Forex trading mein leverage se muraad broker se qarz utha kar trader ke position ka size barhane ka istemal hai. Ye traders ko chote se raqam se bade contracts ko control karne ki ijaazat deta hai, jo margin kehlayi jaati hai. Leverage dono munafa aur nuqsan ko barha sakta hai, jisse ye Forex trading mein ek do tarah ka talwar ban jaata hai.

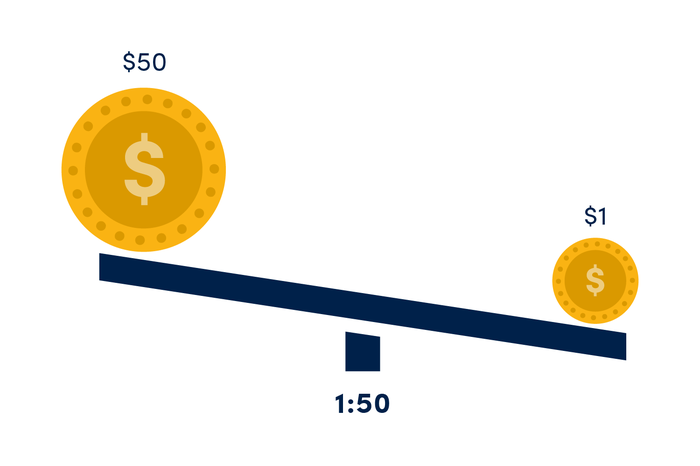

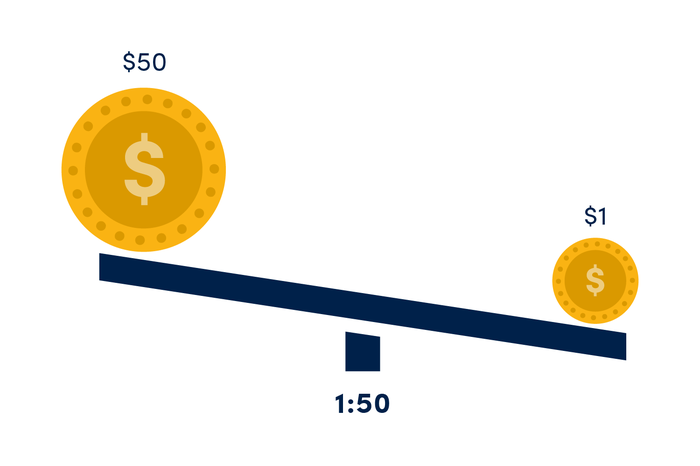

Understanding 1:50 Leverage

1:50 leverage nisbatan ye hai ke har unit capital jo trader invest karta hai, woh 50 guna us raqam ke positions ko khol sakta hai. Misal ke tor par, agar ek trader ke paas unke trading account mein $1,000 hai aur woh iska 1% istemal kar ke ek position kholta hai, toh woh $50,000 ke contract ko control kar sakta hai (1:50 leverage). Jab leverage ka istemal kiya jaata hai, traders ko sirf trade ke mukammal qeemat ka chhota hissa, jo margin kehlaya jaata hai, jama karna hota hai. Broker baaqi raqam faraham karta hai, jisse trader bade positions khol sakta hai. Jab market unki taraf chalta hai, toh trader ke account balance badh jaata hai, aur woh position ko band kar ke munafa ya toh isse mazeed barhne ke liye chala sakte hain.

Benefits of Trading with 1:50 Leverage

Risks Associated with Trading with 1:50 Leverage

Margin Calls: Leverage dono munafe aur nuqsan ko barhata hai. Agar trade trader ke khilaaf chali jati hai, toh unka account balance tezi se ghat sakta hai, jisse broker se margin call ho sakti hai. Margin call tab hoti hai jab trader ka account equity required maintenance margin se kam ho jata hai, jisko account liquidation se bachne ke liye woh zyada funds jama karne ya nuksan ka position band karne ke liye majboor hota hai.

Strategies for Trading with 1:50 Leverage

Choosing the Right Broker

Leverage ke sath trading karte waqt ek qabil-e-aitbaar broker ka intikhab karna zaroori hai. Regulatory compliance, trading platforms, fees, customer support, aur broker ka industry mein kya maqbooliyyat hai, jaise factors ko mad e nazar rakhen. Hamesha broker ki credentials ko tasdeeq karen aur doosre traders ki raayon ko parhne se pehle ek account kholne se pehle. Forex mein 1:50 leverage ke sath trading munafa ka enhance hone ka imkan deta hai aur liquidity tak pahunchata hai, lekin ye bade khatron ke saath bhi aata hai. Apne kamiyabi ke imkaanat ko zyada karna ke liye, leverage ke mechanics ko samajhna, ek mazboot khatra nigrani strategy ka tayyar karna, aur ek aitemaad-e-kaamil broker ka intikhab karna zaroori hai. Ilm, discipline, aur mufeed khatra nigrani ke amal ke jariye, traders 1:50 leverage ke taqat ko apne trading maqasid haasil karne ke liye istemal kar sakte hain.

Understanding 1:50 Leverage

1:50 leverage nisbatan ye hai ke har unit capital jo trader invest karta hai, woh 50 guna us raqam ke positions ko khol sakta hai. Misal ke tor par, agar ek trader ke paas unke trading account mein $1,000 hai aur woh iska 1% istemal kar ke ek position kholta hai, toh woh $50,000 ke contract ko control kar sakta hai (1:50 leverage). Jab leverage ka istemal kiya jaata hai, traders ko sirf trade ke mukammal qeemat ka chhota hissa, jo margin kehlaya jaata hai, jama karna hota hai. Broker baaqi raqam faraham karta hai, jisse trader bade positions khol sakta hai. Jab market unki taraf chalta hai, toh trader ke account balance badh jaata hai, aur woh position ko band kar ke munafa ya toh isse mazeed barhne ke liye chala sakte hain.

Benefits of Trading with 1:50 Leverage

- Enhanced Profit Potential: 1:50 leverage ke sath, traders apne munafe ko barha kar chhote shuruati nivesh se bade positions ko control kar sakte hain. Ye unhe apne capital par zyada munafa kamane ki ijaazat deta hai.

- Access to Liquidity: Leverage traders ko Forex market ki wasee liquidity tak pahunchata hai, jisse unhe positions mein dakhil hona aur unse nikalna jaldi aur kam slip ke saath hota hai.

- Diversification: Leverage traders ko chhoti raqam lagane se bade positions kholne ki ijaazat deta hai, apne portfolio ko taqseem kar ke aur mukammal khatra ko kam karne ka imkan deta hai.

Risks Associated with Trading with 1:50 Leverage

Margin Calls: Leverage dono munafe aur nuqsan ko barhata hai. Agar trade trader ke khilaaf chali jati hai, toh unka account balance tezi se ghat sakta hai, jisse broker se margin call ho sakti hai. Margin call tab hoti hai jab trader ka account equity required maintenance margin se kam ho jata hai, jisko account liquidation se bachne ke liye woh zyada funds jama karne ya nuksan ka position band karne ke liye majboor hota hai.

- Overtrading: Zyada leverage ka hona traders ko overtrade karne par majboor kar sakta hai, jisme wo jaldi munafa kamane ki koshish mein zyada khatra uthate hain. Overtrading ghalat faislon, zyada nuqsan, aur account khali hone tak pahuncha sakta hai.

- Volatility: Zyada leverage market ki intesharat ka asar mazeed barha sakta hai, agar sahi taur par manage na kiya gaya.

Strategies for Trading with 1:50 Leverage

- Risk Management: Ek mazboot khatra nigrani strategy ka amal mein laana zaroori hai jab leverage ke sath trading ki jaati hai. Isme stop-loss orders set karna, kisi bhi ek trade ka exposure mehdood karna, aur apne portfolio ko taqseem karna shaamil hai.

- Trade Size: Apne account balance aur khatra bardasht karne ki tahammul ke mutabiq munasib trade size ka tayyun karen. Overtrading se bachen aur ye ensure karen ke aapki position size aapke overall risk management plan ke mutabiq ho.

- Education and Experience: Apni trading ka ilm aur hunar taleem, mashq, aur tajurba se barhayein. Market dynamics, technical aur fundamental analysis, aur risk management techniques ko samajh kar faislon par inform kiye gaye faislon par pahunchein.

- Stay Disciplined: Apne trading approach mein discipline ko barqarar rakhen aur emotional faislon se bachen. Apne trading plan ko follow karen aur apni performance ko baar baar jaanch karne ke liye apna tajurba hasil karen.

Choosing the Right Broker

Leverage ke sath trading karte waqt ek qabil-e-aitbaar broker ka intikhab karna zaroori hai. Regulatory compliance, trading platforms, fees, customer support, aur broker ka industry mein kya maqbooliyyat hai, jaise factors ko mad e nazar rakhen. Hamesha broker ki credentials ko tasdeeq karen aur doosre traders ki raayon ko parhne se pehle ek account kholne se pehle. Forex mein 1:50 leverage ke sath trading munafa ka enhance hone ka imkan deta hai aur liquidity tak pahunchata hai, lekin ye bade khatron ke saath bhi aata hai. Apne kamiyabi ke imkaanat ko zyada karna ke liye, leverage ke mechanics ko samajhna, ek mazboot khatra nigrani strategy ka tayyar karna, aur ek aitemaad-e-kaamil broker ka intikhab karna zaroori hai. Ilm, discipline, aur mufeed khatra nigrani ke amal ke jariye, traders 1:50 leverage ke taqat ko apne trading maqasid haasil karne ke liye istemal kar sakte hain.