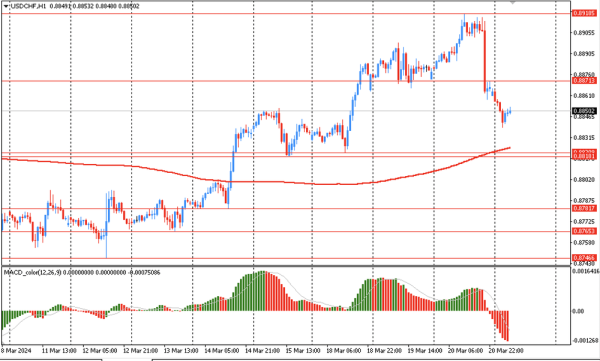

Tajziya mutabiq, bearish Wolfe pattern ke 5th wave ka target 0.8521 ke darje par darust hone ki mumkinat ka ishaara hai. Is ke ilawa, aik dosra manzar bhi madde nazar laaya ja sakta hai jahan price action 4-hour chart par aik inverted triangle pattern ka banne ka ishaara deta hai. Agar bullish breakout hota hai, to pair upper boundary of the inverted triangle tak chadh sakta hai, jahan 0.8799 ke darja hai. Mukhalif tor par, triangle pattern se bearish breakout hone par Wolfe's 5th wave ke target ke saath milta julta hoga. Pehle manzar ka tajziya karte hue, bearish Wolfe pattern ne currency pair ke liye neeche ki taraf potential rukh ka ishaara diya hai. Is pattern ke 5th wave ka target 0.8876 ke darje par hai. Is pattern ko dekhne wale traders ko bearish continuation ki tasdiq ke liye price action ko qareebi nigrani se dekhna chahiye aur specified level ko nishana banate hue short positions ke liye potential dakhil points ka intezaar karna chahiye. Doosri taraf, 4-hour chart par aik inverted triangle pattern ka banne ka aik mukhalif manzar bhi hai. Agar bullish breakout hota hai, to market sentiment mein tabdeeli ka ishaara dene par pair triangle pattern ke upper boundary ki taraf chadh sakta hai. Lambi positions par nazar rakhne wale traders ko breakout ki tasdiq hone par market mein dakhil hone ka tajwez diya jata hai, jahan 0.8854 ke resistance level ko nishana banaya ja sakta hai. Magar, agar keemat rukh badal kar triangle pattern ke lower boundary se guzarti hai, to yeh Wolfe's 5th wave dwara dastak di gayi bearish scenarioke sath milta julta hoga. Is manzar mein, traders ko mazeed downside momentum ka intezaar hai, jahan 0.8731 ke target level ko nafa hasil karne ya position exits ke liye potential area samjha jata hai. Hamesha ki tarah, traders ko ehtiyaat bartna chahiye aur nuqsaan ko kam karne ke liye risk management strategies ka istemal karna chahiye. Is mein sahi darje par stop-loss orders lagana aur pehle se tay shuda risk-reward ratios ka amal shamil hai. Is ke ilawa, market ke taraqqiyat par maaloomati hona aur key support aur resistance levels ko nigrani mein rakhna traders ko maqbool trading decisions lene aur market volatility ko mukammal taur par samajhne mein madad faraham kar sakta hai. Mukhtasar tor par, tajziya do potential scenarios ko highlight karta hai currency pair ke liye, jahan bearish Wolfe pattern 0.8621 ke target ki taraf rukh ka ishaara deta hai, jab ke inverted triangle pattern ke banne se bullish breakout ke towards 0.8829 ke darja tak chadhne ki mumkinat darust hoti hai. Traders ko muta'addid technical patterns aur bazaar ke baraay mein dynamics ko madde nazar rakhte hue apni strategies ko muntazir karna chahiye.Click image for larger version

No announcement yet.

X

Collapse

new posts

-

#1516 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#1517 Collapse

USDCHF

USDCHF Jodi ki Tafseeli Tehqeeq M5 Timeframe par: Tijarat Strategy Ke Faislay

Adaab, saathi tijaratkar! Jab hum USDCHF jodi ki M5 timeframe par tafseeli tehqeeq mein dakhil hote hain, chaliye ek trading strategy ko dekhte hain jo Relative Strength Index (RSI) indicator ko 14 dino ke doran istemal karta hai. Halankeh mujhe asal taur par 5 minute tak ke chhote muddaton par trade par tawajjo di jati hai, yeh strategy khaas qawaid aur usoolon ke saath baray timeframes par istemal ke liye bhi tasaruf hasil kar sakti hai.

Jab yeh strategy istemal hoti hai, toh RSI indicator ko khaas tor par nazdeek se nigrani karna zaroori hai, khaaskar jab ke daam overbought zone mein dakhil hota hai. Yeh is waqt hota hai jab RSI 70 ke darja tak pohanchta hai, jo ke potential baray daam ke tabdiliyon ki ishaarat deta hai. Tijarat ke liye mojooda areas ke aas-paas acha dakhil point pehchaana ja sakta hai, jo market movement ke mutabiq hai.

Acha dakhil point pehchannay ke baad, main do orders execute karta hoon. Pehla order thori door dari se current daam se rakha jata hai, jabke doosra order aik choti retracement ke baad position mein aata hai. Yeh dobara order wala tareeqa flexibility aur adaptability ko barqarar rakhta hai, market ke fluctuations ke jawab mein.

Khatra nigrani ke lehaz se, main nisbatan sada risk-to-reward ratios ka palan karta hoon, aam tor par munafa ko 1 se 2 ke daam tak ka target banata hoon. Magar traders apni khatra bardasht ke mutabiq aur trading preferences ke mutabiq in parameters ko adjust kar sakte hain. Iske alawa, positions ko lambay muddaton ke liye rakhne ka tajziya bhi istemal kiya ja sakta hai, inhein mazeed tehqeeq ke liye aik "bookkeeping" marhala mein tabdeel kiya jata hai.

Tijarat ke doran, daam ki harkat ke jawab mein, khaas tor par jab market nishana daam ke areas ke qareeb pohanchta hai, mutaqarar rehna zaroori hai. Yeh proactive tareeqa waqt par faislay ka faisla karne aur moqaat ke khatre ko kam karne mein madad deta hai.

Nukhsano ko kam karne ke liye, stop orders ko aqalmandi se rakha jata hai, jin ka size aam tor par 15 points par set kiya jata hai. Yeh qeemat M5 timeframe ke liye behtareen samjhi jati hai, khatra nigrani aur maal ki hifazat ke darmiyan aik hamwar satah qaim karta hai.

Ikhtitami tor par, USDCHF jodi ke liye M5 timeframe par tajziya ki gayi trading strategy chhotay muddat ke market fluctuations se faida uthane ke liye aik manzar-e-amal faraham karta hai. RSI indicator ka istemal karke aur pehle se tay shuda qawaid aur khatra nigrani ke usoolon ka palan karte hue, traders currency market ke mojuda peyshwar manzar ko pur itminan aur maharat ke saath sailaab kar sakte hain.

Jaise ke hamesha, musalsal nigrani, tarteeb dain, aur mizaaj ke ejra ka aham hissa maqsood trading kamiyabi tak pohanchne ke liye lazmi hai. Aapki tawajjo ka shukriya, aur umeed hai ke aapki tijarat ke koshishat kamyabi aur munafa se milti rahen.

- 0.9062 USDCHF

- Mentions 0

-

سا0 like

-

#1518 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Mufeed Asami: Central bank policies, khas tor par United States mein Federal Reserve (Fed) aur Switzerland mein Swiss National Bank (SNB) ki, ahem kirdaar ada karte hain. Donon maalikon ke darmiyan ke fark ka asar un ke mukhtalif currencies ki kashish par pad sakta hai. United States ke muqable mein Switzerland mein izafa CHF ke khilaf USD ko mazboot kar sakta hai aur ulta bhi ho sakta hai. Iqtisadi Tawazo: GDP ke izafe, rozgar ke reports, mahangi shumooliyat ke adad aur istehqaq-e-sarfeen jaise iqtisadi dastavezat ka izhaar currency pairs par asar daal sakta hai. United States se mazboot iqtisadi dastavezat USD ko taqwiyat de sakti hain, jabke Switzerland se mazboot iqtisadi indicators CHF ko taqwiyat de sakte hain. Amanat Sahar: Swiss franc aksar aik safe haven currency ke tor par dekha jata hai, matlab ke isay uncertainty ya market ke hangame waqt mein mazboot rehne ki khasiyat hoti hai. Kisi bhi tajziyaat mein global khatron se hedging ke tajziyaat CHF ko USD ke khilaf mazboot kar sakte hain. Trade balance aur current account: Switzerland aam tor par bara trade surplus chalata hai aur aik mazboot current account surplus ko barqarar rakhta hai, jo ke Swiss franc ko taqwiyat de sakta hai. Mutabiqan, United States mein trade deficit ya current account deficit USD ko kamzor kar sakte hain. Siyasi darjaat aur siyasi pasand: Do mulko ke darmiyan siyasi ittehadat ya ikhtilafat un ke currency par asar daal sakte hain. Is ke ilawa, aik global mandi ya mandi ke asrat investors ke jazbat aur USD/CHF exchange rate par asar daal sakte hain. Maliyat Polisi ka Bayan: Maliyat polisi ke bayanat aur central banks ke karwaiyan, jaise ke rating decisions, maqrooz haiyat tadbeeron, ya agah rahnumai, aik currency ke qeemat par ahem asar daal sakti hain.

- 0.9063 USDCHF

- Mentions 0

-

سا4 likes

-

#1519 Collapse

Asian trading session ke doran, USD/CHF currency pair ne aik qabil-e-zikar performance ka muzahira kiya, jo aik tight trading range ko barqarar rakhta raha. Jodi ne pichle din ke trading session ke band hone ke darjay ke qareeb barqarar rehne ka dikhaya. Khaas tor par, Budh ke din, Swiss franc ne apne US muqabil ke khilaf mamooli izafa ka samna kiya. Asian market ke fa'aliyat mein, USD/CHF exchange rate ne kisi numaya harkat ka naqsh nahi dikha, jo jodi ke qeemat mein aik doran ya mustawar period ki alamat thi. Is sust performance ka sabab bazaar ke jazbat aur traders ke rawayyaat ko mutasir karne wale mukhtalif factors ho sakte hain, jaise ke iqtisadi dastavezat ke izhaar, siyasi tensions, aur maliyat polisi ki umeedat.

Investors aur traders ne USD/CHF pair ke rawayyaat ka mutaala kiya, bazaar ke asal dyanamiks ke baray mein maloomat haasil karne ke liye. Jabke kuch market participants intezar-o-tawaqo ka raasta ikhtiyar kar sakte the, dusre tajarbaat ke moukaat ko talaash kar sakte the, jis mein jodi ke tang trading range ke andar shamil hai. Asian trading session ke doran zahir taur par kisi khaas shadeed zyada rawani ki kami ke bawajood, USD/CHF pair ke pichle din ke band hone ke darjay ke qareeb honay ka ishara mojooda bazaar ke trends ka jari rehne ya kisi naye catalyst ke zahir hone ke doran ek mustawar period ka hota hai.

Swiss franc ke halqi izafa ka aik nazar-e-aam ka chashma budh ke din dekha gaya, jo ke mukhtalif factors par mabni ho sakta hai, jaise ke iqtisadi dastavezat ke izhaar, siyasi tensions, aur safe-haven currencies ke daramadon mein tabdeeliyan. Jabke traders aur investors foreign exchange market ke complexities ko samajhte hain, wo currency valuations aur trading strategies par asar dalne wale kisi bhi tabdeelion ke liye agah rehte hain. Chahe wo iqtisadi indicators, siyasi waqiat, ya central bank announcements ke zariye driven hon, USD/CHF exchange rate mein fluctuations duniya bhar ke market participants ka tawajjo jari rakhte hain.

- 0.9064 USDCHF

- Mentions 0

-

سا3 likes

-

#1520 Collapse

Asian trading session mein, USD/CHF currency pair ne ek relatively subdued performance dikhai, aur ek tight trading range maintain ki. Pair pichle din ke trading session ke closing levels ke qareeb hi raha. Khaas tor par, Budhwar ko Swiss franc ne apne US ke muqabil mein thori izafa kiya. Asian market activities ke doran, USD/CHF exchange rate ne kisi significant movement ka ailaan nahi kiya, jo ke pair ke value mein consolidation ya stabilization ki period ki nishani hai. Ye subdued performance market sentiment aur trader behavior par asar daalne wale mukhtalif factors ki wajah se hosakti hai, jaise ke economic data releases, geopolitical developments, aur monetary policy expectations.

Investors aur traders ne USD/CHF pair ka behavior nazdeek se dekha, foreign exchange market ke mool dynamics ke andar ke insights ke talash mein. Jabke kuch market participants wait-and-see approach ikhtiyar kar sakte hain, to kuch doosre chhote trading range ke andar trading opportunities talash kar sakte hain. Asian trading session mein zahir volatility ki kami ke bawajood, USD/CHF pair ke pichle din ke closing levels ke qareeb hone ka matlab hai ke mukhtalif market trends ka jari rehna ya phir new catalysts ke nazar aane se pehle consolidation ka dor hosakta hai.

Swiss franc ki haal hi mein moderate izafa, jo ke Budhwar ko dekha gaya, mukhtalif factors par asar daal sakta hai, jaise ke economic data releases, geopolitical tensions, aur safe-haven currencies ke nisbat market sentiment mein tabdeeliyan. Jab traders aur investors foreign exchange market ke complexities ko samajhne ki koshish karte hain, to wo currency valuations aur trading strategies par asar daalne wale kisi bhi developments ke liye mutawajjeh rahte hain. Chahe wo economic indicators, geopolitical events, ya central bank announcements se mutasir ho, USD/CHF exchange rate ke fluctuations duniya bhar ke market participants ki tawajju ko jama rakte hain.

-

#1521 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Asian trading session mein, USD/CHF currency pair ne ek relatively subdued performance dikhai, aur ek tight trading range maintain ki. Pair pichle din ke trading session ke closing levels ke qareeb hi raha. Khaas tor par, Budhwar ko Swiss franc ne apne US ke muqabil mein thori izafa kiya. Asian market activities ke doran, USD/CHF exchange rate ne kisi significant movement ka ailaan nahi kiya, jo ke pair ke value mein consolidation ya stabilization ki period ki nishani hai. Ye subdued performance market sentiment aur trader behavior par asar daalne wale mukhtalif factors ki wajah se hosakti hai, jaise ke economic data releases, geopolitical developments, aur monetary policy expectations.

Investors aur traders ne USD/CHF pair ka behavior nazdeek se dekha, foreign exchange market ke mool dynamics ke andar ke insights ke talash mein. Jabke kuch market participants wait-and-see approach ikhtiyar kar sakte hain, to kuch doosre chhote trading range ke andar trading opportunities talash kar sakte hain. Asian trading session mein zahir volatility ki kami ke bawajood, USD/CHF pair ke pichle din ke closing levels ke qareeb hone ka matlab hai ke mukhtalif market trends ka jari rehna ya phir new catalysts ke nazar aane se pehle consolidation ka dor hosakta hai.

Swiss franc ki haal hi mein moderate izafa, jo ke Budhwar ko dekha gaya, mukhtalif factors par asar daal sakta hai, jaise ke economic data releases, geopolitical tensions, aur safe-haven currencies ke nisbat market sentiment mein tabdeeliyan. Jab traders aur investors foreign exchange market ke complexities ko samajhne ki koshish karte hain, to wo currency valuations aur trading strategies par asar daalne wale kisi bhi developments ke liye mutawajjeh rahte hain. Chahe wo economic indicators, geopolitical events, ya central bank announcements se mutasir ho, USD/CHF exchange rate ke fluctuations duniya bhar ke market participants ki tawajju ko jama rakte hain.

- 0.9049 USDCHF

- Mentions 0

-

سا0 like

-

#1522 Collapse

USD/CHF currency pair ke maamlay mein current scenario mein kuch taqatwar winds ka samna kar rahi hai. Ye pair taqreeban 0.9034 ke aas paas thori si girawat ke saath trade ho raha hai. Is samay, yeh movement primarily Swiss franc ki strength ke peeche sthit hai aur USD ki kamzori ko reflect kar rahi hai. Swiss franc, traditionally, safe haven currency ke tor par maana jaata hai, jiska matlab hai ke jab global financial markets mein uncertainty hota hai, log Swiss franc mein apna paisa safe rakhna pasand karte hain. Is wajah se, jab bhi global economic ya geopolitical tensions barhti hain, USD/CHF pair mein Swiss franc ki demand barh jaati hai, jo ki pair ko upar uthata hai. AIs samay, global economic conditions mein kuch instability aur uncertainty hai jo Swiss franc ko mehfooz maana ja raha hai. Geo-political tensions, trade disputes, ya koi bada saamraajyik samasya, ye sab factors market sentiment ko prabhavit kar sakte hain. Jaisa ke halaat ab hain, investors global economic outlook ke bare mein cautious hain aur isliye safe haven currencies jaise Swiss franc ki taraf rujhaan dikhate hain. Ek aur important factor jo is samay USD/CHF pair ko prabhavit kar raha hai, woh hai Federal Reserve ke monetary policy ke expectations. Agar Federal Reserve, ya FED, interest rates ko kam karta hai ya monetary easing ke kadam uthata hai, toh USD ki value kam ho jaati hai, aur isse USD/CHF pair ki kamzori hoti hai. Swiss National Bank (SNB) ka role bhi mahatvapurn hai. SNB ke monetary policies bhi USD/CHF pair ko directly influence karte hain. SNB apni monetary policy mein changes karta hai jab wo apne economy ko support karne ki zarurat mehsoos karta hai. Agar SNB apne monetary policy ko accommodative banaye rakhta hai, toh isse Swiss franc ki value mein izafa hota hai, jo USD/CHF pair ko niche le jaata hai. Overall, USD/CHF pair abhi ek samay hai jahan market sentiment, global economic conditions, aur central bank policies ke impacts ke tehet fluctuating hai. Traders ko yeh samajhna zaroori hai ke kaise in factors ko analyze kiya jaaye aur kis tarah ke trades ki positions li jaayein, taake wo is volatility ka faayda utha sakein.

- 0.9049 USDCHF

- Mentions 0

-

سا1 like

-

#1523 Collapse

USD/CHF currency pair ki taraf noticeable trend ka mosar hawa aata hai, jismein 0.910 ka maqsah ho sakta hai. Lekin iski mustanad tajziya, jismein technical aur fundamental pehluon ko shaamil kia jaye, iske mustaqbil ke rastay mein gehri samajh hasil karne ke liye zaroori hai. Technical analysis, chart patterns, indicators, aur tareekhi qeemat data shaamil karne se aik qeemti nazriya milta hai. Trends, support aur resistance levels, aur moving averages ke jaise momentum indicators dekhna, potential price movements ke bare mein isharon faraham kar sakta hai. Is ke ilawa, Relative Strength Index (RSI) ya Stochastic Oscillator jaise oscillators overbought ya oversold conditions ki nishandahi kar sakte hain, jisse potential reversal points ka pehchan kiya ja sakta hai.

Fundamental analysis technical insights ko perfect karti hai, macroeconomic factors, geopolitical events, aur central bank policies ko dekhte hue currency movements par asar dalta hai. USD/CHF pair ke case mein, US dollar exchange rate ki haal ki mazbooti fundamental driver ka kaam karta hai. Factors jaise ke economic indicators (masalan, GDP growth, inflation rates), monetary policy decisions, aur US aur Switzerland ke darmiyan geopolitical tensions ahem kirdar ada karte hain. Fundamental analysis ko madde nazar rakhte hue, prognosis ye dikhata hai ke ek upward trend ka jari rahna mumkin hai, jiske ek mansoobah price target 0.9050 hai. Ye forecast uss mazbooti se milta hai jo pichle hafton se dekhi gayi hai. Is ke ilawa, employment reports, inflation figures, aur central bank statements jaise economic data releases, mustaqbil ke price movements ke baray mein mazeed insights faraham kar sakte hain.

Ikhtitami tor par, aik perfect approach jo technical aur fundamental analysis ko shaamil karta hai, moaser trading decisions banane ke liye zaroori hai. Jabke technical analysis price patterns aur trends ke baray mein insights faraham karta hai, fundamental analysis neeche mohiyat ke maamooli drivers ki behtar samajh faraham karta hai. In methodologies ko jama kar ke, traders mustaqbil mein USD/CHF currency pair ke dynamic movements ka behtar andaza laga sakte hain aur un par mutabiq ho sakte hain.

-

#1524 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

USD/CHF pair channel resistance ki taraf mustaqil taraqqi kar raha hai, jaise ek scout apna rasta tay karta hai. Halankeh yeh ghair yaqeeni hai ke pair is level tak pohanchega ya nahi, lekin mojooda indicators ek tarz e kar ke hawale se is tarah ke izafa ko fa'vor karte hain. Aaj ke news, khaaskar Powell ki monetary policy aur inflation par tafsili guftagu, market sentiment ko mutasir karne ka imkan hai, jis se qeematien bulandi ki taraf ja sakti hain. Powell ke taqreeron ka maqsad tezi se market reaction ko provoke karna hai, khaaskar agli haftay ke CPI data ke intizar mein, jo qeematien mazeed buland kar sakta hai. Is pichle saaye mein, USD/CHF apne maqsad level 0.9240 ki taraf apne silsile mein taraqqi ka imkan hai. Aaj pair ke liye significant activity hai, jahan mojooda price movements deliberate market dynamics ko darust karte hain, jis mein buyers ke liye potential opportunities ka ishara hai. Ab tak, USD/CHF 0.9184 level ki taraf bulandi ki raah par hai, jab ke 0.9091 mark ko paar kar chuka hai. Umeed hai ke is trend ka jari rahay ga, jahan mazeed bulandi ke movement ka intizar hai jo qarar mein mojooda trajectory se na hatay. 0.9091 level ko paar karna yaqeeni hai, jo 0.9267 ki taraf mazeed izafa ke imkan ko rasta faraham kare ga. Neeche ke scenarios ka ghoor karne par, imkanat kam rehti hain, kisi bhi potential retreat ka imkan 0.8927 level tak mehdood hai. Mojooda manzar bullish momentum ko fa'vor karta hai, jahan pair mazeed fa'ida hasil karne ke liye tayyar hai jab market dynamics unfold hoti hain. Agar qeemat waqai is level se rebound karti hai, to yeh ek momentum shift ka ishara ho sakta hai buland qeematien ki taraf. Isi tarah, 0.9056 par ikhtraai ilaqa ki taraf rukh ki taraf manfi nateejay ho sakta hai. Bunyadi tor par, in mukhtalif levels ke darmiyan ka khail qeematien ki potential harekaton ke liye ahem insights faraham karta hai. Is tajziya ka istemal karke, traders USD/CHF pair ke complexities mein behtar tor par safar kar sakte hain aur emerging opportunities se faida uthane ke liye maloomati faislay kar sakte hain. Isliye, mojooda trading landscape mein, 0.8973 level ki ahmiyat ko zyada naqabil-e-faramosh nahi kiya ja sakta. Yeh ek ahem darja hai, jahan market forces ka toal ho sakta hai, aur aakhir mein USD/CHF pair ke aane wale sessions ke silsile ko darust karta hai.

- 0.9040 USDCHF

- Mentions 0

-

سا0 like

-

#1525 Collapse

USD/CHF pair channel resistance ki taraf independent taraqqi kar raha hai, jaise ek scout apna rasta tay karta hai. Halankeh yeh ghair yaqeeni hai ke pair is level tak pohanchega ya nahi, lekin mojooda indicators ek tarz e kar ke hawale se is tarah ke izafa ko fa'vor karte hain. Aaj ke news, special Powell ki monetary policy aur inflation par tafsili guftagu, market sentiment ko mutasir karne ka imkan hai, jis se qeematien bulandi ki taraf ja sakti hain. Powell ke taqreeron ka maqsad tezi se market reaction ko provoke karna hai, utsalar agli haftay ke CPI data ke intizar mein, jo qeematien mazeed buland kar sakta hai. Is pichle saaye mein, USD/CHF apne maqsad level 0.9240 ki taraf apne silsile mein taraqqi ka imkan hai. Aaj pair ke liye significant activity hai, jahan mojooda price movements deliberate market dynamics ko darust karte hain, jis mein buyers ke liye potential opportunities ka ishara hai. Ab tak, USD/CHF 0.9184 level ki taraf bulandi ki raah par hai, jab ke 0.9091 mark ko paar kar chuka hai. Umeed hai ke is trend ka jari rahay ga, jahan mazeed bulandi ke movement ka intizar hai jo qarar mein mojooda trajectory se na hatay. 0.9091 level ko paar karna yaqeeni hai, jo 0.9267 ki taraf mazeed izafa ke imkan ko rasta faraham kare ga. Neeche ke scenarios ka ghoor karne par, imkanat kam rehti hain, kisi bhi potential retreat ka imkan 0.8927 level tak mehdood hai. Mojooda manzar bullish momentum ko fa'vor karta hai, jahan pair mazeed fa'ida hasil karne ke liye tayyar hai jab market dynamics unfold hoti hain. Agar qeemat waqai is level se rebound karti hai, to yeh ek momentum shift ka ishara ho sakta hai buland qeematien ki taraf. Isi tarah, 0.9056 par ikhtraai ilaqa ki taraf rukh ki taraf manfi nateejay ho sakta hai. Bunyadi tor par, in mukhtalif levels ke darmiyan ka khail qeematien ki potential harekaton ke liye ahem insights faraham karta hai. Is tajziya ka istemal karke, traders USD/CHF pair ke complexities mein behtar tor par safar kar sakte hain aur emerging opportunities se faida uthane ke liye maloomati faislay kar sakte hain. Isliye, mojooda trading landscape mein, 0.8973 level ki ahmiyat ko zyada naqabil-e-faramosh nahi kiya ja sakta. Yeh ek ahem darja hai, jahan market forces ka toal ho sakta hai, aur aakhir mein USD/CHF pair ke aane wale sessions ke silsile ko darust karta hai.

-

#1526 Collapse

USD/CHF

Traders aur Investors price levels ko nazdeek se nigrani mein rakhte hain, unhe dhyan se tajziya karke apne trades ke liye behtareen dhalve aur kharij points ka pata lagate hain. Band hone wale price aur moving average price ke darmiyan taluqat market ki mojooda halat aur mumkinah mustaqbil ki price harkat mein ahem maloomat faraham karte hain. Jab keemat naye uroojon aur nichawaron ko pohanchti hai, zigzag pattern market ke trends ko mazboot karta hai aur traders ke liye mumkinah mauqay ko faida uthane ka ishara deta hai. Price ki is pechida taal-mel ka jhalkar financial markets ki dynamic tabiyat ko zahir karta hai aur tafseeli tajziya ke ahmiyat ko roshan karta hai jo maloomat se pehle tajziya karne mein madad karta hai.Title: Bullish Trends Ka Faida Uthana: Forex Trading Mein Ek Strategy Ka Manhaj

Forex trading ke daira mein, bullish trends ko pehchan karke iska faida uthana munasib nataij hasil karne ke liye zaroori hai. Takneeki tajziya par mabni ek manhaj ka istemal karke, forex market ke dynamic manzaron ko samajhna aur samajhna traders ki salahiyat ko wazeh kar sakta hai. Yeh article ek perfect strategy par ghaor karta hai jo optimal trading nateejay hasil karne ke liye bullish structures ka faida uthane ke liye tayar ki gayi hai.Is strategy ke aghaaz mein market mein ek bullish structure ke pehchan ka hai. Is mein price movements aur chart patterns ki tehlil ki jati hai taki upar ki raftar aur musbat jazbaat ko nukta cheeni kiya ja sake. Aam market ki jazbat ko andaaza lagakar, traders market ke mojooda bullish trend ke saath apni positions ko mazbooti se mila sakte hain, jisse unki kamiyabi ke imkanat barh jaati hain.

Is strategy mein trades shuru karne ke liye muqarrar entry point level hota hai. Yeh faisla takneeki tajziya par mabni hota hai, jo ek faida munasib shuru ka nishan deta hai bullish trend ki upar rawani mein. Is mukarar lamha par dakhil ho kar, traders apne aap ko potenti -

#1527 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

CHF/JPY

CHF/JPY ka Technical Analysis CHF/JPY jodi tees saal ke buland darjoo par pohanchne ke baad gir rahi hai, khaaskar 166.62 ke neeche se tezi se barhne ke baad. Momentum indicators mojooda bearish rally ko sahara dene ka aasar dikhate hain.

CHF/JPY aaj nichle hisaab se trading shuru ki, jodi ne apne tees saal ke buland darjoo par 171.61 par pehli baar apna teesra seedha lal mombatti banaya. Jodi ne nichle darjoo se tezi se punhcha, lekin is hafte kai ahem tajziye hone ki wajah se oopri dabav kam ho sakta hai. Ek doosri baat, bullish unchaaiyaan aur neecheaiyan jaari hain, lekin aaj banayi gayi doji mombatti ki keemat aur bhi shakkar badha sakti hai. Halankeh, mojooda samay mein momentum indicators ko mojooda correction wave ko sahara dene ka aasar dikh raha hai. Dilchasp baat yeh hai ke stochastic indicator ne moving averages ke neeche gir kar overbought zone ko tor diya hai, jo ke aur zyada bearish price movement ko dikhata hai. Yahaan neeche chart hai:

Agar kharidari karne wale control ko qaim rakh sakte hain, to unka yeh koshish ho sakti hai ke jodi ko 170.95 ke darjoo par qaim rakhen. Phir woh 171.55 ke ilaake se bahar nikalne ki koshish kar sakte hain. Agar unka yeh kaamyaab hota hai, to woh 2024 mein naye buland darjoo ki taraf ja sakte hain aur shayad 173.7 tak pohanch sakte hain. Dusri taraf, bechne wale mojooda correction wave ko barhaane ka mazboot iraada dikhate hain aur shayad pehle hi price ko 165.30 ke neeche kheenchna chahenge. Khaaskar, woh ise 163.94 ke ilaake ki taraf kheench sakte hain, jo uptrend ka 23.6% Fibonacci retracement aur 50-day simple moving average se juda hai. Phir, ek mazboot support line ek oopri trend line banayi ja sakti hai. Mukhtasir tor par, CHF/JPY bechne wale hilte hue negative momentum ka faida utha rahe hain taake wo haal ki tezi se barhne ke nuksan ko khatam kar sakein. Yahaan neeche chart hai:

-

#1528 Collapse

Ab mojooda waqt mein, USD/CHF 0.9100 ke darjay ki taraf barh raha hai, 0.9000 ke mark ko guzar chuka hai. Umeed hai ke yeh trend jaari rahega, aur mazeed upar ki taraf move ka intezar hai jo mojooda raftar ke sath mawafiq hai. 0.9091 ke darjaat ko paar karna tay hai, jo shayad 0.9267 ki taraf mazeed faida dene ka rasta banaye. Neeche ke manazir ko mad e nazar rakhte hue, mumkinat mehdood rehte hain, kisi bhi mumkin ghutne ke liye 0.8927 ke darje tak mehdood. Mojooda nazriya bullish momentum ki taraf rujhan deta hai, jodi aur munafa ke liye tayyar hai jab takarir ke mojuda dynamics aam hoti hai. Agar yeh darja asal mein is darje se phir se uchhalta hai, to yeh bulandi ke qeemat par mansoob hota hai. Isi tarah, manfi natija buland qeemat par 0.9056 tak ke ilaqa ki taraf le ja sakta hai.

Bunyadi tor par, in mukhtalif darjaat ke darmiyan ke khailafat neyaye hai jaise ke sambhav bazar ke naqsha ko mutayyan karte hain. Is tahlil ka faida uthakar, traders USD/CHF jodi ke complexities ko zyada behtar taur par samajh sakte hain aur aarzi moqay par faida uthane ke liye munafa mein istiqdam kar sakte hain. Is liye, mojooda trading manzar mein, 0.8973 ke darja ka ahmiyat nazar andaz nahi kiya ja sakta. Yeh ek ahem moqam hai jahan bazar ke quwwat milte hain, jo aane wale sessions mein USD/CHF jodi ka rukh rehnuma banayenge.

Humne EMA50 se bounce dekha, jo 0.9020 par support ke tor par kaam kiya, aur aaj, Switzerland se manfi deta ke baad, USDCHF mein izafa dekha ja raha hai jo kal ke uchayi aur 0.9105 ke resistance darje ko dobara test karne ki taraf raasta talash kar raha hai. Main rozana ki time frame mein paanchwe wave ka mukammal honay ka intezar karta raha hoon jo pehle wave ke 161.80% par hota hai, jo beech-0.93 darje tak izafa ka bai's ban sakta hai. Hum dekhenge ke yeh kaise hota hai. Kam az kam, ascending channel ke upper boundary ki taraf, kareeb 0.92, jodi izafa dikha sakti hai.

- 0.9040 USDCHF

- Mentions 0

-

سا0 like

-

#1529 Collapse

USD/CHF

USD/CHF pair H1 time frame mein steady taraqqi kar raha hai channel resistance ki taraf, jaise ek scout apna raasta tay kar raha ho. Halankeh yeh ghair yaqeeni hai ke pair iss level tak pohanchega ya nahi, magar mojooda indicators is tarz ka development favou karte hain. Aaj ke news, khaaskar Powell ki monetary policy aur inflation par tafseeli guftagu, market sentiment ko asar daal sakti hai, jo ke prices ko buland kar sakti hai. Powell ke remarks ka maqsad uss market reaction ko tezi se utthaana hai, khaaskar agli haftay CPI data ke intezar mein, jo ke prices ko aur bhi buland kar sakta hai. Is context mein, USD/CHF ka target level 0.9240 ki taraf taraqqi karne ka potential hai. Aaj ke liye pair ke liye significant activity hai, jahan mojooda price movements dhan-dhanayi market dynamics ko reflect kar rahe hain, jo ke buyers ke liye potential opportunities ki ishaarat hain. Ab tak, USD/CHF 0.9184 level ki taraf upward trajectory par hai, 0.9091 mark ko paar kar chuka hai. Umeed hai ke yeh trend jaari rahega, aur aur taraqqi ki umeed hai jo mojooda trajectory ke saath mutabiq hai. 0.9091 level ko paar karna yaqeenan hai, jo ke mazeed faidaan ki taraf raasta ban sakta hai 0.9267 ki taraf. Downside scenarios ko ghor se dekhte hue, mumkinat mehdood hain, jahan kisi bhi potential retreat ko 0.8927 level tak mehdood samjha jaa sakta hai. Mojooda nazar bullish momentum ko favou karti hai, jahan pair tayyar hai mazeed munafa hasil karne ke liye jab tak market dynamics unfold hoti hain. Agar asal mein price iss level se rebound hoti hai, toh yeh ek momentum shift ki ishaarat ho sakti hai jismein higher valuations ki taraf taraqqi ho. Barabar, ek negative outcome 0.9056 accumulation area ki taraf le ja sakta hai. Fundamentally, in mukhtalif levels ke darmiyan interplay, potential market movements ke baare mein significant insights faraham karti hai. Is analysis ko leverage karke, traders USD/CHF pair ke complexities ko zyada effectively navigate kar sakte hain aur emerging opportunities par faida uthane ke liye informed decisions le sakte hain. Isliye, mojooda trading landscape mein 0.8973 level ki ahmiyat ko nazrandaaz nahi kiya ja sakta. Yeh ek crucial juncture hai jahan market forces converge ho sakti hain, jo aakhir mein USD/CHF pair ke trajectory ko agle sessions mein guide kar sakti hain.

- 0.9040 USDCHF

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#1530 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

USD/CHF Daily Timeframe

Mujhe yeh bhi nahi pata ke yahan kya trade kiya ja sakta hai) Main mazid uttar ki shuruwat ki khatam hone ka manzar dekh raha hoon. Aur meri taqatwar raay se yeh samajhta hoon ke aap jo hasil karne ki koshish kar rahe hain, woh hasil karne ke laayak nahi hai. Yahan, nazar mein, sirf hum baith sakte hain aur intezaar kar sakte hain ke hum pehla hisaab lagaye hue resistance tak pohunchen - hamare case mein, yeh thirtieth of October ke pichle saal ke maximum - 0.9110. Aur phir aap wahan se kuch mod pakad sakte hain. Asal mein, ab USDCHF ke saath mushkil hai kyun ke agar aap is "eagle" ka poori raah track karte hain, to aap dekh sakte hain ke seedha nichle se woh kafi uljha hua hai, bilkul ek khargosh ki tarah - aap nahi samajh sakte ke kaun se roolbacks, kis tarah se hum uttar ki taraf chadh rahe hain. Pichle haftay mein lag raha tha ke woh 0.9030 ke level par ruk gaye hain, lag raha tha ke yeh pehle se modhava hai. Magar asal zindagi mein, main dekh raha hoon ke hum ab bhi us se ladh rahe hain, upar chadhne ki koshish kar rahe hain. Jo humare paas indicators ke mutabiq hai: - MA100 farsh ke barabar ke space ke zariye kaam kar raha hai - aik sign haftai mizaj flatness ka.- MA18 ab thaka hua hai aur uttar ki taraf chaal raha hai bohot trendy angle ke saath chaalis degree ka, yeh samajh mein aata hai ke bulls din ke doran neend mein nahi hain. Ichimoku cloud bullish hai; tajwez ke mutabiq, iska ubharta rehne ke liye kafi bhar diya gaya hai.

Click image for larger version

USD/CHF H1 Timeframe

Acha din. Jaise ke main dekh sakta hoon ke haal hi mein waqt mein USD/CHF pair ne apne chart par kuch bohot mushabah koora bana liya hai, jo haqeeqat mein is trading instrument ke qeemat ko neeche bhej sakta hai aur yeh ho sakta hai agar abhi ke model ko toorna aur qeemat ko 0.9056 ke jama hoti qeemati mein qaim nahi hone dena. Agar yeh yahan na ho, to ek scenario kaam karne lag sakta hai, jo ke ek dakshini rang ka ho sakta hai aur jis ke mutabiq, mere tasveer mein dikhaye gaye qadam se seedha yahan se, is pair ki qeemat neeche ja sakti hai, kahin 0.8931 ke jama hui raqam ke level ke as paas. Agar abhi qeemat upar jaati hai aur baad mein USD/CHF 0.9056 ke level ko qeemat ko upar jaane ki ijaazat deta hai, to is case mein, agar aisa dakshini mumkin hai, to puri raddi ho sakti hai.

- 0.9040 USDCHF

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:40 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим