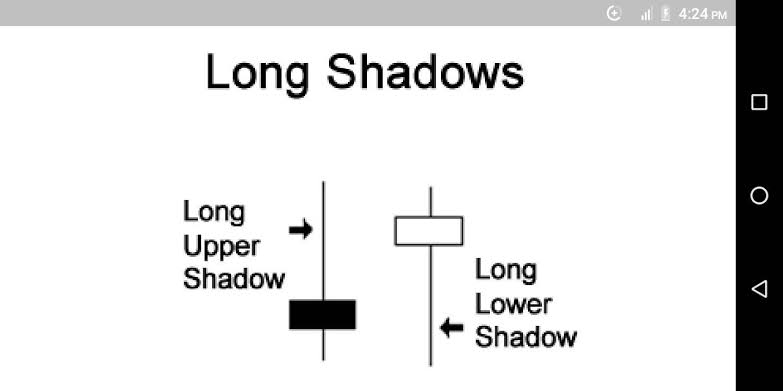

Dear friends Long shadow candle bary time frames main kafi useful saabit hoti hain aur aksar jab aap analysis karin aur wahan long shadow candle ko dekhin to usko azmaany kay liey demo account par trade lazmi lagaya karin ess say aapko andaza ho jaata hai. Aur zaida tar aap*H1, H4 ya 1D*wali shadow candles par trade lagain kunkay 30min ya es say choti candles itna asar nahi rakhti.

Sell Signal

Jab long shadow candle ooper say neechy ke tarf aai ho aur neechy aa kar close hui ho to eska matlab hai kay market main apko sell ka signal mill raha hai.

Buy Signal

Jab shadow candle neechy say ooper ke taraf ho to uska matlab hai kay market aapko buy ka signal day rahi hai. Magar ye baat lazmi zehan ma rakhin kay jitna time frame use kar rahy hon us hisab say order ko close karin ya tp sl lagain.

Confirmation

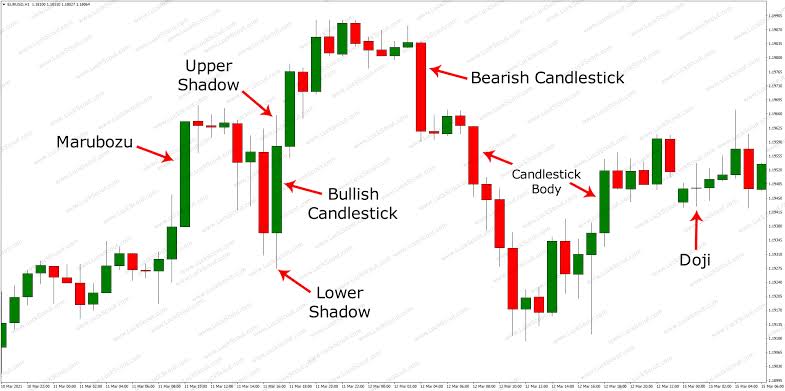

Long Shadow ki confirmation bullish ya bearish trend ka traders ko clear signal deta hay, long shadow se hi market ya to up move karti hay aur ya down hamy long body candle se market trend ka andaza ho sakta magar hamy long shadow ko ignore nahi karna chaye, agar yahi long shadow candles support ya resistance level par show ho jaye to market conform trend ko change karti hay aur yahi time hota hay key traders high risk le kar trading karen aur zeyda se zeyda pips earn karny ki koshish kary.

Timeframe

Candles kisi khas tim period like m1 se le kar D1 tak price ki opening aur closing ko zahir karti hain. Candlestick k kuch patterns aisy hain jin k samanay atay hi andaza ho jata ha k market ki next movement kiya hogi? In mein se aik Long shadow candle ha, jab long shadow candle zahir ho jaye to traders ko smajh lena chahiye k (agar market bullish ha) to next movement bearish hogi, similarly agar bearish market ha to next movement bullish hogi. Oper ki taraf long shadow bearish move ka signal ha, specially agar ye strong resistance k nazdeek ho. Similarly nechay ki taraf long shadow ka matlab buy signal ha, specially agar ye strong support k nazdeek zahir ho.

Trading Strategy

Jab candle banti hay to us time market main buyers aur seller dono majood hotay hain aur un kay darmian mukabla hota hay ka kon us candle ki closing apni side per kerwata hay. dono traf say sahi koshish hoti hay. kabi seller zayada ho jatay hain to kabi buyes enter ho jatay hian lakin end per ager boht zayada seller ya buyer a gay to wo candle us side per long shadow kay sath close ho jati hay jo kay ye zahir kerti hay kay candle ki closing kay mutabiq market ab kuch der kay liye sell jaye gi ya buy jaye gi.

Real Body

Ye candles jo key distinction kind key hoty hy aur ye market ky exclusive behavior ka bata sakty hey sab se pehly candle ko samjny ki koshish karni chaye, candle ki real body jo key large be ho sakti aur small be, candle ki body market ki starting charge aur closing charge show karti hay jes se marketplace key conduct aur marketplace me buying ya selling trades ka andaza lagany me koi mushkil nahi hoti, candle ki short body zeyda promoting orders aur kam shopping for orders ka bataty whats up esi technical technique se bahot se candles se marketplace key future conduct ko samjny me asani ho sakti hay.

Sell Signal

Jab long shadow candle ooper say neechy ke tarf aai ho aur neechy aa kar close hui ho to eska matlab hai kay market main apko sell ka signal mill raha hai.

Buy Signal

Jab shadow candle neechy say ooper ke taraf ho to uska matlab hai kay market aapko buy ka signal day rahi hai. Magar ye baat lazmi zehan ma rakhin kay jitna time frame use kar rahy hon us hisab say order ko close karin ya tp sl lagain.

Confirmation

Long Shadow ki confirmation bullish ya bearish trend ka traders ko clear signal deta hay, long shadow se hi market ya to up move karti hay aur ya down hamy long body candle se market trend ka andaza ho sakta magar hamy long shadow ko ignore nahi karna chaye, agar yahi long shadow candles support ya resistance level par show ho jaye to market conform trend ko change karti hay aur yahi time hota hay key traders high risk le kar trading karen aur zeyda se zeyda pips earn karny ki koshish kary.

Timeframe

Candles kisi khas tim period like m1 se le kar D1 tak price ki opening aur closing ko zahir karti hain. Candlestick k kuch patterns aisy hain jin k samanay atay hi andaza ho jata ha k market ki next movement kiya hogi? In mein se aik Long shadow candle ha, jab long shadow candle zahir ho jaye to traders ko smajh lena chahiye k (agar market bullish ha) to next movement bearish hogi, similarly agar bearish market ha to next movement bullish hogi. Oper ki taraf long shadow bearish move ka signal ha, specially agar ye strong resistance k nazdeek ho. Similarly nechay ki taraf long shadow ka matlab buy signal ha, specially agar ye strong support k nazdeek zahir ho.

Trading Strategy

Jab candle banti hay to us time market main buyers aur seller dono majood hotay hain aur un kay darmian mukabla hota hay ka kon us candle ki closing apni side per kerwata hay. dono traf say sahi koshish hoti hay. kabi seller zayada ho jatay hain to kabi buyes enter ho jatay hian lakin end per ager boht zayada seller ya buyer a gay to wo candle us side per long shadow kay sath close ho jati hay jo kay ye zahir kerti hay kay candle ki closing kay mutabiq market ab kuch der kay liye sell jaye gi ya buy jaye gi.

Real Body

Ye candles jo key distinction kind key hoty hy aur ye market ky exclusive behavior ka bata sakty hey sab se pehly candle ko samjny ki koshish karni chaye, candle ki real body jo key large be ho sakti aur small be, candle ki body market ki starting charge aur closing charge show karti hay jes se marketplace key conduct aur marketplace me buying ya selling trades ka andaza lagany me koi mushkil nahi hoti, candle ki short body zeyda promoting orders aur kam shopping for orders ka bataty whats up esi technical technique se bahot se candles se marketplace key future conduct ko samjny me asani ho sakti hay.