Assalam O Alaikum dear Forex Friends...

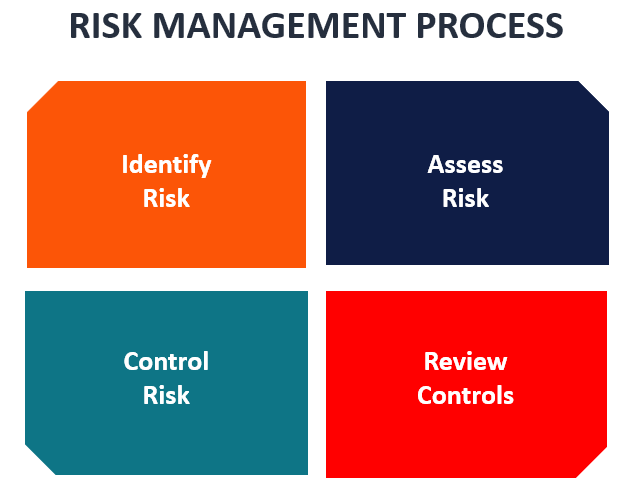

Ummid karta hun aap sab khairiyat se honge. Friends risk trading mein ek game changer ki haisiyat rakhta hai. Risky trades apko ya to bahut profit dy jati hain ya phir bahut loss uthana parh skta hai apko... Risk ek double face coin hai jiska ek face profit ka hai aur ek face Loss ka hai. Ye aap per depend krta hai k heat of the moment aap ka decision kya hota hai aur aap apny analysis ko kese utilities krty hain aur kahan tak ly k ja sakty hain. Risky trades mein careful rhen aur apnay aap ko safe rakhty huye utna Risk len jitna aap bear kar saktay hain. A

Ummid karta hun aap sab khairiyat se honge. Friends risk trading mein ek game changer ki haisiyat rakhta hai. Risky trades apko ya to bahut profit dy jati hain ya phir bahut loss uthana parh skta hai apko... Risk ek double face coin hai jiska ek face profit ka hai aur ek face Loss ka hai. Ye aap per depend krta hai k heat of the moment aap ka decision kya hota hai aur aap apny analysis ko kese utilities krty hain aur kahan tak ly k ja sakty hain. Risky trades mein careful rhen aur apnay aap ko safe rakhty huye utna Risk len jitna aap bear kar saktay hain. A

تبصرہ

Расширенный режим Обычный режим