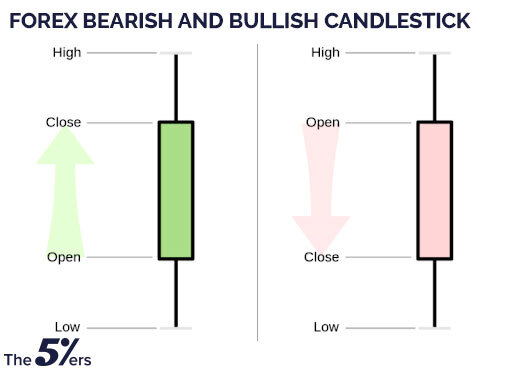

Assalamu Alaikum dear members aap Forex trading Main bearish aur bullish candlestick main different important points ki basis for is main differentiate Karin.

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bearish / bullish candlestick difference -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Re: Bearish / bullish candlestick difference

Walaikum salam dear member aapane bahut hi acchi information Hamare Sath share Ki Hai Jab Ham Forex trading Mein kam Karte Hain To Hamen different important analysis focus karne hote hain use per Ham Agar completely focus Karte Hain To ismein Ham ko bahut jyada advantages Hasil ho sakte hain isliye aapko chahie ki aap different important analysis par focus karte hue aapko Jab bearish candlesticks and Bole scan list ke bare mein information hoti hai to aapko yah Mein batana chahti Hun Ki bearish hua hai jo Ke Jab market ki price down ho rahi ho to use bearish candlestick Kahate Hain aur job market ki price badh rahi ho to use bullish candlesticks Kahate Hain. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Re: Bearish / bullish candlestick difference

Yes very bearis bullish main difference lazmi hai iske liye Anil se uski jarurat hoti hai agar Ham ine Indifference ko Samne rakhte Hain To Hamen Kafi help milati Hai trade karne mein Forex work karne mein -

#4 Collapse

Re: Bearish / bullish candlestick difference

dear member Forex trading me jab aap market mein prices ko increase hota dekhte Hain to aisi condition main aapko hamesha market mein bullish candlestick charts available hoti hai jo aapko yah indicate karti hai ki market mein prices increase ho rahi hai aur iski against jab market mein prices down words a Rahi hoti hai aur consistently market mein prices decrease ho rahi hoti hai to US time par market mein hamesha aapko bearish candlestick charts available hoti hai inmein differentiate karna bahut hi aasan hota hai. -

#5 Collapse

Re: Bearish / bullish candlestick difference

Assalamu alaikum ji bhai ummid hai aap khairiyat se honge bullish candlestick pattern ek aisa candlestick pattern hai jismein aapke pass Jo candle banti hai uska friend upward hota hai aur jab ke bearish candlestick pattern kaise candlestick pattern hai jismein aapki market niche ki taraf karti hai yahi ine donon ke darmiyaan difference hai isiliye aapko chahie kya kar aapko market mein bullish candlestick pattern najar aaye to aapko samajh Jana chahie ki yahan se aap market UP mein jaane wali hai aur jab aapko bearish candlestick pattern najar aaye to aapko samajh Jana chahie de yahan se ab market niche jaane wali hai -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Re: Bearish / bullish candlestick difference

ji han is samay bahut fayda ho sakta hai very good trade agar message to ham bahut kuchh kar sakte hain barish Ka mausam bhi bahut achcha hota hai shukriya -

#7 Collapse

Dear ap ko chart main pattern candlestick jab chose karain gy tu ap us kay bad time frame chose kar lain. Ap ager time frame H4 yani 4 ghanty ka rahkty hain tu ap kay chart pay jo candles show ho rahi hai har candle 4 ghanty ki show kary ga. Jab ap kisi be candle pay mouse lay kay jain gy tu ap ko har candle us 4 ghanty ka high,low,open or close sari price bata daiti hai. baqi ap es pay mazeed mehnat kar kay es sy achi earning kar sakty hain.اصل پيغام ارسال کردہ از: Janu123 پيغام ديکھيےRe: Bearish / bullish candlestick difference

ji han is samay bahut fayda ho sakta hai very good trade agar message to ham bahut kuchh kar sakte hain barish Ka mausam bhi bahut achcha hota hai shukriya -

#8 Collapse

BULLISH /BEARISH CANDLESTICK DIFFERENCE DEFINITION

Overtime ke sath candlestick recognizable pattern mein group Ban Jaati Hai Jinhen investor buying and selling Ke decision karne ke liye use kar sakte hain candlestick ka naam isliye Rakha gaya hai because Dono siron per and line wick wali candle se resemble hai Har candle usually stock ke bare mein Ek Din Ki price Ke Data ki represent karti hai candlestick chart Ek type ke financial Chart hain jo securities ki movement ko track karne ke liye hai Inki centuries old Japanese rice ki trade Se Hui Hai and unhun Ne modern day ke stock ki price ki charting mein aapna way banaya

BULLISH CANDLESTICK PATTERN

Candle ke many patterns Hain Jo buy ke opportunity ki indicate Karte Hain ham five candlestick ke patterns per focus merkoz Karenge jo sabse strong reversal signal Dete Hain bullish Ke reversal patterns ko down trend Mein form kar dena chahie otherwise bullish ka pattern Nahin Hai Bal ke Ek continuation pattern hai buyers ke pressure ki confirmation karne ke liye traditional technical analysis ke othrer other means Jaise trend line oscillators Momentum ya volume ke indicators ke jarie bulls ke reversal pattern ki confirmed ki Ja sakti hai most bullish ke pattern ko bullish ki confirmation ki require hoti hai inke bad price ka ek up side Hona zaruri hai Jo Ek long hollow candlestick ya gape up ke Taur per a sakta hai And is ke sath high trading volume bhi ho sakta hai yah confirmation pattern ke 3 days ke andar Dekhi Jaani chahie

THE HAMMER OR THE INVETER HAMMER

Hammer bullish se reversal pattern hai jo is baat ki signal karta hai Ek STOCK down trend mein bottom ke kareeb hai candle Ka body longer lower shadow ke sath short hota hai yah is baat ka sign karta hai ke sellers trading session ke dauran prices lower kar rahe hain Jiske bad session ko higher close PER end karne ke liye buying ka strong pressure parta hai trading volume Mein rise Ke zarie Bhi reversal ki validate ki Jaani chahie

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

BULLISH /BEARISH CANDLESTICK DIFFERENCEIntroduction

Candlestick patterns, forex trading mein aik aham hissa hain jo traders ko market ki movements aur trends samajhne mein madad karte hain. Bearish aur bullish candlesticks, dono hi traders ke liye aham hai kyun ke inka istemal market ki direction ko tajwez karne mein hota hai. Is post mein hum dekheinge ke bearish aur bullish candlesticks mein kya farq hai.

Bearish Candlestick:

Bearish candlestick, market mein girawat ko darust karta hai. Iski pehchan, candle ka closing price opening price se kam hoti hai. Yeh candlestick market ke bearish ya downtrend hone ki nishani hai. Bearish candlestick ke kuch mukhtalif types hoti hain, jese ke:

Engulfing Patterns:

Bearish engulfing pattern mein, ek choti bullish candle ek bara bearish candle ko poori tarah se cover karta hai. Yeh indicate karta hai ke buyers ke control mein hone wala trend ab girne wala hai.

Shooting Star:

Shooting star, ek lambi upper shadow ke sath ek choti body wala candle hota hai. Yeh indicate karta hai ke market mein buyers initially strong the lekin phir se gir gaye hain aur sellers control mein aaye hain.

Hanging Man:

Hanging man bhi ek bearish candlestick pattern hai. Yeh bullish trend ke doran atay hai aur indicate karta hai ke market mein reversal hone wala hai.

Bullish Candlestick:

Bullish candlestick, market mein izafa ko darust karta hai. Iski pehchan, candle ka closing price opening price se ziada hoti hai. Yeh candlestick market ke bullish ya uptrend hone ki nishani hai. Kuch mukhtalif bullish candlestick patterns mein shaamil hain:

Hammer:

Hammer ek bullish reversal pattern hai. Isme ek choti body aur lambi lower shadow hoti hai, jo indicate karta hai ke sellers initially control mein the, lekin phir buyers ne control haasil kiya hai.

Bullish Engulfing:

Bullish engulfing pattern mein, ek choti bearish candle ek bara bullish candle ko cover karta hai. Yeh indicate karta hai ke market mein buyers ne control haasil kiya hai.

Doji:

Doji ek aisa candlestick hai jisme opening aur closing price aik doosre ke bohat qareeb hoti hain. Agar doji bullish trend ke baad aaye, to yeh indicate karta hai ke market mein indecision hai, lekin agar iske baad strong bullish candle aati hai, to yeh bullish reversal ke liye point hai.

Bearish aur Bullish Candlestick Mein Farq

Direction of Market:

Sabse bada farq yeh hai ke bearish candlestick market ki girawat ya downtrend ko darust karta hai, jabke bullish candlestick market ki izafa ya uptrend ko darust karta hai.

Closing Price:

Bearish candlestick mein closing price opening price se kam hoti hai, jabke bullish candlestick mein closing price opening price se ziada hoti hai.

Market Sentiment:

Bearish candlestick market mein bearish sentiment ko darust karta hai, jabke bullish candlestick bullish sentiment ko darust karta hai.

Conclusion:

Candlestick patterns, traders ko market movements ko samajhne mein madad karte hain. Bearish aur bullish candlesticks, market ki direction ko tajwez karne mein aham role ada karte hain. Traders ko in patterns ko samajhna aur unka istemal sahi waqt par karna chahiye taake woh behtar trading decisions le sakein. Iske alawa, risk management aur market analysis bhi traders ke liye zaroori hai taki woh market ke fluctuations ke saath behtar taur par deal kar sakein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:27 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим