USD/CHF

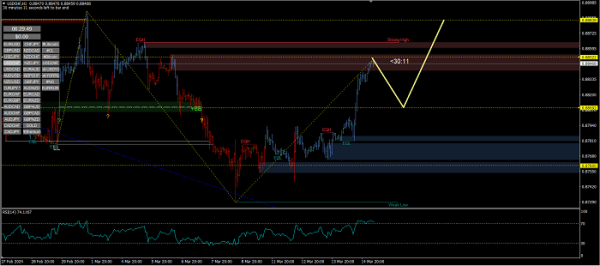

Assalam Alaikum! Kal, US dollar/Swiss franc ki jodi ne mazbut oopri raftar hasil ki. Aaj bhi market me tezi ka mahaul hai. Bahar hal, mujhe lagta hai keh asset me dobara nuqsanat shuru ho jayega. Mai tawaqqo karta hun keh dollar/franc joda 0.88522 ki muzahmati satah se 0.88092 ki support satah tak fisal jayega. Iske bad jodi ke ooper ki taraf ulatne ka imkan hai, ek nayi muqami bulandi par pahunchne aur 0.88838 ki muzahmati satah ki taraf badhne ka imkan hai.

Assalam Alaikum! Kal, US dollar/Swiss franc ki jodi ne mazbut oopri raftar hasil ki. Aaj bhi market me tezi ka mahaul hai. Bahar hal, mujhe lagta hai keh asset me dobara nuqsanat shuru ho jayega. Mai tawaqqo karta hun keh dollar/franc joda 0.88522 ki muzahmati satah se 0.88092 ki support satah tak fisal jayega. Iske bad jodi ke ooper ki taraf ulatne ka imkan hai, ek nayi muqami bulandi par pahunchne aur 0.88838 ki muzahmati satah ki taraf badhne ka imkan hai.

تبصرہ

Расширенный режим Обычный режим