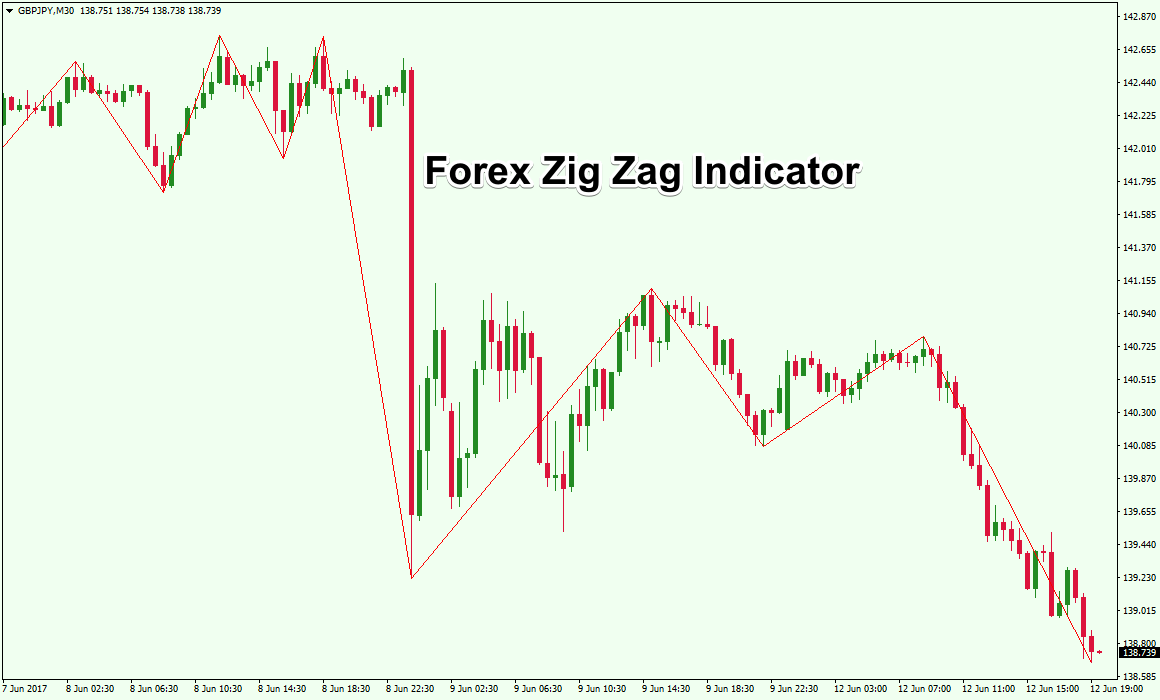

What is Zigzag Pattern forex trading mein, Zigzag pattern se morad takneeki tajzia ka tool hota hai jo qeemat ki naqal o harkat ki simt aur raftaar ki shanakht ke liye istemaal hota hai.​ bnta ha js ki movement kuch wazeh nai hoti yeh mukhtalif wajohaat ki binaa par ho sakta hai lekin aik acha trader aasani se qeemat ke diagram standard is nuqta ki nishandahi kar sakta hai aur es trah wo apni trade ko laga skta ha jahan supply maang se ziyada hona shuru ho jati hai ma ap ko btata chlun kay yeh support ki terhan aik level ya zone ho sakta hai .trader koi trade shuru krnay Kay liye ya support ya muzahmat ke ilaqay ki nishandahi ki gayi hai, to qeemat ki ye level dakhlay ya kharji maqamat ke peak standard kaam kar sakti hain kyun kay jaisay qeemat muzahmat ki neechy tak pahunchti hai, ye ya to is satah se peechay hatt jaye gi ya opposite jae gi is satah standard trader aur mukhalif simt mein agay barhatay rahen aur is trah ma aap ko batana chahta hun kay yah market mein es waqt is mafroozay ki bunyaad standard hota hai kay support aur muzahmat kay levels end nahi hun gay trader qeemat ki direction taizi se is baat ka pata laga satke hain ke aaya woh durst hain aur market ma en ki movement tek ha.  maloom hona chahiye ke taaza tareen zig zag line shayad mustaqil nah ho. jab qeemat simt badalti hai isharay aik nai lakeer khenchna shuru kar deta hai. agar woh line isharay ki feesad ki tarteeb tak nahi pahunchti hai aur security ki qeemat simt ko tabdeel karti hai to line ko hata diya jata hai aur rujhan ki asal simt mein aik tosee shuda zig zag line se tabdeel kar diya jata hai. waqfay ko dekhte hue bohat se tajir zig zag isharay ka istemaal karte hain bajaye is ke ke aik behtareen dakhlay ya bahar niklny ki koshish karen. Understanding the Zig Zag Indicator. Working of zigzag indicagtor aap ke liye mukhtalif eqdaar aazma satke hain. tabdeeli qeemat ki tabdeelion ke liye isharay ki hsasit ko mutasir kere gi. agar nichli qadren set ki jayen to muqami oonch neech ki tadaad barh jaye gi aur is terhan isharay mazeed linon ko paint kere ga. Zigzag Pattern ka Estmaal: standard crisscross mandarja zail tareeqay se kaam karta hai pehlay sab se nichale point ko record karne ke baad yeh aik ulat palat point ki talaash mein hai poke tak ke islahi neechay ki taraf harkat muqarara qadron se ziyada nah ho jaye. jaisay howdy yeh hota hai crisscross qeemat graph mein dosray sab se ziyada point ki nishandahi karta hai. agla isharay isi usool ke mutabiq teesra point dekh raha hai muddat mein sab se kam aur isi terhan punch tak ke geherai ke boundary ko poora kya jaye. is terhan forex mein patteren ke zariye tayyar kardah zawiye qeematon mein aik khaas feesad ki tabdeeli ke nateejay mein muqarrar kardah eqdaar ke barabar ya ziyada hotay hain.

maloom hona chahiye ke taaza tareen zig zag line shayad mustaqil nah ho. jab qeemat simt badalti hai isharay aik nai lakeer khenchna shuru kar deta hai. agar woh line isharay ki feesad ki tarteeb tak nahi pahunchti hai aur security ki qeemat simt ko tabdeel karti hai to line ko hata diya jata hai aur rujhan ki asal simt mein aik tosee shuda zig zag line se tabdeel kar diya jata hai. waqfay ko dekhte hue bohat se tajir zig zag isharay ka istemaal karte hain bajaye is ke ke aik behtareen dakhlay ya bahar niklny ki koshish karen. Understanding the Zig Zag Indicator. Working of zigzag indicagtor aap ke liye mukhtalif eqdaar aazma satke hain. tabdeeli qeemat ki tabdeelion ke liye isharay ki hsasit ko mutasir kere gi. agar nichli qadren set ki jayen to muqami oonch neech ki tadaad barh jaye gi aur is terhan isharay mazeed linon ko paint kere ga. Zigzag Pattern ka Estmaal: standard crisscross mandarja zail tareeqay se kaam karta hai pehlay sab se nichale point ko record karne ke baad yeh aik ulat palat point ki talaash mein hai poke tak ke islahi neechay ki taraf harkat muqarara qadron se ziyada nah ho jaye. jaisay howdy yeh hota hai crisscross qeemat graph mein dosray sab se ziyada point ki nishandahi karta hai. agla isharay isi usool ke mutabiq teesra point dekh raha hai muddat mein sab se kam aur isi terhan punch tak ke geherai ke boundary ko poora kya jaye. is terhan forex mein patteren ke zariye tayyar kardah zawiye qeematon mein aik khaas feesad ki tabdeeli ke nateejay mein muqarrar kardah eqdaar ke barabar ya ziyada hotay hain.  Dostu es pattern ki market mein use ki baat ki Jaaye to is ko samajhne aur jaanchne ke liye is ka technically analysis karna zaruri hota ha jab bhi ZIG ZAG pattern main market ek top per jakar aapke pass ek hi banay gi to usko Ham registers bolate Hain registers vo level hota hai jis par jane ke bad market wapas aati ha es trah market How To Calculate the Zig Zag Indicator strategies ko improve karne mein madad milti hai. Zigzag Pattern ka istemaal aik bohat hi popular tool hai jo traders dwara frequently use kia jata hai. Is tool ki madad se traders market ke trend ko easily identify kar sakte hain aur phir unko apni trading strategies ko iske basis par design kar sakte hain. Yeh tool market mein high aur low points ko identify karne mein madad deta hai aur phir un points ko connect kar ke trend lines create karta hai. Zigzag Pattern ki madad se traders ko market mein price action ke baray mein pata chalta hai aur phir unko trading opportunities ke baaray mein pata chalta hai. Zigzag Pattern ke kuch limitations bhi hain jinhe traders ko samajhna zaroori hai. Is tool ke istemaal se traders ko market ke trend ke baray mein pata chalta hai, lekin yeh tool aik specific time frame ke liye hi work karta hai. Is tool ki madad se traders ko aik clear picture milta hai, lekin yeh tool sirf short term trends ke liye work karta hai. Long term trends ke liye, traders ko aur advanced tools ki madad leni hoti hai. Zig Zag Indicator Limitations

Dostu es pattern ki market mein use ki baat ki Jaaye to is ko samajhne aur jaanchne ke liye is ka technically analysis karna zaruri hota ha jab bhi ZIG ZAG pattern main market ek top per jakar aapke pass ek hi banay gi to usko Ham registers bolate Hain registers vo level hota hai jis par jane ke bad market wapas aati ha es trah market How To Calculate the Zig Zag Indicator strategies ko improve karne mein madad milti hai. Zigzag Pattern ka istemaal aik bohat hi popular tool hai jo traders dwara frequently use kia jata hai. Is tool ki madad se traders market ke trend ko easily identify kar sakte hain aur phir unko apni trading strategies ko iske basis par design kar sakte hain. Yeh tool market mein high aur low points ko identify karne mein madad deta hai aur phir un points ko connect kar ke trend lines create karta hai. Zigzag Pattern ki madad se traders ko market mein price action ke baray mein pata chalta hai aur phir unko trading opportunities ke baaray mein pata chalta hai. Zigzag Pattern ke kuch limitations bhi hain jinhe traders ko samajhna zaroori hai. Is tool ke istemaal se traders ko market ke trend ke baray mein pata chalta hai, lekin yeh tool aik specific time frame ke liye hi work karta hai. Is tool ki madad se traders ko aik clear picture milta hai, lekin yeh tool sirf short term trends ke liye work karta hai. Long term trends ke liye, traders ko aur advanced tools ki madad leni hoti hai. Zig Zag Indicator Limitations

تبصرہ

Расширенный режим Обычный режим