Brief Description.

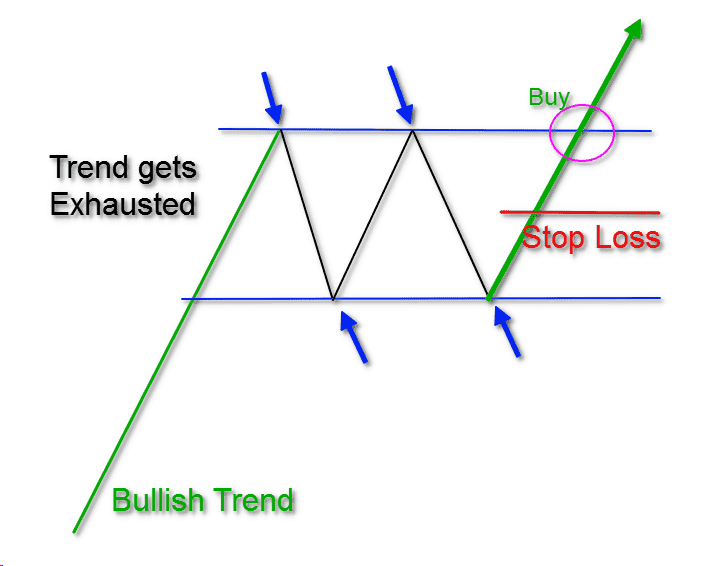

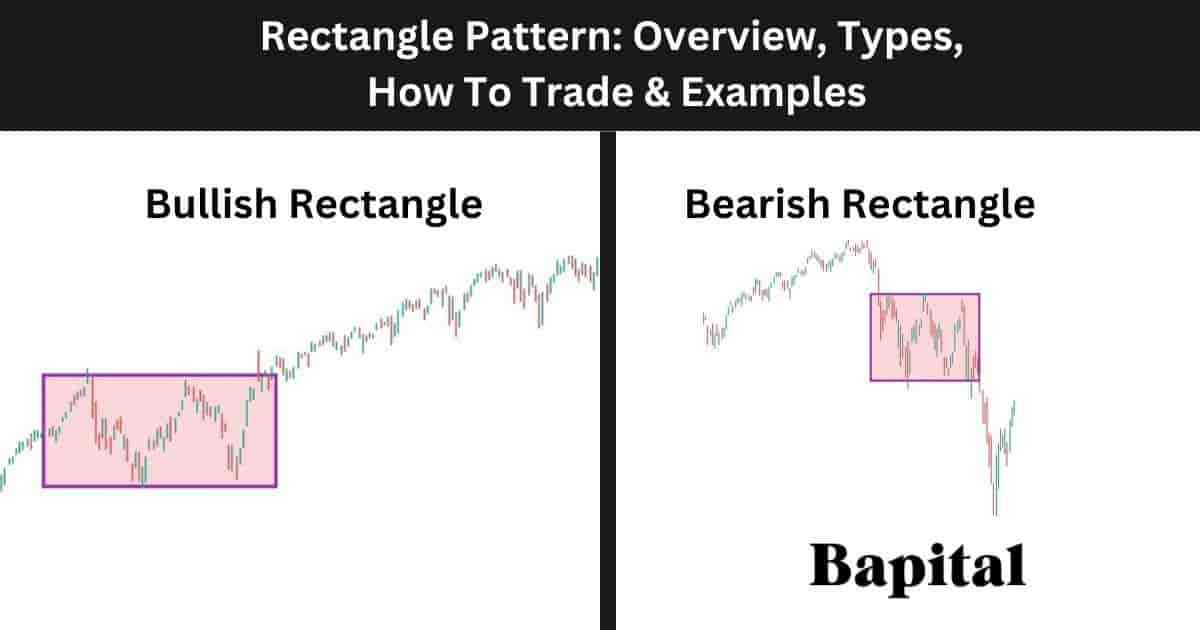

Dear traders Bullish Rectangle candlestick pattern main jab price support se neeche girta nahi aur resistance ko todta nahi go iska matlab hota hai ke market mein buyers aur sellers ke darmiyan aik balance hai. Lekin jab ye pattern tod diya jata hai aksar ye signal deta hai ke price agay aur barhne wala hai yani bullish trend continue hoga ye pattern tab samajh aata hai jab price aik specific range mein consolidate kar raha ho yani upar aur neeche ke levels ke darmiyan ruk gaya ho. Is pattern mein price horizontal support aur resistance levels ke darmiyan ghoomta hai.

Identification.

Is pattern ko samajhne ke liye zaroori hai ke aap price action ko dekhain aur is kee identification kay liye aap ko btata chaloon kay yea pattern mein do horizontal lines hoti hain upar wali resistance level aur neeche wali support level.Is pattern ka kaam ye hota hai ke ye market ke consolidation phase ko dikhata hai jo aksar aglay uptrend ka pehla signal hota hai. Jab price resistance todta hai aur volume mein izafa hota hai, to ye bullish breakout ka signal hota hai jo traders ke liye buying ka mauqa hota hai.Jab price resistance ke qareeb pohanchta hai aur wahan se neeche ata hai, phir support par rukta hai aur wahan se dobara upar jata hai, to aik rectangle shape banti hai.

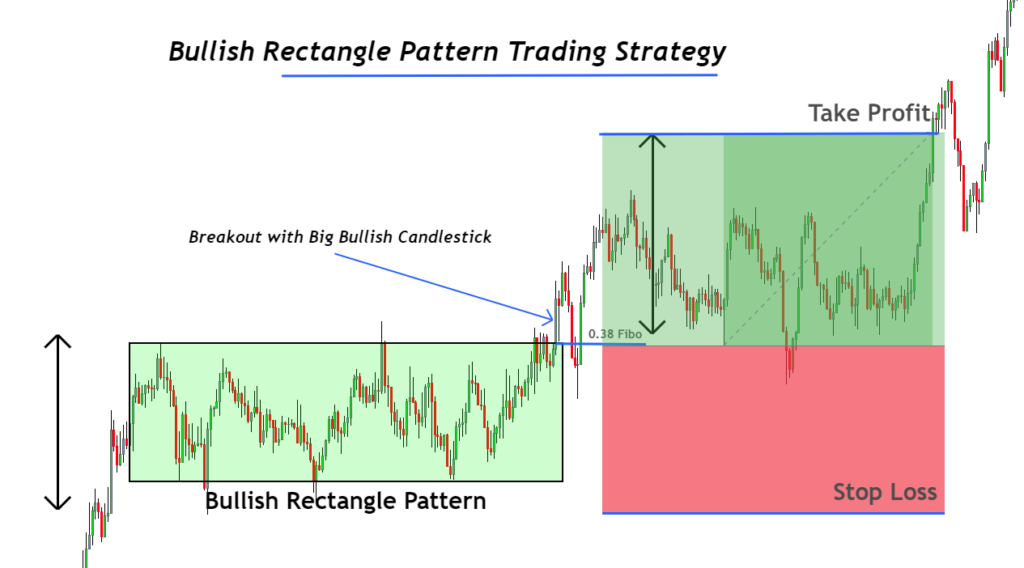

Trading Strategy.

Ded friends Bullish Rectangle pattern par trading karte waqt sabse zaroori cheez breakout ka intezar karna hai jab price resistance todta hai aur saath hi volume barhta hai to ye confirmation hoti hai ke bullish trend shuru ho chuka hai.Is waqt traders ko buy karna chahiye aur apna stop-loss support level ke neeche lagana chahiye taake risk manage ho sake aur jo range price ne rectangle ke andar cover ki hoti hai us he ke barabar aglay breakout ke baad price move karne ki umeed hoti hai. Agar breakout ke baad price wapis rectangle ke andar chala jaye, to iska matlab hota hai ke breakout false tha, aur trade ko band karna chahiye.

Dear traders Bullish Rectangle candlestick pattern main jab price support se neeche girta nahi aur resistance ko todta nahi go iska matlab hota hai ke market mein buyers aur sellers ke darmiyan aik balance hai. Lekin jab ye pattern tod diya jata hai aksar ye signal deta hai ke price agay aur barhne wala hai yani bullish trend continue hoga ye pattern tab samajh aata hai jab price aik specific range mein consolidate kar raha ho yani upar aur neeche ke levels ke darmiyan ruk gaya ho. Is pattern mein price horizontal support aur resistance levels ke darmiyan ghoomta hai.

Identification.

Is pattern ko samajhne ke liye zaroori hai ke aap price action ko dekhain aur is kee identification kay liye aap ko btata chaloon kay yea pattern mein do horizontal lines hoti hain upar wali resistance level aur neeche wali support level.Is pattern ka kaam ye hota hai ke ye market ke consolidation phase ko dikhata hai jo aksar aglay uptrend ka pehla signal hota hai. Jab price resistance todta hai aur volume mein izafa hota hai, to ye bullish breakout ka signal hota hai jo traders ke liye buying ka mauqa hota hai.Jab price resistance ke qareeb pohanchta hai aur wahan se neeche ata hai, phir support par rukta hai aur wahan se dobara upar jata hai, to aik rectangle shape banti hai.

Trading Strategy.

Ded friends Bullish Rectangle pattern par trading karte waqt sabse zaroori cheez breakout ka intezar karna hai jab price resistance todta hai aur saath hi volume barhta hai to ye confirmation hoti hai ke bullish trend shuru ho chuka hai.Is waqt traders ko buy karna chahiye aur apna stop-loss support level ke neeche lagana chahiye taake risk manage ho sake aur jo range price ne rectangle ke andar cover ki hoti hai us he ke barabar aglay breakout ke baad price move karne ki umeed hoti hai. Agar breakout ke baad price wapis rectangle ke andar chala jaye, to iska matlab hota hai ke breakout false tha, aur trade ko band karna chahiye.

Strategy.

Strategy. analysis:Is design ka kaam ye hota hai ke ye market ke solidification stage ko dikhata hai jo aksar aglay upturn ka pehla signal hota hai.cost obstruction todta hai aur volume mein izafa hota hai, to ye bullish breakout ka signal hota hai jo brokers ke liye purchasing ka mauqa hota hai.Jab cost opposition ke qareeb pohanchta hai aur wahan se neeche ata hai, phir support standard rukta hai aur wahan se dobara upar jata hai, to aik square shape banti hai.

analysis:Is design ka kaam ye hota hai ke ye market ke solidification stage ko dikhata hai jo aksar aglay upturn ka pehla signal hota hai.cost obstruction todta hai aur volume mein izafa hota hai, to ye bullish breakout ka signal hota hai jo brokers ke liye purchasing ka mauqa hota hai.Jab cost opposition ke qareeb pohanchta hai aur wahan se neeche ata hai, phir support standard rukta hai aur wahan se dobara upar jata hai, to aik square shape banti hai.

تبصرہ

Расширенный режим Обычный режим