Decending Hawk Candlestick Pattern:-

Aslam u alaikum,

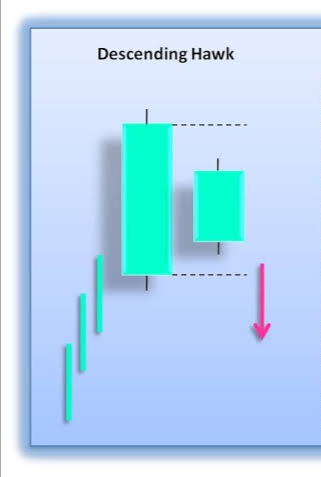

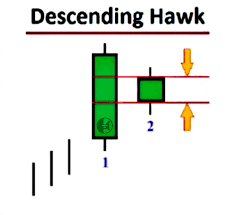

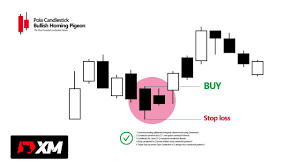

Dear Forex member umeed karta hun aap sab khairiyat se honge dear members Decending Hawk Candlestick Pattern aik bearish trend reversal pattern hai, jo k prices k uptrend main banta hai. Ye pattern aam tawar par two days candles par mushtamil hota hai, jo k "Homing Pigeon Pattern" ka opposite hai. Decending Hawk Candlestick Pattern shap main "Bearish Harami Pattern" se meltta jullta hai, lekin last candle bullish hone ki waja se ye bearish harami pattern se mukhtalef ho jatta hai. Ye pattern bhi bearish harami pattern ki tarrah bearish reversal k leye estemal hotta hai, jab bhi ye bullish trend main bantta hai.

Decending Hawk Candlestick Pattern do bullish candles par mushtamil hota hai, jo k format me bearish harami pattern ki tarah hi hotti hai, aur ye donno pattern trend reversal k leye estemal hotte hen. Decending Hawk Candlestick Pattern main candles ki formation darjazzel tarah se honni chaheye ;

1. First Candle: Decending Hawk Candlestick Pattern ki pehlee candle aik strong long real body wali bullish candle hotti hai, jo k market main prices k uptrend ki power dekhatti hai.

2. Second Candle: Decending Hawk Candlestick Pattern ki dosree candle bhi same bullish candle hi hotti hai, lekin ye candle pehlee candle ki nisbbat ziadda strong bhi nahi hotti hai, aur na hi ye pehlee candle k close pe open hotti hai.

Dosree candle pehlee candle k close price se nechay (yanni real body main) open hotti hai aur aik small real body bananne k baad pehlee candle k close point se pehle close bhi ho jatti hai. Ye candle bullish trend ki kamzzori bhi battati hai aur sath hi trend k khatme ka ishara bhi detti hai. Dosree candle k high aur low pehlee candle k high aur low se kam hote hen.

Decending Hawk Candlestick Pattern uptrend ko bearish trend me badalne ka kaam karta hai. Ye pattern do candles par mushtamil hotta hai, jis me teen patterns "Bearish Harami", "Bullish Engulfing" aur "Homing Pigeon Pattern" ki hososeyyat hotti hai. Is pattern me pehlee candle dosri candle ko apne adar engulf kartti hai, jab k pattern same to same bearish harami jaisa hi hai, lekin dosri candle k color ka farraq hotta hai. Ye pattern homing pigeon pattern ka opposite aur pattern me shamil dono candles bullish hotti hai.

Decending Hawk Candlestick Pattern ki pehlee candle ek bullish long real body wali strong candle bantti hai, jis se market me buyers ya bear power ki mazzbotti ka pata chaltta hai. Lekin dosre din ki candle aik to bantti bhi small size main hai aur dosra ye candle pehlee candle k real body main ban jatti hai. Yani candle ki open aur close dono prices pehlee candle k centre me hotti hai. Ye candle bullish trend ki kamzzori k sath sath bearish trend k reversal ka bhi signal detti hai.

Decending Hawk Candlestick Pattern trading k leye thora sa ajeeb pattern hai, q k is main shamil dono din k candles bullish hone k bawajood bhi ye bearish trend reversal ka kaam kartta hai. Pattern k banne ki position up trend hona chaheye aur long timeframe bhipe banna chaheye.

Pattern par entry se pehle trend confirmation k leye teesree black candle ka intezar zarror karen, q k ye pattern normal neutral hososeyat rakhtti hai. Teesri bearish candle k baad market main buy ki entry kia karen, aur Stop Loss pattern k sab se upper point ya pehli candle k high price par set karen.

Aslam u alaikum,

Dear Forex member umeed karta hun aap sab khairiyat se honge dear members Decending Hawk Candlestick Pattern aik bearish trend reversal pattern hai, jo k prices k uptrend main banta hai. Ye pattern aam tawar par two days candles par mushtamil hota hai, jo k "Homing Pigeon Pattern" ka opposite hai. Decending Hawk Candlestick Pattern shap main "Bearish Harami Pattern" se meltta jullta hai, lekin last candle bullish hone ki waja se ye bearish harami pattern se mukhtalef ho jatta hai. Ye pattern bhi bearish harami pattern ki tarrah bearish reversal k leye estemal hotta hai, jab bhi ye bullish trend main bantta hai.

Candles Formation

Decending Hawk Candlestick Pattern do bullish candles par mushtamil hota hai, jo k format me bearish harami pattern ki tarah hi hotti hai, aur ye donno pattern trend reversal k leye estemal hotte hen. Decending Hawk Candlestick Pattern main candles ki formation darjazzel tarah se honni chaheye ;

1. First Candle: Decending Hawk Candlestick Pattern ki pehlee candle aik strong long real body wali bullish candle hotti hai, jo k market main prices k uptrend ki power dekhatti hai.

2. Second Candle: Decending Hawk Candlestick Pattern ki dosree candle bhi same bullish candle hi hotti hai, lekin ye candle pehlee candle ki nisbbat ziadda strong bhi nahi hotti hai, aur na hi ye pehlee candle k close pe open hotti hai.

Dosree candle pehlee candle k close price se nechay (yanni real body main) open hotti hai aur aik small real body bananne k baad pehlee candle k close point se pehle close bhi ho jatti hai. Ye candle bullish trend ki kamzzori bhi battati hai aur sath hi trend k khatme ka ishara bhi detti hai. Dosree candle k high aur low pehlee candle k high aur low se kam hote hen.

Explaination

Decending Hawk Candlestick Pattern uptrend ko bearish trend me badalne ka kaam karta hai. Ye pattern do candles par mushtamil hotta hai, jis me teen patterns "Bearish Harami", "Bullish Engulfing" aur "Homing Pigeon Pattern" ki hososeyyat hotti hai. Is pattern me pehlee candle dosri candle ko apne adar engulf kartti hai, jab k pattern same to same bearish harami jaisa hi hai, lekin dosri candle k color ka farraq hotta hai. Ye pattern homing pigeon pattern ka opposite aur pattern me shamil dono candles bullish hotti hai.

Decending Hawk Candlestick Pattern ki pehlee candle ek bullish long real body wali strong candle bantti hai, jis se market me buyers ya bear power ki mazzbotti ka pata chaltta hai. Lekin dosre din ki candle aik to bantti bhi small size main hai aur dosra ye candle pehlee candle k real body main ban jatti hai. Yani candle ki open aur close dono prices pehlee candle k centre me hotti hai. Ye candle bullish trend ki kamzzori k sath sath bearish trend k reversal ka bhi signal detti hai.

Trading

Decending Hawk Candlestick Pattern trading k leye thora sa ajeeb pattern hai, q k is main shamil dono din k candles bullish hone k bawajood bhi ye bearish trend reversal ka kaam kartta hai. Pattern k banne ki position up trend hona chaheye aur long timeframe bhipe banna chaheye.

Pattern par entry se pehle trend confirmation k leye teesree black candle ka intezar zarror karen, q k ye pattern normal neutral hososeyat rakhtti hai. Teesri bearish candle k baad market main buy ki entry kia karen, aur Stop Loss pattern k sab se upper point ya pehli candle k high price par set karen.