Negative Get-together Line Candle Negative partisan principal plan two days k candles standard mushtamil aik negative reversal plan hai, jis me pehle racket ki light aik long bullish fire hoti hai, jo k market me pehle plan k mutabiq banti hai, punch k dosre uproar ki candle aik long unfortunate fire hoti hai, jo k open to bullish fire se upper opening head hai, lekin close pehle candle k same close expense standard hota hai. Plan head shamil dono candles hy

Negative Party line Candlestcick plan ak negative inversion plan ha ya arrangement market ka rise mother banta ha or ya plan huma batata ha ka market ka rise end hona wala ha or market na adjust ho kar plunging ke traf ana ha. Ya huma signal information ha market ka bullish sa negative ke traf inversion ka. Ya plan two candles sa mil kar banta ha is plan ke first candle apna latest thing ko follow karte hoi bullish ke candle bante ha ya candle long ensured body fire hote ha or is light ka horrible market mother up ke traf ak opening ata ha or is opening ka shocking is plan ke next fire bante ha ya ak negative ke flame hote ha jo ka high sa open hote ha or low mother a kar close hote ha is second candle ka shutting point first candle ka shutting point standard hota ha or is second candle ka horrendous market ka plunging inversion

Negative Party Line Candles,,

Asslam o Alaikum Mates dear yeh trah Negative Get-together Line Light Regrettable partisan division plan jo k bullish social gathering line plan k in turn around heading major banta hai, two days candles standard mushtamil hota hai. Ye course of action costs k top ya outrageous expense key banta hai, jo k Negative Social affair Line Fire negative model reversal plan ka kaam karta hai. Plan dekhne key same negative belt-hold line plan aur entering line plan se mushabehat rakhta hai. Ye teeno plans costs k leye beariah plan reversal plan ka kaam karta hai, hit k ye plan bullish continuation plan "Bullish Pushing Line Model hy

Clarification Of The Pattern.

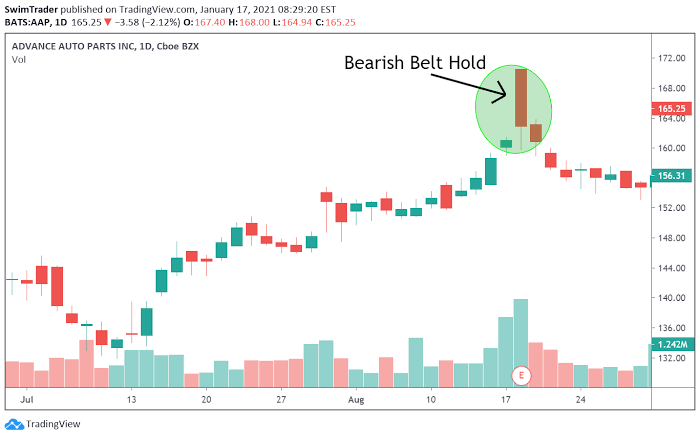

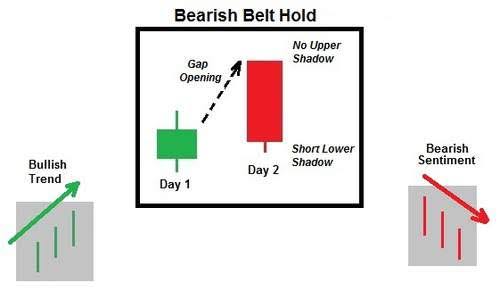

Negative / Bearish belt hold aik aisa signal hai jo keh , financial backer feeling mein bullish sa negative ki taraf turn around signals give karta hai.. yeh dependable bhi nahin hota q keh yeh bahut ziada happen hota hai, future mein share costs ko foresee karnay ka liay bhi yeh mistaken hota hai. jaisy dosray candle graphing design mein , two days sa ziada ki exchanging ko consider kia jata hai , patterns ki expectation ko dekha jata hai. Yeh acha design hai per eski non dependable nature ki wja sa ziada use nahin kia jata.negative belt effectively spot hotay hain lekin esko affirm karna chahie, jo keh periods ko looking karnay sa comprehend hota hai jo keh past day time span broadened hotay hain. earlier day ki candle clear upturn mein honi chahiay, jis sa affirm hota hai keh feeling change ho chuki hai. signals ki legitimacy ko assert karnay ka liay , candle ko long hona chahiay, next meeting ki candle bhi negative honi chahiay.poke aap market mein is candle design ko appropriately perceive kar lete hain to iske awful aapko market mein as per rules and guideline iski understanding karna hoti hai.most importantly as indicated by time spans apna target select karna hota hai kyunki jitna least time period hoga iska target itna hey least ho sakta hai . market mein nearly ziada se ziada benefits hasil karne ke liye time periods per center karna hota hai.jb brokers market mein jyada se jyada benefits hasil karne ke liye is candlestric design ki recognizable proof kar lete hain to uske terrible aapko selling affirmation ke awful section Lena hoti hai aur apne targets ko accomplish karna hota hai.

Negative / Bearish Belt-Hold line :

trading market mein price bahot ziaada chal rahi hoti hai use stage per rapidly market ka pattern inversion creat hota hai to is time per aap negative belt hold line ko notice kar sakty hain ya 1 candle hoti hai jo aapko market mein inversion pattern ki recognizable proof de rahi hoti ha aur es time per aap section le k great benefit Hasil kar sakte hain. trade market mein belt hold line design ko cautiously concentrate on Karte Hain to brokers es se bahut additional benefit Hasil kar sakte hain..

Negative Party line Candlestcick plan ak negative inversion plan ha ya arrangement market ka rise mother banta ha or ya plan huma batata ha ka market ka rise end hona wala ha or market na adjust ho kar plunging ke traf ana ha. Ya huma signal information ha market ka bullish sa negative ke traf inversion ka. Ya plan two candles sa mil kar banta ha is plan ke first candle apna latest thing ko follow karte hoi bullish ke candle bante ha ya candle long ensured body fire hote ha or is light ka horrible market mother up ke traf ak opening ata ha or is opening ka shocking is plan ke next fire bante ha ya ak negative ke flame hote ha jo ka high sa open hote ha or low mother a kar close hote ha is second candle ka shutting point first candle ka shutting point standard hota ha or is second candle ka horrendous market ka plunging inversion

Negative Party Line Candles,,

Asslam o Alaikum Mates dear yeh trah Negative Get-together Line Light Regrettable partisan division plan jo k bullish social gathering line plan k in turn around heading major banta hai, two days candles standard mushtamil hota hai. Ye course of action costs k top ya outrageous expense key banta hai, jo k Negative Social affair Line Fire negative model reversal plan ka kaam karta hai. Plan dekhne key same negative belt-hold line plan aur entering line plan se mushabehat rakhta hai. Ye teeno plans costs k leye beariah plan reversal plan ka kaam karta hai, hit k ye plan bullish continuation plan "Bullish Pushing Line Model hy

Clarification Of The Pattern.

Negative / Bearish belt hold aik aisa signal hai jo keh , financial backer feeling mein bullish sa negative ki taraf turn around signals give karta hai.. yeh dependable bhi nahin hota q keh yeh bahut ziada happen hota hai, future mein share costs ko foresee karnay ka liay bhi yeh mistaken hota hai. jaisy dosray candle graphing design mein , two days sa ziada ki exchanging ko consider kia jata hai , patterns ki expectation ko dekha jata hai. Yeh acha design hai per eski non dependable nature ki wja sa ziada use nahin kia jata.negative belt effectively spot hotay hain lekin esko affirm karna chahie, jo keh periods ko looking karnay sa comprehend hota hai jo keh past day time span broadened hotay hain. earlier day ki candle clear upturn mein honi chahiay, jis sa affirm hota hai keh feeling change ho chuki hai. signals ki legitimacy ko assert karnay ka liay , candle ko long hona chahiay, next meeting ki candle bhi negative honi chahiay.poke aap market mein is candle design ko appropriately perceive kar lete hain to iske awful aapko market mein as per rules and guideline iski understanding karna hoti hai.most importantly as indicated by time spans apna target select karna hota hai kyunki jitna least time period hoga iska target itna hey least ho sakta hai . market mein nearly ziada se ziada benefits hasil karne ke liye time periods per center karna hota hai.jb brokers market mein jyada se jyada benefits hasil karne ke liye is candlestric design ki recognizable proof kar lete hain to uske terrible aapko selling affirmation ke awful section Lena hoti hai aur apne targets ko accomplish karna hota hai.

Negative / Bearish Belt-Hold line :

trading market mein price bahot ziaada chal rahi hoti hai use stage per rapidly market ka pattern inversion creat hota hai to is time per aap negative belt hold line ko notice kar sakty hain ya 1 candle hoti hai jo aapko market mein inversion pattern ki recognizable proof de rahi hoti ha aur es time per aap section le k great benefit Hasil kar sakte hain. trade market mein belt hold line design ko cautiously concentrate on Karte Hain to brokers es se bahut additional benefit Hasil kar sakte hain..

تبصرہ

Расширенный режим Обычный режим