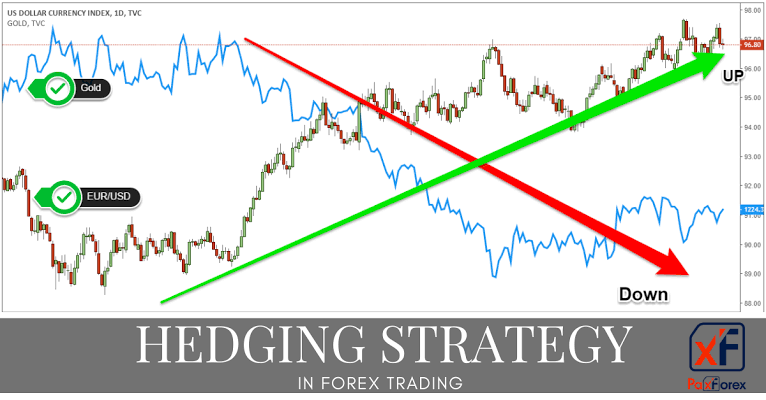

Dear friends Hedging forex trading me aik aisi strategy hai jo traders ka loss Kam krnay me bht kaam ati hai. Traders is strategy ki help say apny loss ko kisi na kisi had tak control ker lety hen aur kabhi kabhi loss recover bhi ho jata hai aur isi strategy say profits bhi expert traders acha ker laitay hain. Hedging her trader ko benefit daiti hai laikin sirf iss strategy ko apply krnay ka time hi correct hona zaruri hai.

When to use Hedging Strategy

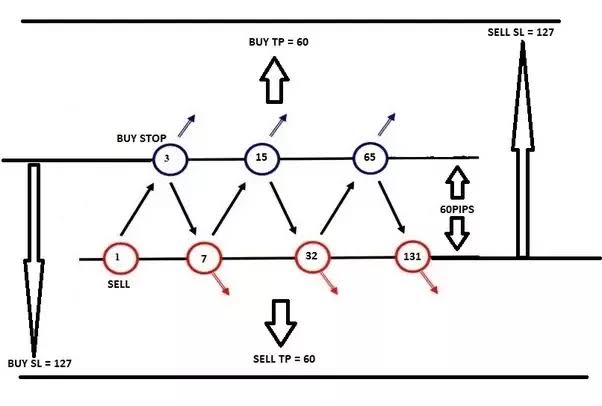

Hedging say faida uss waqt hota hai jab traders ko jald he apni wrong trade ka andaza ho Jaye aur lot size bhi ziada rakh Lia ho tou usi waqt hedge ker laina chaiye kiyu kay iss Tarah aik trade say faida aur Dusri say loss honay say bhi account ki equity Pay koi faraq nahi parta. Laikin Agar aik trade 10 $ mai jaa chuki ho to hedge kernay kay liye dusri trade ka lot size itna zaruri hai kay pehla loss dusri kay profit say jaldi mill sakey. Warna dono he trade loss mai jaengi aur account bhi jaldi he wash out ho jay ga.

Loss Control with Hedging

Agr Traders ne aik trades open ki ha aur wo trade loss me run ho rahi ha aur phir again usay analysis karne se pata chala ke trend mazeed os ki open trade ke against move kare ga jis se mazeed loss ho sakta ha tu ab traders apni trades ko loss me close bhi nehi karna chahta ha or mazeed loss se bhi bachna chahta tu yaha par traders apni trades ko hedge kar le ga or jub os ko market ki movement ki achi pridiction ho gi jaha se wo profit earn kar sakta ha waha par wo hedge khatam karke apni trade ko run karke profit earn kar sakta ha.

Profit Possiblity

Dosto misal Kay tor py agr kisi trader ne GBPUSD me aik buy ki trade open ki 1.3675 ki price par par wo trade trend change kar ke loss me chali gai or price 1.3640 par a gai trader ne trade ko analysis kea tu pata chala ke eurusd ki price mazeed down move kare gi tu yaha par traders apni trade ko hedge karke mazeed loss se bach jaye ga or jub os ko maloom ho ga ab price os theek ha reverse ho kar profit de day gi tu hedge khatam kar ke profit earn kar ley ga.

Benefits Of Hedging.

Hedging ka sb sy big benefit ye hota hai k es sy trader ka account safe rehta hai. So trader jis ka account wash hony wala hu wo es strategy ki help sy apny account ko bachany ma kamyab ho jaty hain. But hedging tb kamyab hoti hai jb trader ko market analysis ka b acha knowledge hu.

Draw Backs Of Hedging.

Hedging technique tab hi acha kam karti hai jb trader deheding achy time par kary. Agr trader dehedging time sy pehle ya dair sy kary ga to usko hedging ma kio benefit hasil ni ho ga. Jo trader market ko achi tarha analyze karty hain wo he hedging sy benefit hasil kar sakty hain. So trader ko agr market ki knowledge ni ho gi to wo profit hasil karny ma kbi kamyab ni ho paye ga. But ye b ik haqiqat hai k wo trader hedging ni karta ya esko use ni karta jo market analysis ma expert hota hai.

Factual Analysis of Hedging

1. Loss ki recovery karni ho sab se best technique hi hedge trading ho sakti hay.

2. Important news release ho to market unexpected movement karti hay es situation me normal trading (technical, fundamental) base par karna mushkil ho jata hay es condition me hedge trading ki jaye to successful trading possible hay

When to use Hedging Strategy

Hedging say faida uss waqt hota hai jab traders ko jald he apni wrong trade ka andaza ho Jaye aur lot size bhi ziada rakh Lia ho tou usi waqt hedge ker laina chaiye kiyu kay iss Tarah aik trade say faida aur Dusri say loss honay say bhi account ki equity Pay koi faraq nahi parta. Laikin Agar aik trade 10 $ mai jaa chuki ho to hedge kernay kay liye dusri trade ka lot size itna zaruri hai kay pehla loss dusri kay profit say jaldi mill sakey. Warna dono he trade loss mai jaengi aur account bhi jaldi he wash out ho jay ga.

Loss Control with Hedging

Agr Traders ne aik trades open ki ha aur wo trade loss me run ho rahi ha aur phir again usay analysis karne se pata chala ke trend mazeed os ki open trade ke against move kare ga jis se mazeed loss ho sakta ha tu ab traders apni trades ko loss me close bhi nehi karna chahta ha or mazeed loss se bhi bachna chahta tu yaha par traders apni trades ko hedge kar le ga or jub os ko market ki movement ki achi pridiction ho gi jaha se wo profit earn kar sakta ha waha par wo hedge khatam karke apni trade ko run karke profit earn kar sakta ha.

Profit Possiblity

Dosto misal Kay tor py agr kisi trader ne GBPUSD me aik buy ki trade open ki 1.3675 ki price par par wo trade trend change kar ke loss me chali gai or price 1.3640 par a gai trader ne trade ko analysis kea tu pata chala ke eurusd ki price mazeed down move kare gi tu yaha par traders apni trade ko hedge karke mazeed loss se bach jaye ga or jub os ko maloom ho ga ab price os theek ha reverse ho kar profit de day gi tu hedge khatam kar ke profit earn kar ley ga.

Benefits Of Hedging.

Hedging ka sb sy big benefit ye hota hai k es sy trader ka account safe rehta hai. So trader jis ka account wash hony wala hu wo es strategy ki help sy apny account ko bachany ma kamyab ho jaty hain. But hedging tb kamyab hoti hai jb trader ko market analysis ka b acha knowledge hu.

Draw Backs Of Hedging.

Hedging technique tab hi acha kam karti hai jb trader deheding achy time par kary. Agr trader dehedging time sy pehle ya dair sy kary ga to usko hedging ma kio benefit hasil ni ho ga. Jo trader market ko achi tarha analyze karty hain wo he hedging sy benefit hasil kar sakty hain. So trader ko agr market ki knowledge ni ho gi to wo profit hasil karny ma kbi kamyab ni ho paye ga. But ye b ik haqiqat hai k wo trader hedging ni karta ya esko use ni karta jo market analysis ma expert hota hai.

Factual Analysis of Hedging

1. Loss ki recovery karni ho sab se best technique hi hedge trading ho sakti hay.

2. Important news release ho to market unexpected movement karti hay es situation me normal trading (technical, fundamental) base par karna mushkil ho jata hay es condition me hedge trading ki jaye to successful trading possible hay