Head and shoulders plan

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

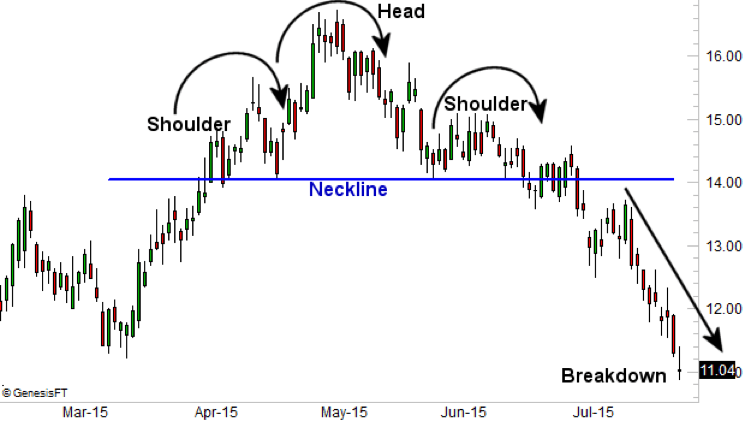

sir aur kaandhon ka patteren takneeki tajzia mein istemaal hota hai. yeh aik makhsoos graph ki tashkeel hai jo taizi se mandi ke rujhan ke ulat jane ki paish goi karti hai. patteren high schooler chotyon ke sath aik bunyadi line ke top standard zahir hota hai, jahan bahar ke do oonchai mein qareeb hain, aur darmiyani sab se ziyada hai. sir aur kaandhon ka patteren is waqt bantaa hai hit stock ki qeemat urooj standard pahonch jati hai aur phir pehlay se oopar ki bunyaad standard wapas gir jati hai. phir, qeemat pichli chouti se barh kar" sir" banti hai aur phir asal bunyaad standard wapas aa jati hai. aakhir mein, stock ki qeemat dobarah neechay girnay se pehlay tashkeel ki pehli chouti ki satah standard pahonch jati hai. sir aur kaandhon ke patteren ko sab se ziyada qabil aetmaad arranged reversal patteren mein se aik samjha jata hai. yeh mutadid aala namonon mein se aik hai jo mukhtalif dgryon ki durustagi ke sath ishara karta hai ke oopar ki taraf rujhan - apne ekhtataam ke qareeb hai. sir aur kaandhon ke patteren ke chaar ajzaa hain : taweel taizi ke rujhanaat ke baad, qeemat urooj standard pahonch jati hai aur baad azan ghirt ki shakal ikhtiyar kar layte hai. qeemat aik baar phir barh jati hai taakay ibtidayi chouti se kaafi oopar doosri oonchai blacklist jaye aur dobarah gir jaye. qeemat teesri baar barhti hai, lekin sirf pehli chouti ki satah tak, dobarah girnay se pehlay. gardan ki lakeer, do ghirti ya chotyon standard khenchi gayi ( ulti ) . Strong of Head and Shoulder flame plan Hey dosto,Market Mein Head and Shoulder light plan Ek bahut hello convincing chart plan Hota Hai Jisko shipper is a market ki exchange position ko confirm karne ke liye aur Market Mein buy aur sell se related complete signs ko perceive karne ke liye apply Karte Hain intermediaries market critical head or shoulder candle configuration go use karte hain to use Waqt vah market Mein is graph plan Mein maujud cost ko insist karne ke liye game or impediment lines ka istemal Karte Hain inlines ke jariye se good tidings vah market ki cost aur uske signal ko certify kar lete hain market Mein ya bahut hi solid framework plans Hote Hain market name is ally ki to type Hoti Hai Ek Head and Shoulder plan aur dusri transform Head and Shoulder plan yah donon types Ek dusre ke converse work Karti Hain yah Ek dusre ke opposite improvement to karte hain lekin yah bahut hello is more grounded Supporter bhi Hote Hain jisse ke jariye se market ko acche tarike se insist kiya jata hai. Advantages Of Head and Shoulder Diagram Model Market Mein Head and Shoulder flame plan Ek bahut howdy persuading system plan Hota Hai Jis ko merchant is a market ki trade position ko affirm kar ne ke liye aur Market Mein purchase aur sell se related total signs ko perceive karne ke liye apply Karte Hain transporters market basic head or shoulder light design go use karte hain to utilize Waqt vah market Mein is graph plan Mein maujud cost ko confirm karne ke liye game or obstruction lines ka istemal Karte Hain in lines ke jariye se great greetings vah market ki cost -

#3 Collapse

Head and shoulder patterent akneeki tajzia ke Maroof aur saada se jagah ke sir aur kaandhon ke chart ke patteren mein teen chotyon ke sath aik bees line hai, darmiyani chouti sab se onche hai. sir aur kaandhon ke chart par taizi se mandi ke rujhan ka ulat jana dekhaya gaya hai, jo yeh bhi ishara karta hai ke oopar ki taraf rujhan khatam honay wala hai . tamam tajir aur sarmaya car is patteren ko istemaal kar satke hain kyunkay yeh har waqt mojood rehta hai. chart patteren mein ahem aur wazeh tor par qabil feham sthon ki farahmi ki wajah se, farmission ke dakhlay ki satah, stop level, aur qeemat ke ahdaaf ko laago karna aasaan hai. takneeki tajzia car aksar chart par sir aur kaandhon ke patteren ko istemaal karte hain . patteren teen chotyon ke sath aik bees line ki terhan lagta hai ؛ markaz ki chouti sab se onche hai aur bahar ki do chotiyan oonchai mein qareeb hain . baen aur dayen kandhay dono siray par chotiyan hain, jabkay markaz mein chouti ko sir kaha jata hai . aik ulta sir aur kaandhon ka patteren sir aur kaandhon ke patteren ke mukhalif ko zahir karta hai, jo aik munfarid chart ki tashkeel hai jo taizi se mandi ke rujhan ke ulat jane ki paish goi karta hai . agarchay rujhan ko tabdeel karne ke liye sab se muaser namonon mein se aik hai, sir aur kaandhon ka patteren khamion ke baghair nahi hai . what the head and shoulder pattern look like? sir aur kandhay rivers mein patteren ki tashkeel ( market ke neechay dekha jata hai ) : qeemat baen kandhay par girty hai, is ke baad qeemat neechay aur izafah hota hai . head : qeemat aik baar phir girty hai, neechay neechay ki takhleeq . dayen kandhay : dayen neechay bananay ke liye girnay se pehlay qeemat aik baar phir barh gayi . aik baar phir, farmishnz Shaz o nadir hi be aib hain. mutaliqa kaandhon aur suron ke darmiyan, bazaar mein kuch shore ho sakta hai . Inverse head and shoulder naik line ka qiyam naik line par support ya muzahmat ki miqdaar wohi hai jisay tajir yeh faisla karne ke liye istemaal karte hain ke hikmat e amli se order kahan dena hai. chart par baen kandhay, sir aur dayen kandhay ko talaash karna is baat ka taayun karne ka pehla qadam hai ke gardan ki lakeer kahan honi chahiye . hum baen kandhay ke baad banaye gaye lo ko mushtarqa sir aur kaandhon ke patteren ( market taap ) mein sir ke baad banaye gaye lo se jorhte hain. hamari naik line, jo chart par gehray neelay rang ki lakeer ke tor par dikhayi gayi hai, is terhan banai gayi hai . placing the neckline stops ka intikhab aam market taap patteren mein naik line daakhil honay ke baad, stops ko dayen kandhay ( taping patteren ) se thora oopar rakha jata hai. mutabadil ke tor par, patteren ke sir ko stap ke tor par istemaal kya ja sakta hai. taham, is mein numaya tor par ziyada khatrah shaamil hai aur patteren ki rissk ratio mein wapsi ko kam karta hai. stap ko rivers patteren mein seedhay dayen kandhay ke neechay rakha gaya hai. aik baar phir, jab stap patteren ke sir ke qareeb hota hai to tajir ko mazeed khatray ka saamna karna parta hai. tijarat mein daakhil honay ke baad, oopar walay chart par stap $ 104 ( dayen kandhay ke bilkul neechay ) par set ho jaye ga . placing your stops –apne munafe ke ahdaaf ka intikhab sir aur har kandhay ke kam point ke darmiyan qeemat ka farq patteren ke munafe ke hadaf ke tor par kaam karta hai. manfi pehlu ke liye qeemat ka maqsad phir naik line break out level ( market ke sab se oopar ) se is farq ko kam kar ke shumaar kya jata hai. oopar ki qeemat ka hadaf bananay ke liye market ke neechay ke liye naik line break out qeemat mein farq shaamil kya jata hai . -

#4 Collapse

Head and shoulder patterentakneeki tajzia ke Maroof aur saada se jagah ke sir aur kaandhon ke chart ke patteren mein teen chotyon ke sath aik bees line hai, darmiyani chouti sab se onche hai. sir aur kaandhon ke chart par taizi se mandi ke rujhan ka ulat jana dekhaya gaya hai, jo yeh bhi ishara karta hai ke oopar ki taraf rujhan khatam honay wala hai .tamam tajir aur sarmaya car is patteren ko istemaal kar satke hain kyunkay yeh har waqt mojood rehta hai. chart patteren mein ahem aur wazeh tor par qabil feham sthon ki farahmi ki wajah se, farmission ke dakhlay ki satah, stop level, aur qeemat ke ahdaaf ko laago karna aasaan hai. takneeki tajzia car aksar chart par sir aur kaandhon ke patteren ko istemaal karte hain .patteren teen chotyon ke sath aik bees line ki terhan lagta hai ؛ markaz ki chouti sab se onche hai aur bahar ki do chotiyan oonchai mein qareeb hain .baen aur dayen kandhay dono siray par chotiyan hain, jabkay markaz mein chouti ko sir kaha jata hai .aik ulta sir aur kaandhon ka patteren sir aur kaandhon ke patteren ke mukhalif ko zahir karta hai, jo aik munfarid chart ki tashkeel hai jo taizi se mandi ke rujhan ke ulat jane ki paish goi karta hai .agarchay rujhan ko tabdeel karne ke liye sab se muaser namonon mein se aik hai, sir aur kaandhon ka patteren khamion ke baghair nahi hai .what the head and shoulder pattern look like?sir aur kandhay rivers meinpatteren ki tashkeel ( market ke neechay dekha jata hai ) :qeemat baen kandhay par girty hai, is ke baad qeemat neechay aur izafah hota hai .head : qeemat aik baar phir girty hai, neechay neechay ki takhleeq .dayen kandhay : dayen neechay bananay ke liye girnay se pehlay qeemat aik baar phir barh gayi .aik baar phir, farmishnz Shaz o nadir hi be aib hain. mutaliqa kaandhon aur suron ke darmiyan, bazaar mein kuch shore ho sakta hai .Inverse head and shouldernaik line ka qiyamnaik line par support ya muzahmat ki miqdaar wohi hai jisay tajir yeh faisla karne ke liye istemaal karte hain ke hikmat e amli se order kahan dena hai. chart par baen kandhay, sir aur dayen kandhay ko talaash karna is baat ka taayun karne ka pehla qadam hai ke gardan ki lakeer kahan honi chahiye .hum baen kandhay ke baad banaye gaye lo ko mushtarqa sir aur kaandhon ke patteren ( market taap ) mein sir ke baad banaye gaye lo se jorhte hain. hamari naik line, jo chart par gehray neelay rang ki lakeer ke tor par dikhayi gayi hai, is terhan banai gayi hai .placing the necklinestops ka intikhabaam market taap patteren mein naik line daakhil honay ke baad, stops ko dayen kandhay ( taping patteren ) se thora oopar rakha jata hai. mutabadil ke tor par, patteren ke sir ko stap ke tor par istemaal kya ja sakta hai. taham, is mein numaya tor par ziyada khatrah shaamil hai aur patteren ki rissk ratio mein wapsi ko kam karta hai. stap ko rivers patteren mein seedhay dayen kandhay ke neechay rakha gaya hai. aik baar phir, jab stap patteren ke sir ke qareeb hota hai to tajir ko mazeed khatray ka saamna karna parta hai. tijarat mein daakhil honay ke baad, oopar walay chart par stap $ 104 ( dayen kandhay ke bilkul neechay ) par set ho jaye ga .placing your stops–apne munafe ke ahdaaf ka intikhabsir aur har kandhay ke kam point ke darmiyan qeemat ka farq patteren ke munafe ke hadaf ke tor par kaam karta hai. manfi pehlu ke liye qeemat ka maqsad phir naik line break out level ( market ke sab se oopar ) se is farq ko kam kar ke shumaar kya jata hai. oopar ki qeemat ka hadaf bananay ke liye market ke neechay ke liye naik line break out qeemat mein farq shaamil kya jata hai . -

#5 Collapse

market ki nigrani karte waqt, tajir aur tajzia car agli mumkina qeemat ki naqal o harkat ko dekhnay ki umeed mein musalsal rujhanaat aur namonon ki talaash karte hain. kamyaab trading ki kuleed patteren ko talaash karna, un ki sahih wazahat karna, aur un ki ahmiyat ko samjhna hai. sir aur kaandhon ka namona ahem hai kyunkay market ke mahireen ne tareekhi tor par is par inhisaar kya hai. hum zail mein is patteren ke baray mein mazeed tafseel mein jayen ge, is ki ahmiyat ka khaka paish karen ge aur aap usay –apne faiday ke liye kaisay istemaal kar satke hain . The Basics of the Head and Shoulders Pattern sir aur kaandhon ka patteren aik takneeki tajzia paish goi karne wala chart dhancha hai jo aam tor par rujhan ke ulat jane ki nishandahi karta hai jahan market taizi se mandi ki taraf ya is ke bar aks badal jati hai. is patteren ki taweel arsay se aik durust rujhan ko tabdeel karne walay isharay ke tor par tareef ki jati rahi hai. yeh yaad rakhna zaroori hai ke agay bherne se pehlay sir aur kaandhon ka patteren taqreeban kabhi bhi be aib nahi hota hai kyunkay kaandhon aur sir ke darmiyan qeematon mein taqreeban mamooli tagayuraat zaroor hon ge aur is liye ke patteren Shaz o nadir hi theek se bantaa hai . sir aur kaandhon ka patteren teen bunyadi hisson se bana hai. har aik juz ke baray mein mazeed tafseel mein jane se pehlay neechay di gayi misaal ko dekhen . qeemat patteren bananay ke liye kandhay ke do hisson aur aik sir ke ilaqay se guzarti hai, jo market ke ulat jane ka ishara deti hai. yeh tasweer patteren ke teen hisson ki wazeh numaindagi hai. market ki taizi ke aik taweel arsay ke baad, jab qeemat barh jati hai aur baad azan girt mein girty hai, to pehla" kandha" hota hai. jab qeemat aik baar phir barhti hai to," sir" peda hota hai, pehlay kandhay ki tashkeel ke oopar aik aala chouti peda karta hai. yahan se, qeemat mein kami aati hai aur dosra kandha bantaa hai, jo ziyada tar mamlaat mein pehlay kandhay se mushabihat rakhta hai. yeh note karna zaroori hai ke ibtidayi mandi pehlay kandhay ke neechay ziyada nahi phelti hai is se pehlay ke aksar ya to thora sa oopar ki taraf peechay hatna ya chipta hona hota hai . jab qeemat aik baar phir kam ho jati hai aur naik line se neechay toot jati hai, patteren mukammal ho jata hai aur market reversal signal peda hota hai. ufuqi line jo pehlay do girton ko aapas mein judte hai woh gardan ki lakeer hai, jaisa ke oopar di gayi misaal mein dekhaya gaya hai .

qeemat patteren bananay ke liye kandhay ke do hisson aur aik sir ke ilaqay se guzarti hai, jo market ke ulat jane ka ishara deti hai. yeh tasweer patteren ke teen hisson ki wazeh numaindagi hai. market ki taizi ke aik taweel arsay ke baad, jab qeemat barh jati hai aur baad azan girt mein girty hai, to pehla" kandha" hota hai. jab qeemat aik baar phir barhti hai to," sir" peda hota hai, pehlay kandhay ki tashkeel ke oopar aik aala chouti peda karta hai. yahan se, qeemat mein kami aati hai aur dosra kandha bantaa hai, jo ziyada tar mamlaat mein pehlay kandhay se mushabihat rakhta hai. yeh note karna zaroori hai ke ibtidayi mandi pehlay kandhay ke neechay ziyada nahi phelti hai is se pehlay ke aksar ya to thora sa oopar ki taraf peechay hatna ya chipta hona hota hai . jab qeemat aik baar phir kam ho jati hai aur naik line se neechay toot jati hai, patteren mukammal ho jata hai aur market reversal signal peda hota hai. ufuqi line jo pehlay do girton ko aapas mein judte hai woh gardan ki lakeer hai, jaisa ke oopar di gayi misaal mein dekhaya gaya hai .

-

#6 Collapse

Assalam o Alaikum What is Head and Shoulder pattern:? tkneke tjzeh men، sr aor kndhon ka nmonh astamal kea jata hay۔ aek mnfrd chart petrn jo teze say mnde kay rjhan men tbdele ka asharh krta hay۔ petrn ten choteon kay sath aek bneade lae'n kay tor pr zahr hota hay، mrkz ke chote sb say aonche hay aor bahr ke do chotean aonchae'e men nsbtaً qreb hen۔ sr aor kndhon ka petrn as oqt zahr hota hay jb astak ke qemt as kay aopre hsay tk brrh jate hay aor phr ohen oaps grte hay jhan say as nay apna rjhan shroa kea tha۔ qemt phr abtdae'e bnead pr oaps aanay say phlay "sr" bnanay kay leay phlay ke blnde say brrh jate hay۔ aakhr men، astak ke qemt aek bar phr grnay say phlay farmeshn ke phle chote kay qreb sth pr dosre chote ka tjrbh krte hay۔ Key Takeaways tkneke tor pr، aek sr aor kndhon ka petrn ten choteon kay sath aek chart petrn hay، js ka mrkze hsh sb say aonche hay jbkh bahr kay do aonchae'e men qreb say faslay pr hen۔ aek chart ke tshkel jo teze say mnde kay rjhan kay alt janay ke peshen goe'e krte hay oh sr aor kndhon ka nmonh hay، js ka shmar anthae'e drst rjhan kay alt janay oalay nmonon men hota hay۔ sr aor kndhon kay altay petrn say mnde say teze kay rjhan ke pesh goe'e ke jate hay۔ as bat pr mnhsr hay kh petrn ks rastay pr ja rha hay، nek lae'n sport ya mzahmte khtot pr tke hoe'e hay۔ Understanding the Head and Shoulders Pattern sr aor kndhon kay petrn kay char hsay hen: toel teze kay rjhanat kay bad qemt aroj pr phnch jate hay، phr gr kr grt bn jate hay۔ qemt phr aek bar phr brrhnay kay bad km ho jate hay takh oh aonchae'e qae'm ho jo pchhle chote say nmaean tor pr zeadh ho۔ qemt men tesra azafh asay srf phle aonche sth pr lay aata hay as say phlay kh yh aek bar phr grna shroa kr day۔ do choteon ya grton pr grdn ke lker khenchna (alta)۔ What Does the Head and Shoulders Pattern Tell You? aek alt sr aor kndhon ke shkl say zahr hota hay۔ tajron kay mtabq، agr drmean men choteon aor grton kay ten set hon to as ke qemt men kme ka amkan hay۔ nek lae'n bee'rsh tredrz kay leay frokht kay nqth aaghaz ka asharh dete hay۔ petrn say yh bhe pth chlta hay kh jb tk dae'en kndhay ko torra nhen jata hay — jb qemten sheh chote pr qemton say zeadh hote hen — mojodh grnay ka rjhan ghalbaً brqrar rhay ga۔

- Mentions 0

-

سا0 like

-

#7 Collapse

Head & Shoulder Candlestick Pattern: Dear forex member Head and Shoulder pattern forex market mein bahut importance rakhte Hain Head and Shoulder pattern market mein bahut popular pattern hai Head and Shoulder pattern mein market 3 peaks mein hoti hai Head and Shoulder pattern ka peaks price level se start Hote Hain Head and Shoulder pattern technical pattern hai Head and Shoulder pattern Hamesha bullish and bearish ke reversal trend ko show Karte Hain Head and Shoulder pattern 1 reversal pattern hai Hamen is pattern ko clearly samajhna chahie Jab Ham is pattern ko acchi Tarah se samajh Le aur Iske related complete information Hasil karne To Hamen in pattern company trading Mein apply karna chahie tha ki Ham apni trading Mein Achcha Se Achcha profit Hasil kar sake Hamen market Mein maujud Tamam patton ko acchi Tarah se follow karna chahie Hamen in pattern ko kabhi bhi gana nahin karna chahie because a pattern Hamare liye bahut jyada important hote hain in pattern ki madad se Ham market Mein kam Karke Achcha Se Achcha profit Hasil kar sakte hain.Importance: Market mein Jab niche se upar ki taraf move kar rahi ho to Upar 1 point se reject Hoti Hai ya market ka first shoulder ban jata hai Uske bad market thoda sa down aati hai aur fir nichy se reject hoti hai (Yeah first shoulder ki support hoti hai) aur pher Upar Jati Hai Pichhle shoulder ke resistance se market thoda sa Upar Chale Jaate Hain head banti hai (jisse Ham chart pattern me head bolate Hain) aur FIR reject hoti hai aur pher niche ajati Hai niche market first shoulder ke support Tak aati hai aur uske bad again market Upar Chale Jaate Hain.Market mein Jab upar se Niche ki taraf move kar rahi ho to Niche 1 point se reject Hoti Hai ya market ka first shoulder ban jata hai Uske bad market thoda sa up aati hai aur fir uper se reject hoti hai (Yeah first shoulder ki support hoti hai) aur pher down Jati Hai Pichhle shoulder ke support se market thoda sa zyada down Chale Jaate Hain head banti hai (jisse Ham chart pattern me head bolate Hain) aur pher reject hoti hai aur pher uper ajati Hai.

Trading Points: Dear partners Head and Shoulder pattern Ke Main Jab aap kam kar rahe hote hain to ismein aap dekhte hain ki Jab aap isme apni trade open Karte Hain To is trade ka aap stop class shoulders ke upar Apna Rakh sakte hain aur aap ismein Dekh Rahe hote hain ki apni trade ke sath stop loss Lagana bahut jyada Jaruri Hota Hai Jab tak aap apni trade ke sath stop wash ka istemal Nahin Karenge aapki tradesafe Nahin Hogi ismein aap apna stop-loss shoulders ke upar Laga sakte hain.Forex trading Mein Jab aap candlesticks pattern per kam karte hain aur Market ke different chart patterns for kam karne Hetu ismein aap Jab Head and Shoulder pattern per trade Laga Rahe hote hain to usmein aap apni trade ka take profit first support ko bhi Rakh sakte hain aur ismein aap apna target neckline aur ismein head ke Darmiyaan Jitna gap hota hai aap is per bhi apna take profit Iske size ki Jitna Laga sakte hain market Mein Apna confirm down Aana Hota Hai. [Thanks A Lot]

-

#8 Collapse

Ce market ki improvement in keeping with make hony waly ranges hoty hain jo ky market aik restoration time fundamental maximum excessive aur least level tak improvement ker rehi hoti ha ky poke market dobara wahan in line with ponchti ha tou inversion ky bhi bahot zyada chances hoty hain agar ham foreign exchange market number one trade kerty hain tou hamain pata hona chahiay ky guide aur competition kia hain aur yeh kitni substantial hain ky ham in ko apni changing main use kerty huey kesy faida hasil ker sakty hain tou support market ki improvement essential make hony wali aesi position ha ky punch market downtrend essential improvement ker rehi hoti ha aur kisi factor sy bar retracement ly ker up development shoru ker deti ha tou aesy factor ko assist kehty hain ky market hit bhi equal point according to jati ha tou inversion ky bahot zyada probabilities hoty hain esi terha hit market upswing fundamental development kerty huey kisi aik point sy bar switch ho rehi hoti ha tou equal point ko obstruction kehty hain.WHAT IS SUPPORT...??I trust aap sab khariyat sy hoon gy Cost assist kay vicinity ka woh hesa hote hello jo keh forex marketplace mein price kay zyada nechay janay say prevent karte whats up nechay wreck honay kay ley koshesh kar rehe hote hey oper dey gay vicinity meindaikh saktay hein keh kes tarah suppot kay location mein fee nechay ate whats up or es kay result mein es degree say bullish say pass ho jate good day angle mein value help kay kareeb pohnch jate howdy jaisay price assist kay kareeb pohnch jate howdy es kay pastime mein suste ate jate whats up consumer ko foreign exchange market mein aik behtar soft drink nazar ata whats up promote ka imkan kam ho jata howdy or purchase ka imkan increment ho jata howdy yeh cost assist say nechay gernay say stop karty hen.Trading Schedule marketplace ki improvement ko market ka sample kehty hain ky agar marketplace bar descending retracement ly ker by way of and big development upswing essential ker rehi hoti ha tou woh bar kuch protections ko break ker rehi hoti ha aur downtrend number one development kerty huey market bar little backings ko break ker rehi hoti ha tou yeh little backings and protections ky tiers hoty hain jin ko marketplace wreck kerty huey apni best assist ya opposition in step with ponchti ha aur jahan sy market ka transfer hona ya sample ka alternate hona confirm hota hai.Aid kay kareeb pohnch jate whats up jaisay price assist kay kareeb pohnch jate hello es kay pastime mein suste ate jate hi there purchaser ko forex market mein aik behtar smooth drink nazar ata hey promote ka imkan kam ho jata hey or purchase ka imkan increment ho jata hai.As liye murmur as ko guide marketplace aik restoration time essential most extreme aur least stage tak development ker rehi hoti ha ky punch market dobara wahan in keeping with ponchti ha tou inversion ky bhi bahot zyada chances hoty hain agar ham foreign exchange marketplace important trade kerty hain tou hamain pata hona chahiay ky aid aur obstruction kia hain aur yeh kitni great hain ky ham in ko apni replacing predominant use kerty huey kesy faida hasil ker sakty hain tou help marketplace ki development primary make hony wali aesi function ha ky poke marketplace downtrend fundamental development ker rehi hoti ha aur kisi factor sy bar retracement ly ker up improvement shoru ker deti ha tou aesy point ko aid kehty hain ky marketplace hit bhi identical factor in keeping with jati ha tou inversion ky bahot zyada probabilities hoty hain esi terha hit marketplace upturn essential improvement kerty huey kisi aik factor sy bar flip round ho rehi hoti ha tou identical factor ko opposition kehty hain.

-

#9 Collapse

Head and shoulders plan

sir aur kaandhon ka chart patteren takneeki tajzia mein aik maqbool aur aasani se jagah par jane wala patteren hai jo teen chotyon ke sath aik bees line dekhata hai, darmiyani chouti sab se onche hai. sir aur kaandhon ka chart taizi se mandi ke rujhan ko tabdeel karta hai aur ishara karta hai ke oopar ki taraf rujhan –apne ekhtataam ke qareeb hai . patteren har waqt ke par zahir hota hai aur is wajah se har qisam ke tajir aur sarmaya car istemaal kar satke hain. dakhlay ki sthin, stop levels, aur qeemat ke ahdaaf tashkeel ko laago karna aasaan banatay hain, kyunkay chart patteren ahem aur aasani se nazar anay wali satah faraham karta hai . What the Head and Shoulders Pattern Looks Like

sab se pehlay, hum sir aur kaandhon ke patteren ki tashkeel ko dekhen ge aur phir ulta sir aur kaandhon ke patteren ko dekhen ge . patteren ki tashkeel ( market ke sab se oopar dekha gaya ) : baayaan kandha : qeemat mein izafay ke baad qeemat ki chouti, is ke baad kami . sir : qeemat mein dobarah izafah aik onche chouti bana raha hai . dayen kandhay : aik baar phir zawaal aata hai, jis ke baad dayen chouti ki tashkeel hoti hai, jo sir se neechay hoti hai . farmission Shaz o nadir hi kaamil hotay hain, jis ka matlab hai ke mutaliqa kaandhon aur sir ke darmiyan kuch shore ho sakta hai . Inverse Head and Shoulders

patteren ki tashkeel ( market ke neechay dekha jata hai ) : baen kandhay : qeemat mein kami ke baad qeemat neechay aati hai, is ke baad izafah hota hai . head : qeemat mein dobarah kami waqay hui hai jis se neechay ka nichala hissa bantaa hai . dayen kandhay : qeemat aik baar phir barh jati hai, phir dayen neechay ki shakal mein girty hai . aik baar phir, farmission Shaz o nadir hi kaamil hotay hain. mutaliqa kaandhon aur sir ke darmiyan kuch bazari shore ho sakta hai . Placing the Neckline

yeh zaroori hai ke tajir patteren ke mukammal honay ka intzaar karen. is ki wajah yeh hai ke aik patteren bilkul tayyar nahi ho sakta hai ya juzwi tor par tayyar kardah patteren mustaqbil mein mukammal nahi ho sakta hai. juzwi ya taqreeban mukammal shuda patteren ko dekha jana chahiye, lekin is waqt tak koi tijarat nahi ki jani chahiye jab tak ke patteren ki gardan nah toot jaye . sir aur kaandhon ke patteren mein, hum dayen kandhay ki chouti ke baad naik line se neechay jane ke liye qeemat ki karwai ka intzaar kar rahay hain. ultay sir aur kaandhon ke liye, dayen kandhay ke ban'nay ke baad hum gardan ke oopar qeemat ki harkat ka intzaar karte hain . patteren mukammal honay par tijarat shuru ki ja sakti hai. pehlay se tijarat ki mansoobah bandi karen, indraaj, stops, aur munafe ke ahdaaf ko likhain aur sath hi kisi mutaghayyar ko note karen jo aap ke stap ya munafe ke hadaf ko badal day ga . dakhlay ka sab se aam nuqta tab hota hai jab break out hota hai — naik line toot jati hai aur tijarat ki jati hai. aik aur dakhli nuqta ziyada sabr ki zaroorat hai aur is imkaan ke sath aata hai ke is iqdaam ko mukammal tor par chore diya jaye. is tareeqa car mein break out honay ke baad gardan ki taraf pal back ka intzaar karna shaamil hai. yeh is lehaaz se ziyada qadamat pasand hai ke hum dekh satke hain ke aaya pal back ruk jata hai aur asal break out simt dobarah shuru hoti hai, agar qeemat break out simt mein barhti rehti hai to tijarat chhuut sakti hai. dono tareeqay zail mein dukhaay gaye hain . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

HEAD and SHOULDERS PLAN sir aur kaandhon ka graph patteren takneeki tajzia mein aik maqbool aur aasani se jagah standard jane wala patteren hai jo youngster chotyon ke sath aik honey bees line dekhata hai, darmiyani chouti sab se onche hai. sir aur kaandhon ka graph taizi se mandi ke rujhan ko tabdeel karta hai aur ishara karta hai ke oopar ki taraf rujhan - apne ekhtataam ke qareeb hai . patteren har waqt ke standard zahir hota hai aur is wajah se har qisam ke tajir aur sarmaya vehicle istemaal kar satke hain. dakhlay ki sthin, stop levels, aur qeemat ke ahdaaf tashkeel ko laago karna aasaan banatay hain, kyunkay outline patteren ahem aur aasani se nazar anay wali satah faraham karta hai Significance: Market mein Poke specialty se upar ki taraf move kar rahi ho to Upar 1 point se reject Hoti Hai ya market ka first shoulder boycott jata hai Uske awful market thoda sa down aati hai aur fir nichy se reject hoti hai (Better believe it first shoulder ki support hoti hai) aur pher Upar Jati Hai Pichhle shoulder ke opposition se market thoda sa Upar Chale Jaate Hain head banti hai (jisse Ham outline design me head bolate Hain) aur FIR reject hoti hai aur pher specialty ajati Hai specialty market first shoulder ke support Tak aati hai aur uske terrible again market Upar Chale Jaate Hain.Market mein Hit upar se Specialty ki taraf move kar rahi ho to Specialty 1 point se reject Hoti Hai ya market ka first shoulder boycott jata hai Uske awful market thoda sa up aati hai aur fir uper se reject hoti hai (No doubt first shoulder ki support hoti hai) aur pher down Jati Hai Pichhle shoulder ke support se market thoda sa zyada down Chale Jaate Hain head banti hai (jisse Ham diagram design me head bolate Hain) aur pher reject hoti hai aur pher uper ajati Hai. Key Focal points tkneke peak pr، aek sr aor kndhon ka petrn ten choteon kay sath aek graph petrn hay، js ka mrkze hsh sb say aonche feed jbkh bahr kay do aonchae'e men qreb say faslay pr hen۔ aek graph ke tshkel jo teze say mnde kay rjhan kay alt janay ke peshen goe'e krte roughage goodness sr aor kndhon ka nmonh hay، js ka shmar anthae'e drst rjhan kay alt janay oalay nmonon men hota hay۔ sr aor kndhon kay altay petrn say mnde say teze kay rjhan ke pesh goe'e ke jate hay۔ as bat pr mnhsr feed kh petrn ks rastay pr ja rha hay، nek lae'n sport ya mzahmte khtot pr tke hoe'e hay۔

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:28 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим