Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members Jab hum Trading ko as a career choose karty hain to iss ki basics ky bary mn jankari bht zaroori hai hai. Basics humain trade karnh mn bht help karti hain. Aj hum Margin, Equity & Spread ky bary mn bat karen gy.

Margin:

Trader ky account mn mojood wo raqam jo kisi bhi currency ko purchase karny ky liye broker ko darkar hoti hai Margin kehlati hai. Margin kam hony ki soorat mn trading platform trader ko currency khareedny ki ijazat nahi deta. Bilkul issi tarah agar 1 trade nuqsaan mn ja rahi ho to broker ka trading software us trade ko tab tak hi open rehny dy ga jab tak ky trader ky account mn darkar margin baqi rahy ga. Margin khatam ho jany ki soorat mn trade automatically band ho jati hai. For Example ap ky account mn $1000 hain. Iss ka matlab ky hai ky ap ka margin $1000 hai. Farz Karen ky Leverage ki ratio 100:1 hai. Yani ap ko 1 mini lot Khareedny ky liye $100 darkar hon gy. Ap 1.1750 par EUR/USD ki 4 lots khareed lety hain. Ab ap ky pas $600 ka margin reh jae ga. Badqismati sy pair ki qeemat ap ki khareedi hui qeemat ky opposite jana shuru ho jati hai. Aesy mn trading software har Pip ky girny par $4 ka loss dikhana shuru kar dy ga. Q k 100 times leverage ky baes ap ny $400 sy $40000 ki currency khareed rakhi hai. So. 1 pip ki value $4 tak ho jati hai. Issi hisaab sy ap ka margin jo ky $600 hai ap ki trade ko 200 Pips ky nuqsaan tak support kar saky ga. Or jaisy hi pair ki qeemat 1.1550 tak ponchy gi trading ka pair ap ki trade automatically band kar dy ga. Q k ap ky account mn nuqsaan bardasht karny ky liye margin baqi nahi bacha ho ga. Margin ka formula darj zail hota hai.

Equity - Used Margin = Usable Margin

$1000 - $400 = $600

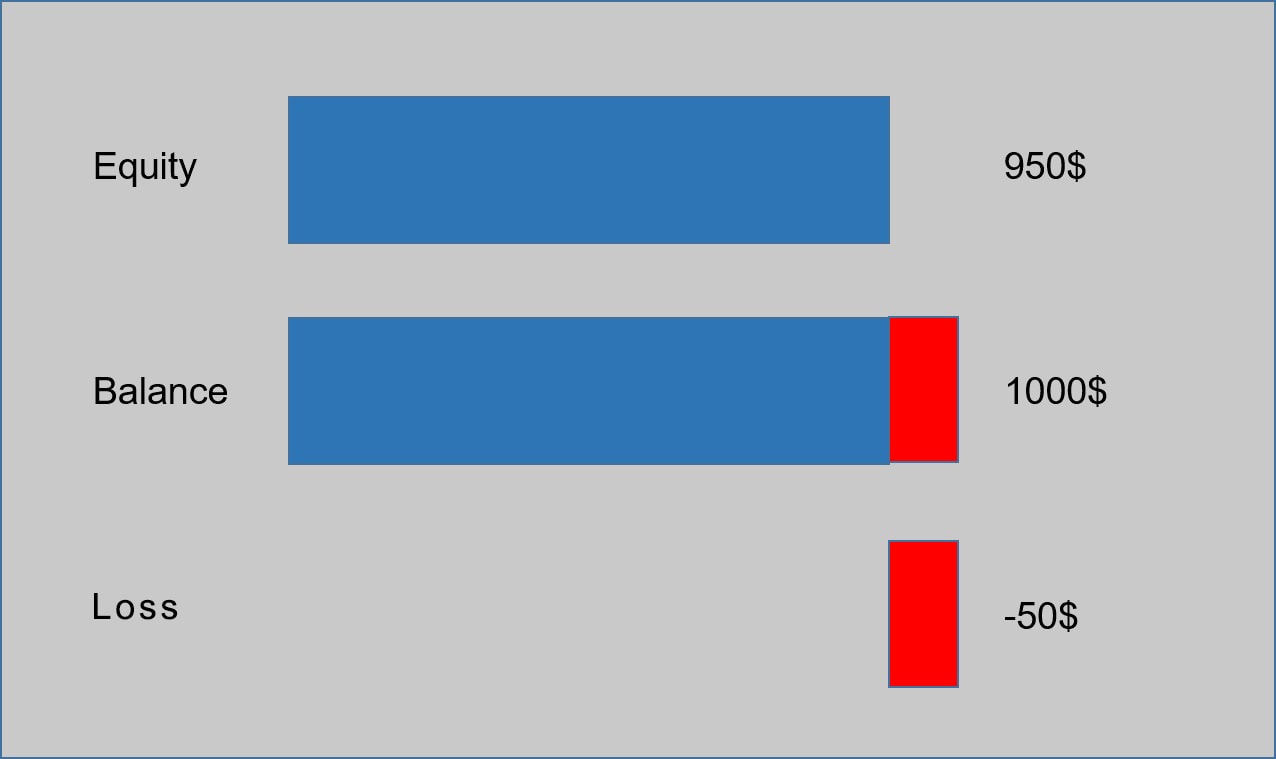

Equity:

Account balance ky sath hi 1 column equity ka bhi hota hai. Ooper ki misaal lain trade open karny sy pehly ap ki equity $1000 ho gi. Ap ky account balance mn kisi bhi trade sy hony waly profit ki loss ki jama tafreeq sirf iss waqt hoti hai jab ap wo trade band karty hain ya margin ki kami ki waja sy wo automatically band ho jati hai. Iss sy pehly ap apna virtual balance joky open trade ky profit ya loss ki jama tafreeq karny ky baad hasil kiya ja sakta hai equity ky column mn dekh sakty hain. Broker ka software apka margin issi equity ki base par ooper diye gae formuly ky teht calculate karta hai.

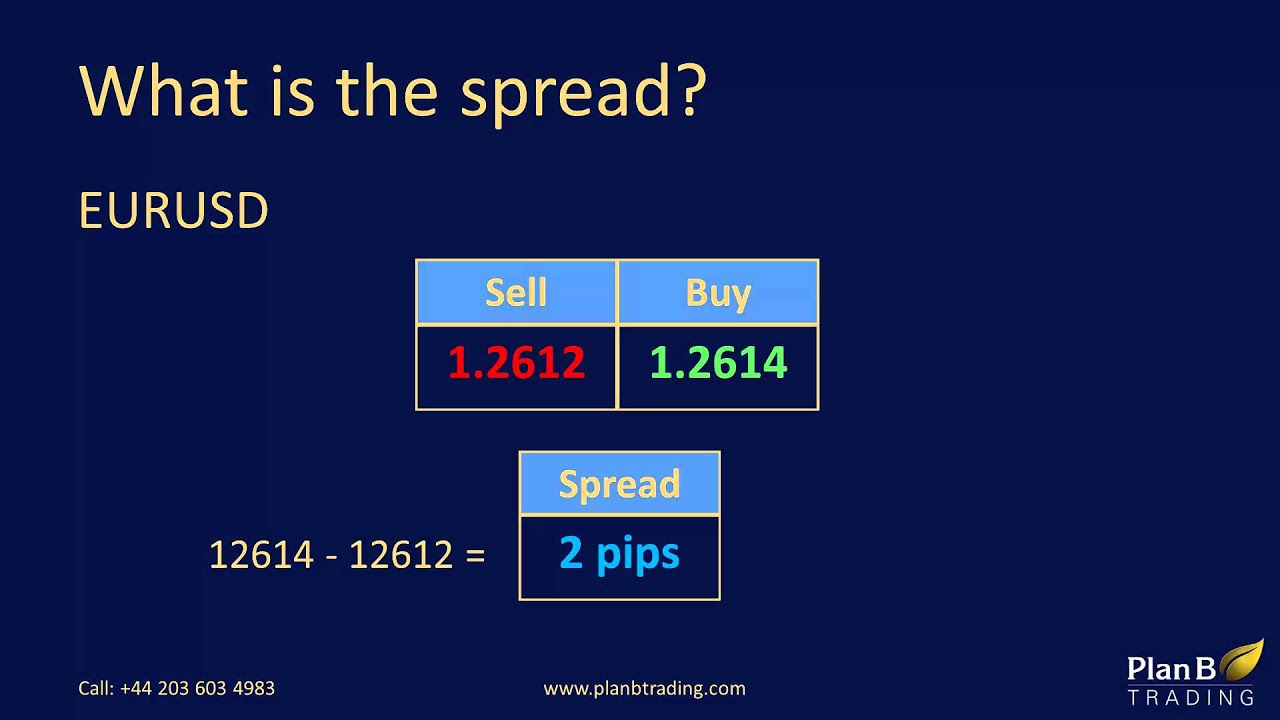

Spread:

Aakhir broker humain itna high leverage q offer karta hai. Kia wo hamary nafa sy kuch kamata hai ya hamara nafa uss ki pocket mn jata hai? G nahi, aesa nahi hota. Axhy broker trader ky nafa nuqsaan ya commission ky bajae qeemat khareed or qeemat farokht ky beech mojood farq sy nafa kamaty hain. Issy spread kaha jata hai. For Example agar ap EUR/USD ki trade lety hain to us ki qeemat khareed or keemat farokht ky darmean 3 pips ka farq hota hai. Jo ky hamari 1 trade ki cost hoti hai. Jo hamara broker or trade sy wasool karta hai.

Dear forex member umeed karta hun aap sab khairiyat se honge dear members Jab hum Trading ko as a career choose karty hain to iss ki basics ky bary mn jankari bht zaroori hai hai. Basics humain trade karnh mn bht help karti hain. Aj hum Margin, Equity & Spread ky bary mn bat karen gy.

Margin:

Trader ky account mn mojood wo raqam jo kisi bhi currency ko purchase karny ky liye broker ko darkar hoti hai Margin kehlati hai. Margin kam hony ki soorat mn trading platform trader ko currency khareedny ki ijazat nahi deta. Bilkul issi tarah agar 1 trade nuqsaan mn ja rahi ho to broker ka trading software us trade ko tab tak hi open rehny dy ga jab tak ky trader ky account mn darkar margin baqi rahy ga. Margin khatam ho jany ki soorat mn trade automatically band ho jati hai. For Example ap ky account mn $1000 hain. Iss ka matlab ky hai ky ap ka margin $1000 hai. Farz Karen ky Leverage ki ratio 100:1 hai. Yani ap ko 1 mini lot Khareedny ky liye $100 darkar hon gy. Ap 1.1750 par EUR/USD ki 4 lots khareed lety hain. Ab ap ky pas $600 ka margin reh jae ga. Badqismati sy pair ki qeemat ap ki khareedi hui qeemat ky opposite jana shuru ho jati hai. Aesy mn trading software har Pip ky girny par $4 ka loss dikhana shuru kar dy ga. Q k 100 times leverage ky baes ap ny $400 sy $40000 ki currency khareed rakhi hai. So. 1 pip ki value $4 tak ho jati hai. Issi hisaab sy ap ka margin jo ky $600 hai ap ki trade ko 200 Pips ky nuqsaan tak support kar saky ga. Or jaisy hi pair ki qeemat 1.1550 tak ponchy gi trading ka pair ap ki trade automatically band kar dy ga. Q k ap ky account mn nuqsaan bardasht karny ky liye margin baqi nahi bacha ho ga. Margin ka formula darj zail hota hai.

Equity - Used Margin = Usable Margin

$1000 - $400 = $600

Equity:

Account balance ky sath hi 1 column equity ka bhi hota hai. Ooper ki misaal lain trade open karny sy pehly ap ki equity $1000 ho gi. Ap ky account balance mn kisi bhi trade sy hony waly profit ki loss ki jama tafreeq sirf iss waqt hoti hai jab ap wo trade band karty hain ya margin ki kami ki waja sy wo automatically band ho jati hai. Iss sy pehly ap apna virtual balance joky open trade ky profit ya loss ki jama tafreeq karny ky baad hasil kiya ja sakta hai equity ky column mn dekh sakty hain. Broker ka software apka margin issi equity ki base par ooper diye gae formuly ky teht calculate karta hai.

Spread:

Aakhir broker humain itna high leverage q offer karta hai. Kia wo hamary nafa sy kuch kamata hai ya hamara nafa uss ki pocket mn jata hai? G nahi, aesa nahi hota. Axhy broker trader ky nafa nuqsaan ya commission ky bajae qeemat khareed or qeemat farokht ky beech mojood farq sy nafa kamaty hain. Issy spread kaha jata hai. For Example agar ap EUR/USD ki trade lety hain to us ki qeemat khareed or keemat farokht ky darmean 3 pips ka farq hota hai. Jo ky hamari 1 trade ki cost hoti hai. Jo hamara broker or trade sy wasool karta hai.