Relative Strength Index (RSI)

Kisi asasay ki qeemat ki raftaar ka andaza laga kar, rishta daar taaqat index ( rsi ) is baat ki nishandahi kar sakta hai ke aaya yeh ziyada khareeda gaya hai ya ziyada farokht sun-hwa hai. indicators a. welles wilder jr. ne banaya, jis ne daawa kya ke 30 ki momentum level ( sifar se 100 ke pemanay par ) ishara karta hai ke aik asasa ziyada farokht sun-hwa hai, jo ke kharidari ke mauqa ki nishandahi karta hai, aur 70 feesad ki satah ishara karti hai ke aik asasa ziyada khareeda gaya hai. farokht ya mukhtasir farokht ke mauqa ki nishandahi karna. brown, si am tea, ne index ki darkhwast ko wazeh karte hue kaha ke oopar ki taraf rujhan rakhnay wali market mein, over sealed level darasal 30 se ziyada thi, jab ke neechay ki taraf rujhan rakhnay wali market mein over baat level 70 se bohat kam thi. ki eqdaar ka istemaal karte hue, asasa ki qeemat kuch waqt ke liye bulandi ka rujhan jari rakh sakti hai jab rsi ziyada kharidari ka ishara day raha ho aur is ke bar aks. nateejay ke tor par, rsi ka istemaal sirf is soorat mein kya jana chahiye jab is ka signal qeemat ke rujhan se mawafiq ho. jab qeemat ka rujhan manfi ho, misaal ke tor par, bearish momentum ke nishanaat talaash karen aur jab qeemat ka rujhan taiz ho to inhen nazar andaaz Karen

Moving Averages Convergence and Divergence (MACD)

Moving average convergance and divergance ( macd ) indicators aap ko qeemat ke kuch rujhanaat ko ziyada taizi se talaash karne mein madad kar sakta hai. do chart linen macd banati hain. macd line tayyar karne ke liye 26 muddat ke exponantioal moving average ( ema ) ko 12 ke ema se manhaa kya jata hai. ema kisi khaas muddat ke douran kisi asasa ki ost qeemat hoti hai, is ke sath ke haliya qeematon ko agay ki qeematon se ziyada wazan diya jata hai. signal line, jo ke no muddat ki ema hai, doosri line hai. jab macd line signal line ke neechay se guzarti hai, to mandi ka rujhan zahir hota hai. jab macd line signal line ke oopar se guzarti hai, to taizi ka rujhan zahir hota hai .

Bollinger Bands

Bollinger band aik peechay reh jane walay isharay hain jo aap ko yeh maloom karne mein madad kar satke hain ke qeematein nisbatan ziyada hain ya kam, neez utaar charhao ke baray mein baseerat faraham karte hain. 20 din ki saada moving average aksar center line ya" baind" ( sma ) ki shanakht ke liye istemaal hoti hai. oopri line ka hisaab darmiyani baind ko rozana mayaari inhiraf se dugna kar ke lagaya jata hai. rozana mayaari inhiraf ko do baar ghatanay se nichli line haasil hoti hai. yeh کمپیوٹیشنز aik aisa baind faraham karte hain jo ziyada kharidi hui ya ziyada farokht honay wali sthon ke sath sath rujhan saaz qeemat ke lifafay ko zahir karne ke liye istemaal kya ja sakta hai .

Exponential Moving Average (Ema)

Exponential moving average ( ema ), jaisay bunyadi moving average, aik lagging indicators hai jisay waqt ke sath patteren ka pata laganay ke liye istemaal kya ja sakta hai. chunkay yeh qeematon ki haliya naqal o harkat ke liye ziyada hassas hai, is liye ema aap ko sma se jald patteren talaash karne ki ijazat day sakta hai .

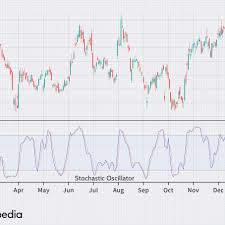

Stochastic Oscillator

Stochastic aik momentum indicators hai jo apni qadron ka hisaab laganay ke liye ikhtitami qeemat ke rujhanaat ka istemaal karta hai. usay george lain ne 1950 ki dahai mein banaya tha aur usay ziyada kharidi hui aur ziyada farokht ki satah ka taayun karne ke liye istemaal kya ja sakta hai. jab line oopar se 80 ki satah se neechay tak jati hai, to aap ko farokht ke signal mil satke hain, aur jab yeh neechay se 20 ki satah se oopar jati hai, to aap ko khareed ke isharay mil satke hain.

Fibonacci Retracements

Fibonacci retracements aik ahem isharay hain jo kam aur ziyada qeemat ke darmiyan trained line ke sath qeemat ki himayat ya muzahmat ke makhsoos maqamat ki nishandahi karne ke liye fibonacci nambaron ko istemaal karte hain : 0 %, 23. 6, 38. 2 feesad, 50 %, 61. 8 feesad, aur 100 % rujhan line. is ke baad yeh feesad makhsoos muddat ke liye kam aur ziyada qeematon ke darmiyan farq par laago kiye ja satke hain. fibonacci retracement ki sthin un maqamat ki nishandahi kar sakti hain jahan qeematein pichlle rujhan ko wapas le sakti hain aur aik ulat palat dekh sakti hain. khulasa day trading ki ahem khasusiyat yeh hai ke is mein aik hi tijarti din mein asason ki khareed o farokht shaamil hai. yeh ishara karta hai ke tijarti din ke ekhtataam par, tamam tijarti pozishnin khatam ho jati hain. day trading ke bunyadi maqasid qaleel mudti market ki ki nishandahi karna aur un se faida uthana hai. din ke tajir, bohat se dosray sarmaya karon ke bar aks, sikyortiz ki taweel mudti qader ke baray mein be fikar hain. din ke tajir sirf qaleel mudti qeematon mein tabdeeli ki parwah karte hain. din ki tijarat aik aala rissk sarmaya kaari ka tareeqa hai. yahan tak ke agar koi tajir asason ki qeematon ki naqal o harkat ka sahih andaza laga sakta hai, lain deen ki fees qeemat ke utaar charhao se honay wali aamdani ko poora kar sakti hai. din ke tajir maliyati khidmaat ki farmon jaisay bankon aur sarmaya kaari funds ke sath sath niji afraad ke mulazim ho satke hain. aap investsocial ke sath day trading ki koshish kar satke hain jab ke aap samajte hain ke day trading ke isharay kaisay kaam karte hain.

Kisi asasay ki qeemat ki raftaar ka andaza laga kar, rishta daar taaqat index ( rsi ) is baat ki nishandahi kar sakta hai ke aaya yeh ziyada khareeda gaya hai ya ziyada farokht sun-hwa hai. indicators a. welles wilder jr. ne banaya, jis ne daawa kya ke 30 ki momentum level ( sifar se 100 ke pemanay par ) ishara karta hai ke aik asasa ziyada farokht sun-hwa hai, jo ke kharidari ke mauqa ki nishandahi karta hai, aur 70 feesad ki satah ishara karti hai ke aik asasa ziyada khareeda gaya hai. farokht ya mukhtasir farokht ke mauqa ki nishandahi karna. brown, si am tea, ne index ki darkhwast ko wazeh karte hue kaha ke oopar ki taraf rujhan rakhnay wali market mein, over sealed level darasal 30 se ziyada thi, jab ke neechay ki taraf rujhan rakhnay wali market mein over baat level 70 se bohat kam thi. ki eqdaar ka istemaal karte hue, asasa ki qeemat kuch waqt ke liye bulandi ka rujhan jari rakh sakti hai jab rsi ziyada kharidari ka ishara day raha ho aur is ke bar aks. nateejay ke tor par, rsi ka istemaal sirf is soorat mein kya jana chahiye jab is ka signal qeemat ke rujhan se mawafiq ho. jab qeemat ka rujhan manfi ho, misaal ke tor par, bearish momentum ke nishanaat talaash karen aur jab qeemat ka rujhan taiz ho to inhen nazar andaaz Karen

Moving Averages Convergence and Divergence (MACD)

Moving average convergance and divergance ( macd ) indicators aap ko qeemat ke kuch rujhanaat ko ziyada taizi se talaash karne mein madad kar sakta hai. do chart linen macd banati hain. macd line tayyar karne ke liye 26 muddat ke exponantioal moving average ( ema ) ko 12 ke ema se manhaa kya jata hai. ema kisi khaas muddat ke douran kisi asasa ki ost qeemat hoti hai, is ke sath ke haliya qeematon ko agay ki qeematon se ziyada wazan diya jata hai. signal line, jo ke no muddat ki ema hai, doosri line hai. jab macd line signal line ke neechay se guzarti hai, to mandi ka rujhan zahir hota hai. jab macd line signal line ke oopar se guzarti hai, to taizi ka rujhan zahir hota hai .

Bollinger Bands

Bollinger band aik peechay reh jane walay isharay hain jo aap ko yeh maloom karne mein madad kar satke hain ke qeematein nisbatan ziyada hain ya kam, neez utaar charhao ke baray mein baseerat faraham karte hain. 20 din ki saada moving average aksar center line ya" baind" ( sma ) ki shanakht ke liye istemaal hoti hai. oopri line ka hisaab darmiyani baind ko rozana mayaari inhiraf se dugna kar ke lagaya jata hai. rozana mayaari inhiraf ko do baar ghatanay se nichli line haasil hoti hai. yeh کمپیوٹیشنز aik aisa baind faraham karte hain jo ziyada kharidi hui ya ziyada farokht honay wali sthon ke sath sath rujhan saaz qeemat ke lifafay ko zahir karne ke liye istemaal kya ja sakta hai .

Exponential Moving Average (Ema)

Exponential moving average ( ema ), jaisay bunyadi moving average, aik lagging indicators hai jisay waqt ke sath patteren ka pata laganay ke liye istemaal kya ja sakta hai. chunkay yeh qeematon ki haliya naqal o harkat ke liye ziyada hassas hai, is liye ema aap ko sma se jald patteren talaash karne ki ijazat day sakta hai .

Stochastic Oscillator

Stochastic aik momentum indicators hai jo apni qadron ka hisaab laganay ke liye ikhtitami qeemat ke rujhanaat ka istemaal karta hai. usay george lain ne 1950 ki dahai mein banaya tha aur usay ziyada kharidi hui aur ziyada farokht ki satah ka taayun karne ke liye istemaal kya ja sakta hai. jab line oopar se 80 ki satah se neechay tak jati hai, to aap ko farokht ke signal mil satke hain, aur jab yeh neechay se 20 ki satah se oopar jati hai, to aap ko khareed ke isharay mil satke hain.

Fibonacci Retracements

Fibonacci retracements aik ahem isharay hain jo kam aur ziyada qeemat ke darmiyan trained line ke sath qeemat ki himayat ya muzahmat ke makhsoos maqamat ki nishandahi karne ke liye fibonacci nambaron ko istemaal karte hain : 0 %, 23. 6, 38. 2 feesad, 50 %, 61. 8 feesad, aur 100 % rujhan line. is ke baad yeh feesad makhsoos muddat ke liye kam aur ziyada qeematon ke darmiyan farq par laago kiye ja satke hain. fibonacci retracement ki sthin un maqamat ki nishandahi kar sakti hain jahan qeematein pichlle rujhan ko wapas le sakti hain aur aik ulat palat dekh sakti hain. khulasa day trading ki ahem khasusiyat yeh hai ke is mein aik hi tijarti din mein asason ki khareed o farokht shaamil hai. yeh ishara karta hai ke tijarti din ke ekhtataam par, tamam tijarti pozishnin khatam ho jati hain. day trading ke bunyadi maqasid qaleel mudti market ki ki nishandahi karna aur un se faida uthana hai. din ke tajir, bohat se dosray sarmaya karon ke bar aks, sikyortiz ki taweel mudti qader ke baray mein be fikar hain. din ke tajir sirf qaleel mudti qeematon mein tabdeeli ki parwah karte hain. din ki tijarat aik aala rissk sarmaya kaari ka tareeqa hai. yahan tak ke agar koi tajir asason ki qeematon ki naqal o harkat ka sahih andaza laga sakta hai, lain deen ki fees qeemat ke utaar charhao se honay wali aamdani ko poora kar sakti hai. din ke tajir maliyati khidmaat ki farmon jaisay bankon aur sarmaya kaari funds ke sath sath niji afraad ke mulazim ho satke hain. aap investsocial ke sath day trading ki koshish kar satke hain jab ke aap samajte hain ke day trading ke isharay kaisay kaam karte hain.