EURJPY Ka Takhmina

Din mein muddat frame chart ki tashreeh:

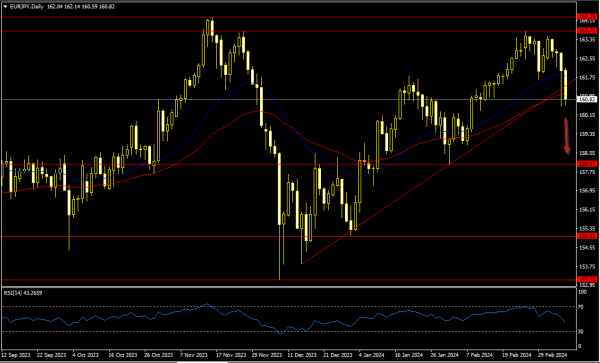

Kuch din pehle, EURJPY ne rozana muddat frame chart par 163.70 ke swing resistance level ko chhua, aur EURJPY uss waqt se bearish tarz mein chalna shuru kar diya. Lekin, maine umeed ki thi ke EUR/JPY pehle upper resistance level tak pohanchay gi phir giray gi; girne ki keemat jis qeemat par shuru hui wo upper resistance level se bohot door nahi thi. Iss haftay ke jumeraat ko EURJPY ne dono simit gatividhiyon ka muzahira kiya; pehle, qeemat tezi se gir gayi, lekin New York trading session ke doran wo trend line ko chu gayi, jo ke qeemat mein izafa aur pin bar candle ke banne ka sabab bana. Friday ko phir se bearen khatarnak quwat dikhai gayi, jaise ke EURJPY ne trend line ko todi aur 26 aur 50 EMA lines ko bhi bearish raaste mein cross kar diya. Iss haftay ke amalat ki wajah se, EURJPY ka trend badal gaya hai, aur natije mein, qeemat girne ke liye tayar hai ek lambi muddat ke liye. Bearon ki madad ke liye, maine jin kuch support levels ko diagram mein shaamil kiya hai, unko wazeh kiya gaya hai.

EURJPY ka tasveeri manzar:

Chart ki tashreeh ke doran, EURJPY ne aik mukhtalif safar tay kiya hai. Qeemat ne upper resistance level ko chhua, lekin phir girne ki taraf rukh kar liya. Ye giravat pehli nazar mein tawajju ki muntazir thi, lekin jaise hi EURJPY nay trend line ko tod diya, is ne bullish rukh apna liya. Ye achanak tabdeel hawale se baazaron ko heran kar diya aur tajziyat ka ba'is ban gaya. Aane wale haftay mein, mukhtalif amoomi tawajju ko madd-e nazar rakhtay hue, umeed hai ke currency pair mazeed girawat ka samna na karay aur giravat ko giraftar karay.

Taraqqi ka sahi soorat-e-haal:

EURJPY ki price ne 164.00 se ooper barqarar hone ki jo muhimat dikhayi hai, wo ek mumkin tarin rah hai uski agle tezi ke liye. Is mustaqil barqarari ne EURJPY ki qeemat ko 163.80 markar ke aas paas jari rakha hai. Is mustaqil barqarari se ek taeed hai jo aane wale dor ke tezi ke liye achha nazariya hai, jo traders ko mazeed ooper ke rukh ke liye munfarid soorat-e-haal deta hai.

Technical indicators ki roshni mein:

Chart ki tashreeh se wazeh hota hai ke EURJPY ki qeemat ne 163.50 ki muhimat ke daire mein remarkable taqat dikhayi hai. Bazar ke hararat mein is taaqat se madd-e nazar hona, currency pair ki bullish jazbaat ko samajhne aur traders aur investors mein itminan aur umeed peda karta hai. 163.20 ke daire mein barqarari ka aamadna tajziya bazar ke hissey ko pukhta karne ke sath sath barqarari ke mustaqbil ke liye manzil ko mukammal karta hai. 163.00 ki satah ke ooper barqarari ke mustaqil barqarar rehne ka natija bazar ki itmenan mein kami ki nishandahi hai, jise ke saath saath traders ke darmiyan umeed mand soorat-e-haal ka mushtarik hota hai.

Yaksaani ke ilaaj:

EURJPY ki barqarari ke tehzeebi tajziyat, Eurozone se mustaqil maqbula maqool aur Japan ki Bank ki asaaniyat bartaraf raqamadariyon ke saath mila kar, currency pair ke ooper rukh ke liye acha guman hai.

Din mein muddat frame chart ki tashreeh:

Kuch din pehle, EURJPY ne rozana muddat frame chart par 163.70 ke swing resistance level ko chhua, aur EURJPY uss waqt se bearish tarz mein chalna shuru kar diya. Lekin, maine umeed ki thi ke EUR/JPY pehle upper resistance level tak pohanchay gi phir giray gi; girne ki keemat jis qeemat par shuru hui wo upper resistance level se bohot door nahi thi. Iss haftay ke jumeraat ko EURJPY ne dono simit gatividhiyon ka muzahira kiya; pehle, qeemat tezi se gir gayi, lekin New York trading session ke doran wo trend line ko chu gayi, jo ke qeemat mein izafa aur pin bar candle ke banne ka sabab bana. Friday ko phir se bearen khatarnak quwat dikhai gayi, jaise ke EURJPY ne trend line ko todi aur 26 aur 50 EMA lines ko bhi bearish raaste mein cross kar diya. Iss haftay ke amalat ki wajah se, EURJPY ka trend badal gaya hai, aur natije mein, qeemat girne ke liye tayar hai ek lambi muddat ke liye. Bearon ki madad ke liye, maine jin kuch support levels ko diagram mein shaamil kiya hai, unko wazeh kiya gaya hai.

EURJPY ka tasveeri manzar:

Chart ki tashreeh ke doran, EURJPY ne aik mukhtalif safar tay kiya hai. Qeemat ne upper resistance level ko chhua, lekin phir girne ki taraf rukh kar liya. Ye giravat pehli nazar mein tawajju ki muntazir thi, lekin jaise hi EURJPY nay trend line ko tod diya, is ne bullish rukh apna liya. Ye achanak tabdeel hawale se baazaron ko heran kar diya aur tajziyat ka ba'is ban gaya. Aane wale haftay mein, mukhtalif amoomi tawajju ko madd-e nazar rakhtay hue, umeed hai ke currency pair mazeed girawat ka samna na karay aur giravat ko giraftar karay.

Taraqqi ka sahi soorat-e-haal:

EURJPY ki price ne 164.00 se ooper barqarar hone ki jo muhimat dikhayi hai, wo ek mumkin tarin rah hai uski agle tezi ke liye. Is mustaqil barqarari ne EURJPY ki qeemat ko 163.80 markar ke aas paas jari rakha hai. Is mustaqil barqarari se ek taeed hai jo aane wale dor ke tezi ke liye achha nazariya hai, jo traders ko mazeed ooper ke rukh ke liye munfarid soorat-e-haal deta hai.

Technical indicators ki roshni mein:

Chart ki tashreeh se wazeh hota hai ke EURJPY ki qeemat ne 163.50 ki muhimat ke daire mein remarkable taqat dikhayi hai. Bazar ke hararat mein is taaqat se madd-e nazar hona, currency pair ki bullish jazbaat ko samajhne aur traders aur investors mein itminan aur umeed peda karta hai. 163.20 ke daire mein barqarari ka aamadna tajziya bazar ke hissey ko pukhta karne ke sath sath barqarari ke mustaqbil ke liye manzil ko mukammal karta hai. 163.00 ki satah ke ooper barqarari ke mustaqil barqarar rehne ka natija bazar ki itmenan mein kami ki nishandahi hai, jise ke saath saath traders ke darmiyan umeed mand soorat-e-haal ka mushtarik hota hai.

Yaksaani ke ilaaj:

EURJPY ki barqarari ke tehzeebi tajziyat, Eurozone se mustaqil maqbula maqool aur Japan ki Bank ki asaaniyat bartaraf raqamadariyon ke saath mila kar, currency pair ke ooper rukh ke liye acha guman hai.

تبصرہ

Расширенный режим Обычный режим