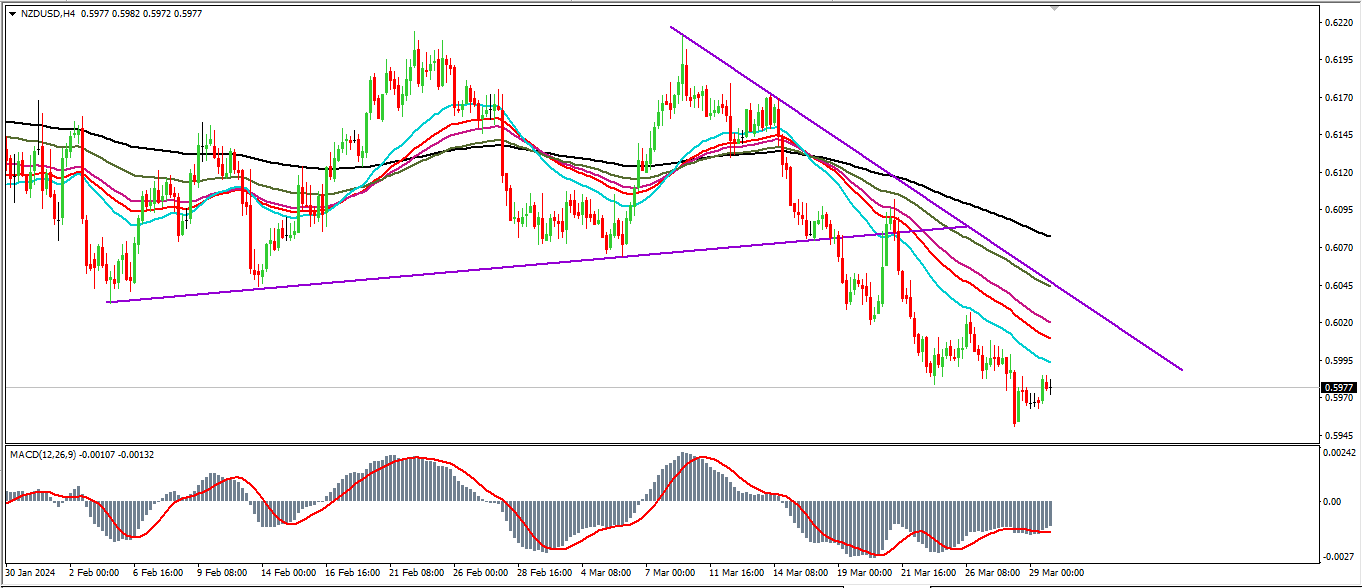

nzd/usd weekly plan.

H4 time frame par, ek bearish movement ke baad, jo oversold level tak pahunch gayi thi, RSI ke level 30 par, ek maqbool faraqt ki aai hai. Iske alawa, giravat ne RBS area range mein bearish inkaar ka samna kiya hai jo 0.5953 par hai. Ye dikhata hai ki ek qeemat ke surge ka azeem moqa hai jo ek potential correction phase ko shuru kar sakta hai, khaaskar ma50 (red) moving area tak pahunchne ke liye jo 0.6010 ke aaspaas hai. Resistance zone ke andar 0.6027 par upper boundary ek ahem area ka taur par kaam kar sakti hai ek potential further bullish correction phase ke liye, jo ke supply area ke aas paas 0.6085 ke qareeb ke liye lakshya rakhta hai. Aane wale haftay ke market ke liye short-term khareedariyon par dhyan dena hai, seemit parinaam se uplabdh hai jo 0.5960-0.5970 ke dauran dakhilai ki yojana bana raha hai. Is keemat badhne ke liye target TP 1 0.6010 ke star aur TP 2 0.6085 ke karib jane ka hai. Ye khareedari ka tajarba neeche 0.5950 ke is haftay ke sab se kam keemat area ke neeche nuksan ka khatra muqarrar kar sakta hai.Ek bullish phase mein trend ki mukhsoos hone ki sambhavna ke doraan dakhilai ke upper boundary ka movement ma200 (blue) ke moving range ke andar hai jo 0.6103 par hai. Jaise hi bikri kaal ke jari rakhne ki raay di jati hai, bechne ke mawaqe ko khojne mein dilchaspi rahti hai, supply area range ke andar aur ma50 (red) movement ke had tak 0.6010-0.6020 ke andar. Niche ke target ko naye kam keemat level ka sthapit karne ka mauka lagta hai, jo 0.5950 ke star ko peecha chhodta hai aur uske neeche 0.5900 ke dauraan Zero area tak pahunchne ki koshish karta hai.daily ky time frame ke reference mein, ye bhi dekha ja sakta hai ki ek neeche ki or ka movement hai jo RSI ke star 30 par pahunch gaya hai. Ye ek mumkin bullish ulta pher sambhavna ko kholta hai jise ek correction phase ko carry out karne ki koshish ya trend ke disha mein parivartan karne ki koshish ki ja sakti hai. Ye sthiti chhoti avadhi mein kharidari ki gati ko vichar karne ke liye istemal kiya ja sakta hai, khaaskar bullish gatiyon ke liye jo ma200 (blue) ke movement seema ko phir se parikshan karne ke liye 0.6060 ke aaspaas hoti hai.

Misaal ke taur par, agar keemat phir se ma200 ke movement seema mein bullish inkaar shart mein hoti hai ek adhik satik bearish keemat ke kaam se, toh bechne ke len den ka dhyan fir se liya ja sakta hai.Giravat ki koshish ka aage ka avsar ek mool giravat rally gati ko pahunchane ki khuli sambhavna hai jo agle maang kshetr tak pahunchane ki koshish karti hai lagbhag 0.5880 ke aaspaas.

H4 time frame par, ek bearish movement ke baad, jo oversold level tak pahunch gayi thi, RSI ke level 30 par, ek maqbool faraqt ki aai hai. Iske alawa, giravat ne RBS area range mein bearish inkaar ka samna kiya hai jo 0.5953 par hai. Ye dikhata hai ki ek qeemat ke surge ka azeem moqa hai jo ek potential correction phase ko shuru kar sakta hai, khaaskar ma50 (red) moving area tak pahunchne ke liye jo 0.6010 ke aaspaas hai. Resistance zone ke andar 0.6027 par upper boundary ek ahem area ka taur par kaam kar sakti hai ek potential further bullish correction phase ke liye, jo ke supply area ke aas paas 0.6085 ke qareeb ke liye lakshya rakhta hai. Aane wale haftay ke market ke liye short-term khareedariyon par dhyan dena hai, seemit parinaam se uplabdh hai jo 0.5960-0.5970 ke dauran dakhilai ki yojana bana raha hai. Is keemat badhne ke liye target TP 1 0.6010 ke star aur TP 2 0.6085 ke karib jane ka hai. Ye khareedari ka tajarba neeche 0.5950 ke is haftay ke sab se kam keemat area ke neeche nuksan ka khatra muqarrar kar sakta hai.Ek bullish phase mein trend ki mukhsoos hone ki sambhavna ke doraan dakhilai ke upper boundary ka movement ma200 (blue) ke moving range ke andar hai jo 0.6103 par hai. Jaise hi bikri kaal ke jari rakhne ki raay di jati hai, bechne ke mawaqe ko khojne mein dilchaspi rahti hai, supply area range ke andar aur ma50 (red) movement ke had tak 0.6010-0.6020 ke andar. Niche ke target ko naye kam keemat level ka sthapit karne ka mauka lagta hai, jo 0.5950 ke star ko peecha chhodta hai aur uske neeche 0.5900 ke dauraan Zero area tak pahunchne ki koshish karta hai.daily ky time frame ke reference mein, ye bhi dekha ja sakta hai ki ek neeche ki or ka movement hai jo RSI ke star 30 par pahunch gaya hai. Ye ek mumkin bullish ulta pher sambhavna ko kholta hai jise ek correction phase ko carry out karne ki koshish ya trend ke disha mein parivartan karne ki koshish ki ja sakti hai. Ye sthiti chhoti avadhi mein kharidari ki gati ko vichar karne ke liye istemal kiya ja sakta hai, khaaskar bullish gatiyon ke liye jo ma200 (blue) ke movement seema ko phir se parikshan karne ke liye 0.6060 ke aaspaas hoti hai.

Misaal ke taur par, agar keemat phir se ma200 ke movement seema mein bullish inkaar shart mein hoti hai ek adhik satik bearish keemat ke kaam se, toh bechne ke len den ka dhyan fir se liya ja sakta hai.Giravat ki koshish ka aage ka avsar ek mool giravat rally gati ko pahunchane ki khuli sambhavna hai jo agle maang kshetr tak pahunchane ki koshish karti hai lagbhag 0.5880 ke aaspaas.

تبصرہ

Расширенный режим Обычный режим