Teesri Andher Batti Candlestick Pattern Ki Ahmiyat

Teesri Andher Batti (Three Inside Down) Candlestick Pattern ek bearish reversal pattern hai jo charting mein trend ki disha badalne ka sanket deta hai. Yah pattern tab banta hai jab char price chart par teen consecutive bearish candlesticks dikhte hain, jinmein se har ek ki closing price usse pehle ki candlestick ki closing price se kam hoti hai. Pattern ka teesra candlestick sabse chhota hona chahiye aur uska real body sabse pehle aur doosre candlestick ke real body se andar hona chahiye.

Teesri Andher Batti Pattern ki Ahmiyat

Teesri Andher Batti Pattern ki ahmiyat isliye hai kyunki yah bulls aur bears ke bich sentiment mein badlav ka sanket deta hai. Pehle do bearish candlesticks yah batate hain ki bears par zor hai, lekin teesra chhota candlestick yeh batata hai ki bulls wapas aane lage hain aur bears ki taqat kam ho rahi hai.

Teesri Andher Batti Pattern ka Istemal

Teesri Andher Batti Pattern ka istemal trend ki disha badalne ki sambhavna ka pata lagane ke liye kiya ja sakta hai. Agar pattern ek uptrend mein banta hai, to yah ek bearish reversal ka sanket ho sakta hai. Agar pattern ek downtrend mein banta hai, to yah ek bullish continuation ka sanket ho sakta hai.

Teesri Andher Batti Pattern ki Seemaen

Teesri Andher Batti Pattern ek surefire reversal signal nahi hai. Kabhi kabhi, yah pattern ek pullback ya consolidation ka sanket ho sakta hai, aur trend mein koi badlav nahi ho sakta hai. Isliye, is pattern ka istemal dusre technical indicators ke sath karna chahiye.

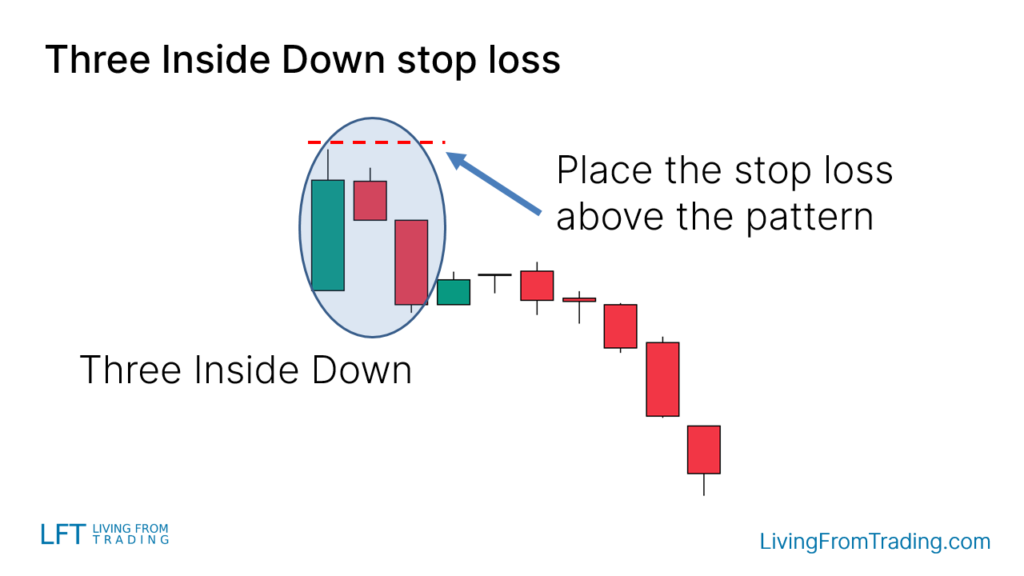

Teesri Andher Batti Pattern ka Example

Upward trend mein, teesra chhota candlestick bearish reversal ka sanket de sakta hai.

Nishkarsh

Teesri Andher Batti Candlestick Pattern ek bearish reversal pattern hai jo charting mein trend ki disha badalne ka sanket deta hai. Yah pattern tab banta hai jab char price chart par teen consecutive bearish candlesticks dikhte hain, jinmein se har ek ki closing price usse pehle ki candlestick ki closing price se kam hoti hai. Pattern ka teesra candlestick sabse chhota hona chahiye aur uska real body sabse pehle aur doosre candlestick ke real body se andar hona chahiye.

Teesri Andher Batti Pattern ki ahmiyat isliye hai kyunki yah bulls aur bears ke bich sentiment mein badlav ka sanket deta hai. Pehle do bearish candlesticks yah batate hain ki bears par zor hai, lekin teesra chhota candlestick yeh batata hai ki bulls wapas aane lage hain aur bears ki taqat kam ho rahi hai.

Teesri Andher Batti Pattern ka istemal trend ki disha badalne ki sambhavna ka pata lagane ke liye kiya ja sakta hai. Agar pattern ek uptrend mein banta hai, to yah ek bearish reversal ka sanket ho sakta hai. Agar pattern ek downtrend mein banta hai, to yah ek bullish continuation ka sanket ho sakta hai.

Teesri Andher Batti Pattern ki Seemaen hain. Kabhi kabhi, yah pattern ek pullback ya consolidation ka sanket ho sakta hai, aur trend mein koi badlav nahi ho sakta hai. Isliye, is pattern ka istemal dusre technical indicators ke sath karna chahiye.

Teesri Andher Batti (Three Inside Down) Candlestick Pattern ek bearish reversal pattern hai jo charting mein trend ki disha badalne ka sanket deta hai. Yah pattern tab banta hai jab char price chart par teen consecutive bearish candlesticks dikhte hain, jinmein se har ek ki closing price usse pehle ki candlestick ki closing price se kam hoti hai. Pattern ka teesra candlestick sabse chhota hona chahiye aur uska real body sabse pehle aur doosre candlestick ke real body se andar hona chahiye.

Teesri Andher Batti Pattern ki Ahmiyat

Teesri Andher Batti Pattern ki ahmiyat isliye hai kyunki yah bulls aur bears ke bich sentiment mein badlav ka sanket deta hai. Pehle do bearish candlesticks yah batate hain ki bears par zor hai, lekin teesra chhota candlestick yeh batata hai ki bulls wapas aane lage hain aur bears ki taqat kam ho rahi hai.

Teesri Andher Batti Pattern ka Istemal

Teesri Andher Batti Pattern ka istemal trend ki disha badalne ki sambhavna ka pata lagane ke liye kiya ja sakta hai. Agar pattern ek uptrend mein banta hai, to yah ek bearish reversal ka sanket ho sakta hai. Agar pattern ek downtrend mein banta hai, to yah ek bullish continuation ka sanket ho sakta hai.

Teesri Andher Batti Pattern ki Seemaen

Teesri Andher Batti Pattern ek surefire reversal signal nahi hai. Kabhi kabhi, yah pattern ek pullback ya consolidation ka sanket ho sakta hai, aur trend mein koi badlav nahi ho sakta hai. Isliye, is pattern ka istemal dusre technical indicators ke sath karna chahiye.

Teesri Andher Batti Pattern ka Example

Upward trend mein, teesra chhota candlestick bearish reversal ka sanket de sakta hai.

Nishkarsh

Teesri Andher Batti Candlestick Pattern ek bearish reversal pattern hai jo charting mein trend ki disha badalne ka sanket deta hai. Yah pattern tab banta hai jab char price chart par teen consecutive bearish candlesticks dikhte hain, jinmein se har ek ki closing price usse pehle ki candlestick ki closing price se kam hoti hai. Pattern ka teesra candlestick sabse chhota hona chahiye aur uska real body sabse pehle aur doosre candlestick ke real body se andar hona chahiye.

Teesri Andher Batti Pattern ki ahmiyat isliye hai kyunki yah bulls aur bears ke bich sentiment mein badlav ka sanket deta hai. Pehle do bearish candlesticks yah batate hain ki bears par zor hai, lekin teesra chhota candlestick yeh batata hai ki bulls wapas aane lage hain aur bears ki taqat kam ho rahi hai.

Teesri Andher Batti Pattern ka istemal trend ki disha badalne ki sambhavna ka pata lagane ke liye kiya ja sakta hai. Agar pattern ek uptrend mein banta hai, to yah ek bearish reversal ka sanket ho sakta hai. Agar pattern ek downtrend mein banta hai, to yah ek bullish continuation ka sanket ho sakta hai.

Teesri Andher Batti Pattern ki Seemaen hain. Kabhi kabhi, yah pattern ek pullback ya consolidation ka sanket ho sakta hai, aur trend mein koi badlav nahi ho sakta hai. Isliye, is pattern ka istemal dusre technical indicators ke sath karna chahiye.

تبصرہ

Расширенный режим Обычный режим