What is Intraday Breakout Trading Strategy?

Break out means moves below any support or above any resistance. Price breakout from

Benefits of Intraday Breakout Trading Strategy:

Benefits of Intraday Breakout Trading Strategy:

There are several benefits to trading breakouts. For example

The demerit of Breakout Trading Strategy:

False breakout or trapWhen should we avoid trading breakouts?

Don’t trade breakouts when the market is far from Support or Resistance (S/R) Why?

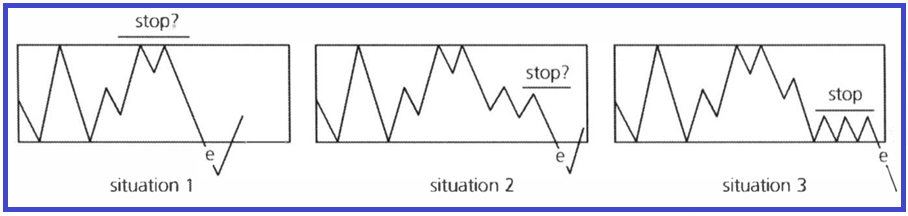

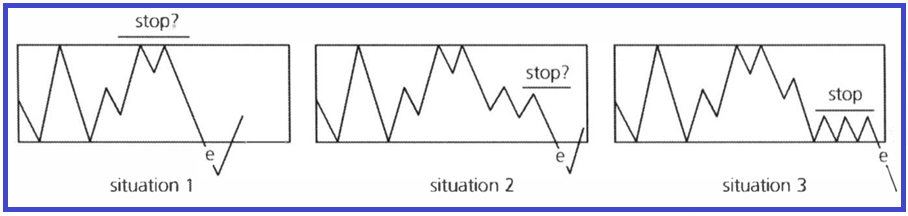

Because you don’t have a logical level to place your stop loss. Even if you do, it usually results in a poor risk to reward profile Based on the stop loss placement we can divide the break out into three typesFalse Breaks, Tease Breaks, and Proper Breaks

Whether to take a position or not on a break is always a function of how well the technical credentials of the chart back up the prospects for follow-through. The difference in consolidation prior to a breakout not only affects the likelihood of follow-through but the level for protection as well. An excellent way to play a break is shown in Situation 3. Now we can truly see the virtues of proper consolidation up. The breakout may still fail soon after, but technically seen, this is the more favorable scenario

The difference in consolidation prior to a breakout not only affects the likelihood of follow-through but the level for protection as well. An excellent way to play a break is shown in Situation 3. Now we can truly see the virtues of proper consolidation up. The breakout may still fail soon after, but technically seen, this is the more favorable scenario

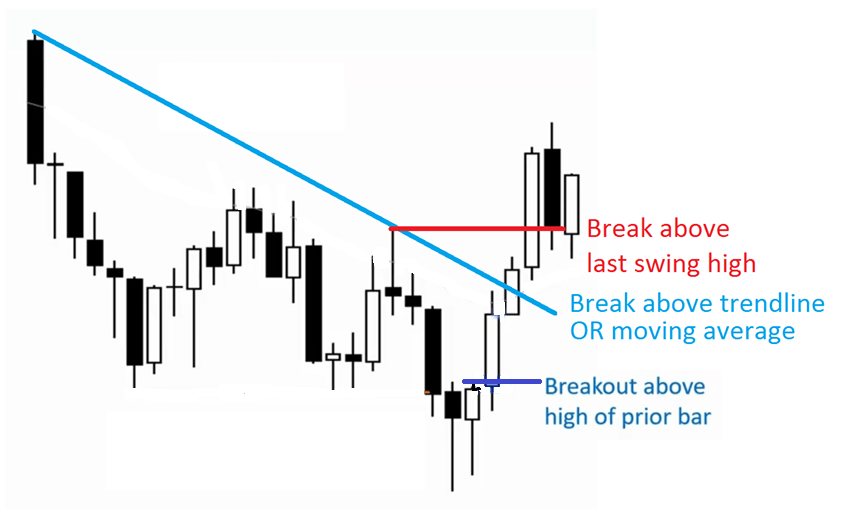

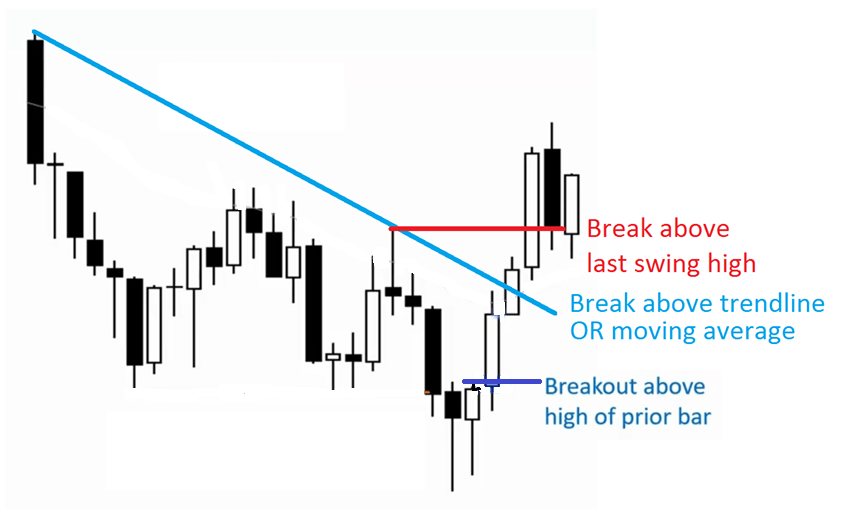

Break out means moves below any support or above any resistance. Price breakout from

- First support and resistance is a break of previous candle high or low

- Last swing high or low (shorter-term support and resistance)

- Major support and resistance

- Trend line or moving average

Benefits of Intraday Breakout Trading Strategy:

Benefits of Intraday Breakout Trading Strategy:There are several benefits to trading breakouts. For example

- Momentum is with you – Trading breakouts allow you to enter your trade with momentum at your back

- Catch big trends – If you were to trade pullbacks, sometimes it may never come. But with breakouts, you never have to worry about missing another move in the markets

The demerit of Breakout Trading Strategy:

False breakout or trapWhen should we avoid trading breakouts?

- Don’t trade breakouts when the market is far from Support/Resistance (S/R) and Are there obstacles overhead or underfoot that could possibly obstruct an advance or decline

- Don’t trade breakouts without TIGHT TRADING RANGE (consolidation) before the breakout

- Don’t trade breakout when the break set against the dominant pressure

Don’t trade breakouts when the market is far from Support or Resistance (S/R) Why?

Because you don’t have a logical level to place your stop loss. Even if you do, it usually results in a poor risk to reward profile Based on the stop loss placement we can divide the break out into three typesFalse Breaks, Tease Breaks, and Proper Breaks

Whether to take a position or not on a break is always a function of how well the technical credentials of the chart back up the prospects for follow-through.

The difference in consolidation prior to a breakout not only affects the likelihood of follow-through but the level for protection as well. An excellent way to play a break is shown in Situation 3. Now we can truly see the virtues of proper consolidation up. The breakout may still fail soon after, but technically seen, this is the more favorable scenario

The difference in consolidation prior to a breakout not only affects the likelihood of follow-through but the level for protection as well. An excellent way to play a break is shown in Situation 3. Now we can truly see the virtues of proper consolidation up. The breakout may still fail soon after, but technically seen, this is the more favorable scenario