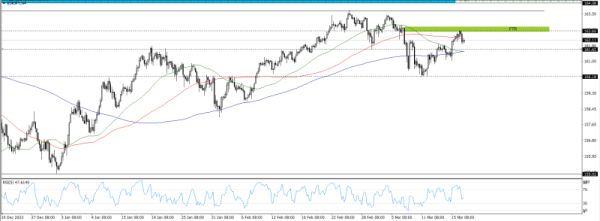

H4 waqt fram chart istemal kar ke market ka tajziya karne par saabit hota hai ke EURJPY jodi ke daam pehle bahut zyada bearish tehreerat ki taraf muqarrar the. Phir 162.60 ke daam pe H4 FTR area banaya gaya jo ke mazeed bech ki dafa mein wapsi ke liye aham tha. Jaise hi daam rukhsat hua aur tajweez tak correction ka samna kiya, yeh mauqa hamen sale ke mawaqe par daleel karne ke liye hai, jo ke 96.27 ke daam ke range par nishana rakhta hai. Do mustakil bearish H4 mombattiyan ki dikhayi dena bech mein izafa hone ki alamat hai.

Iske ilawa, Relative Strength Index (RSI) dour 5 ke mojudgi, jahan daam ka moqa phir se 30 ke level ke neeche chal raha hai, ye ishara hai ke market ab bhi bearish trend mein chal raha hai. Mazeed, 100 Simple Moving Average (SMA) indicator, jo haftay ke murnay tak neeche ki taraf tehreer kar raha tha, iske peeche is maheene ke shuru ki daam giravat ka asar tha, ishara karte hain. Sarasar, H4 waqt fram par shumaraat ke zyadatar ishaarat bearish trend ke saath mel khate hain, jo EURJPY jodi mein sale ke mawaqe ke liye aik mufeed mahaul ka nashan dete hain.

Jabke kharidarein ab bhi asar rakhte hain, Relative Strength Index (RSI) mein neeche ki taraf ki harkat dikha raha hai, jo ke uparward momentum mein aik mukhtalif wakt ke liye rokawat ki nishani hai. Is ke ilawa, Moving Average Convergence Divergence (MACD) mein barh rahi surkhiyan barh rahi hain, jo ke chand short-term bechne ki dabao ki nishani hai. Agar yeh manzar samne aaye, to main umeed karta hoon ke daam ya to 161.80 ke support level ya phir 160.40 ke support level ki taraf wapas chalega. In support levels ke ird gird, main bullish signals ka mutalia karunga, ummed karte hue ke daamon mein phir se uchal aayegi. To iss tarah, aaj ke liye koi ahem muqami tabdeeliyan nahi hain. Mera tawajju ab 164.00 ke nazdeeki resistance levels par hai, aur agar daam inko test karne ke liye qareeb aata hai to main bazar ke halat ka tajziya karoonga.

Iske ilawa, Relative Strength Index (RSI) dour 5 ke mojudgi, jahan daam ka moqa phir se 30 ke level ke neeche chal raha hai, ye ishara hai ke market ab bhi bearish trend mein chal raha hai. Mazeed, 100 Simple Moving Average (SMA) indicator, jo haftay ke murnay tak neeche ki taraf tehreer kar raha tha, iske peeche is maheene ke shuru ki daam giravat ka asar tha, ishara karte hain. Sarasar, H4 waqt fram par shumaraat ke zyadatar ishaarat bearish trend ke saath mel khate hain, jo EURJPY jodi mein sale ke mawaqe ke liye aik mufeed mahaul ka nashan dete hain.

Jabke kharidarein ab bhi asar rakhte hain, Relative Strength Index (RSI) mein neeche ki taraf ki harkat dikha raha hai, jo ke uparward momentum mein aik mukhtalif wakt ke liye rokawat ki nishani hai. Is ke ilawa, Moving Average Convergence Divergence (MACD) mein barh rahi surkhiyan barh rahi hain, jo ke chand short-term bechne ki dabao ki nishani hai. Agar yeh manzar samne aaye, to main umeed karta hoon ke daam ya to 161.80 ke support level ya phir 160.40 ke support level ki taraf wapas chalega. In support levels ke ird gird, main bullish signals ka mutalia karunga, ummed karte hue ke daamon mein phir se uchal aayegi. To iss tarah, aaj ke liye koi ahem muqami tabdeeliyan nahi hain. Mera tawajju ab 164.00 ke nazdeeki resistance levels par hai, aur agar daam inko test karne ke liye qareeb aata hai to main bazar ke halat ka tajziya karoonga.

تبصرہ

Расширенный режим Обычный режим