What is Supporting..? How it Works...?

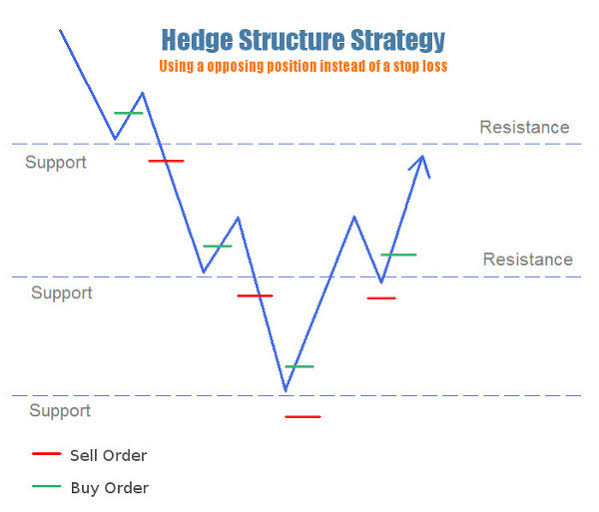

Dear companions Supporting forex exchanging me aik aisi technique hai jo dealers ka misfortune Kam krnay me bht kaam ati hai. Dealers is technique ki help say apny misfortune ko kisi na kisi had tak control ker lety hen aur kabhi misfortune recuperate bhi ho jata hai aur isi methodology say benefits bhi master brokers acha ker laitay hain. Supporting her broker ko benefit daiti hai laikin sirf iss methodology ko apply krnay ka time greetings right hona zaruri hai.

When to utilize Supporting Technique

Supporting say faida uss waqt hota hai punch brokers ko jald he apni wrong exchange ka andaza ho Jaye aur parcel size bhi ziada rakh Lia ho tou usi waqt fence ker laina chaiye kiyu kay iss Tarah aik exchange say faida aur Dusri say misfortune honay say bhi account ki value Pay koi faraq nahi parta. Laikin Agar aik exchange 10 $ mai jaa chuki ho to support kernay kay liye dusri exchange ka parcel size itna zaruri hai kay pehla misfortune dusri kay benefit say jaldi plant sakey. Warna dono he exchange misfortune mai jaengi aur account bhi jaldi he wash out ho jay ga.

the most effective method to recuperate misfortune with supporting procedure:

Forex exchanging primary kai merchant supporting karnay fundamental kamyab ho jaty hain laikin wo aksar dehedging karnay principal nakam ho jaty hain kiun kay wo market ko achay say dissect ni kar patay. Forex mama market ki investigation mama achi learning hasil ho jae to broker ko supporting system ko use karny ko nobat he ni ati. So merchant ko pehle market k investigation ko learn kary or phr he exchange mama enter hony ki khosis kary warna broker ko kio benefit ni ho ga.

profit possibility

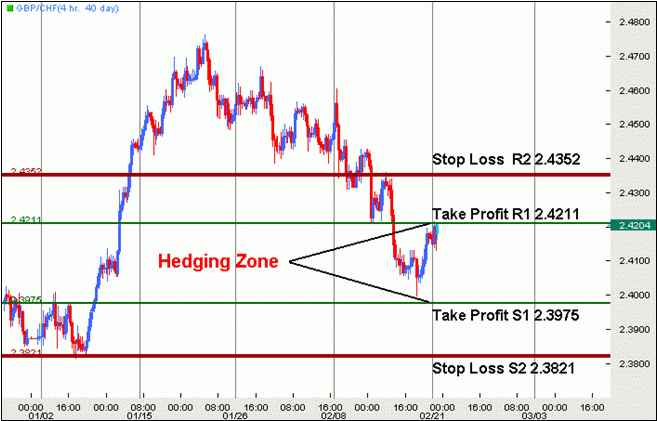

Dosto misal Kay tor py agr kisi trader ne GBPUSD me aik buy ki trade open ki 1.3675 ki price par par wo trade trend change kar ke loss me chali gai or price 1.3640 par a gai trader ne trade ko analysis kea tu pata chala ke eurusd ki price mazeed down move kare gi tu yaha par traders apni trade ko hedge karke mazeed loss se bach jaye ga or jub os ko maloom ho ga ab price os theek ha reverse ho kar profit de day gi tu hedge khatam kar ke profit earn kar ley ga.

Hanging man candle

Iske ilawa, Hanging Man candle design ka affirmation aur legitimacy ke liye kuch zaroori factors hote hain. Iske liye merchants ko iske setting aur encompassing cost activity ko notice karna hoga. Agar iske encompassing candle designs aur pointers bhi negative pattern ka signal de rahe hain, toh Hanging Man candle design ka signal areas of strength for aur legitimate mana ja sakta hai. Hanging Man candle design ka signal areas of strength for aur ke ilawa, dealers ko iske exchange passage aur exit ke liye bhi kuch zaroori focuses ya methodologies ka use karna chahiye. Iske liye, stop misfortune orders ka use karna chahiye, taaki brokers ko market ke eccentric developments ke saath bargain karna na pade. Iske saath hey, brokers ko apni exchanges ko baraksar screen karna chahiye aur apne exchanging methodology ke agreeing apni exchanges ko oversee karna chahiye.

Hanging Man candle design ka use aur examination karna forex exchanging mein ek significant ability hai, kyunke iska use brokers ko market patterns aur developments ke baare mein significant data give karta hai. Iske ilawa, merchants ko candle designs aur specialized pointers ke information aur experience ka hona bhi zaroori hai, taaki woh Hanging Man candle design aur dusre candle designs aur markers ko baraksar investigate aur use kar sakein. Hanging Man candle design ko perceive karna forex brokers ke liye significant expertise hai, kyunke iske signal se dealers ko market developments aur patterns ke baare mein significant data mil sakti hai. Iske liye merchants ko Hanging Man candle design ke shape aur size ko distinguish karna zaroori hai.

Dear companions Supporting forex exchanging me aik aisi technique hai jo dealers ka misfortune Kam krnay me bht kaam ati hai. Dealers is technique ki help say apny misfortune ko kisi na kisi had tak control ker lety hen aur kabhi misfortune recuperate bhi ho jata hai aur isi methodology say benefits bhi master brokers acha ker laitay hain. Supporting her broker ko benefit daiti hai laikin sirf iss methodology ko apply krnay ka time greetings right hona zaruri hai.

When to utilize Supporting Technique

Supporting say faida uss waqt hota hai punch brokers ko jald he apni wrong exchange ka andaza ho Jaye aur parcel size bhi ziada rakh Lia ho tou usi waqt fence ker laina chaiye kiyu kay iss Tarah aik exchange say faida aur Dusri say misfortune honay say bhi account ki value Pay koi faraq nahi parta. Laikin Agar aik exchange 10 $ mai jaa chuki ho to support kernay kay liye dusri exchange ka parcel size itna zaruri hai kay pehla misfortune dusri kay benefit say jaldi plant sakey. Warna dono he exchange misfortune mai jaengi aur account bhi jaldi he wash out ho jay ga.

the most effective method to recuperate misfortune with supporting procedure:

Forex exchanging primary kai merchant supporting karnay fundamental kamyab ho jaty hain laikin wo aksar dehedging karnay principal nakam ho jaty hain kiun kay wo market ko achay say dissect ni kar patay. Forex mama market ki investigation mama achi learning hasil ho jae to broker ko supporting system ko use karny ko nobat he ni ati. So merchant ko pehle market k investigation ko learn kary or phr he exchange mama enter hony ki khosis kary warna broker ko kio benefit ni ho ga.

profit possibility

Dosto misal Kay tor py agr kisi trader ne GBPUSD me aik buy ki trade open ki 1.3675 ki price par par wo trade trend change kar ke loss me chali gai or price 1.3640 par a gai trader ne trade ko analysis kea tu pata chala ke eurusd ki price mazeed down move kare gi tu yaha par traders apni trade ko hedge karke mazeed loss se bach jaye ga or jub os ko maloom ho ga ab price os theek ha reverse ho kar profit de day gi tu hedge khatam kar ke profit earn kar ley ga.

Hanging man candle

Iske ilawa, Hanging Man candle design ka affirmation aur legitimacy ke liye kuch zaroori factors hote hain. Iske liye merchants ko iske setting aur encompassing cost activity ko notice karna hoga. Agar iske encompassing candle designs aur pointers bhi negative pattern ka signal de rahe hain, toh Hanging Man candle design ka signal areas of strength for aur legitimate mana ja sakta hai. Hanging Man candle design ka signal areas of strength for aur ke ilawa, dealers ko iske exchange passage aur exit ke liye bhi kuch zaroori focuses ya methodologies ka use karna chahiye. Iske liye, stop misfortune orders ka use karna chahiye, taaki brokers ko market ke eccentric developments ke saath bargain karna na pade. Iske saath hey, brokers ko apni exchanges ko baraksar screen karna chahiye aur apne exchanging methodology ke agreeing apni exchanges ko oversee karna chahiye.

Hanging Man candle design ka use aur examination karna forex exchanging mein ek significant ability hai, kyunke iska use brokers ko market patterns aur developments ke baare mein significant data give karta hai. Iske ilawa, merchants ko candle designs aur specialized pointers ke information aur experience ka hona bhi zaroori hai, taaki woh Hanging Man candle design aur dusre candle designs aur markers ko baraksar investigate aur use kar sakein. Hanging Man candle design ko perceive karna forex brokers ke liye significant expertise hai, kyunke iske signal se dealers ko market developments aur patterns ke baare mein significant data mil sakti hai. Iske liye merchants ko Hanging Man candle design ke shape aur size ko distinguish karna zaroori hai.