Euro Japanese Yen ke khilaf acha nazar aa raha hai, Bank of Japan ke halqi rate faislay ke baad 163.00 ke qareeb rah raha hai. Bank of Japan ne negative interest rates ka waqt band karne ka faisla liya hai, jo 2016 mein shuru hua tha. Market ne isse mutaasir hona tha. Ye faisla money exchange market ke liye ahem hai, khaaskar Euro ke liye Yen ke muqablay mein.

Bank of Japan ka faisla negative interest rates ko band karne ka ye dikhata hai ke unka khayal hai ke maeeshat behtar ho rahi hai aur woh yakeen rakhte hain ke ye mazeed behter hoga. Unka maqsad maeeshat ko zyada kar ke prices ko unki marzi ke mutabiq buland karna hai. Negative interest rates ko band karna ye kehna hai ke woh paise ke mamlaat ko kaise handle karte hain, isme tabdili kar rahe hain, aur ye agle kuch hafton mein money exchange ko kaise asar dal sakta hai.

Sath hi, European Central Bank bhi highlight mein hai. ECB ke leader, de Cos, ne kaha ke agar prices eurozone mein zyada nahi uth rahe hain toh woh June mein interest rates ko kam kar sakte hain. Ye dikhata hai ke ECB maeeshat ko barhawa dena chahta hai aur eurozone mein prices ko mustahkam rakhna chahta hai. Paise mein invest karne wale log ECB ke agle kadam ko dekh rahe hain kyunki unke faislay paise ke keemat ko kaise badal sakte hain.

Agli baat, log tez nazar lagayeinge jab German aur eurozone ZEW Survey ko Tuesday ko release kiya jayega. Ye survey humein ye batata hai ke log maeeshat ke baray mein kaisa mehsoos karte hain aur wo eurozone aur Germany mein kya umeed rakhte hain. Agar logon ka maeeshat ke baray mein khayal acha hai toh ye Euro ko Yen aur doosri currencies ke muqablay mein zyada mazboot kar sakta hai.

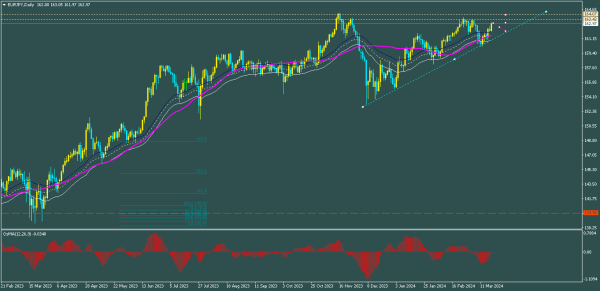

Euro Japanese Yen ke muqablay mein mazboot performance dikha raha hai, khaaskar Bank of Japan ke conference mein, jahan ye pair kafi taqat ke sath surge kiya. Lagta hai ke is pair ka upper movement ka target 163.43 hai. Candlestick pattern dekhte hue, last two candles ne ek numaya upward trend dikhaya hai, jo traders ko market mein dakhil hone ke liye majboor karta hai, apne nigaah 163.43 ke target par rakhte hue.

Magar, ye zaroori hai ke yaad rakha jaye ke 163.44 se lekar 164.00 tak ka range liquidity zone ke tor par consider kiya jata hai. Is zone mein trading se bachna behtar hai. Balki, price movement ko qareeb se dekha jaye. Is zone ke bahar koi movement pair ke trend ke bare mein mazeed wazahat dega.

Mukhtasir mein, Euro Japanese Yen ke muqablay mein mazboot performance dikhata hai, 163.43 ka potential target hai. Traders ko liquidity zone ke andar ehtiyaat bartani chahiye lekin pair ke movement ko qareeb se dekhte rahein taake future trends ke isharaat mil sakein.

Bank of Japan ka faisla negative interest rates ko band karne ka ye dikhata hai ke unka khayal hai ke maeeshat behtar ho rahi hai aur woh yakeen rakhte hain ke ye mazeed behter hoga. Unka maqsad maeeshat ko zyada kar ke prices ko unki marzi ke mutabiq buland karna hai. Negative interest rates ko band karna ye kehna hai ke woh paise ke mamlaat ko kaise handle karte hain, isme tabdili kar rahe hain, aur ye agle kuch hafton mein money exchange ko kaise asar dal sakta hai.

Sath hi, European Central Bank bhi highlight mein hai. ECB ke leader, de Cos, ne kaha ke agar prices eurozone mein zyada nahi uth rahe hain toh woh June mein interest rates ko kam kar sakte hain. Ye dikhata hai ke ECB maeeshat ko barhawa dena chahta hai aur eurozone mein prices ko mustahkam rakhna chahta hai. Paise mein invest karne wale log ECB ke agle kadam ko dekh rahe hain kyunki unke faislay paise ke keemat ko kaise badal sakte hain.

Agli baat, log tez nazar lagayeinge jab German aur eurozone ZEW Survey ko Tuesday ko release kiya jayega. Ye survey humein ye batata hai ke log maeeshat ke baray mein kaisa mehsoos karte hain aur wo eurozone aur Germany mein kya umeed rakhte hain. Agar logon ka maeeshat ke baray mein khayal acha hai toh ye Euro ko Yen aur doosri currencies ke muqablay mein zyada mazboot kar sakta hai.

Euro Japanese Yen ke muqablay mein mazboot performance dikha raha hai, khaaskar Bank of Japan ke conference mein, jahan ye pair kafi taqat ke sath surge kiya. Lagta hai ke is pair ka upper movement ka target 163.43 hai. Candlestick pattern dekhte hue, last two candles ne ek numaya upward trend dikhaya hai, jo traders ko market mein dakhil hone ke liye majboor karta hai, apne nigaah 163.43 ke target par rakhte hue.

Magar, ye zaroori hai ke yaad rakha jaye ke 163.44 se lekar 164.00 tak ka range liquidity zone ke tor par consider kiya jata hai. Is zone mein trading se bachna behtar hai. Balki, price movement ko qareeb se dekha jaye. Is zone ke bahar koi movement pair ke trend ke bare mein mazeed wazahat dega.

Mukhtasir mein, Euro Japanese Yen ke muqablay mein mazboot performance dikhata hai, 163.43 ka potential target hai. Traders ko liquidity zone ke andar ehtiyaat bartani chahiye lekin pair ke movement ko qareeb se dekhte rahein taake future trends ke isharaat mil sakein.

تبصرہ

Расширенный режим Обычный режим